Key Insights

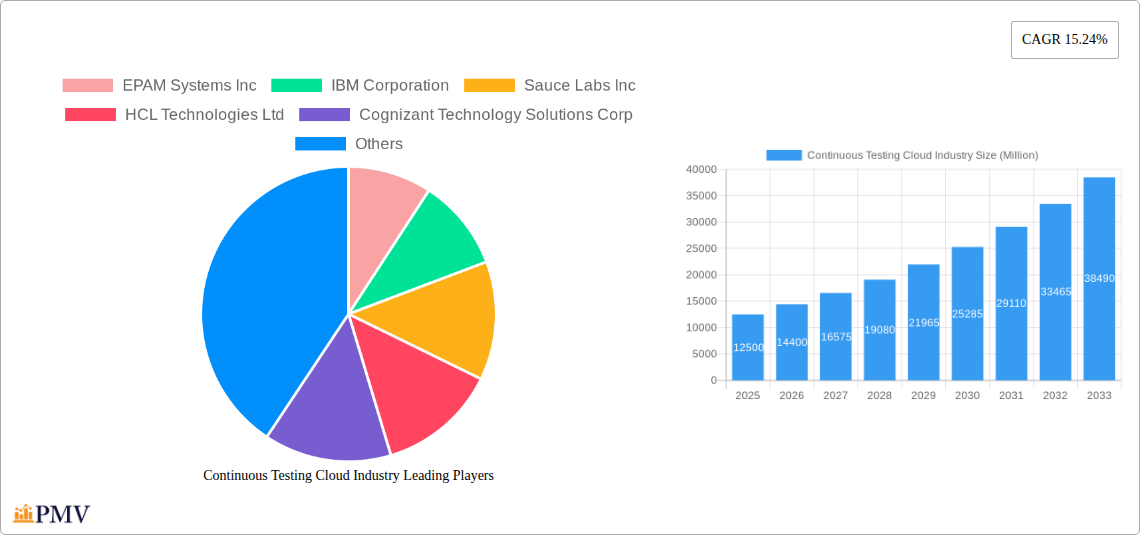

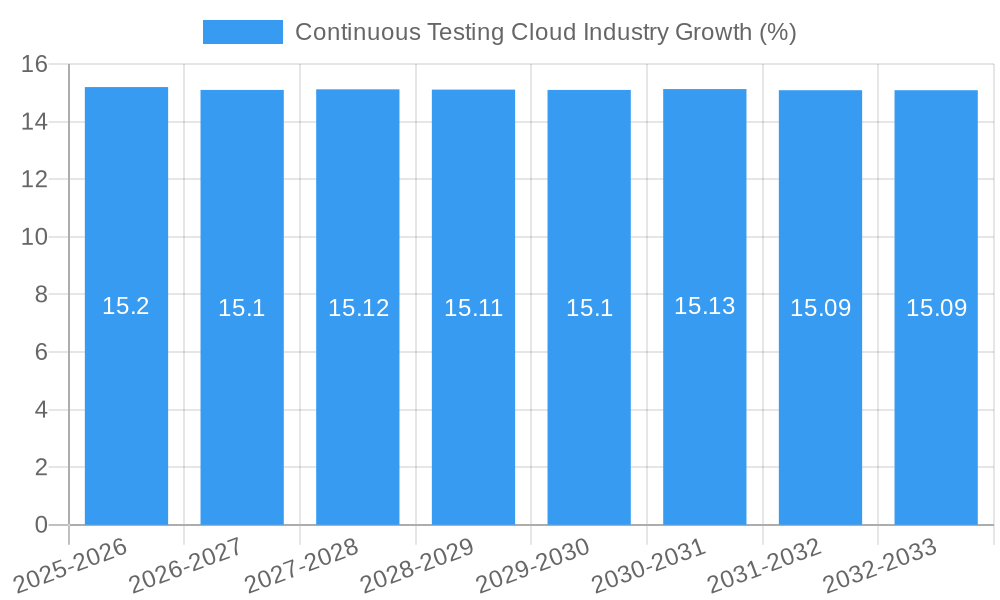

The global Continuous Testing Cloud market is poised for significant expansion, projected to reach a substantial Market Size of USD 12,500 Million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 15.24% throughout the forecast period of 2025-2033. This impressive growth is largely propelled by the escalating demand for faster software delivery cycles, enhanced application quality, and improved customer experiences across diverse industries. As businesses increasingly embrace agile and DevOps methodologies, the imperative for continuous testing becomes paramount to identify and rectify defects early in the development lifecycle, thereby reducing costs and minimizing risks. Key drivers fueling this market surge include the proliferation of complex software applications, the growing adoption of cloud-native architectures, and the rising need for comprehensive test coverage across web, desktop, and mobile interfaces. The increasing emphasis on automation in testing processes further amplifies the market's upward trajectory, as organizations seek to optimize resource utilization and accelerate testing execution.

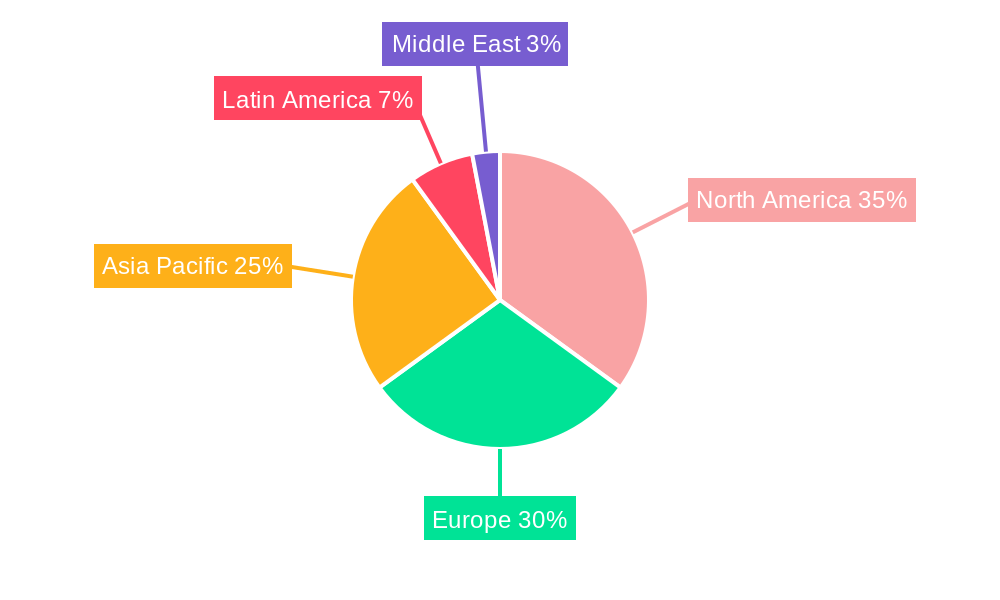

The Continuous Testing Cloud market is characterized by a dynamic landscape, with Managed Services and Professional Services emerging as dominant segments. These service offerings cater to the growing need for specialized expertise and scalable testing infrastructure. The market also witnesses a strong preference for cloud-based deployment models, driven by their inherent flexibility, cost-effectiveness, and accessibility, though on-premise solutions still hold relevance for organizations with stringent data security requirements. Geographically, North America and Europe are expected to lead the market in terms of adoption and revenue, owing to their mature technology ecosystems and early embrace of advanced testing practices. However, the Asia Pacific region is anticipated to exhibit the fastest growth, fueled by rapid digital transformation initiatives and a burgeoning IT services sector. Restraints such as the initial investment cost for cloud infrastructure and the need for skilled personnel to manage complex testing environments are being steadily overcome by the clear advantages offered by cloud-based continuous testing solutions.

This in-depth report provides an exhaustive analysis of the Continuous Testing Cloud Industry, offering critical insights into market structure, competitive landscapes, emerging trends, and future projections. Covering the Study Period of 2019–2033, with a Base Year and Estimated Year of 2025, and a Forecast Period from 2025–2033, this report is an indispensable resource for stakeholders seeking to navigate the evolving cloud testing solutions market.

Continuous Testing Cloud Industry Market Structure & Competitive Dynamics

The Continuous Testing Cloud Industry exhibits a dynamic market structure characterized by moderate to high concentration, driven by significant investments in R&D and strategic mergers and acquisitions. Key players are actively expanding their portfolios to cater to the growing demand for agile and efficient software delivery. The innovation ecosystem is robust, with continuous integration and continuous delivery (CI/CD) pipelines becoming integral to enterprise IT strategies. Regulatory frameworks are evolving to ensure data security and compliance in cloud environments, influencing the adoption of standardized testing protocols. Product substitutes, while present in the form of on-premise testing solutions, are increasingly being outpaced by the scalability and flexibility of cloud-based offerings. End-user trends are heavily skewed towards faster release cycles, enhanced application performance, and improved customer experience, all of which are facilitated by continuous testing in the cloud.

- Market Share Dynamics: The market is witnessing a gradual shift towards cloud-native testing platforms, with leading providers capturing significant shares through advanced AI/ML capabilities and comprehensive service offerings.

- M&A Activities: The industry has seen several high-value M&A deals, such as the acquisition of Testim by Tricentis for an undisclosed sum, aimed at bolstering AI-powered testing capabilities and expanding market reach. These consolidations are reshaping the competitive landscape, with projected M&A deal values in the hundreds of millions expected in the coming years.

- Innovation Ecosystem: Collaboration between technology vendors and software development companies is fostering a vibrant innovation ecosystem.

- End-User Focus: A strong emphasis on improving user experience and reducing time-to-market is a primary driver for cloud testing adoption.

Continuous Testing Cloud Industry Industry Trends & Insights

The Continuous Testing Cloud Industry is experiencing exponential growth, fueled by the relentless digital transformation initiatives across global enterprises. The average Compound Annual Growth Rate (CAGR) is projected to be in the double digits, estimated at XX% for the forecast period. This surge is primarily attributed to the increasing adoption of Agile and DevOps methodologies, which necessitate automated and continuous testing to ensure the quality and reliability of software releases. Technological disruptions, particularly the integration of Artificial Intelligence (AI) and Machine Learning (ML) in test automation, are revolutionizing how testing is performed. These advancements enable predictive analytics, self-healing tests, and intelligent test case generation, significantly reducing manual effort and increasing efficiency.

Consumer preferences are increasingly demanding seamless, high-performance, and secure applications across all platforms, placing immense pressure on organizations to deliver flawless software rapidly. This demand directly translates into a greater need for robust cloud-based testing solutions. The competitive dynamics are intensifying, with companies vying for market dominance through product differentiation, strategic partnerships, and aggressive market penetration strategies. Market penetration for continuous testing cloud solutions is rapidly increasing, currently estimated at XX%, with significant room for growth as more organizations embrace cloud-native architectures. The rise of microservices and containerization further amplifies the complexity of software development, making continuous testing in a cloud environment not just beneficial but essential. The global market size for continuous testing cloud is anticipated to reach millions of dollars by 2033.

Dominant Markets & Segments in Continuous Testing Cloud Industry

The Continuous Testing Cloud Industry is characterized by distinct regional dominance and segment preferences. North America currently leads the market, driven by its advanced technological infrastructure, high adoption rates of cloud computing, and a strong presence of large enterprises investing heavily in digital transformation. Within North America, the United States holds a significant market share due to the concentration of technology giants and a proactive approach to adopting cutting-edge testing solutions.

Service Dominance:

- Managed Service: This segment is experiencing substantial growth as organizations increasingly seek specialized expertise and cost-efficiency in managing their complex testing environments. Companies are outsourcing their continuous testing needs to service providers who offer end-to-end solutions, from test strategy and execution to reporting and analytics. This is projected to capture XX% of the market by 2033.

- Professional Service: While Managed Services are gaining traction, Professional Services remain crucial for initial setup, customization, and specialized consulting, supporting organizations in integrating continuous testing into their existing workflows. This segment is expected to grow at a CAGR of XX%.

Interface Dominance:

- Web Interface: The ubiquitization of web applications and the ongoing shift towards progressive web apps (PWAs) make this interface the largest and fastest-growing segment. The demand for seamless user experiences across various browsers and devices fuels the need for extensive web testing. This segment is expected to account for over XX% of the market.

- Mobile Interface: With the explosion of mobile usage, mobile application testing remains a critical component. The diverse range of mobile devices, operating systems, and network conditions necessitates sophisticated mobile testing solutions within the cloud. The mobile segment is projected to grow at a CAGR of XX%.

- Desktop Interface: While declining in relative importance compared to web and mobile, desktop application testing remains vital for specific enterprise software and legacy systems.

Deployment Type Dominance:

- Cloud-based Deployment: This is the undisputed dominant deployment type, reflecting the broader industry trend towards cloud adoption. Cloud-based solutions offer unparalleled scalability, flexibility, and cost-effectiveness, making them the preferred choice for most organizations. This segment is expected to represent XX% of the market by 2033.

- On-premise Deployment: This segment is witnessing a gradual decline as organizations migrate their infrastructure and testing capabilities to the cloud. However, it continues to hold a niche for organizations with stringent data sovereignty requirements or existing substantial on-premise investments.

Continuous Testing Cloud Industry Product Innovations

Product innovations in the Continuous Testing Cloud Industry are centered on enhancing automation capabilities, integrating AI/ML for intelligent testing, and improving the user experience for testers and developers. Advanced platforms are offering capabilities like codeless test creation, AI-driven test script maintenance, and real-time performance monitoring. The integration of these solutions with CI/CD pipelines is seamless, enabling faster feedback loops and quicker issue resolution. Competitive advantages are being carved out through specialized features such as cross-browser and cross-device testing at scale, API testing automation, and comprehensive security testing integrated into the continuous delivery process. These innovations are crucial for meeting the escalating demands for quality and speed in software development.

Report Segmentation & Scope

This report segments the Continuous Testing Cloud Industry across several key dimensions to provide a granular understanding of the market. The analysis encompasses:

Service:

- Managed Service: This segment includes comprehensive outsourcing of continuous testing operations, encompassing strategy, execution, maintenance, and reporting. Projected market size of XX million USD by 2033, with a CAGR of XX%.

- Professional Service: This segment covers consulting, implementation, integration, and specialized testing support. Expected to reach XX million USD by 2033, with a CAGR of XX%.

Interface:

- Web: Testing of web applications across various browsers and devices. Expected market size of XX million USD, with a CAGR of XX%.

- Desktop: Testing of traditional desktop applications. Projected market size of XX million USD.

- Mobile: Testing of native, hybrid, and web-based mobile applications. Expected to grow to XX million USD by 2033, with a CAGR of XX%.

Deployment Type:

- On-premise: Testing solutions deployed and managed within an organization's own data centers.

- Cloud-based: Testing solutions delivered via the internet, typically on a subscription basis. This segment is projected to dominate, reaching XX million USD by 2033, with a CAGR of XX%.

Key Drivers of Continuous Testing Cloud Industry Growth

The growth of the Continuous Testing Cloud Industry is propelled by several interconnected factors:

- Accelerated Digital Transformation: Businesses worldwide are rapidly adopting digital technologies, necessitating robust and agile software development practices, with continuous testing being a cornerstone.

- DevOps and Agile Methodologies: The widespread adoption of DevOps and Agile methodologies mandates automated and continuous testing to ensure rapid, high-quality software releases.

- Increasing Complexity of Applications: The rise of microservices, APIs, and distributed systems creates intricate testing environments that are best managed through scalable cloud solutions.

- Demand for Faster Time-to-Market: Competitive pressures and evolving consumer expectations drive the need for quicker product development cycles, achievable with efficient continuous testing.

- Technological Advancements: Innovations in AI, ML, and cloud infrastructure are enhancing the capabilities and efficiency of continuous testing tools and platforms.

- Cost-Effectiveness and Scalability: Cloud-based testing offers significant advantages in terms of reduced infrastructure costs and on-demand scalability, making it attractive for organizations of all sizes.

Challenges in the Continuous Testing Cloud Industry Sector

Despite its robust growth, the Continuous Testing Cloud Industry faces certain challenges:

- Integration Complexity: Integrating continuous testing tools with existing, often disparate, development and deployment pipelines can be challenging.

- Skill Gap: A shortage of skilled professionals with expertise in advanced test automation, cloud technologies, and AI/ML in testing can hinder adoption.

- Data Security and Privacy Concerns: While cloud providers offer robust security, some organizations still harbor concerns regarding the security and privacy of sensitive test data in the cloud.

- Legacy System Compatibility: Testing legacy applications within a cloud-based continuous testing framework can present technical hurdles and require significant customization.

- Cost Management: While cloud offers cost benefits, managing cloud expenditure effectively, especially with extensive testing across multiple environments, requires careful planning and optimization.

- Resistance to Change: Overcoming organizational inertia and resistance to adopting new methodologies and tools can be a significant barrier.

Leading Players in the Continuous Testing Cloud Industry Market

The Continuous Testing Cloud Industry market is populated by a diverse range of companies, including both established technology giants and specialized testing solution providers. The competitive landscape is dynamic, with continuous innovation and strategic partnerships shaping market share.

- EPAM Systems Inc

- IBM Corporation

- Sauce Labs Inc

- HCL Technologies Ltd

- Cognizant Technology Solutions Corp

- Cigniti Technologies Limited

- Larsen & Toubro Infotech Ltd

- Atos SE

- Mindtree Limited

- Tech Mahindra Limited

- Hexaware Technologies Ltd

- Broadcom Inc (CA Technologies Inc )

Key Developments in Continuous Testing Cloud Industry Sector

The Continuous Testing Cloud Industry has witnessed significant strategic moves and technological advancements that are shaping its trajectory. These developments underscore the industry's commitment to innovation and market expansion.

- February 2022 - Tricentis announced new strategies and solutions for helping enterprise organizations accelerate cloud adoption across their most critical business applications and data. As organizations shift to cloud-centric IT, seamless continuous testing is anticipated to become the norm alongside migration to the cloud. It has been the driving force of the launch of new solutions by Tricentis. This initiative highlights Tricentis' focus on enabling enterprises to leverage the cloud for their critical applications, positioning continuous testing as a fundamental component of cloud migration strategies.

- February 2022 - Tricentis, a key player in test automation for modern cloud and enterprise applications, announced the acquisition of Testim, an AI-based SaaS test automation platform, in an attempt to extend the company's existing AI-powered continuous testing platform. The acquisition allows the company's prevailing customers to adopt cloud-based testing capabilities with flexible consumption models. This strategic acquisition significantly bolsters Tricentis' AI capabilities and expands its cloud-based testing offerings, providing customers with more flexible and intelligent solutions.

- May 2022 - Opera partnered with Mindtree. The aim of this collaboration will enable enterprises to increase scale, speed-to-market, and customer satisfaction as they advance along their transformation journey. This partnership focuses on enhancing enterprise capabilities in scaling operations, accelerating market entry, and improving customer satisfaction through collaborative efforts in digital transformation, likely involving advanced testing methodologies.

Strategic Continuous Testing Cloud Industry Market Outlook

The Continuous Testing Cloud Industry is poised for significant strategic growth, driven by the ongoing digital transformation and the increasing imperative for rapid, high-quality software delivery. Future market potential lies in the deeper integration of AI and ML into testing workflows, enabling predictive quality, autonomous testing, and hyper-personalization of testing efforts. Opportunities exist for vendors to offer specialized solutions catering to emerging technologies like IoT, blockchain, and edge computing. Strategic partnerships between cloud providers, testing tool vendors, and system integrators will be crucial for expanding market reach and providing end-to-end solutions. The industry will likely see further consolidation and the emergence of platforms that offer a holistic approach to application quality throughout the entire software development lifecycle. The focus will increasingly shift towards intelligent automation and proactive quality assurance, making continuous testing an indispensable pillar of modern IT operations.

Continuous Testing Cloud Industry Segmentation

-

1. Service

- 1.1. Managed Service

- 1.2. Professional Service

-

2. Interface

- 2.1. Web

- 2.2. Desktop

- 2.3. Mobile

-

3. Deployment Type

- 3.1. On-premise

- 3.2. Cloud-based

Continuous Testing Cloud Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Continuous Testing Cloud Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Agile and DevOps; Increasing Need for Continuous and Timely Delivery

- 3.3. Market Restrains

- 3.3.1. Dependency on Traditional Approaches; Lack of a Skilled and Experienced Test Automation Workforce

- 3.4. Market Trends

- 3.4.1. Cloud Based Deployment to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Continuous Testing Cloud Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Managed Service

- 5.1.2. Professional Service

- 5.2. Market Analysis, Insights and Forecast - by Interface

- 5.2.1. Web

- 5.2.2. Desktop

- 5.2.3. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Deployment Type

- 5.3.1. On-premise

- 5.3.2. Cloud-based

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Continuous Testing Cloud Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Managed Service

- 6.1.2. Professional Service

- 6.2. Market Analysis, Insights and Forecast - by Interface

- 6.2.1. Web

- 6.2.2. Desktop

- 6.2.3. Mobile

- 6.3. Market Analysis, Insights and Forecast - by Deployment Type

- 6.3.1. On-premise

- 6.3.2. Cloud-based

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Continuous Testing Cloud Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Managed Service

- 7.1.2. Professional Service

- 7.2. Market Analysis, Insights and Forecast - by Interface

- 7.2.1. Web

- 7.2.2. Desktop

- 7.2.3. Mobile

- 7.3. Market Analysis, Insights and Forecast - by Deployment Type

- 7.3.1. On-premise

- 7.3.2. Cloud-based

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Continuous Testing Cloud Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Managed Service

- 8.1.2. Professional Service

- 8.2. Market Analysis, Insights and Forecast - by Interface

- 8.2.1. Web

- 8.2.2. Desktop

- 8.2.3. Mobile

- 8.3. Market Analysis, Insights and Forecast - by Deployment Type

- 8.3.1. On-premise

- 8.3.2. Cloud-based

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Latin America Continuous Testing Cloud Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Managed Service

- 9.1.2. Professional Service

- 9.2. Market Analysis, Insights and Forecast - by Interface

- 9.2.1. Web

- 9.2.2. Desktop

- 9.2.3. Mobile

- 9.3. Market Analysis, Insights and Forecast - by Deployment Type

- 9.3.1. On-premise

- 9.3.2. Cloud-based

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East Continuous Testing Cloud Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Managed Service

- 10.1.2. Professional Service

- 10.2. Market Analysis, Insights and Forecast - by Interface

- 10.2.1. Web

- 10.2.2. Desktop

- 10.2.3. Mobile

- 10.3. Market Analysis, Insights and Forecast - by Deployment Type

- 10.3.1. On-premise

- 10.3.2. Cloud-based

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. North America Continuous Testing Cloud Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Continuous Testing Cloud Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Continuous Testing Cloud Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Continuous Testing Cloud Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Continuous Testing Cloud Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 EPAM Systems Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 IBM Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sauce Labs Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 HCL Technologies Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Cognizant Technology Solutions Corp

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cigniti Technologies Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Larsen & Toubro Infotech Ltd*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Atos SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Mindtree Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Tech Mahindra Limited

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Hexaware Technologies Ltd

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Broadcom Inc (CA Technologies Inc )

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 EPAM Systems Inc

List of Figures

- Figure 1: Global Continuous Testing Cloud Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Continuous Testing Cloud Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Continuous Testing Cloud Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Continuous Testing Cloud Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Continuous Testing Cloud Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Continuous Testing Cloud Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Continuous Testing Cloud Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Continuous Testing Cloud Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Continuous Testing Cloud Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Continuous Testing Cloud Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Continuous Testing Cloud Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Continuous Testing Cloud Industry Revenue (Million), by Service 2024 & 2032

- Figure 13: North America Continuous Testing Cloud Industry Revenue Share (%), by Service 2024 & 2032

- Figure 14: North America Continuous Testing Cloud Industry Revenue (Million), by Interface 2024 & 2032

- Figure 15: North America Continuous Testing Cloud Industry Revenue Share (%), by Interface 2024 & 2032

- Figure 16: North America Continuous Testing Cloud Industry Revenue (Million), by Deployment Type 2024 & 2032

- Figure 17: North America Continuous Testing Cloud Industry Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 18: North America Continuous Testing Cloud Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Continuous Testing Cloud Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Continuous Testing Cloud Industry Revenue (Million), by Service 2024 & 2032

- Figure 21: Europe Continuous Testing Cloud Industry Revenue Share (%), by Service 2024 & 2032

- Figure 22: Europe Continuous Testing Cloud Industry Revenue (Million), by Interface 2024 & 2032

- Figure 23: Europe Continuous Testing Cloud Industry Revenue Share (%), by Interface 2024 & 2032

- Figure 24: Europe Continuous Testing Cloud Industry Revenue (Million), by Deployment Type 2024 & 2032

- Figure 25: Europe Continuous Testing Cloud Industry Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 26: Europe Continuous Testing Cloud Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Continuous Testing Cloud Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Continuous Testing Cloud Industry Revenue (Million), by Service 2024 & 2032

- Figure 29: Asia Pacific Continuous Testing Cloud Industry Revenue Share (%), by Service 2024 & 2032

- Figure 30: Asia Pacific Continuous Testing Cloud Industry Revenue (Million), by Interface 2024 & 2032

- Figure 31: Asia Pacific Continuous Testing Cloud Industry Revenue Share (%), by Interface 2024 & 2032

- Figure 32: Asia Pacific Continuous Testing Cloud Industry Revenue (Million), by Deployment Type 2024 & 2032

- Figure 33: Asia Pacific Continuous Testing Cloud Industry Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 34: Asia Pacific Continuous Testing Cloud Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Continuous Testing Cloud Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Continuous Testing Cloud Industry Revenue (Million), by Service 2024 & 2032

- Figure 37: Latin America Continuous Testing Cloud Industry Revenue Share (%), by Service 2024 & 2032

- Figure 38: Latin America Continuous Testing Cloud Industry Revenue (Million), by Interface 2024 & 2032

- Figure 39: Latin America Continuous Testing Cloud Industry Revenue Share (%), by Interface 2024 & 2032

- Figure 40: Latin America Continuous Testing Cloud Industry Revenue (Million), by Deployment Type 2024 & 2032

- Figure 41: Latin America Continuous Testing Cloud Industry Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 42: Latin America Continuous Testing Cloud Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Continuous Testing Cloud Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East Continuous Testing Cloud Industry Revenue (Million), by Service 2024 & 2032

- Figure 45: Middle East Continuous Testing Cloud Industry Revenue Share (%), by Service 2024 & 2032

- Figure 46: Middle East Continuous Testing Cloud Industry Revenue (Million), by Interface 2024 & 2032

- Figure 47: Middle East Continuous Testing Cloud Industry Revenue Share (%), by Interface 2024 & 2032

- Figure 48: Middle East Continuous Testing Cloud Industry Revenue (Million), by Deployment Type 2024 & 2032

- Figure 49: Middle East Continuous Testing Cloud Industry Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 50: Middle East Continuous Testing Cloud Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East Continuous Testing Cloud Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Interface 2019 & 2032

- Table 4: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 5: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Continuous Testing Cloud Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Continuous Testing Cloud Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Continuous Testing Cloud Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Continuous Testing Cloud Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Continuous Testing Cloud Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 17: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Interface 2019 & 2032

- Table 18: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 19: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 21: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Interface 2019 & 2032

- Table 22: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 23: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 25: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Interface 2019 & 2032

- Table 26: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 27: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 29: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Interface 2019 & 2032

- Table 30: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 31: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 33: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Interface 2019 & 2032

- Table 34: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 35: Global Continuous Testing Cloud Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Continuous Testing Cloud Industry?

The projected CAGR is approximately 15.24%.

2. Which companies are prominent players in the Continuous Testing Cloud Industry?

Key companies in the market include EPAM Systems Inc, IBM Corporation, Sauce Labs Inc, HCL Technologies Ltd, Cognizant Technology Solutions Corp, Cigniti Technologies Limited, Larsen & Toubro Infotech Ltd*List Not Exhaustive, Atos SE, Mindtree Limited, Tech Mahindra Limited, Hexaware Technologies Ltd, Broadcom Inc (CA Technologies Inc ).

3. What are the main segments of the Continuous Testing Cloud Industry?

The market segments include Service, Interface, Deployment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Agile and DevOps; Increasing Need for Continuous and Timely Delivery.

6. What are the notable trends driving market growth?

Cloud Based Deployment to Grow Significantly.

7. Are there any restraints impacting market growth?

Dependency on Traditional Approaches; Lack of a Skilled and Experienced Test Automation Workforce.

8. Can you provide examples of recent developments in the market?

February 2022 - Tricentis announced new strategies and solutions for helping enterprise organizations accelerate cloud adoption across their most critical business applications and data. As organizations shift to cloud-centric IT, seamless continuous testing is anticipated to become the norm alongside migration to the cloud. It has been the driving force of the launch of new solutions by Tricentis.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Continuous Testing Cloud Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Continuous Testing Cloud Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Continuous Testing Cloud Industry?

To stay informed about further developments, trends, and reports in the Continuous Testing Cloud Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence