Key Insights

The global Shortwave Infrared (SWIR) market is projected to experience substantial growth, reaching an estimated 628.8 million USD by 2025, with a Compound Annual Growth Rate (CAGR) of 11.2%. This expansion is driven by the increasing integration of SWIR technology across key sectors. Significant demand arises from defense and military applications for enhanced surveillance and reconnaissance, alongside healthcare and research utilizing SWIR for advanced medical imaging and diagnostics. The automotive industry's adoption of SWIR for improved perception in autonomous driving and ADAS further fuels market growth.

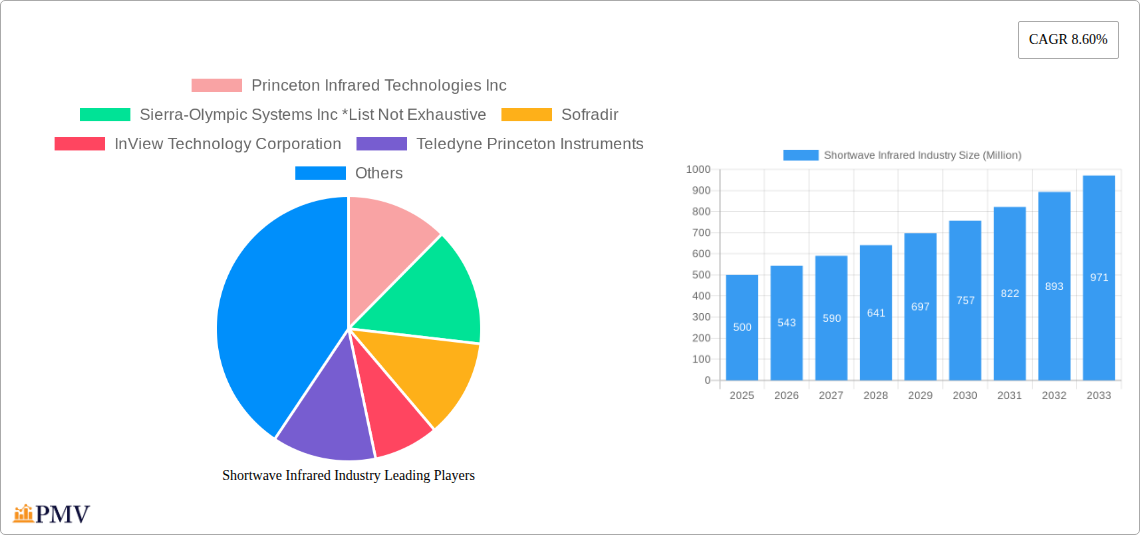

Shortwave Infrared Industry Market Size (In Million)

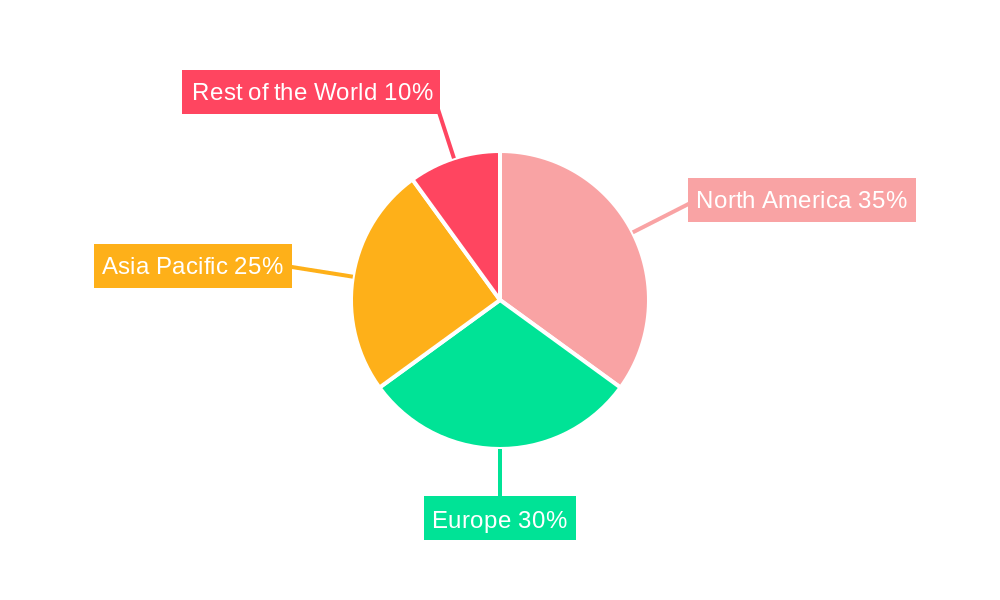

Innovations in detector technology, including more sensitive and cost-effective uncooled and cooled SWIR sensors, are broadening SWIR's application scope. The market is segmented by SWIR Area Cameras and SWIR Linear Cameras. While market expansion is robust, initial system costs and the requirement for specialized expertise represent potential challenges, though ongoing R&D aims to mitigate these. Geographically, North America and Europe lead due to substantial R&D investment and a strong presence of end-user industries. The Asia Pacific region, particularly China and Japan, is emerging as a high-growth area driven by industrialization and government support for advanced technologies.

Shortwave Infrared Industry Company Market Share

This comprehensive market report offers deep insights into the Shortwave Infrared (SWIR) industry from 2019-2024, with 2025 as the base year and a forecast extending to 2033. It details market dynamics, growth catalysts, technological evolution, and competitive analysis. With an anticipated market size exceeding 628.8 million by 2025, driven by demand from Defense and Military, Healthcare & Research, Automotive, and Other industries, understanding this sector is vital. The report provides a granular analysis of uncooled and cooled SWIR technologies, SWIR Area Cameras, and SWIR Linear Cameras.

Shortwave Infrared Industry Market Structure & Competitive Dynamics

The Shortwave Infrared (SWIR) industry exhibits a dynamic market structure characterized by a moderate level of concentration among key players and a robust innovation ecosystem. Companies are actively investing in research and development to enhance sensor sensitivity, spectral range, and resolution, driving technological advancements in both uncooled and cooled SWIR technologies. Regulatory frameworks, particularly in defense and surveillance, influence product development and adoption. While direct product substitutes are limited, advancements in complementary imaging technologies can pose indirect competitive pressures. End-user trends indicate a growing demand for miniaturized, high-performance SWIR cameras across diverse applications. Mergers and acquisitions (M&A) activity has been a strategic tool for market consolidation and technology integration, with deal values reaching significant figures in the Millions. For instance, strategic partnerships and acquisitions are enabling companies to expand their product portfolios and market reach. The competitive landscape is shaped by a blend of established global players and emerging specialized firms, all vying for market share through continuous innovation and strategic collaborations. Market share is distributed across leading companies, with a significant portion held by key players in the defense and industrial automation sectors.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized entrants.

- Innovation Ecosystem: Driven by R&D in sensor technology, miniaturization, and spectral responsiveness.

- Regulatory Frameworks: Significant influence from defense, security, and industrial safety standards.

- Product Substitutes: Limited direct substitutes; indirect competition from other imaging modalities.

- End-User Trends: Increasing adoption in machine vision, inspection, surveillance, and scientific research.

- M&A Activities: Active consolidation to gain technological capabilities and market access, with deal values in the Millions.

Shortwave Infrared Industry Industry Trends & Insights

The Shortwave Infrared (SWIR) industry is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025-2033. This surge is primarily fueled by escalating demand for advanced imaging solutions across a spectrum of critical applications. Technological disruptions are at the forefront, with continuous innovation in InGaAs (Indium Gallium Arsenide) and emerging sensor materials driving improved performance and cost-effectiveness. The miniaturization of SWIR cameras, coupled with enhanced sensitivity and wider spectral coverage, is opening up new market penetration opportunities in portable devices and embedded systems. Consumer preferences, though less direct in industrial applications, are indirectly influenced by the demand for higher resolution, faster frame rates, and lower power consumption in end-user devices. Competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and a focus on niche market segments. For example, the EUR 6 Million funding for Emberion to address VIS-SWIR market needs highlights the significant investment flowing into this sector. Furthermore, the launch of advanced cameras like UCID Vision Labs' Atlas SWIR IP67-rated cameras with Sony SenSWIR sensors underscores the trend towards robust, high-performance industrial imaging solutions. The integration of SWIR capabilities into broader machine vision platforms is a significant trend, enabling more sophisticated automation and quality control processes. The growing awareness of SWIR's capabilities in non-visible light spectrum analysis is also expanding its application base beyond traditional uses.

Dominant Markets & Segments in Shortwave Infrared Industry

The Shortwave Infrared (SWIR) industry is dominated by specific regions, countries, and application segments, each driven by distinct economic policies, infrastructure development, and end-user adoption rates.

Leading Region/Country: North America and Europe currently lead the SWIR market, largely due to their strong presence in defense and aerospace sectors, coupled with significant investments in research and development and advanced manufacturing capabilities.

- Economic Policies: Favorable government funding for defense, security, and scientific research initiatives.

- Infrastructure: Well-established R&D infrastructure and manufacturing facilities for high-tech components.

Dominant Technology Segment: Uncooled SWIR Cameras Uncooled SWIR cameras are experiencing rapid growth due to their lower cost, smaller size, and reduced power consumption compared to their cooled counterparts. This makes them ideal for a wider range of applications where extreme temperature performance is not the primary concern.

- Key Drivers:

- Cost-effectiveness: Lower manufacturing and operational costs translate to broader market accessibility.

- Miniaturization: Enables integration into compact systems and portable devices.

- Power Efficiency: Crucial for battery-operated and embedded applications.

- Advancements in Sensor Technology: Improved performance of uncooled detectors is closing the gap with cooled systems.

Dominant Product Type: SWIR Area Cameras SWIR Area Cameras, offering 2D imaging capabilities, are the most widely adopted product type. Their versatility makes them suitable for a broad array of inspection, surveillance, and measurement tasks where spatial information is critical.

- Key Drivers:

- Versatility: Applicable in machine vision, quality control, remote sensing, and security.

- High Resolution: Ability to capture detailed images for precise analysis.

- Ease of Integration: Compatible with existing imaging systems and software.

Dominant End-User Industry: Defense and Military The Defense and Military sector remains a primary driver for SWIR technology adoption. The ability of SWIR to penetrate smoke, fog, and camouflage, and to detect heat signatures, makes it invaluable for surveillance, targeting, and reconnaissance.

- Key Drivers:

- Enhanced Situational Awareness: Crucial for night vision, target acquisition, and border surveillance.

- Non-Destructive Testing: Used for detecting concealed threats and material defects.

- Strategic Importance: Continuous government investment in advanced defense technologies.

Healthcare & Research: This segment is also showing significant growth, with SWIR cameras being utilized in medical imaging, disease diagnosis, and scientific research for material analysis and spectroscopy.

- Key Drivers:

- Non-invasive Imaging: Applications in diagnostics and surgical guidance.

- Material Analysis: Used in laboratories for spectral characterization.

Automotive: The automotive sector is emerging as a key growth area, particularly with the integration of SWIR for advanced driver-assistance systems (ADAS) and autonomous driving, enabling improved visibility in adverse conditions like fog and low light.

- Key Drivers:

- Enhanced ADAS Performance: Improved detection of road hazards and pedestrians in various weather.

- Autonomous Driving Reliability: Critical for robust perception systems.

Shortwave Infrared Industry Product Innovations

Recent product innovations in the Shortwave Infrared (SWIR) industry are focused on enhancing spectral range, sensitivity, and miniaturization, thereby expanding their application reach and competitive advantages. Companies are developing VIS-SWIR cameras that capture images across both visible and short-wave infrared spectrums, bridging a critical market gap for broad-spectrum imaging. The introduction of cameras with higher resolutions and smaller pixel sizes, such as the 5μm pixel size in UCID Vision Labs' Atlas SWIR, allows for more detailed imaging and compact camera designs. These advancements are enabling SWIR technology to be integrated into a wider array of applications, from sophisticated machine vision systems to advanced surveillance equipment, providing superior performance in challenging lighting and environmental conditions. The competitive advantage lies in offering more integrated solutions that require less complex illumination and deliver richer data.

Report Segmentation & Scope

This report segments the Shortwave Infrared (SWIR) market by Technology, Product Type, and End-User Industries. The market encompasses Uncooled and Cooled SWIR technologies, catering to different performance and cost requirements. Product segmentation includes SWIR Area Cameras and SWIR Linear Cameras, each serving distinct imaging needs. Key End-User Industries analyzed are Defense and Military, Healthcare & Research, Automotive, and Other End-user segments. Each segment is projected to experience varying growth rates, with Defense and Military currently dominating, while Automotive and Healthcare & Research show substantial expansion potential. The scope covers market sizes, growth projections, and competitive dynamics within these segments, providing a granular understanding of market opportunities.

Key Drivers of Shortwave Infrared Industry Growth

The growth of the Shortwave Infrared (SWIR) industry is propelled by a confluence of technological, economic, and regulatory factors. Key drivers include the increasing demand for advanced imaging capabilities in surveillance and security applications, necessitating superior visibility in adverse weather conditions and low-light scenarios. Advancements in semiconductor technology, particularly in InGaAs sensors, are leading to more sensitive, compact, and cost-effective SWIR cameras. Economic factors such as growing investments in industrial automation, quality control, and scientific research are further fueling adoption. Regulatory initiatives promoting enhanced safety and security standards also indirectly support the SWIR market. The expanding use of SWIR in emerging fields like autonomous vehicles for improved perception further contributes to sustained growth.

Challenges in the Shortwave Infrared Industry Sector

Despite robust growth, the Shortwave Infrared (SWIR) industry faces several challenges. The high cost of some advanced SWIR sensors and cameras can be a barrier to entry for smaller businesses and certain applications, limiting market penetration. Supply chain complexities for specialized materials and components can also lead to production delays and increased costs. Stringent regulatory requirements in sensitive sectors like defense can slow down the adoption of new technologies. Furthermore, intense competition among established players and emerging startups necessitates continuous innovation and cost optimization. The relatively niche nature of some SWIR applications compared to visible light imaging can also present marketing and awareness challenges.

Leading Players in the Shortwave Infrared Industry Market

- Princeton Infrared Technologies Inc

- Sierra-Olympic Systems Inc

- Sofradir

- InView Technology Corporation

- Teledyne Princeton Instruments

- Sensors Unlimited (United Technologies Company)

- Allied Vision Technologies GmbH

- Raptor Photonics

- Leonardo DRS

- Xenics

- Flir Systems Inc

- Hamamatsu Photonics K K

- IRCameras LLC

Key Developments in Shortwave Infrared Industry Sector

- February 2022: Espoo, Finland-based Emberion announced that it had raised EUR 6 million to address the needs of the machine vision and surveillance markets for VIS-SWIR (Visible/Short Wave Infrared) cameras with a broad spectrum and wide dynamic range imaging performance. Emberion strives to bridge the gap in the market for [short-wave infrared] SWIR cameras with no sensors covering such a wide spectral range and the high cost of existing cameras.

- January 2022: UCID Vision Labs, Inc., a designer, and manufacturer of industrial vision cameras, launched the latest Atlas SWIR IP67-rated 1.3 MP and 0.3 MP cameras. The Atlas SWIR is a GigE PoE+ camera featuring wide-band and high-sensitivity Sony SenSWIR1.3 MP IMX990 and 0.3 MP IMX991 InGaAs sensors, capable of capturing images across visible and invisible light spectrums and boasting a miniaturized pixel size of 5μm.

Strategic Shortwave Infrared Industry Market Outlook

The strategic outlook for the Shortwave Infrared (SWIR) industry remains exceptionally positive, driven by persistent demand for advanced imaging across critical sectors. Future growth accelerators include the increasing integration of SWIR into AI-powered machine vision systems for enhanced automation and defect detection, and its expanding role in autonomous systems for improved environmental perception. The development of novel, more cost-effective SWIR sensor technologies promises to democratize access and broaden market penetration. Strategic opportunities lie in the burgeoning applications within the healthcare sector for advanced diagnostics and in the automotive industry for enhanced ADAS features. Continuous innovation in spectral imaging capabilities and miniaturization will be key to capturing emerging market niches and solidifying competitive advantages.

Shortwave Infrared Industry Segmentation

-

1. Technology

- 1.1. Uncooled

- 1.2. Cooled

-

2. Product Type

- 2.1. SWIR Area Cameras

- 2.2. SWIR Linear Cameras

-

3. End-User Industries

- 3.1. Defense and Military

- 3.2. Healthcare & Research

- 3.3. Automotive

- 3.4. Other End-user

Shortwave Infrared Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

Shortwave Infrared Industry Regional Market Share

Geographic Coverage of Shortwave Infrared Industry

Shortwave Infrared Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications across End-user Industries; Need for Miniaturisation and Low-power Consumption Technology

- 3.3. Market Restrains

- 3.3.1. High Cost of SWIR Cameras and Detectors

- 3.4. Market Trends

- 3.4.1. The Military and Defense Sector is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Shortwave Infrared Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Uncooled

- 5.1.2. Cooled

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. SWIR Area Cameras

- 5.2.2. SWIR Linear Cameras

- 5.3. Market Analysis, Insights and Forecast - by End-User Industries

- 5.3.1. Defense and Military

- 5.3.2. Healthcare & Research

- 5.3.3. Automotive

- 5.3.4. Other End-user

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Shortwave Infrared Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Uncooled

- 6.1.2. Cooled

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. SWIR Area Cameras

- 6.2.2. SWIR Linear Cameras

- 6.3. Market Analysis, Insights and Forecast - by End-User Industries

- 6.3.1. Defense and Military

- 6.3.2. Healthcare & Research

- 6.3.3. Automotive

- 6.3.4. Other End-user

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Shortwave Infrared Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Uncooled

- 7.1.2. Cooled

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. SWIR Area Cameras

- 7.2.2. SWIR Linear Cameras

- 7.3. Market Analysis, Insights and Forecast - by End-User Industries

- 7.3.1. Defense and Military

- 7.3.2. Healthcare & Research

- 7.3.3. Automotive

- 7.3.4. Other End-user

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Shortwave Infrared Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Uncooled

- 8.1.2. Cooled

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. SWIR Area Cameras

- 8.2.2. SWIR Linear Cameras

- 8.3. Market Analysis, Insights and Forecast - by End-User Industries

- 8.3.1. Defense and Military

- 8.3.2. Healthcare & Research

- 8.3.3. Automotive

- 8.3.4. Other End-user

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World Shortwave Infrared Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Uncooled

- 9.1.2. Cooled

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. SWIR Area Cameras

- 9.2.2. SWIR Linear Cameras

- 9.3. Market Analysis, Insights and Forecast - by End-User Industries

- 9.3.1. Defense and Military

- 9.3.2. Healthcare & Research

- 9.3.3. Automotive

- 9.3.4. Other End-user

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Princeton Infrared Technologies Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sierra-Olympic Systems Inc *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sofradir

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 InView Technology Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Teledyne Princeton Instruments

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sensors Unlimited (United Technologies Company)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Allied Vision Technologies GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Raptor Photonics

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Leonardo DRS

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Xenics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Flir Systems Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Hamamatsu Photonics K K

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 IRCameras LLC

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Princeton Infrared Technologies Inc

List of Figures

- Figure 1: Global Shortwave Infrared Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Shortwave Infrared Industry Revenue (million), by Technology 2025 & 2033

- Figure 3: North America Shortwave Infrared Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Shortwave Infrared Industry Revenue (million), by Product Type 2025 & 2033

- Figure 5: North America Shortwave Infrared Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Shortwave Infrared Industry Revenue (million), by End-User Industries 2025 & 2033

- Figure 7: North America Shortwave Infrared Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 8: North America Shortwave Infrared Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America Shortwave Infrared Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Shortwave Infrared Industry Revenue (million), by Technology 2025 & 2033

- Figure 11: Europe Shortwave Infrared Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Shortwave Infrared Industry Revenue (million), by Product Type 2025 & 2033

- Figure 13: Europe Shortwave Infrared Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Shortwave Infrared Industry Revenue (million), by End-User Industries 2025 & 2033

- Figure 15: Europe Shortwave Infrared Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 16: Europe Shortwave Infrared Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Shortwave Infrared Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Shortwave Infrared Industry Revenue (million), by Technology 2025 & 2033

- Figure 19: Asia Pacific Shortwave Infrared Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific Shortwave Infrared Industry Revenue (million), by Product Type 2025 & 2033

- Figure 21: Asia Pacific Shortwave Infrared Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Pacific Shortwave Infrared Industry Revenue (million), by End-User Industries 2025 & 2033

- Figure 23: Asia Pacific Shortwave Infrared Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 24: Asia Pacific Shortwave Infrared Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Shortwave Infrared Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Shortwave Infrared Industry Revenue (million), by Technology 2025 & 2033

- Figure 27: Rest of the World Shortwave Infrared Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Rest of the World Shortwave Infrared Industry Revenue (million), by Product Type 2025 & 2033

- Figure 29: Rest of the World Shortwave Infrared Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Rest of the World Shortwave Infrared Industry Revenue (million), by End-User Industries 2025 & 2033

- Figure 31: Rest of the World Shortwave Infrared Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 32: Rest of the World Shortwave Infrared Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World Shortwave Infrared Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Shortwave Infrared Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Global Shortwave Infrared Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Global Shortwave Infrared Industry Revenue million Forecast, by End-User Industries 2020 & 2033

- Table 4: Global Shortwave Infrared Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Shortwave Infrared Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 6: Global Shortwave Infrared Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Global Shortwave Infrared Industry Revenue million Forecast, by End-User Industries 2020 & 2033

- Table 8: Global Shortwave Infrared Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Global Shortwave Infrared Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 12: Global Shortwave Infrared Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 13: Global Shortwave Infrared Industry Revenue million Forecast, by End-User Industries 2020 & 2033

- Table 14: Global Shortwave Infrared Industry Revenue million Forecast, by Country 2020 & 2033

- Table 15: Germany Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: France Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Shortwave Infrared Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 20: Global Shortwave Infrared Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 21: Global Shortwave Infrared Industry Revenue million Forecast, by End-User Industries 2020 & 2033

- Table 22: Global Shortwave Infrared Industry Revenue million Forecast, by Country 2020 & 2033

- Table 23: China Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Japan Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: India Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Global Shortwave Infrared Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 28: Global Shortwave Infrared Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 29: Global Shortwave Infrared Industry Revenue million Forecast, by End-User Industries 2020 & 2033

- Table 30: Global Shortwave Infrared Industry Revenue million Forecast, by Country 2020 & 2033

- Table 31: Latin America Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Middle East Shortwave Infrared Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Shortwave Infrared Industry?

The projected CAGR is approximately 11.2%.

2. Which companies are prominent players in the Shortwave Infrared Industry?

Key companies in the market include Princeton Infrared Technologies Inc, Sierra-Olympic Systems Inc *List Not Exhaustive, Sofradir, InView Technology Corporation, Teledyne Princeton Instruments, Sensors Unlimited (United Technologies Company), Allied Vision Technologies GmbH, Raptor Photonics, Leonardo DRS, Xenics, Flir Systems Inc, Hamamatsu Photonics K K, IRCameras LLC.

3. What are the main segments of the Shortwave Infrared Industry?

The market segments include Technology, Product Type, End-User Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 628.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications across End-user Industries; Need for Miniaturisation and Low-power Consumption Technology.

6. What are the notable trends driving market growth?

The Military and Defense Sector is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of SWIR Cameras and Detectors.

8. Can you provide examples of recent developments in the market?

February 2022 - Espoo, Finland-based Emberionannounced that it had raised EUR 6 million to address the needs of the machine vision and surveillance markets for VIS-SWIR (Visible/Short Wave Infrared) cameras with a broad spectrum and wide dynamic range imaging performance. Emberionstrives to bridge the gap in the market for [short-wave infrared] SWIR cameras with no sensors covering such a wide spectral range and the high cost of existing cameras.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Shortwave Infrared Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Shortwave Infrared Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Shortwave Infrared Industry?

To stay informed about further developments, trends, and reports in the Shortwave Infrared Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence