Key Insights

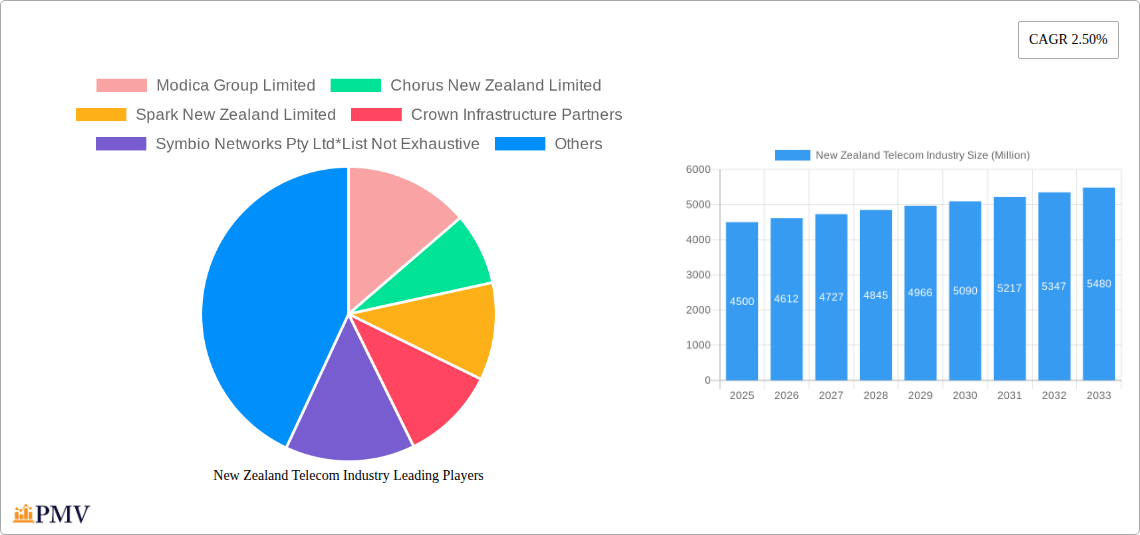

The New Zealand telecommunications market is projected for robust growth, with an estimated market size of $3.4 billion by 2025. The industry anticipates a Compound Annual Growth Rate (CAGR) of 1.2% from 2025 to 2033. This expansion is fueled by increasing demand for high-speed data, widespread adoption of Over-The-Top (OTT) platforms, and ongoing investment in advanced pay-TV infrastructure. Growth is further supported by the shift to wireless voice services and the continued deployment of fiber optic networks for broadband. Major players such as Spark New Zealand, Vodafone New Zealand, and Chorus New Zealand are strategically investing in network enhancements and service innovation to secure market share. Government initiatives promoting digital inclusion and expanding rural broadband access are also key growth drivers.

New Zealand Telecom Industry Market Size (In Billion)

Key challenges include significant capital investment for network modernization and intense market competition. The evolving regulatory landscape presents both hurdles and opportunities. Market segments including voice, data, and OTT/pay-TV services are expected to experience sustained demand, with data services anticipated to be the primary revenue driver. Companies are focusing on service bundling and convergent solutions to boost customer retention and average revenue per user. Continuous innovation in connectivity and the increasing reliance on digital communication across all economic sectors will ensure the sustained growth and importance of the New Zealand telecommunications sector.

New Zealand Telecom Industry Company Market Share

New Zealand Telecom Industry Market Report: Analysis of Future Growth, Trends, and Key Players (2019-2033)

This comprehensive report delves into the dynamic New Zealand telecom industry, providing an in-depth market analysis from 2019 to 2033. Leveraging real-time data and expert insights, this study examines the evolving market structure, competitive landscape, and future outlook for telecommunications in New Zealand. Our analysis covers key segments including voice services (wired, wireless), data, and OTT & Pay-TV services, offering a detailed breakdown of market penetration, growth drivers, and emerging trends. The report is structured for industry professionals, investors, and policymakers seeking actionable intelligence on this rapidly evolving sector.

New Zealand Telecom Industry Market Structure & Competitive Dynamics

The New Zealand telecom market exhibits a moderate level of concentration, with a few dominant players influencing market dynamics. Spark New Zealand Limited, Vodafone New Zealand Limited, and Chorus New Zealand Limited hold significant market share across various segments. Innovation ecosystems are flourishing, driven by the widespread adoption of 5G technology and the increasing demand for high-speed broadband. Regulatory frameworks, managed by bodies like the Commerce Commission, play a crucial role in shaping competition and investment. Product substitutes, such as over-the-top (OTT) communication apps, continue to challenge traditional voice services. End-user trends indicate a strong preference for data-intensive services and digital entertainment. Mergers and acquisitions (M&A) activity, while present, has been strategic, focusing on expanding network capabilities and service portfolios. For example, the proposed acquisition of 2degrees by Voyage was valued at approximately 1,300 million NZD, highlighting ongoing consolidation efforts. The overall market value is estimated to reach around 7,500 million NZD by 2025.

New Zealand Telecom Industry Industry Trends & Insights

The New Zealand telecom industry is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). This growth is primarily fueled by the relentless demand for high-speed internet, driving significant investment in broadband infrastructure and 5G deployment. Technological disruptions, including the ongoing rollout of 5G and the exploration of future technologies like 6G, are reshaping the competitive landscape. Consumer preferences are increasingly shifting towards data-intensive applications, streaming services, and the Internet of Things (IoT), pushing telcos to innovate their service offerings. Fiber broadband penetration is steadily increasing, projected to exceed 70% of households by 2027, underscoring a key market driver. The competitive dynamics are characterized by a mix of established players and new entrants, all vying for market share by offering bundled services, superior network performance, and enhanced customer experiences. Cloud adoption within the telecom sector is also a significant trend, with operators investing in cloud-native solutions to improve network agility and reduce operational costs. The market penetration of mobile data services is expected to reach over 95% by 2028.

Dominant Markets & Segments in New Zealand Telecom Industry

The Data and Broadband segment is currently the dominant market within the New Zealand telecommunications industry, holding an estimated market share of 55% in 2025, valued at approximately 4,125 million NZD. This dominance is driven by several key factors:

- Infrastructure Investment: Significant government and private sector investment in fiber optic networks and 5G infrastructure has expanded access and improved the quality of data services. The government's Ultra-Fast Broadband (UFB) initiative has been instrumental in this expansion.

- Consumer Demand: A growing population, coupled with an increasing reliance on digital services for work, education, and entertainment, fuels the demand for high-speed, reliable data connectivity. The average monthly data consumption per user is projected to grow by 15% annually.

- Business Needs: Enterprises across New Zealand are increasingly adopting cloud-based solutions, big data analytics, and remote work capabilities, all of which are heavily reliant on robust data networks. This segment is expected to continue its upward trajectory, with a projected market value of over 6,000 million NZD by 2033.

- OTT and Pay-TV Services: This segment, encompassing streaming platforms and digital television, is the second-largest, valued at approximately 2,475 million NZD in 2025. Its growth is directly correlated with increased broadband penetration and changing entertainment consumption habits. The market share for this segment is estimated at 33%.

- Voice Services (Wired & Wireless): While still a significant segment, traditional voice services (wired and wireless) are experiencing a gradual decline in market share, estimated at 12% in 2025, valued at around 900 million NZD. This is largely due to the rise of Voice over IP (VoIP) and over-the-top (OTT) communication applications.

New Zealand Telecom Industry Product Innovations

Product innovations in the New Zealand telecom sector are heavily focused on enhancing network capabilities and expanding service offerings. The testing of end-to-end 5G standalone networks by Spark New Zealand, in collaboration with technology partners like Mavenir and Nokia, signifies a leap towards more advanced mobile services. Furthermore, Vodafone New Zealand's strategic partnership with Nokia to accelerate 6G and 5G-Advanced development highlights a commitment to future-proofing the network. These innovations are crucial for developing new applications in areas like augmented reality, virtual reality, and advanced IoT solutions, providing a competitive edge to companies investing in these technologies.

Report Segmentation & Scope

This report segments the New Zealand telecom market into three primary categories:

- Voice Services (Wired & Wireless): This segment, valued at approximately 900 million NZD in 2025, encompasses traditional landline and mobile voice communication. While facing competition from VoIP and OTT services, it remains essential for certain business and consumer needs. Projections indicate a stable but slowly declining market share over the forecast period.

- Data and Broadband: The largest segment, projected to reach over 6,000 million NZD by 2033, includes fixed broadband, mobile data, and business data solutions. Driven by 5G rollout and fiber expansion, this segment is expected to see significant growth and innovation.

- OTT and Pay-TV Services: Valued at approximately 2,475 million NZD in 2025, this segment includes digital streaming, video-on-demand, and subscription-based television services. Its growth is intrinsically linked to broadband availability and consumer digital lifestyle trends.

Key Drivers of New Zealand Telecom Industry Growth

Several factors are propelling the New Zealand telecom industry forward. The ongoing 5G network rollout is a major catalyst, enabling faster speeds and lower latency, thereby driving demand for new applications and services. Significant government and private sector investment in fiber optic broadband infrastructure is crucial for closing the digital divide and enhancing connectivity for businesses and households. Evolving consumer preferences for streaming services, cloud computing, and the Internet of Things (IoT) are creating new revenue streams. Furthermore, supportive regulatory policies aimed at promoting competition and investment, such as the Telecommunications Act, play a vital role.

Challenges in the New Zealand Telecom Industry Sector

Despite robust growth, the New Zealand telecom sector faces several challenges. High capital expenditure required for 5G deployment and fiber network expansion can strain operator finances. Regulatory hurdles and complex permitting processes can slow down infrastructure development. Supply chain disruptions, particularly for critical network equipment, pose a persistent risk. Intense competitive pressures can lead to price wars and compressed margins. Furthermore, ensuring equitable access to high-speed broadband across all regions, particularly rural areas, remains a significant challenge. The cost of spectrum acquisition also presents a financial burden for operators.

Leading Players in the New Zealand Telecom Industry Market

- Modica Group Limited

- Chorus New Zealand Limited

- Spark New Zealand Limited

- Crown Infrastructure Partners

- Symbio Networks Pty Ltd

- Two Degrees Mobile Limited

- Vodafone New Zealand Limited

- Vocus Group Limited

- Tuatahi First Fibre

- Compass NZ

Key Developments in New Zealand Telecom Industry Sector

- August 2022: Spark tested the first end-to-end 5G standalone network in New Zealand. Technology companies Mavenir, AWS, Nokia, and Oppo participated. This development is significant for telecommunications businesses as operators roll out 5G, though data centers and network cores still rely on 4G and older technologies.

- September 2022: Vodafone New Zealand confirmed its partnership with Nokia to accelerate network innovation with 6G and 5G-Advanced. This strengthens their 30-year relationship and paves the path for 6G, focusing on innovative use cases for consumers, businesses, and industries.

Strategic New Zealand Telecom Industry Market Outlook

The New Zealand telecom industry is poised for sustained growth, driven by continued advancements in 5G technology, the expansion of fiber optic broadband, and the burgeoning demand for digital services. Strategic opportunities lie in developing and deploying innovative IoT solutions, supporting the transition to cloud-native infrastructure, and enhancing customer experiences through personalized service offerings. The industry's ability to adapt to evolving technological landscapes and consumer needs will be critical for future success. Collaboration between telcos, technology providers, and government entities will be essential for addressing infrastructure gaps and fostering a competitive yet sustainable market. The focus on future technologies like 6G signifies a forward-looking approach to market development.

New Zealand Telecom Industry Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and Pay-TV Services

-

1.1. Voice Services

New Zealand Telecom Industry Segmentation By Geography

- 1. New Zealand

New Zealand Telecom Industry Regional Market Share

Geographic Coverage of New Zealand Telecom Industry

New Zealand Telecom Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Market for OTT; Investment on Rural Connectivity

- 3.3. Market Restrains

- 3.3.1. Rigid Competition in the Market

- 3.4. Market Trends

- 3.4.1. Growing Market of OTT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and Pay-TV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Modica Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chorus New Zealand Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Spark New Zealand Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Crown Infrastructure Partners

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Symbio Networks Pty Ltd*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Two Degrees Mobile Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vodafone New Zealand Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vocus Group Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tuatahi First Fibre

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Compass NZ

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Modica Group Limited

List of Figures

- Figure 1: New Zealand Telecom Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: New Zealand Telecom Industry Share (%) by Company 2025

List of Tables

- Table 1: New Zealand Telecom Industry Revenue billion Forecast, by Segmenta 2020 & 2033

- Table 2: New Zealand Telecom Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: New Zealand Telecom Industry Revenue billion Forecast, by Segmenta 2020 & 2033

- Table 4: New Zealand Telecom Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand Telecom Industry?

The projected CAGR is approximately 1.2%.

2. Which companies are prominent players in the New Zealand Telecom Industry?

Key companies in the market include Modica Group Limited, Chorus New Zealand Limited, Spark New Zealand Limited, Crown Infrastructure Partners, Symbio Networks Pty Ltd*List Not Exhaustive, Two Degrees Mobile Limited, Vodafone New Zealand Limited, Vocus Group Limited, Tuatahi First Fibre, Compass NZ.

3. What are the main segments of the New Zealand Telecom Industry?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Market for OTT; Investment on Rural Connectivity.

6. What are the notable trends driving market growth?

Growing Market of OTT.

7. Are there any restraints impacting market growth?

Rigid Competition in the Market.

8. Can you provide examples of recent developments in the market?

August 2022: Spark tested the first end-to-end 5G standalone network in New Zealand. Technology companies Mavenir, AWS, Nokia, and Oppo, have participated in the testing. Such development would be significant for telecommunications businesses in New Zealand, where operators are now rolling out 5G networks. However, data centers and network cores still use 4G infrastructure and older technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand Telecom Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand Telecom Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand Telecom Industry?

To stay informed about further developments, trends, and reports in the New Zealand Telecom Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence