Key Insights

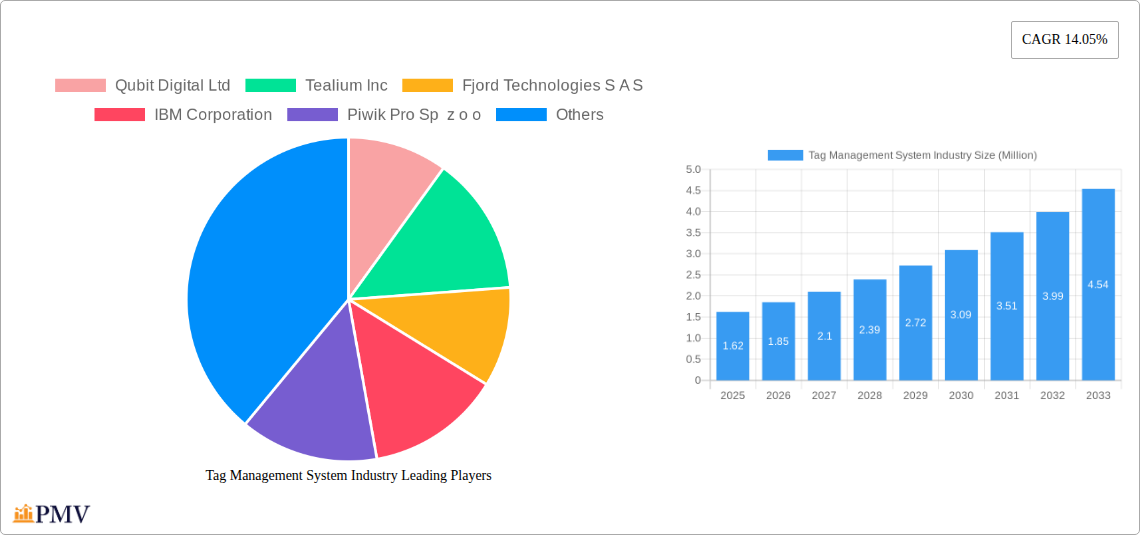

The global Tag Management System (TMS) market is experiencing robust expansion, projected to reach USD 1.62 million by 2025 and exhibit a significant Compound Annual Growth Rate (CAGR) of 14.05% during the forecast period of 2025-2033. This accelerated growth is primarily fueled by the escalating need for streamlined website analytics, enhanced user experience, and improved digital marketing campaign effectiveness across diverse industries. Businesses are increasingly recognizing the imperative of efficiently managing website tags for data collection, performance tracking, and consent management, especially in light of evolving privacy regulations. The shift towards cloud-based TMS solutions is a dominant trend, offering scalability, flexibility, and cost-efficiency, appealing to enterprises of all sizes.

Tag Management System Industry Market Size (In Million)

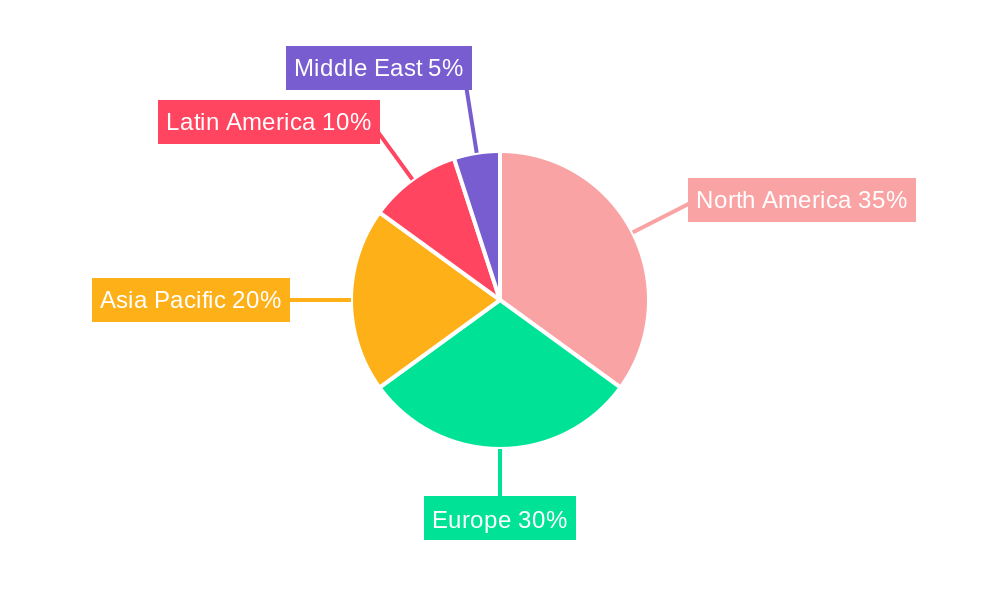

Key drivers propelling this market forward include the growing complexity of digital marketing ecosystems, the demand for real-time data insights, and the critical need for compliance with data privacy laws like GDPR and CCPA. The application segment is characterized by the dominance of Campaign Management and Content Management, with Compliance Management emerging as a rapidly growing area. The BFSI, Retail & E-commerce, and Healthcare sectors are leading the adoption of TMS solutions due to their substantial online operations and stringent data handling requirements. While the market enjoys strong growth, potential restraints such as the initial implementation costs and the need for skilled personnel to manage complex TMS platforms may pose challenges. North America and Europe currently dominate the market, but the Asia Pacific region is anticipated to witness substantial growth driven by increasing digital transformation initiatives.

Tag Management System Industry Company Market Share

Gain unparalleled insights into the global Tag Management System (TMS) industry with this comprehensive report. Covering the historical period of 2019-2024 and projecting growth through 2033, this analysis delves deep into market dynamics, key trends, dominant segments, and strategic opportunities. Understand how companies like Qubit Digital Ltd, Tealium Inc, Adobe Inc, and Google Inc are shaping the future of digital data governance. This report provides actionable intelligence for stakeholders seeking to navigate the evolving tag management solutions landscape, optimize digital marketing tags, and ensure data compliance.

Tag Management System Industry Market Structure & Competitive Dynamics

The Tag Management System market exhibits a dynamic structure characterized by a moderate to high level of competition, with key players like Adobe Inc, Google Inc, and Tealium Inc holding significant market share. Innovation ecosystems are robust, driven by the increasing demand for sophisticated tag management platforms that offer advanced features such as consent management, data governance, and privacy compliance. Regulatory frameworks, including GDPR and CCPA, are continuously shaping the market, pushing companies to adopt more secure and transparent tagging strategies. Product substitutes, while emerging, primarily focus on niche functionalities rather than comprehensive TMS capabilities. End-user trends indicate a strong preference for cloud-based solutions, fueling the growth of SaaS tag management. Mergers and acquisitions (M&A) activities are strategic, aimed at consolidating market presence and acquiring innovative technologies. For instance, M&A deal values are projected to reach tens of millions by 2025. The market concentration is evolving, with larger players leveraging their extensive resources to acquire smaller, innovative firms.

- Market Concentration: Moderate to High.

- Innovation Ecosystems: Robust, driven by data privacy and personalization needs.

- Regulatory Frameworks: Influential, particularly in data privacy (GDPR, CCPA).

- Product Substitutes: Limited comprehensive alternatives.

- End-User Trends: Strong inclination towards cloud deployments.

- M&A Activities: Strategic acquisitions for market consolidation and technology integration.

Tag Management System Industry Industry Trends & Insights

The Tag Management System industry is experiencing robust growth driven by the escalating need for efficient digital data management and enhanced user experience. The projected Compound Annual Growth Rate (CAGR) for the tag management solutions market is estimated at 15-18% during the forecast period of 2025-2033. Technological disruptions, such as the rise of AI-powered analytics and the increasing adoption of server-side tagging, are revolutionizing how businesses collect, analyze, and leverage customer data. Consumer preferences are shifting towards greater privacy and control over personal data, making privacy-centric tag management a critical differentiator. Competitive dynamics are intense, with companies focusing on offering comprehensive digital tag management features, seamless integration capabilities, and robust data governance tools. Market penetration for advanced tag management platforms is expected to reach 70-75% by 2028, as more businesses recognize the strategic importance of a unified approach to data tagging. The increasing complexity of the digital landscape, coupled with the proliferation of data sources, necessitates sophisticated web tag management solutions to ensure data accuracy, consistency, and compliance. The demand for enterprise tag management systems is particularly high in sectors that handle sensitive information, driving innovation in compliance management functionalities.

Dominant Markets & Segments in Tag Management System Industry

The Cloud deployment type is emerging as the dominant segment within the Tag Management System industry, driven by its scalability, flexibility, and cost-effectiveness. This dominance is further propelled by the increasing adoption of cloud infrastructure across various end-user industries.

- Leading Deployment Type: Cloud

- Key Drivers: Reduced infrastructure costs, enhanced accessibility, rapid deployment, and continuous updates.

- Dominance Analysis: Businesses are increasingly migrating their operations to the cloud, leading to a higher demand for cloud-native TMS solutions. Cloud TMS allows for seamless integration with other cloud-based marketing and analytics tools, further solidifying its leading position. This segment is expected to capture over 70% of the market share by 2028.

The Retail & E-commerce sector stands out as a dominant end-user for Tag Management Systems, owing to the critical need for personalized customer experiences, conversion optimization, and effective campaign management.

- Leading End-User: Retail & E-commerce

- Key Drivers: Real-time customer behavior tracking, personalized marketing campaigns, A/B testing for website optimization, and seamless integration with e-commerce platforms.

- Dominance Analysis: Retailers and e-commerce businesses rely heavily on data-driven insights to understand customer journeys, predict purchasing behavior, and optimize conversion rates. TMS enables them to efficiently manage marketing tags for analytics, advertising, and personalization, leading to increased sales and customer loyalty. The market size for TMS in this sector is projected to reach over $2 Billion by 2028.

Within applications, Campaign Management is a leading segment, underscoring the integral role of TMS in executing and optimizing digital advertising and marketing initiatives.

- Leading Application: Campaign Management

- Key Drivers: Efficient deployment and management of advertising tags (e.g., Google Ads, Facebook Ads), performance tracking of campaigns, audience segmentation, and ROI measurement.

- Dominance Analysis: Businesses use TMS extensively to streamline the process of adding, managing, and testing advertising tags across their digital properties. This allows for greater control over campaign performance, enabling marketers to allocate budgets more effectively and achieve better campaign outcomes. The demand for advanced marketing tag management is a primary growth factor.

Geographically, North America is expected to remain the dominant market due to the early adoption of digital technologies, the presence of major technology companies, and stringent data privacy regulations that necessitate robust TMS solutions.

- Dominant Region: North America

- Key Drivers: High digital penetration, advanced technological infrastructure, presence of key market players, and proactive regulatory environment.

- Dominance Analysis: North America has consistently led in the adoption of digital marketing tools and analytics solutions. The region's strong emphasis on data privacy and compliance, driven by regulations like CCPA, further fuels the demand for comprehensive TMS. The market size in North America is anticipated to exceed $3 Billion by 2028.

Tag Management System Industry Product Innovations

Product innovations in the Tag Management System industry are centered around enhancing data accuracy, improving security, and enabling seamless integration with a growing ecosystem of digital tools. Key developments include the rise of server-side tagging solutions, which offer improved performance and control over data collection, and advanced consent management platforms that ensure compliance with evolving privacy regulations. Features like automated tag auditing, real-time data validation, and AI-driven tag recommendations are becoming standard, providing users with greater efficiency and insight. These innovations empower businesses to manage their digital tags more effectively, leading to better data quality for analytics, marketing, and compliance purposes. The competitive advantage lies in offering robust, user-friendly, and secure tagging solutions that adapt to the dynamic digital landscape.

Report Segmentation & Scope

This report segments the Tag Management System market by Deployment Type, including Cloud and On-premises solutions. The Cloud segment is projected to dominate, driven by its flexibility and scalability, with a market size estimated to reach over $4 Billion by 2028. The On-premises segment, while still relevant for specific enterprise needs, is expected to grow at a slower pace.

The market is further segmented by Application, encompassing Campaign Management, Content Management, Compliance Management, and Other Applications. Campaign Management and Compliance Management are anticipated to be the fastest-growing segments, fueled by the increasing focus on marketing ROI and data privacy, respectively.

By End-User, the report analyzes the BFSI, Retail & E-commerce, Healthcare, Manufacturing, and Other End-Users segments. Retail & E-commerce is expected to lead in market share, with significant growth anticipated in the BFSI and Healthcare sectors due to their stringent data handling requirements.

Key Drivers of Tag Management System Industry Growth

The Tag Management System industry's growth is propelled by several key drivers. The escalating need for data-driven decision-making across all business functions necessitates robust tools for collecting, managing, and analyzing digital data. Evolving data privacy regulations globally, such as GDPR and CCPA, are a significant catalyst, compelling organizations to implement compliant tagging strategies and consent management. The increasing complexity of digital marketing campaigns and the proliferation of marketing technology tools also drive demand for centralized tag management solutions to ensure consistency and efficiency. Furthermore, the growing emphasis on personalized customer experiences and conversion rate optimization requires precise data capture and audience segmentation, capabilities intrinsically linked to effective TMS.

Challenges in the Tag Management System Industry Sector

Despite robust growth, the Tag Management System industry faces several challenges. Ensuring comprehensive data privacy compliance across diverse regulatory landscapes remains a significant hurdle. The technical complexity of integrating TMS with a multitude of third-party tools and maintaining tag accuracy can also pose challenges for businesses. Concerns around data security and the potential for data breaches when using external tagging solutions necessitate stringent security protocols. Additionally, the evolving digital ecosystem, with the phasing out of third-party cookies, is prompting the need for advanced and adaptable tag management strategies.

Leading Players in the Tag Management System Industry Market

- Qubit Digital Ltd

- Tealium Inc

- Fjord Technologies S A S

- IBM Corporation

- Piwik Pro Sp z o o

- Yottaa Inc

- Hub'Scan Inc

- Datalicious Pty Ltd

- Adobe Inc

- Oracle Corporation

- OpenX Software Ltd

- Ensighten Inc

- Google Inc

- Signal Group Inc

Key Developments in Tag Management System Industry Sector

- September 2023: Atlan launched Tag Management, a new way for data teams to manage data access across the modern data stack. Tags are essential metadata that can be assigned to data assets to monitor sensitive data for discovery, compliance, and protection use cases. With the launch of Tag Management, Atlan enables bi-directional tag movement in and out of Atlan. This means data teams can start using Atlan as the control plane for tags, ensuring that data assets in Atlan are tagged and protected everywhere in the data ecosystem.

- March 2022: Mouse Flow and Google Tag jointly developed Tag Management Software for E-commerce companies, where users can integrate the shopping cart value into a Mouseflow recording variable to monitor further the value of conversions and the possible loss of sales. This will enable the retailer to fix the problems that are costing money.

Strategic Tag Management System Industry Market Outlook

The strategic outlook for the Tag Management System industry remains highly positive, fueled by the persistent digital transformation across all sectors. Future growth will be accelerated by the increasing demand for unified data governance and sophisticated digital tag auditing. Opportunities lie in developing more intuitive tag management solutions that cater to a broader range of technical expertise and in offering enhanced privacy management features that provide businesses with greater control and transparency. The shift towards server-side tagging and the exploration of alternative tracking methods will also shape the market. Companies that can offer integrated platforms for tag deployment, data quality management, and compliance assurance will be well-positioned for sustained success in this dynamic market.

Tag Management System Industry Segmentation

-

1. Deployment Type

- 1.1. Cloud

- 1.2. On-premises

-

2. Application

- 2.1. Campaign Management

- 2.2. Content Management

- 2.3. Compliance Management

- 2.4. Other Applications

-

3. End-User

- 3.1. BFSI

- 3.2. Retail & E-commerce

- 3.3. Healthcare

- 3.4. Manufacturing

- 3.5. Other End-Users

Tag Management System Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. Japan

- 3.2. India

- 3.3. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

- 5. Middle East

Tag Management System Industry Regional Market Share

Geographic Coverage of Tag Management System Industry

Tag Management System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. User-friendly and Feature-packed Software; Better Customer Experience Deliverance; Ability to Build a Unified Ecosystem

- 3.3. Market Restrains

- 3.3.1. High Initial Fee for Tag Management Systems

- 3.4. Market Trends

- 3.4.1. Tag Management Systems to Play a Significant Role in Retail and E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tag Management System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. Cloud

- 5.1.2. On-premises

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Campaign Management

- 5.2.2. Content Management

- 5.2.3. Compliance Management

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. BFSI

- 5.3.2. Retail & E-commerce

- 5.3.3. Healthcare

- 5.3.4. Manufacturing

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. North America Tag Management System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6.1.1. Cloud

- 6.1.2. On-premises

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Campaign Management

- 6.2.2. Content Management

- 6.2.3. Compliance Management

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. BFSI

- 6.3.2. Retail & E-commerce

- 6.3.3. Healthcare

- 6.3.4. Manufacturing

- 6.3.5. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7. Europe Tag Management System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7.1.1. Cloud

- 7.1.2. On-premises

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Campaign Management

- 7.2.2. Content Management

- 7.2.3. Compliance Management

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. BFSI

- 7.3.2. Retail & E-commerce

- 7.3.3. Healthcare

- 7.3.4. Manufacturing

- 7.3.5. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8. Asia Pacific Tag Management System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8.1.1. Cloud

- 8.1.2. On-premises

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Campaign Management

- 8.2.2. Content Management

- 8.2.3. Compliance Management

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. BFSI

- 8.3.2. Retail & E-commerce

- 8.3.3. Healthcare

- 8.3.4. Manufacturing

- 8.3.5. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9. Latin America Tag Management System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9.1.1. Cloud

- 9.1.2. On-premises

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Campaign Management

- 9.2.2. Content Management

- 9.2.3. Compliance Management

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. BFSI

- 9.3.2. Retail & E-commerce

- 9.3.3. Healthcare

- 9.3.4. Manufacturing

- 9.3.5. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10. Middle East Tag Management System Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10.1.1. Cloud

- 10.1.2. On-premises

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Campaign Management

- 10.2.2. Content Management

- 10.2.3. Compliance Management

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. BFSI

- 10.3.2. Retail & E-commerce

- 10.3.3. Healthcare

- 10.3.4. Manufacturing

- 10.3.5. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Qubit Digital Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tealium Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fjord Technologies S A S

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Piwik Pro Sp z o o

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yottaa Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hub'Scan Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Datalicious Pty Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Adobe Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oracle Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OpenX Software Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ensighten Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Google Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Signal Group Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Qubit Digital Ltd

List of Figures

- Figure 1: Global Tag Management System Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Tag Management System Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Tag Management System Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 4: North America Tag Management System Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 5: North America Tag Management System Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 6: North America Tag Management System Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 7: North America Tag Management System Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Tag Management System Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Tag Management System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Tag Management System Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Tag Management System Industry Revenue (Million), by End-User 2025 & 2033

- Figure 12: North America Tag Management System Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 13: North America Tag Management System Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 14: North America Tag Management System Industry Volume Share (%), by End-User 2025 & 2033

- Figure 15: North America Tag Management System Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Tag Management System Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Tag Management System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Tag Management System Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Tag Management System Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 20: Europe Tag Management System Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 21: Europe Tag Management System Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 22: Europe Tag Management System Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 23: Europe Tag Management System Industry Revenue (Million), by Application 2025 & 2033

- Figure 24: Europe Tag Management System Industry Volume (K Unit), by Application 2025 & 2033

- Figure 25: Europe Tag Management System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Tag Management System Industry Volume Share (%), by Application 2025 & 2033

- Figure 27: Europe Tag Management System Industry Revenue (Million), by End-User 2025 & 2033

- Figure 28: Europe Tag Management System Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 29: Europe Tag Management System Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe Tag Management System Industry Volume Share (%), by End-User 2025 & 2033

- Figure 31: Europe Tag Management System Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Tag Management System Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Tag Management System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Tag Management System Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Tag Management System Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 36: Asia Pacific Tag Management System Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 37: Asia Pacific Tag Management System Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 38: Asia Pacific Tag Management System Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 39: Asia Pacific Tag Management System Industry Revenue (Million), by Application 2025 & 2033

- Figure 40: Asia Pacific Tag Management System Industry Volume (K Unit), by Application 2025 & 2033

- Figure 41: Asia Pacific Tag Management System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 42: Asia Pacific Tag Management System Industry Volume Share (%), by Application 2025 & 2033

- Figure 43: Asia Pacific Tag Management System Industry Revenue (Million), by End-User 2025 & 2033

- Figure 44: Asia Pacific Tag Management System Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 45: Asia Pacific Tag Management System Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Asia Pacific Tag Management System Industry Volume Share (%), by End-User 2025 & 2033

- Figure 47: Asia Pacific Tag Management System Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Tag Management System Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Tag Management System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Tag Management System Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Tag Management System Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 52: Latin America Tag Management System Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 53: Latin America Tag Management System Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 54: Latin America Tag Management System Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 55: Latin America Tag Management System Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Latin America Tag Management System Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: Latin America Tag Management System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Latin America Tag Management System Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Latin America Tag Management System Industry Revenue (Million), by End-User 2025 & 2033

- Figure 60: Latin America Tag Management System Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 61: Latin America Tag Management System Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 62: Latin America Tag Management System Industry Volume Share (%), by End-User 2025 & 2033

- Figure 63: Latin America Tag Management System Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Latin America Tag Management System Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Latin America Tag Management System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Tag Management System Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East Tag Management System Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 68: Middle East Tag Management System Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 69: Middle East Tag Management System Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 70: Middle East Tag Management System Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 71: Middle East Tag Management System Industry Revenue (Million), by Application 2025 & 2033

- Figure 72: Middle East Tag Management System Industry Volume (K Unit), by Application 2025 & 2033

- Figure 73: Middle East Tag Management System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 74: Middle East Tag Management System Industry Volume Share (%), by Application 2025 & 2033

- Figure 75: Middle East Tag Management System Industry Revenue (Million), by End-User 2025 & 2033

- Figure 76: Middle East Tag Management System Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 77: Middle East Tag Management System Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 78: Middle East Tag Management System Industry Volume Share (%), by End-User 2025 & 2033

- Figure 79: Middle East Tag Management System Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East Tag Management System Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East Tag Management System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East Tag Management System Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tag Management System Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 2: Global Tag Management System Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 3: Global Tag Management System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Tag Management System Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Tag Management System Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Tag Management System Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Global Tag Management System Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Tag Management System Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Tag Management System Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 10: Global Tag Management System Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 11: Global Tag Management System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Tag Management System Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Global Tag Management System Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 14: Global Tag Management System Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 15: Global Tag Management System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Tag Management System Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global Tag Management System Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 22: Global Tag Management System Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 23: Global Tag Management System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Tag Management System Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 25: Global Tag Management System Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 26: Global Tag Management System Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 27: Global Tag Management System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Tag Management System Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Tag Management System Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 38: Global Tag Management System Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 39: Global Tag Management System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Tag Management System Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Global Tag Management System Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 42: Global Tag Management System Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 43: Global Tag Management System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Tag Management System Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: Japan Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Rest of Asia Pacific Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Asia Pacific Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Global Tag Management System Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 52: Global Tag Management System Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 53: Global Tag Management System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 54: Global Tag Management System Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 55: Global Tag Management System Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 56: Global Tag Management System Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 57: Global Tag Management System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Tag Management System Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 59: Mexico Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Mexico Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Brazil Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Brazil Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Rest of Latin America Tag Management System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Latin America Tag Management System Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Global Tag Management System Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 66: Global Tag Management System Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 67: Global Tag Management System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 68: Global Tag Management System Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 69: Global Tag Management System Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 70: Global Tag Management System Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 71: Global Tag Management System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Tag Management System Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tag Management System Industry?

The projected CAGR is approximately 14.05%.

2. Which companies are prominent players in the Tag Management System Industry?

Key companies in the market include Qubit Digital Ltd, Tealium Inc, Fjord Technologies S A S, IBM Corporation, Piwik Pro Sp z o o, Yottaa Inc, Hub'Scan Inc, Datalicious Pty Ltd, Adobe Inc, Oracle Corporation, OpenX Software Ltd, Ensighten Inc, Google Inc, Signal Group Inc.

3. What are the main segments of the Tag Management System Industry?

The market segments include Deployment Type, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.62 Million as of 2022.

5. What are some drivers contributing to market growth?

User-friendly and Feature-packed Software; Better Customer Experience Deliverance; Ability to Build a Unified Ecosystem.

6. What are the notable trends driving market growth?

Tag Management Systems to Play a Significant Role in Retail and E-commerce Sector.

7. Are there any restraints impacting market growth?

High Initial Fee for Tag Management Systems.

8. Can you provide examples of recent developments in the market?

September 2023 : Atlan launched Tag Management, a new way for data teams to manage data access across the modern data stack. Tags are essential metadata that can be assigned to data assets to monitor sensitive data for discovery, compliance, and protection use cases. With the launch of Tag Management, Atlan enables bi-directional tag movement in and out of Atlan. This means data teams can start using Atlan as the control plane for tags, ensuring that data assets in Atlan are tagged and protected everywhere in the data ecosystem.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tag Management System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tag Management System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tag Management System Industry?

To stay informed about further developments, trends, and reports in the Tag Management System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence