Key Insights

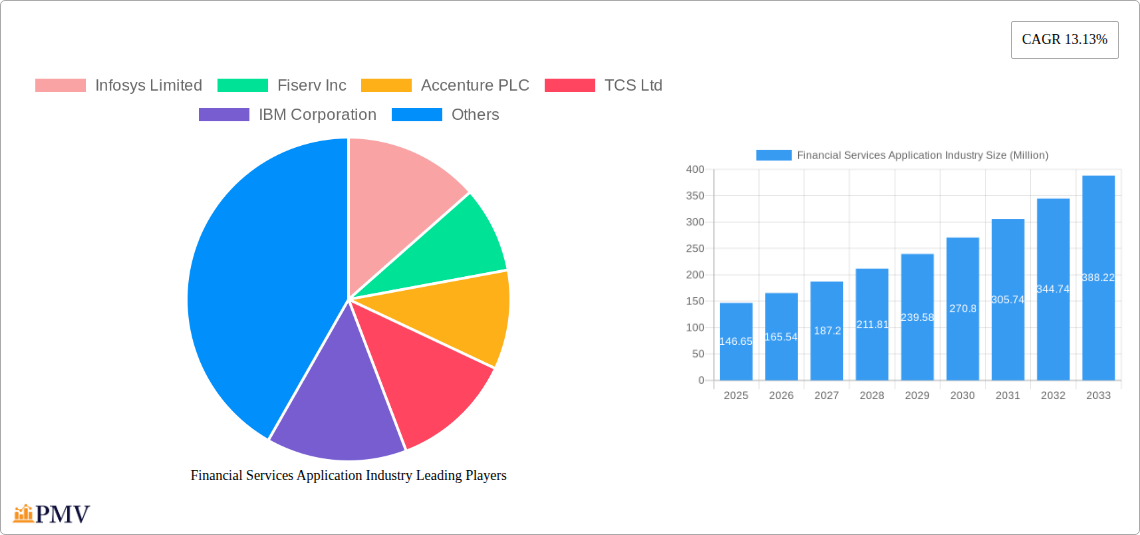

The Financial Services Application Industry is poised for significant expansion, with a projected market size of $146.65 million and a robust Compound Annual Growth Rate (CAGR) of 13.13% expected to continue through 2033. This dynamic growth is fueled by several critical drivers. The increasing demand for advanced risk management and compliance solutions, driven by stringent regulatory landscapes and evolving cybersecurity threats, is a primary impetus. Furthermore, the widespread adoption of Business Intelligence (BI) and Analytics applications is empowering financial institutions to gain deeper customer insights, optimize operational efficiency, and make data-driven strategic decisions. The burgeoning need for seamless customer experience solutions, enabling personalized interactions and digital engagement, is also a key growth factor. As financial organizations increasingly prioritize digital transformation, investment in Enterprise IT modernization and sophisticated business transaction processing applications will accelerate.

Financial Services Application Industry Market Size (In Million)

The market is characterized by a strong trend towards cloud deployment, offering scalability, flexibility, and cost-effectiveness for financial institutions of all sizes. This shift is particularly evident among Small and Medium Enterprises (SMEs) who can leverage cloud-based solutions to access advanced functionalities previously only available to larger corporations. While the integration and consulting services segments are vital for successful implementation, training and support services are crucial for ensuring ongoing value realization and user adoption. Large enterprises, while already having established IT infrastructures, are also increasingly adopting cloud solutions for specific workloads and for enhancing their existing on-premise systems. The competitive landscape features prominent players like Infosys, Fiserv, Accenture, TCS, IBM, Oracle, and SAP, all actively innovating and expanding their offerings to capture market share in this rapidly evolving sector.

Financial Services Application Industry Company Market Share

This in-depth report provides an exhaustive analysis of the global Financial Services Application Industry, offering critical insights into market dynamics, growth trajectories, and competitive landscapes. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research is essential for stakeholders seeking to understand and capitalize on the evolving fintech software, digital banking solutions, and financial technology platforms. Dive into actionable strategies for navigating this robust and rapidly transforming sector.

Financial Services Application Industry Market Structure & Competitive Dynamics

The Financial Services Application Industry exhibits a moderately concentrated market structure, characterized by the presence of major technology giants and specialized fintech providers. Innovation ecosystems are highly dynamic, driven by continuous advancements in AI, blockchain, and cloud computing, fueling the development of sophisticated risk management software, compliance solutions, and business intelligence for finance. Regulatory frameworks, such as GDPR and evolving open banking mandates, significantly influence market entry and product development, creating both opportunities and challenges. Product substitutes, ranging from in-house developed systems to emerging AI-driven automation tools, are increasing, necessitating constant innovation and value-addition. End-user trends favor personalized, seamless, and secure customer experience applications for financial institutions. Mergers and acquisitions (M&A) activity remains robust, with significant deal values often exceeding one hundred million dollars, as larger players consolidate market share and acquire specialized capabilities in areas like fraud detection systems and payments processing software. Key players like Infosys Limited, Fiserv Inc., and Accenture PLC consistently invest in R&D, bolstering their competitive positions. Market share for leading software offerings is estimated to be concentrated, with BI and Analytics Applications and Business Transaction Processing segments holding substantial portions, while M&A deal values in the past year are projected to reach five hundred million dollars.

Financial Services Application Industry Industry Trends & Insights

The Financial Services Application Industry is experiencing robust growth, projected at a compound annual growth rate (CAGR) of 15% during the forecast period (2025–2033). This surge is primarily driven by the escalating demand for digital transformation in banking and financial services, spurred by evolving consumer preferences for mobile-first, personalized, and secure financial interactions. Technological disruptions are at the forefront, with the widespread adoption of cloud-based financial solutions, the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics and fraud detection, and the exploration of blockchain for enhanced transaction security and transparency. The rise of open banking and embedded finance is further reshaping the competitive landscape, enabling new business models and partnership opportunities. Consumer preferences are heavily skewed towards intuitive, user-friendly interfaces and instant access to financial services, pushing for enhanced customer relationship management (CRM) for finance and digital payment gateways. Competitive dynamics are intensifying, with intense rivalry among established IT service providers, specialized fintech startups, and large banking institutions developing in-house capabilities. The market penetration of advanced wealth management platforms and lending software is expanding significantly, particularly in emerging economies. The increasing focus on data security and regulatory compliance, such as the implementation of Know Your Customer (KYC) solutions, is also a significant trend. The shift towards hybrid deployment models, combining the flexibility of cloud with the control of on-premise solutions, is also gaining traction.

Dominant Markets & Segments in Financial Services Application Industry

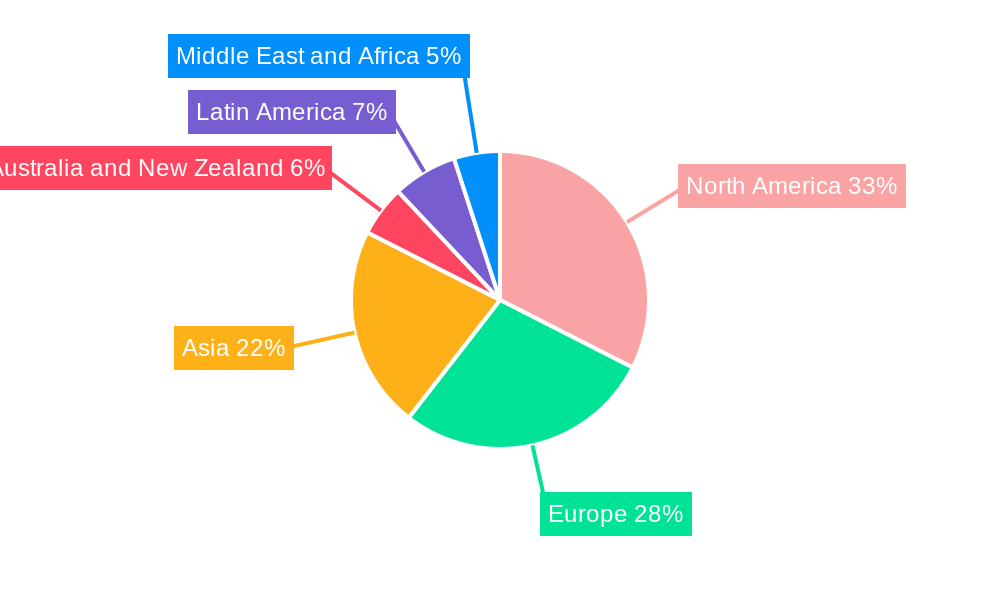

The Financial Services Application Industry is witnessing dominant growth across several key segments and regions. North America continues to be a leading market, driven by its mature financial infrastructure, high digital adoption rates, and significant investment in technological innovation. The United States, in particular, stands out due to the presence of major financial institutions and a thriving fintech ecosystem. Within offerings, Software continues to dominate, with BI and Analytics Applications and Business Transaction Processing holding substantial market share, estimated at twenty percent and eighteen percent respectively. These segments are crucial for data-driven decision-making, operational efficiency, and regulatory reporting.

- Key Drivers for Software Dominance:

- Data Analytics: The need for actionable insights from vast amounts of financial data to improve customer targeting, risk assessment, and fraud detection.

- Automation: The drive for efficiency in core banking operations, loan processing, and customer service.

- Regulatory Compliance: The increasing complexity of financial regulations necessitates sophisticated software solutions for compliance management.

The Services segment is also experiencing significant growth, particularly Consulting Services and Integration Services, as financial institutions seek expert guidance in implementing complex digital solutions and integrating disparate systems.

- Key Drivers for Services Dominance:

- Digital Transformation Initiatives: Financial institutions require specialized expertise to navigate the complexities of digital transformation.

- System Integration Challenges: Integrating new fintech solutions with legacy systems is a critical and complex undertaking.

- Customization Needs: The demand for tailored solutions that address specific business requirements.

In terms of Deployment, Cloud is the dominant model, projected to capture over seventy percent of the market share by 2030. The scalability, flexibility, and cost-effectiveness of cloud solutions are highly attractive to financial institutions.

- Key Drivers for Cloud Dominance:

- Scalability and Agility: Cloud platforms allow financial institutions to scale their operations up or down quickly based on demand.

- Cost Efficiency: Reduced upfront investment in hardware and infrastructure.

- Innovation Pace: Cloud providers offer faster access to new technologies and updates.

The Size of Enterprise segment is characterized by strong growth in both Small and Medium Enterprises (SMEs) and Large Enterprises. While large enterprises have historically been the primary adopters, SMEs are increasingly leveraging accessible and affordable fintech solutions to compete. The market size for SMEs is projected to reach one hundred fifty million dollars by 2028.

- Key Drivers for Enterprise Segment Growth:

- Digitalization Imperative: Both SMEs and large enterprises recognize the need to digitize their operations to remain competitive.

- API-driven Ecosystems: The rise of open APIs facilitates easier integration and access to specialized financial services for all business sizes.

- Cloud-native Solutions: The availability of cloud-native applications makes advanced financial tools more accessible to SMEs.

Financial Services Application Industry Product Innovations

Product innovations in the Financial Services Application Industry are centered around leveraging cutting-edge technologies to enhance efficiency, security, and customer experience. AI-powered analytics are revolutionizing risk and compliance management, enabling proactive identification of potential issues and automated reporting. Advancements in Business Transaction Processing include real-time payment systems and tokenization for secure transactions. Customer Experience applications are increasingly incorporating hyper-personalization through AI-driven recommendations and conversational interfaces. Enterprise IT solutions are focusing on scalable, cloud-native architectures and robust cybersecurity measures to protect sensitive financial data. These innovations provide a significant competitive advantage by offering faster processing, reduced operational costs, and superior customer engagement.

Report Segmentation & Scope

This report comprehensively segments the Financial Services Application Industry across key dimensions. Offerings are divided into Software and Services. The software segment further includes Audit, Risk, and Compliance Management, BI and Analytics Applications, Business Transaction Processing, Customer Experience, and Enterprise IT. The services segment encompasses Consulting Services, Integration Services, Training and Support Services, and Operations and Maintenance. Deployment options are analyzed as Cloud and On-Premise. The Size of Enterprise segmentation includes Small and Medium Enterprises and Large Enterprises. Each segment is analyzed for market size, growth projections, and competitive dynamics. The Cloud deployment segment is projected to grow at a CAGR of 17%, reaching a market size of six hundred million dollars by 2030.

Key Drivers of Financial Services Application Industry Growth

Several pivotal factors are propelling the growth of the Financial Services Application Industry. The relentless pursuit of operational efficiency and cost reduction through automation and AI is a primary driver. The increasing digitalization of financial services, fueled by evolving consumer expectations for seamless, mobile-first experiences, is another significant catalyst. Regulatory mandates, such as enhanced data privacy and AML/KYC requirements, are driving the adoption of specialized compliance and risk management applications. The expansion of emerging markets and the growing financial inclusion initiatives in these regions also present substantial growth opportunities. Furthermore, the continuous innovation in fintech, including blockchain and open banking, fosters the development of new, sophisticated application solutions.

Challenges in the Financial Services Application Industry Sector

Despite its robust growth, the Financial Services Application Industry faces several challenges. Stringent and evolving regulatory landscapes worldwide necessitate significant compliance investments and can slow down innovation cycles. Cybersecurity threats and data privacy concerns remain paramount, requiring continuous investment in robust security measures and risk mitigation strategies. The integration of new fintech applications with legacy IT infrastructure can be complex and costly, posing a significant hurdle for many institutions. Intense competition from a growing number of fintech startups and established players puts pressure on pricing and necessitates continuous differentiation. Furthermore, the scarcity of skilled talent in areas like AI, data science, and cybersecurity can impede the development and deployment of advanced solutions.

Leading Players in the Financial Services Application Industry Market

- Infosys Limited

- Fiserv Inc.

- Accenture PLC

- TCS Ltd

- IBM Corporation

- Misys

- FIS Corporation

- Temenos Group Ag

- Oracle Corporation

- SAP SE

Key Developments in Financial Services Application Industry Sector

- January 2024: Hitachi Payment Services introduced Hitachi Money Spot Plus, focusing on inclusive financial services. This extension to their existing suite includes ATM Services, Domestic Money Transfers, Aadhaar Enabled Payment Services, Micro Mobile and DTH Recharges, and Bill Payments, enhancing growth opportunities.

- January 2024: Tiqmo, a fintech app licensed by the Saudi Central Bank (SAMA), partnered exclusively with Mastercard to issue prepaid cards in Saudi Arabia. The partnership will leverage Mastercard's Cross-Border Payment services and tokenization to offer advanced digital payment services, aligning with Saudi Vision 2030.

Strategic Financial Services Application Industry Market Outlook

The strategic outlook for the Financial Services Application Industry is exceptionally promising, driven by ongoing digital transformation and the increasing reliance on technology for competitive advantage. Future growth will be accelerated by the continued adoption of AI and ML for personalized services and enhanced risk management, the expansion of cloud-native solutions for greater agility and scalability, and the proliferation of open banking APIs creating new avenues for collaboration and service delivery. Investments in cybersecurity and data analytics will remain critical. Opportunities lie in catering to the growing demand for embedded finance solutions and in expanding into underserved emerging markets. The strategic focus on customer-centricity and regulatory compliance will continue to shape product development and market penetration.

Financial Services Application Industry Segmentation

-

1. Offerings

-

1.1. Software

- 1.1.1. Audit, Risk, and Compliance Management

- 1.1.2. BI and Analytics Applications

- 1.1.3. Business Transaction Processing

- 1.1.4. Customer Experience

- 1.1.5. Enterprise IT

-

1.2. Services

- 1.2.1. Consulting Services

- 1.2.2. Integration Services

- 1.2.3. Training and Support Services

- 1.2.4. Operations and Maintenance

-

1.1. Software

-

2. Deployment

- 2.1. Cloud

- 2.2. On-Premise

-

3. Size of Enterprise

- 3.1. Small and Medium Enterprises

- 3.2. Large Enterprises

Financial Services Application Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Financial Services Application Industry Regional Market Share

Geographic Coverage of Financial Services Application Industry

Financial Services Application Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Number of Financial Institutions; Increasing Emphasis on Customer Experience

- 3.3. Market Restrains

- 3.3.1. High Deployment Costs

- 3.4. Market Trends

- 3.4.1. BI & Analytics Application is Expected to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Financial Services Application Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offerings

- 5.1.1. Software

- 5.1.1.1. Audit, Risk, and Compliance Management

- 5.1.1.2. BI and Analytics Applications

- 5.1.1.3. Business Transaction Processing

- 5.1.1.4. Customer Experience

- 5.1.1.5. Enterprise IT

- 5.1.2. Services

- 5.1.2.1. Consulting Services

- 5.1.2.2. Integration Services

- 5.1.2.3. Training and Support Services

- 5.1.2.4. Operations and Maintenance

- 5.1.1. Software

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-Premise

- 5.3. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.3.1. Small and Medium Enterprises

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offerings

- 6. North America Financial Services Application Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offerings

- 6.1.1. Software

- 6.1.1.1. Audit, Risk, and Compliance Management

- 6.1.1.2. BI and Analytics Applications

- 6.1.1.3. Business Transaction Processing

- 6.1.1.4. Customer Experience

- 6.1.1.5. Enterprise IT

- 6.1.2. Services

- 6.1.2.1. Consulting Services

- 6.1.2.2. Integration Services

- 6.1.2.3. Training and Support Services

- 6.1.2.4. Operations and Maintenance

- 6.1.1. Software

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-Premise

- 6.3. Market Analysis, Insights and Forecast - by Size of Enterprise

- 6.3.1. Small and Medium Enterprises

- 6.3.2. Large Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Offerings

- 7. Europe Financial Services Application Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offerings

- 7.1.1. Software

- 7.1.1.1. Audit, Risk, and Compliance Management

- 7.1.1.2. BI and Analytics Applications

- 7.1.1.3. Business Transaction Processing

- 7.1.1.4. Customer Experience

- 7.1.1.5. Enterprise IT

- 7.1.2. Services

- 7.1.2.1. Consulting Services

- 7.1.2.2. Integration Services

- 7.1.2.3. Training and Support Services

- 7.1.2.4. Operations and Maintenance

- 7.1.1. Software

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-Premise

- 7.3. Market Analysis, Insights and Forecast - by Size of Enterprise

- 7.3.1. Small and Medium Enterprises

- 7.3.2. Large Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Offerings

- 8. Asia Financial Services Application Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offerings

- 8.1.1. Software

- 8.1.1.1. Audit, Risk, and Compliance Management

- 8.1.1.2. BI and Analytics Applications

- 8.1.1.3. Business Transaction Processing

- 8.1.1.4. Customer Experience

- 8.1.1.5. Enterprise IT

- 8.1.2. Services

- 8.1.2.1. Consulting Services

- 8.1.2.2. Integration Services

- 8.1.2.3. Training and Support Services

- 8.1.2.4. Operations and Maintenance

- 8.1.1. Software

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-Premise

- 8.3. Market Analysis, Insights and Forecast - by Size of Enterprise

- 8.3.1. Small and Medium Enterprises

- 8.3.2. Large Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Offerings

- 9. Australia and New Zealand Financial Services Application Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offerings

- 9.1.1. Software

- 9.1.1.1. Audit, Risk, and Compliance Management

- 9.1.1.2. BI and Analytics Applications

- 9.1.1.3. Business Transaction Processing

- 9.1.1.4. Customer Experience

- 9.1.1.5. Enterprise IT

- 9.1.2. Services

- 9.1.2.1. Consulting Services

- 9.1.2.2. Integration Services

- 9.1.2.3. Training and Support Services

- 9.1.2.4. Operations and Maintenance

- 9.1.1. Software

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-Premise

- 9.3. Market Analysis, Insights and Forecast - by Size of Enterprise

- 9.3.1. Small and Medium Enterprises

- 9.3.2. Large Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Offerings

- 10. Latin America Financial Services Application Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offerings

- 10.1.1. Software

- 10.1.1.1. Audit, Risk, and Compliance Management

- 10.1.1.2. BI and Analytics Applications

- 10.1.1.3. Business Transaction Processing

- 10.1.1.4. Customer Experience

- 10.1.1.5. Enterprise IT

- 10.1.2. Services

- 10.1.2.1. Consulting Services

- 10.1.2.2. Integration Services

- 10.1.2.3. Training and Support Services

- 10.1.2.4. Operations and Maintenance

- 10.1.1. Software

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-Premise

- 10.3. Market Analysis, Insights and Forecast - by Size of Enterprise

- 10.3.1. Small and Medium Enterprises

- 10.3.2. Large Enterprises

- 10.1. Market Analysis, Insights and Forecast - by Offerings

- 11. Middle East and Africa Financial Services Application Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Offerings

- 11.1.1. Software

- 11.1.1.1. Audit, Risk, and Compliance Management

- 11.1.1.2. BI and Analytics Applications

- 11.1.1.3. Business Transaction Processing

- 11.1.1.4. Customer Experience

- 11.1.1.5. Enterprise IT

- 11.1.2. Services

- 11.1.2.1. Consulting Services

- 11.1.2.2. Integration Services

- 11.1.2.3. Training and Support Services

- 11.1.2.4. Operations and Maintenance

- 11.1.1. Software

- 11.2. Market Analysis, Insights and Forecast - by Deployment

- 11.2.1. Cloud

- 11.2.2. On-Premise

- 11.3. Market Analysis, Insights and Forecast - by Size of Enterprise

- 11.3.1. Small and Medium Enterprises

- 11.3.2. Large Enterprises

- 11.1. Market Analysis, Insights and Forecast - by Offerings

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Infosys Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Fiserv Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Accenture PLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 TCS Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 IBM Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Misys

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 FIS Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Temenos Group Ag

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Oracle Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SAP SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Infosys Limited

List of Figures

- Figure 1: Global Financial Services Application Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Financial Services Application Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Financial Services Application Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 4: North America Financial Services Application Industry Volume (K Unit), by Offerings 2025 & 2033

- Figure 5: North America Financial Services Application Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 6: North America Financial Services Application Industry Volume Share (%), by Offerings 2025 & 2033

- Figure 7: North America Financial Services Application Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 8: North America Financial Services Application Industry Volume (K Unit), by Deployment 2025 & 2033

- Figure 9: North America Financial Services Application Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: North America Financial Services Application Industry Volume Share (%), by Deployment 2025 & 2033

- Figure 11: North America Financial Services Application Industry Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 12: North America Financial Services Application Industry Volume (K Unit), by Size of Enterprise 2025 & 2033

- Figure 13: North America Financial Services Application Industry Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 14: North America Financial Services Application Industry Volume Share (%), by Size of Enterprise 2025 & 2033

- Figure 15: North America Financial Services Application Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Financial Services Application Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Financial Services Application Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Financial Services Application Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Financial Services Application Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 20: Europe Financial Services Application Industry Volume (K Unit), by Offerings 2025 & 2033

- Figure 21: Europe Financial Services Application Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 22: Europe Financial Services Application Industry Volume Share (%), by Offerings 2025 & 2033

- Figure 23: Europe Financial Services Application Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 24: Europe Financial Services Application Industry Volume (K Unit), by Deployment 2025 & 2033

- Figure 25: Europe Financial Services Application Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 26: Europe Financial Services Application Industry Volume Share (%), by Deployment 2025 & 2033

- Figure 27: Europe Financial Services Application Industry Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 28: Europe Financial Services Application Industry Volume (K Unit), by Size of Enterprise 2025 & 2033

- Figure 29: Europe Financial Services Application Industry Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 30: Europe Financial Services Application Industry Volume Share (%), by Size of Enterprise 2025 & 2033

- Figure 31: Europe Financial Services Application Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Financial Services Application Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Financial Services Application Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Financial Services Application Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Financial Services Application Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 36: Asia Financial Services Application Industry Volume (K Unit), by Offerings 2025 & 2033

- Figure 37: Asia Financial Services Application Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 38: Asia Financial Services Application Industry Volume Share (%), by Offerings 2025 & 2033

- Figure 39: Asia Financial Services Application Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 40: Asia Financial Services Application Industry Volume (K Unit), by Deployment 2025 & 2033

- Figure 41: Asia Financial Services Application Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 42: Asia Financial Services Application Industry Volume Share (%), by Deployment 2025 & 2033

- Figure 43: Asia Financial Services Application Industry Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 44: Asia Financial Services Application Industry Volume (K Unit), by Size of Enterprise 2025 & 2033

- Figure 45: Asia Financial Services Application Industry Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 46: Asia Financial Services Application Industry Volume Share (%), by Size of Enterprise 2025 & 2033

- Figure 47: Asia Financial Services Application Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Financial Services Application Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Financial Services Application Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Financial Services Application Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Australia and New Zealand Financial Services Application Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 52: Australia and New Zealand Financial Services Application Industry Volume (K Unit), by Offerings 2025 & 2033

- Figure 53: Australia and New Zealand Financial Services Application Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 54: Australia and New Zealand Financial Services Application Industry Volume Share (%), by Offerings 2025 & 2033

- Figure 55: Australia and New Zealand Financial Services Application Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 56: Australia and New Zealand Financial Services Application Industry Volume (K Unit), by Deployment 2025 & 2033

- Figure 57: Australia and New Zealand Financial Services Application Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 58: Australia and New Zealand Financial Services Application Industry Volume Share (%), by Deployment 2025 & 2033

- Figure 59: Australia and New Zealand Financial Services Application Industry Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 60: Australia and New Zealand Financial Services Application Industry Volume (K Unit), by Size of Enterprise 2025 & 2033

- Figure 61: Australia and New Zealand Financial Services Application Industry Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 62: Australia and New Zealand Financial Services Application Industry Volume Share (%), by Size of Enterprise 2025 & 2033

- Figure 63: Australia and New Zealand Financial Services Application Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Australia and New Zealand Financial Services Application Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Australia and New Zealand Financial Services Application Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Australia and New Zealand Financial Services Application Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Latin America Financial Services Application Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 68: Latin America Financial Services Application Industry Volume (K Unit), by Offerings 2025 & 2033

- Figure 69: Latin America Financial Services Application Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 70: Latin America Financial Services Application Industry Volume Share (%), by Offerings 2025 & 2033

- Figure 71: Latin America Financial Services Application Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 72: Latin America Financial Services Application Industry Volume (K Unit), by Deployment 2025 & 2033

- Figure 73: Latin America Financial Services Application Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 74: Latin America Financial Services Application Industry Volume Share (%), by Deployment 2025 & 2033

- Figure 75: Latin America Financial Services Application Industry Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 76: Latin America Financial Services Application Industry Volume (K Unit), by Size of Enterprise 2025 & 2033

- Figure 77: Latin America Financial Services Application Industry Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 78: Latin America Financial Services Application Industry Volume Share (%), by Size of Enterprise 2025 & 2033

- Figure 79: Latin America Financial Services Application Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Latin America Financial Services Application Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Latin America Financial Services Application Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Latin America Financial Services Application Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East and Africa Financial Services Application Industry Revenue (Million), by Offerings 2025 & 2033

- Figure 84: Middle East and Africa Financial Services Application Industry Volume (K Unit), by Offerings 2025 & 2033

- Figure 85: Middle East and Africa Financial Services Application Industry Revenue Share (%), by Offerings 2025 & 2033

- Figure 86: Middle East and Africa Financial Services Application Industry Volume Share (%), by Offerings 2025 & 2033

- Figure 87: Middle East and Africa Financial Services Application Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 88: Middle East and Africa Financial Services Application Industry Volume (K Unit), by Deployment 2025 & 2033

- Figure 89: Middle East and Africa Financial Services Application Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 90: Middle East and Africa Financial Services Application Industry Volume Share (%), by Deployment 2025 & 2033

- Figure 91: Middle East and Africa Financial Services Application Industry Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 92: Middle East and Africa Financial Services Application Industry Volume (K Unit), by Size of Enterprise 2025 & 2033

- Figure 93: Middle East and Africa Financial Services Application Industry Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 94: Middle East and Africa Financial Services Application Industry Volume Share (%), by Size of Enterprise 2025 & 2033

- Figure 95: Middle East and Africa Financial Services Application Industry Revenue (Million), by Country 2025 & 2033

- Figure 96: Middle East and Africa Financial Services Application Industry Volume (K Unit), by Country 2025 & 2033

- Figure 97: Middle East and Africa Financial Services Application Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East and Africa Financial Services Application Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Financial Services Application Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 2: Global Financial Services Application Industry Volume K Unit Forecast, by Offerings 2020 & 2033

- Table 3: Global Financial Services Application Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: Global Financial Services Application Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 5: Global Financial Services Application Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 6: Global Financial Services Application Industry Volume K Unit Forecast, by Size of Enterprise 2020 & 2033

- Table 7: Global Financial Services Application Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Financial Services Application Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Financial Services Application Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 10: Global Financial Services Application Industry Volume K Unit Forecast, by Offerings 2020 & 2033

- Table 11: Global Financial Services Application Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 12: Global Financial Services Application Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 13: Global Financial Services Application Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 14: Global Financial Services Application Industry Volume K Unit Forecast, by Size of Enterprise 2020 & 2033

- Table 15: Global Financial Services Application Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Financial Services Application Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Financial Services Application Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 18: Global Financial Services Application Industry Volume K Unit Forecast, by Offerings 2020 & 2033

- Table 19: Global Financial Services Application Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 20: Global Financial Services Application Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 21: Global Financial Services Application Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 22: Global Financial Services Application Industry Volume K Unit Forecast, by Size of Enterprise 2020 & 2033

- Table 23: Global Financial Services Application Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Financial Services Application Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Financial Services Application Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 26: Global Financial Services Application Industry Volume K Unit Forecast, by Offerings 2020 & 2033

- Table 27: Global Financial Services Application Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 28: Global Financial Services Application Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 29: Global Financial Services Application Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 30: Global Financial Services Application Industry Volume K Unit Forecast, by Size of Enterprise 2020 & 2033

- Table 31: Global Financial Services Application Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Financial Services Application Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Financial Services Application Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 34: Global Financial Services Application Industry Volume K Unit Forecast, by Offerings 2020 & 2033

- Table 35: Global Financial Services Application Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 36: Global Financial Services Application Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 37: Global Financial Services Application Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 38: Global Financial Services Application Industry Volume K Unit Forecast, by Size of Enterprise 2020 & 2033

- Table 39: Global Financial Services Application Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Financial Services Application Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Financial Services Application Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 42: Global Financial Services Application Industry Volume K Unit Forecast, by Offerings 2020 & 2033

- Table 43: Global Financial Services Application Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 44: Global Financial Services Application Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 45: Global Financial Services Application Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 46: Global Financial Services Application Industry Volume K Unit Forecast, by Size of Enterprise 2020 & 2033

- Table 47: Global Financial Services Application Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Financial Services Application Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Global Financial Services Application Industry Revenue Million Forecast, by Offerings 2020 & 2033

- Table 50: Global Financial Services Application Industry Volume K Unit Forecast, by Offerings 2020 & 2033

- Table 51: Global Financial Services Application Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 52: Global Financial Services Application Industry Volume K Unit Forecast, by Deployment 2020 & 2033

- Table 53: Global Financial Services Application Industry Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 54: Global Financial Services Application Industry Volume K Unit Forecast, by Size of Enterprise 2020 & 2033

- Table 55: Global Financial Services Application Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Financial Services Application Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Financial Services Application Industry?

The projected CAGR is approximately 13.13%.

2. Which companies are prominent players in the Financial Services Application Industry?

Key companies in the market include Infosys Limited, Fiserv Inc, Accenture PLC, TCS Ltd, IBM Corporation, Misys, FIS Corporation, Temenos Group Ag, Oracle Corporation, SAP SE.

3. What are the main segments of the Financial Services Application Industry?

The market segments include Offerings, Deployment, Size of Enterprise.

4. Can you provide details about the market size?

The market size is estimated to be USD 146.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Number of Financial Institutions; Increasing Emphasis on Customer Experience.

6. What are the notable trends driving market growth?

BI & Analytics Application is Expected to Witness High Growth.

7. Are there any restraints impacting market growth?

High Deployment Costs.

8. Can you provide examples of recent developments in the market?

January 2024 - Hitachi Payment Services has introduced Hitachi Money Spot Plus, especially for inclusive financial services, as well as to combine an extension to its existing suite of services and further enhance growth. The list of services included in Hitachi Money Spot Plus includes ATM Services, Domestic Money Transfers, Aadhaar Enabled Payment Services, Micro Mobile and DTH Recharges, and Bill Payments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Financial Services Application Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Financial Services Application Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Financial Services Application Industry?

To stay informed about further developments, trends, and reports in the Financial Services Application Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence