Key Insights

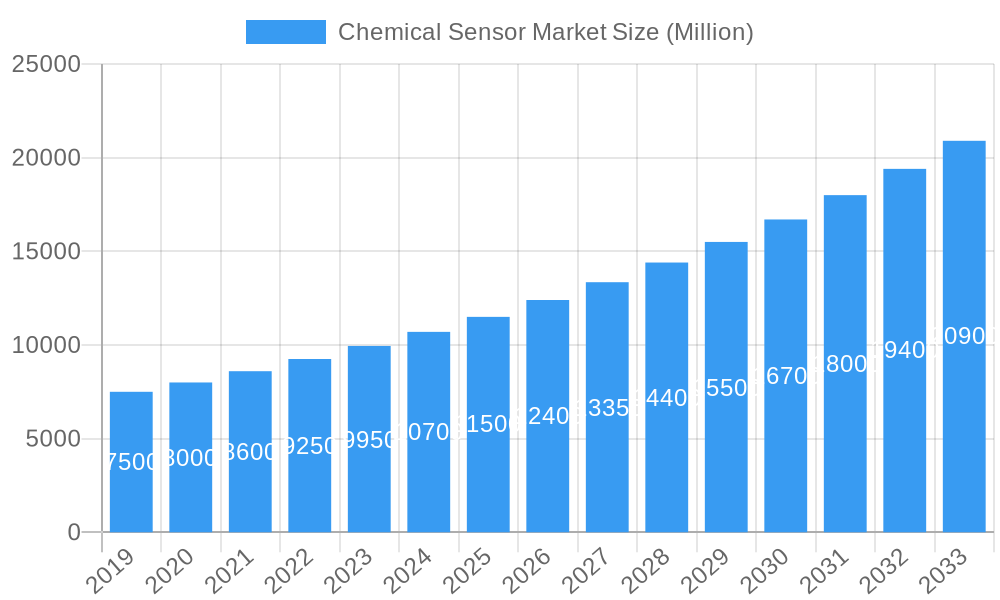

The global Chemical Sensor Market is poised for substantial expansion, projected to reach a significant valuation of approximately $12,000 million by 2025, and continuing its upward trajectory with a Compound Annual Growth Rate (CAGR) of 7.51% through 2033. This robust growth is primarily fueled by escalating demand across diverse end-user applications, including industrial manufacturing, healthcare, environmental monitoring, and the burgeoning oil and gas sector. Industries are increasingly relying on chemical sensors for critical functions such as process optimization, safety monitoring, quality control, and environmental compliance. The rising need for real-time data analytics and the development of sophisticated, miniaturized sensors with enhanced sensitivity and selectivity are key technological drivers propelling market advancement. Furthermore, stringent regulatory frameworks mandating the detection and control of hazardous substances in industrial and environmental settings are significantly contributing to market adoption.

Chemical Sensor Market Market Size (In Billion)

The market is characterized by a dynamic competitive landscape with prominent players like Honeywell International Inc., ABB Ltd., and Siemens AG innovating across various product types, including electrochemical, optical, and pellister/catalytic bead sensors. While electrochemical and optical sensors are gaining traction due to their high accuracy and versatility, advancements in catalytic bead technology continue to cater to specific industrial needs. Restraints such as high initial investment costs for advanced sensor technologies and the need for specialized calibration and maintenance are being addressed through ongoing research and development focused on cost-effectiveness and user-friendly interfaces. The increasing adoption of IoT and AI in conjunction with chemical sensors is expected to unlock new opportunities, enabling predictive maintenance and intelligent automation, further solidifying the market's growth potential over the forecast period.

Chemical Sensor Market Company Market Share

Chemical Sensor Market: Comprehensive Analysis & Future Outlook (2019–2033)

Report Description:

This in-depth Chemical Sensor Market report provides a definitive analysis of the global chemical sensor market, meticulously dissecting key segments, driving forces, and competitive landscapes. With a comprehensive study period spanning from 2019 to 2033, featuring a base and estimated year of 2025, and a detailed forecast period from 2025 to 2033, this report offers unparalleled insights for stakeholders seeking to understand and capitalize on the evolving chemical sensor industry. The historical period of 2019–2024 provides crucial context for market trajectory. This report leverages high-ranking keywords to ensure maximum search visibility, making it an indispensable resource for industry professionals, investors, and researchers. It delves into critical aspects such as market structure, innovation trends, dominant geographical regions, emerging product types, and diverse end-user applications. Gain actionable intelligence on market concentration, regulatory impacts, product innovation, growth drivers, challenges, and the strategic moves of leading players like Honeywell International Inc, ABB Ltd, Smiths Detection Inc, Denso Corporation, Delphi Automotive PLC, Alpha MOS, MSA Safety Incorporated, Halma plc, Siemens AG, General Electric Co, Yokogawa Electric Corporation, and Pepperl+Fuchs Group. This report is designed for immediate use without any further modification, offering a detailed roadmap for navigating the complex and dynamic chemical sensor market.

Chemical Sensor Market Market Structure & Competitive Dynamics

The chemical sensor market exhibits a moderately concentrated structure, characterized by the presence of both large, established multinational corporations and a growing number of specialized, innovative small and medium-sized enterprises. Key players like Honeywell International Inc., Siemens AG, and General Electric Co. hold significant market share due to their extensive product portfolios, robust distribution networks, and strong brand recognition across diverse end-user applications. However, innovation ecosystems are vibrant, with companies like Alpha MOS driving advancements in specific niches. Regulatory frameworks, particularly those pertaining to environmental monitoring and healthcare diagnostics, play a pivotal role in shaping market entry and product development. The threat of product substitutes, such as laboratory-based analytical instruments, exists but is often mitigated by the portability, real-time sensing capabilities, and cost-effectiveness of chemical sensors. End-user trends, such as the increasing demand for miniaturized and highly sensitive sensors, are compelling manufacturers to invest heavily in research and development. Mergers and acquisitions (M&A) activities, with estimated deal values often in the tens of millions to hundreds of millions of dollars, are strategic moves employed by larger companies to acquire technological expertise, expand their product offerings, or gain access to new markets and customer bases. For instance, the acquisition of specialized sensor technology firms by major industrial automation companies is a recurring theme.

Chemical Sensor Market Industry Trends & Insights

The global chemical sensor market is experiencing robust growth, driven by an increasing emphasis on safety, efficiency, and environmental consciousness across a multitude of sectors. Technological disruptions, particularly in the realm of micro-electromechanical systems (MEMS) and advanced material science, are enabling the development of smaller, more sensitive, and cost-effective chemical sensors. These advancements are crucial for applications ranging from industrial process control and environmental pollution monitoring to sophisticated healthcare diagnostics and homeland security. The market penetration of electrochemical sensors, for example, continues to expand due to their versatility and established reliability. Consumer preferences are shifting towards real-time, on-site detection capabilities, pushing the demand for portable and wearable chemical sensor devices. The competitive dynamics are characterized by a constant race for technological superiority, with companies differentiating themselves through superior accuracy, faster response times, lower power consumption, and enhanced durability. The projected Compound Annual Growth Rate (CAGR) for the chemical sensor market is robust, estimated to be in the range of 7% to 9% over the forecast period. This growth is underpinned by significant investments in research and development, a growing awareness of the importance of gas detection in industrial settings (estimated market value of over $20,000 Million), and the critical need for advanced threat detection in defense and security applications (estimated market value of over $8,000 Million). Furthermore, the burgeoning healthcare sector, with its increasing reliance on point-of-care diagnostics and personalized medicine, represents another substantial growth avenue, estimated to contribute over $6,000 Million to the market by 2033.

Dominant Markets & Segments in Chemical Sensor Market

The Industrial end-user application segment currently dominates the chemical sensor market, driven by extensive adoption in manufacturing, petrochemicals, and process automation. The Oil and Gas industry, a significant sub-segment of the industrial sector, requires continuous monitoring for hazardous gas leaks and process optimization, making it a perpetual strong market, estimated at over $15,000 Million. The Electrochemical product type segment is also a leading force, valued at approximately $18,000 Million, due to its established reliability and wide applicability in detecting various gases and analytes.

Industrial Segment Dominance:

- Key Drivers: Stringent safety regulations, the need for enhanced operational efficiency, predictive maintenance, and automation in manufacturing processes.

- Infrastructure: Robust industrial infrastructure globally, including chemical plants, refineries, and factories, necessitates continuous gas monitoring and process control.

- Economic Policies: Government initiatives promoting industrial growth and workplace safety standards directly fuel the demand for industrial chemical sensors.

- Market Size: Projected to exceed $30,000 Million by 2033.

Electrochemical Product Type Dominance:

- Key Drivers: Versatility in detecting a wide range of gases (e.g., CO, H2S, O2, NO2), high accuracy, long operational life, and relatively lower cost compared to some advanced sensor technologies.

- Technological Advancements: Continuous improvements in material science and electrochemical cell design enhance sensitivity and selectivity.

- Market Size: Estimated to be around $18,000 Million in the base year 2025.

Environmental Monitoring Segment Growth:

- Key Drivers: Increasing global concern over air and water pollution, stringent environmental regulations, and the need for real-time data for policy implementation and public health initiatives.

- Market Size: Projected to grow at a significant CAGR of over 8%, reaching an estimated $12,000 Million by 2033.

Healthcare Segment Potential:

- Key Drivers: Growing demand for point-of-care diagnostics, home healthcare, wearable health monitoring devices, and rapid disease detection.

- Market Size: Expected to witness substantial growth, crossing the $8,000 Million mark by 2033.

Chemical Sensor Market Product Innovations

Recent product innovations in the chemical sensor market are primarily focused on miniaturization, increased sensitivity, improved selectivity, and enhanced connectivity. The development of novel materials, such as graphene and advanced polymers, is enabling the creation of highly responsive sensors for detecting trace amounts of specific chemicals. Optical sensors, particularly those utilizing spectroscopic techniques, are gaining traction for their non-contact measurement capabilities and versatility. For example, Honeywell's Optical Caliper Measurement Sensor for Lithium Ion Battery production exemplifies a targeted innovation addressing critical manufacturing needs. Furthermore, advancements in micro-fabrication techniques are leading to the integration of multiple sensor types onto a single chip, enabling multi-parameter sensing and reducing overall system costs and footprint, thereby providing significant competitive advantages.

Report Segmentation & Scope

This report meticulously segments the chemical sensor market across two primary dimensions: Product Type and End-user Application.

Product Type Segmentation: The market is analyzed based on Electrochemical, Optical, Pellister/Catalytic Bead, and Other Types. Electrochemical sensors represent a substantial market share due to their broad applicability and cost-effectiveness. Optical sensors are gaining prominence for their non-contact capabilities and advanced applications. Pellister/Catalytic Bead sensors remain relevant in specific industrial gas detection scenarios.

End-user Application Segmentation: The report covers Industrial, Healthcare, Environmental Monitoring, Defense, Oil and Gas Industry, and Homeland Security. The Industrial segment, encompassing process control and manufacturing, leads in market size. Environmental Monitoring and Healthcare are experiencing rapid growth driven by regulatory mandates and increasing health awareness, respectively. Defense and Homeland Security applications are crucial, especially for threat detection and public safety, contributing significantly to market value. Growth projections for each segment are detailed, with market sizes and competitive dynamics assessed to provide a holistic view.

Key Drivers of Chemical Sensor Market Growth

The chemical sensor market is propelled by a confluence of technological, economic, and regulatory factors.

- Technological Advancements: Innovations in nanotechnology, MEMS, and advanced materials are leading to the development of more sensitive, selective, and miniaturized sensors.

- Increasing Safety Concerns: Stringent regulations and growing awareness of the health and environmental impacts of hazardous substances are driving demand for gas and chemical detection systems across industries like oil & gas, manufacturing, and healthcare.

- Industrial Automation & IoT Integration: The proliferation of the Industrial Internet of Things (IIoT) necessitates real-time data acquisition, making chemical sensors integral for process optimization, predictive maintenance, and smart manufacturing.

- Growing Healthcare Sector: The demand for point-of-care diagnostics, wearable health monitors, and continuous physiological monitoring fuels the expansion of chemical sensors in medical devices.

Challenges in the Chemical Sensor Market Sector

Despite its robust growth, the chemical sensor market faces several challenges.

- High R&D Costs: Developing novel sensor technologies and materials requires substantial investment in research and development.

- Regulatory Hurdles: Navigating diverse and evolving regulatory frameworks across different regions and applications can be complex and time-consuming for manufacturers.

- Interference and Cross-Sensitivity: Ensuring sensor selectivity in complex environments, where multiple chemicals may be present, remains a technical challenge, impacting accuracy.

- Cost Sensitivity in Certain Applications: While advanced sensors offer superior performance, cost remains a significant barrier to adoption in price-sensitive markets, especially for disposable or low-margin applications.

- Supply Chain Volatility: Dependence on specific raw materials and components can lead to supply chain disruptions and price fluctuations.

Leading Players in the Chemical Sensor Market Market

- Honeywell International Inc.

- ABB Ltd

- Smiths Detection Inc.

- Denso Corporation

- Delphi Automotive PLC

- Alpha MOS

- MSA Safety Incorporated

- Halma plc

- Siemens AG

- General Electric Co.

- Yokogawa Electric Corporation

- Pepperl+Fuchs Group

- AirTest Technologies Inc.

Key Developments in Chemical Sensor Market Sector

- August 2022: Smiths Detection Inc., in collaboration with Block MEMS, LLC, was selected by the Defense Threat Reduction Agency (DTRA) and the Joint Program Executive Office for Chemical, Biological, Radiological, and Nuclear Defense to develop a proximate chemical agent detector (PCAD). This development aims to provide a non-contact, stand-off detection capability for solid and liquid chemical threats, enhancing security and defense applications.

- January 2021: Honeywell introduced an Optical Caliper Measurement Sensor specifically designed to optimize Lithium Ion Battery (LIB) production. This sensor facilitates accurate measurement of electrode material thickness during coating and pressing, a critical factor for optimal battery performance and manufacturing efficiency.

Strategic Chemical Sensor Market Market Outlook

The strategic outlook for the chemical sensor market is exceptionally positive, fueled by the accelerating integration of advanced sensing technologies across virtually every industry. The increasing emphasis on smart cities, Industry 4.0 initiatives, and the burgeoning demand for personalized healthcare will continue to drive innovation and market expansion. Emerging applications in areas like food safety, agriculture, and wearable technology present significant growth accelerators. Furthermore, geopolitical concerns and the increasing need for robust environmental monitoring and public safety will ensure sustained demand for sophisticated chemical detection solutions. Strategic partnerships and M&A activities are expected to continue as companies seek to consolidate market positions, acquire new technologies, and expand their global reach, positioning the chemical sensor market for sustained and dynamic growth in the coming years.

Chemical Sensor Market Segmentation

-

1. Product Type

- 1.1. Electrochemical

- 1.2. Optical

- 1.3. Pellister/Catalytic Bead

- 1.4. Other Types

-

2. End-user Application

- 2.1. Industrial

- 2.2. Healthcare

- 2.3. Environmental Monitoring

- 2.4. Defense

- 2.5. Oil and Gas Industry

- 2.6. Homeland Security

Chemical Sensor Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Chemical Sensor Market Regional Market Share

Geographic Coverage of Chemical Sensor Market

Chemical Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Developments in Miniaturised and Portable Electrochemical Sensors; Increased Adoption from Automotive and Healthcare Sector

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel

- 3.4. Market Trends

- 3.4.1. Medical Industry to Hold the Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Electrochemical

- 5.1.2. Optical

- 5.1.3. Pellister/Catalytic Bead

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Industrial

- 5.2.2. Healthcare

- 5.2.3. Environmental Monitoring

- 5.2.4. Defense

- 5.2.5. Oil and Gas Industry

- 5.2.6. Homeland Security

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Electrochemical

- 6.1.2. Optical

- 6.1.3. Pellister/Catalytic Bead

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Application

- 6.2.1. Industrial

- 6.2.2. Healthcare

- 6.2.3. Environmental Monitoring

- 6.2.4. Defense

- 6.2.5. Oil and Gas Industry

- 6.2.6. Homeland Security

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Electrochemical

- 7.1.2. Optical

- 7.1.3. Pellister/Catalytic Bead

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Application

- 7.2.1. Industrial

- 7.2.2. Healthcare

- 7.2.3. Environmental Monitoring

- 7.2.4. Defense

- 7.2.5. Oil and Gas Industry

- 7.2.6. Homeland Security

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Electrochemical

- 8.1.2. Optical

- 8.1.3. Pellister/Catalytic Bead

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Application

- 8.2.1. Industrial

- 8.2.2. Healthcare

- 8.2.3. Environmental Monitoring

- 8.2.4. Defense

- 8.2.5. Oil and Gas Industry

- 8.2.6. Homeland Security

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Electrochemical

- 9.1.2. Optical

- 9.1.3. Pellister/Catalytic Bead

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Application

- 9.2.1. Industrial

- 9.2.2. Healthcare

- 9.2.3. Environmental Monitoring

- 9.2.4. Defense

- 9.2.5. Oil and Gas Industry

- 9.2.6. Homeland Security

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Chemical Sensor Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Electrochemical

- 10.1.2. Optical

- 10.1.3. Pellister/Catalytic Bead

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Application

- 10.2.1. Industrial

- 10.2.2. Healthcare

- 10.2.3. Environmental Monitoring

- 10.2.4. Defense

- 10.2.5. Oil and Gas Industry

- 10.2.6. Homeland Security

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Smiths Detection Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Denso Corporation*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Delphi Automotive PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alpha MOS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MSA Safety Incorporated

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Halma plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Siemens AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 General Electric Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Yokogawa Electric Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pepperl+Fuchs Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AirTest Technologies Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Chemical Sensor Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Chemical Sensor Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Chemical Sensor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Chemical Sensor Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 5: North America Chemical Sensor Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 6: North America Chemical Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Chemical Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Chemical Sensor Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Chemical Sensor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Chemical Sensor Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 11: Europe Chemical Sensor Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 12: Europe Chemical Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Chemical Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Chemical Sensor Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Chemical Sensor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Chemical Sensor Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 17: Asia Pacific Chemical Sensor Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 18: Asia Pacific Chemical Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Chemical Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Chemical Sensor Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Latin America Chemical Sensor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Latin America Chemical Sensor Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 23: Latin America Chemical Sensor Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 24: Latin America Chemical Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Chemical Sensor Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Chemical Sensor Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Chemical Sensor Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Chemical Sensor Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 29: Middle East and Africa Chemical Sensor Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 30: Middle East and Africa Chemical Sensor Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Chemical Sensor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 3: Global Chemical Sensor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 6: Global Chemical Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 9: Global Chemical Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 12: Global Chemical Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 15: Global Chemical Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Chemical Sensor Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Chemical Sensor Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 18: Global Chemical Sensor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chemical Sensor Market?

The projected CAGR is approximately 7.51%.

2. Which companies are prominent players in the Chemical Sensor Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Smiths Detection Inc, Denso Corporation*List Not Exhaustive, Delphi Automotive PLC, Alpha MOS, MSA Safety Incorporated, Halma plc, Siemens AG, General Electric Co, Yokogawa Electric Corporation, Pepperl+Fuchs Group, AirTest Technologies Inc.

3. What are the main segments of the Chemical Sensor Market?

The market segments include Product Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Developments in Miniaturised and Portable Electrochemical Sensors; Increased Adoption from Automotive and Healthcare Sector.

6. What are the notable trends driving market growth?

Medical Industry to Hold the Major Share.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel.

8. Can you provide examples of recent developments in the market?

August 2022: Smiths Detection Inc., a global leader in threat detection and security technology, along with Block MEMS, LLC (Block), has been selected by the Defense Threat Reduction Agency (DTRA) and the Joint Program Executive Office for Chemical, Biological, Radiological, and Nuclear Defense to develop a proximate chemical agent detector (PCAD) capable of non-contact detection of solid and liquid threats. PCAD will provide a stand-off (non-contact) chemical agent detector that will be able to identify and classify solid and liquid hazards on various surfaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chemical Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chemical Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chemical Sensor Market?

To stay informed about further developments, trends, and reports in the Chemical Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence