Key Insights

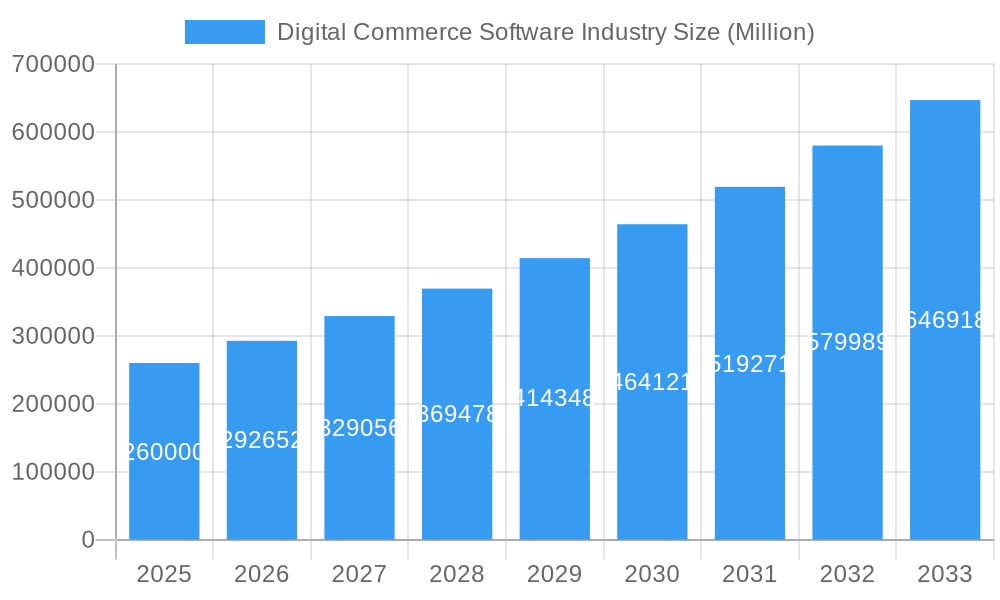

The Digital Commerce Software market is projected for significant expansion, with an estimated market size of $6.79 billion by 2025. The sector is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 15.3%. This robust growth is driven by the widespread adoption of e-commerce, increasing demand for enhanced customer experiences, and continuous innovation in digital payment systems. Key growth catalysts include the thriving online retail sector, the necessity for businesses to establish a strong digital presence, and the growing reliance on scalable, flexible cloud-based solutions. Ongoing digital transformation initiatives, coupled with expanding internet penetration and smartphone usage worldwide, are further amplifying market demand. Moreover, advancements in AI, machine learning, and personalized marketing tools are empowering businesses to deliver more tailored and engaging customer journeys, thereby fueling market expansion.

Digital Commerce Software Industry Market Size (In Billion)

The market is characterized by significant trends, including the rise of omnichannel commerce, a heightened focus on data analytics for customer insights, and the growing popularity of mobile commerce. Hybrid deployment models are gaining traction as businesses seek to balance on-premise security with cloud scalability. However, challenges such as data security concerns, integration complexities with existing systems, and the cost of advanced platform implementation can temper growth. The market is segmented by deployment type, with cloud-based solutions expected to lead due to their cost-effectiveness and scalability, and by end-user industries, with Retail and BFSI anticipated to be the largest adopters, followed by Travel & Tourism and IT & Communications. Leading players like Salesforce, Shopify, and Oracle are actively shaping the market through strategic collaborations and product innovation, addressing the evolving needs of businesses pursuing digital commerce excellence.

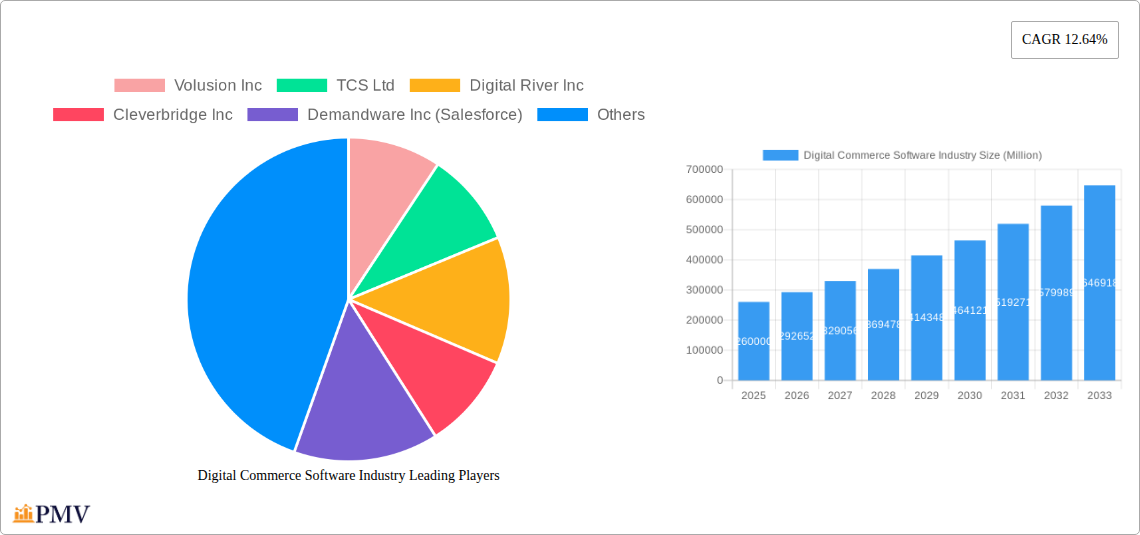

Digital Commerce Software Industry Company Market Share

This report offers a comprehensive analysis of the Digital Commerce Software industry, covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. Explore the market structure, competitive landscape, emerging trends, and future outlook. Gain actionable insights for businesses in Retail, BFSI, Travel & Tourism, IT & Communications, and Entertainment & Media.

Digital Commerce Software Industry Market Structure & Competitive Dynamics

The Digital Commerce Software Industry exhibits a moderately concentrated market structure, with a blend of large established players and innovative startups driving competition. Key players like Oracle Corporation, SAP SE, and Salesforce (Demandware Inc.) hold significant market share, estimated to be over 30% collectively. However, the rise of agile cloud-based solutions from companies such as Shopify Inc. and Volusion Inc. fosters a vibrant innovation ecosystem. Regulatory frameworks, while evolving, primarily focus on data privacy and security, influencing platform development and adoption. Product substitutes, including off-the-shelf solutions and bespoke development, present ongoing competitive pressures. End-user industries are increasingly demanding seamless, omnichannel experiences, pushing for greater integration and personalization. Merger and acquisition (M&A) activities are prevalent, with estimated deal values exceeding $5 Million annually, as larger entities seek to acquire innovative technologies and expand their market reach. For instance, acquisitions in the e-commerce platform and digital payment solutions space are common.

Digital Commerce Software Industry Industry Trends & Insights

The Digital Commerce Software Industry is experiencing robust growth, driven by the accelerating shift towards online transactions and the increasing adoption of digital technologies across all sectors. The projected Compound Annual Growth Rate (CAGR) for the forecast period is estimated at 15%, reflecting strong market penetration and ongoing digital transformation initiatives. Key growth drivers include the proliferation of mobile commerce, the demand for personalized customer experiences, and the need for sophisticated e-commerce solutions that can manage complex sales channels and supply chains. Technological disruptions, such as the integration of Artificial Intelligence (AI) for personalized recommendations and fraud detection, and the increasing adoption of cloud-based SaaS e-commerce platforms, are reshaping the competitive landscape. Consumer preferences are increasingly leaning towards convenient, secure, and intuitive online shopping experiences, pushing vendors to invest heavily in user interface (UI) and user experience (UX) enhancements. The competitive dynamics are characterized by intense innovation, with companies striving to offer comprehensive digital transformation services and cutting-edge online retail software. The market penetration of advanced e-commerce technologies is expected to reach over 75% by 2033.

Dominant Markets & Segments in Digital Commerce Software Industry

The Retail sector stands out as the dominant end-user industry for Digital Commerce Software, accounting for an estimated 45% of the total market share. This dominance is propelled by the relentless growth of online shopping and the need for robust online store solutions, inventory management, and customer relationship management (CRM) functionalities.

- Cloud-Based Deployment Model: This segment is experiencing exponential growth, driven by its scalability, flexibility, and cost-effectiveness. Businesses are increasingly migrating from on-premise solutions to cloud-based e-commerce platforms to leverage faster deployment and easier updates.

- Key Drivers: Reduced IT infrastructure costs, enhanced accessibility from anywhere, and automatic software updates.

- Retail End-User Industry: The sheer volume of online transactions and the continuous need for updated merchandising software and digital marketing tools solidifies its leading position.

- Key Drivers: Growing consumer spending online, demand for personalized shopping experiences, and the rise of direct-to-consumer (DTC) models.

- North America: This region continues to lead in the adoption of e-commerce technology due to high internet penetration, a technologically savvy consumer base, and a mature business environment supportive of digital innovation.

- Key Drivers: Strong economic policies, advanced digital infrastructure, and a high concentration of leading e-commerce players.

The BFSI sector is also showing significant traction, driven by the demand for secure and efficient online banking, investment, and insurance platforms. Similarly, the Travel & Tourism industry relies heavily on sophisticated booking engines and online travel agency (OTA) software to manage bookings, payments, and customer interactions. The IT & Communications sector utilizes these solutions for software sales and subscription management, while Entertainment & Media leverages them for digital content distribution and subscription services, driving demand for specialized digital content delivery platforms.

Digital Commerce Software Industry Product Innovations

Product innovation in the Digital Commerce Software Industry is primarily focused on enhancing user experience, automating processes, and providing deeper analytical insights. Advancements in AI and machine learning are enabling hyper-personalization of customer journeys, from product recommendations to targeted marketing campaigns. Integration with emerging technologies like augmented reality (AR) for virtual try-ons and blockchain for secure transaction verification is gaining momentum. The competitive advantage lies in offering seamless omnichannel integration, robust security features, and scalable solutions that can adapt to evolving business needs. Developers are also prioritizing the creation of low-code/no-code platforms to democratize e-commerce development and reduce time-to-market for new online stores and functionalities.

Report Segmentation & Scope

This report segments the Digital Commerce Software Industry by Deployment Model and End-User Industries.

- Deployment Model: This includes On-Premise, Cloud-Based, and Hybrid solutions. The Cloud-Based segment is projected to dominate, with an estimated market share of over 60% by 2033, driven by scalability and flexibility. On-Premise solutions will continue to be relevant for large enterprises with specific security needs, while Hybrid models offer a transitional pathway.

- End-User Industries: Key segments analyzed include Retail, BFSI, Travel & Tourism, IT & Communications, and Entertainment & Media. The Retail segment is expected to maintain its leading position with significant growth, followed by BFSI and Travel & Tourism. IT & Communications and Entertainment & Media are also significant contributors with specialized needs for digital content management and subscription billing software.

Key Drivers of Digital Commerce Software Industry Growth

The rapid expansion of the Digital Commerce Software Industry is propelled by several key factors. The increasing penetration of high-speed internet and mobile devices globally is a fundamental enabler. Growing consumer comfort and preference for online shopping, coupled with the convenience and wider product selection it offers, fuels demand for advanced e-commerce solutions. Furthermore, businesses across all sectors are undergoing digital transformation, recognizing the necessity of robust online presence and transactional capabilities to remain competitive. Government initiatives promoting digital adoption and e-commerce, along with the development of secure and efficient digital payment systems, are also significant growth catalysts.

Challenges in the Digital Commerce Software Industry Sector

Despite its strong growth trajectory, the Digital Commerce Software Industry faces several challenges. Intense market competition leads to price pressures and necessitates continuous innovation, impacting profit margins. Evolving data privacy regulations, such as GDPR and CCPA, impose compliance burdens and require significant investment in security infrastructure. Supply chain disruptions and logistical complexities can impact the seamless delivery of goods ordered online, affecting customer satisfaction. Furthermore, the need for skilled IT professionals to develop, implement, and manage these sophisticated software solutions presents a talent acquisition challenge. The increasing sophistication of cyber threats also poses a constant risk, requiring ongoing vigilance and investment in cybersecurity measures.

Leading Players in the Digital Commerce Software Industry Market

- Volusion Inc.

- TCS Ltd

- Digital River Inc.

- Cleverbridge Inc.

- Salesforce (Demandware Inc.)

- Shopify Inc.

- Kibo Software (MarketLive Inc.)

- eBay Enterprise

- Sappi Limited

- Oracle Corporation

- Intershop Communications AG

- SAP SE

Key Developments in Digital Commerce Software Industry Sector

- August 2022: papmall announced the launch of an e-commerce marketplace platform to support online sellers and buyers communities worldwide to connect and exchange values. The platform is expected to be the most technologically advanced assistant for online business and freelancing work.

- January 2022: Zitec, a European IT company, announced a partnership with the Kingfisher group to develop and launch Brico Dépôt, an online shop on the Magento 2 Commerce Cloud platform, as an external stimulant of their digital transformation. Zitec migrated the online store from Laravel to the Magento 2 Commerce Cloud and added several UX/UI improvements, such as improving the search function and identifying products on the site with the help of the integrated Magento 2 components.

Strategic Digital Commerce Software Industry Market Outlook

The strategic outlook for the Digital Commerce Software Industry remains exceptionally bright. Future growth will be accelerated by the increasing integration of AI and machine learning for hyper-personalized customer experiences and predictive analytics. The expansion of the metaverse and Web3 technologies presents new avenues for immersive e-commerce experiences and novel revenue streams. Businesses will continue to prioritize omnichannel strategies, demanding integrated e-commerce platforms that unify online and offline customer journeys. The growing adoption of headless commerce architectures will offer greater flexibility and customization for brands. Furthermore, the increasing focus on sustainability and ethical sourcing will influence the development of responsible e-commerce solutions. Strategic investments in cloud infrastructure, data analytics, and robust security measures will be crucial for companies to capitalize on these evolving market opportunities.

Digital Commerce Software Industry Segmentation

-

1. Deployment Model

- 1.1. On-Premise

- 1.2. Cloud-Based

- 1.3. Hybrid

-

2. End-User Industries

- 2.1. Retail

- 2.2. BFSI

- 2.3. Travel & Tourism

- 2.4. IT & Communications

- 2.5. Entertainment & Media

Digital Commerce Software Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Digital Commerce Software Industry Regional Market Share

Geographic Coverage of Digital Commerce Software Industry

Digital Commerce Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 6.1 Growth in Adoption of Cloud-Based Services6.2 Growing Development in Wired and Wireless Communications Networks

- 3.3. Market Restrains

- 3.3.1. 7.1 Increasing Security and Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Growth in the Adoption of Cloud-Based Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Commerce Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Model

- 5.1.1. On-Premise

- 5.1.2. Cloud-Based

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End-User Industries

- 5.2.1. Retail

- 5.2.2. BFSI

- 5.2.3. Travel & Tourism

- 5.2.4. IT & Communications

- 5.2.5. Entertainment & Media

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Deployment Model

- 6. North America Digital Commerce Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Model

- 6.1.1. On-Premise

- 6.1.2. Cloud-Based

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by End-User Industries

- 6.2.1. Retail

- 6.2.2. BFSI

- 6.2.3. Travel & Tourism

- 6.2.4. IT & Communications

- 6.2.5. Entertainment & Media

- 6.1. Market Analysis, Insights and Forecast - by Deployment Model

- 7. Europe Digital Commerce Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Model

- 7.1.1. On-Premise

- 7.1.2. Cloud-Based

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by End-User Industries

- 7.2.1. Retail

- 7.2.2. BFSI

- 7.2.3. Travel & Tourism

- 7.2.4. IT & Communications

- 7.2.5. Entertainment & Media

- 7.1. Market Analysis, Insights and Forecast - by Deployment Model

- 8. Asia Pacific Digital Commerce Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Model

- 8.1.1. On-Premise

- 8.1.2. Cloud-Based

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by End-User Industries

- 8.2.1. Retail

- 8.2.2. BFSI

- 8.2.3. Travel & Tourism

- 8.2.4. IT & Communications

- 8.2.5. Entertainment & Media

- 8.1. Market Analysis, Insights and Forecast - by Deployment Model

- 9. Rest of the World Digital Commerce Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Model

- 9.1.1. On-Premise

- 9.1.2. Cloud-Based

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by End-User Industries

- 9.2.1. Retail

- 9.2.2. BFSI

- 9.2.3. Travel & Tourism

- 9.2.4. IT & Communications

- 9.2.5. Entertainment & Media

- 9.1. Market Analysis, Insights and Forecast - by Deployment Model

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Volusion Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TCS Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Digital River Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cleverbridge Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Demandware Inc (Salesforce)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Shopify Inc*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 MarketLive Inc ( Kibo Software)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 eBay Enterprise

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sappi Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Oracle Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Intershop Communications AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 SAP SE

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Volusion Inc

List of Figures

- Figure 1: Global Digital Commerce Software Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Digital Commerce Software Industry Revenue (billion), by Deployment Model 2025 & 2033

- Figure 3: North America Digital Commerce Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 4: North America Digital Commerce Software Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 5: North America Digital Commerce Software Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 6: North America Digital Commerce Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Digital Commerce Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Digital Commerce Software Industry Revenue (billion), by Deployment Model 2025 & 2033

- Figure 9: Europe Digital Commerce Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 10: Europe Digital Commerce Software Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 11: Europe Digital Commerce Software Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 12: Europe Digital Commerce Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Digital Commerce Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Digital Commerce Software Industry Revenue (billion), by Deployment Model 2025 & 2033

- Figure 15: Asia Pacific Digital Commerce Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 16: Asia Pacific Digital Commerce Software Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 17: Asia Pacific Digital Commerce Software Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 18: Asia Pacific Digital Commerce Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Digital Commerce Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Digital Commerce Software Industry Revenue (billion), by Deployment Model 2025 & 2033

- Figure 21: Rest of the World Digital Commerce Software Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 22: Rest of the World Digital Commerce Software Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 23: Rest of the World Digital Commerce Software Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 24: Rest of the World Digital Commerce Software Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Digital Commerce Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Commerce Software Industry Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 2: Global Digital Commerce Software Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 3: Global Digital Commerce Software Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Digital Commerce Software Industry Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 5: Global Digital Commerce Software Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 6: Global Digital Commerce Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Digital Commerce Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Digital Commerce Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Digital Commerce Software Industry Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 10: Global Digital Commerce Software Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 11: Global Digital Commerce Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Digital Commerce Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Digital Commerce Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Digital Commerce Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Digital Commerce Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Digital Commerce Software Industry Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 17: Global Digital Commerce Software Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 18: Global Digital Commerce Software Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Digital Commerce Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Digital Commerce Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Digital Commerce Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Digital Commerce Software Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Digital Commerce Software Industry Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 24: Global Digital Commerce Software Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 25: Global Digital Commerce Software Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Commerce Software Industry?

The projected CAGR is approximately 15.3%.

2. Which companies are prominent players in the Digital Commerce Software Industry?

Key companies in the market include Volusion Inc, TCS Ltd, Digital River Inc, Cleverbridge Inc, Demandware Inc (Salesforce), Shopify Inc*List Not Exhaustive, MarketLive Inc ( Kibo Software), eBay Enterprise, Sappi Limited, Oracle Corporation, Intershop Communications AG, SAP SE.

3. What are the main segments of the Digital Commerce Software Industry?

The market segments include Deployment Model, End-User Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.79 billion as of 2022.

5. What are some drivers contributing to market growth?

6.1 Growth in Adoption of Cloud-Based Services6.2 Growing Development in Wired and Wireless Communications Networks.

6. What are the notable trends driving market growth?

Growth in the Adoption of Cloud-Based Services.

7. Are there any restraints impacting market growth?

7.1 Increasing Security and Privacy Concerns.

8. Can you provide examples of recent developments in the market?

August 2022: papmall announced the launch of an e-commerce marketplace platform to support online sellers and buyers communities worldwide to connect and exchange values. The platform is expected to be the most technologically advanced assistant for online business and freelancing work.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Commerce Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Commerce Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Commerce Software Industry?

To stay informed about further developments, trends, and reports in the Digital Commerce Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence