Key Insights

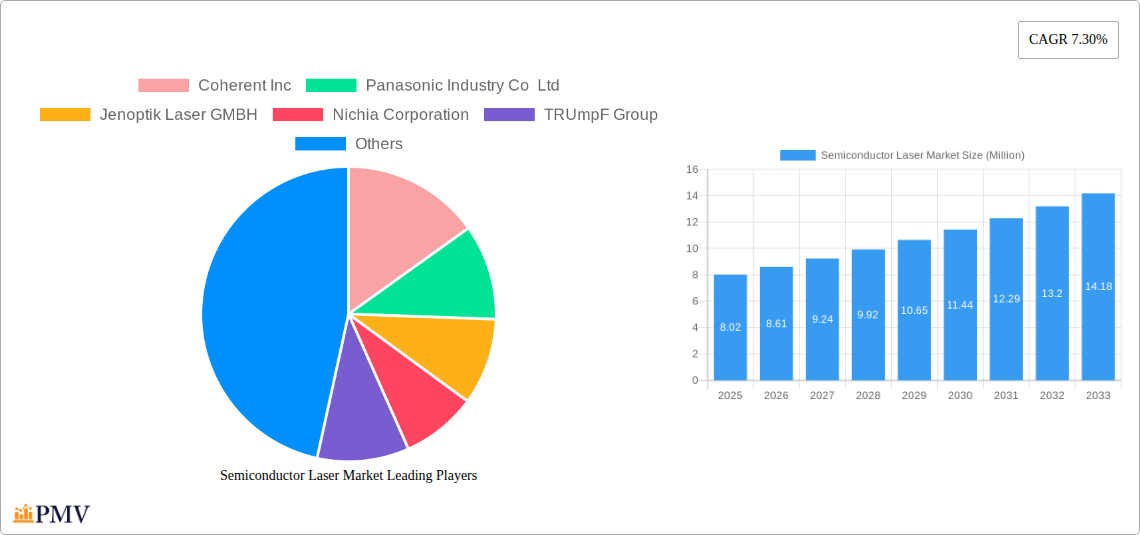

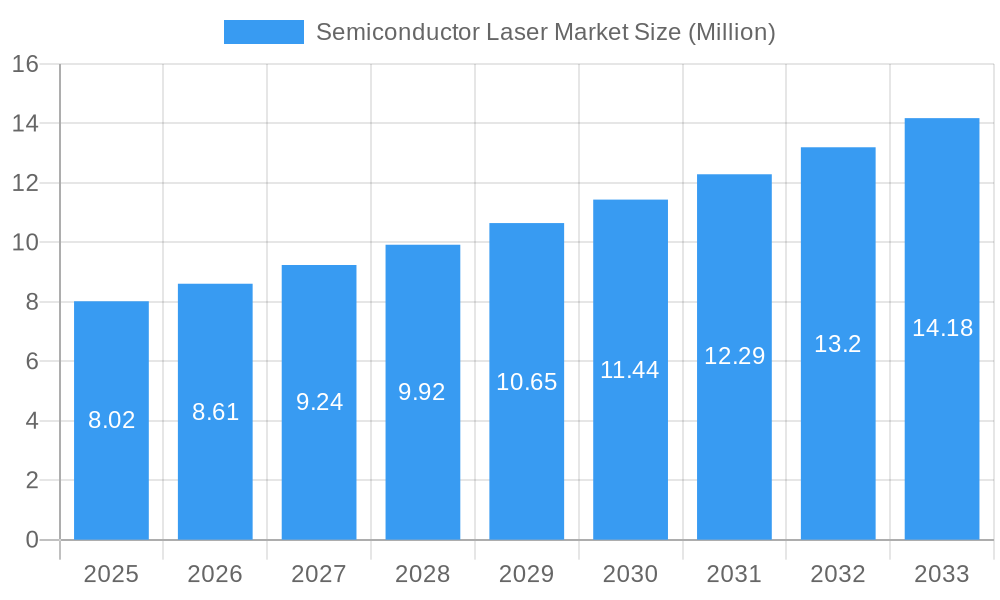

The global Semiconductor Laser Market is poised for robust expansion, projected to reach $8.02 million in 2025 and demonstrating a healthy Compound Annual Growth Rate (CAGR) of 7.30% throughout the forecast period of 2025-2033. This dynamic growth is underpinned by a confluence of escalating demand across diverse industries and ongoing technological advancements. Key drivers fueling this market surge include the burgeoning adoption of semiconductor lasers in high-speed optical communication networks, the increasing miniaturization and efficiency of electronic devices, and the expanding applications in advanced medical procedures such as laser surgery and diagnostics. Furthermore, the defense sector's reliance on semiconductor lasers for targeting systems, surveillance, and countermeasures contributes significantly to market momentum. The industrial sector's embrace of laser-based manufacturing processes, including welding, cutting, and marking, further solidifies this upward trajectory.

Semiconductor Laser Market Market Size (In Million)

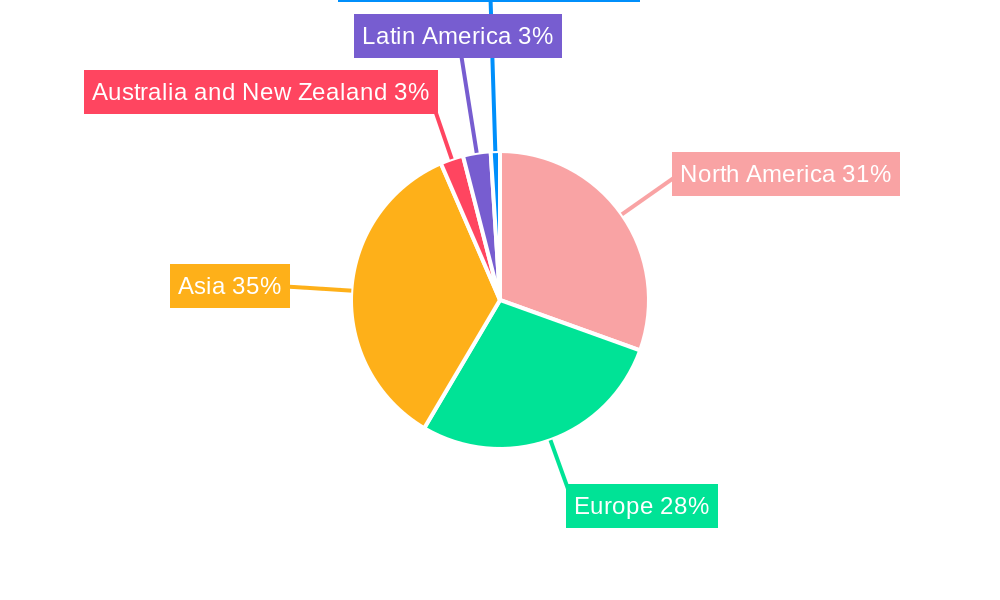

The market's growth is further shaped by evolving trends and specific segment performance. Infrared lasers, driven by their pervasive use in telecommunications and industrial heating, represent a significant segment. The increasing demand for high-resolution imaging and advanced display technologies is propelling the growth of red, green, and blue lasers. Vertical-cavity Surface-Emitting Lasers (VCSELs) are gaining prominence due to their cost-effectiveness and suitability for short-range communication and sensing applications, while Edge-Emitting Lasers (EELs) continue to dominate longer-range communication. Quantum Cascade Lasers are finding niche but growing applications in specialized sensing and spectroscopy. Geographically, North America and Asia are expected to lead market share due to strong technological infrastructure and significant investments in R&D and manufacturing. However, emerging economies in other regions present substantial untapped potential. While the market enjoys strong growth, potential restraints such as the high initial cost of some advanced laser technologies and the need for skilled personnel for operation and maintenance, could present moderate challenges.

Semiconductor Laser Market Company Market Share

This comprehensive Semiconductor Laser Market report provides an in-depth analysis of the global market from 2019 to 2033, with a base and estimated year of 2025. Covering a historical period of 2019–2024 and a forecast period of 2025–2033, this report is an essential resource for understanding current trends, future opportunities, and competitive landscapes in the rapidly evolving semiconductor laser industry. We delve into key market segments, technological advancements, and the strategic initiatives of leading players, offering actionable insights for stakeholders.

Semiconductor Laser Market Market Structure & Competitive Dynamics

The global semiconductor laser market exhibits a moderately concentrated structure, characterized by a mix of established giants and emerging innovators. Key players like Coherent Inc., Lumentum Holdings Inc., and IPG Photonics Corporation hold significant market share, driven by their extensive portfolios and strong R&D investments. Innovation ecosystems are thriving, with continuous advancements in laser efficiency, power, and wavelength control. Regulatory frameworks, primarily focused on safety and export controls, play a crucial role in shaping market access and product development. Product substitutes, though evolving, currently offer limited direct competition to the unique capabilities of semiconductor lasers across various applications. End-user trends point towards an increasing demand for higher performance, miniaturization, and cost-effectiveness. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and technological integration, with significant deal values often seen in acquisitions aimed at expanding technological capabilities or market reach. For instance, the acquisition of Newport Corporation by MKS Instruments Inc. demonstrates this trend. The market share distribution among the top 5 players is estimated to be around 60%, with M&A deal values in the hundreds of millions of dollars annually, signifying strategic consolidation.

Semiconductor Laser Market Industry Trends & Insights

The semiconductor laser market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 8-10% over the forecast period. This expansion is fueled by an array of potent growth drivers, prominently the relentless demand from the telecommunications sector for higher bandwidth and faster data transmission, propelled by the advent of 5G and the burgeoning IoT ecosystem. Technological disruptions are continuously redefining the market, with advancements in laser diode materials, such as GaN and InP, enabling higher power outputs and broader wavelength coverage. The increasing adoption of VCSELs (Vertical-cavity Surface-emitting Lasers) in consumer electronics for applications like facial recognition and augmented reality is a significant trend. Furthermore, the medical sector's growing reliance on laser-based therapies for diagnostics, surgery, and aesthetics, alongside the expanding use of lasers in industrial manufacturing for precision cutting, welding, and marking, are substantial contributors to market penetration. Consumer preferences are increasingly leaning towards miniaturized, energy-efficient, and highly reliable laser solutions. Competitive dynamics are intense, with companies investing heavily in R&D to maintain a technological edge and secure market share. The market penetration of semiconductor lasers in emerging applications like autonomous driving and advanced sensing is projected to grow significantly, further bolstering overall market expansion. The market size is estimated to reach over $20 Billion by 2030.

Dominant Markets & Segments in Semiconductor Laser Market

The semiconductor laser market is segmented across various wavelengths, types, and applications, each demonstrating distinct growth trajectories and dominance.

Wavelength:

- Infrared Lasers: Currently, Infrared Lasers represent the largest segment by market value, driven by extensive applications in fiber optic communication, industrial heating, and defense systems. The high demand for data transmission and the increasing use of fiber optics in global networks are key drivers.

- Key Drivers: Widespread use in telecommunications infrastructure; applications in industrial processing and remote sensing.

- Red Lasers: Dominant in consumer electronics, laser pointers, and barcode scanners, Red Lasers maintain a strong market presence due to their cost-effectiveness and established applications.

- Key Drivers: Ubiquitous use in consumer devices; cost-effective manufacturing.

- Green Lasers: Growing in popularity for laser displays, advanced microscopy, and certain medical applications, Green Lasers are witnessing significant adoption.

- Key Drivers: Emerging applications in display technology and scientific research.

- Blue Lasers: Crucial for Blu-ray technology, high-density data storage, and emerging applications in medical treatments and industrial curing, Blue Lasers are a growing segment.

- Key Drivers: Role in data storage and advanced industrial processes.

- Ultraviolet Lasers: Experiencing rapid growth due to their application in semiconductor lithography, medical sterilization, and material processing, Ultraviolet Lasers are becoming increasingly vital. The development of high-power UV lasers for industrial and scientific applications, such as the single frequency 308 nm fiber-based UV laser developed by AdValue Photonics for NASA, underscores this segment's importance.

- Key Drivers: Essential for semiconductor manufacturing; increasing use in sterilization and curing.

Type:

- EEL (Edge-emitting Laser): This is the most established and widely used type, accounting for a substantial market share due to its versatility and cost-effectiveness in a broad range of applications.

- Key Drivers: Versatility in power and wavelength; mature manufacturing processes.

- VCSEL (Vertical-cavity Surface-emitting Laser): VCSELs are rapidly gaining traction due to their excellent beam quality, low cost of manufacturing in arrays, and suitability for short-range optical interconnects and sensing applications. Their adoption in smartphones and data centers is a major growth accelerator.

- Key Drivers: Cost-effective mass production; ideal for sensing and short-range communication.

- Quantum Cascade Laser: While a niche segment, Quantum Cascade Lasers are crucial for specific applications requiring mid-infrared wavelength tuning, such as gas sensing and spectroscopy.

- Key Drivers: Unique wavelength tunability for specialized sensing applications.

- Fiber Laser: Though often powered by semiconductor diode lasers, Fiber Lasers themselves are a significant category for high-power industrial applications, including cutting, welding, and marking. The advancements in pumping efficiency by semiconductor lasers directly impact Fiber Laser performance.

- Key Drivers: High power and beam quality for industrial processing.

- Other Types: This category includes emerging laser technologies and specialized designs catering to unique market needs.

Application:

- Communication: This is the dominant application segment, driven by the insatiable demand for high-speed data transmission in telecommunications, data centers, and optical networking. The expansion of fiber optic networks and the rollout of 5G are major contributors.

- Key Drivers: Global demand for high-speed internet; expansion of 5G networks and data centers.

- Medical: Lasers are integral to minimally invasive surgery, dermatology, ophthalmology, and diagnostics, representing a significant and growing application.

- Key Drivers: Advancements in medical procedures and patient care.

- Military and Defense: Applications include target designation, rangefinding, and directed energy weapons, where reliability and precision are paramount.

- Key Drivers: National security requirements and technological advancements in defense systems.

- Industrial: Laser technology is revolutionizing manufacturing through cutting, welding, marking, and 3D printing, driving efficiency and precision.

- Key Drivers: Automation, precision manufacturing, and advanced fabrication techniques.

- Instrumentation and Sensor: Lasers are critical for a wide array of sensors, including Lidar for autonomous vehicles, gas detection systems, and scientific instruments.

- Key Drivers: Growth in autonomous systems and advanced analytical instrumentation.

- Automotive: Increasing use in advanced driver-assistance systems (ADAS) and future autonomous driving, particularly with Lidar technology.

- Key Drivers: Development of autonomous vehicles and enhanced safety features.

- Other Applications: This broad category encompasses diverse uses in scientific research, entertainment, and consumer electronics.

Semiconductor Laser Market Product Innovations

Product innovations in the semiconductor laser market are primarily focused on enhancing power efficiency, increasing output power, miniaturization, and expanding wavelength capabilities. Recent developments include high-power ultraviolet (UV) lasers for atmospheric measurements, as demonstrated by AdValue Photonics, Inc., and advanced laser lift-off (LLO) systems for microLED production, as announced by 3D-Micromac AG. These innovations offer competitive advantages by enabling new applications in fields like atmospheric science, dermatology, and advanced display manufacturing, pushing the boundaries of performance and reliability.

Report Segmentation & Scope

This report segments the Semiconductor Laser Market by Wavelength (Infrared Lasers, Red Lasers, Green Lasers, Blue lasers, Ultraviolet Lasers), Type (EEL, VCSEL, Quantum Cascade Laser, Fiber Laser, Other Types), and Application (Communication, Medical, Military and Defense, Industrial, Instrumentation and Sensor, Automotive, Other Applications). Each segment is analyzed for its market size, growth projections, and competitive dynamics. For instance, the Communication segment is projected to witness a CAGR of approximately 12% due to 5G deployment, while the Medical segment is expected to grow at a CAGR of 9% driven by increased adoption of laser therapies. The VCSEL type is anticipated to experience a CAGR of 15% owing to its expanding use in consumer electronics and automotive sensing.

Key Drivers of Semiconductor Laser Market Growth

Several key drivers are propelling the semiconductor laser market forward. Technological advancements in materials science and fabrication techniques enable higher performance and lower costs. The exponential growth in data consumption fuels the demand for advanced optical communication solutions. Increasing adoption across diverse industries, including automotive (ADAS, Lidar), medical (diagnostics, surgery), and industrial (automation, 3D printing), further stimulates market expansion. Government initiatives and investments in areas like telecommunications infrastructure and advanced manufacturing also contribute significantly. For example, the ongoing global rollout of 5G networks is a substantial driver for high-speed communication lasers.

Challenges in the Semiconductor Laser Market Sector

Despite robust growth, the semiconductor laser market faces several challenges. Intense competition can lead to price pressures and impact profit margins. Supply chain disruptions, as evidenced in recent global events, can affect raw material availability and production timelines. Stringent regulatory compliance for certain applications, particularly in medical and defense, adds complexity and cost to product development. Furthermore, the high R&D investment required for next-generation technologies presents a barrier for smaller players. Supply chain issues, for instance, have led to lead times extending by up to 30% for certain critical components.

Leading Players in the Semiconductor Laser Market Market

The semiconductor laser market is characterized by the presence of several key industry leaders:

- Coherent Inc.

- Panasonic Industry Co Ltd

- Jenoptik Laser GMBH

- Nichia Corporation

- TRUmpF Group

- Lumentum Holdings Inc.

- Rohm Company Limited

- TT Electronics

- ams OSRAM AG

- Sheaumann Laser Inc.

- Newport Corporation (mks Instruments Inc )

- IPG Photonics Corporation

- Sharp Corporation

- Hamamatsu Photonics K K

- Sumitomo Electric Industries Ltd

Key Developments in Semiconductor Laser Market Sector

- January 2023: AdValue Photonics, Inc. announced the production of a single frequency 308 nm fiber-based, high-power ultraviolet (UV) laser for NASA Goddard Space Flight Center. This laser is significant for atmospheric measurements and has applications in medical, industrial, and scientific fields due to its quick absorption and distinct effects. It is the first all-solid-state version to radiate 3 W average power with a diffraction-limited beam, enhancing reliability in atmospheric sensing, dermatology, and electronics manufacturing.

- November 2022: 3D-Micromac AG announced that a major optical solutions provider purchased multiple microMIRA Laser Lift-Off (LLO) systems. These systems are intended for the production of microLED devices and will be installed in pilot and production lines at the customer's advanced LED chip factory in Asia, signaling a significant advancement in microLED manufacturing technology.

Strategic Semiconductor Laser Market Market Outlook

The strategic outlook for the semiconductor laser market remains exceptionally positive. Growth accelerators include the continued expansion of 5G networks, the proliferation of data centers, and the increasing demand for high-performance lasers in industrial automation and advanced manufacturing. The automotive sector's transition towards autonomous driving will further drive demand for Lidar and other sensing technologies, directly benefiting the semiconductor laser market. Emerging applications in areas like quantum computing and advanced medical diagnostics also present significant future growth potential. Strategic opportunities lie in developing more efficient, compact, and cost-effective laser solutions tailored to these evolving needs.

Semiconductor Laser Market Segmentation

-

1. Wavelength

- 1.1. Infrared Lasers

- 1.2. Red Lasers

- 1.3. Green Lasers

- 1.4. Blue lasers

- 1.5. Ultraviolet Lasers

-

2. Type

- 2.1. EEL (Edge-emitting Laser)

- 2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 2.3. Quantum Cascade Laser

- 2.4. Fiber Laser

- 2.5. Other Types

-

3. Application

- 3.1. Communication

- 3.2. Medical

- 3.3. Military and Defense

- 3.4. Industrial

- 3.5. Instrumentation and Sensor

- 3.6. Automotive

- 3.7. Other Applications

Semiconductor Laser Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Semiconductor Laser Market Regional Market Share

Geographic Coverage of Semiconductor Laser Market

Semiconductor Laser Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Proliferation of Semiconductor Laser Applications; Growth in the Fiber Laser Market; Preference for Semiconductor Lasers Over Other Light Sources

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investments

- 3.4. Market Trends

- 3.4.1. The Inspection & Metrology Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Laser Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Wavelength

- 5.1.1. Infrared Lasers

- 5.1.2. Red Lasers

- 5.1.3. Green Lasers

- 5.1.4. Blue lasers

- 5.1.5. Ultraviolet Lasers

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. EEL (Edge-emitting Laser)

- 5.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 5.2.3. Quantum Cascade Laser

- 5.2.4. Fiber Laser

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Communication

- 5.3.2. Medical

- 5.3.3. Military and Defense

- 5.3.4. Industrial

- 5.3.5. Instrumentation and Sensor

- 5.3.6. Automotive

- 5.3.7. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Wavelength

- 6. North America Semiconductor Laser Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Wavelength

- 6.1.1. Infrared Lasers

- 6.1.2. Red Lasers

- 6.1.3. Green Lasers

- 6.1.4. Blue lasers

- 6.1.5. Ultraviolet Lasers

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. EEL (Edge-emitting Laser)

- 6.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 6.2.3. Quantum Cascade Laser

- 6.2.4. Fiber Laser

- 6.2.5. Other Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Communication

- 6.3.2. Medical

- 6.3.3. Military and Defense

- 6.3.4. Industrial

- 6.3.5. Instrumentation and Sensor

- 6.3.6. Automotive

- 6.3.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Wavelength

- 7. Europe Semiconductor Laser Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Wavelength

- 7.1.1. Infrared Lasers

- 7.1.2. Red Lasers

- 7.1.3. Green Lasers

- 7.1.4. Blue lasers

- 7.1.5. Ultraviolet Lasers

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. EEL (Edge-emitting Laser)

- 7.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 7.2.3. Quantum Cascade Laser

- 7.2.4. Fiber Laser

- 7.2.5. Other Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Communication

- 7.3.2. Medical

- 7.3.3. Military and Defense

- 7.3.4. Industrial

- 7.3.5. Instrumentation and Sensor

- 7.3.6. Automotive

- 7.3.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Wavelength

- 8. Asia Semiconductor Laser Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Wavelength

- 8.1.1. Infrared Lasers

- 8.1.2. Red Lasers

- 8.1.3. Green Lasers

- 8.1.4. Blue lasers

- 8.1.5. Ultraviolet Lasers

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. EEL (Edge-emitting Laser)

- 8.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 8.2.3. Quantum Cascade Laser

- 8.2.4. Fiber Laser

- 8.2.5. Other Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Communication

- 8.3.2. Medical

- 8.3.3. Military and Defense

- 8.3.4. Industrial

- 8.3.5. Instrumentation and Sensor

- 8.3.6. Automotive

- 8.3.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Wavelength

- 9. Australia and New Zealand Semiconductor Laser Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Wavelength

- 9.1.1. Infrared Lasers

- 9.1.2. Red Lasers

- 9.1.3. Green Lasers

- 9.1.4. Blue lasers

- 9.1.5. Ultraviolet Lasers

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. EEL (Edge-emitting Laser)

- 9.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 9.2.3. Quantum Cascade Laser

- 9.2.4. Fiber Laser

- 9.2.5. Other Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Communication

- 9.3.2. Medical

- 9.3.3. Military and Defense

- 9.3.4. Industrial

- 9.3.5. Instrumentation and Sensor

- 9.3.6. Automotive

- 9.3.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Wavelength

- 10. Latin America Semiconductor Laser Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Wavelength

- 10.1.1. Infrared Lasers

- 10.1.2. Red Lasers

- 10.1.3. Green Lasers

- 10.1.4. Blue lasers

- 10.1.5. Ultraviolet Lasers

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. EEL (Edge-emitting Laser)

- 10.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 10.2.3. Quantum Cascade Laser

- 10.2.4. Fiber Laser

- 10.2.5. Other Types

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Communication

- 10.3.2. Medical

- 10.3.3. Military and Defense

- 10.3.4. Industrial

- 10.3.5. Instrumentation and Sensor

- 10.3.6. Automotive

- 10.3.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Wavelength

- 11. Middle East and Africa Semiconductor Laser Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Wavelength

- 11.1.1. Infrared Lasers

- 11.1.2. Red Lasers

- 11.1.3. Green Lasers

- 11.1.4. Blue lasers

- 11.1.5. Ultraviolet Lasers

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. EEL (Edge-emitting Laser)

- 11.2.2. VCSEL (Vertical-cavity Surface-emitting Laser)

- 11.2.3. Quantum Cascade Laser

- 11.2.4. Fiber Laser

- 11.2.5. Other Types

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Communication

- 11.3.2. Medical

- 11.3.3. Military and Defense

- 11.3.4. Industrial

- 11.3.5. Instrumentation and Sensor

- 11.3.6. Automotive

- 11.3.7. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Wavelength

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Coherent Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Panasonic Industry Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Jenoptik Laser GMBH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nichia Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 TRUmpF Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Lumentum Holdings Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Rohm Company Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 TT Electronics

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ams OSRAM AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sheaumann Laser Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Newport Corporation (mks Instruments Inc )

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 IPG Photonics Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Sharp Corporation

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Hamamatsu Photonics K K

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Sumitomo Electric Industries Ltd

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Coherent Inc

List of Figures

- Figure 1: Global Semiconductor Laser Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Semiconductor Laser Market Revenue (Million), by Wavelength 2025 & 2033

- Figure 3: North America Semiconductor Laser Market Revenue Share (%), by Wavelength 2025 & 2033

- Figure 4: North America Semiconductor Laser Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Semiconductor Laser Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Semiconductor Laser Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Semiconductor Laser Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Semiconductor Laser Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Semiconductor Laser Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Semiconductor Laser Market Revenue (Million), by Wavelength 2025 & 2033

- Figure 11: Europe Semiconductor Laser Market Revenue Share (%), by Wavelength 2025 & 2033

- Figure 12: Europe Semiconductor Laser Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Semiconductor Laser Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Semiconductor Laser Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Semiconductor Laser Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Semiconductor Laser Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Semiconductor Laser Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Semiconductor Laser Market Revenue (Million), by Wavelength 2025 & 2033

- Figure 19: Asia Semiconductor Laser Market Revenue Share (%), by Wavelength 2025 & 2033

- Figure 20: Asia Semiconductor Laser Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Semiconductor Laser Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Semiconductor Laser Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Semiconductor Laser Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Semiconductor Laser Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Semiconductor Laser Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Semiconductor Laser Market Revenue (Million), by Wavelength 2025 & 2033

- Figure 27: Australia and New Zealand Semiconductor Laser Market Revenue Share (%), by Wavelength 2025 & 2033

- Figure 28: Australia and New Zealand Semiconductor Laser Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Australia and New Zealand Semiconductor Laser Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Australia and New Zealand Semiconductor Laser Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Australia and New Zealand Semiconductor Laser Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Australia and New Zealand Semiconductor Laser Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Semiconductor Laser Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Semiconductor Laser Market Revenue (Million), by Wavelength 2025 & 2033

- Figure 35: Latin America Semiconductor Laser Market Revenue Share (%), by Wavelength 2025 & 2033

- Figure 36: Latin America Semiconductor Laser Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Latin America Semiconductor Laser Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Latin America Semiconductor Laser Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Latin America Semiconductor Laser Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Latin America Semiconductor Laser Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Semiconductor Laser Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Semiconductor Laser Market Revenue (Million), by Wavelength 2025 & 2033

- Figure 43: Middle East and Africa Semiconductor Laser Market Revenue Share (%), by Wavelength 2025 & 2033

- Figure 44: Middle East and Africa Semiconductor Laser Market Revenue (Million), by Type 2025 & 2033

- Figure 45: Middle East and Africa Semiconductor Laser Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East and Africa Semiconductor Laser Market Revenue (Million), by Application 2025 & 2033

- Figure 47: Middle East and Africa Semiconductor Laser Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Middle East and Africa Semiconductor Laser Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa Semiconductor Laser Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Laser Market Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 2: Global Semiconductor Laser Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Semiconductor Laser Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Semiconductor Laser Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Semiconductor Laser Market Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 6: Global Semiconductor Laser Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Semiconductor Laser Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Semiconductor Laser Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Semiconductor Laser Market Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 10: Global Semiconductor Laser Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Semiconductor Laser Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Semiconductor Laser Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Semiconductor Laser Market Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 14: Global Semiconductor Laser Market Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Semiconductor Laser Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Semiconductor Laser Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Semiconductor Laser Market Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 18: Global Semiconductor Laser Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Semiconductor Laser Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Semiconductor Laser Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Semiconductor Laser Market Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 22: Global Semiconductor Laser Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Semiconductor Laser Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Semiconductor Laser Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Semiconductor Laser Market Revenue Million Forecast, by Wavelength 2020 & 2033

- Table 26: Global Semiconductor Laser Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Semiconductor Laser Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Semiconductor Laser Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Laser Market?

The projected CAGR is approximately 7.30%.

2. Which companies are prominent players in the Semiconductor Laser Market?

Key companies in the market include Coherent Inc, Panasonic Industry Co Ltd, Jenoptik Laser GMBH, Nichia Corporation, TRUmpF Group, Lumentum Holdings Inc, Rohm Company Limited, TT Electronics, ams OSRAM AG, Sheaumann Laser Inc, Newport Corporation (mks Instruments Inc ), IPG Photonics Corporation, Sharp Corporation, Hamamatsu Photonics K K, Sumitomo Electric Industries Ltd.

3. What are the main segments of the Semiconductor Laser Market?

The market segments include Wavelength, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Proliferation of Semiconductor Laser Applications; Growth in the Fiber Laser Market; Preference for Semiconductor Lasers Over Other Light Sources.

6. What are the notable trends driving market growth?

The Inspection & Metrology Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

; High Initial Investments.

8. Can you provide examples of recent developments in the market?

January 2023 - AdValue Photonics, Inc. announced that it produced a single frequency 308 nm fiber-based, high-power ultraviolet (UV) laser for NASA Goddard Space Flight Center for applications in atmospheric measurements. The 308 nm wavelength, or color of the laser light, is well-established in the medical, industrial, & scientific fields due to the quick absorption and distinct effects associated with this wavelength. It is the first of its kind, all solid-state version, to radiate 3 W average power with a diffraction-limited beam. These features allow reliable, high-performance operation in atmospheric sensing systems, dermatology clinics, and electronics factories worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Laser Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Laser Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Laser Market?

To stay informed about further developments, trends, and reports in the Semiconductor Laser Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence