Key Insights

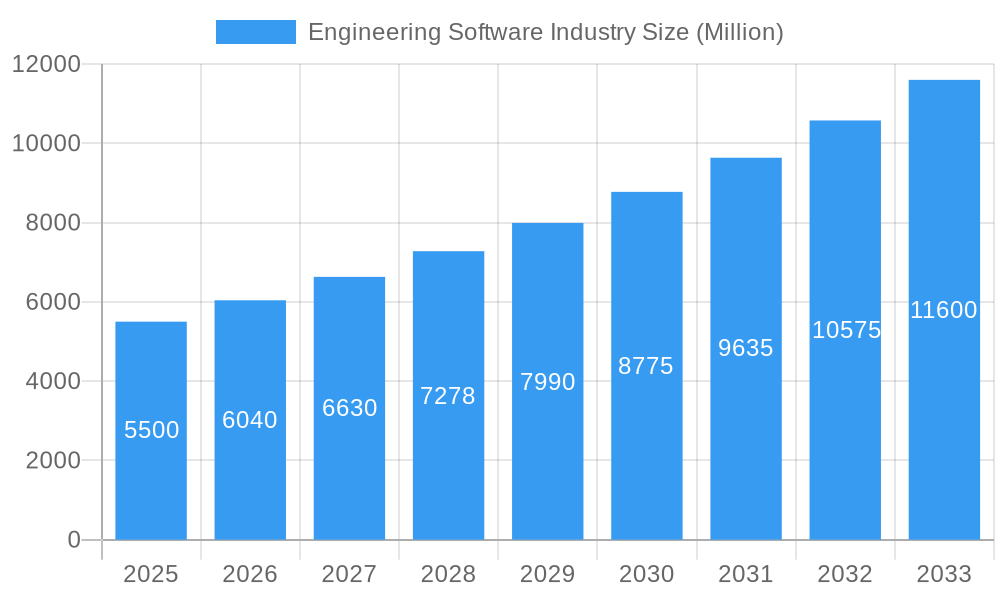

The global Engineering Software market is poised for significant expansion, projected to reach a substantial XX million by 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of 9.80% through 2033. This growth is fueled by an escalating demand for enhanced design automation, sophisticated product design and testing capabilities, and precise drafting and 3D modeling. The increasing complexity of modern engineering projects across sectors like automotive, aerospace, and construction necessitates advanced software solutions to streamline workflows, improve accuracy, and accelerate time-to-market. Furthermore, the digital transformation initiatives sweeping across industries are driving the adoption of integrated engineering software suites that offer end-to-end solutions from conceptualization to manufacturing. The market is witnessing a strong trend towards cloud-based solutions, enabling greater accessibility, collaboration, and scalability for engineering teams worldwide. This shift also supports the growing need for data analytics and AI-driven insights within the engineering lifecycle, leading to more efficient and innovative product development.

Engineering Software Industry Market Size (In Billion)

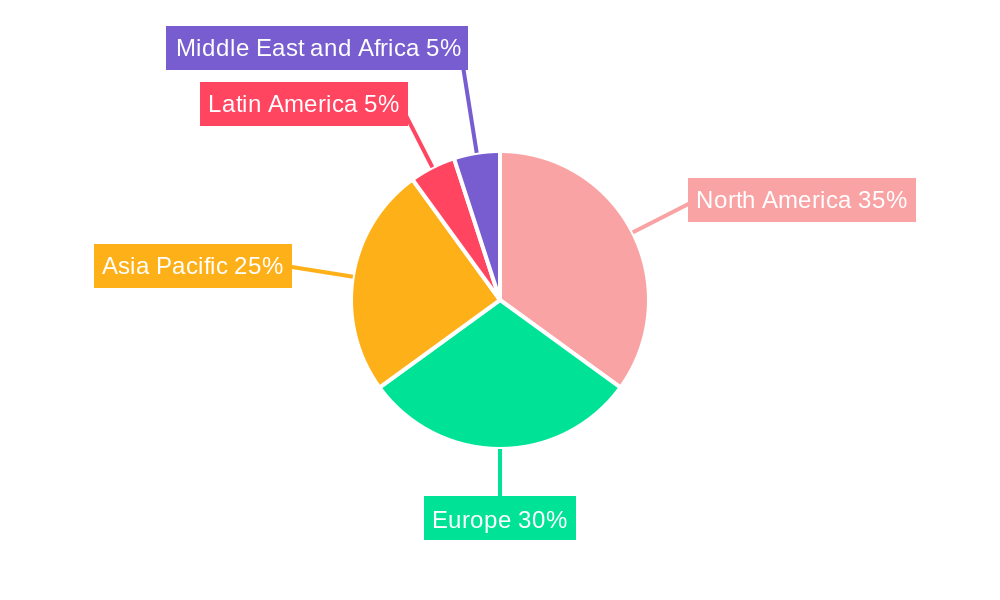

The market's dynamism is further shaped by the evolving landscape of specialized software categories. Computer-Aided Design (CAD), Computer-Aided Engineering (CAE), and Computer-Aided Manufacturing (CAM) software continue to be foundational pillars, with increasing integration and advanced functionalities. Electronic Design Automation (EDA) software is experiencing a surge due to the proliferation of complex electronic devices. While the industry benefits from strong growth drivers, certain restraints, such as the high initial investment cost for some advanced solutions and the need for skilled personnel to operate them effectively, need to be addressed. However, the overarching trend of digital product development, coupled with innovations in areas like simulation and virtual prototyping, is expected to outweigh these challenges, ensuring a sustained period of growth and opportunity for key players like Siemens Digital Industries Software, Dassault Systèmes S.A., and Autodesk Inc. The market's regional distribution is expected to see significant contributions from North America and Europe, with Asia Pacific emerging as a rapidly growing hub.

Engineering Software Industry Company Market Share

This in-depth engineering software market report provides a comprehensive analysis of the global engineering software industry, offering crucial insights for stakeholders seeking to understand market dynamics and capitalize on future opportunities. Covering the historical period (2019–2024), base year (2025), and an extensive forecast period (2025–2033), this report delivers precise projections and actionable intelligence. We delve into the intricate market structure, competitive landscape, pivotal industry trends, dominant segments, product innovations, and strategic outlook of the CAD software market, CAE software market, CAM software market, EDA software market, and other vital engineering software applications.

Engineering Software Industry Market Structure & Competitive Dynamics

The engineering software industry is characterized by a moderate to high market concentration, with a few dominant players holding significant market share, estimated at over 50% in 2025. Innovation ecosystems are thriving, driven by rapid advancements in cloud computing, artificial intelligence (AI), and the Internet of Things (IoT), fostering continuous product development. Regulatory frameworks vary across regions, primarily focusing on data security and intellectual property protection. The threat of product substitutes, while present from open-source alternatives and in-house solutions, is mitigated by the complex functionality and specialized support offered by established vendors. End-user trends highlight a growing demand for integrated solutions that streamline workflows from design to manufacturing. Merger and acquisition (M&A) activities are robust, with an estimated global M&A deal value exceeding $5 Billion in 2024, indicating a strategic consolidation to expand product portfolios and market reach. Key M&A drivers include the acquisition of niche technologies and companies with strong customer bases.

- Market Concentration: Dominated by a few key players, but with significant opportunities for niche providers.

- Innovation Ecosystems: Driven by AI, ML, cloud, and IoT integration.

- Regulatory Frameworks: Focus on data privacy, cybersecurity, and IP protection.

- Product Substitutes: Emerging open-source solutions and bespoke internal development pose a challenge.

- End-User Trends: Demand for integrated, cloud-based, and AI-powered solutions is rising.

- M&A Activities: Significant deal volume and value, targeting technology acquisition and market expansion.

Engineering Software Industry Industry Trends & Insights

The engineering software industry is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 8% from 2025 to 2033. This expansion is fueled by several key market growth drivers. The increasing adoption of digital transformation initiatives across manufacturing, aerospace, automotive, and construction sectors is a primary catalyst. Computer-Aided Design (CAD) software, Computer-Aided Engineering (CAE) software, and Computer-Aided Manufacturing (CAM) software are becoming indispensable tools for optimizing product development cycles, reducing time-to-market, and enhancing product quality. Technological disruptions, particularly the integration of Artificial Intelligence (AI) and Machine Learning (ML) into engineering workflows, are revolutionizing design automation, simulation accuracy, and predictive maintenance. AI-powered tools are enabling more sophisticated product design & testing and accelerating drafting & 3D modeling processes. Consumer preferences are shifting towards subscription-based licensing models and cloud-hosted solutions, offering greater flexibility, scalability, and accessibility. The Electronic Design Automation (EDA) software segment is witnessing significant traction due to the proliferation of complex electronic devices and the demand for miniaturization and enhanced performance. Market penetration for advanced engineering software solutions is steadily increasing across emerging economies, driven by government investments in infrastructure and manufacturing capabilities. The competitive dynamics are intensifying, with established players focusing on R&D to maintain their edge and smaller companies carving out niches in specialized areas like plant design and architec solutions. The growing complexity of engineering projects necessitates sophisticated software for efficient project management and execution.

Dominant Markets & Segments in Engineering Software Industry

The engineering software industry exhibits distinct regional dominance and segment leadership. North America, particularly the United States, holds a commanding market share, estimated at over 30% in 2025, driven by a strong presence of major engineering and manufacturing companies, significant R&D investments, and favorable government policies promoting technological adoption. Within this region, the Product Design & Testing segment is a key revenue generator, accounting for an estimated 25% of the total market. The Computer-Aided Design (CAD) Software segment is the largest by market size, projected to reach over $15 Billion in 2025, owing to its foundational role in virtually all engineering disciplines. The increasing demand for complex product development in sectors like automotive and aerospace propels the growth of Computer-Aided Engineering (CAE) Software, which is expected to see a CAGR of 9% during the forecast period.

- Leading Region: North America, with a significant market share driven by innovation and industry concentration.

- Key Drivers: Robust R&D spending, presence of major engineering firms, supportive government initiatives for advanced manufacturing, and high adoption of sophisticated technologies.

- Dominant Type Segment: Computer-Aided Design (CAD) Software, forming the bedrock of engineering workflows.

- Key Drivers: Ubiquitous use in product development, continuous feature enhancements, and integration with other engineering disciplines.

- Leading Application Segment: Product Design & Testing, critical for validating and optimizing new product concepts.

- Key Drivers: Emphasis on product quality, safety regulations, rapid prototyping, and virtual simulation capabilities.

- Emerging Application: Design Automation is gaining traction as companies seek to streamline repetitive design tasks and improve efficiency.

- Key Drivers: AI integration, standardization of design processes, and demand for faster design iterations.

- Significant Growth Potential: Electronic Design Automation (EDA) Software, fueled by the booming electronics sector and the increasing complexity of semiconductors and integrated circuits.

- Key Drivers: Proliferation of IoT devices, 5G technology development, and advancements in chip design.

Engineering Software Industry Product Innovations

Recent product innovations in the engineering software industry are centered on enhancing user experience, improving collaboration, and integrating advanced technologies. Companies are increasingly embedding AI and ML capabilities to automate repetitive tasks, optimize designs, and provide predictive insights. Cloud-native platforms are gaining prominence, enabling seamless collaboration among geographically dispersed teams and offering scalable computing power for complex simulations. Innovations in areas like generative design, digital twins, and augmented reality (AR) are transforming how products are conceived, tested, and manufactured, offering significant competitive advantages through faster iteration cycles and reduced physical prototyping needs.

Report Segmentation & Scope

This report segments the engineering software market across various dimensions to provide a granular understanding of market dynamics. The segmentation includes: Computer-Aided Design (CAD) Software, Computer-Aided Engineering (CAE) Software, Computer-Aided Manufacturing (CAM) Software, Architec (referring to architectural engineering software), Electronic Design Automation (EDA) Software, and various applications such as Design Automation, Plant Design, Product Design & Testing, Drafting & 3D Modeling, and Other Applications. Each segment is analyzed for its market size, projected growth, and competitive landscape. For instance, the CAD software segment is anticipated to experience a CAGR of 7.5% through 2033, while EDA software is projected to grow at a CAGR of 10.2%, driven by the semiconductor industry. Product Design & Testing is expected to maintain a steady growth of 8.8% as innovation remains paramount.

Key Drivers of Engineering Software Industry Growth

The engineering software industry is propelled by a confluence of potent drivers. Technological advancements, particularly the widespread integration of AI, ML, and cloud computing, are fundamental. The increasing adoption of Digital Twin technology for real-time monitoring and predictive maintenance is significantly enhancing operational efficiency. Economic factors, such as escalating global infrastructure development and increased R&D investments by manufacturing giants in sectors like automotive and aerospace, play a crucial role. Regulatory frameworks promoting product safety and sustainability are also indirectly boosting the demand for sophisticated engineering simulation and design tools. Furthermore, the growing trend of outsourcing engineering services is expanding the addressable market for these software solutions.

Challenges in the Engineering Software Industry Sector

Despite its robust growth, the engineering software industry faces several significant challenges. High upfront costs associated with acquiring and implementing comprehensive engineering software suites can be a barrier for small and medium-sized enterprises (SMEs). The complexity of some software solutions necessitates extensive training and skilled personnel, leading to a talent gap. Ensuring data security and intellectual property protection in cloud-based environments remains a persistent concern for many organizations. Intense competition among established players and the emergence of disruptive technologies can lead to pricing pressures and market fragmentation. Supply chain disruptions, while less direct, can impact the demand for manufacturing-specific engineering software.

Leading Players in the Engineering Software Industry Market

- Siemens Digital Industries Software

- HCL Technologies

- Dassault Systemes S A

- Altair Engineering Inc

- Geometric Ltd

- PTC Inc

- IBM corporation

- Autodesk Inc

- Synopsys Inc

- Bentley Systems Inc

- Rockwell Automation Inc

- SAP SE

Key Developments in Engineering Software Industry Sector

- November 2022: SAP declared the release of a robust commercial technology to fuel the next wave of business transformation by unleashing the wisdom of people who know best - business users - at the SAP TechEd conference. AP Build is a low-code solution that gives business users immediate, secure access to the end-to-end processes, data, and context they need to make better decisions and spur creativity rapidly. It does this by putting SAP's top-notch enterprise technology in its hands.

- July 2022: HCL Technologies partnered with Microsoft to introduce the new Digital Contact Center platform, which is anticipated to bring about a significant digital revolution of customer support operations across sectors. Beyond customer service operations, this comprehensive system has broad applications. Essential advantages of the center include immediate cost reductions, measurable improvements in critical KPIs, and possible income generating through upsell and cross-sell opportunities.

Strategic Engineering Software Industry Market Outlook

The engineering software industry is poised for continued expansion, driven by ongoing digital transformation and the relentless pursuit of innovation across manufacturing and technology sectors. The future outlook is characterized by the increasing adoption of AI-driven design tools, the pervasive integration of cloud-based collaboration platforms, and the growing importance of digital twins for optimizing product lifecycles. Strategic opportunities lie in expanding into emerging markets, developing specialized solutions for niche industries, and fostering partnerships that enhance interoperability and provide end-to-end workflow solutions. The market will likely witness further consolidation as companies seek to strengthen their technological capabilities and market positions. The emphasis on sustainable design and manufacturing will also create new avenues for growth in specialized engineering software.

Engineering Software Industry Segmentation

-

1. Type

- 1.1. Computer-Aided Design (CAD) Software

- 1.2. Computer-Aided Engineering (CAE) Software

- 1.3. Computer-Aided Manufacturing (CAM) Software

- 1.4. Architec

- 1.5. Electronic Design Automation (EDA) Software

-

2. Application

- 2.1. Design Automation

- 2.2. Plant Design

- 2.3. Product Design & Testing

- 2.4. Drafting & 3D Modeling

- 2.5. Other Applications

Engineering Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Engineering Software Industry Regional Market Share

Geographic Coverage of Engineering Software Industry

Engineering Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Cloud Based Software; Robust Demand for Computer-Aided Design (CAD) Software

- 3.3. Market Restrains

- 3.3.1. Ever-Changing Demands of the Clients

- 3.4. Market Trends

- 3.4.1. Cloud-Based Deployments are Gaining Significant Importance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Engineering Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Computer-Aided Design (CAD) Software

- 5.1.2. Computer-Aided Engineering (CAE) Software

- 5.1.3. Computer-Aided Manufacturing (CAM) Software

- 5.1.4. Architec

- 5.1.5. Electronic Design Automation (EDA) Software

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Design Automation

- 5.2.2. Plant Design

- 5.2.3. Product Design & Testing

- 5.2.4. Drafting & 3D Modeling

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Engineering Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Computer-Aided Design (CAD) Software

- 6.1.2. Computer-Aided Engineering (CAE) Software

- 6.1.3. Computer-Aided Manufacturing (CAM) Software

- 6.1.4. Architec

- 6.1.5. Electronic Design Automation (EDA) Software

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Design Automation

- 6.2.2. Plant Design

- 6.2.3. Product Design & Testing

- 6.2.4. Drafting & 3D Modeling

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Engineering Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Computer-Aided Design (CAD) Software

- 7.1.2. Computer-Aided Engineering (CAE) Software

- 7.1.3. Computer-Aided Manufacturing (CAM) Software

- 7.1.4. Architec

- 7.1.5. Electronic Design Automation (EDA) Software

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Design Automation

- 7.2.2. Plant Design

- 7.2.3. Product Design & Testing

- 7.2.4. Drafting & 3D Modeling

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Engineering Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Computer-Aided Design (CAD) Software

- 8.1.2. Computer-Aided Engineering (CAE) Software

- 8.1.3. Computer-Aided Manufacturing (CAM) Software

- 8.1.4. Architec

- 8.1.5. Electronic Design Automation (EDA) Software

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Design Automation

- 8.2.2. Plant Design

- 8.2.3. Product Design & Testing

- 8.2.4. Drafting & 3D Modeling

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Engineering Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Computer-Aided Design (CAD) Software

- 9.1.2. Computer-Aided Engineering (CAE) Software

- 9.1.3. Computer-Aided Manufacturing (CAM) Software

- 9.1.4. Architec

- 9.1.5. Electronic Design Automation (EDA) Software

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Design Automation

- 9.2.2. Plant Design

- 9.2.3. Product Design & Testing

- 9.2.4. Drafting & 3D Modeling

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Engineering Software Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Computer-Aided Design (CAD) Software

- 10.1.2. Computer-Aided Engineering (CAE) Software

- 10.1.3. Computer-Aided Manufacturing (CAM) Software

- 10.1.4. Architec

- 10.1.5. Electronic Design Automation (EDA) Software

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Design Automation

- 10.2.2. Plant Design

- 10.2.3. Product Design & Testing

- 10.2.4. Drafting & 3D Modeling

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Siemens Digital Industries Software

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HCL Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dassault Systemes S A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Altair Engineering Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Geometric Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PTC Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IBM corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Autodesk Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Synopsys Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bentley Systems Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rockwell Automation Inc *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SAP SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Siemens Digital Industries Software

List of Figures

- Figure 1: Global Engineering Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Engineering Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Engineering Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Engineering Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Engineering Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Engineering Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Engineering Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Engineering Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Engineering Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Engineering Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Engineering Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Engineering Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Engineering Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Engineering Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Engineering Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Engineering Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Engineering Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Engineering Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Engineering Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Engineering Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Engineering Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Engineering Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America Engineering Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Engineering Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Engineering Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Engineering Software Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Engineering Software Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Engineering Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Engineering Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Engineering Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Engineering Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Engineering Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Engineering Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Engineering Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Engineering Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Engineering Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Engineering Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Engineering Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Engineering Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Engineering Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Engineering Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Engineering Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Engineering Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Engineering Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Engineering Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Engineering Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Engineering Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Engineering Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Engineering Software Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Engineering Software Industry?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the Engineering Software Industry?

Key companies in the market include Siemens Digital Industries Software, HCL Technologies, Dassault Systemes S A, Altair Engineering Inc, Geometric Ltd, PTC Inc, IBM corporation, Autodesk Inc, Synopsys Inc, Bentley Systems Inc, Rockwell Automation Inc *List Not Exhaustive, SAP SE.

3. What are the main segments of the Engineering Software Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Cloud Based Software; Robust Demand for Computer-Aided Design (CAD) Software.

6. What are the notable trends driving market growth?

Cloud-Based Deployments are Gaining Significant Importance.

7. Are there any restraints impacting market growth?

Ever-Changing Demands of the Clients.

8. Can you provide examples of recent developments in the market?

In November 2022, SAP declared the release of a robust commercial technology to fuel the next wave of business transformation by unleashing the wisdom of people who know best - business users - at the SAP TechEd conference. AP Build is a low-code solution that gives business users immediate, secure access to the end-to-end processes, data, and context they need to make better decisions and spur creativity rapidly. It does this by putting SAP's top-notch enterprise technology in its hands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Engineering Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Engineering Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Engineering Software Industry?

To stay informed about further developments, trends, and reports in the Engineering Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence