Key Insights

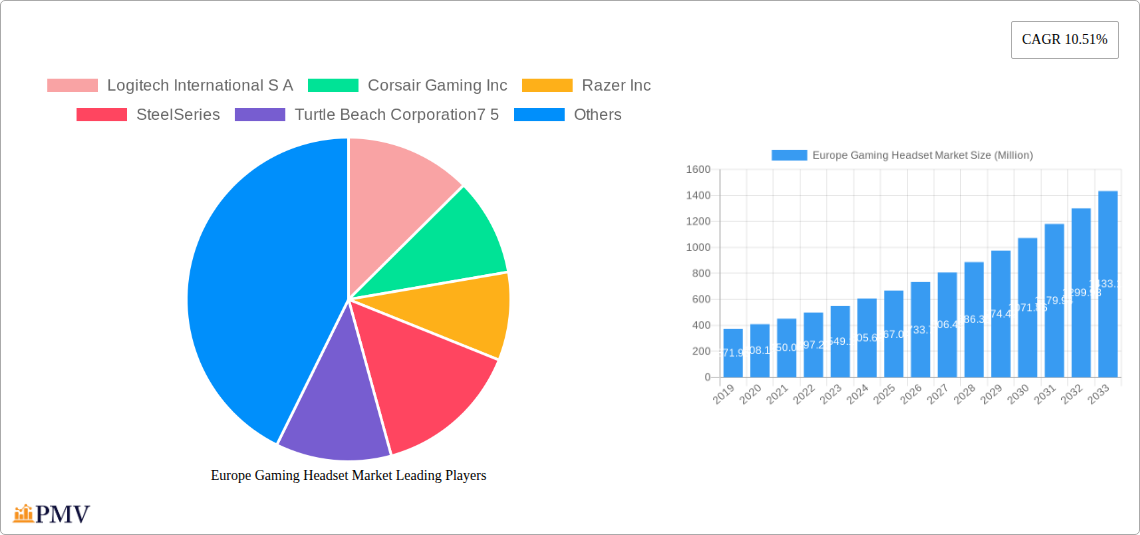

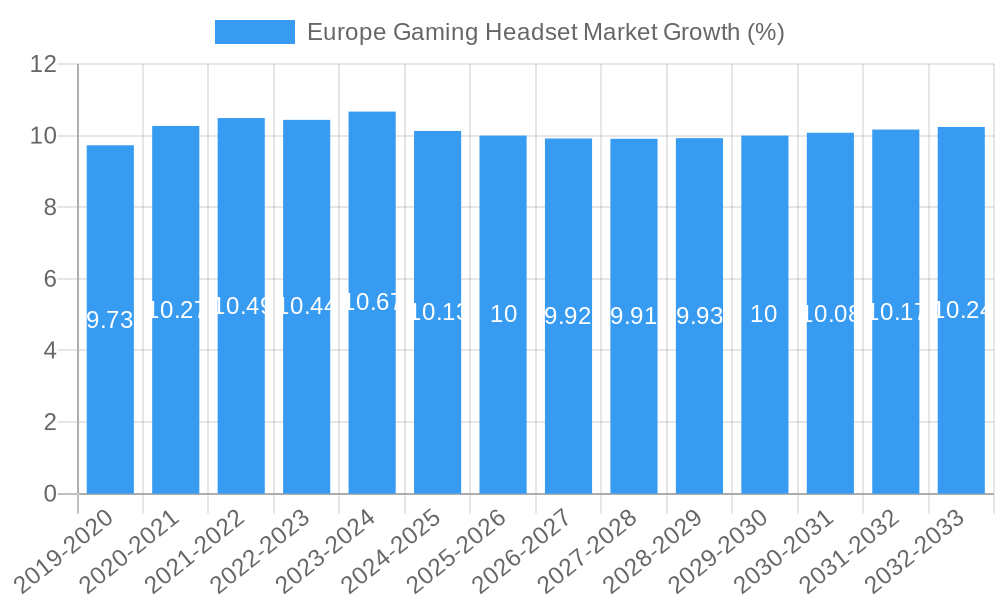

The European gaming headset market is poised for substantial growth, with a current market size of USD 579.62 million and a projected Compound Annual Growth Rate (CAGR) of 10.51% from 2019 to 2033. This robust expansion is fueled by a confluence of factors, notably the escalating popularity of esports across the continent, driving demand for high-performance audio equipment. The increasing penetration of gaming consoles and PCs, coupled with the growing adoption of sophisticated gaming peripherals, further underpins this upward trajectory. Consumers are increasingly prioritizing immersive audio experiences that enhance gameplay, leading to a greater demand for features like spatial audio, noise cancellation, and advanced microphone quality. The shift towards wireless connectivity is also a significant driver, offering greater freedom of movement and convenience, aligning with evolving consumer preferences.

The market segmentation reveals a dynamic landscape. PC headsets are expected to hold a dominant share, driven by the expansive PC gaming community and the platform's versatility. Console headsets are also witnessing strong growth, mirroring the increasing sales of gaming consoles. In terms of connectivity, wireless headsets are rapidly gaining traction, capturing a larger market share as technology advances and prices become more accessible. Wired headsets will continue to cater to a segment prioritizing affordability and zero latency. Sales channels are diversifying, with online retail channels experiencing remarkable growth due to their convenience, wider product selection, and competitive pricing, while traditional retail outlets remain relevant for in-person experience and immediate purchase. Key players like Logitech International S.A., Corsair Gaming Inc., Razer Inc., SteelSeries, and Turtle Beach Corporation are actively innovating and expanding their product portfolios to capture this burgeoning market.

This detailed report provides an in-depth analysis of the Europe Gaming Headset Market, offering strategic insights and actionable intelligence for industry stakeholders. Covering the historical period from 2019 to 2024 and a forecast period extending to 2033, with a base year of 2025, this research delves into market structure, key trends, dominant segments, product innovations, growth drivers, challenges, and the competitive landscape. We meticulously examine PC headsets, console headsets, wired gaming headsets, wireless gaming headsets, and the impact of online and retail sales channels. High-ranking keywords such as "gaming peripherals Europe," "esports audio devices," "high-performance gaming headsets," and "wireless gaming audio" are embedded throughout to maximize search visibility for critical industry audiences. The total market value is projected to reach €15,800 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 8.5% from 2025.

Europe Gaming Headset Market Market Structure & Competitive Dynamics

The Europe Gaming Headset Market is characterized by a moderately concentrated structure, with key players like Logitech International S.A., Corsair Gaming Inc., Razer Inc., SteelSeries, and Turtle Beach Corporation dominating significant market share. The market exhibits a dynamic innovation ecosystem, driven by continuous technological advancements in audio quality, connectivity, and ergonomic design. Regulatory frameworks, particularly concerning e-waste and consumer product safety across EU member states, play a crucial role in shaping manufacturing and distribution strategies. Product substitutes, while present in the form of standard headphones, are largely outcompeted by specialized gaming headsets due to their integrated microphones, immersive audio capabilities, and gaming-specific features. End-user trends are increasingly leaning towards wireless connectivity and enhanced spatial audio for a more immersive esports audio experience. Mergers and acquisitions (M&A) activities are anticipated to play a strategic role in consolidation and market expansion, with estimated M&A deal values projected to exceed €500 Million cumulatively over the forecast period. The market capitalization of publicly traded gaming peripheral companies in Europe is estimated at €18,500 Million, reflecting investor confidence in the sector's growth trajectory.

Europe Gaming Headset Market Industry Trends & Insights

The Europe Gaming Headset Market is experiencing robust growth, fueled by the escalating popularity of esports and the increasing penetration of gaming across demographics. The surge in competitive gaming events and professional esports leagues has directly translated into higher demand for high-performance gaming peripherals, particularly advanced audio solutions. Technological disruptions are continuously redefining the market, with advancements in virtual surround sound, active noise cancellation (ANC), and low-latency wireless technologies becoming standard expectations. Consumers are increasingly prioritizing wireless gaming headsets for their convenience and freedom of movement, contributing significantly to market expansion. The integration of AI-powered audio processing for enhanced voice clarity and immersive soundscapes represents a key trend. Furthermore, the growing casual gaming segment, driven by mobile and cross-platform play, is also contributing to the market's diversification, increasing the demand for more accessible yet capable PC headsets and console headsets. Brand loyalty is strong, but a growing segment of consumers prioritizes feature sets and performance over brand name alone. The overall market penetration of gaming headsets within the European gaming population is estimated to be at 68% in 2025, with an anticipated rise to 75% by 2033. The market is projected to grow at a CAGR of 8.5% from 2025 to 2033, with an estimated market value of €15,800 Million by the end of the forecast period.

Dominant Markets & Segments in Europe Gaming Headset Market

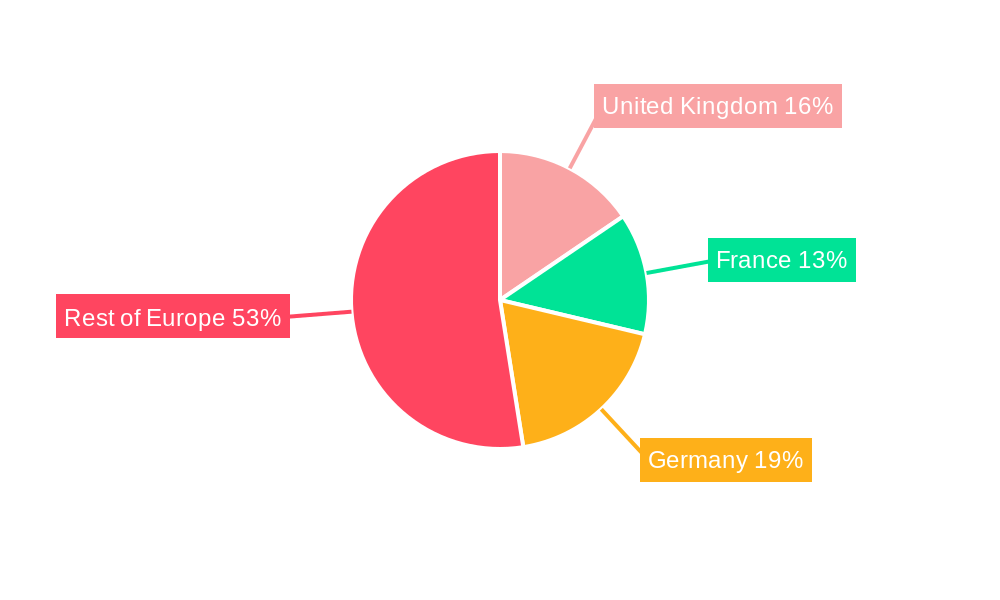

The Europe Gaming Headset Market exhibits distinct dominance across various geographical regions and product segments. Germany, the United Kingdom, and France represent the leading markets due to their large gaming populations, strong esports infrastructure, and high disposable incomes. The PC Headset segment continues to hold a substantial market share, driven by the enduring popularity of PC gaming and the widespread adoption of high-fidelity audio for immersive experiences. However, the Console Headset segment is witnessing rapid growth, propelled by the widespread adoption of PlayStation and Xbox consoles and the increasing popularity of online multiplayer gaming on these platforms.

Compatibility Type:

- PC Headset: Dominant due to the established PC gaming ecosystem, access to high-end audio technologies, and the prevalence of streaming. Factors contributing to its dominance include the availability of a wide range of gaming titles optimized for PC and the flexibility for customization and upgrades.

- Console Headset: Experiencing significant growth driven by the popularity of next-generation consoles and the rise of cross-platform gaming. The ease of plug-and-play functionality for console headsets further boosts their appeal.

Connectivity Type:

- Wireless: This segment is experiencing the most dynamic growth, with consumers increasingly valuing the convenience and freedom offered by wireless gaming headsets. Low-latency wireless technologies are mitigating previous concerns about audio lag. Key drivers include technological advancements in battery life and connection stability.

- Wired: Remains a strong contender, particularly for audiophiles and professional gamers who prioritize zero latency and uncompromised audio fidelity. The affordability and simplicity of wired connections continue to appeal to a broad consumer base.

Sales Channel:

- Online: The online sales channel is paramount, accounting for the largest share of sales due to its convenience, wider product selection, and competitive pricing. E-commerce platforms offer a direct gateway for manufacturers to reach a global audience. Key drivers include the ease of price comparison and customer reviews.

- Retail: While online sales dominate, retail channels, including electronics stores and specialized gaming outlets, play a crucial role in brand visibility and allowing consumers to experience products firsthand. The in-store demonstration of audio quality and comfort is a significant advantage.

Europe Gaming Headset Market Product Innovations

The Europe Gaming Headset Market is a hotbed of continuous product innovation, focusing on enhancing user experience and competitive advantage. Recent developments highlight advancements in audio fidelity, including the integration of studio-grade drivers for unparalleled sound reproduction, as seen in premium offerings. Innovations in microphone technology emphasize crystal-clear communication through high-sensitivity condenser microphones, crucial for team coordination in competitive gaming. The market is also seeing a push towards lighter, more ergonomic designs for extended comfort during long gaming sessions. Furthermore, the integration of customizable RGB lighting and software-driven audio profiles allows for personalized gaming experiences, appealing to the aesthetic preferences of gamers. These innovations collectively contribute to superior immersion and performance for gamers.

Report Segmentation & Scope

This report meticulously segments the Europe Gaming Headset Market across key categories. The Compatibility Type is divided into Console Headset and PC Headset, each analyzed for its unique growth trajectory and market dynamics. The Connectivity Type segment differentiates between Wired and Wireless offerings, examining the adoption rates and technological advancements within each. Furthermore, the Sales Channel is dissected into Retail and Online, evaluating their respective market shares and strategic importance. Each segment’s growth projections and market sizes are detailed, alongside an assessment of the competitive landscape within these specific divisions, providing a granular understanding of market opportunities.

Key Drivers of Europe Gaming Headset Market Growth

Several key factors are propelling the growth of the Europe Gaming Headset Market. The exponential rise of esports globally and within Europe is a primary driver, increasing the demand for high-performance audio equipment. Technological advancements, such as the development of low-latency wireless technology and immersive surround sound, are enhancing the gaming experience and encouraging upgrades. The increasing affordability of gaming consoles and gaming PCs, coupled with the proliferation of high-speed internet infrastructure, is expanding the gaming audience. Furthermore, a growing trend towards premiumization, where consumers are willing to invest more in high-quality peripherals for an enhanced gaming experience, is a significant contributor.

Challenges in the Europe Gaming Headset Market Sector

Despite its robust growth, the Europe Gaming Headset Market faces several challenges. Intense competition among established and emerging players can lead to price wars and pressure on profit margins. Supply chain disruptions, exacerbated by global events, can impact product availability and manufacturing costs. Evolving regulatory standards regarding electronic waste and product certifications across different European countries can add complexity and cost to market entry and compliance. Furthermore, the rapid pace of technological innovation requires continuous investment in research and development, posing a challenge for smaller manufacturers to keep up. The potential for market saturation in certain sub-segments also presents a hurdle for sustained rapid growth.

Leading Players in the Europe Gaming Headset Market Market

- Logitech International S.A.

- Corsair Gaming Inc.

- Razer Inc.

- SteelSeries

- Turtle Beach Corporation

Key Developments in Europe Gaming Headset Market Sector

- July 2024: German audio specialist Beyerdynamic unveiled its latest offering: the MMX 300 Pro, a wired gaming headset boasting studio-grade drivers. The headset showcases the same high-end 45mm Stellar.45 drivers featured in Beyerdynamic's premium studio headphones, such as the DT 900 Pro X. Additionally, it comes fitted with a 10mm condenser microphone, ensuring crystal-clear communication with your gaming teammates.

- April 2024: Berlin International Gaming (BIG), Germany’s top-tier esports organization, and Logitech G, a gaming technology and gear innovator under Logitech, have unveiled a global strategic partnership. This alliance, driven by a joint pursuit of excellence and innovation, promises to unlock fresh avenues for both entities. Moreover, it's poised to enrich the gaming journey for esports fans not just in the GSA region but on a global scale.

Strategic Europe Gaming Headset Market Market Outlook

The future outlook for the Europe Gaming Headset Market is exceptionally positive, driven by sustained interest in gaming and continuous technological advancements. Strategic opportunities lie in the expansion of product portfolios to cater to niche gaming genres and emerging platforms, such as cloud gaming. The growing demand for sustainable and eco-friendly gaming peripherals presents another avenue for innovation and brand differentiation. Focus on enhancing wireless connectivity with even lower latency and longer battery life will be crucial for capturing market share. Furthermore, strategic partnerships with esports teams and influencers will continue to be vital for brand visibility and consumer trust. The market is poised for further growth, with an estimated market value of €15,800 Million by 2033.

Europe Gaming Headset Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

Europe Gaming Headset Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Rest of Europe

Europe Gaming Headset Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Virtual Reality; Rise in e-sports gaming to fuel the demand for gaming accessory equipment

- 3.3. Market Restrains

- 3.3.1. Growing Popularity of Virtual Reality; Rise in e-sports gaming to fuel the demand for gaming accessory equipment

- 3.4. Market Trends

- 3.4.1. Wireless Headsets to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Gaming Headset Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. France

- 5.4.3. Germany

- 5.4.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. United Kingdom Europe Gaming Headset Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6.1.1. Console Headset

- 6.1.2. PC Headset

- 6.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 6.2.1. Wired

- 6.2.2. Wireless

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. Retail

- 6.3.2. Online

- 6.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 7. France Europe Gaming Headset Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 7.1.1. Console Headset

- 7.1.2. PC Headset

- 7.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 7.2.1. Wired

- 7.2.2. Wireless

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. Retail

- 7.3.2. Online

- 7.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 8. Germany Europe Gaming Headset Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 8.1.1. Console Headset

- 8.1.2. PC Headset

- 8.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 8.2.1. Wired

- 8.2.2. Wireless

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. Retail

- 8.3.2. Online

- 8.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 9. Rest of Europe Europe Gaming Headset Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 9.1.1. Console Headset

- 9.1.2. PC Headset

- 9.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 9.2.1. Wired

- 9.2.2. Wireless

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. Retail

- 9.3.2. Online

- 9.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Logitech International S A

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Corsair Gaming Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Razer Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SteelSeries

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Turtle Beach Corporation7 5

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 Logitech International S A

List of Figures

- Figure 1: Global Europe Gaming Headset Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Europe Gaming Headset Market Volume Breakdown (Million, %) by Region 2024 & 2032

- Figure 3: United Kingdom Europe Gaming Headset Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 4: United Kingdom Europe Gaming Headset Market Volume (Million), by Compatibility Type 2024 & 2032

- Figure 5: United Kingdom Europe Gaming Headset Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 6: United Kingdom Europe Gaming Headset Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 7: United Kingdom Europe Gaming Headset Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 8: United Kingdom Europe Gaming Headset Market Volume (Million), by Connectivity Type 2024 & 2032

- Figure 9: United Kingdom Europe Gaming Headset Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 10: United Kingdom Europe Gaming Headset Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 11: United Kingdom Europe Gaming Headset Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 12: United Kingdom Europe Gaming Headset Market Volume (Million), by Sales Channel 2024 & 2032

- Figure 13: United Kingdom Europe Gaming Headset Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 14: United Kingdom Europe Gaming Headset Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 15: United Kingdom Europe Gaming Headset Market Revenue (Million), by Country 2024 & 2032

- Figure 16: United Kingdom Europe Gaming Headset Market Volume (Million), by Country 2024 & 2032

- Figure 17: United Kingdom Europe Gaming Headset Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: United Kingdom Europe Gaming Headset Market Volume Share (%), by Country 2024 & 2032

- Figure 19: France Europe Gaming Headset Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 20: France Europe Gaming Headset Market Volume (Million), by Compatibility Type 2024 & 2032

- Figure 21: France Europe Gaming Headset Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 22: France Europe Gaming Headset Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 23: France Europe Gaming Headset Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 24: France Europe Gaming Headset Market Volume (Million), by Connectivity Type 2024 & 2032

- Figure 25: France Europe Gaming Headset Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 26: France Europe Gaming Headset Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 27: France Europe Gaming Headset Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 28: France Europe Gaming Headset Market Volume (Million), by Sales Channel 2024 & 2032

- Figure 29: France Europe Gaming Headset Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 30: France Europe Gaming Headset Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 31: France Europe Gaming Headset Market Revenue (Million), by Country 2024 & 2032

- Figure 32: France Europe Gaming Headset Market Volume (Million), by Country 2024 & 2032

- Figure 33: France Europe Gaming Headset Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: France Europe Gaming Headset Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Germany Europe Gaming Headset Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 36: Germany Europe Gaming Headset Market Volume (Million), by Compatibility Type 2024 & 2032

- Figure 37: Germany Europe Gaming Headset Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 38: Germany Europe Gaming Headset Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 39: Germany Europe Gaming Headset Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 40: Germany Europe Gaming Headset Market Volume (Million), by Connectivity Type 2024 & 2032

- Figure 41: Germany Europe Gaming Headset Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 42: Germany Europe Gaming Headset Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 43: Germany Europe Gaming Headset Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 44: Germany Europe Gaming Headset Market Volume (Million), by Sales Channel 2024 & 2032

- Figure 45: Germany Europe Gaming Headset Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 46: Germany Europe Gaming Headset Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 47: Germany Europe Gaming Headset Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Germany Europe Gaming Headset Market Volume (Million), by Country 2024 & 2032

- Figure 49: Germany Europe Gaming Headset Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Germany Europe Gaming Headset Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Rest of Europe Europe Gaming Headset Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 52: Rest of Europe Europe Gaming Headset Market Volume (Million), by Compatibility Type 2024 & 2032

- Figure 53: Rest of Europe Europe Gaming Headset Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 54: Rest of Europe Europe Gaming Headset Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 55: Rest of Europe Europe Gaming Headset Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 56: Rest of Europe Europe Gaming Headset Market Volume (Million), by Connectivity Type 2024 & 2032

- Figure 57: Rest of Europe Europe Gaming Headset Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 58: Rest of Europe Europe Gaming Headset Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 59: Rest of Europe Europe Gaming Headset Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 60: Rest of Europe Europe Gaming Headset Market Volume (Million), by Sales Channel 2024 & 2032

- Figure 61: Rest of Europe Europe Gaming Headset Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 62: Rest of Europe Europe Gaming Headset Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 63: Rest of Europe Europe Gaming Headset Market Revenue (Million), by Country 2024 & 2032

- Figure 64: Rest of Europe Europe Gaming Headset Market Volume (Million), by Country 2024 & 2032

- Figure 65: Rest of Europe Europe Gaming Headset Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Rest of Europe Europe Gaming Headset Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Europe Gaming Headset Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Europe Gaming Headset Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Global Europe Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: Global Europe Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 5: Global Europe Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 6: Global Europe Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 7: Global Europe Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: Global Europe Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 9: Global Europe Gaming Headset Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Europe Gaming Headset Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Global Europe Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 12: Global Europe Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 13: Global Europe Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 14: Global Europe Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 15: Global Europe Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: Global Europe Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 17: Global Europe Gaming Headset Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Europe Gaming Headset Market Volume Million Forecast, by Country 2019 & 2032

- Table 19: Global Europe Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 20: Global Europe Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 21: Global Europe Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 22: Global Europe Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 23: Global Europe Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 24: Global Europe Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 25: Global Europe Gaming Headset Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Europe Gaming Headset Market Volume Million Forecast, by Country 2019 & 2032

- Table 27: Global Europe Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 28: Global Europe Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 29: Global Europe Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 30: Global Europe Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 31: Global Europe Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 32: Global Europe Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 33: Global Europe Gaming Headset Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Europe Gaming Headset Market Volume Million Forecast, by Country 2019 & 2032

- Table 35: Global Europe Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 36: Global Europe Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 37: Global Europe Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 38: Global Europe Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 39: Global Europe Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 40: Global Europe Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 41: Global Europe Gaming Headset Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Europe Gaming Headset Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Gaming Headset Market?

The projected CAGR is approximately 10.51%.

2. Which companies are prominent players in the Europe Gaming Headset Market?

Key companies in the market include Logitech International S A, Corsair Gaming Inc, Razer Inc, SteelSeries, Turtle Beach Corporation7 5.

3. What are the main segments of the Europe Gaming Headset Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 579.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Virtual Reality; Rise in e-sports gaming to fuel the demand for gaming accessory equipment.

6. What are the notable trends driving market growth?

Wireless Headsets to Drive the Market.

7. Are there any restraints impacting market growth?

Growing Popularity of Virtual Reality; Rise in e-sports gaming to fuel the demand for gaming accessory equipment.

8. Can you provide examples of recent developments in the market?

July 2024 - German audio specialist Beyerdynamic unveiled its latest offering: the MMX 300 Pro, a wired gaming headset boasting studio-grade drivers. The headset showcases the same high-end 45mm Stellar.45 drivers featured in Beyerdynamic's premium studio headphones, such as the DT 900 Pro X. Additionally, it comes fitted with a 10mm condenser microphone, ensuring crystal-clear communication with your gaming teammates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Gaming Headset Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Gaming Headset Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Gaming Headset Market?

To stay informed about further developments, trends, and reports in the Europe Gaming Headset Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence