Key Insights

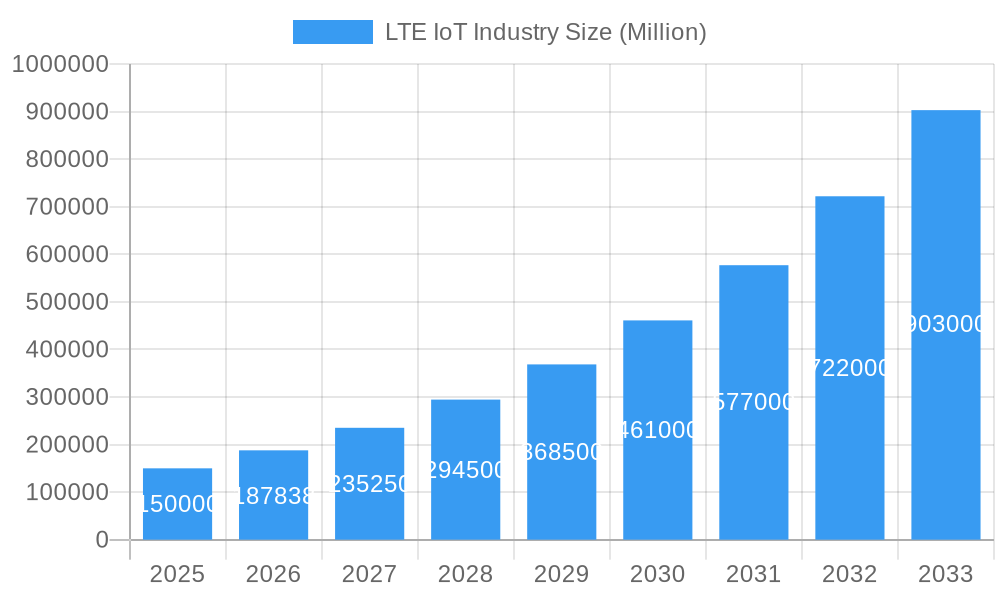

The LTE IoT market is demonstrating significant expansion, with a projected market size of $21.1 billion by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 13.2%, anticipated to continue through 2033. Key catalysts for this surge include escalating demand for connected devices across industries, widespread adoption of Industrial IoT (IIoT), smart city initiatives, and growth in consumer electronics. Advancements in LTE technologies, specifically NB-IoT and LTE-M, facilitate cost-effective connectivity for diverse applications. The increasing need for real-time data analytics, remote monitoring, and automation in sectors such as IT & Telecommunication, Retail, Healthcare, and Industrial environments are primary contributors to this market dynamic.

LTE IoT Industry Market Size (In Billion)

While the market shows a strong upward trend, potential restraints include network infrastructure upgrades and standardization challenges, particularly in emerging economies, and the initial deployment costs of large-scale IoT solutions. Security and data privacy remain critical considerations being actively addressed by industry players. Nevertheless, the market is positioned for sustained growth, amplified by ongoing innovation in IoT platforms and the integration of AI and machine learning. The competitive landscape features major telecommunication companies, chipset manufacturers, and specialized IoT solution providers, driving advancements and strategic partnerships.

LTE IoT Industry Company Market Share

LTE IoT Industry Market Analysis & Forecast: 2019-2033

Explore the dynamic LTE IoT landscape with this comprehensive market report. Analyzing the LTE IoT industry from 2019 to 2033, this report offers actionable insights into market structure, growth drivers, key segments, and competitive dynamics. With a base year of 2025 and a forecast to 2033, this analysis is crucial for stakeholders seeking to leverage the Internet of Things (IoT) evolution powered by LTE connectivity. Understand the pivotal roles of NB-IoT (Cat-NB1) and LTE-M (eMTC Cat-M1), their impact across industries like IT & Telecommunication, Consumer Electronics, Retail, Healthcare, and Industrial applications, and gain strategic foresight into emerging trends.

LTE IoT Industry Market Structure & Competitive Dynamics

The global LTE IoT industry exhibits a dynamic market structure characterized by intense competition and strategic collaborations. Market concentration varies, with leading players like u-blox AG, Telefonaktiebolaget LM Ericsson, Sequans Communications S A, AT&T Inc, Qualcomm Technologies Inc, PureSoftware, Verizon Communications, TELUS Corporation, MediaTek Inc, Cisco System Inc (Jasper), Cradlepoint Inc, and Gemalto N V driving innovation and market share. These companies are at the forefront of developing advanced LTE IoT solutions, including NB-IoT and LTE-M modules, driving the adoption of IoT devices across various sectors. Innovation ecosystems are thriving, fueled by consistent R&D investments and the emergence of specialized IoT platforms. Regulatory frameworks, while evolving, continue to shape deployment strategies, influencing network standards and device certification processes. Product substitutes, such as 5G IoT, are emerging but LTE IoT currently holds a significant market position due to its established infrastructure and cost-effectiveness for many applications. End-user trends point towards an increasing demand for real-time data analytics, remote monitoring, and automated processes, further accelerating IoT market growth. Merger and acquisition (M&A) activities are strategic, aiming to consolidate market positions, expand technological portfolios, and enhance global reach. For instance, significant M&A deal values are observed as companies seek to integrate specialized IoT capabilities and expand their service offerings in the managed IoT services and professional IoT services segments. Market share shifts are driven by technological advancements, successful product launches, and strategic partnerships, all contributing to the complex and competitive nature of the LTE IoT market.

LTE IoT Industry Industry Trends & Insights

The LTE IoT industry is experiencing unprecedented growth, propelled by a confluence of technological advancements, evolving consumer preferences, and expanding enterprise adoption. The increasing demand for connected devices in smart cities, industrial automation, and connected vehicles is a primary growth driver. LTE-M and NB-IoT technologies are instrumental in enabling low-power, wide-area network (LPWAN) communication, making them ideal for battery-operated IoT devices that require long operational lifespans and cost-effective connectivity. This has led to a significant market penetration of IoT solutions in sectors like Healthcare, where remote patient monitoring devices rely on reliable and efficient connectivity. The IT & Telecommunication sector is not only a provider of connectivity but also a major consumer of IoT solutions, leveraging them for network management and infrastructure optimization.

Technological disruptions, including the continuous refinement of LTE standards and the integration with cloud platforms, are enhancing the capabilities and performance of IoT ecosystems. The development of more sophisticated data analytics and artificial intelligence (AI) integrated into IoT platforms allows for deeper insights and more intelligent decision-making. Consumer preferences are shifting towards smart home devices, wearable technology, and connected appliances, further boosting the Consumer Electronics segment's reliance on LTE IoT. The Retail (Digital Ecommerce) sector is increasingly adopting IoT for inventory management, supply chain visibility, and enhanced customer experiences through personalized offers and smart store operations.

Competitive dynamics are intensifying as new players enter the market and existing ones expand their offerings. Companies are focusing on providing end-to-end IoT solutions, encompassing hardware, software, and managed IoT services, to meet the diverse needs of their clientele. The projected Compound Annual Growth Rate (CAGR) for the LTE IoT market indicates a robust expansion trajectory, driven by the continuous innovation and the growing recognition of IoT's value proposition across industries. The ongoing evolution of network infrastructure and the increasing availability of affordable IoT modules are further catalyzing this growth, making LTE IoT a cornerstone of the digital transformation journey for businesses worldwide. The report projects sustained double-digit growth in the coming years, emphasizing the strategic importance of investing in LTE IoT solutions.

Dominant Markets & Segments in LTE IoT Industry

The LTE IoT industry's dominance is a multifaceted phenomenon, with specific regions, countries, and segments showcasing significant leadership and growth potential. North America, particularly the United States, often leads in the adoption and deployment of advanced LTE IoT solutions, driven by robust telecommunications infrastructure, significant investments in smart city initiatives, and a strong enterprise demand for Industrial IoT applications. Economic policies fostering technological innovation and substantial government backing for smart infrastructure development contribute to this regional dominance.

In terms of Product Type, both NB-IoT (Cat-NB1) and LTE-M (eMTC Cat-M1) are crucial, with their dominance varying by application. NB-IoT excels in applications requiring deep indoor penetration and ultra-low power consumption, such as smart metering and asset tracking in remote locations. Conversely, LTE-M offers higher data rates and lower latency, making it preferable for applications like wearables, asset management with real-time location services, and connected vehicles. The choice between them is dictated by specific connectivity requirements and cost considerations.

The IT & Telecommunication sector stands out as a dominant end-user industry, not only as a service provider but also as a significant adopter of IoT for network optimization, predictive maintenance, and enhanced customer service offerings. Consumer Electronics is another rapidly expanding segment, with the proliferation of smart home devices, personal health trackers, and connected entertainment systems driving demand for seamless LTE connectivity. The Retail (Digital Ecommerce) sector is increasingly leveraging IoT for supply chain management, inventory tracking, and in-store analytics, enhancing operational efficiency and customer engagement. Healthcare is witnessing substantial growth in the adoption of remote patient monitoring, connected medical devices, and hospital asset tracking, underpinned by the reliability of LTE IoT. The Industrial sector, encompassing manufacturing, energy, and logistics, is a cornerstone of LTE IoT adoption, with applications ranging from predictive maintenance and automated production lines to smart grids and fleet management. Key drivers for dominance in these segments include the availability of advanced communication networks, supportive regulatory environments, and a clear return on investment for implemented IoT solutions. The Other End-user Industries segment, encompassing agriculture, transportation, and smart buildings, also shows significant growth.

LTE IoT Industry Product Innovations

LTE IoT is witnessing a surge in product innovations focused on enhancing device efficiency, connectivity robustness, and data security. Manufacturers are developing more compact and power-efficient LTE IoT modules that support both NB-IoT and LTE-M standards, catering to a wider range of low-power applications. Innovations in antenna design and integrated chipsets are improving signal strength and reducing form factors, crucial for widespread adoption in the Consumer Electronics and Healthcare sectors. Edge computing capabilities are being integrated into IoT devices, enabling localized data processing and reducing latency, which is particularly beneficial for real-time applications in the Industrial and Retail sectors. Furthermore, enhanced security features, including hardware-based encryption and secure boot processes, are being incorporated to address growing concerns about data breaches and network vulnerabilities in the increasingly connected world. These advancements are critical for the continued expansion of the LTE IoT market.

Report Segmentation & Scope

This comprehensive report segments the LTE IoT industry across crucial categories to provide granular insights. The Service segment is analyzed into Professional Services, encompassing design, integration, and consulting for IoT solutions, and Managed Services, which include ongoing network monitoring, maintenance, and support. Product Type segmentation focuses on NB-IoT (Cat-NB1), optimized for low-power, wide-area communication, and LTE-M (eMTC Cat-M1), offering higher throughput and lower latency. The End-user Industry segmentation provides in-depth analysis of adoption trends and market dynamics within IT & Telecommunication, Consumer Electronics, Retail (Digital Ecommerce), Healthcare, Industrial, and Other End-user Industries. Each segment's market size, growth projections, and competitive landscape are meticulously detailed. The report's scope encompasses the global LTE IoT market, with a detailed examination of historical data from 2019-2024, a base year analysis for 2025, and a comprehensive forecast period from 2025-2033, projecting the future trajectory of this vital technology.

Key Drivers of LTE IoT Industry Growth

The LTE IoT industry's growth is propelled by several interconnected factors. Technologically, the maturation and widespread availability of LTE networks, including the specific capabilities of NB-IoT and LTE-M, are foundational. These technologies offer cost-effective, low-power, and reliable connectivity solutions crucial for a vast array of IoT applications. Economic factors, such as the decreasing cost of IoT modules and sensors, coupled with increasing investments in digital transformation initiatives by enterprises across various sectors, are significant accelerators. Regulatory support, including spectrum allocation for IoT services and initiatives promoting smart infrastructure, further fosters market expansion. For instance, the increasing adoption of connected devices in smart cities for traffic management and public safety, driven by government mandates and investments, directly fuels growth. The growing demand for real-time data and analytics in sectors like Healthcare and Retail also plays a pivotal role.

Challenges in the LTE IoT Industry Sector

Despite its promising growth, the LTE IoT industry faces several significant challenges. Regulatory hurdles, including varying standards and certification processes across different regions, can slow down global deployments and increase complexity for manufacturers. Supply chain issues, particularly concerning the availability of critical components and semiconductors, can lead to production delays and impact market availability, as evidenced by recent global disruptions. Competitive pressures from emerging technologies like 5G IoT, while offering greater capabilities, also present a challenge as industries evaluate migration strategies. Security concerns remain paramount; ensuring the integrity and privacy of vast amounts of data generated by connected devices is a complex undertaking, requiring robust cybersecurity measures. Furthermore, the integration of diverse IoT devices and platforms can be technically challenging, demanding specialized expertise and interoperability solutions.

Leading Players in the LTE IoT Industry Market

- u-blox AG

- Telefonaktiebolaget LM Ericsson

- Sequans Communications S A

- AT&T Inc

- Qualcomm Technologies Inc

- PureSoftware

- Verizon Communications

- TELUS Corporation

- MediaTek Inc

- Cisco System Inc (Jasper)

- Cradlepoint Inc

- Gemalto N V

Key Developments in LTE IoT Industry Sector

- June 2022: System Loco selected the Aeris Intelligent IoT network to provide next-generation connectivity that includes LTE-M, NB-IoT, LTE, and 2G/3G coverage from 600 carriers globally to offer a dynamic and flexible connectivity solution that ensures that all demands from current and future networks are met to support and manage the worldwide track and trace of smart pallets employed by System Loco's customers throughout the world. This development underscores the growing demand for comprehensive and versatile connectivity solutions in asset tracking.

- April 2022: UScellular Collaborated with Qualcomm and Inseego to Launch 5G mmWave High-Speed Internet Service to provide high-speed internet access wirelessly to customers' homes or businesses. Inseego Wavemaker FW2010 outdoor CPE delivers multi-gigabit download speeds for data-hungry applications and supports 5G sub-6 GHz and Cat 22 LTE, making it great for a wide range of locations and applications. This initiative highlights the evolution of LTE capabilities and its integration with emerging 5G technologies, enhancing high-speed data delivery for consumers and businesses.

Strategic LTE IoT Industry Market Outlook

The strategic outlook for the LTE IoT industry remains exceptionally strong, driven by the continuous evolution of connected devices and the ever-expanding need for efficient data transmission. Future market potential is immense, particularly in areas like smart agriculture, advanced industrial automation, and the continued growth of the Internet of Medical Things (IoMT). Key growth accelerators include the ongoing development of smarter, more integrated IoT platforms that combine connectivity, analytics, and AI, enabling predictive capabilities and proactive decision-making. Strategic opportunities lie in addressing niche market needs with specialized NB-IoT and LTE-M solutions, fostering partnerships across the value chain to create end-to-end IoT ecosystems, and investing in enhanced cybersecurity measures to build trust and encourage wider adoption. The seamless integration of LTE IoT with emerging technologies like 5G will further unlock new applications and revenue streams, solidifying its position as a critical enabler of the digital economy.

LTE IoT Industry Segmentation

-

1. Service

- 1.1. Professional

- 1.2. Managed

-

2. Product Type

- 2.1. NB-IoT (Cat-NB1)

- 2.2. LTE-M (eMTC Cat-M1)

-

3. End-user Industry

- 3.1. IT & Telecommunication

- 3.2. Consumer Electronics

- 3.3. Retail (Digital Ecommerce)

- 3.4. Healthcare

- 3.5. Industrial

- 3.6. Other End-user Industries

LTE IoT Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

LTE IoT Industry Regional Market Share

Geographic Coverage of LTE IoT Industry

LTE IoT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for High-speed Broadband Connectivity; Rising Demand for the Industrial IoT among End-user Industries

- 3.3. Market Restrains

- 3.3.1. Reduction in PC Demand

- 3.4. Market Trends

- 3.4.1. Industrial Sector is Expected to Grow at a Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LTE IoT Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Professional

- 5.1.2. Managed

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. NB-IoT (Cat-NB1)

- 5.2.2. LTE-M (eMTC Cat-M1)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT & Telecommunication

- 5.3.2. Consumer Electronics

- 5.3.3. Retail (Digital Ecommerce)

- 5.3.4. Healthcare

- 5.3.5. Industrial

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America LTE IoT Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Professional

- 6.1.2. Managed

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. NB-IoT (Cat-NB1)

- 6.2.2. LTE-M (eMTC Cat-M1)

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. IT & Telecommunication

- 6.3.2. Consumer Electronics

- 6.3.3. Retail (Digital Ecommerce)

- 6.3.4. Healthcare

- 6.3.5. Industrial

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe LTE IoT Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Professional

- 7.1.2. Managed

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. NB-IoT (Cat-NB1)

- 7.2.2. LTE-M (eMTC Cat-M1)

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. IT & Telecommunication

- 7.3.2. Consumer Electronics

- 7.3.3. Retail (Digital Ecommerce)

- 7.3.4. Healthcare

- 7.3.5. Industrial

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific LTE IoT Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Professional

- 8.1.2. Managed

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. NB-IoT (Cat-NB1)

- 8.2.2. LTE-M (eMTC Cat-M1)

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. IT & Telecommunication

- 8.3.2. Consumer Electronics

- 8.3.3. Retail (Digital Ecommerce)

- 8.3.4. Healthcare

- 8.3.5. Industrial

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Rest of the World LTE IoT Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Professional

- 9.1.2. Managed

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. NB-IoT (Cat-NB1)

- 9.2.2. LTE-M (eMTC Cat-M1)

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. IT & Telecommunication

- 9.3.2. Consumer Electronics

- 9.3.3. Retail (Digital Ecommerce)

- 9.3.4. Healthcare

- 9.3.5. Industrial

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 u-blox AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Telefonaktiebolaget LM Ericsson

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sequans Communications S A

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 AT&T Inc *List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Qualcomm Technologies Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 PureSoftware

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Verizon Communications

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TELUS Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 MediaTek Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Cisco Syatem Inc (Jasper)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Cradlepoint Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Gemalto N V

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 u-blox AG

List of Figures

- Figure 1: Global LTE IoT Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America LTE IoT Industry Revenue (billion), by Service 2025 & 2033

- Figure 3: North America LTE IoT Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America LTE IoT Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America LTE IoT Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America LTE IoT Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: North America LTE IoT Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America LTE IoT Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America LTE IoT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe LTE IoT Industry Revenue (billion), by Service 2025 & 2033

- Figure 11: Europe LTE IoT Industry Revenue Share (%), by Service 2025 & 2033

- Figure 12: Europe LTE IoT Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 13: Europe LTE IoT Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe LTE IoT Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe LTE IoT Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe LTE IoT Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe LTE IoT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific LTE IoT Industry Revenue (billion), by Service 2025 & 2033

- Figure 19: Asia Pacific LTE IoT Industry Revenue Share (%), by Service 2025 & 2033

- Figure 20: Asia Pacific LTE IoT Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Asia Pacific LTE IoT Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Pacific LTE IoT Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific LTE IoT Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific LTE IoT Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific LTE IoT Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World LTE IoT Industry Revenue (billion), by Service 2025 & 2033

- Figure 27: Rest of the World LTE IoT Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Rest of the World LTE IoT Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Rest of the World LTE IoT Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Rest of the World LTE IoT Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World LTE IoT Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Rest of the World LTE IoT Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World LTE IoT Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LTE IoT Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global LTE IoT Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global LTE IoT Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global LTE IoT Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global LTE IoT Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Global LTE IoT Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global LTE IoT Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global LTE IoT Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global LTE IoT Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Global LTE IoT Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global LTE IoT Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global LTE IoT Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global LTE IoT Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Global LTE IoT Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 15: Global LTE IoT Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Global LTE IoT Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global LTE IoT Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global LTE IoT Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 19: Global LTE IoT Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global LTE IoT Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LTE IoT Industry?

The projected CAGR is approximately 13.2%.

2. Which companies are prominent players in the LTE IoT Industry?

Key companies in the market include u-blox AG, Telefonaktiebolaget LM Ericsson, Sequans Communications S A, AT&T Inc *List Not Exhaustive, Qualcomm Technologies Inc, PureSoftware, Verizon Communications, TELUS Corporation, MediaTek Inc, Cisco Syatem Inc (Jasper), Cradlepoint Inc, Gemalto N V.

3. What are the main segments of the LTE IoT Industry?

The market segments include Service, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for High-speed Broadband Connectivity; Rising Demand for the Industrial IoT among End-user Industries.

6. What are the notable trends driving market growth?

Industrial Sector is Expected to Grow at a Significant Rate.

7. Are there any restraints impacting market growth?

Reduction in PC Demand.

8. Can you provide examples of recent developments in the market?

June 2022 - System Loco selected the Aeris Intelligent IoT network to provide next-generation connectivity that includes LTE-M, NB-IoT, LTE, and 2G/3G coverage from 600 carriers globally to offer a dynamic and flexible connectivity solution that ensures that all demands from current and future networks are met to support and manage the worldwide track and trace of smart pallets employed by System Loco's customers throughout the world.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LTE IoT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LTE IoT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LTE IoT Industry?

To stay informed about further developments, trends, and reports in the LTE IoT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence