Key Insights

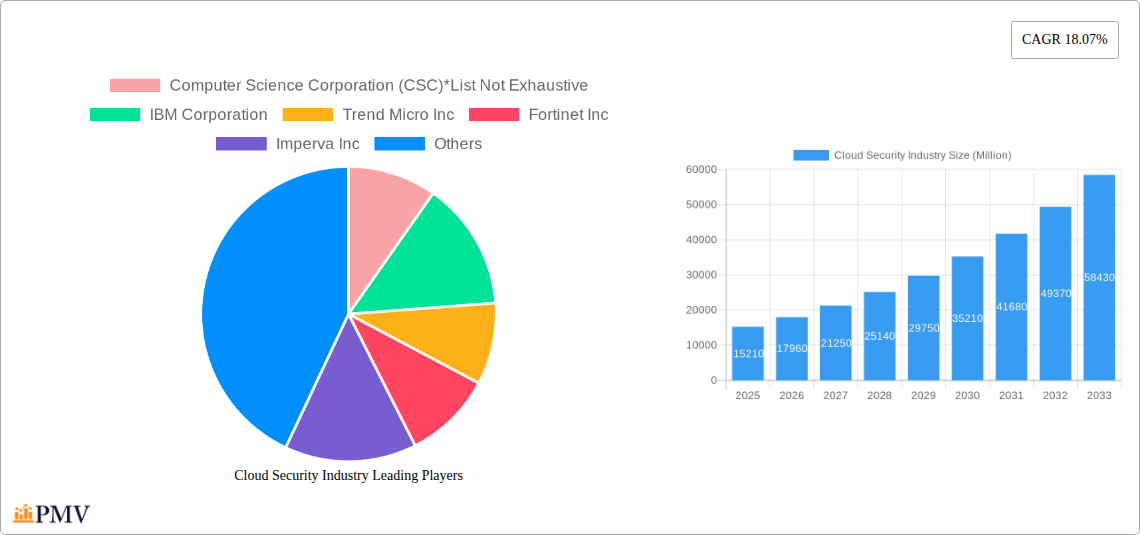

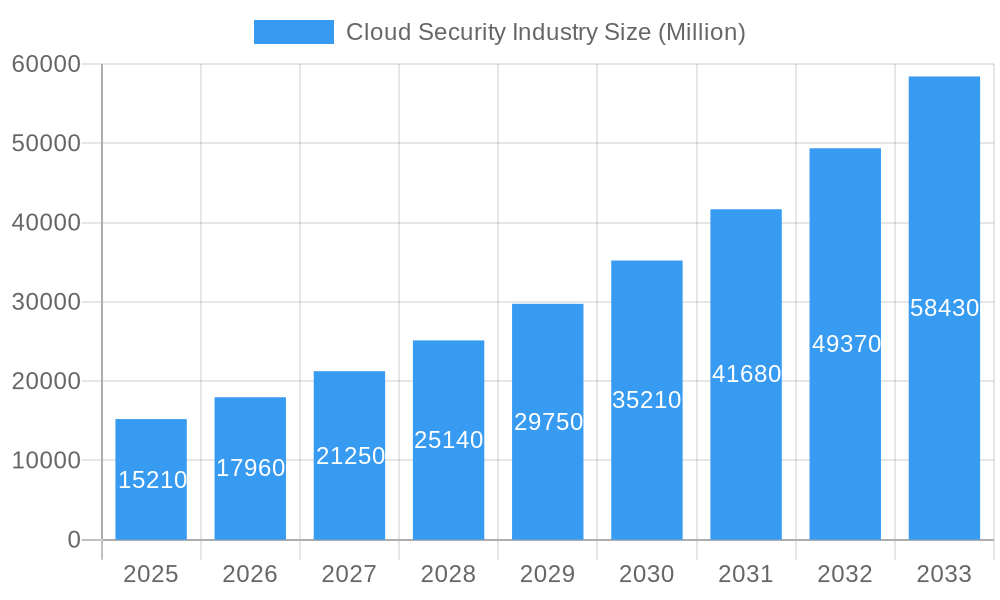

The global Cloud Security market is poised for substantial expansion, projected to reach a valuation of $15.21 billion by 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 18.07% through 2033. This remarkable growth is primarily fueled by the escalating adoption of cloud computing services across enterprises of all sizes, coupled with the increasing sophistication and frequency of cyber threats targeting cloud environments. Organizations are prioritizing cloud security solutions to protect sensitive data, ensure compliance with stringent regulations, and maintain operational continuity in an increasingly digitalized world. Key market drivers include the growing demand for advanced identity and access management (IAM) to control user privileges, the imperative for data loss prevention (DLP) to safeguard confidential information, and the widespread implementation of Intrusion Detection and Prevention Systems (IDS/IPS) for proactive threat mitigation. Furthermore, the rising adoption of Security Information and Event Management (SIEM) solutions to gain comprehensive visibility into cloud infrastructure and the increasing use of encryption technologies to secure data at rest and in transit are significant contributors to market growth.

Cloud Security Industry Market Size (In Billion)

The cloud security landscape is characterized by a diverse range of solutions designed to address multifaceted security challenges. In terms of solutions, Identity and Access Management (IAM) is a critical segment, ensuring only authorized users can access specific resources. Data Loss Prevention (DLP) plays a vital role in preventing sensitive data from leaving organizational control. IDS/IPS solutions are crucial for detecting and blocking malicious network activity. SIEM platforms offer centralized security monitoring and analysis. Encryption is fundamental for protecting data confidentiality. Within security domains, Application Security, Database Security, Endpoint Security, Network Security, and Web and Email Security are paramount. Deployment modes are also diversifying, with Public, Private, and Hybrid cloud environments each presenting unique security considerations and demanding tailored solutions. Major industry players like IBM Corporation, Trend Micro Inc., Fortinet Inc., Imperva Inc., Check Point Software Technologies Ltd., McAfee LLC, Cisco Systems Inc., Broadcom Inc., Qualys Inc., and Sophos PLC are actively innovating and expanding their offerings to meet the dynamic needs of this rapidly evolving market.

Cloud Security Industry Company Market Share

Cloud Security Industry Report: Market Analysis, Trends, and Forecast 2019-2033

This comprehensive report delves into the dynamic cloud security market, offering in-depth analysis of cloud-native security, SaaS security, IaaS security, and PaaS security solutions. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study provides critical insights for stakeholders seeking to navigate the evolving landscape of digital asset protection in the cloud. With an estimated market value projected to reach over US$ 300 Million by 2033, this report is an indispensable resource for understanding market concentration, innovation, key drivers, and future growth accelerators within the global cybersecurity in cloud domain.

Cloud Security Industry Market Structure & Competitive Dynamics

The cloud security industry exhibits a moderately concentrated market structure, characterized by a blend of large, established cybersecurity vendors and agile, emerging players specializing in niche cloud security solutions. Innovation ecosystems are robust, driven by continuous advancements in threat detection, automated security orchestration, and the adoption of AI and machine learning for predictive threat intelligence. Regulatory frameworks, such as GDPR, CCPA, and various industry-specific compliance mandates, significantly shape market dynamics, compelling organizations to invest heavily in secure cloud infrastructure and data protection. Product substitutes are increasing, with integrated cloud provider security offerings competing with third-party specialized solutions. End-user trends highlight a growing preference for unified security platforms and zero-trust architectures. Mergers and acquisitions (M&A) are a significant factor in market consolidation, with recent deals valued in the hundreds of millions of dollars. For example, the acquisition of a leading cloud workload protection platform by a major security vendor for over US$ 500 Million demonstrates the aggressive expansion strategies.

- Market Share Dynamics: Key players like IBM Corporation and Cisco Systems Inc. hold substantial market share, driven by their comprehensive portfolios and extensive enterprise client bases.

- Innovation Hubs: The US, Europe, and APAC regions are prominent innovation hubs, fostering a competitive environment for new technology development.

- Regulatory Impact: Compliance with standards like ISO 27001 and SOC 2 is a non-negotiable requirement, influencing product development and go-to-market strategies.

- End-User Preferences: Increased adoption of multi-cloud and hybrid cloud environments necessitates flexible and interoperable cloud security solutions.

Cloud Security Industry Industry Trends & Insights

The cloud security market is experiencing unprecedented growth, propelled by the pervasive adoption of cloud computing across all industries. The primary growth driver remains the escalating sophistication and volume of cyber threats, necessitating robust cloud protection strategies and cloud vulnerability management. Digital transformation initiatives, accelerated by remote work trends and the demand for scalable IT infrastructure, further fuel the need for secure cloud environments. Technological disruptions, including the rise of serverless computing, containerization, and edge computing, present new attack vectors, prompting continuous innovation in areas like container security and API security. Consumer preferences are shifting towards cloud-agnostic security solutions that offer consistent protection across diverse cloud deployments, emphasizing multi-cloud security and hybrid cloud security. Competitive dynamics are intensifying, with companies focusing on providing comprehensive cloud workload protection, advanced threat analytics, and automated incident response. The market penetration of advanced cloud security solutions is projected to reach over 70% by 2033. The projected Compound Annual Growth Rate (CAGR) for the cloud security industry is approximately 18% over the forecast period.

- AI and ML Integration: The integration of Artificial Intelligence (AI) and Machine Learning (ML) in cloud security platforms is revolutionizing threat detection and response, enabling real-time anomaly identification and automated remediation.

- Zero Trust Architecture: The widespread adoption of Zero Trust principles is a major trend, demanding granular access controls and continuous verification for all users and devices accessing cloud resources.

- Data Privacy and Compliance: Heightened awareness of data privacy regulations is driving demand for robust data encryption and data loss prevention (DLP) solutions within cloud environments.

- Managed Security Services: The increasing complexity of cloud security is leading to a surge in demand for managed security services providers (MSSPs) offering specialized cloud security expertise and support.

- Cloud Security Posture Management (CSPM): The growing need to continuously monitor and improve cloud security configurations is making CSPM solutions an essential component of any cloud security strategy.

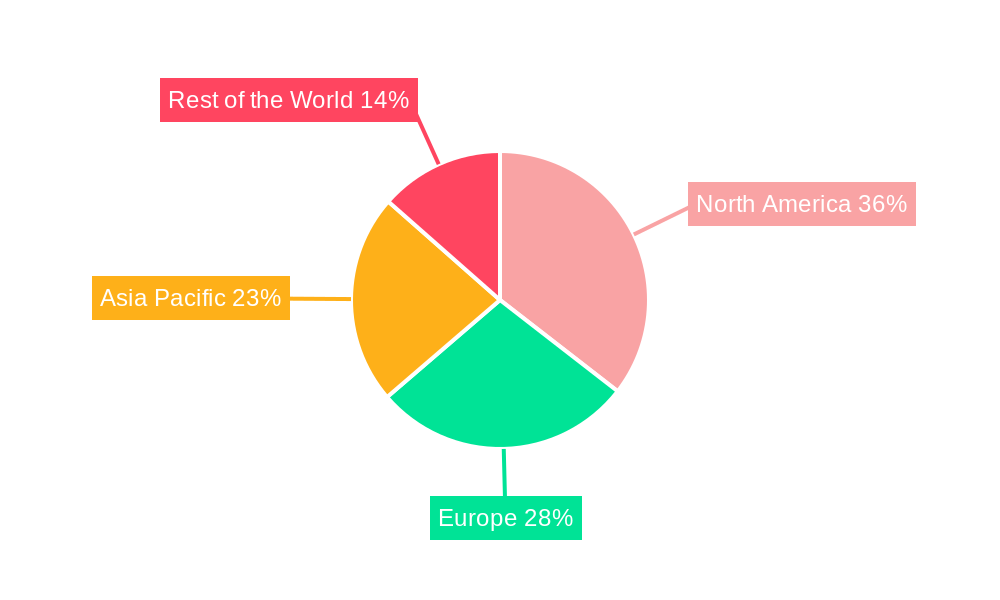

Dominant Markets & Segments in Cloud Security Industry

The cloud security industry is dominated by the North America region, driven by its advanced technological infrastructure, high adoption rates of cloud services, and stringent regulatory environment. Within North America, the United States leads due to the presence of major cloud service providers and a large concentration of enterprises investing heavily in cybersecurity.

Dominant Solution Segments:

- Identity and Access Management (IAM): This segment holds significant dominance due to the fundamental need for secure access control in cloud environments. With an estimated market share of over US$ 70 Million in 2025, IAM solutions are critical for managing user privileges and preventing unauthorized access.

- Key Drivers: Increased focus on privileged access management (PAM), multi-factor authentication (MFA) adoption, and regulatory compliance requirements for access control.

- Network Security: This segment, encompassing firewalls, intrusion detection and prevention systems (IDS/IPS), and secure web gateways, is vital for protecting cloud perimeters. The market for network security solutions within the cloud is expected to reach over US$ 60 Million in 2025.

- Key Drivers: The proliferation of cloud-based applications and services, the rise of sophisticated network-based attacks, and the need for micro-segmentation in complex cloud architectures.

- Security Information and Event Management (SIEM): SIEM solutions are crucial for aggregating and analyzing security logs from various cloud sources, enabling threat detection and incident response. This segment is projected to grow substantially, reaching over US$ 50 Million by 2025.

- Key Drivers: The increasing volume of security data generated by cloud environments, the need for centralized security visibility, and the integration of AI/ML for advanced threat hunting.

Dominant Deployment Modes:

- Public Cloud: The widespread adoption of public cloud services (AWS, Azure, GCP) makes this the dominant deployment mode for cloud security solutions, with an estimated market size exceeding US$ 200 Million in 2025.

- Key Drivers: Cost-effectiveness, scalability, and the inherent security features offered by major public cloud providers.

- Hybrid Cloud: As organizations increasingly adopt hybrid cloud strategies, the demand for integrated security solutions that span both on-premises and cloud environments is growing significantly. This segment is anticipated to represent over US$ 80 Million in 2025.

- Key Drivers: The need for seamless data flow and consistent security policies across diverse IT infrastructures, enabling phased cloud migration and maintaining control over sensitive data.

Cloud Security Industry Product Innovations

Product innovations in the cloud security industry are centered on delivering intelligent, automated, and integrated solutions. Companies are increasingly leveraging AI and machine learning to enhance threat detection, predictive analytics, and automated response capabilities. Key developments include advancements in cloud workload protection platforms (CWPP) that offer comprehensive security for containers and microservices, and cloud security posture management (CSPM) tools that ensure continuous compliance and misconfiguration detection. Furthermore, the integration of security into DevOps pipelines (DevSecOps) is a significant trend, enabling early detection and remediation of vulnerabilities. The competitive advantage lies in offering unified platforms that simplify security management across multi-cloud and hybrid environments, providing enhanced visibility and streamlined policy enforcement.

Report Segmentation & Scope

This report segments the cloud security market based on critical categories to provide a granular understanding of market dynamics.

- Solution: The report examines segments including Identity and Access Management, Data Loss Prevention, Intrusion Detection/Prevention Systems (IDS/IPS), Security Information and Event Management (SIEM), and Encryption. Each segment's market size, growth projections, and competitive landscape are detailed. For instance, the Identity and Access Management segment is projected to grow at a CAGR of over 19%, reaching an estimated US$ 150 Million by 2033.

- Security: Key security sub-segments analyzed include Application Security, Database Security, Endpoint Security, Network Security, and Web and Email Security. Market penetration and growth forecasts for each are provided.

- Deployment Mode: The report covers Public, Private, and Hybrid cloud deployment modes, assessing their respective market sizes and adoption trends. The Hybrid cloud segment is expected to witness significant growth, driven by the increasing adoption of hybrid IT infrastructures.

Key Drivers of Cloud Security Industry Growth

The cloud security industry is propelled by several critical growth drivers. The escalating frequency and sophistication of cyberattacks worldwide necessitate robust cloud security measures, directly driving investment in advanced protection solutions. The accelerating adoption of digital transformation initiatives, including cloud migration by enterprises of all sizes, inherently increases the demand for securing cloud infrastructure and data. Furthermore, stringent data privacy regulations and compliance mandates, such as GDPR and CCPA, compel organizations to implement comprehensive cloud security strategies to avoid hefty penalties and reputational damage. The expansion of remote workforces also contributes to growth, as organizations need to secure distributed access to cloud resources.

- Increasing Cyber Threats: The constant evolution of malware, ransomware, and phishing attacks creates an ongoing need for sophisticated defense mechanisms.

- Digital Transformation: The shift towards cloud-native applications and services necessitates a corresponding evolution in security approaches.

- Regulatory Landscape: Evolving data protection laws globally are a significant catalyst for cloud security investments.

- Growth of IoT and Big Data: The interconnectedness of IoT devices and the vast amounts of data generated require scalable and secure cloud platforms.

Challenges in the Cloud Security Industry Sector

Despite robust growth, the cloud security industry faces several significant challenges. The complexity of securing multi-cloud and hybrid cloud environments presents a major hurdle, demanding integrated solutions that can manage diverse platforms and policies effectively. A persistent shortage of skilled cybersecurity professionals exacerbates the problem, making it difficult for organizations to implement and manage advanced cloud security solutions. The rapidly evolving threat landscape also poses a challenge, requiring continuous updates and adaptations of security tools and strategies. Supply chain vulnerabilities within the cloud ecosystem can also create indirect security risks. Furthermore, the cost of implementing comprehensive cloud security can be a barrier for small and medium-sized businesses.

- Talent Shortage: A global deficit in cybersecurity experts hinders the effective deployment and management of cloud security.

- Complexity of Multi-Cloud: Managing security policies and visibility across multiple cloud providers is intricate and resource-intensive.

- Evolving Threat Landscape: The continuous emergence of new attack vectors demands constant innovation and adaptation of security measures.

- Cost of Implementation: The financial investment required for robust cloud security solutions can be prohibitive for some organizations.

Leading Players in the Cloud Security Industry Market

- Computer Science Corporation (CSC)

- IBM Corporation

- Trend Micro Inc

- Fortinet Inc

- Imperva Inc

- Check Point Software Technologies Ltd

- Mcafee LLC

- Cisco Systems Inc

- Broadcom Inc

- Qualys Inc

- Sophos PLC

Key Developments in Cloud Security Industry Sector

- May 2023: Fujitsu Limited and Microsoft Corporation announced a five-year partnership to significantly expand their existing collaboration. The agreement, which involved investment by companies to drive the expansion of Fujitsu's Uvance business, leverages the Microsoft Cloud and industry-leading technologies to digitally transform organizations around the globe, develop more sustainable practices and solutions that address societal needs, and unlock new streams of business growth. This partnership is expected to enhance cloud security offerings for mutual clients.

- June 2022: Cisco, the leader in corporate networking and security, announced its plan for a global, cloud-delivered, integrated platform that can secure and connect organizations of any size and shape. The Cisco Security Cloud is designed to be the most open platform in the industry, ensuring the integrity of the entire IT ecosystem without public cloud lock-in. This development signals a move towards unified and open cloud security architectures.

Strategic Cloud Security Industry Market Outlook

The strategic outlook for the cloud security industry is exceptionally positive, driven by the fundamental shift towards cloud-native operations and the ever-present threat of cyberattacks. Future growth will be significantly accelerated by the increasing adoption of AI-powered security solutions, which promise enhanced threat prediction and automated response capabilities. The growing emphasis on data privacy and compliance will continue to fuel demand for advanced encryption, DLP, and identity management solutions. Furthermore, the ongoing expansion of hybrid and multi-cloud environments will create opportunities for vendors offering integrated and interoperable security platforms. Strategic investments in threat intelligence sharing, cloud-native security tools, and managed security services are expected to shape the market, creating a more resilient and secure digital future for organizations worldwide.

Cloud Security Industry Segmentation

-

1. Solution

- 1.1. Identity and Access Management

- 1.2. Data Loss Prevention

- 1.3. IDS/IPS

- 1.4. Security Information and Event Management

- 1.5. Encryption

-

2. Security

- 2.1. Application Security

- 2.2. Database Security

- 2.3. Endpoint Security

- 2.4. Network Security

- 2.5. Web and Email Security

-

3. Deployment Mode

- 3.1. Public

- 3.2. Private

- 3.3. Hybrid

Cloud Security Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Cloud Security Industry Regional Market Share

Geographic Coverage of Cloud Security Industry

Cloud Security Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Threats of Cyber Attacks is Expanding the Market

- 3.3. Market Restrains

- 3.3.1. Migration of Manufacturing Processes from On-premise to Cloud is a Major Challenge

- 3.4. Market Trends

- 3.4.1. Intrusion Detection and Prevention is the Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Security Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Identity and Access Management

- 5.1.2. Data Loss Prevention

- 5.1.3. IDS/IPS

- 5.1.4. Security Information and Event Management

- 5.1.5. Encryption

- 5.2. Market Analysis, Insights and Forecast - by Security

- 5.2.1. Application Security

- 5.2.2. Database Security

- 5.2.3. Endpoint Security

- 5.2.4. Network Security

- 5.2.5. Web and Email Security

- 5.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.3.1. Public

- 5.3.2. Private

- 5.3.3. Hybrid

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Cloud Security Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Identity and Access Management

- 6.1.2. Data Loss Prevention

- 6.1.3. IDS/IPS

- 6.1.4. Security Information and Event Management

- 6.1.5. Encryption

- 6.2. Market Analysis, Insights and Forecast - by Security

- 6.2.1. Application Security

- 6.2.2. Database Security

- 6.2.3. Endpoint Security

- 6.2.4. Network Security

- 6.2.5. Web and Email Security

- 6.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.3.1. Public

- 6.3.2. Private

- 6.3.3. Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Cloud Security Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Identity and Access Management

- 7.1.2. Data Loss Prevention

- 7.1.3. IDS/IPS

- 7.1.4. Security Information and Event Management

- 7.1.5. Encryption

- 7.2. Market Analysis, Insights and Forecast - by Security

- 7.2.1. Application Security

- 7.2.2. Database Security

- 7.2.3. Endpoint Security

- 7.2.4. Network Security

- 7.2.5. Web and Email Security

- 7.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.3.1. Public

- 7.3.2. Private

- 7.3.3. Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Cloud Security Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Identity and Access Management

- 8.1.2. Data Loss Prevention

- 8.1.3. IDS/IPS

- 8.1.4. Security Information and Event Management

- 8.1.5. Encryption

- 8.2. Market Analysis, Insights and Forecast - by Security

- 8.2.1. Application Security

- 8.2.2. Database Security

- 8.2.3. Endpoint Security

- 8.2.4. Network Security

- 8.2.5. Web and Email Security

- 8.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.3.1. Public

- 8.3.2. Private

- 8.3.3. Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Rest of the World Cloud Security Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Identity and Access Management

- 9.1.2. Data Loss Prevention

- 9.1.3. IDS/IPS

- 9.1.4. Security Information and Event Management

- 9.1.5. Encryption

- 9.2. Market Analysis, Insights and Forecast - by Security

- 9.2.1. Application Security

- 9.2.2. Database Security

- 9.2.3. Endpoint Security

- 9.2.4. Network Security

- 9.2.5. Web and Email Security

- 9.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.3.1. Public

- 9.3.2. Private

- 9.3.3. Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Computer Science Corporation (CSC)*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IBM Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Trend Micro Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fortinet Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Imperva Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Check Point Software Technologies Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mcafee LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cisco Systems Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Broadcom Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Qualys Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sophos PLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Computer Science Corporation (CSC)*List Not Exhaustive

List of Figures

- Figure 1: Global Cloud Security Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cloud Security Industry Revenue (Million), by Solution 2025 & 2033

- Figure 3: North America Cloud Security Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 4: North America Cloud Security Industry Revenue (Million), by Security 2025 & 2033

- Figure 5: North America Cloud Security Industry Revenue Share (%), by Security 2025 & 2033

- Figure 6: North America Cloud Security Industry Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 7: North America Cloud Security Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 8: North America Cloud Security Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cloud Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cloud Security Industry Revenue (Million), by Solution 2025 & 2033

- Figure 11: Europe Cloud Security Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 12: Europe Cloud Security Industry Revenue (Million), by Security 2025 & 2033

- Figure 13: Europe Cloud Security Industry Revenue Share (%), by Security 2025 & 2033

- Figure 14: Europe Cloud Security Industry Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 15: Europe Cloud Security Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 16: Europe Cloud Security Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Cloud Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Cloud Security Industry Revenue (Million), by Solution 2025 & 2033

- Figure 19: Asia Pacific Cloud Security Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 20: Asia Pacific Cloud Security Industry Revenue (Million), by Security 2025 & 2033

- Figure 21: Asia Pacific Cloud Security Industry Revenue Share (%), by Security 2025 & 2033

- Figure 22: Asia Pacific Cloud Security Industry Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 23: Asia Pacific Cloud Security Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 24: Asia Pacific Cloud Security Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Cloud Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Cloud Security Industry Revenue (Million), by Solution 2025 & 2033

- Figure 27: Rest of the World Cloud Security Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 28: Rest of the World Cloud Security Industry Revenue (Million), by Security 2025 & 2033

- Figure 29: Rest of the World Cloud Security Industry Revenue Share (%), by Security 2025 & 2033

- Figure 30: Rest of the World Cloud Security Industry Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 31: Rest of the World Cloud Security Industry Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 32: Rest of the World Cloud Security Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Cloud Security Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Security Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 2: Global Cloud Security Industry Revenue Million Forecast, by Security 2020 & 2033

- Table 3: Global Cloud Security Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 4: Global Cloud Security Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cloud Security Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 6: Global Cloud Security Industry Revenue Million Forecast, by Security 2020 & 2033

- Table 7: Global Cloud Security Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 8: Global Cloud Security Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Cloud Security Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 10: Global Cloud Security Industry Revenue Million Forecast, by Security 2020 & 2033

- Table 11: Global Cloud Security Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 12: Global Cloud Security Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Cloud Security Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 14: Global Cloud Security Industry Revenue Million Forecast, by Security 2020 & 2033

- Table 15: Global Cloud Security Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 16: Global Cloud Security Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Cloud Security Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 18: Global Cloud Security Industry Revenue Million Forecast, by Security 2020 & 2033

- Table 19: Global Cloud Security Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 20: Global Cloud Security Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Security Industry?

The projected CAGR is approximately 18.07%.

2. Which companies are prominent players in the Cloud Security Industry?

Key companies in the market include Computer Science Corporation (CSC)*List Not Exhaustive, IBM Corporation, Trend Micro Inc, Fortinet Inc, Imperva Inc, Check Point Software Technologies Ltd, Mcafee LLC, Cisco Systems Inc, Broadcom Inc, Qualys Inc, Sophos PLC.

3. What are the main segments of the Cloud Security Industry?

The market segments include Solution, Security, Deployment Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Threats of Cyber Attacks is Expanding the Market.

6. What are the notable trends driving market growth?

Intrusion Detection and Prevention is the Fastest Growing Segment.

7. Are there any restraints impacting market growth?

Migration of Manufacturing Processes from On-premise to Cloud is a Major Challenge.

8. Can you provide examples of recent developments in the market?

May 2023 - Fujitsu Limited and Microsoft Corporation announced a five-year partnership to significantly expand their existing collaboration. The agreement, which involved investment by companies to drive the expansion of Fujitsu's Uvance business, leverages the Microsoft Cloud and industry-leading technologies to digitally transform organizations around the globe, develop more sustainable practices and solutions that address societal needs, and unlock new streams of business growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Security Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Security Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Security Industry?

To stay informed about further developments, trends, and reports in the Cloud Security Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence