Key Insights

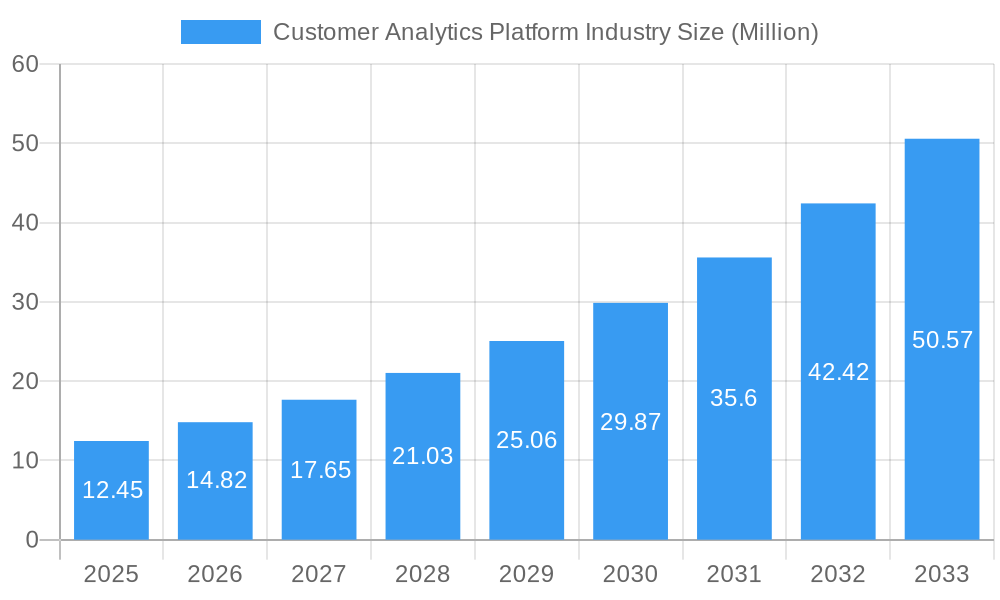

The Customer Analytics Platform market is poised for significant expansion, projected to reach an impressive $12.45 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 19.01% anticipated throughout the forecast period of 2025-2033. This dynamic growth is fueled by a confluence of powerful drivers, most notably the escalating need for businesses across all sectors to gain deeper insights into customer behavior, preferences, and journey mapping. The proliferation of digital touchpoints and the resulting surge in customer data necessitate sophisticated platforms that can effectively ingest, process, and analyze this information. Furthermore, the increasing adoption of AI and machine learning technologies within customer analytics is empowering organizations to move beyond descriptive analysis to predictive and prescriptive insights, enabling proactive customer engagement strategies and personalized experiences. The imperative to enhance customer retention, optimize marketing spend, and drive revenue growth through data-driven decision-making is a primary catalyst propelling market advancement.

Customer Analytics Platform Industry Market Size (In Million)

The market's trajectory is further shaped by several key trends, including the rising demand for real-time analytics capabilities, allowing businesses to respond instantaneously to evolving customer needs and market shifts. The integration of Voice of the Customer (VOC) solutions is becoming paramount, enabling companies to systematically capture and analyze customer feedback from various channels. Cloud-based deployment models are dominating, offering scalability, flexibility, and cost-effectiveness. In terms of solutions, Social Media Analytical Tools and Web Analytical Tools are experiencing substantial uptake, alongside the continued importance of Dashboard and Reporting Tools for visualizing complex data. While the market is experiencing strong tailwinds, certain restraints, such as data privacy concerns and the complexity of integrating disparate data sources, require careful navigation. However, the overwhelming market potential, driven by the continuous quest for enhanced customer understanding and loyalty, suggests a highly promising future for the Customer Analytics Platform industry.

Customer Analytics Platform Industry Company Market Share

Gain a comprehensive understanding of the dynamic Customer Analytics Platform Industry with this in-depth report, meticulously crafted to provide actionable insights for industry leaders, strategists, and investors. Covering the historical period of 2019–2024 and extending to a detailed forecast period of 2025–2033, this report analyzes market trends, competitive landscapes, and future growth trajectories. We delve into the intricate details of customer data platform (CDP) solutions, AI in customer analytics, machine learning for customer insights, and data-driven marketing strategies, offering an unparalleled view of how businesses are leveraging customer intelligence to drive revenue and enhance customer experience. The report forecasts the market to reach xx Million by 2033, with a Compound Annual Growth Rate (CAGR) of xx% from the base year of 2025.

Customer Analytics Platform Industry Market Structure & Competitive Dynamics

The Customer Analytics Platform Industry is characterized by a moderate to high market concentration, with a mix of established technology giants and specialized customer analytics software providers. Key players like Microsoft, Oracle, IBM, and Salesforce Inc. command significant market share through their extensive product portfolios and robust global presence. However, the rise of innovative SaaS customer analytics platforms from companies such as Adobe, Alteryx, and niche players like Angoss Software Corporation, SAS Institute Inc. (SAS), Axtria, NGDATA NV, and Manthan Software Services Pvt Ltd ensures a vibrant competitive landscape. The innovation ecosystem is fueled by continuous advancements in AI and machine learning, leading to the development of more sophisticated customer insight tools and predictive analytics solutions. Regulatory frameworks, particularly data privacy laws like GDPR and CCPA, significantly influence market dynamics, pushing for enhanced data governance and security features within customer data management platforms. Product substitutes, including traditional Business Intelligence (BI) tools and standalone data visualization software, exist but often lack the integrated capabilities of dedicated customer analytics solutions. End-user trends are increasingly favoring cloud-based analytics for scalability and flexibility. Mergers and Acquisitions (M&A) activities are strategic, with larger firms acquiring innovative startups to enhance their customer 360 capabilities and expand their market reach. For example, Bridgei2i Analytics Solution (Accenture)’s strategic integrations underscore the trend of consolidation and capability enhancement. The market is projected to see a steady stream of M&A deals valued in the hundreds of Million annually, further shaping the competitive arena.

Customer Analytics Platform Industry Industry Trends & Insights

The Customer Analytics Platform Industry is experiencing robust growth, driven by the escalating need for businesses to understand and cater to individual customer needs in an increasingly competitive digital landscape. The pervasive adoption of AI and machine learning is revolutionizing how customer data is analyzed, enabling advanced predictive analytics, personalized marketing campaigns, and improved customer service. The demand for Voice of Customer (VOC) solutions is soaring, as companies prioritize collecting and acting upon customer feedback across all touchpoints to foster loyalty and enhance brand reputation. This trend is further amplified by the exponential growth in digital channels, leading to a surge in the adoption of Web Analytical Tools and Social Media Analytical Tools to glean insights from online interactions. The Customer Analytics Platform Industry is witnessing a significant shift towards cloud-based deployment models, offering greater scalability, cost-efficiency, and accessibility for businesses of all sizes. This transition facilitates the seamless integration of ETL (Extract, Transform, and Load) processes and Analytical Modules/Tools, empowering organizations to derive actionable insights from vast datasets in near real-time. The market penetration of customer analytics solutions is expected to reach over xx% by 2033, with the Telecommunications and IT and BFSI sectors leading in adoption due to their data-intensive nature and the criticality of customer retention. The report highlights a projected CAGR of xx% during the forecast period, underscoring the immense growth potential. Evolving consumer preferences for hyper-personalization and seamless customer journeys are compelling businesses to invest heavily in sophisticated customer relationship management (CRM) analytics and customer data platforms (CDP). Competitive dynamics are intensifying, with a constant race to innovate and offer more comprehensive, integrated customer analytics solutions. Companies are increasingly focusing on providing managed services and professional services to support clients in effectively implementing and leveraging these powerful platforms, further driving market expansion. The emergence of specialized customer segmentation tools and customer journey analytics further fuels this trend.

Dominant Markets & Segments in Customer Analytics Platform Industry

The Customer Analytics Platform Industry is witnessing significant dominance across several key segments and geographical regions.

Deployment Type:

- Cloud-based deployment is the most dominant segment, driven by its inherent scalability, cost-effectiveness, and agility. The flexibility to access powerful customer analytics tools from anywhere and the reduced IT overhead make it the preferred choice for most organizations, particularly Small and Medium Enterprises (SMEs) and rapidly growing businesses.

- On-premise deployment, while still relevant for highly regulated industries with stringent data sovereignty requirements, represents a smaller but stable segment.

Solution:

- Analytical Modules/Tools form the core of the market, encompassing a wide array of functionalities including predictive modeling, segmentation, and churn analysis.

- Dashboard and Reporting Tools are critical for visualizing insights and communicating findings to stakeholders, making them highly sought after.

- Voice of Customer (VOC) solutions are rapidly gaining traction as businesses prioritize customer feedback for service improvement and product development.

- Web Analytical Tools and Social Media Analytical Tools are essential for understanding online customer behavior and engagement.

- ETL (Extract, Transform, and Load) solutions are foundational, enabling the seamless integration and preparation of diverse data sources for analysis.

Organization Size:

- Large Enterprises are major contributors to market revenue, owing to their extensive data volumes and sophisticated analytical needs. Their investments in comprehensive customer intelligence platforms are substantial.

- Small and Medium Enterprises (SMEs) represent a rapidly growing segment, increasingly adopting affordable and scalable SaaS customer analytics solutions to compete effectively.

Service:

- Managed Service offerings are gaining prominence as organizations seek to outsource the complexities of data management and analytics to specialized providers, ensuring optimal utilization of customer analytics platforms.

- Professional Service, including consulting, implementation, and training, remains crucial for successful deployment and adoption of these advanced solutions.

End-user Industry:

- Telecommunications and IT and BFSI (Banking, Financial Services, and Insurance) sectors are leading the adoption of customer analytics platforms. These industries are characterized by high volumes of customer data, intense competition, and a strong focus on customer retention and personalized offerings.

- Retail is another significant sector, leveraging analytics for inventory management, personalized promotions, and enhanced customer experiences.

- Media and Entertainment, Healthcare, Travel and Hospitality, and Manufacturing are emerging as key growth areas, with increasing recognition of the value of customer insights.

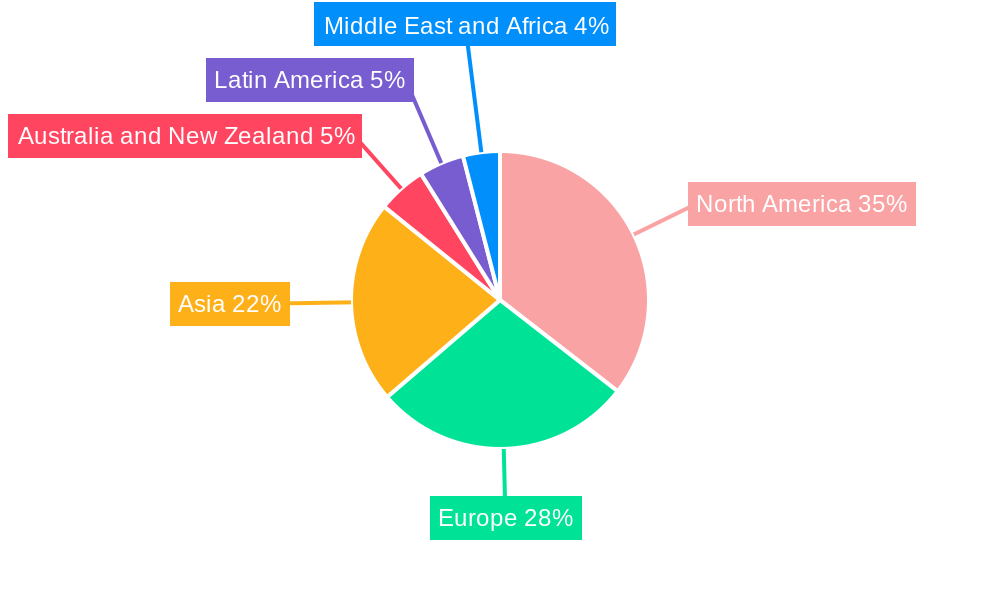

Regional Dominance: North America currently leads the market, driven by technological advancements, a mature digital economy, and significant investment in AI-powered analytics. Asia Pacific is projected to be the fastest-growing region due to increasing digitalization, a burgeoning middle class, and the rapid adoption of mobile technologies.

Customer Analytics Platform Industry Product Innovations

Recent product innovations in the Customer Analytics Platform Industry are heavily focused on augmenting AI and machine learning capabilities to deliver deeper, more predictive customer insights. Companies are developing solutions that automate complex analytical tasks, enabling faster decision-making and personalized customer engagement. Key advancements include the integration of natural language processing (NLP) for analyzing unstructured data like customer reviews, and the creation of self-service analytics tools that empower business users without deep technical expertise. The focus is on building integrated customer data platforms (CDPs) that can unify disparate data sources, providing a true customer 360 view. These innovations aim to enhance competitive advantages by offering businesses the ability to anticipate customer needs, optimize marketing spend, and improve customer lifetime value through hyper-personalized experiences and proactive service.

Report Segmentation & Scope

This report comprehensively segments the Customer Analytics Platform Industry across critical dimensions. The Deployment Type segment includes On-premise and Cloud-based solutions, analyzing their respective market sizes and growth projections. The Solution segmentation covers Social Media Analytical Tools, Web Analytical Tools, Dashboard and Reporting Tools, Voice of Customer (VOC), ETL (Extract, Transform, and Load), and Analytical Modules/Tools, detailing their market penetration and competitive dynamics. The Organization Size segment differentiates between Small and Medium Enterprises (SMEs) and Large Enterprises, assessing their investment patterns and adoption rates. Furthermore, the report examines the Service offerings, namely Managed Service and Professional Service, and their impact on market growth. The End-user Industry segmentation is extensive, encompassing Telecommunications and IT, Travel and Hospitality, Retail, BFSI, Media and Entertainment, Healthcare, Transportation and Logistics, Manufacturing, and Other End-user Industries, providing granular insights into sector-specific adoption trends and future potential. Each segment is analyzed for its projected market share and key growth drivers within the forecast period of 2025–2033.

Key Drivers of Customer Analytics Platform Industry Growth

The growth of the Customer Analytics Platform Industry is propelled by several critical factors. The pervasive digital transformation across industries mandates a deeper understanding of customer behavior, driving demand for sophisticated customer analytics software. The exponential increase in available customer data from various touchpoints, including online interactions, transactions, and social media, necessitates advanced tools for analysis and insight generation. Furthermore, the growing emphasis on delivering personalized customer experiences to enhance loyalty and retention is a significant growth accelerator. The rapid advancements in Artificial Intelligence (AI) and Machine Learning (ML) are enabling more powerful predictive analytics and automation capabilities, making customer analytics platforms indispensable. Economic factors, such as the need for improved marketing ROI and operational efficiency, also contribute to market expansion. Regulatory drivers, while sometimes posing challenges, also spur innovation in data privacy and compliance features within these platforms.

Challenges in the Customer Analytics Platform Industry Sector

Despite its strong growth trajectory, the Customer Analytics Platform Industry faces several challenges. The complexity of data integration from disparate sources remains a significant hurdle for many organizations, often requiring substantial ETL effort and expertise. Data privacy concerns and evolving regulatory landscapes, such as GDPR and CCPA, necessitate robust compliance measures and can lead to increased implementation costs and operational complexities. A shortage of skilled data scientists and analysts capable of effectively leveraging advanced customer analytics tools can hinder widespread adoption and optimal utilization. Competitive pressures among vendors lead to rapid product evolution, requiring continuous investment in R&D and potential integration challenges for users. Furthermore, the upfront investment in sophisticated customer analytics platforms can be a barrier for some Small and Medium Enterprises (SMEs).

Leading Players in the Customer Analytics Platform Industry Market

- Angoss Software Corporation

- SAS Institute Inc.

- Microsoft

- Axtria

- Aruba Networks Inc (Hewlett Packard Enterprise Development LP)

- NGDATA NV

- Teoco Corporation

- Salesforce Inc.

- Bridgei2i Analytics Solution (Accenture)

- Manthan Software Services Pvt Ltd

- Pitney Bowes Inc.

- Adobe

- Alteryx

- Oracle

- IBM

Key Developments in Customer Analytics Platform Industry Sector

- January 2022: SAS launched SAS Customer Intelligence 360, a new tool that automatically identifies better solutions for searching for common qualities in customer data. Using AI and machine learning, this integrated customer analytics enhances customer insights. It also offers out-of-the-box analytical automation support to help clients make better decisions, respond faster, and create income more quickly.

- June 2022: Acquia, a digital experience firm, partnered with Workato, an integration and workflow automation platform, to offer enterprise access to Acquia Customer Data Platform (CDP). Organizations may link Acquia CDP with hundreds of external cloud services via secure, enterprise-grade APIs using out-of-the-box connectors. Businesses can connect Acquia CDP to hundreds of other cloud services through secure, enterprise-grade APIs and pre-built connectors.

Strategic Customer Analytics Platform Industry Market Outlook

The strategic outlook for the Customer Analytics Platform Industry is exceptionally strong, driven by the unwavering demand for data-driven decision-making and enhanced customer engagement. The increasing adoption of AI and machine learning will continue to fuel innovation, leading to more sophisticated and predictive analytical capabilities. The continued migration towards cloud-based solutions will expand market accessibility, particularly for Small and Medium Enterprises (SMEs). Strategic opportunities lie in developing integrated customer data platforms (CDPs) that offer a unified view of the customer and seamless data integration. Companies that focus on providing robust Voice of Customer (VOC) solutions and personalized customer journey analytics will be well-positioned for success. The growing importance of data privacy and ethical data usage presents an opportunity for vendors to differentiate themselves through transparent and compliant platforms. The expanding application of customer analytics across diverse end-user industries, from traditional sectors like BFSI and Retail to emerging fields like IoT and healthcare, indicates significant untapped market potential and avenues for strategic growth.

Customer Analytics Platform Industry Segmentation

-

1. Deployment Type

- 1.1. On-premise

- 1.2. Cloud-based

-

2. Solution

- 2.1. Social Media Analytical Tools

- 2.2. Web Analytical Tools

- 2.3. Dashboard and Reporting Tools

- 2.4. Voice of Customer (VOC)

- 2.5. ETL (Extract, Transform, and Load)

- 2.6. Analytical Modules/Tools

-

3. Organization Size

- 3.1. Small and Medium Enterprises

- 3.2. Large Enterprises

-

4. Service

- 4.1. Managed Service

- 4.2. Professional Service

-

5. End-user Industry

- 5.1. Telecommunications and IT

- 5.2. Travel and Hospitality

- 5.3. Retail

- 5.4. BFSI

- 5.5. Media and Entertainment

- 5.6. Healthcare

- 5.7. Transportation and Logistics

- 5.8. Manufacturing

- 5.9. Other End-user Industries

Customer Analytics Platform Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Customer Analytics Platform Industry Regional Market Share

Geographic Coverage of Customer Analytics Platform Industry

Customer Analytics Platform Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Improved Customer Satisfaction; Increase in Social Media Concern to Address Customer Behavior

- 3.3. Market Restrains

- 3.3.1. Data Security and Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Growing Retail Sector to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Customer Analytics Platform Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. On-premise

- 5.1.2. Cloud-based

- 5.2. Market Analysis, Insights and Forecast - by Solution

- 5.2.1. Social Media Analytical Tools

- 5.2.2. Web Analytical Tools

- 5.2.3. Dashboard and Reporting Tools

- 5.2.4. Voice of Customer (VOC)

- 5.2.5. ETL (Extract, Transform, and Load)

- 5.2.6. Analytical Modules/Tools

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Small and Medium Enterprises

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Service

- 5.4.1. Managed Service

- 5.4.2. Professional Service

- 5.5. Market Analysis, Insights and Forecast - by End-user Industry

- 5.5.1. Telecommunications and IT

- 5.5.2. Travel and Hospitality

- 5.5.3. Retail

- 5.5.4. BFSI

- 5.5.5. Media and Entertainment

- 5.5.6. Healthcare

- 5.5.7. Transportation and Logistics

- 5.5.8. Manufacturing

- 5.5.9. Other End-user Industries

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia

- 5.6.4. Australia and New Zealand

- 5.6.5. Latin America

- 5.6.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. North America Customer Analytics Platform Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6.1.1. On-premise

- 6.1.2. Cloud-based

- 6.2. Market Analysis, Insights and Forecast - by Solution

- 6.2.1. Social Media Analytical Tools

- 6.2.2. Web Analytical Tools

- 6.2.3. Dashboard and Reporting Tools

- 6.2.4. Voice of Customer (VOC)

- 6.2.5. ETL (Extract, Transform, and Load)

- 6.2.6. Analytical Modules/Tools

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. Small and Medium Enterprises

- 6.3.2. Large Enterprises

- 6.4. Market Analysis, Insights and Forecast - by Service

- 6.4.1. Managed Service

- 6.4.2. Professional Service

- 6.5. Market Analysis, Insights and Forecast - by End-user Industry

- 6.5.1. Telecommunications and IT

- 6.5.2. Travel and Hospitality

- 6.5.3. Retail

- 6.5.4. BFSI

- 6.5.5. Media and Entertainment

- 6.5.6. Healthcare

- 6.5.7. Transportation and Logistics

- 6.5.8. Manufacturing

- 6.5.9. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7. Europe Customer Analytics Platform Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7.1.1. On-premise

- 7.1.2. Cloud-based

- 7.2. Market Analysis, Insights and Forecast - by Solution

- 7.2.1. Social Media Analytical Tools

- 7.2.2. Web Analytical Tools

- 7.2.3. Dashboard and Reporting Tools

- 7.2.4. Voice of Customer (VOC)

- 7.2.5. ETL (Extract, Transform, and Load)

- 7.2.6. Analytical Modules/Tools

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. Small and Medium Enterprises

- 7.3.2. Large Enterprises

- 7.4. Market Analysis, Insights and Forecast - by Service

- 7.4.1. Managed Service

- 7.4.2. Professional Service

- 7.5. Market Analysis, Insights and Forecast - by End-user Industry

- 7.5.1. Telecommunications and IT

- 7.5.2. Travel and Hospitality

- 7.5.3. Retail

- 7.5.4. BFSI

- 7.5.5. Media and Entertainment

- 7.5.6. Healthcare

- 7.5.7. Transportation and Logistics

- 7.5.8. Manufacturing

- 7.5.9. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8. Asia Customer Analytics Platform Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8.1.1. On-premise

- 8.1.2. Cloud-based

- 8.2. Market Analysis, Insights and Forecast - by Solution

- 8.2.1. Social Media Analytical Tools

- 8.2.2. Web Analytical Tools

- 8.2.3. Dashboard and Reporting Tools

- 8.2.4. Voice of Customer (VOC)

- 8.2.5. ETL (Extract, Transform, and Load)

- 8.2.6. Analytical Modules/Tools

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. Small and Medium Enterprises

- 8.3.2. Large Enterprises

- 8.4. Market Analysis, Insights and Forecast - by Service

- 8.4.1. Managed Service

- 8.4.2. Professional Service

- 8.5. Market Analysis, Insights and Forecast - by End-user Industry

- 8.5.1. Telecommunications and IT

- 8.5.2. Travel and Hospitality

- 8.5.3. Retail

- 8.5.4. BFSI

- 8.5.5. Media and Entertainment

- 8.5.6. Healthcare

- 8.5.7. Transportation and Logistics

- 8.5.8. Manufacturing

- 8.5.9. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9. Australia and New Zealand Customer Analytics Platform Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9.1.1. On-premise

- 9.1.2. Cloud-based

- 9.2. Market Analysis, Insights and Forecast - by Solution

- 9.2.1. Social Media Analytical Tools

- 9.2.2. Web Analytical Tools

- 9.2.3. Dashboard and Reporting Tools

- 9.2.4. Voice of Customer (VOC)

- 9.2.5. ETL (Extract, Transform, and Load)

- 9.2.6. Analytical Modules/Tools

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. Small and Medium Enterprises

- 9.3.2. Large Enterprises

- 9.4. Market Analysis, Insights and Forecast - by Service

- 9.4.1. Managed Service

- 9.4.2. Professional Service

- 9.5. Market Analysis, Insights and Forecast - by End-user Industry

- 9.5.1. Telecommunications and IT

- 9.5.2. Travel and Hospitality

- 9.5.3. Retail

- 9.5.4. BFSI

- 9.5.5. Media and Entertainment

- 9.5.6. Healthcare

- 9.5.7. Transportation and Logistics

- 9.5.8. Manufacturing

- 9.5.9. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10. Latin America Customer Analytics Platform Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10.1.1. On-premise

- 10.1.2. Cloud-based

- 10.2. Market Analysis, Insights and Forecast - by Solution

- 10.2.1. Social Media Analytical Tools

- 10.2.2. Web Analytical Tools

- 10.2.3. Dashboard and Reporting Tools

- 10.2.4. Voice of Customer (VOC)

- 10.2.5. ETL (Extract, Transform, and Load)

- 10.2.6. Analytical Modules/Tools

- 10.3. Market Analysis, Insights and Forecast - by Organization Size

- 10.3.1. Small and Medium Enterprises

- 10.3.2. Large Enterprises

- 10.4. Market Analysis, Insights and Forecast - by Service

- 10.4.1. Managed Service

- 10.4.2. Professional Service

- 10.5. Market Analysis, Insights and Forecast - by End-user Industry

- 10.5.1. Telecommunications and IT

- 10.5.2. Travel and Hospitality

- 10.5.3. Retail

- 10.5.4. BFSI

- 10.5.5. Media and Entertainment

- 10.5.6. Healthcare

- 10.5.7. Transportation and Logistics

- 10.5.8. Manufacturing

- 10.5.9. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11. Middle East and Africa Customer Analytics Platform Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11.1.1. On-premise

- 11.1.2. Cloud-based

- 11.2. Market Analysis, Insights and Forecast - by Solution

- 11.2.1. Social Media Analytical Tools

- 11.2.2. Web Analytical Tools

- 11.2.3. Dashboard and Reporting Tools

- 11.2.4. Voice of Customer (VOC)

- 11.2.5. ETL (Extract, Transform, and Load)

- 11.2.6. Analytical Modules/Tools

- 11.3. Market Analysis, Insights and Forecast - by Organization Size

- 11.3.1. Small and Medium Enterprises

- 11.3.2. Large Enterprises

- 11.4. Market Analysis, Insights and Forecast - by Service

- 11.4.1. Managed Service

- 11.4.2. Professional Service

- 11.5. Market Analysis, Insights and Forecast - by End-user Industry

- 11.5.1. Telecommunications and IT

- 11.5.2. Travel and Hospitality

- 11.5.3. Retail

- 11.5.4. BFSI

- 11.5.5. Media and Entertainment

- 11.5.6. Healthcare

- 11.5.7. Transportation and Logistics

- 11.5.8. Manufacturing

- 11.5.9. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Deployment Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Angoss Software Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SAS Institute Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Microsoft

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Axtria

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Aruba Networks Inc (Hewlett Packard Enterprise Development LP)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NGDATA NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Teoco Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Salesforce Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Bridgei2i Analytics Solution (Accenture)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Manthan Software Services Pvt Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Pitney Bowes Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Adobe

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Alteryx

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Oracle

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 IBM

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Angoss Software Corporation

List of Figures

- Figure 1: Global Customer Analytics Platform Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Customer Analytics Platform Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Customer Analytics Platform Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 4: North America Customer Analytics Platform Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 5: North America Customer Analytics Platform Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 6: North America Customer Analytics Platform Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 7: North America Customer Analytics Platform Industry Revenue (Million), by Solution 2025 & 2033

- Figure 8: North America Customer Analytics Platform Industry Volume (K Unit), by Solution 2025 & 2033

- Figure 9: North America Customer Analytics Platform Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 10: North America Customer Analytics Platform Industry Volume Share (%), by Solution 2025 & 2033

- Figure 11: North America Customer Analytics Platform Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 12: North America Customer Analytics Platform Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 13: North America Customer Analytics Platform Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: North America Customer Analytics Platform Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 15: North America Customer Analytics Platform Industry Revenue (Million), by Service 2025 & 2033

- Figure 16: North America Customer Analytics Platform Industry Volume (K Unit), by Service 2025 & 2033

- Figure 17: North America Customer Analytics Platform Industry Revenue Share (%), by Service 2025 & 2033

- Figure 18: North America Customer Analytics Platform Industry Volume Share (%), by Service 2025 & 2033

- Figure 19: North America Customer Analytics Platform Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: North America Customer Analytics Platform Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: North America Customer Analytics Platform Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: North America Customer Analytics Platform Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: North America Customer Analytics Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Customer Analytics Platform Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: North America Customer Analytics Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Customer Analytics Platform Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Customer Analytics Platform Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 28: Europe Customer Analytics Platform Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 29: Europe Customer Analytics Platform Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 30: Europe Customer Analytics Platform Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 31: Europe Customer Analytics Platform Industry Revenue (Million), by Solution 2025 & 2033

- Figure 32: Europe Customer Analytics Platform Industry Volume (K Unit), by Solution 2025 & 2033

- Figure 33: Europe Customer Analytics Platform Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 34: Europe Customer Analytics Platform Industry Volume Share (%), by Solution 2025 & 2033

- Figure 35: Europe Customer Analytics Platform Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 36: Europe Customer Analytics Platform Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 37: Europe Customer Analytics Platform Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: Europe Customer Analytics Platform Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 39: Europe Customer Analytics Platform Industry Revenue (Million), by Service 2025 & 2033

- Figure 40: Europe Customer Analytics Platform Industry Volume (K Unit), by Service 2025 & 2033

- Figure 41: Europe Customer Analytics Platform Industry Revenue Share (%), by Service 2025 & 2033

- Figure 42: Europe Customer Analytics Platform Industry Volume Share (%), by Service 2025 & 2033

- Figure 43: Europe Customer Analytics Platform Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Europe Customer Analytics Platform Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Europe Customer Analytics Platform Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Europe Customer Analytics Platform Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Europe Customer Analytics Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Customer Analytics Platform Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe Customer Analytics Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Customer Analytics Platform Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Customer Analytics Platform Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 52: Asia Customer Analytics Platform Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 53: Asia Customer Analytics Platform Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 54: Asia Customer Analytics Platform Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 55: Asia Customer Analytics Platform Industry Revenue (Million), by Solution 2025 & 2033

- Figure 56: Asia Customer Analytics Platform Industry Volume (K Unit), by Solution 2025 & 2033

- Figure 57: Asia Customer Analytics Platform Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 58: Asia Customer Analytics Platform Industry Volume Share (%), by Solution 2025 & 2033

- Figure 59: Asia Customer Analytics Platform Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 60: Asia Customer Analytics Platform Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 61: Asia Customer Analytics Platform Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 62: Asia Customer Analytics Platform Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 63: Asia Customer Analytics Platform Industry Revenue (Million), by Service 2025 & 2033

- Figure 64: Asia Customer Analytics Platform Industry Volume (K Unit), by Service 2025 & 2033

- Figure 65: Asia Customer Analytics Platform Industry Revenue Share (%), by Service 2025 & 2033

- Figure 66: Asia Customer Analytics Platform Industry Volume Share (%), by Service 2025 & 2033

- Figure 67: Asia Customer Analytics Platform Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 68: Asia Customer Analytics Platform Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 69: Asia Customer Analytics Platform Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 70: Asia Customer Analytics Platform Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 71: Asia Customer Analytics Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 72: Asia Customer Analytics Platform Industry Volume (K Unit), by Country 2025 & 2033

- Figure 73: Asia Customer Analytics Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Asia Customer Analytics Platform Industry Volume Share (%), by Country 2025 & 2033

- Figure 75: Australia and New Zealand Customer Analytics Platform Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 76: Australia and New Zealand Customer Analytics Platform Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 77: Australia and New Zealand Customer Analytics Platform Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 78: Australia and New Zealand Customer Analytics Platform Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 79: Australia and New Zealand Customer Analytics Platform Industry Revenue (Million), by Solution 2025 & 2033

- Figure 80: Australia and New Zealand Customer Analytics Platform Industry Volume (K Unit), by Solution 2025 & 2033

- Figure 81: Australia and New Zealand Customer Analytics Platform Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 82: Australia and New Zealand Customer Analytics Platform Industry Volume Share (%), by Solution 2025 & 2033

- Figure 83: Australia and New Zealand Customer Analytics Platform Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 84: Australia and New Zealand Customer Analytics Platform Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 85: Australia and New Zealand Customer Analytics Platform Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 86: Australia and New Zealand Customer Analytics Platform Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 87: Australia and New Zealand Customer Analytics Platform Industry Revenue (Million), by Service 2025 & 2033

- Figure 88: Australia and New Zealand Customer Analytics Platform Industry Volume (K Unit), by Service 2025 & 2033

- Figure 89: Australia and New Zealand Customer Analytics Platform Industry Revenue Share (%), by Service 2025 & 2033

- Figure 90: Australia and New Zealand Customer Analytics Platform Industry Volume Share (%), by Service 2025 & 2033

- Figure 91: Australia and New Zealand Customer Analytics Platform Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 92: Australia and New Zealand Customer Analytics Platform Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 93: Australia and New Zealand Customer Analytics Platform Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 94: Australia and New Zealand Customer Analytics Platform Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 95: Australia and New Zealand Customer Analytics Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 96: Australia and New Zealand Customer Analytics Platform Industry Volume (K Unit), by Country 2025 & 2033

- Figure 97: Australia and New Zealand Customer Analytics Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Australia and New Zealand Customer Analytics Platform Industry Volume Share (%), by Country 2025 & 2033

- Figure 99: Latin America Customer Analytics Platform Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 100: Latin America Customer Analytics Platform Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 101: Latin America Customer Analytics Platform Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 102: Latin America Customer Analytics Platform Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 103: Latin America Customer Analytics Platform Industry Revenue (Million), by Solution 2025 & 2033

- Figure 104: Latin America Customer Analytics Platform Industry Volume (K Unit), by Solution 2025 & 2033

- Figure 105: Latin America Customer Analytics Platform Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 106: Latin America Customer Analytics Platform Industry Volume Share (%), by Solution 2025 & 2033

- Figure 107: Latin America Customer Analytics Platform Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 108: Latin America Customer Analytics Platform Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 109: Latin America Customer Analytics Platform Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 110: Latin America Customer Analytics Platform Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 111: Latin America Customer Analytics Platform Industry Revenue (Million), by Service 2025 & 2033

- Figure 112: Latin America Customer Analytics Platform Industry Volume (K Unit), by Service 2025 & 2033

- Figure 113: Latin America Customer Analytics Platform Industry Revenue Share (%), by Service 2025 & 2033

- Figure 114: Latin America Customer Analytics Platform Industry Volume Share (%), by Service 2025 & 2033

- Figure 115: Latin America Customer Analytics Platform Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 116: Latin America Customer Analytics Platform Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 117: Latin America Customer Analytics Platform Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 118: Latin America Customer Analytics Platform Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 119: Latin America Customer Analytics Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 120: Latin America Customer Analytics Platform Industry Volume (K Unit), by Country 2025 & 2033

- Figure 121: Latin America Customer Analytics Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 122: Latin America Customer Analytics Platform Industry Volume Share (%), by Country 2025 & 2033

- Figure 123: Middle East and Africa Customer Analytics Platform Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 124: Middle East and Africa Customer Analytics Platform Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 125: Middle East and Africa Customer Analytics Platform Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 126: Middle East and Africa Customer Analytics Platform Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 127: Middle East and Africa Customer Analytics Platform Industry Revenue (Million), by Solution 2025 & 2033

- Figure 128: Middle East and Africa Customer Analytics Platform Industry Volume (K Unit), by Solution 2025 & 2033

- Figure 129: Middle East and Africa Customer Analytics Platform Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 130: Middle East and Africa Customer Analytics Platform Industry Volume Share (%), by Solution 2025 & 2033

- Figure 131: Middle East and Africa Customer Analytics Platform Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 132: Middle East and Africa Customer Analytics Platform Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 133: Middle East and Africa Customer Analytics Platform Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 134: Middle East and Africa Customer Analytics Platform Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 135: Middle East and Africa Customer Analytics Platform Industry Revenue (Million), by Service 2025 & 2033

- Figure 136: Middle East and Africa Customer Analytics Platform Industry Volume (K Unit), by Service 2025 & 2033

- Figure 137: Middle East and Africa Customer Analytics Platform Industry Revenue Share (%), by Service 2025 & 2033

- Figure 138: Middle East and Africa Customer Analytics Platform Industry Volume Share (%), by Service 2025 & 2033

- Figure 139: Middle East and Africa Customer Analytics Platform Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 140: Middle East and Africa Customer Analytics Platform Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 141: Middle East and Africa Customer Analytics Platform Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 142: Middle East and Africa Customer Analytics Platform Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 143: Middle East and Africa Customer Analytics Platform Industry Revenue (Million), by Country 2025 & 2033

- Figure 144: Middle East and Africa Customer Analytics Platform Industry Volume (K Unit), by Country 2025 & 2033

- Figure 145: Middle East and Africa Customer Analytics Platform Industry Revenue Share (%), by Country 2025 & 2033

- Figure 146: Middle East and Africa Customer Analytics Platform Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Customer Analytics Platform Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 2: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 3: Global Customer Analytics Platform Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 4: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Solution 2020 & 2033

- Table 5: Global Customer Analytics Platform Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 6: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 7: Global Customer Analytics Platform Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 9: Global Customer Analytics Platform Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Customer Analytics Platform Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Customer Analytics Platform Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 13: Global Customer Analytics Platform Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 14: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 15: Global Customer Analytics Platform Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 16: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Solution 2020 & 2033

- Table 17: Global Customer Analytics Platform Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 18: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 19: Global Customer Analytics Platform Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 20: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 21: Global Customer Analytics Platform Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Customer Analytics Platform Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Customer Analytics Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Customer Analytics Platform Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 26: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 27: Global Customer Analytics Platform Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 28: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Solution 2020 & 2033

- Table 29: Global Customer Analytics Platform Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 30: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 31: Global Customer Analytics Platform Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 32: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 33: Global Customer Analytics Platform Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Customer Analytics Platform Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Customer Analytics Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Global Customer Analytics Platform Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 38: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 39: Global Customer Analytics Platform Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 40: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Solution 2020 & 2033

- Table 41: Global Customer Analytics Platform Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 42: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 43: Global Customer Analytics Platform Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 44: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 45: Global Customer Analytics Platform Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Customer Analytics Platform Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Customer Analytics Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Global Customer Analytics Platform Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 50: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 51: Global Customer Analytics Platform Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 52: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Solution 2020 & 2033

- Table 53: Global Customer Analytics Platform Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 54: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 55: Global Customer Analytics Platform Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 56: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 57: Global Customer Analytics Platform Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 58: Global Customer Analytics Platform Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 59: Global Customer Analytics Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Global Customer Analytics Platform Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 62: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 63: Global Customer Analytics Platform Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 64: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Solution 2020 & 2033

- Table 65: Global Customer Analytics Platform Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 66: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 67: Global Customer Analytics Platform Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 68: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 69: Global Customer Analytics Platform Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 70: Global Customer Analytics Platform Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 71: Global Customer Analytics Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Global Customer Analytics Platform Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 74: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 75: Global Customer Analytics Platform Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 76: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Solution 2020 & 2033

- Table 77: Global Customer Analytics Platform Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 78: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 79: Global Customer Analytics Platform Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 80: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 81: Global Customer Analytics Platform Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 82: Global Customer Analytics Platform Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 83: Global Customer Analytics Platform Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Customer Analytics Platform Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Customer Analytics Platform Industry?

The projected CAGR is approximately 19.01%.

2. Which companies are prominent players in the Customer Analytics Platform Industry?

Key companies in the market include Angoss Software Corporation, SAS Institute Inc, Microsoft, Axtria, Aruba Networks Inc (Hewlett Packard Enterprise Development LP), NGDATA NV, Teoco Corporation, Salesforce Inc, Bridgei2i Analytics Solution (Accenture), Manthan Software Services Pvt Ltd, Pitney Bowes Inc, Adobe, Alteryx, Oracle, IBM.

3. What are the main segments of the Customer Analytics Platform Industry?

The market segments include Deployment Type, Solution, Organization Size, Service, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Improved Customer Satisfaction; Increase in Social Media Concern to Address Customer Behavior.

6. What are the notable trends driving market growth?

Growing Retail Sector to Drive Market Growth.

7. Are there any restraints impacting market growth?

Data Security and Privacy Concerns.

8. Can you provide examples of recent developments in the market?

January 2022 - SAS launched SAS Customer Intelligence 360, a new tool that automatically identifies better solutions for searching for common qualities in customer data. Using AI and machine learning, this integrated customer analytics enhances customer insights. It also offers out-of-the-box analytical automation support to help clients make better decisions, respond faster, and create income more quickly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Customer Analytics Platform Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Customer Analytics Platform Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Customer Analytics Platform Industry?

To stay informed about further developments, trends, and reports in the Customer Analytics Platform Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence