Key Insights

The Asia-Pacific Industrial Pumps market is projected for significant expansion, expected to reach $28.5 billion by 2025. This robust growth is driven by a Compound Annual Growth Rate (CAGR) of 5.48% from 2025 to 2033. Key sectors such as Oil & Gas, Water & Wastewater, and Chemicals & Petrochemicals are fueling demand for advanced pumping solutions due to increasing industrialization. Investments in infrastructure, coupled with the need for efficient water management and energy production, are further accelerating the adoption of sophisticated industrial pumps. Rapid urbanization and a growing middle class are also boosting demand from the Food & Beverage and Pharmaceutical industries.

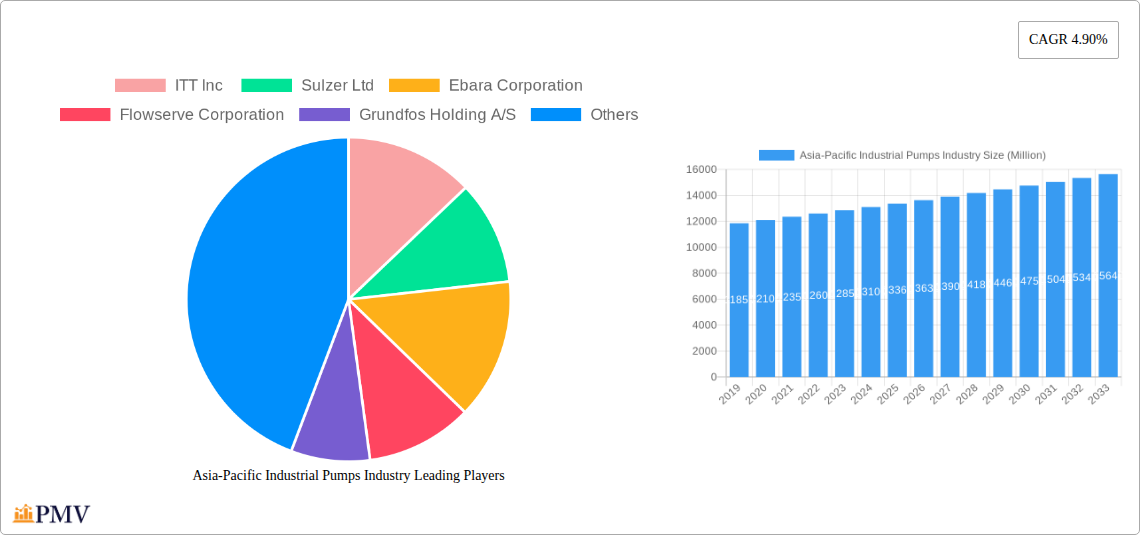

Asia-Pacific Industrial Pumps Industry Market Size (In Billion)

While challenges like rising raw material costs and stringent environmental regulations exist, they are expected to be offset by technological advancements and a focus on efficiency and sustainability. Emerging trends include the integration of IoT and AI for predictive maintenance, a growing preference for energy-efficient pumps, and increased demand for specialized pump solutions. Leading companies are actively investing in R&D and market expansion.

Asia-Pacific Industrial Pumps Industry Company Market Share

This report offers a comprehensive analysis of the Asia-Pacific Industrial Pumps market, providing critical insights into market dynamics, growth drivers, competitive landscape, and future trends. Covering the forecast period with a base year of 2025, this report is an essential resource for stakeholders seeking to understand this vital industrial sector. We explore leading companies, product innovations, and regional trends, delivering actionable intelligence for strategic decision-making.

Asia-Pacific Industrial Pumps Industry Market Structure & Competitive Dynamics

The Asia-Pacific industrial pumps market exhibits a moderately concentrated structure, with a few major global players vying for market share alongside a growing number of regional manufacturers. Innovation ecosystems are thriving, driven by significant R&D investments in energy efficiency, smart technology integration, and advanced materials. Regulatory frameworks, particularly concerning environmental compliance and safety standards, are increasingly stringent across key markets like China and India, influencing product development and market entry strategies. Product substitutes, such as advanced fluid management systems, pose a nascent threat, but the core demand for robust and reliable industrial pumps remains high. End-user trends are characterized by a strong push towards digitalization, automation, and sustainability, demanding pumps with enhanced monitoring capabilities and reduced operational footprints. Merger and acquisition (M&A) activities are a significant facet of market dynamics, with companies strategically acquiring smaller players to expand their product portfolios, geographic reach, and technological expertise. Recent M&A deals, though specific values are proprietary, indicate a strong investor appetite for consolidating market leadership and capturing emerging opportunities. Companies like ITT Inc., Sulzer Ltd., Ebara Corporation, Flowserve Corporation, and Grundfos Holding A/S are at the forefront of these strategic moves, actively shaping the competitive landscape.

Asia-Pacific Industrial Pumps Industry Industry Trends & Insights

The Asia-Pacific industrial pumps industry is poised for robust growth, driven by a confluence of factors that underscore its strategic importance. A projected Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period (2025–2033) highlights the sector's dynamism. Key growth drivers include escalating industrialization across emerging economies, particularly in Southeast Asia and India, leading to increased demand for pumps in manufacturing, construction, and resource extraction. The ever-growing need for efficient water and wastewater management systems, fueled by urbanization and increasing water scarcity, is a significant catalyst. Furthermore, the expansion of the oil and gas sector, alongside the burgeoning chemical and petrochemical industries, necessitates high-performance pumping solutions for fluid transfer and processing. Technological disruptions are profoundly impacting the market, with the integration of the Internet of Things (IoT) and Artificial Intelligence (AI) enabling predictive maintenance, remote monitoring, and enhanced operational efficiency. This shift towards smart pumps allows for real-time performance tracking, energy optimization, and reduced downtime, aligning with end-user preferences for sustainability and cost-effectiveness. Consumer preferences are increasingly leaning towards energy-efficient, low-maintenance, and technologically advanced pumps that offer superior reliability and a longer lifespan. Competitive dynamics are intensifying, with both established global players and agile local manufacturers competing on price, quality, innovation, and after-sales service. Market penetration of advanced pump technologies is expected to deepen as industries recognize the long-term economic and environmental benefits. The ongoing digital transformation across various end-user industries will continue to be a dominant trend, pushing manufacturers to develop intelligent pumping solutions that integrate seamlessly into broader industrial automation ecosystems.

Dominant Markets & Segments in Asia-Pacific Industrial Pumps Industry

The Asia-Pacific industrial pumps market is characterized by strong regional dominance, with China emerging as the largest and fastest-growing market, driven by its expansive manufacturing base and significant infrastructure development projects. Other key markets include India, Japan, and South Korea, each contributing substantially due to their robust industrial sectors.

Centrifugal Pumps represent the dominant segment by type, accounting for over 70% of the market share. Their versatility, efficiency, and reliability in handling large volumes of liquids make them indispensable across a wide array of applications.

- Multi-stage centrifugal pumps are particularly crucial for high-pressure applications found in the oil and gas and power generation sectors.

- Submersible pumps are vital for water and wastewater management, dewatering, and agricultural irrigation.

- The single-stage centrifugal pump segment is also significant, offering cost-effectiveness for moderate pressure and flow rate requirements.

Positive Displacement Pumps hold a significant share, particularly in specialized applications requiring precise dosing and high viscosity fluid handling.

- Rotary pumps, including gear and screw pumps, are widely used in the chemical and petrochemical industries for viscous fluid transfer.

- Reciprocating pumps, such as piston and diaphragm pumps, are employed in high-pressure applications and for handling abrasive or corrosive media.

- Peristaltic pumps are gaining traction in the pharmaceutical and food and beverage sectors due to their hygienic design and ability to handle sensitive fluids without contamination.

End-User Industry Dominance:

- The Water and Wastewater sector is a primary growth engine, driven by increasing investments in water infrastructure and stringent environmental regulations across the region.

- The Oil and Gas industry remains a significant consumer of industrial pumps, particularly for exploration, extraction, refining, and transportation activities, despite cyclical fluctuations.

- The Chemicals and Petrochemicals segment is a consistent demand driver, requiring specialized pumps for handling a wide range of corrosive, hazardous, and high-temperature fluids.

- Power Generation facilities, including thermal and renewable energy plants, rely heavily on pumps for cooling, boiler feed, and other essential operations.

- The Pharmaceutical/Life Sciences sector demands high-purity, hygienic pumps for critical manufacturing processes.

- The Food and Beverage industry utilizes pumps for ingredient transfer, processing, and cleaning-in-place (CIP) systems.

- Other End-user Industries, including mining, construction, and general manufacturing, also contribute to overall market demand.

The dominance of these segments is underpinned by economic policies supporting industrial growth, infrastructure development initiatives, and the inherent need for efficient fluid handling in diverse industrial processes.

Asia-Pacific Industrial Pumps Industry Product Innovations

Product innovation in the Asia-Pacific industrial pumps sector is primarily focused on enhancing energy efficiency, improving operational intelligence through IoT integration, and developing pumps for specialized and demanding applications. Manufacturers are investing in advanced materials to create corrosion-resistant and wear-resistant pumps, thereby extending their lifespan and reducing maintenance costs. The integration of variable frequency drives (VFDs) and smart sensors enables real-time performance monitoring, predictive maintenance, and optimized energy consumption. These innovations are crucial for meeting the stringent environmental regulations and sustainability goals set by governments and industries across the region, giving companies a competitive edge in a market increasingly valuing efficiency and longevity.

Report Segmentation & Scope

This report meticulously segments the Asia-Pacific Industrial Pumps Industry by pump type and end-user industry to provide granular market insights.

- By Type: The market is analyzed across Positive Displacement pumps, encompassing Rotary pumps, Reciprocating pumps, and Peristaltic pumps, and Centrifugal pumps, including Single-stage pumps, Multi-stage pumps, Submersible pumps, and Other pump types.

- By End-User Industry: The analysis covers demand from the Oil and Gas sector, Water and Wastewater management, Chemicals and Petrochemicals industries, Power Generation facilities, Pharmaceutical/Life Sciences companies, Food and Beverage manufacturers, and Other End-user Industries.

Each segment is evaluated for its market size, projected growth rates, and the competitive dynamics influencing its development, offering a comprehensive view of the industry's landscape.

Key Drivers of Asia-Pacific Industrial Pumps Industry Growth

Several key drivers are propelling the Asia-Pacific industrial pumps industry. The sustained industrialization and rapid urbanization across emerging economies are significantly increasing demand for pumps in manufacturing, infrastructure development, and resource management. Growing investments in water and wastewater treatment facilities, driven by environmental concerns and population growth, are a major contributor. The expansion of the oil and gas sector, coupled with the robust growth of the chemical and petrochemical industries, necessitates continuous demand for high-performance pumping solutions. Furthermore, government initiatives promoting energy efficiency and sustainable industrial practices are encouraging the adoption of advanced, technologically superior pumps.

Challenges in the Asia-Pacific Industrial Pumps Industry Sector

Despite the robust growth, the Asia-Pacific industrial pumps industry faces several challenges. Stringent and evolving environmental regulations, while driving innovation, can increase compliance costs for manufacturers. Fluctuations in raw material prices, particularly for metals and specialized alloys, can impact profit margins. Intense competition from both global and local players often leads to price pressures. Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities, can affect production schedules and delivery times. The need for skilled labor to operate and maintain complex pumping systems is also a growing concern in certain regions.

Leading Players in the Asia-Pacific Industrial Pumps Industry Market

- ITT Inc.

- Sulzer Ltd.

- Ebara Corporation

- Flowserve Corporation

- Grundfos Holding A/S

- KSB SE & Co KGaA

- Kirloskar Brothers Limited

- Schlumberger Limited

- Atlas Copco

Key Developments in Asia-Pacific Industrial Pumps Industry Sector

- October 2021: Grundfos introduced its LC232 Controller, a new groundwater pump controller expected to help advance smart agriculture in Indonesia, Thailand, Australia, and New Zealand. The new offering utilizes smart technology to bring ease of use, monitoring capabilities, and greater connectivity for growers and cattle producers.

- November 2021: Atlas Copco completed the acquisition of India-based HHV Pumps. The company designs and manufactures vacuum pumps and systems for applications used in various industries, including chemical, pharmaceutical, and electrical power equipment.

Strategic Asia-Pacific Industrial Pumps Industry Market Outlook

The strategic outlook for the Asia-Pacific industrial pumps market is exceptionally positive, driven by ongoing economic development and technological advancements. Growth accelerators include the increasing adoption of smart technologies, leading to demand for IoT-enabled and AI-driven pumping systems that offer predictive maintenance and enhanced efficiency. The continuous expansion of infrastructure projects, particularly in water management and energy, will sustain demand for reliable and high-performance pumps. Furthermore, the growing emphasis on sustainability and environmental protection will favor manufacturers offering energy-efficient and eco-friendly pumping solutions. Strategic opportunities lie in catering to the burgeoning needs of emerging economies and investing in R&D to stay ahead of technological curves and regulatory changes.

Asia-Pacific Industrial Pumps Industry Segmentation

-

1. Type

-

1.1. Positive Displacement

- 1.1.1. Rotary Pump

- 1.1.2. Reciprocating

- 1.1.3. Peristaltic

-

1.2. Centrifugal

- 1.2.1. Single-stage

- 1.2.2. Multi-stage

- 1.2.3. Submersible

- 1.2.4. Others

-

1.1. Positive Displacement

-

2. End-User Industry

- 2.1. Oil and Gas

- 2.2. Water and Wastewater

- 2.3. Chemicals and Petrochemicals

- 2.4. Power Generation

- 2.5. Pharmaceutical/Life Sciences

- 2.6. Food and Beverage

- 2.7. Other End-user Industries

Asia-Pacific Industrial Pumps Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Industrial Pumps Industry Regional Market Share

Geographic Coverage of Asia-Pacific Industrial Pumps Industry

Asia-Pacific Industrial Pumps Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments in Building and Construction; Technological Advancements in Manufacturing

- 3.3. Market Restrains

- 3.3.1. Rise in the privacy and security issues

- 3.4. Market Trends

- 3.4.1. Centrifugal Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Industrial Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Positive Displacement

- 5.1.1.1. Rotary Pump

- 5.1.1.2. Reciprocating

- 5.1.1.3. Peristaltic

- 5.1.2. Centrifugal

- 5.1.2.1. Single-stage

- 5.1.2.2. Multi-stage

- 5.1.2.3. Submersible

- 5.1.2.4. Others

- 5.1.1. Positive Displacement

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Oil and Gas

- 5.2.2. Water and Wastewater

- 5.2.3. Chemicals and Petrochemicals

- 5.2.4. Power Generation

- 5.2.5. Pharmaceutical/Life Sciences

- 5.2.6. Food and Beverage

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ITT Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sulzer Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ebara Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Flowserve Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grundfos Holding A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KSB SE & Co KGaA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kirloskar Brothers Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schlumberger Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Atlas Copco

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 ITT Inc

List of Figures

- Figure 1: Asia-Pacific Industrial Pumps Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Industrial Pumps Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Industrial Pumps Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Industrial Pumps Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Industrial Pumps Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: Asia-Pacific Industrial Pumps Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 5: Asia-Pacific Industrial Pumps Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Industrial Pumps Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Industrial Pumps Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Asia-Pacific Industrial Pumps Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Asia-Pacific Industrial Pumps Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 10: Asia-Pacific Industrial Pumps Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 11: Asia-Pacific Industrial Pumps Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Industrial Pumps Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia-Pacific Industrial Pumps Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia-Pacific Industrial Pumps Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Industrial Pumps Industry?

The projected CAGR is approximately 5.48%.

2. Which companies are prominent players in the Asia-Pacific Industrial Pumps Industry?

Key companies in the market include ITT Inc , Sulzer Ltd, Ebara Corporation, Flowserve Corporation, Grundfos Holding A/S, KSB SE & Co KGaA, Kirloskar Brothers Limited, Schlumberger Limited, Atlas Copco.

3. What are the main segments of the Asia-Pacific Industrial Pumps Industry?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in Building and Construction; Technological Advancements in Manufacturing.

6. What are the notable trends driving market growth?

Centrifugal Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Rise in the privacy and security issues.

8. Can you provide examples of recent developments in the market?

October 2021 - Grundfos introduced its LC232 Controller, a new groundwater pump controller expected to help advance smart agriculture in four markets in the Asia Pacific region- Indonesia, Thailand, Australia, and New Zealand. The new offering utilizes smart technology to bring ease of use, monitoring capabilities, and greater connectivity for growers and cattle producers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Industrial Pumps Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Industrial Pumps Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Industrial Pumps Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Industrial Pumps Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence