Key Insights

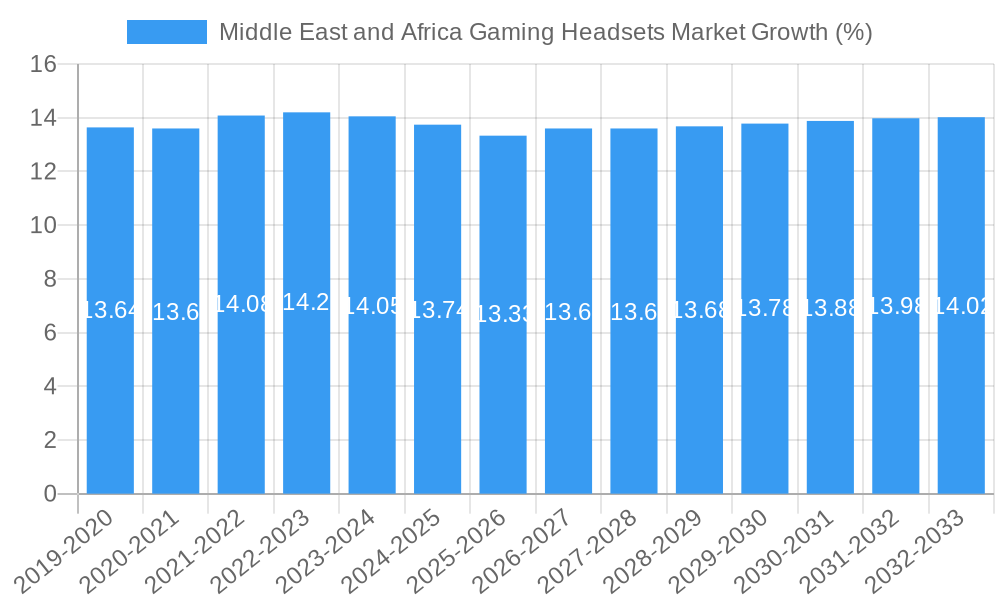

The Middle East and Africa (MEA) gaming headsets market is poised for substantial expansion, projected to reach a valuation of approximately $126.12 million by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 13.64% anticipated between 2025 and 2033. Several key drivers are propelling this upward trajectory. The increasing adoption of gaming consoles and PCs across the region, coupled with a growing youth population with a strong affinity for online gaming, forms a foundational pillar for demand. Furthermore, the proliferation of esports tournaments and events, both locally and internationally, is significantly boosting the need for high-performance gaming headsets that offer immersive audio experiences and clear communication. Major players like Razer Inc., SteelSeries, and Corsair Gaming Inc. are actively investing in product innovation, introducing advanced features such as virtual surround sound, active noise cancellation, and ergonomic designs, further stimulating market growth. The retail and online sales channels are both crucial, with online platforms offering wider accessibility and competitive pricing, while retail stores provide a tangible experience for consumers.

The market is segmented into distinct compatibility types, including console headsets and PC headsets, catering to diverse gaming platforms. Connectivity options are also a key differentiator, with both wired and wireless headsets appealing to different user preferences, with wireless technology gaining significant traction due to its convenience and freedom of movement. Geographically, while specific data for the MEA region is consolidated, key markets like Saudi Arabia and the United Arab Emirates are expected to lead in terms of revenue generation due to higher disposable incomes and a more established gaming culture. However, other nations such as Israel, Qatar, Kuwait, Oman, Bahrain, Jordan, and Lebanon are also showing promising growth potential. Challenges for the market include the impact of economic fluctuations and the availability of counterfeit products, which could hinder outright market value. Nevertheless, the strong underlying demand, coupled with continuous technological advancements and strategic market penetration by leading companies, indicates a highly promising future for the MEA gaming headsets market.

Unlock critical insights into the booming Middle East and Africa (MEA) Gaming Headsets Market. This comprehensive report provides an in-depth analysis of the gaming headset industry across MEA, covering console headsets, PC headsets, wired gaming headsets, wireless gaming headsets, and the influence of both retail and online sales channels. With a meticulous study period from 2019 to 2033, this research offers a definitive understanding of market dynamics, from historical trends (2019-2024) to future projections (2025-2033), anchored by a robust base year of 2025. Explore the competitive landscape featuring industry giants like Razer Inc, SteelSeries, Corsair Gaming Inc, Logitech International SA, HyperX (Kingston Technology Company Inc), Turtle Beach Corporation, ASTRO Gaming (Logitech), Sony Interactive Entertainment Inc, and Cooler Master Technology Inc.

Middle East and Africa Gaming Headsets Market Market Structure & Competitive Dynamics

The Middle East and Africa gaming headsets market is characterized by a dynamic and evolving structure. While Razer Inc and SteelSeries often hold significant market share in the premium segment due to their strong brand recognition and innovative product offerings, Logitech International SA and HyperX present formidable competition with their broad product portfolios catering to various price points. The market's concentration is moderate, with new entrants and established players continuously vying for dominance. The innovation ecosystem is robust, driven by Sony Interactive Entertainment Inc and ASTRO Gaming (Logitech), who are at the forefront of integrating advanced audio technologies and platform-specific optimizations for console headsets. Regulatory frameworks are generally supportive of technology and e-commerce growth, although local import duties and consumer protection laws can influence pricing and distribution strategies. PC headset manufacturers like Corsair Gaming Inc and Cooler Master Technology Inc are also gaining traction. End-user trends indicate a growing preference for wireless connectivity and immersive audio experiences, particularly among the burgeoning youth demographic in countries like the UAE and Saudi Arabia. The market also sees competition from audio brands expanding into the gaming segment. Mergers and acquisitions are less frequent but can significantly alter the competitive landscape; for instance, the acquisition of ASTRO Gaming by Logitech demonstrates a strategic consolidation of strengths. The M&A deal values in this sector, while not publicly disclosed for every transaction, are estimated to be in the tens of millions of USD for significant player acquisitions, bolstering market consolidation and expanding product portfolios.

Middle East and Africa Gaming Headsets Market Industry Trends & Insights

The Middle East and Africa gaming headsets market is poised for significant expansion, driven by a confluence of factors including a rapidly growing youth population, increasing disposable incomes, and the proliferation of high-speed internet infrastructure across key nations. The estimated Compound Annual Growth Rate (CAGR) for the gaming headset market in this region is projected to be between 10% and 15% during the forecast period of 2025–2033. Market penetration of gaming peripherals, including headsets, is steadily increasing, moving from approximately 20% in 2023 to an anticipated 35% by 2033. A major growth driver is the escalating popularity of e-sports and competitive gaming tournaments, which fuels demand for high-performance audio equipment. Wireless gaming headsets are experiencing particularly strong growth, driven by consumer demand for convenience and freedom of movement, with market share projected to rise from 55% in 2025 to over 70% by 2033. Technological disruptions, such as the integration of advanced sound technologies like Dolby Atmos and DTS:X, along with innovations in microphone quality and active noise cancellation, are differentiating products and appealing to discerning gamers. The increasing adoption of cloud gaming services also necessitates high-quality console headsets and PC headsets capable of delivering low-latency audio. Consumer preferences are shifting towards immersive experiences, with gamers actively seeking headsets that offer spatial audio, comfort for extended play sessions, and seamless connectivity across multiple devices. The competitive dynamics are intensifying, with established global brands like Razer Inc, SteelSeries, and Corsair Gaming Inc facing growing competition from regional players and budget-friendly options. The expansion of online retail platforms has democratized access to gaming peripherals, allowing brands to reach a wider audience across diverse geographical locations within the MEA region. Furthermore, the strategic importance of mobile gaming continues to influence headset design, with a rising demand for versatile headsets compatible with smartphones and tablets. The overall market sentiment is optimistic, with continuous innovation and evolving consumer tastes shaping a robust and competitive landscape for gaming headphones.

Dominant Markets & Segments in Middle East and Africa Gaming Headsets Market

The Middle East and Africa gaming headsets market exhibits distinct regional and segment dominance. Within compatibility types, PC Headsets currently hold a dominant market share, estimated at 60% in 2025, owing to the established PC gaming culture in countries like South Africa and Egypt, and the increasing accessibility of gaming PCs. However, Console Headsets are rapidly gaining ground, projected to capture 45% of the market by 2033, propelled by the widespread adoption of gaming consoles like PlayStation and Xbox, particularly in emerging markets where console gaming often represents a more accessible entry point into the gaming ecosystem.

In terms of connectivity, Wireless Gaming Headsets are emerging as the dominant force, projected to command a market share of 55% in 2025 and expand to over 70% by 2033. This shift is driven by the increasing demand for convenience, freedom from tangled wires, and advancements in wireless audio technology that minimize latency. Countries like the UAE and Saudi Arabia are leading this transition due to higher disposable incomes and a strong appetite for cutting-edge technology.

Regarding sales channels, the Online segment is experiencing exponential growth, expected to account for 65% of the market in 2025 and reach 80% by 2033. This dominance is attributed to the vast reach of e-commerce platforms, competitive pricing, wider product selection, and the convenience of home delivery across geographically dispersed populations within the MEA region. The Retail channel, while still significant, is adapting by focusing on experiential showrooms and partnerships with electronics stores to offer a tangible product experience.

Key drivers for this dominance include:

- Economic Policies: Favorable government initiatives promoting technology adoption and e-commerce in countries like the UAE, Saudi Arabia, and Kenya are crucial.

- Infrastructure: The continuous expansion of high-speed internet connectivity and logistics networks across the region is vital for both online sales and the adoption of online gaming.

- Demographics: A large and young population, particularly in North and West Africa, with a growing interest in gaming and esports, fuels demand across all segments.

- Consumer Affordability: While premium products cater to higher-income segments, the availability of a wider range of price points through online channels makes gaming headsets accessible to a broader audience.

The dominance analysis highlights a clear trend towards wireless, online-purchased headsets, with PC gaming leading but console gaming showing robust growth potential.

Middle East and Africa Gaming Headsets Market Product Innovations

Product innovation in the MEA gaming headsets market is primarily focused on enhancing the audio immersion and user experience. Manufacturers like Razer Inc and SteelSeries are continuously integrating advanced 7.1 surround sound and spatial audio technologies, offering gamers a distinct competitive advantage through superior sound localization. Companies are also prioritizing comfort and ergonomics, developing lightweight designs with breathable earcups for extended gaming sessions. HyperX (Kingston Technology Company Inc) is notable for its focus on durable build quality and crystal-clear microphone performance, crucial for team-based online gaming. The competitive advantage lies in offering unique features such as customizable RGB lighting, intuitive software for audio and mic control, and platform-agnostic compatibility, ensuring broader market appeal.

Report Segmentation & Scope

This report meticulously segments the Middle East and Africa Gaming Headsets Market by Compatibility Type, encompassing Console Headset and PC Headset. The Console Headset segment is projected to grow at a CAGR of 12% from 2025 to 2033, driven by increasing console adoption and exclusive gaming titles. The PC Headset segment, currently dominant, is expected to maintain a CAGR of 9% during the same period, supported by the persistent popularity of PC gaming and the rise of high-end gaming PCs.

The market is further segmented by Connectivity, including Wired and Wireless. The Wireless segment is experiencing rapid expansion, with a projected CAGR of 15%, driven by consumer preference for convenience and technological advancements in low-latency audio. The Wired segment, while more established, is anticipated to grow at a CAGR of 6%, appealing to budget-conscious consumers and professional gamers prioritizing zero latency.

Segmentation by Sales Channel covers Retail and Online. The Online segment is set to dominate, with a CAGR of 13%, fueled by e-commerce growth and wider product accessibility. The Retail segment is expected to grow at a CAGR of 7%, driven by brick-and-mortar electronics stores and specialized gaming outlets that offer a tactile purchasing experience.

Key Drivers of Middle East and Africa Gaming Headsets Market Growth

The MEA gaming headsets market is propelled by several key drivers. The rapid expansion of the youth demographic, coupled with increasing disposable incomes in countries like the UAE, Saudi Arabia, and Egypt, fuels consumer spending on gaming peripherals. The burgeoning esports scene across the region, with growing prize pools and fan bases, directly stimulates demand for high-performance gaming headsets. Furthermore, the widespread adoption of smartphones and improved mobile internet connectivity are driving the growth of mobile gaming, creating a significant market for versatile and compatible gaming headsets. Government initiatives promoting technology and digital entertainment also play a crucial role in fostering market growth.

Challenges in the Middle East and Africa Gaming Headsets Market Sector

Despite robust growth, the MEA gaming headsets market faces certain challenges. Economic volatility and currency fluctuations in some nations can impact consumer purchasing power and the affordability of premium gaming peripherals. High import duties and taxes on electronics in certain countries can also increase the final cost for consumers, acting as a barrier to entry. Supply chain disruptions, particularly in logistics and distribution across the vast and diverse MEA region, can lead to stockouts and delivery delays. Intense competition from both established global brands and emerging local manufacturers also puts pressure on profit margins.

Leading Players in the Middle East and Africa Gaming Headsets Market Market

- Razer Inc

- SteelSeries

- Corsair Gaming Inc

- Logitech International SA

- HyperX (Kingston Technology Company Inc)

- Turtle Beach Corporation

- ASTRO Gaming (Logitech)

- Sony Interactive Entertainment Inc

- Cooler Master Technology Inc

Key Developments in Middle East and Africa Gaming Headsets Market Sector

- August 2024: In UAE, Sony introduced a partnership with the National Football League, which names Sony as an official technology partner of the NFL, along with the new official headphones of the NFL. The NFL and Sony will work closely to create this new headset supporting coach-to-coach communication on the field. These will be powered by Verizon Business’ Managed Private Wireless Solution running on Verizon’s reliable 5G network.

- October 2023: EKSA, a key gaming headphones and accessories manufacturer, introduced its participation in GITEX 2023, the key tech event held in Dubai. EKSA has rapidly gained prominence in the gaming industry by prioritizing high-quality products that redefine the gaming experience. Their commitment to excellence encompasses performance, design, comfort, and packaging.

Strategic Middle East and Africa Gaming Headsets Market Market Outlook

- August 2024: In UAE, Sony introduced a partnership with the National Football League, which names Sony as an official technology partner of the NFL, along with the new official headphones of the NFL. The NFL and Sony will work closely to create this new headset supporting coach-to-coach communication on the field. These will be powered by Verizon Business’ Managed Private Wireless Solution running on Verizon’s reliable 5G network.

- October 2023: EKSA, a key gaming headphones and accessories manufacturer, introduced its participation in GITEX 2023, the key tech event held in Dubai. EKSA has rapidly gained prominence in the gaming industry by prioritizing high-quality products that redefine the gaming experience. Their commitment to excellence encompasses performance, design, comfort, and packaging.

Strategic Middle East and Africa Gaming Headsets Market Market Outlook

The strategic outlook for the Middle East and Africa gaming headsets market is exceptionally promising, characterized by accelerating growth and expanding opportunities. The increasing investment in e-sports infrastructure and professional gaming leagues across the region will continue to be a significant growth accelerator, driving demand for high-fidelity audio solutions. Furthermore, the ongoing digital transformation initiatives in various MEA countries are fostering a more tech-savvy consumer base, receptive to advanced gaming peripherals. Strategic partnerships between gaming hardware manufacturers and local telecommunication companies or e-commerce giants can unlock new distribution channels and customer engagement avenues. The focus on product localization, offering headsets tailored to regional preferences and price sensitivities, will be a key differentiator for sustained success.

Middle East and Africa Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

Middle East and Africa Gaming Headsets Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms

- 3.2.2 such as E-sports Betting and Fantasy Sites

- 3.3. Market Restrains

- 3.3.1 Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms

- 3.3.2 such as E-sports Betting and Fantasy Sites

- 3.4. Market Trends

- 3.4.1. Retail Sales Channel Augment the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Razer Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SteelSeries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corsair Gaming Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Logitech International SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HyperX (Kingston Technology Company Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Turtle Beach Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ASTRO Gaming (Logitech)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sony Interactive Entertainment Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cooler Master Technology Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Razer Inc

List of Figures

- Figure 1: Middle East and Africa Gaming Headsets Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Gaming Headsets Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 5: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Connectivity 2019 & 2032

- Table 6: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Connectivity 2019 & 2032

- Table 7: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 9: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 12: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 13: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Connectivity 2019 & 2032

- Table 14: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Connectivity 2019 & 2032

- Table 15: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 17: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Country 2019 & 2032

- Table 19: Saudi Arabia Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Saudi Arabia Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: United Arab Emirates Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Arab Emirates Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Israel Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Israel Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Qatar Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Qatar Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Kuwait Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Kuwait Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Oman Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Oman Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 31: Bahrain Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Bahrain Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 33: Jordan Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Jordan Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 35: Lebanon Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Lebanon Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Gaming Headsets Market?

The projected CAGR is approximately 13.64%.

2. Which companies are prominent players in the Middle East and Africa Gaming Headsets Market?

Key companies in the market include Razer Inc, SteelSeries, Corsair Gaming Inc, Logitech International SA, HyperX (Kingston Technology Company Inc ), Turtle Beach Corporation, ASTRO Gaming (Logitech), Sony Interactive Entertainment Inc, Cooler Master Technology Inc.

3. What are the main segments of the Middle East and Africa Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms. such as E-sports Betting and Fantasy Sites.

6. What are the notable trends driving market growth?

Retail Sales Channel Augment the Market's Growth.

7. Are there any restraints impacting market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms. such as E-sports Betting and Fantasy Sites.

8. Can you provide examples of recent developments in the market?

August 2024 - In UAE, Sony introduced a partnership with the National Football League, which names Sony as an official technology partner of the NFL, along with the new official headphones of the NFL. The NFL and Sony will work closely to create this new headset supporting coach-to-coach communication on the field. These will be powered by Verizon Business’ Managed Private Wireless Solution running on Verizon’s reliable 5G network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence