Key Insights

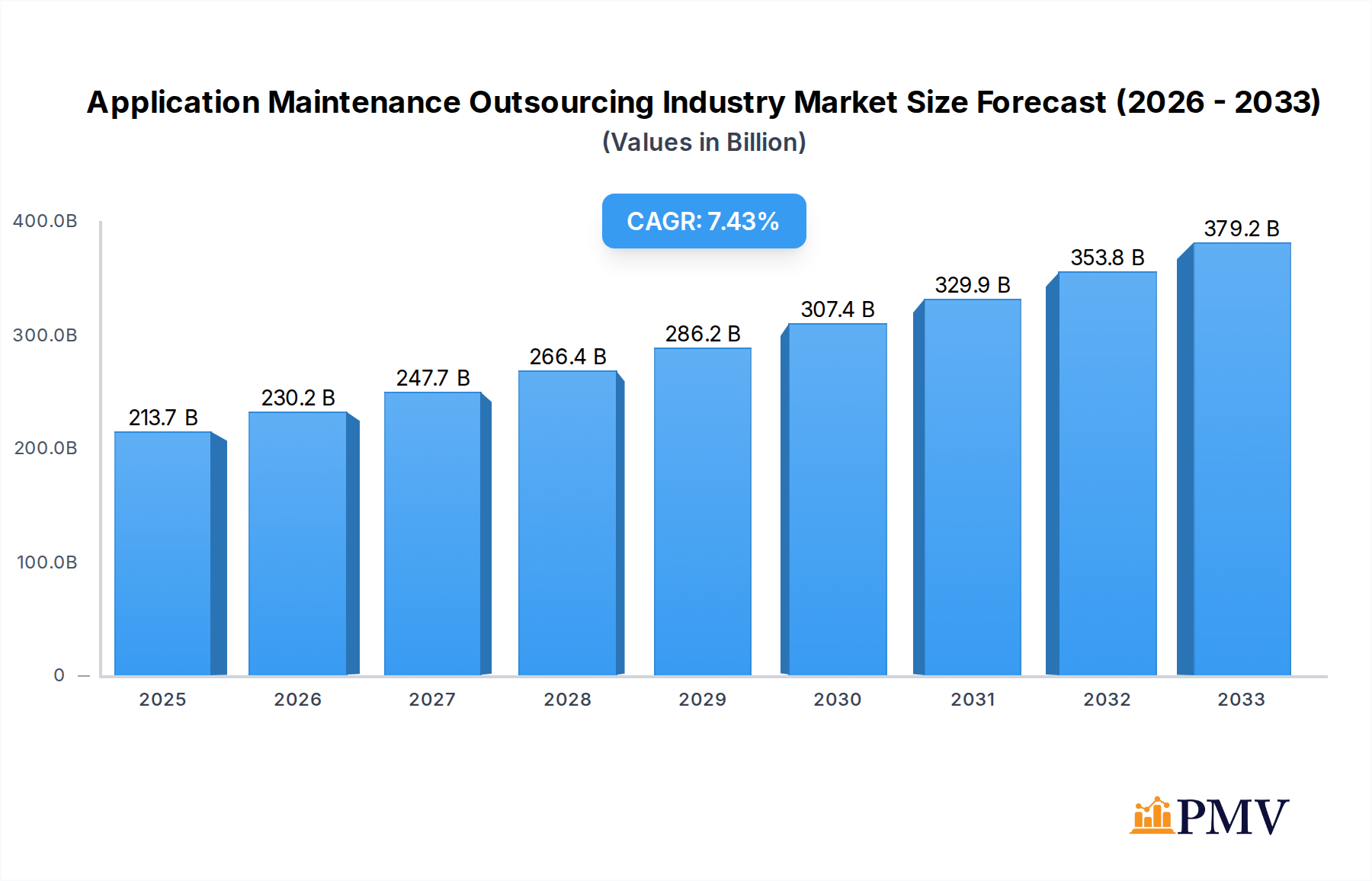

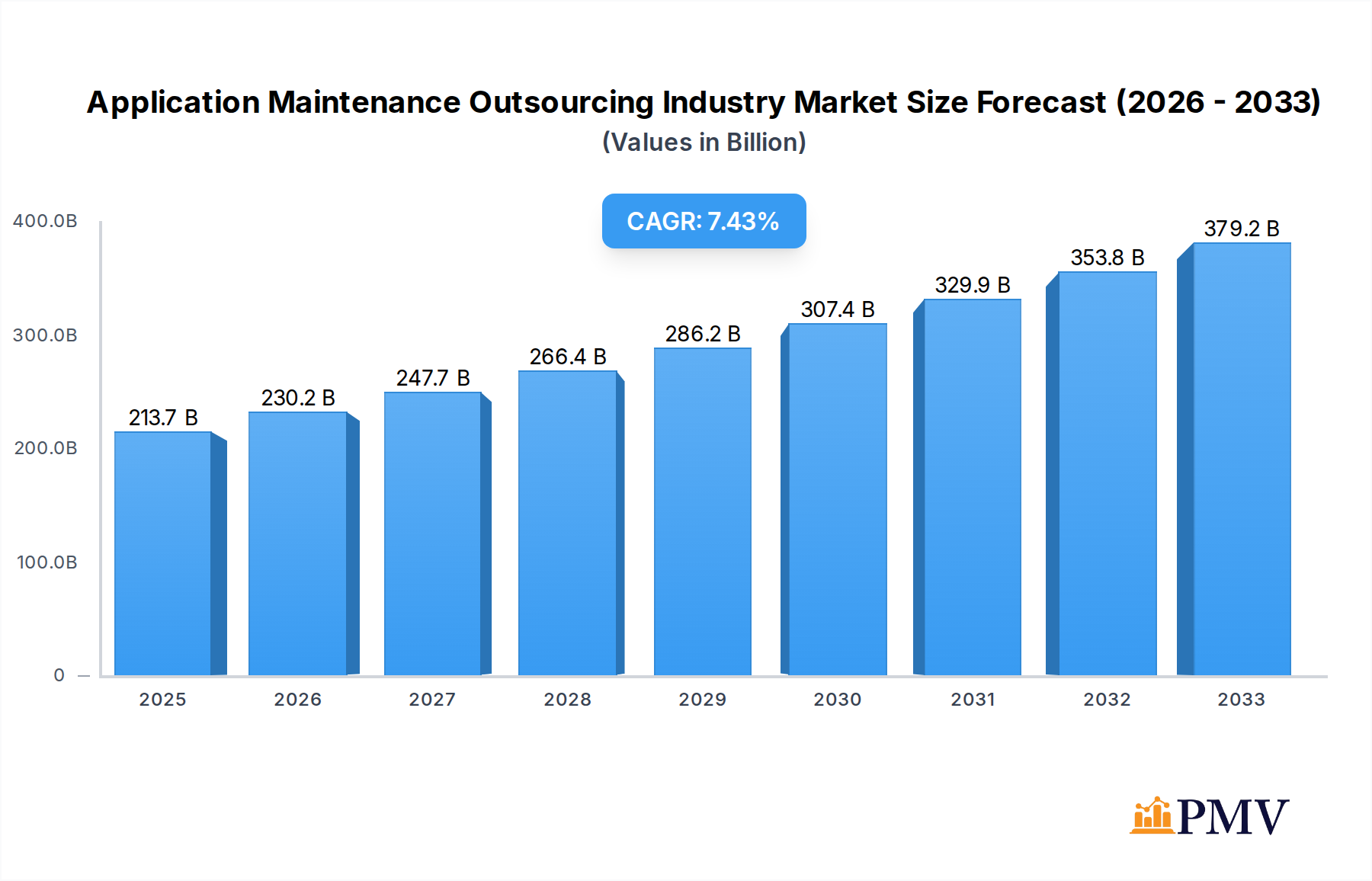

The global Application Maintenance Outsourcing (AMO) market is poised for robust expansion, projected to reach a substantial $213,744.84 million in 2025. This growth trajectory is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 7.7% during the forecast period of 2025-2033. The increasing complexity of enterprise applications, coupled with the imperative for organizations to focus on core competencies and innovation, are significant drivers propelling the AMO market forward. Businesses across various sectors are increasingly recognizing the cost-efficiencies and specialized expertise that outsourcing application maintenance provides, allowing them to reduce operational overheads while ensuring the reliability and performance of their critical software systems. The demand for agile and adaptive maintenance solutions is escalating, as companies strive to keep pace with rapid technological advancements and evolving market demands.

Application Maintenance Outsourcing Industry Market Size (In Billion)

Key industry segments like BFSI, Healthcare and Lifesciences, and Media and Entertainment are leading the charge in AMO adoption due to their reliance on sophisticated and continuously updated applications. The ongoing digital transformation initiatives across these sectors necessitate constant application support and modernization. While the AMO market presents significant opportunities, certain restraints such as data security concerns and the need for seamless integration with existing IT infrastructures need to be carefully managed by service providers. Leading global players including TCS, Accenture, IBM Global Services, and Infosys are strategically positioned to capitalize on these trends, offering comprehensive AMO solutions tailored to diverse end-user needs across major economic regions like North America, Europe, and Asia Pacific. The market's dynamic nature and the sustained demand for efficient application lifecycle management ensure a promising outlook for the AMO industry.

Application Maintenance Outsourcing Industry Company Market Share

This in-depth report provides a definitive analysis of the global Application Maintenance Outsourcing (AMO) industry, offering unparalleled insights for stakeholders seeking to navigate this dynamic market. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study delves into market structure, competitive dynamics, emerging trends, dominant segments, and strategic outlook. We meticulously analyze key players, product innovations, growth drivers, and challenges, equipping businesses with actionable intelligence for strategic decision-making. The report utilizes extensive data, projecting market values in millions, and includes detailed segmentation across crucial end-user industries.

Application Maintenance Outsourcing Industry Market Structure & Competitive Dynamics

The Application Maintenance Outsourcing (AMO) industry exhibits a moderately consolidated market structure, with a significant presence of large, established players alongside a growing number of niche providers. Market concentration is driven by substantial upfront investment requirements in technology, skilled talent, and global delivery centers. Innovation ecosystems are crucial, fostering the development of AI-driven predictive maintenance, low-code/no-code solutions for application modernization, and enhanced cybersecurity protocols. Regulatory frameworks, particularly concerning data privacy (e.g., GDPR, CCPA) and industry-specific compliance, significantly influence service offerings and operational strategies. Product substitutes are evolving, with in-house application management and newer, integrated cloud-native support services posing indirect competition. End-user trends lean towards a greater demand for proactive, outcome-based AMO, focusing on business agility and digital transformation acceleration. Mergers and acquisitions (M&A) remain a key strategy for market consolidation and expansion. Notable M&A activities in recent years have seen large IT service providers acquiring smaller, specialized AMO firms to bolster their capabilities in areas like cloud migration support and application rationalization. The overall market share is distributed, with the top ten players commanding approximately 70% of the global market, and M&A deal values consistently reaching hundreds of millions, indicating strategic consolidation and a drive for comprehensive service portfolios.

Application Maintenance Outsourcing Industry Industry Trends & Insights

The Application Maintenance Outsourcing (AMO) industry is experiencing robust growth, propelled by several interconnected trends. A primary growth driver is the escalating complexity of enterprise applications and the need for continuous updates, patches, and performance optimization to maintain operational efficiency and competitive advantage. The digital transformation imperative further fuels demand, as organizations increasingly rely on sophisticated software for core business functions and seek to offload the burden of application maintenance to specialized vendors. This trend is reflected in a projected Compound Annual Growth Rate (CAGR) of approximately 12.5% for the global AMO market. Technological disruptions are fundamentally reshaping the AMO landscape. The widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML) is enabling predictive maintenance, proactive issue identification, and automated resolution, significantly reducing downtime and operational costs. Cloud computing adoption, including hybrid and multi-cloud strategies, has also created a surge in demand for specialized cloud application maintenance services, focusing on migration, optimization, and ongoing support. Furthermore, the increasing adoption of DevOps and Agile methodologies by businesses necessitates flexible and responsive application maintenance support, driving a shift towards continuous integration and continuous delivery (CI/CD) of maintenance services. Consumer preferences are evolving towards outcome-based models, where clients seek AMO providers who can demonstrate tangible business benefits, such as improved application performance, reduced total cost of ownership (TCO), and enhanced user experience, rather than just task-based execution. Competitive dynamics are characterized by a race towards specialization and value-added services. Providers are differentiating themselves by offering end-to-end solutions, including application modernization, legacy system transformation, and digital innovation services, moving beyond traditional break-fix models. Market penetration of specialized AMO services, particularly in cloud-native and AI-driven maintenance, is projected to exceed 60% by 2030. The shift towards microservices architecture also demands more granular and specialized maintenance approaches, further driving innovation and competition in the AMO sector. The growing emphasis on data security and compliance in an era of increasing cyber threats also positions AMO providers offering robust security maintenance as a critical partner.

Dominant Markets & Segments in Application Maintenance Outsourcing Industry

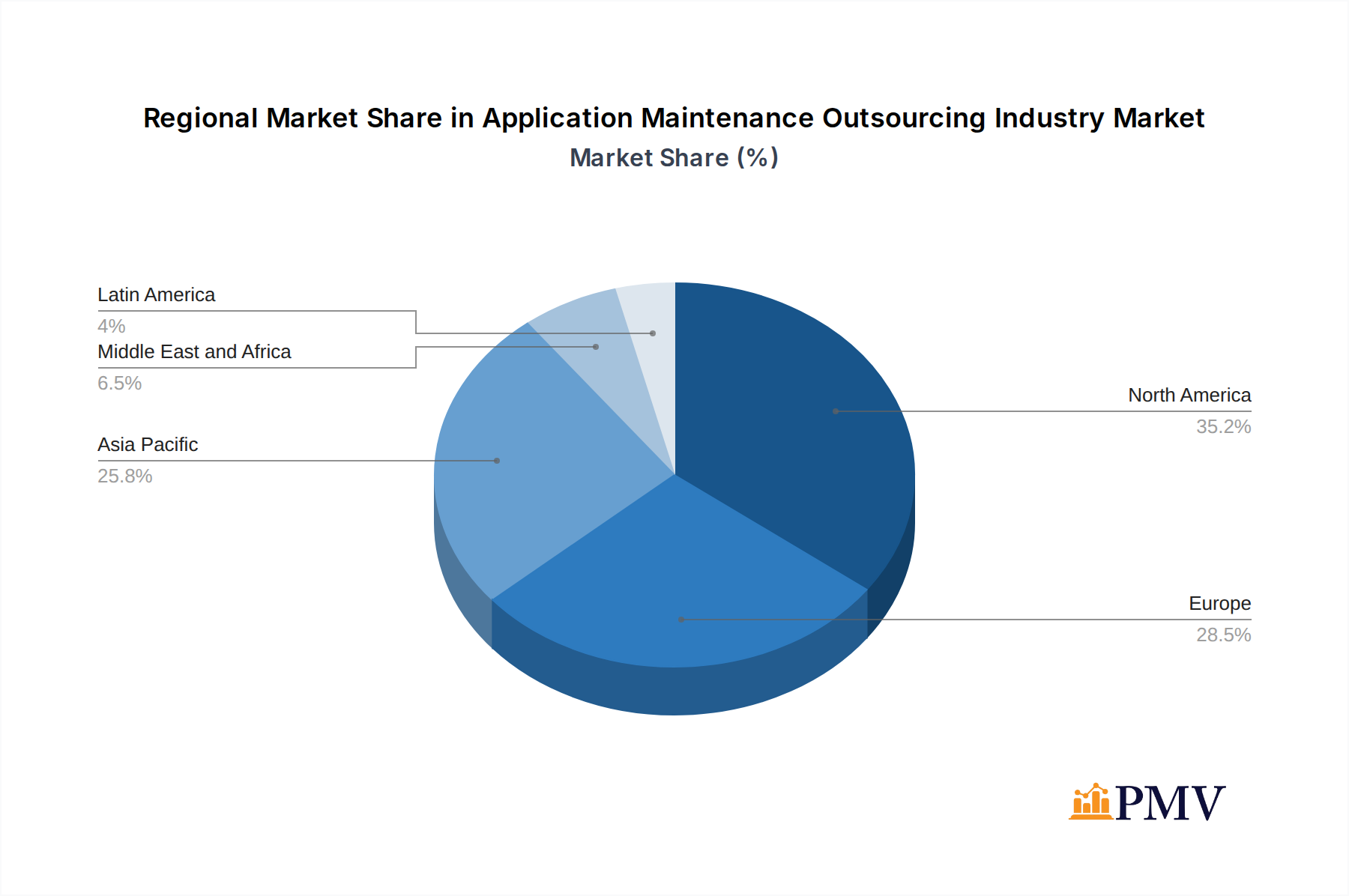

The Application Maintenance Outsourcing (AMO) industry is experiencing significant dominance and growth across various regions and end-user segments. Geographically, North America currently leads the market, driven by a mature IT infrastructure, a high concentration of large enterprises, and significant investments in digital transformation initiatives. The United States, in particular, accounts for a substantial share of the global AMO market due to the presence of major technology hubs and a strong demand for specialized IT services. However, the Asia-Pacific region is emerging as a high-growth market, fueled by rapid economic development, increasing digitalization across all sectors, and a growing pool of skilled IT talent, making it an attractive outsourcing destination.

Within the End-user Industry segmentation, the BFSI (Banking, Financial Services, and Insurance) sector stands out as the dominant segment in the AMO market.

- Key Drivers in BFSI: Regulatory compliance, the imperative to enhance customer experience through digital channels, the need for robust security in handling sensitive financial data, and the ongoing modernization of legacy core banking systems are primary growth accelerators. The increasing adoption of fintech solutions and the demand for seamless integration of new applications with existing infrastructure further bolster AMO services within BFSI.

The Healthcare and Lifesciences sector is another pivotal segment experiencing rapid growth in AMO.

- Key Drivers in Healthcare & Lifesciences: The stringent regulatory environment (e.g., HIPAA), the increasing adoption of Electronic Health Records (EHRs), the demand for interoperability between disparate healthcare systems, and the growing use of AI and data analytics for patient care and drug discovery are significant drivers. Maintaining the integrity and availability of critical healthcare applications is paramount.

The Media and Entertainment industry is also a significant contributor to the AMO market, with a focus on digital content delivery and audience engagement.

- Key Drivers in Media & Entertainment: The shift towards streaming services, the need for scalable content management systems, and the demand for personalized user experiences necessitate continuous application maintenance and updates to ensure optimal performance and competitive edge in a rapidly evolving digital landscape.

The Logistics & Transportation sector is witnessing increasing reliance on sophisticated software for supply chain management, fleet tracking, and route optimization.

- Key Drivers in Logistics & Transportation: The need for real-time data synchronization, efficient operational management, and integration of IoT devices within logistics systems drives demand for specialized AMO to ensure these critical applications remain robust and performant.

The Other Categories segment, encompassing diverse industries like manufacturing, retail, and public sector, collectively represents a substantial portion of the AMO market.

- Key Drivers in Other Categories: Digital transformation across these sectors, the adoption of Industry 4.0 technologies, the need for enterprise resource planning (ERP) system maintenance, and the development of bespoke applications tailored to specific industry needs are key factors contributing to the growth of AMO services.

The dominance of these segments is further amplified by economic policies that encourage IT investment, infrastructure development that supports global service delivery, and the continuous pursuit of operational efficiency and innovation by businesses across the board.

Application Maintenance Outsourcing Industry Product Innovations

Product innovations in the Application Maintenance Outsourcing (AMO) industry are primarily focused on enhancing efficiency, intelligence, and proactive problem-solving. The integration of AI and ML-powered tools for predictive maintenance, anomaly detection, and automated code remediation is a significant trend, allowing for earlier issue identification and resolution. Cloud-native maintenance solutions, designed to support microservices architectures and containerized applications, are gaining traction. Furthermore, the development of low-code/no-code platforms is impacting AMO by enabling faster application updates and enhancements, often managed through hybrid models where vendors support the underlying infrastructure and complex integrations. These innovations offer clients competitive advantages through reduced downtime, improved application performance, and a more agile development lifecycle.

Report Segmentation & Scope

This report meticulously segments the Application Maintenance Outsourcing (AMO) industry across critical end-user verticals and geographical regions. The primary end-user industry segments covered include BFSI, Healthcare and Lifesciences, Media and Entertainment, Logistics & Transportation, and Other Categories. For each segment, we provide detailed market size projections, growth rates, and an analysis of the competitive landscape. For example, the BFSI segment is projected to exhibit a CAGR of 13% from 2025 to 2033, with an estimated market size of over $50,000 million by 2033, driven by regulatory demands and digital innovation. The Healthcare and Lifesciences segment is expected to grow at a CAGR of 11.5%, with a strong focus on data security and interoperability.

Key Drivers of Application Maintenance Outsourcing Industry Growth

The Application Maintenance Outsourcing (AMO) industry is propelled by a confluence of powerful growth drivers. Technological advancements, such as the pervasive adoption of cloud computing, AI, and automation, necessitate specialized maintenance expertise to manage increasingly complex software environments. Economic factors, including the ongoing drive for cost optimization and the need to reallocate internal IT resources to strategic innovation rather than routine maintenance, are significant catalysts. Regulatory compliance, particularly in highly regulated sectors like BFSI and healthcare, requires continuous updates and rigorous maintenance to ensure adherence to evolving standards. The insatiable demand for enhanced digital experiences and faster time-to-market for new applications also pushes businesses to outsource AMO to gain agility and access specialized skills, such as those required for maintaining microservices architectures and legacy system modernization.

Challenges in the Application Maintenance Outsourcing Industry Sector

Despite robust growth, the Application Maintenance Outsourcing (AMO) industry faces several challenges. Ensuring seamless data security and compliance with evolving global data privacy regulations remains a paramount concern, especially when handling sensitive client data. The increasing complexity of multi-cloud and hybrid cloud environments presents technical challenges for maintenance providers, requiring constant upskilling and investment in specialized tools. A persistent talent shortage for highly skilled AMO professionals, particularly those with expertise in niche technologies and legacy systems, can hinder service delivery and impact quality. Furthermore, the competitive pressure to offer services at increasingly competitive price points, while maintaining high service levels and innovating, creates significant margin pressures for vendors. The risk of vendor lock-in and the perceived loss of control over critical application infrastructure by some clients also act as significant adoption barriers.

Leading Players in the Application Maintenance Outsourcing Industry Market

- TCS

- ATOS SE

- HCL

- Accenture

- CSC

- Wipro

- Infosys

- NTT Data

- IBM Global Services

- Capgemini

Key Developments in Application Maintenance Outsourcing Industry Sector

- 2023/Q4: Accenture announced the acquisition of a specialized cloud and AI engineering firm to bolster its cloud AMO capabilities.

- 2024/Q1: HCL Technologies launched a new AI-driven platform for proactive application performance management and predictive maintenance.

- 2024/Q2: Wipro expanded its partnership with a major cloud provider to offer enhanced cloud-native AMO services.

- 2024/Q3: Infosys unveiled its next-generation application modernization suite, designed to accelerate legacy system transformation for its AMO clients.

- 2024/Q4: Capgemini deepened its focus on cybersecurity within its AMO offerings, addressing increasing client concerns.

Strategic Application Maintenance Outsourcing Industry Market Outlook

The strategic outlook for the Application Maintenance Outsourcing (AMO) industry is exceptionally positive, driven by ongoing digital transformation initiatives and the increasing complexity of enterprise IT landscapes. Future growth will be accelerated by the deeper integration of AI and ML for intelligent automation in maintenance tasks, leading to enhanced efficiency and proactive issue resolution. The burgeoning demand for cloud-native AMO services, catering to microservices and containerized applications, will continue to be a significant growth lever. Furthermore, the increasing emphasis on application modernization and legacy system transformation presents substantial opportunities for AMO providers to offer end-to-end solutions. Strategic partnerships and acquisitions will remain critical for market players to expand their service portfolios, geographical reach, and technological capabilities, ensuring they can meet the evolving needs of a diverse global client base.

Application Maintenance Outsourcing Industry Segmentation

-

1. End-user Industry

- 1.1. BFSI

- 1.2. Healthcare and Lifesciences

- 1.3. Media and Entertainment

- 1.4. Logistics & Transportation

- 1.5. Other Categories

Application Maintenance Outsourcing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. China

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of APAC

- 4. Latin America

- 5. Middle East and Africa

Application Maintenance Outsourcing Industry Regional Market Share

Geographic Coverage of Application Maintenance Outsourcing Industry

Application Maintenance Outsourcing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased demand from BFSI; Growing emphasis on customer retention & engagement; Move towards digital transformation

- 3.3. Market Restrains

- 3.3.1. Security & Privacy-related concerns

- 3.4. Market Trends

- 3.4.1. BFSI to have a significant share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Application Maintenance Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. BFSI

- 5.1.2. Healthcare and Lifesciences

- 5.1.3. Media and Entertainment

- 5.1.4. Logistics & Transportation

- 5.1.5. Other Categories

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Application Maintenance Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. BFSI

- 6.1.2. Healthcare and Lifesciences

- 6.1.3. Media and Entertainment

- 6.1.4. Logistics & Transportation

- 6.1.5. Other Categories

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe Application Maintenance Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. BFSI

- 7.1.2. Healthcare and Lifesciences

- 7.1.3. Media and Entertainment

- 7.1.4. Logistics & Transportation

- 7.1.5. Other Categories

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific Application Maintenance Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. BFSI

- 8.1.2. Healthcare and Lifesciences

- 8.1.3. Media and Entertainment

- 8.1.4. Logistics & Transportation

- 8.1.5. Other Categories

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America Application Maintenance Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. BFSI

- 9.1.2. Healthcare and Lifesciences

- 9.1.3. Media and Entertainment

- 9.1.4. Logistics & Transportation

- 9.1.5. Other Categories

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa Application Maintenance Outsourcing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. BFSI

- 10.1.2. Healthcare and Lifesciences

- 10.1.3. Media and Entertainment

- 10.1.4. Logistics & Transportation

- 10.1.5. Other Categories

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TCS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ATOS SE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HCL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Accenture

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CSC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wipro

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Infosys

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NTT Data

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 IBM Global Services

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Capgemini

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 TCS

List of Figures

- Figure 1: Global Application Maintenance Outsourcing Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Application Maintenance Outsourcing Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Application Maintenance Outsourcing Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 4: North America Application Maintenance Outsourcing Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 5: North America Application Maintenance Outsourcing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Application Maintenance Outsourcing Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 7: North America Application Maintenance Outsourcing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 8: North America Application Maintenance Outsourcing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Application Maintenance Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Application Maintenance Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Application Maintenance Outsourcing Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 12: Europe Application Maintenance Outsourcing Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 13: Europe Application Maintenance Outsourcing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Europe Application Maintenance Outsourcing Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Europe Application Maintenance Outsourcing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: Europe Application Maintenance Outsourcing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Application Maintenance Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Application Maintenance Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Application Maintenance Outsourcing Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 20: Asia Pacific Application Maintenance Outsourcing Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: Asia Pacific Application Maintenance Outsourcing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Asia Pacific Application Maintenance Outsourcing Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Application Maintenance Outsourcing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Asia Pacific Application Maintenance Outsourcing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Application Maintenance Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Application Maintenance Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America Application Maintenance Outsourcing Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 28: Latin America Application Maintenance Outsourcing Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 29: Latin America Application Maintenance Outsourcing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Latin America Application Maintenance Outsourcing Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: Latin America Application Maintenance Outsourcing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Latin America Application Maintenance Outsourcing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Latin America Application Maintenance Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Application Maintenance Outsourcing Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Application Maintenance Outsourcing Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 36: Middle East and Africa Application Maintenance Outsourcing Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 37: Middle East and Africa Application Maintenance Outsourcing Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: Middle East and Africa Application Maintenance Outsourcing Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Application Maintenance Outsourcing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 40: Middle East and Africa Application Maintenance Outsourcing Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Middle East and Africa Application Maintenance Outsourcing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Application Maintenance Outsourcing Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Application Maintenance Outsourcing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: United States Application Maintenance Outsourcing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: China Application Maintenance Outsourcing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: China Application Maintenance Outsourcing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Germany Application Maintenance Outsourcing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Germany Application Maintenance Outsourcing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: United Kingdom Application Maintenance Outsourcing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Application Maintenance Outsourcing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: France Application Maintenance Outsourcing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Application Maintenance Outsourcing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Application Maintenance Outsourcing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Application Maintenance Outsourcing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: India Application Maintenance Outsourcing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: India Application Maintenance Outsourcing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: China Application Maintenance Outsourcing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: China Application Maintenance Outsourcing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Japan Application Maintenance Outsourcing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Japan Application Maintenance Outsourcing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: South Korea Application Maintenance Outsourcing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Korea Application Maintenance Outsourcing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Rest of APAC Application Maintenance Outsourcing Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of APAC Application Maintenance Outsourcing Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 41: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 44: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Application Maintenance Outsourcing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Global Application Maintenance Outsourcing Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Application Maintenance Outsourcing Industry?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Application Maintenance Outsourcing Industry?

Key companies in the market include TCS, ATOS SE, HCL, Accenture, CSC, Wipro, Infosys, NTT Data, IBM Global Services, Capgemini.

3. What are the main segments of the Application Maintenance Outsourcing Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased demand from BFSI; Growing emphasis on customer retention & engagement; Move towards digital transformation.

6. What are the notable trends driving market growth?

BFSI to have a significant share.

7. Are there any restraints impacting market growth?

Security & Privacy-related concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Application Maintenance Outsourcing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Application Maintenance Outsourcing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Application Maintenance Outsourcing Industry?

To stay informed about further developments, trends, and reports in the Application Maintenance Outsourcing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence