Key Insights

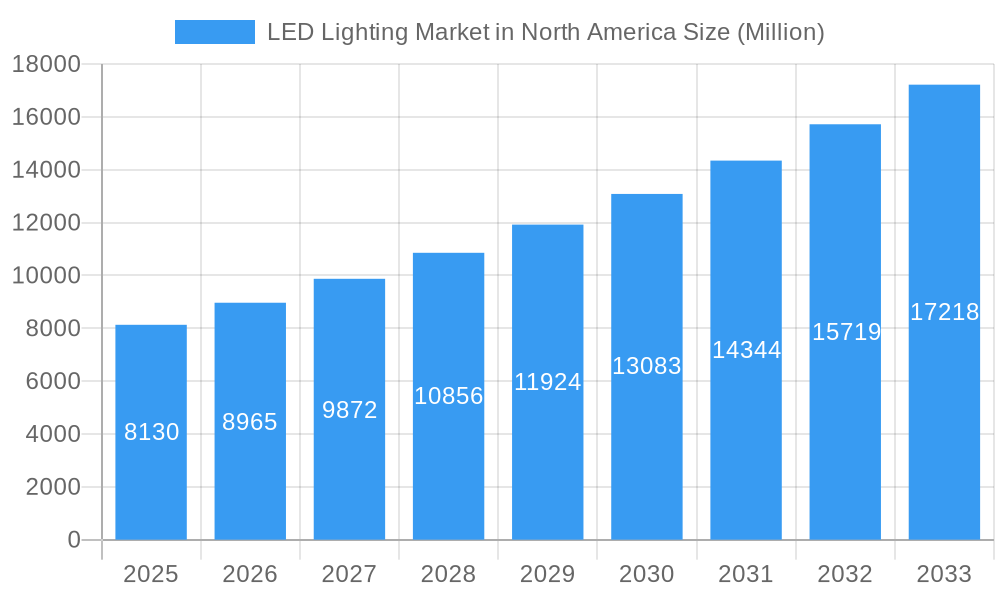

The North American LED lighting market is experiencing robust growth, projected to reach a significant valuation with a Compound Annual Growth Rate (CAGR) of 10.23% during the 2025-2033 forecast period. This expansion is propelled by a confluence of factors, including increasing demand for energy-efficient lighting solutions across residential, commercial, and industrial sectors, driven by growing environmental consciousness and stringent government regulations aimed at reducing energy consumption. The retail sector, in particular, is a major driver, with businesses investing in LED lighting for enhanced product display, ambiance creation, and operational cost savings. The adoption of smart lighting systems, offering advanced control, automation, and integration with building management systems, is also a key trend. Furthermore, the ongoing renovation and retrofitting of existing infrastructure, coupled with new construction projects across commercial offices and healthcare facilities, are contributing to sustained demand for advanced LED luminaires.

LED Lighting Market in North America Market Size (In Billion)

The market is characterized by a diverse range of applications and form factors, catering to specific needs. Troffers and downlights remain dominant in office and retail spaces, while high bay lights are crucial for industrial and warehouse applications. Suspended pendants and track lights are increasingly popular in architectural and decorative lighting projects. The distribution channel is evolving, with a shift towards direct sales for large projects and a continued strong presence of retail and wholesale channels for broader market reach. Major players like Signify Holding, Acuity Brands Inc., and Cree Inc. are actively innovating, introducing new products with enhanced features such as improved lumen output, color rendering, and connectivity options. Despite the positive outlook, potential challenges such as the initial higher cost of LED fixtures compared to traditional lighting and supply chain disruptions could pose minor restraints, though these are being mitigated by declining LED component prices and increasing economies of scale.

LED Lighting Market in North America Company Market Share

This in-depth report provides a definitive analysis of the North America LED lighting market, encompassing a comprehensive market size, growth forecast, and competitive landscape from 2019 to 2033. With a base year of 2025 and a forecast period of 2025-2033, this study offers critical insights for stakeholders seeking to capitalize on the burgeoning demand for energy-efficient and advanced lighting solutions. Delve into key market segments, emerging trends, and the strategic initiatives of leading players shaping the future of LED lighting in North America.

LED Lighting Market in North America Market Structure & Competitive Dynamics

The North America LED lighting market exhibits a dynamic and evolving structure, characterized by a mix of established giants and innovative newcomers. Market concentration is moderate, with several key players holding significant market share, yet ample room exists for specialized and niche providers. The innovation ecosystem is robust, driven by continuous research and development in smart LED technology, energy efficiency, and human-centric lighting. Regulatory frameworks, including stringent energy codes and government incentives for LED adoption, play a pivotal role in shaping market entry and growth. Product substitutes, primarily traditional lighting technologies like fluorescent and incandescent lamps, are rapidly losing ground due to superior LED performance and lifecycle cost savings. End-user trends increasingly favor lighting solutions that offer enhanced control, connectivity, and environmental benefits. Mergers and acquisitions (M&A) activities are common, reflecting the industry's consolidation and the strategic pursuit of market expansion and technological advancement. M&A deal values are projected to see continued growth as companies seek to acquire innovative technologies and expand their product portfolios. Key players are actively investing in LED retrofit solutions and connected lighting systems to meet evolving market demands.

- Market Share: Leading companies such as Signify Holding, Cree Inc., and Acuity Brands Inc. command substantial market shares, but the landscape is fragmented enough to allow for agile smaller enterprises.

- Innovation Ecosystem: Strong collaboration between lighting manufacturers, technology providers, and research institutions fuels advancements in LED efficacy, color rendering, and IoT integration.

- Regulatory Frameworks: Government mandates for energy conservation and building efficiency standards are significant drivers for LED adoption across commercial and residential sectors.

- Product Substitutes: The declining cost and improving performance of LEDs are rapidly displacing legacy lighting technologies.

- End-User Trends: Growing demand for smart lighting, tunable white lighting, and circadian rhythm lighting for improved well-being and productivity.

- M&A Activities: Strategic acquisitions aimed at expanding product offerings, gaining access to new technologies, and consolidating market presence.

LED Lighting Market in North America Industry Trends & Insights

The North America LED lighting market is experiencing robust growth, propelled by a confluence of technological advancements, increasing environmental consciousness, and favorable economic policies. The primary growth driver remains the unparalleled energy efficiency of LED technology compared to traditional lighting sources. This translates into significant cost savings for end-users, particularly in large-scale commercial and industrial applications, making LED retrofitting a highly attractive investment. Technological disruptions are continuously redefining the market, with the integration of smart lighting systems and the Internet of Things (IoT) enabling sophisticated control, automation, and data analytics. These advancements offer enhanced functionality, such as remote management, occupancy sensing, and integration with building management systems, further boosting the value proposition of LED solutions. Consumer preferences are evolving towards lighting that not only illuminates spaces but also enhances well-being and productivity. This includes a growing demand for human-centric lighting, which mimics natural daylight patterns to regulate circadian rhythms, and tunable white lighting that can be adjusted to suit different tasks and times of day. The competitive dynamics are intense, with manufacturers fiercely competing on innovation, product performance, price, and the breadth of their product portfolios. High-efficiency LED fixtures, intelligent lighting controls, and sustainable manufacturing practices are becoming key differentiators. The market penetration of LED lighting in North America is already significant, but substantial opportunities remain, especially in upgrading older infrastructure and in emerging applications like horticultural lighting and dynamic architectural lighting. The projected Compound Annual Growth Rate (CAGR) for the North America LED lighting market is expected to remain strong throughout the forecast period, driven by ongoing technological advancements and increasing adoption across diverse sectors. Cost-effective LED solutions and the continued focus on sustainability are expected to further accelerate market expansion.

Dominant Markets & Segments in LED Lighting Market in North America

The North America LED lighting market is segmented across various applications, form factors, and distribution channels, each contributing to its overall expansion. The dominant region for LED lighting adoption is the United States, owing to its large economy, proactive regulatory environment, and significant investment in infrastructure upgrades. Within the US, major metropolitan areas and industrial hubs lead in the adoption of advanced LED lighting solutions.

Application Dominance:

- Office: This segment is a significant driver of the North American LED lighting market, fueled by the demand for energy savings, improved visual comfort, and integration with smart building technologies. The push for LEED certification and sustainable office environments further boosts the adoption of high-efficiency LED lighting systems. Key drivers include government incentives for energy efficiency, corporate sustainability initiatives, and the need for task-specific lighting to enhance employee productivity and well-being.

- Retail: The retail sector prioritizes LED lighting for its ability to enhance product visibility, create appealing store ambiance, and reduce operational costs. LED track lights and accent lighting are widely used to showcase merchandise effectively, while energy savings contribute to improved profit margins. Economic policies supporting business investments and consumer spending indirectly fuel growth in this segment.

- Hospital: The healthcare sector is increasingly adopting LED lighting for its long lifespan, reduced maintenance, and the ability to provide specific light spectra beneficial for patient care and medical procedures. Hygienic lighting solutions and energy-efficient luminaires are crucial. Factors like increased healthcare spending and government mandates for energy-efficient healthcare facilities drive this segment.

- Architectural: This segment is driven by aesthetic considerations and the desire to create visually striking buildings. LED lighting offers unprecedented flexibility in design, enabling dynamic illumination and accentuation of architectural features. The growth of the construction industry and the increasing use of smart technologies in building design are key drivers.

- Other Applications (Healthcare and Education): This broad category encompasses numerous growth opportunities. In healthcare, beyond hospitals, clinics and laboratories benefit from specialized LED lighting. In education, LED lighting improves classroom visibility and reduces energy consumption in educational institutions. Increased government funding for infrastructure upgrades in public buildings and schools plays a crucial role.

Form Factor Dominance:

- Troffers: Widely used in office and educational settings, LED troffers offer excellent uniformity and energy efficiency for general illumination. Their ease of installation and compatibility with modular ceiling systems make them a popular choice.

- Downlights: Essential for ambient and task lighting in retail, hospitality, and residential spaces, LED downlights provide a focused and versatile illumination solution. Their aesthetic appeal and energy-saving capabilities drive demand.

- High Bay: Critical for industrial, warehouse, and large commercial spaces, LED high bay lights deliver powerful illumination with superior energy efficiency and longer lifespan, significantly reducing maintenance costs in hard-to-reach areas.

- Track Lights: Popular in retail and commercial spaces for their flexibility in directing light and highlighting specific areas or products.

- Suspended Pendants: Used for both ambient and decorative lighting in commercial and residential settings, offering a wide range of design options.

Distribution Channel Dominance:

- Direct Sales: This channel is prevalent for large commercial, industrial, and government projects where custom solutions and extensive project support are required. Manufacturers often work directly with large end-users and specifiers.

- Retail/Wholesale: This channel serves the needs of smaller commercial projects, residential applications, and the renovation market. Wholesale distributors play a crucial role in providing readily available LED products and supporting electrical contractors.

LED Lighting Market in North America Product Innovations

The North America LED lighting market is continuously shaped by innovative product developments focused on enhancing performance, functionality, and sustainability. Key advancements include the development of high-efficacy LED chips that offer superior lumen output per watt, reducing energy consumption further. The integration of smart control systems, including wireless connectivity and sophisticated dimming capabilities, allows for greater flexibility and energy management. Human-centric lighting solutions that mimic natural light patterns are gaining traction for their positive impact on well-being and productivity. Furthermore, manufacturers are innovating in modular LED fixture designs for easier installation and maintenance, as well as developing specialized LEDs for niche applications like horticultural lighting and dynamic architectural displays. These innovations provide a competitive edge by meeting evolving customer demands for efficiency, connectivity, and user experience.

Report Segmentation & Scope

This report meticulously segments the North America LED lighting market by application, form factor, and distribution channel, providing a granular understanding of market dynamics.

Application Segmentation: The report covers Retail S, Office, Hospital, Architectural, and Other Applications (Healthcare and Education). Projections for each application segment will detail market sizes, growth rates, and competitive landscapes, identifying key drivers and challenges specific to each end-use sector.

Form Factor Segmentation: Analysis extends to Troffers, Downlights, High Bay, Track Lights, Suspended Pendants, and Other Type of Form Factors. Growth projections and market share estimations will be provided for each form factor, highlighting their suitability for different applications and their respective competitive dynamics.

Distribution Channel Segmentation: The report examines Direct Sales and Retail/Wholesale channels. Market sizes and growth forecasts will be presented for each channel, detailing their significance in reaching diverse customer segments and their impact on overall market penetration.

Key Drivers of LED Lighting Market in North America Growth

The growth of the North America LED lighting market is propelled by several interconnected factors. Technological advancements in LED efficacy and lifespan, coupled with the development of smart lighting controls, are paramount. Increasingly stringent energy efficiency regulations and government incentives, such as tax credits and rebates for adopting LED technology, significantly encourage adoption. The growing awareness of environmental sustainability and the need to reduce carbon footprints drive demand for energy-saving solutions. Furthermore, the declining cost of LED components makes them a more financially viable option for a wider range of applications. The expansion of sectors like horticultural lighting and the demand for improved lighting in healthcare and education facilities also contribute significantly to market expansion.

Challenges in the LED Lighting Market in North America Sector

Despite its robust growth, the North America LED lighting market faces certain challenges. Initial capital costs for high-performance LED systems can still be a barrier for some smaller businesses and budget-constrained projects, although total cost of ownership is significantly lower. Supply chain disruptions and raw material price volatility can impact product availability and pricing. Intense competitive pressures among manufacturers can lead to price wars, squeezing profit margins. The rapid pace of technological change also requires continuous investment in R&D and adaptation, posing a challenge for companies with legacy product lines. Furthermore, standardization issues in smart lighting protocols and interoperability between different systems can hinder widespread adoption of advanced connected solutions.

Leading Players in the LED Lighting Market in North America Market

- Technical Consumer Products Inc

- Osram Licht Group

- Daylight PLC

- Cree Inc

- Signify Holding (Philips Lighting and Cooper Lighting)

- US LED Limited

- Hubbel Brands Inc

- Acuity Brands Inc

Key Developments in LED Lighting Market in North America Sector

- May 2022: EarthTronics introduced its Color & Wattage Selectable LED Strip Series, designed for high-bay and general lighting in manufacturing, retail, and new commercial facilities, emphasizing energy savings and positive economic/environmental impact.

- September 2021: Sollum Technologies announced its SF05A fixture, a significant advancement in its 100% programmable smart LED lighting solution, offering improved functionality and controllable, automated light system monitoring for greenhouse growers.

- June 2021: Fluence by OSRAM partnered with Prospiant, a provider of controlled environment agriculture (CEA) ecosystems, designating Fluence as the preferred LED technology supplier within Prospiant's full ecosystem offerings.

Strategic LED Lighting Market in North America Market Outlook

The strategic outlook for the North America LED lighting market remains exceptionally promising, driven by ongoing innovation and increasing market penetration. The continued development of smart and connected lighting systems presents significant growth opportunities, enabling enhanced energy management, improved building automation, and greater user control. The expanding adoption in niche sectors like horticultural lighting and the persistent demand for energy-efficient solutions in traditional applications will further fuel market expansion. Companies that focus on delivering high-performance, cost-effective, and sustainable LED products, coupled with integrated smart solutions, are poised for substantial success. Strategic collaborations and investments in R&D will be crucial for maintaining a competitive edge in this dynamic market. The future of lighting in North America is undeniably LED, characterized by intelligence, efficiency, and a commitment to sustainability.

LED Lighting Market in North America Segmentation

-

1. Application

- 1.1. Retail S

- 1.2. Office

- 1.3. Hospital

- 1.4. Architec

- 1.5. Other Applications (Healthcare and Education)

-

2. Form Factor

- 2.1. Troffers

- 2.2. Downlights

- 2.3. High Bay

- 2.4. Track Lights

- 2.5. Suspended Pendants

- 2.6. Other Type of Form Factors

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Retail/Wholesale

LED Lighting Market in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

LED Lighting Market in North America Regional Market Share

Geographic Coverage of LED Lighting Market in North America

LED Lighting Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Smart Lighting and Human Centric Lighting Applications; Increasing Awareness and Emergence of New Business Models

- 3.2.2 such as Lighting-as-a-Service

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investment; Development of Alternative Technologies

- 3.4. Market Trends

- 3.4.1. Smart Lighting is Expected to be the Future of Commercial LED Lighting

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LED Lighting Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Retail S

- 5.1.2. Office

- 5.1.3. Hospital

- 5.1.4. Architec

- 5.1.5. Other Applications (Healthcare and Education)

- 5.2. Market Analysis, Insights and Forecast - by Form Factor

- 5.2.1. Troffers

- 5.2.2. Downlights

- 5.2.3. High Bay

- 5.2.4. Track Lights

- 5.2.5. Suspended Pendants

- 5.2.6. Other Type of Form Factors

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Retail/Wholesale

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America LED Lighting Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Retail S

- 6.1.2. Office

- 6.1.3. Hospital

- 6.1.4. Architec

- 6.1.5. Other Applications (Healthcare and Education)

- 6.2. Market Analysis, Insights and Forecast - by Form Factor

- 6.2.1. Troffers

- 6.2.2. Downlights

- 6.2.3. High Bay

- 6.2.4. Track Lights

- 6.2.5. Suspended Pendants

- 6.2.6. Other Type of Form Factors

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Direct Sales

- 6.3.2. Retail/Wholesale

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America LED Lighting Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Retail S

- 7.1.2. Office

- 7.1.3. Hospital

- 7.1.4. Architec

- 7.1.5. Other Applications (Healthcare and Education)

- 7.2. Market Analysis, Insights and Forecast - by Form Factor

- 7.2.1. Troffers

- 7.2.2. Downlights

- 7.2.3. High Bay

- 7.2.4. Track Lights

- 7.2.5. Suspended Pendants

- 7.2.6. Other Type of Form Factors

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Direct Sales

- 7.3.2. Retail/Wholesale

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe LED Lighting Market in North America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Retail S

- 8.1.2. Office

- 8.1.3. Hospital

- 8.1.4. Architec

- 8.1.5. Other Applications (Healthcare and Education)

- 8.2. Market Analysis, Insights and Forecast - by Form Factor

- 8.2.1. Troffers

- 8.2.2. Downlights

- 8.2.3. High Bay

- 8.2.4. Track Lights

- 8.2.5. Suspended Pendants

- 8.2.6. Other Type of Form Factors

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Direct Sales

- 8.3.2. Retail/Wholesale

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa LED Lighting Market in North America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Retail S

- 9.1.2. Office

- 9.1.3. Hospital

- 9.1.4. Architec

- 9.1.5. Other Applications (Healthcare and Education)

- 9.2. Market Analysis, Insights and Forecast - by Form Factor

- 9.2.1. Troffers

- 9.2.2. Downlights

- 9.2.3. High Bay

- 9.2.4. Track Lights

- 9.2.5. Suspended Pendants

- 9.2.6. Other Type of Form Factors

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Direct Sales

- 9.3.2. Retail/Wholesale

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific LED Lighting Market in North America Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Retail S

- 10.1.2. Office

- 10.1.3. Hospital

- 10.1.4. Architec

- 10.1.5. Other Applications (Healthcare and Education)

- 10.2. Market Analysis, Insights and Forecast - by Form Factor

- 10.2.1. Troffers

- 10.2.2. Downlights

- 10.2.3. High Bay

- 10.2.4. Track Lights

- 10.2.5. Suspended Pendants

- 10.2.6. Other Type of Form Factors

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Direct Sales

- 10.3.2. Retail/Wholesale

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Technical Consumer Products Inc *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Osram Licht Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daylight PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cree Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Signify Holding (Philips Lighting and Cooper Lighting)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 US LED Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hubbel Brands Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Acuity Brands Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Technical Consumer Products Inc *List Not Exhaustive

List of Figures

- Figure 1: Global LED Lighting Market in North America Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America LED Lighting Market in North America Revenue (Million), by Application 2025 & 2033

- Figure 3: North America LED Lighting Market in North America Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America LED Lighting Market in North America Revenue (Million), by Form Factor 2025 & 2033

- Figure 5: North America LED Lighting Market in North America Revenue Share (%), by Form Factor 2025 & 2033

- Figure 6: North America LED Lighting Market in North America Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America LED Lighting Market in North America Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America LED Lighting Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 9: North America LED Lighting Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America LED Lighting Market in North America Revenue (Million), by Application 2025 & 2033

- Figure 11: South America LED Lighting Market in North America Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America LED Lighting Market in North America Revenue (Million), by Form Factor 2025 & 2033

- Figure 13: South America LED Lighting Market in North America Revenue Share (%), by Form Factor 2025 & 2033

- Figure 14: South America LED Lighting Market in North America Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America LED Lighting Market in North America Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America LED Lighting Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 17: South America LED Lighting Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe LED Lighting Market in North America Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe LED Lighting Market in North America Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe LED Lighting Market in North America Revenue (Million), by Form Factor 2025 & 2033

- Figure 21: Europe LED Lighting Market in North America Revenue Share (%), by Form Factor 2025 & 2033

- Figure 22: Europe LED Lighting Market in North America Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe LED Lighting Market in North America Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe LED Lighting Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe LED Lighting Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa LED Lighting Market in North America Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East & Africa LED Lighting Market in North America Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East & Africa LED Lighting Market in North America Revenue (Million), by Form Factor 2025 & 2033

- Figure 29: Middle East & Africa LED Lighting Market in North America Revenue Share (%), by Form Factor 2025 & 2033

- Figure 30: Middle East & Africa LED Lighting Market in North America Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa LED Lighting Market in North America Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa LED Lighting Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa LED Lighting Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific LED Lighting Market in North America Revenue (Million), by Application 2025 & 2033

- Figure 35: Asia Pacific LED Lighting Market in North America Revenue Share (%), by Application 2025 & 2033

- Figure 36: Asia Pacific LED Lighting Market in North America Revenue (Million), by Form Factor 2025 & 2033

- Figure 37: Asia Pacific LED Lighting Market in North America Revenue Share (%), by Form Factor 2025 & 2033

- Figure 38: Asia Pacific LED Lighting Market in North America Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific LED Lighting Market in North America Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific LED Lighting Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific LED Lighting Market in North America Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LED Lighting Market in North America Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global LED Lighting Market in North America Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 3: Global LED Lighting Market in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global LED Lighting Market in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global LED Lighting Market in North America Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global LED Lighting Market in North America Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 7: Global LED Lighting Market in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global LED Lighting Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global LED Lighting Market in North America Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global LED Lighting Market in North America Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 14: Global LED Lighting Market in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global LED Lighting Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global LED Lighting Market in North America Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global LED Lighting Market in North America Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 21: Global LED Lighting Market in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global LED Lighting Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global LED Lighting Market in North America Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global LED Lighting Market in North America Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 34: Global LED Lighting Market in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global LED Lighting Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global LED Lighting Market in North America Revenue Million Forecast, by Application 2020 & 2033

- Table 43: Global LED Lighting Market in North America Revenue Million Forecast, by Form Factor 2020 & 2033

- Table 44: Global LED Lighting Market in North America Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global LED Lighting Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific LED Lighting Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LED Lighting Market in North America?

The projected CAGR is approximately 10.23%.

2. Which companies are prominent players in the LED Lighting Market in North America?

Key companies in the market include Technical Consumer Products Inc *List Not Exhaustive, Osram Licht Group, Daylight PLC, Cree Inc, Signify Holding (Philips Lighting and Cooper Lighting), US LED Limited, Hubbel Brands Inc, Acuity Brands Inc.

3. What are the main segments of the LED Lighting Market in North America?

The market segments include Application, Form Factor, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smart Lighting and Human Centric Lighting Applications; Increasing Awareness and Emergence of New Business Models. such as Lighting-as-a-Service.

6. What are the notable trends driving market growth?

Smart Lighting is Expected to be the Future of Commercial LED Lighting.

7. Are there any restraints impacting market growth?

; High Initial Investment; Development of Alternative Technologies.

8. Can you provide examples of recent developments in the market?

May 2022 - EarthTronics, which develops energy-saving lighting products that provide a positive economic and environmental impact, introduced its Color & Wattage Selectable LED Strip Series. The LED strip series is meant for high-bay and general lighting found in manufacturing, as well as retail and new commercial facilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LED Lighting Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LED Lighting Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LED Lighting Market in North America?

To stay informed about further developments, trends, and reports in the LED Lighting Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence