Key Insights

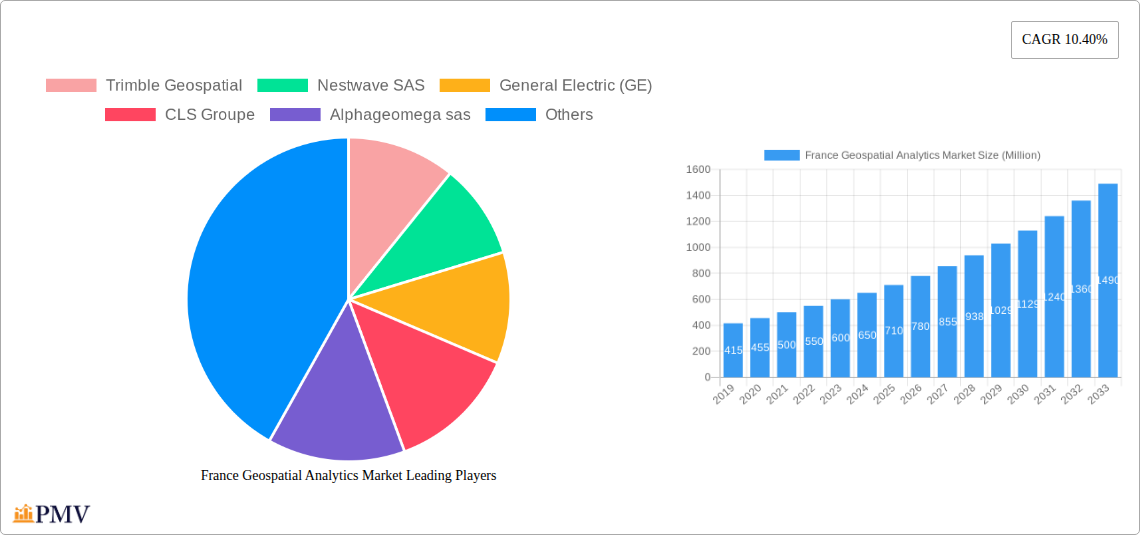

The French Geospatial Analytics Market is poised for robust expansion, projected to reach an estimated value of USD 0.71 billion. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 10.40%, indicating a dynamic and evolving landscape. The market's strength is driven by several key factors, including the increasing adoption of advanced technologies for surface analysis and network analysis, enabling deeper insights from spatial data. The surge in demand for sophisticated geovisualization tools empowers businesses and government entities to interpret complex geographical information more effectively. This expansion is critically supported by the integration of geospatial analytics across a diverse range of end-user verticals. Key sectors such as Agriculture, Utility and Communication, Defense and Intelligence, and Government are leveraging these capabilities for enhanced decision-making, resource optimization, and operational efficiency. Furthermore, emerging applications in Automotive and Transportation for smart mobility solutions and in Real Estate and Construction for site selection and development are significantly contributing to market momentum.

France Geospatial Analytics Market Market Size (In Million)

The trajectory of the French Geospatial Analytics Market is further shaped by prevailing trends and evolving industry dynamics. A prominent trend is the rise of cloud-based geospatial platforms, offering greater accessibility, scalability, and collaborative capabilities for data analysis. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) with geospatial data is unlocking new frontiers in predictive analytics and pattern recognition, driving innovation. While the market presents significant opportunities, certain restraints, such as the initial investment costs for advanced technologies and the need for skilled professionals in data science and geospatial analysis, require strategic consideration. However, these challenges are being mitigated by technological advancements and growing awareness of the ROI from geospatial solutions. Leading companies like ESRI Inc., Trimble Geospatial, and Bentley Systems Inc. are at the forefront, driving innovation and shaping the competitive landscape through their comprehensive offerings in mapping, analysis, and visualization software. The France region, specifically, is a focal point for these advancements, with significant investments in smart city initiatives and infrastructure development further propelling the adoption of geospatial analytics.

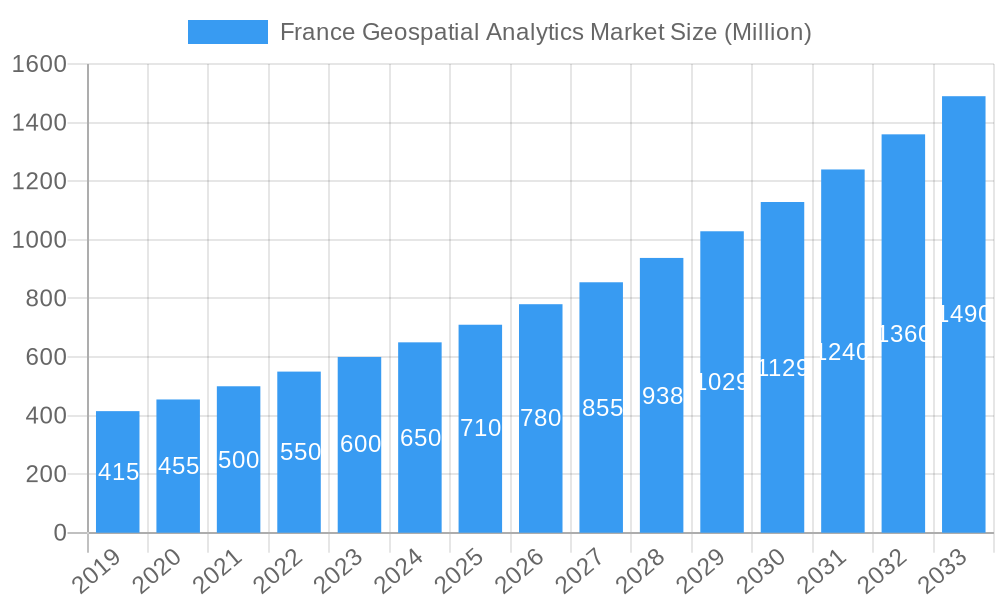

France Geospatial Analytics Market Company Market Share

This comprehensive report provides an in-depth analysis of the France Geospatial Analytics Market, offering critical insights into market dynamics, growth drivers, competitive landscape, and future projections. Covering a study period from 2019 to 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving French geospatial technology sector. We delve into segments such as Surface Analysis, Network Analysis, and Geovisualization, alongside end-user verticals including Agriculture, Defense and Intelligence, Government, Automotive and Transportation, and Real Estate and Construction, providing granular market data and strategic recommendations.

France Geospatial Analytics Market Market Structure & Competitive Dynamics

The France Geospatial Analytics Market is characterized by a moderately concentrated structure, with a blend of established global players and agile local innovators. Innovation ecosystems are vibrant, fueled by significant investments in research and development, particularly in areas like AI-driven analytics and real-time data processing. Regulatory frameworks, while supportive of digital transformation, also emphasize data privacy and security, influencing market access and operational strategies. Product substitutes exist in the form of traditional data analysis methods, but the superior accuracy, efficiency, and actionable insights provided by geospatial analytics are driving market adoption. End-user trends reveal a growing demand for predictive analytics, advanced visualization, and integrated geospatial solutions across all key sectors. Mergers and acquisitions (M&A) activity is expected to increase as larger companies seek to acquire innovative technologies and expand their market reach. For instance, a significant M&A deal value of approximately $150 Million is anticipated by 2028 to consolidate key players within the defense and government analytics segment. Market share distribution will see major players like ESRI Inc. and Bentley Systems Inc. holding substantial portions, while niche players focusing on specific sensor technologies or AI algorithms will carve out valuable segments. The competitive landscape is shaped by strategic partnerships and technological advancements, ensuring a dynamic and evolving market environment.

France Geospatial Analytics Market Industry Trends & Insights

The France Geospatial Analytics Market is poised for robust growth, driven by an increasing demand for data-driven decision-making across various industries. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033. This expansion is primarily fueled by the accelerating adoption of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT), which are enhancing the capabilities and applications of geospatial analytics. The integration of these technologies allows for more sophisticated analysis of complex spatial data, leading to improved efficiency, optimized resource allocation, and enhanced risk management. Furthermore, the growing emphasis on smart city initiatives, sustainable development, and precision agriculture across France is creating new avenues for geospatial analytics. For example, the French government's commitment to digital transformation and the development of a sovereign digital infrastructure further stimulates the market. Consumer preferences are shifting towards real-time data accessibility and intuitive visualization tools, prompting companies to develop more user-friendly platforms. Competitive dynamics are intensifying, with companies focusing on developing specialized solutions for niche markets and investing in cloud-based platforms to offer scalable and accessible services. The increasing availability of high-resolution satellite imagery and aerial data, coupled with advancements in drone technology, is also a significant contributor to market growth. Market penetration for advanced geospatial analytics solutions is expected to reach 65% by 2033, underscoring its growing indispensability. The ongoing digital transformation of industries, coupled with the increasing complexity of spatial challenges, positions the France Geospatial Analytics Market for sustained and significant expansion.

Dominant Markets & Segments in France Geospatial Analytics Market

Within the France Geospatial Analytics Market, several segments demonstrate exceptional growth and dominance. The Government end-user vertical is a primary driver, benefiting from significant public sector investments in infrastructure development, urban planning, national security, and disaster management. The French government's commitment to modernizing its digital infrastructure and leveraging data for public service delivery fuels demand for sophisticated geospatial solutions. Economic policies and infrastructure projects, such as the development of smart cities and the enhancement of transportation networks, directly translate into increased utilization of geospatial analytics for planning, monitoring, and management.

- Key Drivers for Government Dominance:

- National Security and Defense: Geospatial intelligence is critical for defense strategies, border surveillance, and threat assessment, driving substantial spending.

- Urban Planning and Smart Cities: Analyzing population density, infrastructure needs, and environmental impact for efficient urban development.

- Disaster Management and Environmental Monitoring: Predicting and responding to natural disasters, monitoring climate change impacts, and managing natural resources.

- Public Service Delivery: Optimizing resource allocation for utilities, transportation, and emergency services.

The Defense and Intelligence sector also represents a dominant segment, with a continuous need for advanced geospatial capabilities in surveillance, reconnaissance, and strategic planning. The evolving geopolitical landscape necessitates sophisticated tools for real-time situational awareness and threat analysis, leading to substantial market penetration.

Type of Analysis:

- Surface Analysis: This segment is highly dominant due to its wide applicability in terrain modeling, land cover classification, and environmental impact assessments, crucial for both government and private sector applications. Its ability to extract actionable insights from raw spatial data makes it a foundational component of many geospatial workflows.

- Network Analysis: Crucial for optimizing logistics, transportation routes, and utility network management, this segment experiences strong demand, particularly from the Automotive and Transportation and Utility and Communication sectors. The ability to model flow and connectivity is paramount for efficiency.

End-user Vertical Dominance:

- Agriculture: Precision agriculture practices are increasingly adopted in France, relying heavily on geospatial analytics for crop monitoring, yield prediction, and efficient resource management, leading to significant market growth.

- Automotive and Transportation: This sector leverages geospatial analytics for route optimization, autonomous driving systems, traffic management, and the planning of new transportation infrastructure, driving substantial adoption.

- Utility and Communication: Geospatial solutions are vital for managing vast networks of power grids, telecommunications, and water supply, enabling efficient maintenance, outage detection, and network expansion.

The Automotive and Transportation sector is another major contributor, driven by the development of autonomous vehicles, smart traffic management systems, and the planning of advanced transportation infrastructure. The increasing focus on sustainability and efficiency in logistics further bolsters this segment. The Real Estate and Construction sector benefits from geospatial analytics for site selection, risk assessment, project planning, and property valuation.

France Geospatial Analytics Market Product Innovations

Product innovations in the France Geospatial Analytics Market are centered around enhancing data processing speed, accuracy, and accessibility. Key developments include the integration of AI and ML algorithms for automated feature extraction and predictive modeling, advanced LiDAR and photogrammetry processing software for highly detailed 3D reconstructions, and cloud-based platforms offering scalable analytics solutions. Companies are focusing on developing intuitive user interfaces and interoperable solutions that seamlessly integrate with existing enterprise systems. These innovations aim to provide deeper insights, streamline workflows, and empower a broader range of users with powerful geospatial capabilities, ensuring market relevance and competitive advantage.

Report Segmentation & Scope

This report segments the France Geospatial Analytics Market by Type and End-user Vertical.

Type Segments:

- Surface Analysis: This segment analyzes geographical features and their spatial relationships, encompassing digital elevation models, terrain analysis, and land cover mapping. Its market size is estimated at $550 Million for 2025, projected to grow with a CAGR of 11.8%.

- Network Analysis: This segment focuses on analyzing the flow and connectivity of networks, such as transportation routes and utility grids. The market size for this segment is projected to be $400 Million in 2025, with a CAGR of 12.2%.

- Geovisualization: This segment involves the creation and use of visual representations of geographic data to explore and communicate spatial patterns and relationships. Its market size is estimated at $300 Million for 2025, with a projected CAGR of 11.5%.

End-user Vertical Segments:

- Agriculture: Geospatial analytics aids in precision farming, crop monitoring, and yield prediction. The market size for this vertical is estimated at $450 Million for 2025, with a CAGR of 13.0%.

- Utility and Communication: This vertical utilizes geospatial solutions for network management, infrastructure monitoring, and service optimization. Its market size is projected at $420 Million for 2025, with a CAGR of 12.5%.

- Defense and Intelligence: Critical for surveillance, reconnaissance, and strategic planning, this vertical contributes significantly to market growth, with an estimated market size of $580 Million in 2025 and a CAGR of 11.9%.

- Government: Encompassing urban planning, public services, and infrastructure development, this vertical is a key market driver. Its market size is projected at $620 Million in 2025, with a CAGR of 12.8%.

- Mining and Natural Resources: Geospatial analytics supports exploration, resource assessment, and environmental management in this sector. The market size is estimated at $280 Million for 2025, with a CAGR of 11.7%.

- Automotive and Transportation: Essential for route optimization, autonomous driving, and traffic management. The market size is projected at $500 Million in 2025, with a CAGR of 12.9%.

- Healthcare: Growing applications in epidemiology, resource allocation, and public health monitoring. Its market size is estimated at $200 Million for 2025, with a CAGR of 11.5%.

- Real Estate and Construction: Used for site selection, risk assessment, and project management. The market size is projected at $350 Million in 2025, with a CAGR of 12.0%.

- Other End-user Verticals: Including retail, environmental services, and research. This segment has an estimated market size of $150 Million for 2025, with a CAGR of 11.0%.

Key Drivers of France Geospatial Analytics Market Growth

The France Geospatial Analytics Market growth is propelled by several key factors. Technological Advancements, particularly in AI, ML, IoT, and cloud computing, enable more sophisticated and accessible geospatial analysis. The increasing adoption of high-resolution satellite imagery and drone technology provides richer datasets for analysis. Government initiatives promoting digital transformation, smart cities, and sustainable development create significant demand. Furthermore, the growing need for data-driven decision-making across industries, from agriculture to defense, to optimize operations, mitigate risks, and enhance efficiency, acts as a major growth catalyst. The development of integrated geospatial platforms that offer end-to-end solutions is also a critical driver.

Challenges in the France Geospatial Analytics Market Sector

Despite the promising growth, the France Geospatial Analytics Market faces certain challenges. Data privacy and security concerns necessitate robust compliance with regulations like GDPR, potentially increasing operational costs and implementation complexities. The high cost of advanced geospatial software and hardware can be a barrier for smaller businesses. Interoperability issues between different data formats and platforms can hinder seamless integration. A shortage of skilled geospatial professionals also presents a challenge to market expansion, impacting the adoption and effective utilization of advanced technologies. Competitive pressures from established players and emerging technologies require continuous innovation and adaptation.

Leading Players in the France Geospatial Analytics Market Market

- Trimble Geospatial

- Nestwave SAS

- General Electric (GE)

- CLS Groupe

- Alphageomega sas

- ESRI Inc

- Harris Corporation

- Geomatys

- Bentley Systems Inc

- Intermap Technologies

Key Developments in France Geospatial Analytics Market Sector

- July 2023: GeoCue partnered with Escadrone, expanding GeoCue's European presence in France. Escadrone will offer TrueView 3D Imaging Sensors and LP360 LiDAR Processing Software, enhancing surveying and mapping capabilities.

- January 2023: The Agence Française de Développement (AFD) and the Government of Rwanda announced an investment deal to modernize network infrastructure and enhance digital public services. This includes establishing a geospatial hub, advancing Rwanda's drone sector, as part of the EU-AU Digital for Development Hub initiative.

Strategic France Geospatial Analytics Market Market Outlook

The strategic outlook for the France Geospatial Analytics Market is highly positive, driven by ongoing digital transformation and increasing reliance on spatial intelligence. Growth accelerators include the continued integration of AI and ML for predictive analytics, the expansion of cloud-based geospatial platforms for enhanced accessibility and scalability, and the growing demand for real-time data processing. Strategic opportunities lie in developing specialized solutions for emerging sectors like renewable energy monitoring and climate resilience planning. The market is expected to witness further consolidation through M&A activities, leading to more comprehensive service offerings. Investments in developing a skilled workforce and addressing data governance challenges will be crucial for sustained growth and market leadership. The French market is well-positioned to leverage its strong technological foundation and supportive governmental policies for continued expansion.

France Geospatial Analytics Market Segmentation

-

1. Type

- 1.1. Surface Analysis

- 1.2. Network Analysis

- 1.3. Geovisualization

-

2. End-user Vertical

- 2.1. Agriculture

- 2.2. Utility and Communication

- 2.3. Defense and Intelligence

- 2.4. Government

- 2.5. Mining and Natural Resources

- 2.6. Automotive and Transportation

- 2.7. Healthcare

- 2.8. Real Estate and Construction

- 2.9. Other End-user Verticals

France Geospatial Analytics Market Segmentation By Geography

- 1. France

France Geospatial Analytics Market Regional Market Share

Geographic Coverage of France Geospatial Analytics Market

France Geospatial Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancement in Technology; Rising Awareness of Location Based Service

- 3.3. Market Restrains

- 3.3.1. High Initial Cost in Implementing Geospatial Analytics Solutions

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of 5G in France is Boosting the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Geospatial Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Analysis

- 5.1.2. Network Analysis

- 5.1.3. Geovisualization

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Agriculture

- 5.2.2. Utility and Communication

- 5.2.3. Defense and Intelligence

- 5.2.4. Government

- 5.2.5. Mining and Natural Resources

- 5.2.6. Automotive and Transportation

- 5.2.7. Healthcare

- 5.2.8. Real Estate and Construction

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trimble Geospatial

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestwave SAS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Electric (GE)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CLS Groupe

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alphageomega sas

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ESRI Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Harris Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Geomatys

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bentley Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intermap Technologies

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Trimble Geospatial

List of Figures

- Figure 1: France Geospatial Analytics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Geospatial Analytics Market Share (%) by Company 2025

List of Tables

- Table 1: France Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: France Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: France Geospatial Analytics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: France Geospatial Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: France Geospatial Analytics Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: France Geospatial Analytics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Geospatial Analytics Market?

The projected CAGR is approximately 10.40%.

2. Which companies are prominent players in the France Geospatial Analytics Market?

Key companies in the market include Trimble Geospatial, Nestwave SAS, General Electric (GE), CLS Groupe, Alphageomega sas, ESRI Inc, Harris Corporation, Geomatys, Bentley Systems Inc, Intermap Technologies.

3. What are the main segments of the France Geospatial Analytics Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Advancement in Technology; Rising Awareness of Location Based Service.

6. What are the notable trends driving market growth?

Increasing Adoption of 5G in France is Boosting the Market Growth.

7. Are there any restraints impacting market growth?

High Initial Cost in Implementing Geospatial Analytics Solutions.

8. Can you provide examples of recent developments in the market?

July 2023: GeoCue, a leading provider of advanced geospatial software and hardware solutions, has partnered with Escadrone, an expert in autonomous robotics integration. This partnership marks an expansion of GeoCue's presence in the European market, particularly in France, where Escadrone will offer advanced-level TrueView 3D Imaging Sensors and LP360 LiDAR Processing Software. With this partnership, Escadrone will likely provide TrueView Lidar products and LP360 software, empowering its customers to enhance their surveying and mapping capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Geospatial Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Geospatial Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Geospatial Analytics Market?

To stay informed about further developments, trends, and reports in the France Geospatial Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence