Key Insights

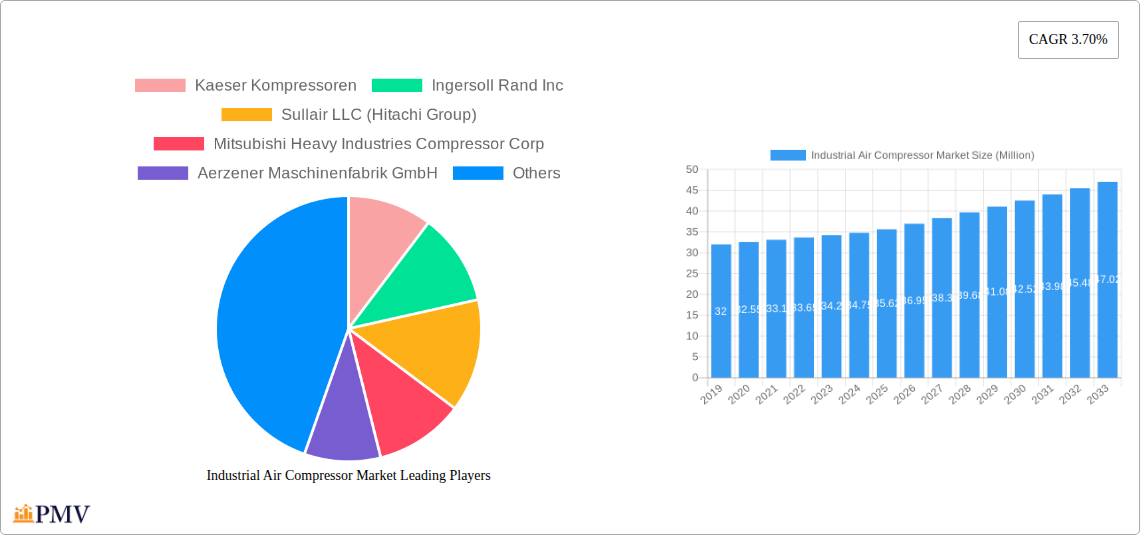

The global industrial air compressor market is projected to reach a significant valuation by 2025, driven by robust industrial expansion and increasing demand for compressed air in various manufacturing processes. With an estimated market size of $35.62 million in 2025, the sector is poised for steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.70% through 2033. Key market drivers include the burgeoning manufacturing sector, particularly in emerging economies, and the critical role of air compressors in industries such as oil and gas for extraction and processing, food and beverages for packaging and automation, and healthcare for critical medical equipment. The construction and mining sectors also represent substantial demand for robust and efficient air compression solutions, further fueling market expansion.

Industrial Air Compressor Market Market Size (In Million)

Technological advancements are shaping the market landscape, with a growing emphasis on energy-efficient and intelligent compressor systems. Rotary air compressors are expected to dominate the market share due to their reliability and continuous operation capabilities, followed by reciprocating and centrifugal compressor types, each catering to specific industrial needs. The market is characterized by intense competition among major global players like Atlas Copco Group, Ingersoll Rand Inc., and Mitsubishi Heavy Industries Compressor Corp., who are actively investing in innovation and expanding their product portfolios to meet evolving industry demands. While the market demonstrates strong growth potential, factors such as the high initial cost of advanced compressor systems and increasing energy costs pose potential restraints, necessitating a focus on lifecycle cost optimization and sustainable operational practices. Regional growth is expected to be led by the Asia Pacific, driven by rapid industrialization in China, India, and other developing nations.

Industrial Air Compressor Market Company Market Share

This in-depth report provides a meticulous analysis of the global Industrial Air Compressor market, offering invaluable insights for stakeholders seeking to understand current dynamics and future trajectories. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025–2033, this study details market size, segmentation, key drivers, challenges, and competitive landscapes. Essential for strategic planning, investment decisions, and market entry strategies in the industrial air compressor sector.

Industrial Air Compressor Market Market Structure & Competitive Dynamics

The Industrial Air Compressor market is characterized by a moderately concentrated structure, with a few key players holding significant market share. Innovation is a critical differentiator, driven by constant advancements in energy efficiency, smart connectivity, and specialized applications. Regulatory frameworks, particularly concerning environmental standards and safety, influence product development and market entry. Product substitutes, such as compressed air treatment systems and alternative power sources in specific niche applications, exist but are generally not direct competitors for core compressor functions. End-user trends, including the increasing demand for sustainable solutions and automation across industries like manufacturing and oil and gas, are shaping product portfolios. Mergers and acquisitions (M&A) are a recurring theme, with companies actively seeking to expand their geographical reach, technological capabilities, and product offerings. For instance, recent M&A activities by Ingersoll Rand Inc. highlight a strategic focus on enhancing air treatment and expanding the compressor ecosystem. Market share is a crucial metric, with leading companies consistently investing in R&D and expanding production capacities. M&A deal values often reach tens to hundreds of millions of US dollars, signaling significant consolidation and strategic growth within the industry.

Industrial Air Compressor Market Industry Trends & Insights

The global Industrial Air Compressor market is poised for robust growth, projected to expand at a substantial Compound Annual Growth Rate (CAGR) throughout the forecast period. This expansion is fueled by a confluence of factors, including the escalating demand for compressed air in a wide array of industrial processes, the continuous push for energy efficiency driven by rising energy costs and environmental regulations, and the accelerating adoption of Industry 4.0 technologies, which necessitate reliable and intelligent compressed air systems. The manufacturing sector, a cornerstone of industrial activity, continues to be a primary driver, with increasing automation and sophisticated production lines requiring a steady and precise supply of compressed air. The oil and gas industry, despite its cyclical nature, remains a significant consumer, particularly for critical applications like gas compression and processing. Furthermore, the growing emphasis on sustainability and emissions reduction is driving innovation towards more energy-efficient compressor designs, including variable speed drives and advanced control systems that minimize energy wastage. The healthcare sector, with its stringent hygiene and operational requirements, also presents a steady demand for high-purity compressed air. Technological disruptions, such as the integration of IoT sensors for predictive maintenance and remote monitoring, are enhancing operational efficiency and reducing downtime for end-users. Consumer preferences are increasingly leaning towards solutions that offer lower total cost of ownership, greater reliability, and enhanced safety features. Competitive dynamics are shaped by global players investing heavily in R&D to develop next-generation compressors that meet these evolving demands, alongside regional manufacturers catering to localized market needs. The market penetration of advanced compressor technologies, such as oil-free compressors and centrifugal compressors for high-capacity applications, is expected to rise.

Dominant Markets & Segments in Industrial Air Compressor Market

The Rotary Air Compressors segment is a dominant force within the Industrial Air Compressor market. This dominance is primarily attributed to their versatility, high efficiency, and suitability for continuous operation across a broad spectrum of industrial applications. Rotary screw compressors, a key sub-segment, are widely favored for their reliability, compact design, and ability to deliver consistent air output, making them indispensable in Manufacturing, Food and Beverages, and Oil and Gas sectors.

- Manufacturing: This sector represents a massive and consistent demand driver. Economic policies promoting industrialization and infrastructure development globally directly translate into increased demand for manufacturing output, consequently boosting the need for industrial air compressors. The trend towards automation and smart factories further elevates the importance of reliable compressed air systems.

- Food and Beverages: Strict hygiene standards and the need for precise process control make rotary compressors essential. Their ability to operate efficiently and provide clean compressed air is critical for packaging, filling, and processing operations.

- Oil and Gas: This sector relies heavily on compressors for various upstream, midstream, and downstream processes, including gas gathering, refining, and petrochemical production. The demand for high-performance and robust compressor solutions in harsh environments solidifies the dominance of rotary and centrifugal types.

The Manufacturing end-user industry is a leading segment, driven by global manufacturing output and the increasing adoption of advanced manufacturing techniques. Countries with strong industrial bases, such as the United States, China, Germany, and Japan, represent significant regional markets. The Oil and Gas sector also holds substantial market share, with demand fluctuating based on exploration and production activities, but consistently requiring powerful and efficient compressor solutions.

- Key Drivers for Dominance:

- Economic Growth and Industrialization: Expansion of manufacturing capabilities and infrastructure projects globally fuels demand.

- Technological Advancements: Development of energy-efficient and smart compressor technologies enhances their appeal.

- Stringent Operational Requirements: Industries like Food & Beverages and Healthcare demand reliable, high-purity compressed air.

- Energy Efficiency Mandates: Growing environmental concerns and energy costs push users towards more efficient compressor types.

Industrial Air Compressor Market Product Innovations

Recent product innovations in the Industrial Air Compressor market are primarily focused on enhancing energy efficiency, incorporating smart technologies, and developing specialized solutions for niche applications. Manufacturers are actively developing compressors with advanced variable speed drives (VSDs) that precisely match air output to demand, significantly reducing energy consumption and operational costs. The integration of IoT capabilities for remote monitoring, diagnostics, and predictive maintenance is becoming standard, enabling optimized performance and minimizing unplanned downtime. Furthermore, there is a growing emphasis on developing oil-free compressor technologies to meet the stringent purity requirements of industries like pharmaceuticals and food processing, offering competitive advantages in terms of product quality and regulatory compliance.

Report Segmentation & Scope

This report segments the Industrial Air Compressor market by Type and End-user.

- Type Segmentation:

- Rotary Air Compressors: This segment, encompassing oil-injected and oil-free screw compressors, is expected to witness sustained growth due to their high efficiency and reliability across various industrial applications.

- Reciprocating Air Compressors: While offering simplicity and robustness, this segment is typically suited for intermittent duty cycles and smaller applications.

- Centrifugal Air Compressors: Dominant in high-volume, continuous operations, these compressors are crucial for large-scale industrial facilities.

- End-user Segmentation:

- Oil and Gas: High demand for process gas compression and general industrial air.

- Food and Beverages: Critical for packaging, processing, and ingredient handling, requiring high purity.

- Manufacturing: A broad category encompassing automotive, electronics, and general manufacturing, driving substantial demand.

- Healthcare: Essential for medical equipment and laboratory applications, demanding sterile and reliable air.

- Power Generation: Used in various auxiliary systems within power plants.

- Construction and Mining: For powering tools and equipment in demanding environments.

- Other End-user Industries: Includes sectors like textiles, chemicals, and pharmaceuticals.

Key Drivers of Industrial Air Compressor Market Growth

The industrial air compressor market is driven by several pivotal factors. Firstly, the global industrial expansion, particularly in emerging economies, fuels the demand for compressed air as a fundamental utility. Secondly, escalating energy costs and stringent environmental regulations are pushing industries towards more energy-efficient compressor technologies, such as variable speed drive (VSD) compressors and advanced control systems, which offer lower operating expenses and reduced carbon footprints. Thirdly, the growing adoption of automation and Industry 4.0 principles across manufacturing, automotive, and other sectors necessitates reliable, intelligent, and connected compressed air systems for precise process control. Finally, the continuous need for compressed air in critical applications within the oil and gas, food and beverage, and healthcare industries ensures a steady and growing market.

Challenges in the Industrial Air Compressor Market Sector

Despite robust growth prospects, the Industrial Air Compressor market faces several challenges. Intense competition among global and regional players can lead to price pressures, impacting profit margins for manufacturers. Fluctuations in raw material costs, particularly for metals and components, can affect production expenses and pricing strategies. The initial capital investment for advanced, energy-efficient compressor systems can be a barrier for some smaller enterprises, hindering widespread adoption. Furthermore, supply chain disruptions, as experienced in recent years, can impact the availability of critical components and lead to extended lead times. Regulatory complexities and evolving environmental standards across different regions require continuous adaptation and investment in R&D, adding to operational costs.

Leading Players in the Industrial Air Compressor Market Market

- Kaeser Kompressoren

- Ingersoll Rand Inc.

- Sullair LLC (Hitachi Group)

- Mitsubishi Heavy Industries Compressor Corp.

- Aerzener Maschinenfabrik GmbH

- Zhejiang Kaishan Compressor Co Ltd (Kaishan Group)

- Gardner Denver Inc.

- Hanwha Power Systems

- Bauer Kompressoren GmbH

- Howden Group Ltd

- FS-Curtis

- Atlas Copco Group

Key Developments in Industrial Air Compressor Market Sector

- September 2022: Howden announced the successful securing of a compressor contract for the Majnoon oilfield in Iraq, partnering with Azku Global Services. This contract involves the supply of two advanced screw compressor packages designed for the flare gas recovery system, aiming to recover waste gas for safe, usable fuel gas, thereby achieving energy savings and minimizing carbon emissions.

- August 2022: Ingersoll Rand Inc. strategically entered into agreements to acquire Holtec Gas Systems LLC, Shanghai Hanye Air Purifying Technology Co., Ltd, and Hydro Prokav Pumps (India) Private Limited for a combined cash purchase price of approximately USD 35 million. These acquisitions are intended to bolster Ingersoll Rand's air treatment capabilities and expand its comprehensive range of solutions within the broader compressor ecosystem.

- May 2022: Mitsubishi Electric Corporation revealed plans for a significant investment of 1.44 billion Turkish Lira (USD 113 million) in a new plant at Mitsubishi Electric Air Conditioning Systems Manufacturing Turkey Joint Stock Company (MACT). This expansion aims to significantly increase MACT's annual production capacity for air-to-water (ATW) heat pumps and room air conditioners, with production scheduled to commence in February 2024.

Strategic Industrial Air Compressor Market Market Outlook

The strategic outlook for the Industrial Air Compressor market remains exceptionally positive, fueled by ongoing industrialization, the imperative for energy efficiency, and the pervasive integration of digital technologies. Growth accelerators include the increasing demand for customized compressor solutions tailored to specific industry needs, such as high-purity air for pharmaceuticals and robust systems for demanding environments. The continuous evolution of IoT and AI in compressor management presents substantial opportunities for enhanced predictive maintenance, remote diagnostics, and optimized performance, leading to lower total cost of ownership for end-users. Strategic partnerships and collaborations are expected to intensify as companies aim to expand their global footprint and technological expertise. Furthermore, the growing focus on sustainability and carbon footprint reduction will drive innovation in environmentally friendly compressor designs and compressed air treatment technologies, opening new market avenues.

Industrial Air Compressor Market Segmentation

-

1. Type

- 1.1. Rotary Air Compressors

- 1.2. Reciprocating Air Compressors

- 1.3. Centrifugal Air Compressors

-

2. End-user

- 2.1. Oil and Gas

- 2.2. Food and Beverages

- 2.3. Manufacturing

- 2.4. Healthcare

- 2.5. Power Generation

- 2.6. Construction and Mining

- 2.7. Other End-user Industries

Industrial Air Compressor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Industrial Air Compressor Market Regional Market Share

Geographic Coverage of Industrial Air Compressor Market

Industrial Air Compressor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Global Investment in Oil and Gas; Demand for Energy Efficient Compressors

- 3.3. Market Restrains

- 3.3.1. Environmental and Safe Use Concerns

- 3.4. Market Trends

- 3.4.1. Rotary Air compressors to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Air Compressor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Rotary Air Compressors

- 5.1.2. Reciprocating Air Compressors

- 5.1.3. Centrifugal Air Compressors

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Oil and Gas

- 5.2.2. Food and Beverages

- 5.2.3. Manufacturing

- 5.2.4. Healthcare

- 5.2.5. Power Generation

- 5.2.6. Construction and Mining

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Industrial Air Compressor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Rotary Air Compressors

- 6.1.2. Reciprocating Air Compressors

- 6.1.3. Centrifugal Air Compressors

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Oil and Gas

- 6.2.2. Food and Beverages

- 6.2.3. Manufacturing

- 6.2.4. Healthcare

- 6.2.5. Power Generation

- 6.2.6. Construction and Mining

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Industrial Air Compressor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Rotary Air Compressors

- 7.1.2. Reciprocating Air Compressors

- 7.1.3. Centrifugal Air Compressors

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Oil and Gas

- 7.2.2. Food and Beverages

- 7.2.3. Manufacturing

- 7.2.4. Healthcare

- 7.2.5. Power Generation

- 7.2.6. Construction and Mining

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Industrial Air Compressor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Rotary Air Compressors

- 8.1.2. Reciprocating Air Compressors

- 8.1.3. Centrifugal Air Compressors

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Oil and Gas

- 8.2.2. Food and Beverages

- 8.2.3. Manufacturing

- 8.2.4. Healthcare

- 8.2.5. Power Generation

- 8.2.6. Construction and Mining

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Industrial Air Compressor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Rotary Air Compressors

- 9.1.2. Reciprocating Air Compressors

- 9.1.3. Centrifugal Air Compressors

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Oil and Gas

- 9.2.2. Food and Beverages

- 9.2.3. Manufacturing

- 9.2.4. Healthcare

- 9.2.5. Power Generation

- 9.2.6. Construction and Mining

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Industrial Air Compressor Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Rotary Air Compressors

- 10.1.2. Reciprocating Air Compressors

- 10.1.3. Centrifugal Air Compressors

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Oil and Gas

- 10.2.2. Food and Beverages

- 10.2.3. Manufacturing

- 10.2.4. Healthcare

- 10.2.5. Power Generation

- 10.2.6. Construction and Mining

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kaeser Kompressoren

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ingersoll Rand Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sullair LLC (Hitachi Group)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Heavy Industries Compressor Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aerzener Maschinenfabrik GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zhejiang Kaishan Compressor Co Ltd (Kaishan Group)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gardner Denver Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hanwha Power Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bauer Kompressoren GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Howden Group Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FS-Curtis

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Atlas Copco Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Kaeser Kompressoren

List of Figures

- Figure 1: Global Industrial Air Compressor Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Industrial Air Compressor Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Industrial Air Compressor Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Industrial Air Compressor Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Industrial Air Compressor Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Industrial Air Compressor Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Industrial Air Compressor Market Revenue (Million), by End-user 2025 & 2033

- Figure 8: North America Industrial Air Compressor Market Volume (K Unit), by End-user 2025 & 2033

- Figure 9: North America Industrial Air Compressor Market Revenue Share (%), by End-user 2025 & 2033

- Figure 10: North America Industrial Air Compressor Market Volume Share (%), by End-user 2025 & 2033

- Figure 11: North America Industrial Air Compressor Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Industrial Air Compressor Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Industrial Air Compressor Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Industrial Air Compressor Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Industrial Air Compressor Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe Industrial Air Compressor Market Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Industrial Air Compressor Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Industrial Air Compressor Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Industrial Air Compressor Market Revenue (Million), by End-user 2025 & 2033

- Figure 20: Europe Industrial Air Compressor Market Volume (K Unit), by End-user 2025 & 2033

- Figure 21: Europe Industrial Air Compressor Market Revenue Share (%), by End-user 2025 & 2033

- Figure 22: Europe Industrial Air Compressor Market Volume Share (%), by End-user 2025 & 2033

- Figure 23: Europe Industrial Air Compressor Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Industrial Air Compressor Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Industrial Air Compressor Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Industrial Air Compressor Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Industrial Air Compressor Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Pacific Industrial Air Compressor Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: Asia Pacific Industrial Air Compressor Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Industrial Air Compressor Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Industrial Air Compressor Market Revenue (Million), by End-user 2025 & 2033

- Figure 32: Asia Pacific Industrial Air Compressor Market Volume (K Unit), by End-user 2025 & 2033

- Figure 33: Asia Pacific Industrial Air Compressor Market Revenue Share (%), by End-user 2025 & 2033

- Figure 34: Asia Pacific Industrial Air Compressor Market Volume Share (%), by End-user 2025 & 2033

- Figure 35: Asia Pacific Industrial Air Compressor Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Industrial Air Compressor Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Industrial Air Compressor Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Industrial Air Compressor Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Industrial Air Compressor Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Latin America Industrial Air Compressor Market Volume (K Unit), by Type 2025 & 2033

- Figure 41: Latin America Industrial Air Compressor Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Latin America Industrial Air Compressor Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Latin America Industrial Air Compressor Market Revenue (Million), by End-user 2025 & 2033

- Figure 44: Latin America Industrial Air Compressor Market Volume (K Unit), by End-user 2025 & 2033

- Figure 45: Latin America Industrial Air Compressor Market Revenue Share (%), by End-user 2025 & 2033

- Figure 46: Latin America Industrial Air Compressor Market Volume Share (%), by End-user 2025 & 2033

- Figure 47: Latin America Industrial Air Compressor Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Industrial Air Compressor Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America Industrial Air Compressor Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Industrial Air Compressor Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Industrial Air Compressor Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Industrial Air Compressor Market Volume (K Unit), by Type 2025 & 2033

- Figure 53: Middle East and Africa Industrial Air Compressor Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Industrial Air Compressor Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Industrial Air Compressor Market Revenue (Million), by End-user 2025 & 2033

- Figure 56: Middle East and Africa Industrial Air Compressor Market Volume (K Unit), by End-user 2025 & 2033

- Figure 57: Middle East and Africa Industrial Air Compressor Market Revenue Share (%), by End-user 2025 & 2033

- Figure 58: Middle East and Africa Industrial Air Compressor Market Volume Share (%), by End-user 2025 & 2033

- Figure 59: Middle East and Africa Industrial Air Compressor Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Industrial Air Compressor Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa Industrial Air Compressor Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Industrial Air Compressor Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Air Compressor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Industrial Air Compressor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Industrial Air Compressor Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 4: Global Industrial Air Compressor Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 5: Global Industrial Air Compressor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Industrial Air Compressor Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Industrial Air Compressor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Industrial Air Compressor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Industrial Air Compressor Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 10: Global Industrial Air Compressor Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 11: Global Industrial Air Compressor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Industrial Air Compressor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Industrial Air Compressor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Industrial Air Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Industrial Air Compressor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Industrial Air Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Global Industrial Air Compressor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Industrial Air Compressor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: Global Industrial Air Compressor Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 20: Global Industrial Air Compressor Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 21: Global Industrial Air Compressor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Industrial Air Compressor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Industrial Air Compressor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Industrial Air Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Germany Industrial Air Compressor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Industrial Air Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: France Industrial Air Compressor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Industrial Air Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Industrial Air Compressor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Industrial Air Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Industrial Air Compressor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Industrial Air Compressor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 33: Global Industrial Air Compressor Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 34: Global Industrial Air Compressor Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 35: Global Industrial Air Compressor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Industrial Air Compressor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: China Industrial Air Compressor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: China Industrial Air Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Japan Industrial Air Compressor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Japan Industrial Air Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: India Industrial Air Compressor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: India Industrial Air Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: South Korea Industrial Air Compressor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: South Korea Industrial Air Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Industrial Air Compressor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Industrial Air Compressor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global Industrial Air Compressor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 48: Global Industrial Air Compressor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 49: Global Industrial Air Compressor Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 50: Global Industrial Air Compressor Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 51: Global Industrial Air Compressor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global Industrial Air Compressor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 53: Global Industrial Air Compressor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 54: Global Industrial Air Compressor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 55: Global Industrial Air Compressor Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 56: Global Industrial Air Compressor Market Volume K Unit Forecast, by End-user 2020 & 2033

- Table 57: Global Industrial Air Compressor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Industrial Air Compressor Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Air Compressor Market?

The projected CAGR is approximately 3.70%.

2. Which companies are prominent players in the Industrial Air Compressor Market?

Key companies in the market include Kaeser Kompressoren, Ingersoll Rand Inc, Sullair LLC (Hitachi Group), Mitsubishi Heavy Industries Compressor Corp, Aerzener Maschinenfabrik GmbH, Zhejiang Kaishan Compressor Co Ltd (Kaishan Group), Gardner Denver Inc, Hanwha Power Systems, Bauer Kompressoren GmbH, Howden Group Ltd, FS-Curtis, Atlas Copco Group.

3. What are the main segments of the Industrial Air Compressor Market?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Global Investment in Oil and Gas; Demand for Energy Efficient Compressors.

6. What are the notable trends driving market growth?

Rotary Air compressors to Hold Significant Share.

7. Are there any restraints impacting market growth?

Environmental and Safe Use Concerns.

8. Can you provide examples of recent developments in the market?

September 2022: Howden announced that it secured a compressor contract for Majnoon oilfield, Iraq. Howden has secured a contract with Azku Global Services, part of the Khudairi Group. Howden will supply two screw compressor packages to Majnoon oilfield, near Basrah, Iraq. Howden's state-of-the-art screw compressor packages will be installed in Majnoon oilfield's flare gas recovery system. The waste gas will be recovered and treated to deliver safe, useable fuel gas, saving energy and minimizing carbon emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Air Compressor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Air Compressor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Air Compressor Market?

To stay informed about further developments, trends, and reports in the Industrial Air Compressor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence