Key Insights

The global Non-Destructive Testing (NDT) in Power Generation market is projected for significant expansion, forecasted to reach approximately $4.18 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.24%. This growth, extending through 2033, is driven by escalating global electricity demand and the critical need for reliable power generation facility operations. Aging infrastructure across thermal, nuclear, renewable, and hydroelectric sectors requires consistent inspections and maintenance to prevent failures and ensure asset longevity. Moreover, stringent safety regulations and environmental compliance mandates are compelling power generation companies to invest in advanced NDT solutions for early defect detection, risk mitigation, and optimized asset performance.

NDT in Power Generation Market Market Size (In Billion)

Market dynamics are further shaped by evolving technological trends and a growing emphasis on proactive asset management. Advanced NDT techniques like phased array ultrasonic testing, digital radiography, and eddy current array are gaining prominence for their enhanced accuracy, speed, and capability in inspecting complex geometries and materials. The integration of artificial intelligence and machine learning for data analysis and predictive maintenance is also emerging as a key trend, promising to revolutionize NDT data interpretation and utilization. However, market restraints include the high initial cost of sophisticated NDT equipment and the demand for skilled technicians. Despite these challenges, the persistent pursuit of operational efficiency, safety, and compliance within the power generation industry ensures a promising outlook for the NDT market.

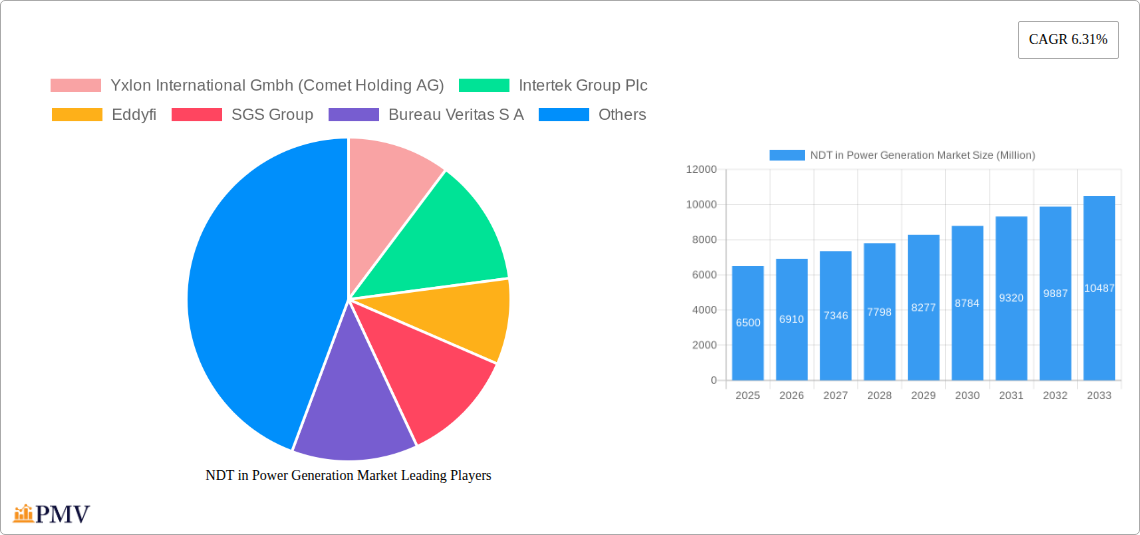

NDT in Power Generation Market Company Market Share

This comprehensive report provides an in-depth analysis of the global Non-Destructive Testing (NDT) in Power Generation market, covering the historical period (2019-2024), the base year (2025), and a detailed forecast period (2025-2033). We examine the crucial role of NDT services and equipment in ensuring the safety, reliability, and efficiency of power generation assets across nuclear, thermal, renewable, and hydroelectric sectors. This report is essential for industry stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the evolving landscape of power plant inspection technologies.

The market is segmented by Type (Services, Equipment), Testing Technology (Radiography Testing, Ultrasonic Testing, Visual Inspection Testing, Eddy Current Testing, Other Testing Technologies), and further analyzed across key regions and countries. Driven by stringent safety regulations, the imperative for asset integrity management, and the increasing complexity of power generation infrastructure, the NDT in Power Generation market is poised for substantial growth. This report utilizes advanced analytical techniques to deliver actionable insights into market structure, key trends, dominant segments, product innovations, growth drivers, challenges, leading players, and strategic outlook.

NDT in Power Generation Market Market Structure & Competitive Dynamics

The NDT in Power Generation market exhibits a moderately consolidated structure, with several prominent global players and a growing number of specialized regional providers. Market concentration is influenced by the high capital investment required for advanced NDT equipment and the need for highly skilled personnel. Innovation ecosystems are driven by collaborations between NDT service providers, technology manufacturers, and research institutions, focusing on developing more efficient, accurate, and automated inspection solutions. Regulatory frameworks, particularly those governing nuclear power plant safety and environmental compliance, play a pivotal role in shaping market demand and standards. Product substitutes, such as advanced sensor technologies and predictive maintenance algorithms, are emerging but currently complement rather than replace traditional NDT methods. End-user trends indicate a strong preference for integrated NDT solutions that offer comprehensive data analysis and reporting capabilities. Mergers and acquisitions (M&A) activities are a significant aspect of market dynamics, aimed at expanding service portfolios, geographical reach, and technological capabilities. For instance, acquisitions in the range of $50 Million to $200 Million are common for consolidating market share and gaining access to new expertise.

NDT in Power Generation Market Industry Trends & Insights

The NDT in Power Generation market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period. This expansion is primarily fueled by the imperative to maintain the integrity and longevity of aging power infrastructure, coupled with the increasing adoption of advanced NDT technologies. Regulatory mandates for rigorous safety inspections in nuclear and fossil fuel power plants are a constant demand driver. The global push towards decarbonization and the expansion of renewable energy sources, such as wind and solar farms, are also contributing to market penetration, as these assets require specialized inspection techniques to ensure optimal performance and prevent failures. Technological disruptions, including the integration of Artificial Intelligence (AI) and Machine Learning (ML) for automated data analysis and defect detection, are revolutionizing inspection efficiency. The development of phased array ultrasonic testing (PAUT) and guided wave testing (GWT) offers enhanced defect characterization and broader coverage, reducing downtime. Consumer preferences are shifting towards NDT service providers that offer end-to-end solutions, encompassing inspection planning, execution, data management, and predictive analytics. The competitive landscape is characterized by continuous innovation in inspection methodologies and a focus on developing specialized NDT solutions tailored to the unique requirements of different power generation sub-sectors.

Dominant Markets & Segments in NDT in Power Generation Market

Leading Region: North America currently dominates the NDT in Power Generation market, driven by a mature nuclear power sector, significant investments in infrastructure upgrades, and stringent safety regulations. The United States, with its extensive network of nuclear power plants and a strong emphasis on asset integrity management, accounts for a substantial portion of regional market share.

Leading Country: Within North America, the United States stands out as the leading country. Key drivers for its dominance include:

- Extensive Nuclear Fleet: A significant number of operational nuclear power plants requiring regular and sophisticated NDT inspections.

- Aging Infrastructure: The need to assess and maintain the integrity of older power generation facilities, including thermal and hydroelectric plants.

- Technological Adoption: Early and widespread adoption of advanced NDT technologies such as phased array ultrasonics and digital radiography.

- Stringent Regulatory Environment: Robust oversight from bodies like the Nuclear Regulatory Commission (NRC) mandates frequent and thorough inspections.

Dominant Segment by Type: Services represent the largest segment within the NDT in Power Generation market.

- Key Drivers: The increasing complexity of power generation assets, the growing demand for specialized inspection expertise, and the trend towards outsourcing maintenance and inspection activities to third-party NDT service providers. The need for qualified personnel to operate advanced NDT equipment and interpret complex data further solidifies the dominance of the services segment.

Dominant Segment by Testing Technology: Ultrasonic Testing (UT) is a dominant testing technology.

- Key Drivers: Its versatility, accuracy in detecting internal flaws, and suitability for a wide range of materials and components found in power plants. Advances in phased array ultrasonic testing (PAUT) and total focusing method (TFM) have significantly enhanced its capabilities, making it indispensable for critical inspections.

Other Significant Segments:

- Radiography Testing (RT): Crucial for weld inspection and identifying volumetric defects, particularly in critical components.

- Visual Inspection Testing: The foundational inspection method, essential for initial assessments and surface defect detection.

- Eddy Current Testing (ECT): Highly effective for surface and near-surface defect detection in conductive materials, widely used for tube inspection in heat exchangers.

NDT in Power Generation Market Product Innovations

Product innovations in the NDT in Power Generation market are focused on enhancing inspection speed, accuracy, data management, and automation. The development of portable and ruggedized NDT equipment with improved imaging capabilities and advanced signal processing is a key trend. AI-powered analytics are being integrated to enable automated defect recognition and classification, significantly reducing human error and inspection time. Innovations in robotic NDT systems are enabling inspections in hazardous or hard-to-reach areas, improving safety and efficiency. Emerging technologies like advanced ultrasonic transducers and portable digital radiography systems are offering higher resolution and faster inspection cycles, directly contributing to improved asset reliability and reduced operational costs for power generation facilities.

Report Segmentation & Scope

This report meticulously segments the NDT in Power Generation market by Type, encompassing Services and Equipment. The Services segment is projected to witness significant growth due to the increasing demand for specialized expertise and outsourcing of maintenance activities, with an estimated market size of over $10 Billion by 2033. The Equipment segment, valued at approximately $5 Billion in 2025, is driven by the adoption of advanced NDT technologies. Further segmentation by Testing Technology includes:

- Radiography Testing: Estimated market size of over $2 Billion by 2033, driven by its critical role in weld integrity.

- Ultrasonic Testing: Projected to be the largest technology segment, exceeding $4 Billion by 2033, owing to advancements like PAUT.

- Visual Inspection Testing: Valued at around $1 Billion by 2033, remaining a fundamental inspection technique.

- Eddy Current Testing: Expected to reach over $1.5 Billion by 2033, crucial for specific applications like heat exchanger tubes.

- Other Testing Technologies: Including magnetic particle testing, liquid penetrant testing, and emerging techniques, collectively projected to exceed $1 Billion by 2033.

Key Drivers of NDT in Power Generation Market Growth

The growth of the NDT in Power Generation market is propelled by several critical factors. Firstly, the increasing demand for energy, coupled with the aging infrastructure of existing power plants, necessitates regular and robust inspection regimes to ensure operational safety and prevent catastrophic failures. Secondly, stringent government regulations and international safety standards, particularly in the nuclear power sector, mandate comprehensive NDT procedures, driving consistent market demand. The third major driver is the ongoing technological advancement in NDT equipment and techniques, such as the adoption of AI for automated data analysis and the development of more sophisticated ultrasonic and radiographic systems, which enhance inspection accuracy and efficiency. Finally, the global transition towards renewable energy sources, including wind and solar, creates new opportunities for NDT services and equipment for the inspection of new infrastructure.

Challenges in the NDT in Power Generation Market Sector

Despite its robust growth, the NDT in Power Generation market faces several challenges. A significant barrier is the shortage of skilled and certified NDT technicians, which can lead to project delays and increased labor costs. The high initial investment required for advanced NDT equipment can also be a deterrent for smaller operators. Supply chain disruptions, particularly for specialized components and raw materials, can impact the availability and cost of NDT equipment. Furthermore, the evolving regulatory landscape, while a driver, can also present challenges as companies need to constantly adapt their methodologies to meet new compliance requirements. Competitive pressures from domestic and international players, especially in emerging markets, can also lead to pricing challenges.

Leading Players in the NDT in Power Generation Market Market

- Yxlon International Gmbh (Comet Holding AG)

- Intertek Group Plc

- Eddyfi

- SGS Group

- Bureau Veritas S A

- Fujifilm Corporation

- Mistras Group Inc

- Zetec Inc

- Applus+ Services Technologies S L

- Baker Hughes Company

- Team Inc

- Olympus Corporation

Key Developments in NDT in Power Generation Market Sector

- June 2022: ALEIA, an AI startup, in collaboration with Omexom NDT Engineering & Services and LAUM UMR CNRS, launched the AUTEND project to accelerate AI-driven inspection of nuclear power plants using eddy current and ultrasonic testing methods.

- April 2021: IR Supplies and Services partnered with Creative Electron, expanding their offering of inspection tools across Canada, including for power generation organizations, to ensure high-quality output.

- March 2021: Applus+ acquired 100% of Inecosa and Adícora from the Iberdrola Group, bolstering its Energy & Industry division and accelerating growth in Power Generation, Transmission & Distribution, and the renewables sector.

Strategic NDT in Power Generation Market Market Outlook

The strategic outlook for the NDT in Power Generation market remains highly promising, driven by sustained demand for asset integrity management and safety assurance. The increasing integration of digital technologies, including AI, IoT, and robotics, will further transform inspection processes, leading to greater automation, efficiency, and predictive capabilities. The global energy transition, with its focus on both maintaining existing power sources and developing new renewable infrastructure, presents a dual opportunity for NDT service providers and equipment manufacturers. Strategic opportunities lie in developing comprehensive, integrated NDT solutions that offer data analytics and insights to optimize maintenance schedules and extend asset lifecycles. Companies that invest in advanced technologies and skilled talent will be best positioned to capitalize on the evolving market demands and secure long-term growth.

NDT in Power Generation Market Segmentation

-

1. Type

- 1.1. Services

- 1.2. Equipment

-

2. Testing Technology

- 2.1. Radiography Testing

- 2.2. Ultrasonic Testing

- 2.3. Visual Inspection Testing

- 2.4. Eddy Current Testing

- 2.5. Other Testing Technologies

NDT in Power Generation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

NDT in Power Generation Market Regional Market Share

Geographic Coverage of NDT in Power Generation Market

NDT in Power Generation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Regulations Mandating Safety Standards; Increase in Demand for Flaw Detection to Reduce Repair Cost; Aging Infrastructure and Increasing Need for Maintenance

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Workforce and Training Regulations

- 3.4. Market Trends

- 3.4.1. Visual Inspection Testing is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NDT in Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Services

- 5.1.2. Equipment

- 5.2. Market Analysis, Insights and Forecast - by Testing Technology

- 5.2.1. Radiography Testing

- 5.2.2. Ultrasonic Testing

- 5.2.3. Visual Inspection Testing

- 5.2.4. Eddy Current Testing

- 5.2.5. Other Testing Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America NDT in Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Services

- 6.1.2. Equipment

- 6.2. Market Analysis, Insights and Forecast - by Testing Technology

- 6.2.1. Radiography Testing

- 6.2.2. Ultrasonic Testing

- 6.2.3. Visual Inspection Testing

- 6.2.4. Eddy Current Testing

- 6.2.5. Other Testing Technologies

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe NDT in Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Services

- 7.1.2. Equipment

- 7.2. Market Analysis, Insights and Forecast - by Testing Technology

- 7.2.1. Radiography Testing

- 7.2.2. Ultrasonic Testing

- 7.2.3. Visual Inspection Testing

- 7.2.4. Eddy Current Testing

- 7.2.5. Other Testing Technologies

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific NDT in Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Services

- 8.1.2. Equipment

- 8.2. Market Analysis, Insights and Forecast - by Testing Technology

- 8.2.1. Radiography Testing

- 8.2.2. Ultrasonic Testing

- 8.2.3. Visual Inspection Testing

- 8.2.4. Eddy Current Testing

- 8.2.5. Other Testing Technologies

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America NDT in Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Services

- 9.1.2. Equipment

- 9.2. Market Analysis, Insights and Forecast - by Testing Technology

- 9.2.1. Radiography Testing

- 9.2.2. Ultrasonic Testing

- 9.2.3. Visual Inspection Testing

- 9.2.4. Eddy Current Testing

- 9.2.5. Other Testing Technologies

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa NDT in Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Services

- 10.1.2. Equipment

- 10.2. Market Analysis, Insights and Forecast - by Testing Technology

- 10.2.1. Radiography Testing

- 10.2.2. Ultrasonic Testing

- 10.2.3. Visual Inspection Testing

- 10.2.4. Eddy Current Testing

- 10.2.5. Other Testing Technologies

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Yxlon International Gmbh (Comet Holding AG)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Intertek Group Plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eddyfi

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SGS Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bureau Veritas S A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fujifilm Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mistras Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zetec Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Applus+ Services Technologies S L

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Baker Hughes Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Team Inc *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Olympus Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Yxlon International Gmbh (Comet Holding AG)

List of Figures

- Figure 1: Global NDT in Power Generation Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America NDT in Power Generation Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America NDT in Power Generation Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America NDT in Power Generation Market Revenue (billion), by Testing Technology 2025 & 2033

- Figure 5: North America NDT in Power Generation Market Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 6: North America NDT in Power Generation Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America NDT in Power Generation Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe NDT in Power Generation Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe NDT in Power Generation Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe NDT in Power Generation Market Revenue (billion), by Testing Technology 2025 & 2033

- Figure 11: Europe NDT in Power Generation Market Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 12: Europe NDT in Power Generation Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe NDT in Power Generation Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific NDT in Power Generation Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific NDT in Power Generation Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific NDT in Power Generation Market Revenue (billion), by Testing Technology 2025 & 2033

- Figure 17: Asia Pacific NDT in Power Generation Market Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 18: Asia Pacific NDT in Power Generation Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific NDT in Power Generation Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America NDT in Power Generation Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America NDT in Power Generation Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America NDT in Power Generation Market Revenue (billion), by Testing Technology 2025 & 2033

- Figure 23: Latin America NDT in Power Generation Market Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 24: Latin America NDT in Power Generation Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America NDT in Power Generation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa NDT in Power Generation Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa NDT in Power Generation Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa NDT in Power Generation Market Revenue (billion), by Testing Technology 2025 & 2033

- Figure 29: Middle East and Africa NDT in Power Generation Market Revenue Share (%), by Testing Technology 2025 & 2033

- Figure 30: Middle East and Africa NDT in Power Generation Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa NDT in Power Generation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NDT in Power Generation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global NDT in Power Generation Market Revenue billion Forecast, by Testing Technology 2020 & 2033

- Table 3: Global NDT in Power Generation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global NDT in Power Generation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global NDT in Power Generation Market Revenue billion Forecast, by Testing Technology 2020 & 2033

- Table 6: Global NDT in Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States NDT in Power Generation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada NDT in Power Generation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global NDT in Power Generation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global NDT in Power Generation Market Revenue billion Forecast, by Testing Technology 2020 & 2033

- Table 11: Global NDT in Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom NDT in Power Generation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany NDT in Power Generation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France NDT in Power Generation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe NDT in Power Generation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global NDT in Power Generation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global NDT in Power Generation Market Revenue billion Forecast, by Testing Technology 2020 & 2033

- Table 18: Global NDT in Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China NDT in Power Generation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan NDT in Power Generation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India NDT in Power Generation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific NDT in Power Generation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global NDT in Power Generation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global NDT in Power Generation Market Revenue billion Forecast, by Testing Technology 2020 & 2033

- Table 25: Global NDT in Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global NDT in Power Generation Market Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global NDT in Power Generation Market Revenue billion Forecast, by Testing Technology 2020 & 2033

- Table 28: Global NDT in Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NDT in Power Generation Market?

The projected CAGR is approximately 6.24%.

2. Which companies are prominent players in the NDT in Power Generation Market?

Key companies in the market include Yxlon International Gmbh (Comet Holding AG), Intertek Group Plc, Eddyfi, SGS Group, Bureau Veritas S A, Fujifilm Corporation, Mistras Group Inc, Zetec Inc, Applus+ Services Technologies S L, Baker Hughes Company, Team Inc *List Not Exhaustive, Olympus Corporation.

3. What are the main segments of the NDT in Power Generation Market?

The market segments include Type, Testing Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.18 billion as of 2022.

5. What are some drivers contributing to market growth?

Stringent Regulations Mandating Safety Standards; Increase in Demand for Flaw Detection to Reduce Repair Cost; Aging Infrastructure and Increasing Need for Maintenance.

6. What are the notable trends driving market growth?

Visual Inspection Testing is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled Workforce and Training Regulations.

8. Can you provide examples of recent developments in the market?

June 2022 - ALEIA, a startup specializing in AI, and Omexom NDT Engineering & Services, in collaboration with the Laboratoire d'Acoustique de l'Université du Mans (LAUM) UMR CNRS, have announced the deployment of the AUTEND project. The project is aimed to accelerate the inspection of nuclear power plants through AI. Moreover, the project is presently focusing on Non-Destructive Testing, which is an inspection process for nuclear infrastructures using eddy current or ultrasonic testing methods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NDT in Power Generation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NDT in Power Generation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NDT in Power Generation Market?

To stay informed about further developments, trends, and reports in the NDT in Power Generation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence