Key Insights

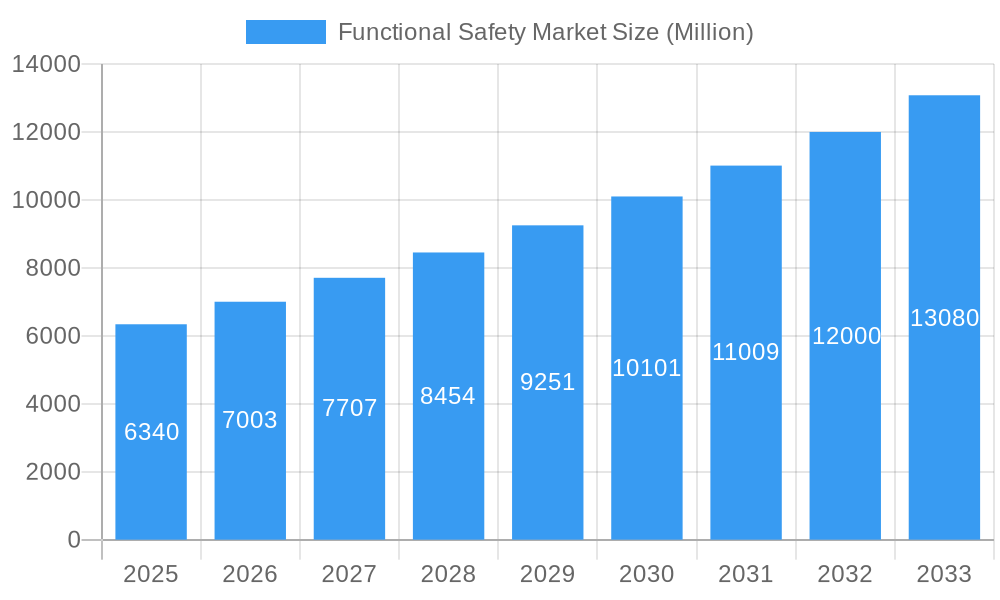

The global Functional Safety Market is poised for significant expansion, projected to reach approximately USD 6.34 billion with a robust Compound Annual Growth Rate (CAGR) of 10.48% during the forecast period of 2025-2033. This impressive growth trajectory is primarily fueled by the escalating demand for enhanced operational integrity and risk mitigation across critical industries. The Oil and Gas sector, a major consumer, is adopting advanced safety systems to prevent catastrophic accidents and ensure regulatory compliance in increasingly complex extraction and processing environments. Similarly, the Power Generation industry is investing heavily in functional safety solutions to safeguard infrastructure and personnel, especially with the growing reliance on diverse energy sources, including renewable and nuclear power, which necessitate stringent safety protocols. Furthermore, the increasing stringency of industrial safety regulations worldwide is compelling manufacturers across sectors like Food & Beverage, Pharmaceuticals, and Automotive to implement comprehensive functional safety measures, thereby driving market penetration.

Functional Safety Market Market Size (In Billion)

The market's growth is further propelled by the continuous innovation in safety technology, with a strong emphasis on Programmable Safety Systems and Distributed Control Systems (DCS) offering greater flexibility and advanced diagnostic capabilities. The integration of these sophisticated systems enhances real-time monitoring and rapid response to potential hazards, reducing downtime and improving overall plant efficiency. Key players such as Honeywell International Inc., ABB Ltd., SICK AG, Siemens AG, and Schneider Electric SE are at the forefront of this innovation, offering a wide array of safety sensors, controllers, emergency stop devices, and comprehensive safety systems like Burner Management Systems (BMS) and Emergency Shutdown Systems (ESD). Regional dynamics show a strong presence in North America and Europe, driven by mature industrial bases and stringent safety standards. However, the Asia Pacific region is expected to witness the fastest growth, fueled by rapid industrialization, increasing foreign investments in manufacturing, and a growing awareness of industrial safety requirements.

Functional Safety Market Company Market Share

Unlock critical insights into the global functional safety market with this in-depth report. Explore growth drivers, dominant segments, key innovations, and competitive landscapes shaping industrial safety protocols. Essential for stakeholders seeking to understand evolving regulatory demands, technological advancements, and end-user industry adoption. The report covers the historical period 2019–2024, with a base year of 2025 and a forecast period from 2025–2033, offering an estimated market value of $55,000 Million for 2025.

Functional Safety Market Market Structure & Competitive Dynamics

The functional safety market is characterized by a moderately consolidated structure, with a few key players holding significant market share, estimated to be over 40% collectively in 2025. Innovation ecosystems are driven by continuous research and development in areas like AI-powered diagnostics, predictive maintenance, and integrated safety solutions. Regulatory frameworks, including IEC 61508, IEC 61511, and ISO 26262, act as crucial enablers, mandating adherence to stringent safety standards and fostering the adoption of certified functional safety systems. Product substitutes, while existing in the form of basic safety devices, are increasingly being superseded by advanced, integrated solutions due to their enhanced reliability and comprehensive safety coverage. End-user trends emphasize a shift towards proactive risk management, remote monitoring capabilities, and the integration of safety systems with overall plant automation strategies. Merger and acquisition (M&A) activities are prevalent, with recent deal values often ranging from $50 Million to $500 Million, as companies aim to expand their product portfolios, geographical reach, and technological expertise. For instance, key players like Siemens and Honeywell International Inc. are actively involved in strategic partnerships and acquisitions to bolster their offerings in critical sectors such as Oil and Gas and Power Generation.

Functional Safety Market Industry Trends & Insights

The functional safety market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, reaching an estimated market size of $98,000 Million by 2033. This robust expansion is primarily fueled by the increasing stringency of industrial safety regulations worldwide and a growing awareness among industries regarding the catastrophic consequences of safety failures. Technological disruptions are a major catalyst, with advancements in Industrial Internet of Things (IIoT), artificial intelligence (AI), machine learning (ML), and cloud computing revolutionizing the way functional safety systems are designed, deployed, and managed. These technologies enable real-time data analysis, predictive maintenance of safety equipment, and sophisticated risk assessment, leading to enhanced system reliability and reduced downtime. Consumer preferences are increasingly leaning towards integrated, software-centric solutions that offer seamless connectivity, remote access, and data-driven insights. This demand is driving innovation in areas such as programmable safety systems and advanced safety controllers. Competitive dynamics are intensifying, with companies investing heavily in R&D to develop cutting-edge solutions and expand their market presence. The increasing adoption of automation and digitalization across various end-user industries, including Oil and Gas, Power Generation, Food and Beverage, Pharmaceutical, and Automotive, further underscores the growing importance of functional safety. The market penetration of advanced functional safety solutions is expected to rise significantly as industries prioritize operational integrity and worker safety, particularly in high-risk environments.

Dominant Markets & Segments in Functional Safety Market

The functional safety market exhibits distinct dominance across various regions and segments. North America and Europe currently lead in market share, driven by stringent regulatory environments, high adoption rates of advanced technologies, and the presence of major industrial hubs.

Device Type Dominance:

- Safety Sensors: This segment holds a substantial market share due to its foundational role in detecting hazardous conditions. Key drivers include the increasing demand for reliable and accurate detection in automated processes and harsh industrial environments.

- Safety Controllers/Modules/Relays: These components are critical for processing safety signals and executing shutdown sequences, making them indispensable. Growth is propelled by the need for sophisticated logic control and interlocking functions in complex machinery.

- Programmable Safety Systems: The increasing complexity of industrial operations and the demand for flexible safety solutions are driving the dominance of programmable safety systems. Their ability to adapt to evolving safety requirements and integrate with higher-level control systems is a significant advantage.

Safety Systems Dominance:

- Emergency Shutdown Systems (ESD): These systems are paramount in critical industries like Oil and Gas and Power Generation, where rapid and reliable shutdown is crucial for preventing catastrophic events. The high-risk nature of these industries ensures continuous demand for robust ESD solutions.

- Fire and Gas Monitoring Control Systems: Essential for detecting and mitigating fire and gas hazards, these systems are vital for industries dealing with flammable materials. Their widespread application in sectors like Oil and Gas and Chemical manufacturing solidifies their dominant position.

End-user Industry Dominance:

- Oil and Gas: This sector consistently represents the largest share of the functional safety market due to the inherently hazardous nature of operations, stringent safety regulations, and the significant investments in safety infrastructure.

- Power Generation: The critical need for operational reliability and personnel safety in power plants, including nuclear, thermal, and renewable energy facilities, makes this a dominant end-user industry.

Geographical Dominance:

- North America: Driven by robust industrial sectors, strict safety standards (e.g., OSHA), and advanced technological adoption.

- Europe: Characterized by stringent EU directives and regulations like SEVESO III, alongside a strong manufacturing base.

Functional Safety Market Product Innovations

Product innovations in the functional safety market are intensely focused on enhancing system intelligence, connectivity, and ease of use. Companies are developing integrated solutions that combine sensing, control, and diagnostics into single, modular platforms. Key trends include the integration of AI and ML for predictive safety analytics, enabling early detection of potential failures and proactive maintenance. Edge computing capabilities are also gaining traction, allowing for faster local processing of safety-critical data. The development of cybersecurity features for safety systems is another crucial area, protecting against potential threats that could compromise operational integrity. These innovations not only improve safety performance but also offer significant operational efficiencies and cost savings for end-users.

Report Segmentation & Scope

This report provides a comprehensive analysis of the global functional safety market, segmented across key areas. The Device Type segmentation includes Safety Sensors, Safety Controllers/Modules/Relays, Safety Switches, Programmable Safety Systems, Emergency Stop Devices, Final Control Elements (Valves, Actuators), and Other Device Types. The Safety Systems segmentation covers Burner Management Systems (BMS), Turbomachinery Control (TMC) Systems, High-Integrity Pressure Protection Systems (HIPPS), Fire and Gas Monitoring Control Systems, Emergency Shutdown Systems (ESD), and Distributed Control Systems (DCS). The End-user Industry segmentation encompasses Oil and Gas, Power Generation, Food and Beverage, Pharmaceutical, Automotive, and Other End-user Industries. Each segment is analyzed for its market size, growth projections, and competitive dynamics, providing a granular view of market opportunities and challenges.

Key Drivers of Functional Safety Market Growth

The functional safety market is propelled by several key drivers. Firstly, stringent government regulations and international safety standards (e.g., IEC 61508, ISO 26262) are mandating the implementation of robust safety systems across industries. Secondly, the increasing complexity of industrial processes and the growing adoption of automation and digitalization necessitate reliable safety mechanisms to prevent accidents and ensure operational continuity. Thirdly, a heightened awareness of the financial and reputational costs associated with industrial accidents is compelling companies to invest more heavily in functional safety solutions. Finally, technological advancements, such as IIoT, AI, and cloud computing, are enabling the development of more sophisticated, predictive, and integrated safety systems, further driving market growth.

Challenges in the Functional Safety Market Sector

Despite its robust growth, the functional safety market faces several challenges. One significant barrier is the high cost of implementing and maintaining advanced functional safety systems, particularly for small and medium-sized enterprises (SMEs). The complex and ever-evolving regulatory landscape can also be challenging to navigate, requiring continuous investment in compliance and certification. Furthermore, a shortage of skilled personnel with expertise in functional safety engineering and implementation can hinder project execution and adoption. Supply chain disruptions, as witnessed in recent years, can also impact the availability and cost of critical safety components. Finally, the increasing sophistication of cyber threats poses a growing risk to connected safety systems, necessitating continuous investment in cybersecurity measures.

Leading Players in the Functional Safety Market Market

- Honeywell International Inc

- ABB Ltd

- SICK AG

- Siemens AG

- Schneider Electric SE

- Omron Corporation

- Panasonic Industry Europe GmbH (Panasonic Corporation)

- Banner Engineering Corporation

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Pepperl+Fuchs

- General Electric Company

- Emerson Electric Company

Key Developments in Functional Safety Market Sector

- October 2022: Schneider Electric introduced EcoStruxure Automation Expert 22.1, a pioneering software-centric industrial automation system. This latest iteration seamlessly integrates with the AVEVA System Platform, providing access to an extensive asset library adhering to the latest situational awareness standards and enabling the creation of AVEVA graphics and control applications within a unified environment. This integration significantly reduces training time by over 50% and enhances overall quality.

- September 2022: Siemens unveiled Fire Safety Digital Services, a revolutionary cloud-connected portfolio for fire safety devices. This innovation empowers organizations to transition from a reactive, compliance-driven approach to intelligent, comprehensive protection through enhanced operation, event management, and maintenance, leading to improved risk identification and prevention, informed decision-making, business continuity, and a secure environment for people and assets.

Strategic Functional Safety Market Market Outlook

The strategic outlook for the functional safety market remains exceptionally positive, driven by an unwavering commitment to industrial safety and the relentless pace of technological innovation. Future growth will be significantly accelerated by the increasing integration of AI and machine learning for predictive safety analytics, enabling proactive risk mitigation and reduced downtime. The expansion of IIoT infrastructure will foster more interconnected and responsive safety systems. Furthermore, the growing demand for customized and scalable safety solutions across a wider range of industries, including emerging markets and critical infrastructure projects, presents substantial strategic opportunities. Companies that focus on developing secure, interoperable, and user-friendly functional safety platforms will be well-positioned to capitalize on this evolving market landscape.

Functional Safety Market Segmentation

-

1. Device Type

- 1.1. Safety Sensors

- 1.2. Safety Controllers/Modules/Relays

- 1.3. Safety Switches

- 1.4. Programmable Safety Systems

- 1.5. Emergency Stop Devices

- 1.6. Final Control Elements (Valves, Actuators)

- 1.7. Other Device Types

-

2. Safety Systems

- 2.1. Burner Management Systems (BMS)

- 2.2. Turbomachinery Control (TMC) Systems

- 2.3. High-Integrity Pressure Protection Systems (HIPPS)

- 2.4. Fire and Gas Monitoring Control Systems

- 2.5. Emergency Shutdown Systems (ESD)

- 2.6. Supervis

- 2.7. Distributed Control Systems (DCS)

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Power Generation

- 3.3. Food and Beverage

- 3.4. Pharmaceutical

- 3.5. Automotive

- 3.6. Other End-user Industries

Functional Safety Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Functional Safety Market Regional Market Share

Geographic Coverage of Functional Safety Market

Functional Safety Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Standards of Industrial Safety; Increasing Adoption of Functional Safety Systems in Industries

- 3.3. Market Restrains

- 3.3.1 Increasing Complexity

- 3.3.2 High Initial Costs and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Automotive to be the Fastest-growing End-user Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Functional Safety Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Safety Sensors

- 5.1.2. Safety Controllers/Modules/Relays

- 5.1.3. Safety Switches

- 5.1.4. Programmable Safety Systems

- 5.1.5. Emergency Stop Devices

- 5.1.6. Final Control Elements (Valves, Actuators)

- 5.1.7. Other Device Types

- 5.2. Market Analysis, Insights and Forecast - by Safety Systems

- 5.2.1. Burner Management Systems (BMS)

- 5.2.2. Turbomachinery Control (TMC) Systems

- 5.2.3. High-Integrity Pressure Protection Systems (HIPPS)

- 5.2.4. Fire and Gas Monitoring Control Systems

- 5.2.5. Emergency Shutdown Systems (ESD)

- 5.2.6. Supervis

- 5.2.7. Distributed Control Systems (DCS)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Power Generation

- 5.3.3. Food and Beverage

- 5.3.4. Pharmaceutical

- 5.3.5. Automotive

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. North America Functional Safety Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Safety Sensors

- 6.1.2. Safety Controllers/Modules/Relays

- 6.1.3. Safety Switches

- 6.1.4. Programmable Safety Systems

- 6.1.5. Emergency Stop Devices

- 6.1.6. Final Control Elements (Valves, Actuators)

- 6.1.7. Other Device Types

- 6.2. Market Analysis, Insights and Forecast - by Safety Systems

- 6.2.1. Burner Management Systems (BMS)

- 6.2.2. Turbomachinery Control (TMC) Systems

- 6.2.3. High-Integrity Pressure Protection Systems (HIPPS)

- 6.2.4. Fire and Gas Monitoring Control Systems

- 6.2.5. Emergency Shutdown Systems (ESD)

- 6.2.6. Supervis

- 6.2.7. Distributed Control Systems (DCS)

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Oil and Gas

- 6.3.2. Power Generation

- 6.3.3. Food and Beverage

- 6.3.4. Pharmaceutical

- 6.3.5. Automotive

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Functional Safety Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Safety Sensors

- 7.1.2. Safety Controllers/Modules/Relays

- 7.1.3. Safety Switches

- 7.1.4. Programmable Safety Systems

- 7.1.5. Emergency Stop Devices

- 7.1.6. Final Control Elements (Valves, Actuators)

- 7.1.7. Other Device Types

- 7.2. Market Analysis, Insights and Forecast - by Safety Systems

- 7.2.1. Burner Management Systems (BMS)

- 7.2.2. Turbomachinery Control (TMC) Systems

- 7.2.3. High-Integrity Pressure Protection Systems (HIPPS)

- 7.2.4. Fire and Gas Monitoring Control Systems

- 7.2.5. Emergency Shutdown Systems (ESD)

- 7.2.6. Supervis

- 7.2.7. Distributed Control Systems (DCS)

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Oil and Gas

- 7.3.2. Power Generation

- 7.3.3. Food and Beverage

- 7.3.4. Pharmaceutical

- 7.3.5. Automotive

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Asia Pacific Functional Safety Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Safety Sensors

- 8.1.2. Safety Controllers/Modules/Relays

- 8.1.3. Safety Switches

- 8.1.4. Programmable Safety Systems

- 8.1.5. Emergency Stop Devices

- 8.1.6. Final Control Elements (Valves, Actuators)

- 8.1.7. Other Device Types

- 8.2. Market Analysis, Insights and Forecast - by Safety Systems

- 8.2.1. Burner Management Systems (BMS)

- 8.2.2. Turbomachinery Control (TMC) Systems

- 8.2.3. High-Integrity Pressure Protection Systems (HIPPS)

- 8.2.4. Fire and Gas Monitoring Control Systems

- 8.2.5. Emergency Shutdown Systems (ESD)

- 8.2.6. Supervis

- 8.2.7. Distributed Control Systems (DCS)

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Oil and Gas

- 8.3.2. Power Generation

- 8.3.3. Food and Beverage

- 8.3.4. Pharmaceutical

- 8.3.5. Automotive

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Latin America Functional Safety Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Safety Sensors

- 9.1.2. Safety Controllers/Modules/Relays

- 9.1.3. Safety Switches

- 9.1.4. Programmable Safety Systems

- 9.1.5. Emergency Stop Devices

- 9.1.6. Final Control Elements (Valves, Actuators)

- 9.1.7. Other Device Types

- 9.2. Market Analysis, Insights and Forecast - by Safety Systems

- 9.2.1. Burner Management Systems (BMS)

- 9.2.2. Turbomachinery Control (TMC) Systems

- 9.2.3. High-Integrity Pressure Protection Systems (HIPPS)

- 9.2.4. Fire and Gas Monitoring Control Systems

- 9.2.5. Emergency Shutdown Systems (ESD)

- 9.2.6. Supervis

- 9.2.7. Distributed Control Systems (DCS)

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Oil and Gas

- 9.3.2. Power Generation

- 9.3.3. Food and Beverage

- 9.3.4. Pharmaceutical

- 9.3.5. Automotive

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Middle East and Africa Functional Safety Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Safety Sensors

- 10.1.2. Safety Controllers/Modules/Relays

- 10.1.3. Safety Switches

- 10.1.4. Programmable Safety Systems

- 10.1.5. Emergency Stop Devices

- 10.1.6. Final Control Elements (Valves, Actuators)

- 10.1.7. Other Device Types

- 10.2. Market Analysis, Insights and Forecast - by Safety Systems

- 10.2.1. Burner Management Systems (BMS)

- 10.2.2. Turbomachinery Control (TMC) Systems

- 10.2.3. High-Integrity Pressure Protection Systems (HIPPS)

- 10.2.4. Fire and Gas Monitoring Control Systems

- 10.2.5. Emergency Shutdown Systems (ESD)

- 10.2.6. Supervis

- 10.2.7. Distributed Control Systems (DCS)

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Oil and Gas

- 10.3.2. Power Generation

- 10.3.3. Food and Beverage

- 10.3.4. Pharmaceutical

- 10.3.5. Automotive

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SICK AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Schneider Electric SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Omron Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Panasonic Industry Europe GmbH (Panasonic Corporation)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Banner Engineering Corporation*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rockwell Automation Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yokogawa Electric Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pepperl+Fuchs

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 General Electric Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Emerson Electric Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Functional Safety Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Functional Safety Market Revenue (Million), by Device Type 2025 & 2033

- Figure 3: North America Functional Safety Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 4: North America Functional Safety Market Revenue (Million), by Safety Systems 2025 & 2033

- Figure 5: North America Functional Safety Market Revenue Share (%), by Safety Systems 2025 & 2033

- Figure 6: North America Functional Safety Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Functional Safety Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Functional Safety Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Functional Safety Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Functional Safety Market Revenue (Million), by Device Type 2025 & 2033

- Figure 11: Europe Functional Safety Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 12: Europe Functional Safety Market Revenue (Million), by Safety Systems 2025 & 2033

- Figure 13: Europe Functional Safety Market Revenue Share (%), by Safety Systems 2025 & 2033

- Figure 14: Europe Functional Safety Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Functional Safety Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Functional Safety Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Functional Safety Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Functional Safety Market Revenue (Million), by Device Type 2025 & 2033

- Figure 19: Asia Pacific Functional Safety Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 20: Asia Pacific Functional Safety Market Revenue (Million), by Safety Systems 2025 & 2033

- Figure 21: Asia Pacific Functional Safety Market Revenue Share (%), by Safety Systems 2025 & 2033

- Figure 22: Asia Pacific Functional Safety Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Functional Safety Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Functional Safety Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Functional Safety Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Functional Safety Market Revenue (Million), by Device Type 2025 & 2033

- Figure 27: Latin America Functional Safety Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 28: Latin America Functional Safety Market Revenue (Million), by Safety Systems 2025 & 2033

- Figure 29: Latin America Functional Safety Market Revenue Share (%), by Safety Systems 2025 & 2033

- Figure 30: Latin America Functional Safety Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Functional Safety Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Functional Safety Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Functional Safety Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Functional Safety Market Revenue (Million), by Device Type 2025 & 2033

- Figure 35: Middle East and Africa Functional Safety Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 36: Middle East and Africa Functional Safety Market Revenue (Million), by Safety Systems 2025 & 2033

- Figure 37: Middle East and Africa Functional Safety Market Revenue Share (%), by Safety Systems 2025 & 2033

- Figure 38: Middle East and Africa Functional Safety Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Functional Safety Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Functional Safety Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Functional Safety Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Functional Safety Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Global Functional Safety Market Revenue Million Forecast, by Safety Systems 2020 & 2033

- Table 3: Global Functional Safety Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Functional Safety Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Functional Safety Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 6: Global Functional Safety Market Revenue Million Forecast, by Safety Systems 2020 & 2033

- Table 7: Global Functional Safety Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Functional Safety Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Functional Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Functional Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Functional Safety Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 12: Global Functional Safety Market Revenue Million Forecast, by Safety Systems 2020 & 2033

- Table 13: Global Functional Safety Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Functional Safety Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Functional Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Functional Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Functional Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Functional Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Functional Safety Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 20: Global Functional Safety Market Revenue Million Forecast, by Safety Systems 2020 & 2033

- Table 21: Global Functional Safety Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Functional Safety Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Functional Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Functional Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Functional Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Functional Safety Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Functional Safety Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 28: Global Functional Safety Market Revenue Million Forecast, by Safety Systems 2020 & 2033

- Table 29: Global Functional Safety Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Functional Safety Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Functional Safety Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 32: Global Functional Safety Market Revenue Million Forecast, by Safety Systems 2020 & 2033

- Table 33: Global Functional Safety Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Functional Safety Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Functional Safety Market?

The projected CAGR is approximately 10.48%.

2. Which companies are prominent players in the Functional Safety Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, SICK AG, Siemens AG, Schneider Electric SE, Omron Corporation, Panasonic Industry Europe GmbH (Panasonic Corporation), Banner Engineering Corporation*List Not Exhaustive, Rockwell Automation Inc, Yokogawa Electric Corporation, Pepperl+Fuchs, General Electric Company, Emerson Electric Company.

3. What are the main segments of the Functional Safety Market?

The market segments include Device Type, Safety Systems, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Standards of Industrial Safety; Increasing Adoption of Functional Safety Systems in Industries.

6. What are the notable trends driving market growth?

Automotive to be the Fastest-growing End-user Sector.

7. Are there any restraints impacting market growth?

Increasing Complexity. High Initial Costs and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

October 2022: Schneider Electric introduced the latest iteration of its industrial technology, aiming to empower individuals and drive sustainable economic growth. The most recent version of EcoStruxure Automation Expert, known as EcoStruxure Automation Expert 22.1, is the world's pioneering software-centric industrial automation system. Notably, this new version seamlessly integrates with the AVEVA System Platform, granting users access to AVEVA's extensive asset library that adheres to the most up-to-date situational awareness standards. It also allows users to create design graphics using the Operations Management Interface. The unique feature of developing AVEVA graphics and control applications within the same environment significantly reduces training time by over 50% while simultaneously enhancing quality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Functional Safety Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Functional Safety Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Functional Safety Market?

To stay informed about further developments, trends, and reports in the Functional Safety Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence