Key Insights

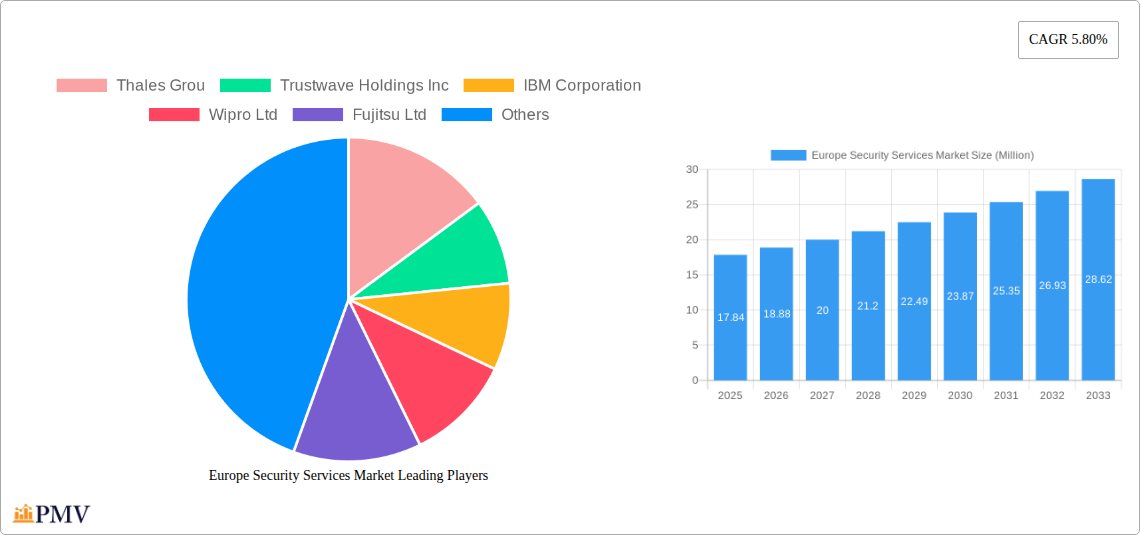

The European Security Services Market is poised for substantial growth, currently valued at an estimated $17.84 million and projected to expand at a Compound Annual Growth Rate (CAGR) of 5.80% through 2033. This robust expansion is fueled by a confluence of escalating cybersecurity threats, increasingly stringent regulatory landscapes, and a growing awareness among businesses of the critical need to protect sensitive data and operations. As organizations across all sectors grapple with sophisticated cyberattacks, the demand for comprehensive security solutions, from managed and professional services to specialized threat intelligence, is accelerating. The shift towards cloud-based deployments is a significant trend, offering scalability and flexibility that on-premise solutions often struggle to match, thus driving adoption of cloud-native security services.

Europe Security Services Market Market Size (In Million)

Within Europe, key markets like the United Kingdom, Germany, and France are leading the charge in adopting advanced security services, driven by their large industrial bases, significant financial sectors, and proactive government initiatives to bolster national cybersecurity. The IT and Infrastructure, Government, and Banking sectors are particularly prominent adopters, reflecting their high-value assets and critical operational needs. While the market benefits from these strong drivers, it also faces certain restraints, such as the ongoing shortage of skilled cybersecurity professionals and the significant initial investment required for advanced security solutions. Nevertheless, the persistent and evolving nature of cyber threats ensures a sustained demand for innovative and reliable security services, making the European market a dynamic and crucial landscape for security providers.

Europe Security Services Market Company Market Share

Here is the SEO-optimized, detailed report description for the Europe Security Services Market, crafted without placeholders and ready for immediate use:

This in-depth market report provides a granular analysis of the Europe Security Services Market, offering critical insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025–2033, this comprehensive study delves into market structure, competitive dynamics, emerging trends, dominant segments, product innovations, key growth drivers, inherent challenges, leading players, and pivotal developments. The Europe Security Services Market is experiencing robust growth fueled by escalating cybersecurity threats, stringent data privacy regulations, and the increasing adoption of digital transformation across various sectors. This report is essential for businesses seeking to understand and capitalize on the evolving European cybersecurity landscape.

Europe Security Services Market Market Structure & Competitive Dynamics

The Europe Security Services Market is characterized by a moderately concentrated structure, with several large global players and a growing number of specialized regional providers vying for market share. Innovation plays a crucial role, driven by the constant evolution of cyber threats and the need for advanced managed security services, professional security services, and threat intelligence security services. Regulatory frameworks, particularly GDPR and upcoming AI regulations, significantly influence market strategies, pushing for enhanced compliance and data protection. Product substitutes are limited for core security functions, but technology convergence and integration of various security solutions present evolving competitive landscapes. End-user trends indicate a strong demand for cloud-based security solutions and integrated platforms that offer comprehensive protection. Merger and acquisition (M&A) activities are observed as companies seek to expand their service portfolios, geographic reach, and technological capabilities. For instance, significant M&A deals in the historical period have consolidated market power and fostered innovation. The market share distribution among key players like Thales Group, Trustwave Holdings Inc, IBM Corporation, and Palo Alto Networks is constantly shifting due to strategic investments and technological advancements.

Europe Security Services Market Industry Trends & Insights

The Europe Security Services Market is on an upward trajectory, projected to witness a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is primarily driven by the escalating sophistication of cyberattacks, the growing volume of data generated, and the increasing awareness of the financial and reputational damage that security breaches can inflict. The shift towards remote work and hybrid models further amplifies the need for robust and flexible cloud security solutions and managed security services. Technological advancements in areas like Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing threat detection and response, leading to the development of more proactive and intelligent security platforms. Consumer preferences are increasingly leaning towards integrated security solutions that offer end-to-end protection, from threat intelligence to incident response. The demand for consulting services to navigate complex regulatory environments and implement effective security strategies is also on the rise. Key industry players are investing heavily in R&D to stay ahead of emerging threats and offer cutting-edge solutions. For example, the increasing adoption of DevSecOps practices is integrating security into the software development lifecycle, further boosting the demand for specialized security services. The market penetration of advanced threat intelligence security services is expanding as organizations recognize the importance of proactive threat hunting and predictive analytics.

Dominant Markets & Segments in Europe Security Services Market

Within the Europe Security Services Market, Managed Security Services (MSS) consistently emerges as the dominant segment, driven by the growing need for organizations to outsource their cybersecurity operations to specialized providers. This segment's dominance is fueled by the complexity of modern threat landscapes and the shortage of in-house cybersecurity expertise. The Cloud deployment mode is rapidly gaining prominence over On-premise solutions, reflecting the broader digital transformation trends across industries. Cloud-based security offers scalability, flexibility, and cost-effectiveness, making it an attractive option for businesses of all sizes.

Service Type Dominance:

- Managed Security Services: Accounted for an estimated XX% of the market revenue in 2025. Driven by the need for 24/7 monitoring, threat detection, and incident response.

- Professional Security Services: Expected to grow at a CAGR of XX% due to demand for specialized services like penetration testing and vulnerability assessments.

- Consulting Services: Crucial for regulatory compliance (GDPR, NIS2 Directive) and strategic security planning.

- Threat Intelligence Security Services: Gaining traction as organizations adopt proactive security postures.

Mode of Deployment Dominance:

- Cloud: Projected to capture over XX% of the market by 2033. Enabled by the ease of integration and scalability of cloud platforms.

- On-premise: Still relevant for highly regulated industries or organizations with specific data sovereignty concerns.

End-user Industry Dominance:

- IT and Infrastructure: A leading adopter of security services due to the inherent nature of digital assets.

- Banking: Highly targeted by cybercriminals, driving significant investment in advanced security solutions.

- Government: Increasing adoption of sophisticated security measures to protect critical national infrastructure and citizen data.

- Healthcare: Experiencing a rise in data breaches, leading to increased demand for robust security services.

- Industrial: The Industrial Internet of Things (IIoT) expansion necessitates enhanced cybersecurity.

- Transportation and Logistics: Growing reliance on digital systems makes this sector a key growth area.

Europe Security Services Market Product Innovations

The Europe Security Services Market is witnessing a wave of innovation focused on enhancing proactive defense and automated response. Companies are integrating AI and ML into their offerings to deliver more intelligent threat detection and predictive analytics. Innovations include the development of advanced platforms for vulnerability management, automated penetration testing, and real-time threat intelligence feeds. The push towards Zero Trust architectures and the emergence of Extended Detection and Response (XDR) solutions are key trends, offering a unified approach to security operations. These advancements provide competitive advantages by enabling faster incident response, reduced false positives, and a more comprehensive understanding of an organization's security posture.

Report Segmentation & Scope

This report segments the Europe Security Services Market based on Service Type, including Managed Security Services, Professional Security Services, Consulting Services, and Threat Intelligence Security Services. The Mode of Deployment is analyzed across On-premise and Cloud solutions. Furthermore, the market is examined by End-user Industry, encompassing IT and Infrastructure, Government, Industrial, Healthcare, Transportation and Logistics, Banking, and Other End-User Industries. Each segment is analyzed for its market size, growth projections, and competitive dynamics, providing a holistic view of the market landscape and identifying key opportunities for growth and investment within the forecast period.

Key Drivers of Europe Security Services Market Growth

Several factors are propelling the growth of the Europe Security Services Market. The escalating frequency and sophistication of cyber threats, including ransomware, phishing, and Advanced Persistent Threats (APTs), are primary drivers. Stringent regulatory mandates like GDPR and NIS2 Directive are compelling organizations to invest in comprehensive security measures to ensure compliance and avoid hefty penalties. The accelerating pace of digital transformation, the widespread adoption of cloud computing, and the proliferation of IoT devices expand the attack surface, necessitating advanced cybersecurity solutions. Furthermore, the increasing awareness among businesses regarding the potential financial and reputational damages of data breaches drives proactive investment in security services.

Challenges in the Europe Security Services Market Sector

Despite robust growth, the Europe Security Services Market faces several challenges. The persistent shortage of skilled cybersecurity professionals creates a talent gap, hindering organizations' ability to implement and manage complex security solutions effectively. Evolving regulatory landscapes, while driving investment, also present compliance complexities for businesses, especially for SMEs. The increasing cost of advanced security technologies and services can be a barrier for smaller organizations. Moreover, the fragmented nature of the threat landscape and the constant need for continuous adaptation to new attack vectors demand ongoing investment and agility from service providers and their clients.

Leading Players in the Europe Security Services Market Market

- Thales Group

- Trustwave Holdings Inc

- IBM Corporation

- Wipro Ltd

- Fujitsu Ltd

- Allied Universal

- Broadcom Inc

- Palo Alto Networks

- Digital Pathways Ltd

- G4S Limited

- SecurityHQ

- Cybaverse Ltd

- Fortra LLC

- Securitas Inc

Key Developments in Europe Security Services Market Sector

- August 2023: Fortra announced new integrations to its offensive security solutions. These integrations streamline the ability to manage vulnerabilities, conduct penetration testing, and conduct red teaming. By working together, the solutions leverage the same tactics threat actors employ to detect and exploit vulnerabilities in an organization's security posture. This proactive security strategy allows customers to identify and remediate vulnerabilities before they are used. The layered approach unifies the capabilities of each solution for a more comprehensive security evaluation, testing, and control.

- June 2023: Thales Group announced a new data security platform as a service that allows businesses to quickly deploy and scale critical management and data security solutions without needing hardware or upfront investment. CipherTrust's advanced service, Cloud Key Management, enables customers to centrally manage and control the encrypted keys securely across a wide range of public clouds and software-as-a-service environments. Enhanced visibility across multiple cloud environments helps organizations increase productivity and meet data protection requirements, including those related to digital sovereignty.

Strategic Europe Security Services Market Market Outlook

The strategic outlook for the Europe Security Services Market is highly positive, driven by increasing cybersecurity investments and the continuous innovation in security technologies. The market is poised for significant growth as organizations prioritize robust defense mechanisms against evolving cyber threats. The demand for integrated, intelligent, and cloud-native security solutions will continue to shape market strategies. Opportunities lie in catering to the specific needs of various end-user industries and in providing specialized services that address emerging risks, such as AI-driven attacks and supply chain vulnerabilities. Strategic collaborations and partnerships are expected to play a crucial role in expanding market reach and enhancing service offerings, ensuring sustained growth and a more secure digital future for Europe.

Europe Security Services Market Segmentation

-

1. Service Type

- 1.1. Managed Security Services

- 1.2. Professional Security Services

- 1.3. Consulting Services

- 1.4. Threat Intelligence Security Services

-

2. Mode of Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. IT and Infrastructure

- 3.2. Government

- 3.3. Industrial

- 3.4. Healthcare

- 3.5. Transportation and Logistics

- 3.6. Banking

- 3.7. Other End-User Industries

Europe Security Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Security Services Market Regional Market Share

Geographic Coverage of Europe Security Services Market

Europe Security Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Proliferation of Internet of Things (IoT) Devices; The Integration of Artificial Intelligence (AI) and Automation in Security Services; Increasing Investments by Organizations to Protect Against Country-sponsored Attacks

- 3.3. Market Restrains

- 3.3.1 Moderation

- 3.3.2 Privacy

- 3.3.3 accessibility & regulatory challenges

- 3.4. Market Trends

- 3.4.1. Cloud Adoption to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Security Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Managed Security Services

- 5.1.2. Professional Security Services

- 5.1.3. Consulting Services

- 5.1.4. Threat Intelligence Security Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Infrastructure

- 5.3.2. Government

- 5.3.3. Industrial

- 5.3.4. Healthcare

- 5.3.5. Transportation and Logistics

- 5.3.6. Banking

- 5.3.7. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Thales Grou

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trustwave Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wipro Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fujitsu Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Allied Universal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Broadcom Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Palo Alto Networks

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Digital Pathways Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 G4S Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SecurityHQ

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Cybaverse Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Fortra LLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Securitas Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Thales Grou

List of Figures

- Figure 1: Europe Security Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Security Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Security Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Europe Security Services Market Revenue Million Forecast, by Mode of Deployment 2020 & 2033

- Table 3: Europe Security Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Security Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Security Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Europe Security Services Market Revenue Million Forecast, by Mode of Deployment 2020 & 2033

- Table 7: Europe Security Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe Security Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Security Services Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Europe Security Services Market?

Key companies in the market include Thales Grou, Trustwave Holdings Inc, IBM Corporation, Wipro Ltd, Fujitsu Ltd, Allied Universal, Broadcom Inc, Palo Alto Networks, Digital Pathways Ltd, G4S Limited, SecurityHQ, Cybaverse Ltd, Fortra LLC, Securitas Inc.

3. What are the main segments of the Europe Security Services Market?

The market segments include Service Type, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.84 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Proliferation of Internet of Things (IoT) Devices; The Integration of Artificial Intelligence (AI) and Automation in Security Services; Increasing Investments by Organizations to Protect Against Country-sponsored Attacks.

6. What are the notable trends driving market growth?

Cloud Adoption to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Moderation. Privacy. accessibility & regulatory challenges.

8. Can you provide examples of recent developments in the market?

August 2023: Fortra announced new integrations to its offensive security solutions. These integrations streamline the ability to manage vulnerabilities, conduct penetration testing, and conduct red teaming. By working together, the solutions leverage the same tactics threat actors employ to detect and exploit vulnerabilities in an organization's security posture. This proactive security strategy allows customers to identify and remediate vulnerabilities before they are used. The layered approach unifies the capabilities of each solution for a more comprehensive security evaluation, testing, and control.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Security Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Security Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Security Services Market?

To stay informed about further developments, trends, and reports in the Europe Security Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence