Key Insights

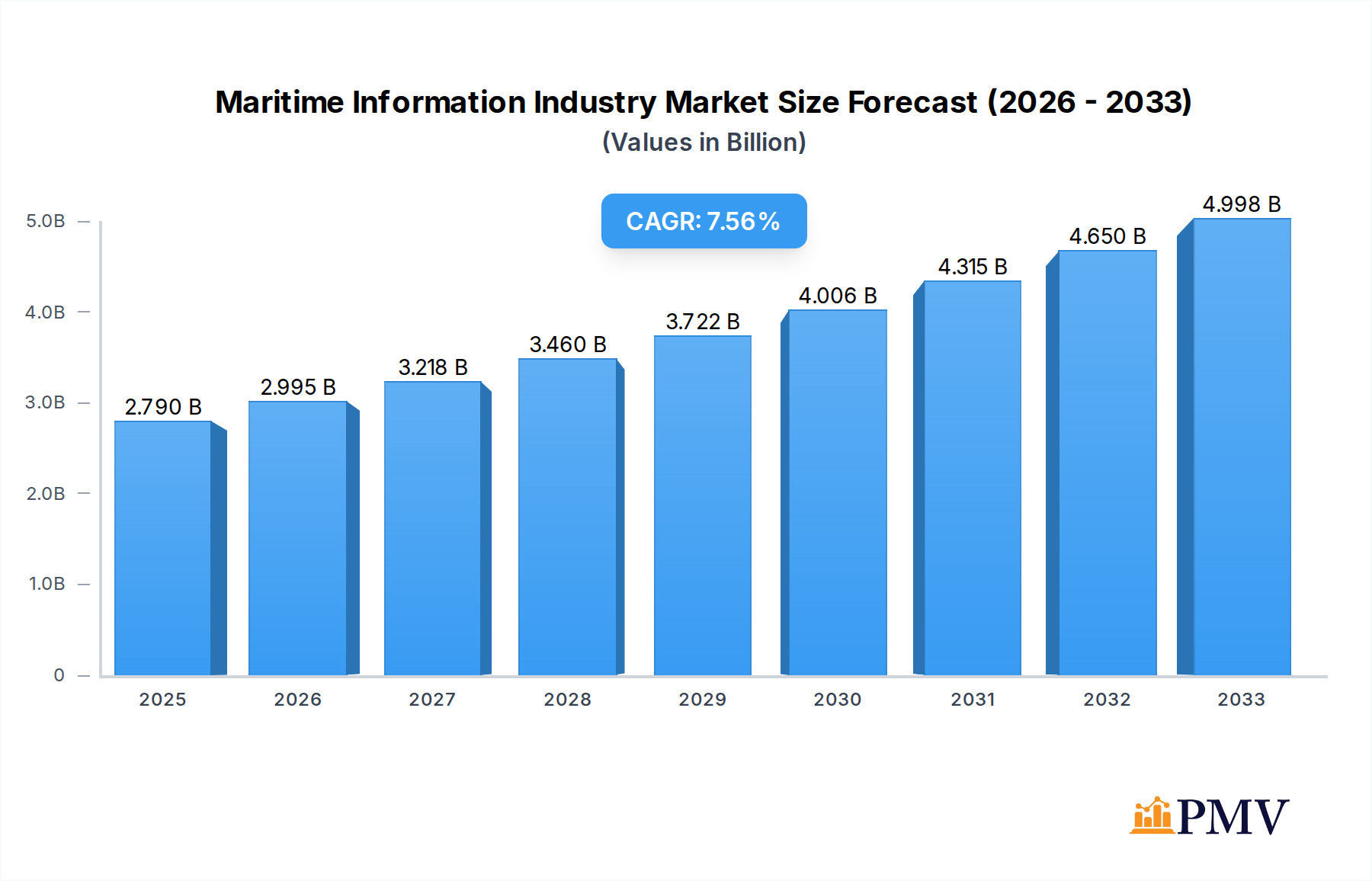

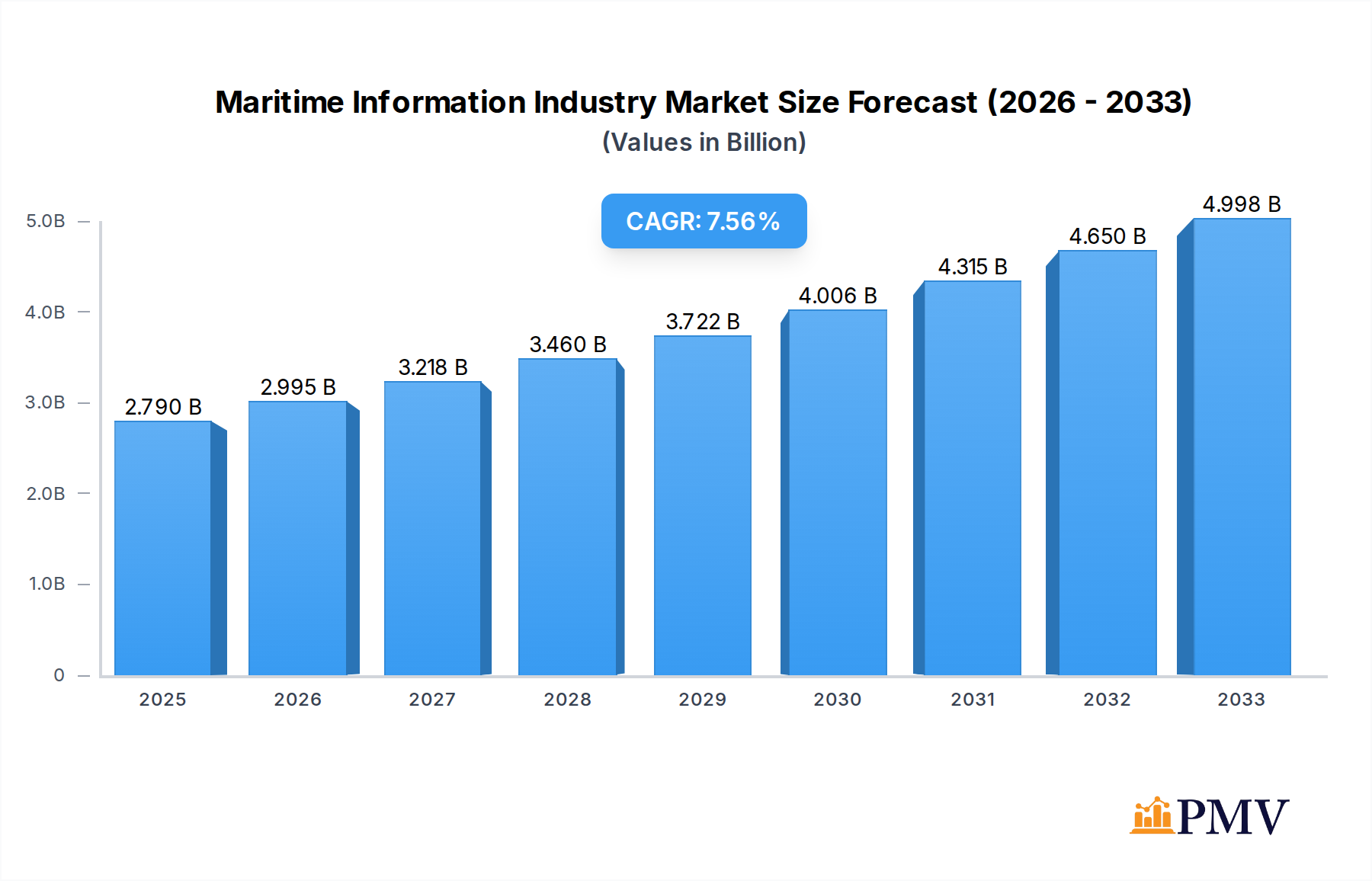

The Maritime Information Industry is poised for significant expansion, projected to reach $2.79 billion in market value. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 7.31% over the forecast period of 2025-2033. Key drivers propelling this industry include the increasing demand for enhanced vessel tracking and identification systems, the growing adoption of Synthetic Aperture Radar (SAR) for maritime surveillance and environmental monitoring, and the critical need for real-time satellite imaging for navigation, safety, and operational efficiency. The escalating complexity of global trade, coupled with heightened concerns about maritime security and environmental protection, further underscores the importance of comprehensive maritime information solutions.

Maritime Information Industry Market Size (In Billion)

The industry is segmented by application into Automatic Identification Systems (AIS), Synthetic Aperture Radar (SAR), Vessel Identification and Tracking, Satellite Imaging, and Other Applications. End-users are primarily categorized into Government and Commercial sectors. The increasing sophistication of technologies like AI and IoT is revolutionizing how maritime data is collected, processed, and analyzed, leading to more precise insights and actionable intelligence. While the market is driven by these strong factors, potential restraints such as the high initial investment costs for advanced technologies and the need for skilled personnel to manage and interpret complex data could pose challenges. However, the overarching trend is towards greater digitization and data-driven decision-making within the maritime domain, ensuring continued innovation and market expansion.

Maritime Information Industry Company Market Share

This in-depth Maritime Information Industry report offers a definitive analysis of the global market, meticulously detailing its structure, competitive landscape, and future trajectory from 2019 to 2033. With a focus on vessel tracking, satellite imaging, Automatic Identification Systems (AIS), and Synthetic Aperture Radar (SAR), this report is an essential resource for understanding the evolving needs of government and commercial end-users. Discover critical market trends, technological innovations, dominant segments, and strategic insights to capitalize on the burgeoning maritime domain awareness and blue economy initiatives. This study leverages historical data from 2019-2024 and provides detailed forecasts for the 2025-2033 period, with 2025 serving as the base and estimated year.

Maritime Information Industry Market Structure & Competitive Dynamics

The maritime information industry exhibits a dynamic market structure, characterized by a mix of established multinational corporations and agile emerging players. Market concentration varies across different segments, with vessel identification and tracking and satellite imaging sectors showing higher levels of competitive intensity. Innovation ecosystems are robust, fueled by advancements in artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) technologies, enabling enhanced maritime surveillance and operational efficiency. Regulatory frameworks, particularly those pertaining to maritime security and environmental monitoring, play a pivotal role in shaping market dynamics. Product substitutes, such as traditional manual reporting, are rapidly being superseded by digital solutions. End-user trends indicate a growing demand for integrated, real-time data analytics and predictive insights. Merger and acquisition (M&A) activities are prevalent, driven by the pursuit of market share expansion and technological convergence. For instance, estimated M&A deal values are projected to reach xx Million over the forecast period, reflecting strategic consolidation. Key players are actively investing in R&D and forming strategic alliances to maintain a competitive edge in this rapidly evolving maritime technology landscape.

- Market Concentration: Moderate to High in key segments like Vessel Identification and Tracking.

- Innovation Ecosystems: Thriving, driven by AI, ML, and IoT for enhanced maritime domain awareness.

- Regulatory Frameworks: Crucial for maritime security, environmental compliance, and data sharing.

- Product Substitutes: Declining as digital maritime information solutions gain traction.

- End-User Trends: Increasing demand for real-time data, analytics, and predictive insights.

- M&A Activities: Significant, indicating consolidation and strategic growth.

Maritime Information Industry Industry Trends & Insights

The maritime information industry is experiencing a significant growth spurt, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% over the forecast period. This expansion is primarily propelled by escalating global trade, increasing maritime traffic, and a growing emphasis on maritime security and border control. The blue economy vision, championed by governments worldwide, is a major catalyst, driving investments in sustainable ocean management and resource utilization. Technological disruptions, particularly the proliferation of low-cost satellite constellations and advanced sensor technologies, are revolutionizing data acquisition and analysis capabilities. Satellite imaging, Automatic Identification Systems (AIS), and Synthetic Aperture Radar (SAR) are becoming indispensable tools for vessel tracking and maritime surveillance. Consumer preferences are shifting towards integrated platforms that offer comprehensive maritime situational awareness, encompassing environmental data, vessel movements, and port operations. Competitive dynamics are intensifying as companies like Spire Global, L3 Harris Technologies Inc, and Inmarsat Global Limited invest heavily in R&D to offer superior data analytics and connectivity solutions. The integration of AI and ML is enabling predictive maintenance, route optimization, and enhanced safety protocols, further boosting market penetration of advanced maritime information services. The demand for specialized applications like ballast water management tracking and illegal fishing detection is also on the rise, highlighting the diverse needs within the maritime sector.

Dominant Markets & Segments in Maritime Information Industry

The maritime information industry is characterized by several dominant markets and segments, each contributing significantly to overall market growth.

Leading Region:

The Asia-Pacific region stands out as a leading market, driven by its extensive coastline, burgeoning maritime trade, and significant investments in port infrastructure and naval modernization. Countries like China, India, and Southeast Asian nations are actively adopting advanced maritime information systems to enhance maritime domain awareness, secure their vast maritime boundaries, and promote blue economy initiatives. The ongoing development of smart shipping technologies and increasing adoption of vessel identification and tracking solutions further bolster the region's dominance.

- Key Drivers in Asia-Pacific:

- Massive maritime trade volumes and extensive shipping routes.

- Government initiatives promoting blue economy and maritime security.

- Rapid adoption of digital technologies in port operations and logistics.

- Increasing naval modernization and focus on maritime defense.

Dominant Application Segments:

Vessel Identification and Tracking: This segment holds a commanding position due to the critical need for real-time visibility of vessel movements for maritime security, search and rescue (SAR) operations, and traffic management. The widespread deployment of Automatic Identification Systems (AIS), coupled with advanced satellite-based tracking, underpins its dominance. Companies are focusing on enhancing accuracy, reliability, and data integration capabilities to meet evolving end-user demands.

- Key Drivers:

- Mandatory AIS regulations for various vessel classes.

- Growing need for maritime situational awareness by governments and commercial entities.

- Integration with other data sources for comprehensive tracking.

- Key Drivers:

Satellite Imaging: This segment is experiencing substantial growth, fueled by the increasing availability of high-resolution satellite imagery and its application in maritime surveillance, environmental monitoring, and resource management. Its ability to provide broad-area coverage and detect subtle changes makes it invaluable for applications such as oil spill detection, illegal fishing, and port infrastructure assessment.

- Key Drivers:

- Advancements in satellite sensor technology and launch capabilities.

- Growing demand for Earth observation data in various maritime applications.

- Support for sustainable ocean management and climate change monitoring.

- Key Drivers:

Automatic Identification Systems (AIS): As a foundational technology for vessel tracking, AIS continues to be a dominant segment. Its role in collision avoidance, port entry/exit management, and maritime safety is indispensable. Ongoing development focuses on improving data integrity, reducing latency, and enhancing the range and coverage of AIS signals.

- Key Drivers:

- International maritime regulations mandating AIS carriage.

- Its role as a primary data source for many maritime information systems.

- Increasing integration with other IoT devices for enhanced data collection.

- Key Drivers:

Dominant End-User Segment:

Government: This segment represents a significant portion of the maritime information industry market. Governments globally utilize these solutions for national security, border protection, maritime law enforcement, environmental regulation, and disaster response. Investments in sophisticated maritime surveillance systems and integrated command and control centers are driving demand. The focus on securing exclusive economic zones (EEZs) and combating illegal activities at sea further amplifies government spending in this sector.

- Key Drivers:

- National security imperatives and geopolitical considerations.

- Enforcement of international maritime laws and regulations.

- Disaster preparedness and response capabilities.

- Management of critical maritime infrastructure.

- Key Drivers:

Maritime Information Industry Product Innovations

Recent product innovations in the maritime information industry are focused on enhancing data fusion, AI-driven analytics, and seamless connectivity. Companies are developing integrated platforms that combine data from AIS, SAR, optical satellite imagery, and vessel sensors to provide unparalleled maritime domain awareness. These innovations offer competitive advantages by enabling predictive analytics for vessel maintenance, optimizing shipping routes for fuel efficiency, and providing early warnings for potential maritime security threats. The trend towards miniaturization of sensors and advancements in low-power communication technologies are also enabling new applications in remote maritime monitoring.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the maritime information industry market, covering key applications and end-user segments to offer granular insights.

Application Segments:

- Automatic Identification Systems (AIS): Focuses on AIS data services, AIS hardware, and related analytics for vessel tracking and identification. Market size is estimated at xx Million with a projected growth of xx% by 2033. Competitive dynamics include providers of AIS transponders and data aggregators.

- Synthetic Aperture Radar (SAR): Encompasses SAR data acquisition, processing, and analysis for maritime surveillance, oil spill detection, and ice monitoring. The market size is estimated at xx Million with a projected growth of xx% by 2033. Key players are satellite operators and data service providers.

- Vessel Identification and Tracking: Includes comprehensive solutions for tracking vessels using multiple data sources, offering real-time location, status, and historical data. Market size is projected at xx Million with a xx% growth rate. Competition involves platform providers and data analytics firms.

- Satellite Imaging: Covers optical and radar satellite imagery for various maritime applications, including port monitoring, ship detection, and environmental studies. Market size is estimated at xx Million with a projected xx% growth. Dominated by satellite imagery providers and geospatial analytics companies.

- Other Applications: Encompasses emerging applications such as maritime cybersecurity, autonomous shipping support, and port automation technologies. Market size is xx Million with a projected xx% growth.

End-User Segments:

- Government: Analyzing demand from defense, coast guard, environmental agencies, and port authorities. Market size is projected at xx Million with a xx% growth.

- Commercial: Covering segments like shipping companies, offshore energy, fisheries, and insurance. Market size is estimated at xx Million with a xx% growth.

Key Drivers of Maritime Information Industry Growth

Several key drivers are propelling the growth of the maritime information industry. Technologically, the rapid advancements in satellite technology, AI, and IoT are enabling more sophisticated and cost-effective solutions for maritime surveillance and data analytics. Economically, the expansion of global trade and the increasing value of maritime assets necessitate enhanced visibility and security. Regulatory frameworks, such as international mandates for AIS and growing pressure for environmental protection in oceans, also play a crucial role. Furthermore, the strategic importance of securing maritime trade routes and combating illegal activities like piracy and smuggling are significant growth accelerators, driving demand for comprehensive maritime domain awareness solutions. The global focus on the blue economy further incentivizes investments in sustainable maritime practices and resource management, requiring advanced information systems.

Challenges in the Maritime Information Industry Sector

Despite robust growth, the maritime information industry faces several challenges. Regulatory hurdles, particularly varying data privacy laws and cybersecurity standards across different regions, can hinder seamless data integration and global deployment. Supply chain issues, including the availability of specialized hardware components and launch opportunities for satellites, can impact market expansion. Intense competitive pressures from numerous players, ranging from large corporations to niche startups, can lead to price erosion and make market differentiation challenging. Furthermore, the significant upfront investment required for developing and deploying advanced maritime information systems can be a barrier for some smaller players and end-users. Quantifiable impacts of these challenges include potential delays in product development and deployment, affecting projected market penetration rates.

Leading Players in the Maritime Information Industry Market

- Spire Global

- L3 Harris Technologies Inc

- Iridium Communications Inc

- BAE Systems

- Windward Limited

- Inmarsat Global Limited

- Thales Group

- ORBCOMM Inc

- SAAB group

- Northrop Grumman Corporation

Key Developments in Maritime Information Industry Sector

- June 2023: Inmarsat Maritime announced the launch of a fleet reach service to bring seamless connectivity to ships from sea to port. This new maritime connectivity service enables uninterrupted access to high-speed connectivity, even when docked in ports, beating the coastal capacity crunch. The company's Fleet Reach service is optimized by Fleet Xpress, which offers supercharged coastal connectivity and enables faster speeds, increased signal strength, lower latency, and more reliable connectivity when sailing near coasts or docked in-port. This development significantly enhances maritime connectivity and data flow.

- October 2023: Prime Minister Narendra Modi launched maritime projects worth INR 23,000 crore and unveiled a long-term vision document for India's blue economy at the Global Maritime India Summit 2023. This initiative underscores the growing government focus on maritime development and blue economy initiatives, likely to drive demand for maritime information systems and vessel tracking solutions in the region.

Strategic Maritime Information Industry Market Outlook

The strategic outlook for the maritime information industry remains highly positive, driven by ongoing digital transformation and the increasing strategic importance of oceans. Future growth accelerators include the integration of AI and ML for predictive analytics, further enhancing maritime security, operational efficiency, and environmental monitoring. The expanding blue economy globally presents significant opportunities for companies offering solutions in sustainable fishing, offshore renewable energy support, and marine conservation. The continuous advancements in satellite technology and the rise of constellations offering enhanced revisit rates and higher resolution imagery will fuel innovation in satellite imaging and vessel tracking. Strategic opportunities lie in developing comprehensive, integrated platforms that can provide end-to-end maritime domain awareness and cater to the evolving needs of both government and commercial entities. The increasing focus on maritime cybersecurity also presents a growing segment for strategic expansion.

Maritime Information Industry Segmentation

-

1. Application

- 1.1. Automatic Identification Systems

- 1.2. Synthetic Aperture Radar

- 1.3. Vessel Identification and Tracking

- 1.4. Satellite Imaging

- 1.5. Other Applications

-

2. End-user

- 2.1. Government

- 2.2. Commercial

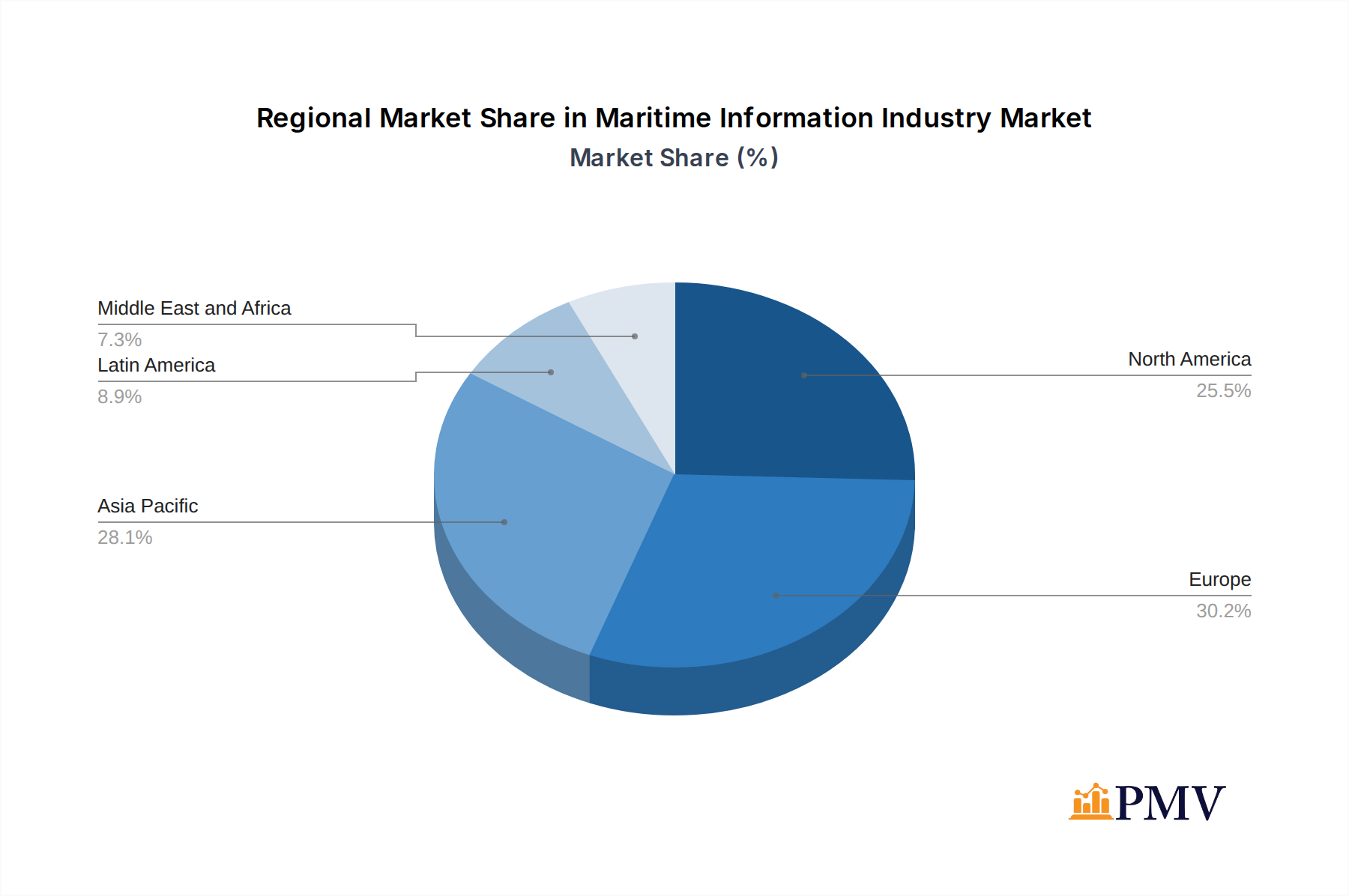

Maritime Information Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Maritime Information Industry Regional Market Share

Geographic Coverage of Maritime Information Industry

Maritime Information Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advantage of Enhancing On-board Safety and Compliance Conditions on Ships

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Automated Identification Systems to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Maritime Information Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automatic Identification Systems

- 5.1.2. Synthetic Aperture Radar

- 5.1.3. Vessel Identification and Tracking

- 5.1.4. Satellite Imaging

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Government

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Maritime Information Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automatic Identification Systems

- 6.1.2. Synthetic Aperture Radar

- 6.1.3. Vessel Identification and Tracking

- 6.1.4. Satellite Imaging

- 6.1.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Government

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Maritime Information Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automatic Identification Systems

- 7.1.2. Synthetic Aperture Radar

- 7.1.3. Vessel Identification and Tracking

- 7.1.4. Satellite Imaging

- 7.1.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Government

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Maritime Information Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automatic Identification Systems

- 8.1.2. Synthetic Aperture Radar

- 8.1.3. Vessel Identification and Tracking

- 8.1.4. Satellite Imaging

- 8.1.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Government

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Maritime Information Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automatic Identification Systems

- 9.1.2. Synthetic Aperture Radar

- 9.1.3. Vessel Identification and Tracking

- 9.1.4. Satellite Imaging

- 9.1.5. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Government

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Maritime Information Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automatic Identification Systems

- 10.1.2. Synthetic Aperture Radar

- 10.1.3. Vessel Identification and Tracking

- 10.1.4. Satellite Imaging

- 10.1.5. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Government

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Spire Global

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 L3 Harris Technologies Inc *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Iridium Communications Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BAE Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Windward Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Inmarsat Global Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thales Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ORBCOMM Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SAAB group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Northrop Grumman Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Spire Global

List of Figures

- Figure 1: Global Maritime Information Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Maritime Information Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Maritime Information Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Maritime Information Industry Revenue (Million), by End-user 2025 & 2033

- Figure 5: North America Maritime Information Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Maritime Information Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Maritime Information Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Maritime Information Industry Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Maritime Information Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Maritime Information Industry Revenue (Million), by End-user 2025 & 2033

- Figure 11: Europe Maritime Information Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Europe Maritime Information Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Maritime Information Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Maritime Information Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Maritime Information Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Maritime Information Industry Revenue (Million), by End-user 2025 & 2033

- Figure 17: Asia Pacific Maritime Information Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Asia Pacific Maritime Information Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Maritime Information Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Maritime Information Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Latin America Maritime Information Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Maritime Information Industry Revenue (Million), by End-user 2025 & 2033

- Figure 23: Latin America Maritime Information Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Latin America Maritime Information Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Maritime Information Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Maritime Information Industry Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Maritime Information Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Maritime Information Industry Revenue (Million), by End-user 2025 & 2033

- Figure 29: Middle East and Africa Maritime Information Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Middle East and Africa Maritime Information Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Maritime Information Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Maritime Information Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Maritime Information Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 3: Global Maritime Information Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Maritime Information Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Maritime Information Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 6: Global Maritime Information Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Maritime Information Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Maritime Information Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 9: Global Maritime Information Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Maritime Information Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Maritime Information Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 12: Global Maritime Information Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Maritime Information Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Maritime Information Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 15: Global Maritime Information Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Maritime Information Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Maritime Information Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 18: Global Maritime Information Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Maritime Information Industry?

The projected CAGR is approximately 7.31%.

2. Which companies are prominent players in the Maritime Information Industry?

Key companies in the market include Spire Global, L3 Harris Technologies Inc *List Not Exhaustive, Iridium Communications Inc, BAE Systems, Windward Limited, Inmarsat Global Limited, Thales Group, ORBCOMM Inc, SAAB group, Northrop Grumman Corporation.

3. What are the main segments of the Maritime Information Industry?

The market segments include Application, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Advantage of Enhancing On-board Safety and Compliance Conditions on Ships.

6. What are the notable trends driving market growth?

Automated Identification Systems to Dominate the Market.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

June 2023 - Inmarsat Maritime announced the launch of a fleet reach service to bring seamless connectivity to ships from sea to port. The new maritime connectivity service will enable uninterrupted access to high-speed connectivity, even when docked in ports, beating the coastal capacity crunch. The company's Fleet Reach service is optimized by Fleet Xpress, which offers supercharged coastal connectivity and enables faster speeds, increased signal strength, lower latency, and more reliable connectivity when sailing near coasts or docked in-port

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Maritime Information Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Maritime Information Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Maritime Information Industry?

To stay informed about further developments, trends, and reports in the Maritime Information Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence