Key Insights

The North America IT Services Market is projected for significant expansion. Driven by a 7.3% CAGR, the market is anticipated to reach $1309 billion by 2025. This growth is propelled by widespread digital transformation initiatives across key sectors including Manufacturing, Government, BFSI, Healthcare, Retail, and Logistics. Enterprises are leveraging IT consulting and implementation services to modernize infrastructure, adopt cloud solutions, and bolster cybersecurity. The increasing adoption of IT outsourcing and Business Process Outsourcing (BPO) by North American businesses to enhance operational efficiency and reduce costs further fuels market expansion. The region's advanced technological ecosystem and commitment to innovation foster the continuous development and adoption of sophisticated IT services.

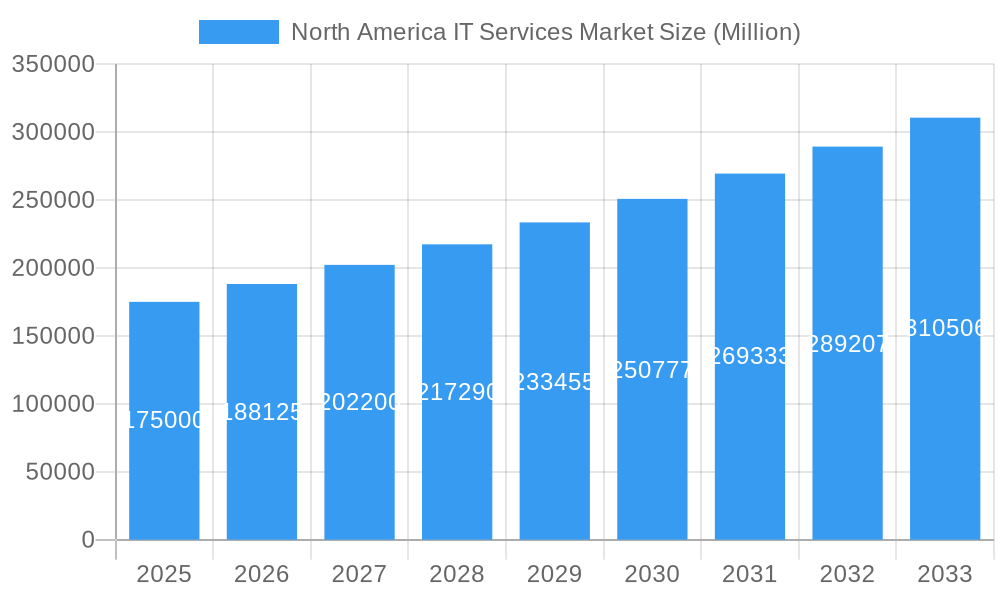

North America IT Services Market Market Size (In Million)

Key emerging trends, including the rapid adoption of Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and Big Data analytics, are fundamentally transforming the IT services landscape. These technologies empower businesses with deeper insights, process automation, and enhanced customer personalization, thereby increasing the demand for specialized IT expertise. While robust growth is evident, challenges such as a growing deficit of skilled IT professionals and escalating data privacy concerns exist. Nevertheless, strategic investments by industry leaders such as Infosys Limited, Wipro Limited, Accenture PLC, Tata Consultancy Services Limited, and Microsoft Corporation in developing new competencies and broadening service offerings are expected to address these challenges and ensure sustained market growth. The market's inherent dynamism, characterized by its adaptability to evolving business requirements, solidifies its crucial role in driving North America's economic prosperity.

North America IT Services Market Company Market Share

North America IT Services Market: Comprehensive Market Analysis and Strategic Outlook (2019–2033)

This in-depth report provides a detailed analysis of the North America IT Services Market, encompassing the period from 2019 to 2033, with a base year of 2025. We delve into market structure, industry trends, dominant segments, product innovations, segmentation scope, key growth drivers, challenges, leading players, significant developments, and a strategic market outlook. Leveraging extensive research, this report offers actionable insights for stakeholders seeking to understand and capitalize on the evolving North American IT services landscape, including critical segments like IT Consulting and Implementation, IT Outsourcing, Business Process Outsourcing, and serving end-users across Manufacturing, Government, BFSI, Healthcare, Retail and Consumer Goods, and Logistics.

North America IT Services Market Market Structure & Competitive Dynamics

The North America IT Services Market is characterized by a dynamic and competitive structure, with a moderate to high level of market concentration. Major global players, alongside agile niche providers, contribute to a vibrant ecosystem. Innovation is a key differentiator, driven by continuous investment in research and development for emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), cloud computing, and cybersecurity. Regulatory frameworks, while varying across countries, generally support the digital transformation initiatives, creating a conducive environment for IT service adoption. Product substitutes, such as in-house IT development, exist but are increasingly being overshadowed by the cost-effectiveness and specialized expertise offered by IT service providers. End-user trends reflect a strong demand for digital transformation, cloud migration, data analytics, and enhanced cybersecurity solutions across all sectors. Mergers and Acquisitions (M&A) activities are prevalent, aimed at consolidating market share, acquiring new technologies, and expanding service portfolios. Notable M&A deal values are anticipated to range from tens of millions to billions of dollars as companies strategically position themselves for future growth.

- Market Concentration: Moderately high, dominated by a few key players alongside a robust segment of specialized service providers.

- Innovation Ecosystems: Driven by a strong focus on AI, ML, cloud, and cybersecurity solutions.

- Regulatory Frameworks: Generally supportive of digital transformation, with varying regional nuances.

- Product Substitutes: In-house IT development, though increasingly less competitive against specialized IT service offerings.

- End-User Trends: Strong demand for cloud migration, digital transformation, data analytics, and robust cybersecurity.

- M&A Activities: Active, with strategic acquisitions to enhance capabilities and market reach. Anticipated M&A deal values: High.

North America IT Services Market Industry Trends & Insights

The North America IT Services Market is experiencing robust growth, fueled by several interconnected industry trends and insights. The escalating demand for digital transformation across all sectors remains a primary growth driver. Businesses are increasingly recognizing the imperative to modernize their IT infrastructure, streamline operations, and enhance customer experiences through advanced digital solutions. This trend is particularly evident in sectors like BFSI, where the adoption of FinTech solutions and digital banking is reshaping the competitive landscape, and in Healthcare, where the implementation of electronic health records (EHR) and telehealth services is revolutionizing patient care.

Technological disruptions are profoundly impacting the market. The widespread adoption of cloud computing, encompassing Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), continues to be a major growth catalyst. Companies are migrating their IT workloads to the cloud to leverage its scalability, flexibility, and cost-efficiency. Furthermore, the burgeoning field of Artificial Intelligence (AI) and Machine Learning (ML) is creating new avenues for innovation in areas such as predictive analytics, automation, and personalized customer experiences. The increasing sophistication of cyber threats necessitates enhanced cybersecurity measures, driving demand for comprehensive security services, including threat detection, prevention, and incident response.

Consumer preferences are also evolving, with a growing expectation for seamless, personalized, and secure digital interactions. This is pushing businesses to invest in customer relationship management (CRM) systems, data analytics platforms, and omnichannel customer service solutions. The remote work paradigm, accelerated by recent global events, has further amplified the need for robust collaboration tools, secure remote access solutions, and managed IT services to support distributed workforces.

Competitive dynamics are intensifying, with IT service providers differentiating themselves through specialized expertise, industry-specific solutions, and the ability to deliver end-to-end digital transformation journeys. Partnerships and collaborations are becoming increasingly strategic, enabling companies to expand their service offerings and reach new markets. The market penetration of advanced IT services is steadily increasing, with organizations across the spectrum, from large enterprises to small and medium-sized businesses (SMBs), recognizing the strategic value of outsourcing their IT functions. The projected Compound Annual Growth Rate (CAGR) for the North America IT Services Market is estimated to be around 10-12% over the forecast period, reflecting the sustained demand and ongoing digital evolution.

Dominant Markets & Segments in North America IT Services Market

The North America IT Services Market is characterized by distinct dominant regions, countries, and service segments, each contributing significantly to overall market dynamics. The United States stands out as the leading country within the North American region, driven by its advanced technological infrastructure, high digital adoption rates, significant investment in R&D, and a large concentration of industries heavily reliant on IT services. Robust economic policies fostering innovation and digital transformation, coupled with substantial government initiatives supporting technology adoption, further solidify its dominance.

Among the end-user segments, the BFSI (Banking, Financial Services, and Insurance) sector consistently emerges as a dominant force. This dominance is attributed to the sector's inherent need for secure, scalable, and efficient IT solutions to manage complex financial transactions, comply with stringent regulations, enhance customer experience through digital channels, and leverage data analytics for risk management and fraud detection. The digital transformation imperative in BFSI, driven by the rise of FinTech and changing consumer expectations, makes it a prime market for IT consulting, cloud services, cybersecurity, and data management.

The IT Consulting and Implementation segment also commands a significant share. Businesses across all industries require expert guidance and execution capabilities to navigate complex technology landscapes, from cloud migration and digital strategy development to AI integration and cybersecurity architecture. The increasing reliance on specialized knowledge to implement cutting-edge technologies makes this segment a cornerstone of the IT services market.

Key drivers underpinning the dominance of these markets and segments include:

- Economic Policies: Pro-innovation government policies, tax incentives for technology investments, and support for digital infrastructure development in countries like the United States.

- Infrastructure: Well-developed digital infrastructure, including high-speed internet connectivity and widespread cloud adoption, facilitating the delivery and consumption of IT services.

- Technological Advancement: Early adoption and rapid integration of emerging technologies such as AI, ML, IoT, and blockchain by leading industries and businesses.

- Regulatory Landscape: Evolving regulatory frameworks in sectors like BFSI and Healthcare that necessitate advanced IT solutions for compliance, data security, and operational efficiency.

- Industry-Specific Needs: Unique requirements within each end-user segment, such as the need for high-availability and robust security in BFSI, or data privacy and patient care enhancement in Healthcare, driving tailored IT service demand.

- Digital Transformation Mandate: A universal push across industries to modernize legacy systems, improve operational efficiency, and enhance customer engagement through digital means.

The Manufacturing sector is also a significant player, driven by the adoption of Industry 4.0 technologies, including IoT, automation, and AI for smart factories, supply chain optimization, and predictive maintenance. The Healthcare sector's demand for IT services is escalating with the push for telehealth, personalized medicine, and robust data security for patient information. The Retail and Consumer Goods sector leverages IT services for e-commerce, supply chain visibility, data analytics for consumer behavior, and personalized marketing. Government entities increasingly rely on IT services for digital citizen services, cybersecurity, and modernization of infrastructure. Logistics benefits from IT services for supply chain visibility, route optimization, and fleet management.

North America IT Services Market Product Innovations

Product innovations in the North America IT Services Market are primarily focused on leveraging cutting-edge technologies to deliver enhanced value and competitive advantages. Key areas of development include AI-powered automation tools for streamlining IT operations, advanced cybersecurity platforms offering proactive threat intelligence and response, and comprehensive cloud management solutions for optimizing hybrid and multi-cloud environments. We are also witnessing significant advancements in data analytics and business intelligence platforms that enable organizations to derive deeper insights from their data for informed decision-making. These innovations are designed to address the evolving needs of end-users by improving efficiency, reducing costs, enhancing security, and enabling faster innovation cycles, thereby securing a strong market fit.

Report Segmentation & Scope

This report meticulously segments the North America IT Services Market to provide a granular understanding of its dynamics. The segmentation by Type includes IT Consulting and Implementation, IT Outsourcing, Business Process Outsourcing, and Other Types, each representing distinct service offerings with unique market sizes and growth projections.

The segmentation by End-user encompasses Manufacturing, Government, BFSI, Healthcare, Retail and Consumer Goods, Logistics, and Other End-users. Each end-user segment exhibits varied adoption rates, specific demands, and competitive landscapes, impacting their respective market shares and growth trajectories. The scope of this report extends to analyzing the competitive dynamics within each of these segments, offering a comprehensive view of the market's intricate structure.

Key Drivers of North America IT Services Market Growth

Several key factors are propelling the growth of the North America IT Services Market. The relentless pursuit of digital transformation across industries is a primary driver, compelling businesses to adopt advanced technologies for operational efficiency and competitive advantage. The widespread adoption of cloud computing solutions, including IaaS, PaaS, and SaaS, offers scalability, flexibility, and cost savings, thus boosting demand for related IT services. The escalating threat landscape necessitates robust cybersecurity solutions, driving significant investment in security services. Furthermore, the growing integration of Artificial Intelligence (AI) and Machine Learning (ML) into business processes creates opportunities for specialized AI/ML IT services. Emerging technologies like IoT and blockchain are also contributing to market expansion as organizations seek to leverage them for innovation and operational improvements.

Challenges in the North America IT Services Market Sector

Despite its robust growth, the North America IT Services Market faces several challenges. Intense competition among service providers can lead to pricing pressures and impact profit margins. The rapidly evolving nature of technology requires continuous upskilling and reskilling of the workforce, posing a challenge in talent acquisition and retention. Data privacy regulations, such as GDPR and CCPA, while promoting security, can also create compliance complexities and add to the operational costs for IT service providers. Moreover, the increasing sophistication of cyber threats demands constant vigilance and investment in advanced security measures, which can be resource-intensive. Supply chain disruptions, though less direct for IT services, can impact hardware and software availability, indirectly affecting project timelines and costs.

Leading Players in the North America IT Services Market Market

- Infosys Limited

- Wipro Limited

- Accenture PLC

- Algoworks Solutions Inc

- HCL Technologies

- Capgemini SE

- Atos

- Synoptek LLC

- Microsoft Corporation

- Tata Consultancy Services Limited

- Innowise Inc

- IBM

Key Developments in North America IT Services Market Sector

- July 2022: In accordance with its agreement with the Defense Microelectronics Activity (DMEA), IBM announced a new 33-month work order to offer security services to the Department of Defense (DoD) microelectronics supply chain for important mission platforms. IBM Consulting will continue to create secure microelectronics production flows at commercial state-of-the-art fabrication facilities as part of the Trusted Foundry Access II program.

- November 2022: IBM collaborated with AWS to drive joint innovation for partners and clients. Through this collaboration, IBM Software products such as Software-as-a-Service (SaaS) will be on AWS Marketplace, making IBM solutions more accessible. IBM also collaborated with Tietoevry to develop financial services technology. Through this collaboration, Tietoevry Banking enhanced its payment solution.

Strategic North America IT Services Market Market Outlook

The strategic outlook for the North America IT Services Market remains highly positive, driven by sustained digital transformation initiatives and the increasing reliance on advanced technologies. The market is poised for significant growth as businesses across all sectors continue to invest in cloud migration, data analytics, AI, and cybersecurity. Opportunities abound for IT service providers who can offer specialized, end-to-end solutions tailored to specific industry needs. Strategic partnerships and a focus on emerging technologies like quantum computing and edge computing will be crucial for future success. The market's resilience and adaptability, coupled with a strong demand for digital innovation, indicate a promising future with ample potential for growth acceleration and market leadership.

North America IT Services Market Segmentation

-

1. Type

- 1.1. IT Consulting and Implementation

- 1.2. IT Outsourcing

- 1.3. Business Process Outsourcing

- 1.4. Other Types

-

2. End-user

- 2.1. Manufacturing

- 2.2. Government

- 2.3. BFSI

- 2.4. Healthcare

- 2.5. Retail and Consumer Goods

- 2.6. Logistics

- 2.7. Other End-users

North America IT Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America IT Services Market Regional Market Share

Geographic Coverage of North America IT Services Market

North America IT Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Acceleration of Digital Transformation Across Industries and Adoption of New Technologies; Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations

- 3.3. Market Restrains

- 3.3.1 Data Security

- 3.3.2 Customization

- 3.3.3 and Data Migration

- 3.4. Market Trends

- 3.4.1. Growing Demand for Cloud Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America IT Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. IT Consulting and Implementation

- 5.1.2. IT Outsourcing

- 5.1.3. Business Process Outsourcing

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Manufacturing

- 5.2.2. Government

- 5.2.3. BFSI

- 5.2.4. Healthcare

- 5.2.5. Retail and Consumer Goods

- 5.2.6. Logistics

- 5.2.7. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infosys Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wipro Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Accenture PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Algoworks Solutions Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HCL Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Capgemini SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Atos*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Synoptek LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Microsoft Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tata Consultancy Services Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Innowise Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 IBM

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Infosys Limited

List of Figures

- Figure 1: North America IT Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America IT Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America IT Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America IT Services Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: North America IT Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America IT Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America IT Services Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: North America IT Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America IT Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America IT Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America IT Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America IT Services Market?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the North America IT Services Market?

Key companies in the market include Infosys Limited, Wipro Limited, Accenture PLC, Algoworks Solutions Inc, HCL Technologies, Capgemini SE, Atos*List Not Exhaustive, Synoptek LLC, Microsoft Corporation, Tata Consultancy Services Limited, Innowise Inc, IBM.

3. What are the main segments of the North America IT Services Market?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 1309 billion as of 2022.

5. What are some drivers contributing to market growth?

Acceleration of Digital Transformation Across Industries and Adoption of New Technologies; Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations.

6. What are the notable trends driving market growth?

Growing Demand for Cloud Services.

7. Are there any restraints impacting market growth?

Data Security. Customization. and Data Migration.

8. Can you provide examples of recent developments in the market?

July 2022: In accordance with its agreement with the Defense Microelectronics Activity (DMEA), IBM announced a new 33-month work order to offer security services to the Department of Defense (DoD) microelectronics supply chain for important mission platforms. IBM Consulting will continue to create secure microelectronics production flows at commercial state-of-the-art fabrication facilities as part of the Trusted Foundry Access II program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America IT Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America IT Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America IT Services Market?

To stay informed about further developments, trends, and reports in the North America IT Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence