Key Insights

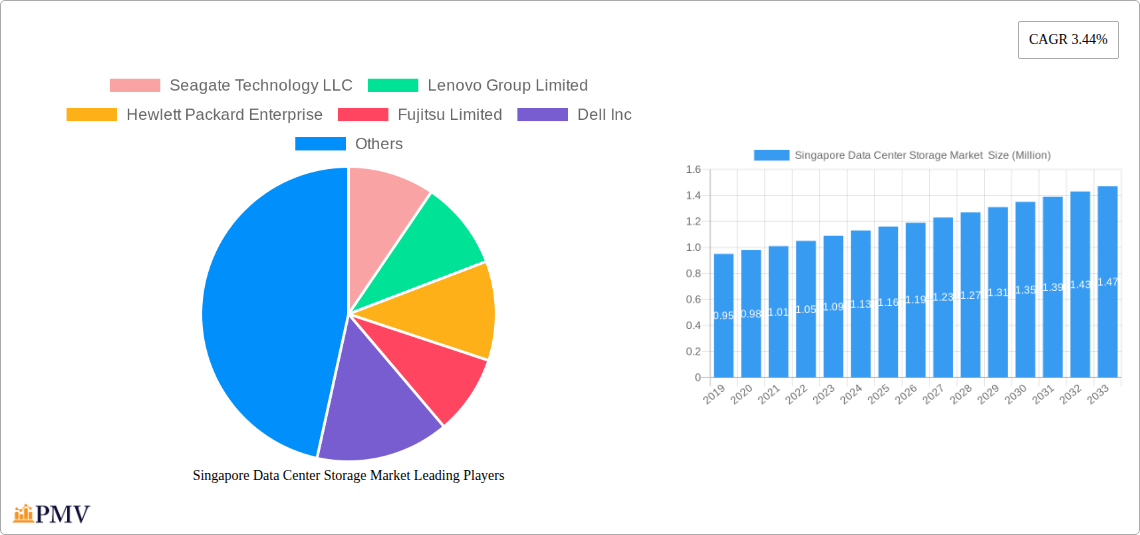

The Singapore Data Center Storage Market is poised for significant expansion, projected to reach $1.16 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 3.44% projected for the forecast period. This growth is primarily fueled by the escalating demand for efficient and scalable data storage solutions driven by the burgeoning digital economy in Singapore. Key market drivers include the rapid adoption of cloud computing services, the increasing volume of data generated by businesses and consumers, and the ongoing digital transformation initiatives across various sectors. Furthermore, the strategic importance of Singapore as a regional hub for data centers and its strong government support for technology infrastructure development are substantial growth catalysts. The market is witnessing a notable shift towards advanced storage technologies that offer superior performance, reliability, and cost-effectiveness.

Singapore Data Center Storage Market Market Size (In Million)

The market segmentation analysis reveals a dynamic landscape. In terms of Storage Technology, Network Attached Storage (NAS) and Storage Area Network (SAN) solutions are expected to dominate, catering to diverse enterprise needs for centralized and high-performance storage. The shift towards All-Flash Storage is a prominent trend, driven by its unparalleled speed and efficiency, especially for mission-critical applications. Traditional Storage continues to hold a share, often integrated into hybrid solutions for cost optimization. Key end-user industries like IT & Telecommunication, BFSI, and Media & Entertainment are the primary consumers, leveraging advanced storage to manage vast datasets and deliver seamless services. While the market benefits from strong growth drivers, potential restraints such as the high initial investment for advanced storage infrastructure and evolving data privacy regulations could influence the pace of adoption. However, ongoing innovation and the strategic imperative for robust data management are expected to outweigh these challenges, ensuring sustained growth for the Singapore Data Center Storage Market.

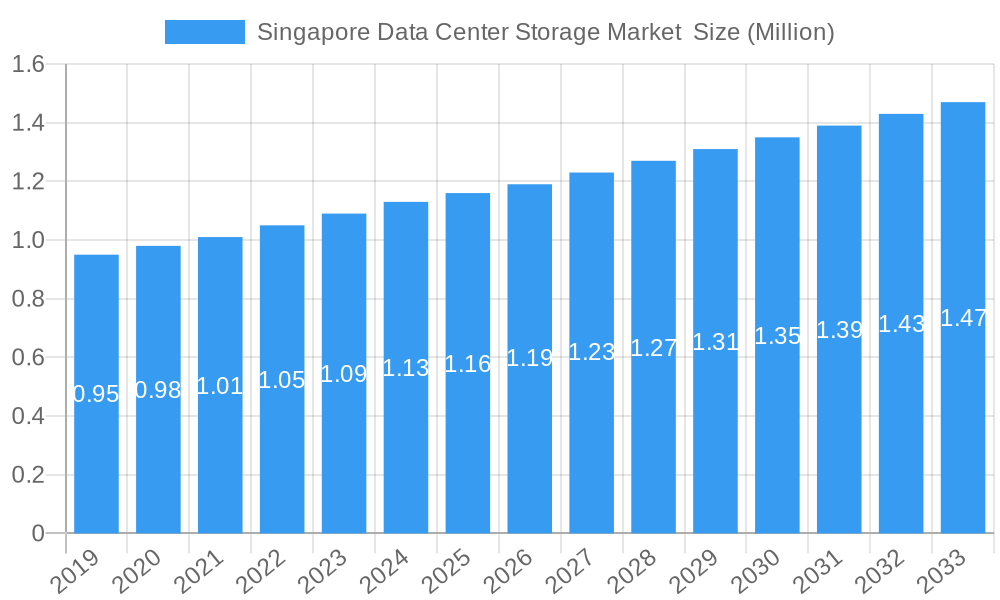

Singapore Data Center Storage Market Company Market Share

Singapore Data Center Storage Market: Comprehensive Market Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Singapore Data Center Storage Market, offering critical insights into its current landscape and projected trajectory from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025–2033, this study delves into market structure, industry trends, dominant segments, product innovations, and key strategic outlooks, making it an indispensable resource for stakeholders seeking to capitalize on this rapidly evolving sector. Our analysis covers leading players like Seagate Technology LLC, Lenovo Group Limited, Hewlett Packard Enterprise, Fujitsu Limited, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Oracle Corporation, and Pure Storage Inc.

Singapore Data Center Storage Market Market Structure & Competitive Dynamics

The Singapore Data Center Storage Market is characterized by a moderate to high level of concentration, with a few dominant players holding significant market share. Innovation ecosystems are robust, driven by substantial R&D investments from key vendors in areas like flash storage, hybrid solutions, and software-defined storage. Regulatory frameworks in Singapore are generally supportive of technological advancements and data security, fostering a stable operating environment. Product substitutes are evolving, with cloud storage solutions presenting a growing alternative, though on-premises and collocated data center storage remains crucial for specific latency and security requirements. End-user trends indicate a strong demand for scalable, high-performance, and cost-effective storage solutions, particularly from the IT & Telecommunication and BFSI sectors. Merger and acquisition (M&A) activities are present, as companies seek to expand their portfolios, gain technological expertise, or consolidate their market position. For instance, recent M&A deals in the broader APAC region have seen values ranging from tens of millions to over a billion Singapore Dollars, reflecting strategic consolidations and technology acquisitions. The market share of key players is dynamic, with leaders like Dell Inc and Hewlett Packard Enterprise consistently vying for top positions.

Singapore Data Center Storage Market Industry Trends & Insights

The Singapore Data Center Storage Market is experiencing significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033. This expansion is fueled by a confluence of potent growth drivers. The escalating volume of data generated by businesses across all sectors, propelled by digital transformation initiatives, IoT adoption, and the rise of big data analytics, necessitates robust and scalable storage infrastructure. Singapore's strategic position as a regional hub for technology and finance further amplifies demand. Technological disruptions, particularly the advancements in Solid State Drive (SSD) technology and the increasing adoption of All-Flash Arrays (AFAs), are reshaping storage performance and efficiency. Hybrid storage solutions, which leverage the benefits of both traditional and flash storage, are gaining traction due to their cost-effectiveness and optimized performance. Consumer preferences are increasingly leaning towards solutions offering higher IOPS (Input/Output Operations Per Second), lower latency, enhanced data protection, and simplified management. The competitive dynamics are intense, with vendors focusing on product differentiation through advanced features, competitive pricing, and comprehensive service offerings. The market penetration of advanced storage technologies, such as NVMe-based solutions, is steadily increasing, indicating a shift towards next-generation storage architectures. Furthermore, the growing emphasis on data sovereignty and regulatory compliance in sectors like BFSI and Government mandates the deployment of secure and localized storage solutions, driving demand for on-premises and private cloud storage. The "Other Technologies" segment, encompassing emerging solutions like DNA storage and computational storage, is nascent but holds significant long-term potential.

Dominant Markets & Segments in Singapore Data Center Storage Market

Dominant Storage Technology: Network Attached Storage (NAS) is currently a dominant segment within Singapore's data center storage market, driven by its ease of use, scalability, and cost-effectiveness for file sharing and collaborative environments. Its adoption is particularly high in the IT & Telecommunication and Media & Entertainment sectors. Storage Area Network (SAN) remains a critical technology for high-performance, block-level storage, essential for mission-critical applications in the BFSI and Government sectors, where low latency and high availability are paramount. Direct Attached Storage (DAS) continues to find its niche in smaller deployments or specific server-level storage needs.

Dominant Storage Type: Traditional Storage, encompassing Hard Disk Drives (HDDs), still holds a significant market share due to its cost-per-terabyte advantage, especially for bulk storage and archival purposes. However, All-Flash Storage is rapidly gaining prominence, fueled by the demand for speed and performance. Its market penetration is accelerating across all end-user segments, particularly those with demanding application workloads. Hybrid Storage solutions, offering a balance of cost and performance, are also experiencing robust growth as they cater to a wider range of needs and budgets.

Dominant End User: The IT & Telecommunication sector is a leading end-user segment, driven by the continuous expansion of data centers, cloud services, and network infrastructure. The Banking, Financial Services, and Insurance (BFSI) sector is another dominant force, requiring high-security, low-latency storage for transactional data, risk management, and regulatory compliance. The Government sector, with its increasing focus on e-governance initiatives and national data security, represents a significant and growing market. The Media & Entertainment industry's demand for high-capacity storage for content creation, distribution, and archival also contributes significantly to the market's dynamism.

Singapore Data Center Storage Market Product Innovations

Singapore's data center storage market is witnessing a surge in product innovations aimed at enhancing performance, efficiency, and data management capabilities. Vendors are actively developing and deploying solutions that leverage advanced flash technologies, such as NVMe and NVMe-oF, to achieve ultra-low latency and high throughput. Software-defined storage (SDS) continues to evolve, offering greater flexibility, automation, and centralized management across diverse storage infrastructures. Innovations also focus on intelligent data placement, automated tiering, and advanced data protection features like immutable snapshots and real-time replication to combat ransomware and ensure business continuity. These advancements are crucial for meeting the escalating demands of data-intensive applications and evolving digital workloads.

Report Segmentation & Scope

This report segments the Singapore Data Center Storage Market across several key dimensions to provide a granular understanding of the market's dynamics. Storage Technology is analyzed through Network Attached Storage (NAS), Storage Area Network (SAN), Direct Attached Storage (DAS), and Other Technologies, with each segment exhibiting distinct growth trajectories and adoption rates. Storage Type is dissected into Traditional Storage, All-Flash Storage, and Hybrid Storage, highlighting the ongoing shift towards performance-driven solutions. The End User segmentation includes IT & Telecommunication, BFSI, Government, Media & Entertainment, and Other End Users, revealing the varied storage needs and investment capacities of each sector. Market size estimations and competitive landscapes are detailed for each segment.

Key Drivers of Singapore Data Center Storage Market Growth

Several key drivers are propelling the Singapore Data Center Storage Market forward. The relentless growth in data volumes, fueled by digitalization and emerging technologies like AI and IoT, creates an insatiable demand for storage capacity and performance. Singapore's status as a global digital hub and a strong proponent of smart nation initiatives fosters significant investment in advanced data center infrastructure. Government initiatives promoting data localization and cybersecurity further bolster the need for robust on-premises and collocated storage solutions. Technological advancements, particularly in flash memory and software-defined storage, are continuously enhancing storage capabilities, making them more accessible and efficient.

Challenges in the Singapore Data Center Storage Market Sector

Despite the robust growth, the Singapore Data Center Storage Market faces several challenges. Increasing energy consumption and cooling requirements for high-density storage solutions pose environmental and operational cost concerns. The rapid pace of technological obsolescence necessitates continuous investment in upgrades, impacting capital expenditure. Cybersecurity threats, including ransomware attacks, demand sophisticated and proactive data protection strategies, adding complexity and cost. Furthermore, the skilled workforce required to manage and maintain advanced storage infrastructure can be a limiting factor. The competitive pressure among vendors also drives down profit margins.

Leading Players in the Singapore Data Center Storage Market Market

- Seagate Technology LLC

- Lenovo Group Limited

- Hewlett Packard Enterprise

- Fujitsu Limited

- Dell Inc

- NetApp Inc

- Kingston Technology Company Inc

- Huawei Technologies Co Ltd

- Oracle Corporation

- Pure Storage Inc

Key Developments in Singapore Data Center Storage Market Sector

- 2023 Q4: Launch of new NVMe-based enterprise SSDs by multiple vendors, offering significant performance improvements for critical applications.

- 2024 Q1: Increased M&A activity targeting data center infrastructure providers and storage solution specialists.

- 2024 Q2: Growing adoption of ransomware protection features like immutable snapshots and advanced backup solutions.

- 2024 Q3: Introduction of AI-driven storage management platforms for enhanced efficiency and predictive maintenance.

- 2024 Q4: Focus on sustainable data center storage solutions with energy-efficient hardware and cooling technologies.

Strategic Singapore Data Center Storage Market Market Outlook

The strategic outlook for the Singapore Data Center Storage Market remains exceptionally positive, driven by sustained demand for high-performance, scalable, and secure storage solutions. The continued digital transformation across industries, coupled with Singapore's strategic importance as a regional data hub, will fuel further investment in cutting-edge storage technologies. Opportunities lie in addressing the growing need for edge computing storage, enhancing data analytics capabilities, and providing robust cybersecurity integrated storage. The market is poised for continued innovation and strategic collaborations, ensuring its relevance and growth in the coming years.

Singapore Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End Users

Singapore Data Center Storage Market Segmentation By Geography

- 1. Singapore

Singapore Data Center Storage Market Regional Market Share

Geographic Coverage of Singapore Data Center Storage Market

Singapore Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth

- 3.3. Market Restrains

- 3.3.1. High Initial Investment Cost To Hinder Market Growth

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Data Center Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Seagate Technology LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lenovo Group Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hewlett Packard Enterprise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fujitsu Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NetApp Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kingston Technology Company Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pure Storage Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Seagate Technology LLC

List of Figures

- Figure 1: Singapore Data Center Storage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Data Center Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Data Center Storage Market Revenue Million Forecast, by Storage Technology 2020 & 2033

- Table 2: Singapore Data Center Storage Market Revenue Million Forecast, by Storage Type 2020 & 2033

- Table 3: Singapore Data Center Storage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Singapore Data Center Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Singapore Data Center Storage Market Revenue Million Forecast, by Storage Technology 2020 & 2033

- Table 6: Singapore Data Center Storage Market Revenue Million Forecast, by Storage Type 2020 & 2033

- Table 7: Singapore Data Center Storage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Singapore Data Center Storage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Data Center Storage Market ?

The projected CAGR is approximately 3.44%.

2. Which companies are prominent players in the Singapore Data Center Storage Market ?

Key companies in the market include Seagate Technology LLC, Lenovo Group Limited, Hewlett Packard Enterprise, Fujitsu Limited, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Oracle Corporation, Pure Storage Inc.

3. What are the main segments of the Singapore Data Center Storage Market ?

The market segments include Storage Technology, Storage Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of IT Infrastructure to Increase Market Growth; Increased Investments in Hyperscale Data Centers To Increase Market Growth.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

High Initial Investment Cost To Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Data Center Storage Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Data Center Storage Market ?

To stay informed about further developments, trends, and reports in the Singapore Data Center Storage Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence