Key Insights

The Middle East and Africa wireless sensors market is projected for substantial growth, driven by technological innovation and widespread industry adoption. With an estimated market size of 27.18 billion in 2025, the region anticipates a robust Compound Annual Growth Rate (CAGR) of 20.6% from 2025 to 2033. This expansion is fueled by increased investments in smart infrastructure, the rise of IoT solutions, and the demand for operational efficiency in sectors such as automotive, healthcare, and energy. The need for advanced sensing technologies, including pressure, temperature, chemical, gas, and proximity sensors, is growing as businesses utilize real-time data for better decision-making and predictive maintenance. Digitalization initiatives by governments and private enterprises across Saudi Arabia, the UAE, and Israel are further promoting wireless sensor deployment.

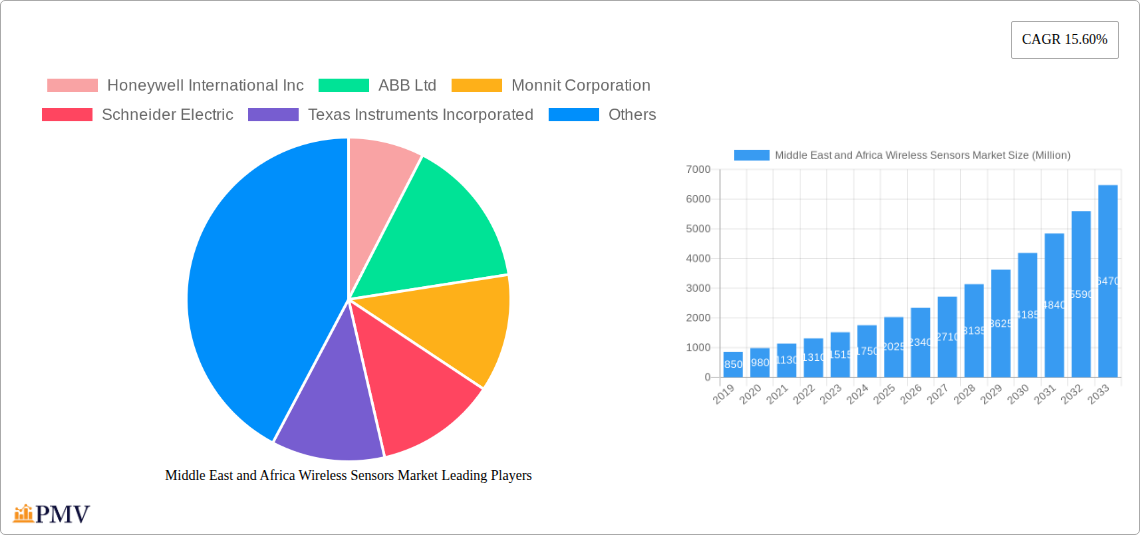

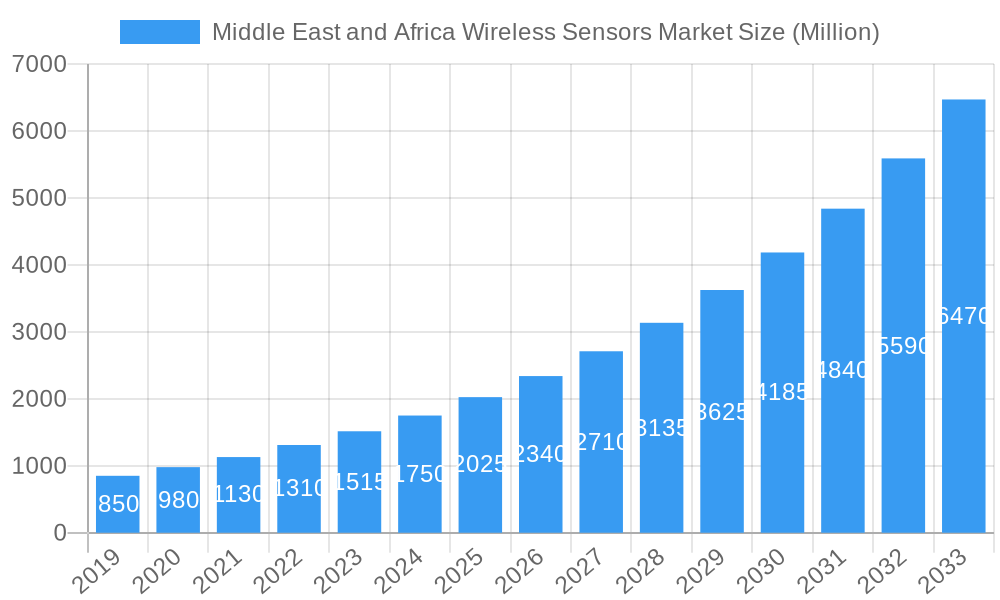

Middle East and Africa Wireless Sensors Market Market Size (In Billion)

Key trends amplifying market growth include sensor miniaturization, advancements in wireless communication protocols like Wi-Fi, Bluetooth, and LoRaWAN, and the integration of AI and machine learning for data analytics. These innovations enhance sensor affordability, versatility, and ease of implementation, expanding their application scope. While initial deployment costs in some developing economies and data security concerns present challenges, the advantages of automation, remote monitoring, and improved safety are expected to drive market adoption. Leading companies are actively innovating and expanding to secure a significant share of this dynamic market.

Middle East and Africa Wireless Sensors Market Company Market Share

This comprehensive report offers strategic analysis and crucial insights into the Middle East and Africa Wireless Sensors Market. It covers the period from 2019 to 2033, with 2025 as the base and estimated year, detailing market structure, key trends, dominant segments, product innovations, and competitive landscape.

Middle East and Africa Wireless Sensors Market Market Structure & Competitive Dynamics

The Middle East and Africa Wireless Sensors Market exhibits a moderately concentrated structure, with key players investing heavily in research and development to drive innovation. The innovation ecosystem is characterized by the increasing adoption of IoT and AI technologies, fostering the development of advanced wireless sensor solutions. Regulatory frameworks are evolving, with governments in the region prioritizing industrial automation and smart infrastructure, which indirectly supports the growth of the wireless sensors market. Product substitutes, while present, often lack the real-time data, scalability, and flexibility offered by wireless sensor networks. End-user trends are strongly influenced by digital transformation initiatives across industries such as Healthcare, Energy and Power, and Automotive. Mergers and acquisitions (M&A) are expected to play a significant role in consolidating the market, with strategic alliances aimed at expanding product portfolios and geographic reach. Market share data and M&A deal values are meticulously analyzed to provide a clear picture of the competitive landscape. For instance, the estimated M&A deal value within this sector is projected to reach USD 5,800 Million by 2028, indicating significant consolidation and investment activity. The market share of leading players like Honeywell International Inc and Siemens AG is anticipated to grow by approximately 15-20% in the forecast period, driven by their robust product offerings and strategic partnerships.

Middle East and Africa Wireless Sensors Market Industry Trends & Insights

The Middle East and Africa Wireless Sensors Market is poised for substantial growth, driven by a confluence of technological advancements, increasing industrialization, and a growing demand for real-time data monitoring. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033, reaching an estimated market size of USD 4,500 Million by 2033. Technological disruptions are at the forefront, with the integration of the Internet of Things (IoT), Artificial Intelligence (AI), and machine learning significantly enhancing the capabilities of wireless sensors. These technologies enable predictive maintenance, optimize operational efficiency, and improve safety across various sectors. Consumer preferences are shifting towards smarter, more connected solutions that offer greater visibility and control. The Energy and Power sector, driven by the need for efficient grid management and renewable energy monitoring, is a significant growth driver. Similarly, the Healthcare industry is increasingly adopting wireless sensors for remote patient monitoring and pharmaceutical cold chain management, exemplified by Swift Sensors' vaccine storage monitoring system. The Automotive industry is leveraging wireless sensors for advanced driver-assistance systems (ADAS) and in-vehicle diagnostics. The penetration of wireless sensor technology is expected to reach 35% within industrial automation by 2028. The competitive dynamics are characterized by intense innovation, with companies focusing on developing smaller, more energy-efficient, and highly accurate sensors. This includes advancements in battery life, data transmission capabilities, and integration with cloud-based platforms. Furthermore, government initiatives promoting smart cities and digital infrastructure across countries like the UAE and Saudi Arabia are creating fertile ground for the widespread adoption of wireless sensors. The demand for specialized sensors, such as Chemical and Gas Sensors for environmental monitoring and industrial safety, is also on the rise. The report delves into these trends, providing actionable insights into market penetration, key growth factors, and the evolving competitive landscape.

Dominant Markets & Segments in Middle East and Africa Wireless Sensors Market

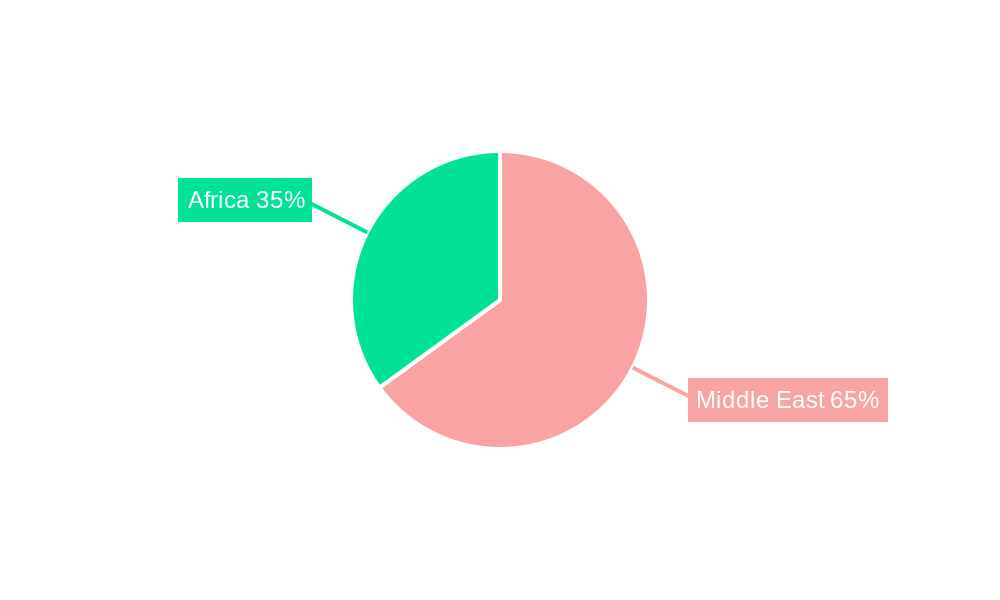

The Middle East and Africa Wireless Sensors Market is witnessing significant dominance from specific regions and industry segments, driven by robust economic development, strategic investments, and burgeoning industrial sectors.

Leading Region: The Middle East, particularly countries like the UAE and Saudi Arabia, is emerging as the dominant region. This leadership is attributed to:

- Government Initiatives: Proactive government investments in smart city projects, industrial diversification, and digital transformation programs create a high demand for advanced sensor technologies.

- Infrastructure Development: Extensive infrastructure projects in sectors like energy, transportation, and construction necessitate sophisticated monitoring and control systems, propelling wireless sensor adoption.

- Oil and Gas Sector: The region's strong reliance on the oil and gas industry drives the adoption of wireless sensors for pipeline monitoring, process control, and safety applications. Estimated investment in this sector for sensor upgrades is USD 1,200 Million annually.

Dominant Segments by Type:

- Temperature Sensors: These are crucial across numerous industries, including Food and Beverage for spoilage prevention, Healthcare for cold chain logistics, and Energy and Power for equipment monitoring. Their widespread application and relatively mature technology contribute to their market leadership. The market share for temperature sensors is estimated to be 25% of the total wireless sensors market.

- Pressure Sensors: Essential for monitoring fluid and gas pressures in industrial processes, automotive systems, and aerospace applications. Their reliability and diverse use cases ensure consistent demand.

- Chemical and Gas Sensors: With increasing environmental regulations and safety concerns, these sensors are experiencing rapid growth, particularly in industrial and environmental monitoring applications.

Dominant Segments by End-user Industry:

- Energy and Power: This sector is a primary consumer of wireless sensors, driven by the need for efficient grid management, remote asset monitoring, and the integration of renewable energy sources. The demand from this sector is projected to grow by 15% annually due to large-scale infrastructure projects.

- Automotive: The increasing adoption of intelligent transportation systems, ADAS, and the need for improved vehicle diagnostics are fueling the demand for various wireless sensors in this industry.

- Healthcare: Driven by the demand for remote patient monitoring, smart hospitals, and the stringent requirements of vaccine cold chain management, the healthcare sector is a significant growth area.

The interplay of these factors positions the Middle East and Africa wireless sensors market for sustained expansion. The estimated market size for wireless temperature sensors in MEA is expected to reach USD 750 Million by 2028, while the pressure sensors segment is projected to hit USD 600 Million in the same period.

Middle East and Africa Wireless Sensors Market Product Innovations

Product innovations in the Middle East and Africa Wireless Sensors Market are focused on enhancing sensor accuracy, reducing power consumption, and improving connectivity for seamless data integration. Key trends include the development of miniaturized sensors for niche applications, advanced materials for improved durability in harsh environments, and the integration of AI and edge computing for on-device data processing. These innovations aim to provide real-time, actionable insights for predictive maintenance, operational efficiency, and enhanced safety across industries like Automotive, Healthcare, and Energy. The competitive advantage lies in offering end-to-end solutions that combine hardware, software, and robust connectivity.

Report Segmentation & Scope

This report provides a comprehensive analysis of the Middle East and Africa Wireless Sensors Market, segmented by Type and End-user Industry.

- By Type: The market is analyzed across Pressure Sensor, Temperature Sensor, Chemical and Gas Sensor, Position and Proximity Sensor, and Other Types. Each segment's market size, growth projections, and competitive dynamics are detailed. For instance, the Temperature Sensor segment is projected to reach USD 750 Million by 2028, driven by its widespread application.

- By End-user Industry: The report covers Automotive, Healthcare, Aerospace and Defense, Energy and Power, Food and Beverage, and Other End-user Industries. The Energy and Power sector is expected to dominate, with growth projections around 15% annually.

Key Drivers of Middle East and Africa Wireless Sensors Market Growth

The growth of the Middle East and Africa Wireless Sensors Market is primarily propelled by several key factors. The increasing adoption of the Internet of Things (IoT) across industries, driven by the need for real-time data and automation, is a significant catalyst. Government initiatives promoting smart infrastructure, industrial digitization, and smart city development in countries like the UAE and Saudi Arabia are creating substantial demand. The booming Energy and Power sector, with its focus on efficient resource management and renewable energy integration, is a major consumer of wireless sensors for monitoring and control. Furthermore, advancements in sensor technology, leading to more accurate, energy-efficient, and cost-effective solutions, are expanding their applicability. The estimated annual investment in industrial IoT solutions in MEA is projected to reach USD 8,500 Million by 2027.

Challenges in the Middle East and Africa Wireless Sensors Market Sector

Despite the robust growth prospects, the Middle East and Africa Wireless Sensors Market faces several challenges. Regulatory inconsistencies and varying standards across different countries can hinder seamless market integration and adoption. The significant upfront investment required for deploying comprehensive wireless sensor networks can be a barrier for small and medium-sized enterprises. Cybersecurity concerns related to data privacy and system integrity of connected devices are also a growing apprehension for end-users. Additionally, the availability of skilled labor for installation, maintenance, and data analysis of these advanced systems can be limited in certain regions. The supply chain for specialized components can also be a challenge, potentially leading to project delays and increased costs.

Leading Players in the Middle East and Africa Wireless Sensors Market Market

- Honeywell International Inc

- ABB Ltd

- Monnit Corporation

- Schneider Electric

- Texas Instruments Incorporated

- Pasco Scientific

- Emerson Electric Co

- Siemens AG

- Phoenix Sensors LLC

Key Developments in Middle East and Africa Wireless Sensors Market Sector

- January 2021 - Swift Sensors, a provider of industrial IoT sensor solutions, announced the launch of its secure wireless vaccine storage unit monitoring and alert system to enable medical facilities and pharmacies to monitor COVID-19 vaccine storage temperatures remotely, automate data logging, and respond quickly in case of an equipment problem or power failure.

- June 2020 - ABB announced a wireless condition monitoring solution for rotating equipment on an industrial scale. The use of wireless sensors reduces the expense and complexity of sensor installation, wiring, and connection. Customers with large sites, such as automotive manufacturing plants, processing plants, or airport baggage handling systems, can now collect valuable health and performance data from rotating equipment using ABB ability smart sensor technology and Aruba Wi-Fi infrastructure.

Strategic Middle East and Africa Wireless Sensors Market Market Outlook

The strategic outlook for the Middle East and Africa Wireless Sensors Market is highly positive, fueled by ongoing digital transformation initiatives and significant investments in smart technologies. The increasing adoption of IoT and AI is creating new opportunities for enhanced efficiency, predictive maintenance, and improved safety across diverse industries. Key growth accelerators include government support for industrial automation, the expansion of the Energy and Power sector, and the rising demand for sophisticated solutions in Healthcare and Automotive. Strategic opportunities lie in developing integrated, cloud-based sensor solutions, focusing on niche applications, and catering to the unique requirements of emerging markets within the region. The market is expected to witness increased collaboration between technology providers and end-users to drive innovation and overcome adoption challenges.

Middle East and Africa Wireless Sensors Market Segmentation

-

1. Type

- 1.1. Pressure Sensor

- 1.2. Temperature Sensor

- 1.3. Chemical and Gas Sensor

- 1.4. Position and Proximity Sensor

- 1.5. Other Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Healthcare

- 2.3. Aerospace and Defense

- 2.4. Energy and Power

- 2.5. Food and Beverage

- 2.6. Other End-user Industries

Middle East and Africa Wireless Sensors Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Wireless Sensors Market Regional Market Share

Geographic Coverage of Middle East and Africa Wireless Sensors Market

Middle East and Africa Wireless Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation)

- 3.3. Market Restrains

- 3.3.1. False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems

- 3.4. Market Trends

- 3.4.1. Position and proximity sensor is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Wireless Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure Sensor

- 5.1.2. Temperature Sensor

- 5.1.3. Chemical and Gas Sensor

- 5.1.4. Position and Proximity Sensor

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Healthcare

- 5.2.3. Aerospace and Defense

- 5.2.4. Energy and Power

- 5.2.5. Food and Beverage

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Monnit Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider Electric

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Texas Instruments Incorporated

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pasco Scientific

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Emerson Electric Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siemens AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Phoenix Sensors LLC*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Middle East and Africa Wireless Sensors Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Wireless Sensors Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Wireless Sensors Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa Wireless Sensors Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Middle East and Africa Wireless Sensors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Wireless Sensors Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Middle East and Africa Wireless Sensors Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Middle East and Africa Wireless Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Wireless Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Wireless Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Wireless Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Wireless Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Wireless Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Wireless Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Wireless Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Wireless Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Wireless Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Wireless Sensors Market?

The projected CAGR is approximately 20.6%.

2. Which companies are prominent players in the Middle East and Africa Wireless Sensors Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Monnit Corporation, Schneider Electric, Texas Instruments Incorporated, Pasco Scientific, Emerson Electric Co, Siemens AG, Phoenix Sensors LLC*List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Wireless Sensors Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.18 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation).

6. What are the notable trends driving market growth?

Position and proximity sensor is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems.

8. Can you provide examples of recent developments in the market?

January 2021 - Swift Sensors, a provider of industrial IoT sensor solutions, announced the launch of its secure wireless vaccine storage unit monitoring and alert system to enable medical facilities and pharmacies to monitor COVID-19 vaccine storage temperatures remotely, automate data logging, and respond quickly in case of an equipment problem or power failure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Wireless Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Wireless Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Wireless Sensors Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Wireless Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence