Key Insights

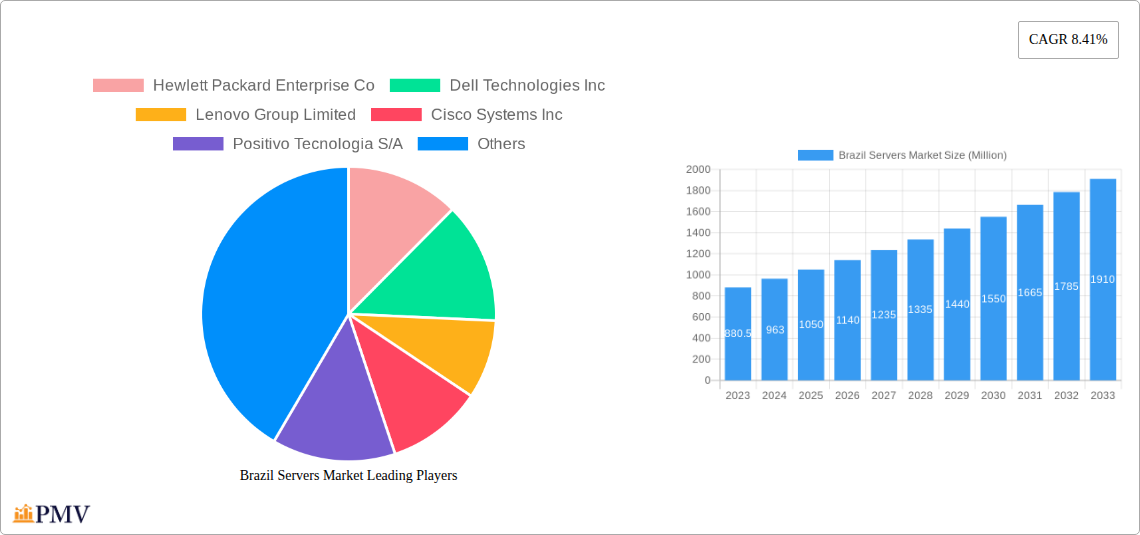

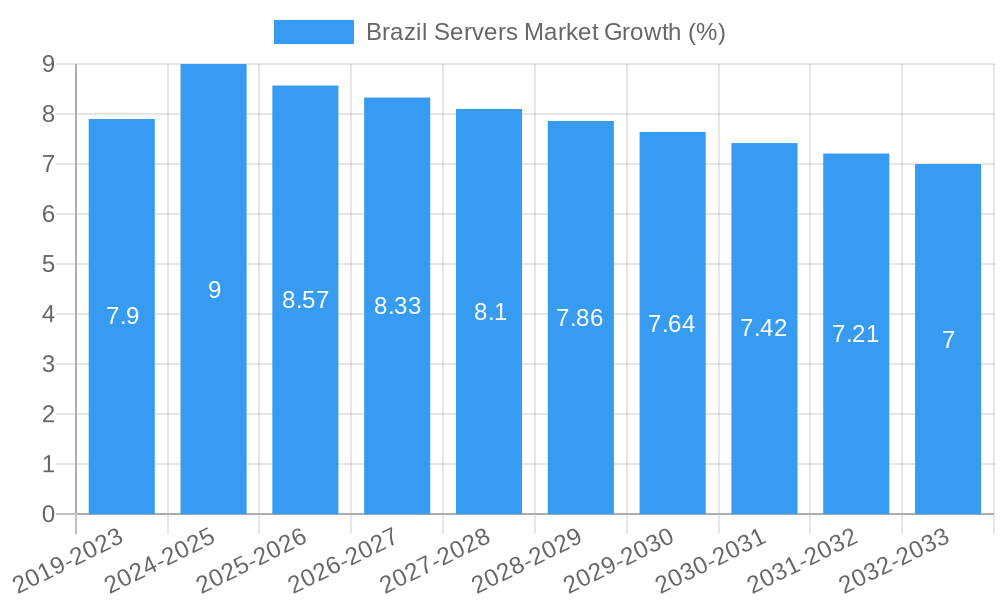

The Brazil Servers Market is poised for substantial growth, projected to reach an estimated value of approximately USD 1.05 million in the base year of 2025. This growth is driven by a robust Compound Annual Growth Rate (CAGR) of 8.41% anticipated to persist through the forecast period of 2025-2033. This upward trajectory is primarily fueled by the increasing adoption of advanced technologies across various end-user industries, including IT and Telecommunications, BFSI, and Manufacturing, which are heavily reliant on scalable and performant server infrastructure. The burgeoning digital transformation initiatives within Brazil, coupled with the growing demand for cloud computing services and big data analytics, are acting as significant catalysts for this market expansion. Furthermore, the ongoing modernization of IT infrastructure within enterprises, aiming to enhance operational efficiency and data processing capabilities, will continue to be a key driver.

The market is segmented across various operating systems, with Windows and Linux expected to dominate, catering to diverse enterprise needs. Server class segmentation will likely see high-end and mid-range servers experiencing elevated demand due to the increasing complexity of workloads. In terms of server type, rack-optimized and blade servers are set to witness significant adoption, driven by their space-saving and performance-enhancing attributes, particularly in data center environments. While the market benefits from strong demand drivers, potential restraints such as high initial investment costs and the need for specialized technical expertise for deployment and management of advanced server solutions may pose challenges. However, the persistent drive towards digital innovation and the expanding digital economy in Brazil are expected to outweigh these restraints, ensuring a dynamic and growing server market.

This in-depth report delivers a detailed examination of the Brazil servers market, projecting significant growth and offering actionable insights for stakeholders. Covering the historical period from 2019 to 2024 and extending to a forecast period of 2025–2033, with 2025 as the base and estimated year, this analysis delves into market structure, competitive dynamics, emerging trends, product innovations, and key growth drivers and challenges. We dissect the market by operating system, server class, server type, and end-user industry, providing a granular view of opportunities and risks within this dynamic landscape. Anticipate a market expansion driven by digital transformation initiatives, cloud adoption, and the burgeoning demand for high-performance computing across Brazil's diverse economic sectors.

Brazil Servers Market Market Structure & Competitive Dynamics

The Brazil servers market is characterized by a moderately concentrated structure, with established global players vying for market share alongside emerging local contenders. Innovation is a critical differentiator, driven by ongoing advancements in processor technology, cloud integration, and the increasing demand for specialized server solutions. Regulatory frameworks, while evolving, generally support foreign investment and technological adoption, though local content requirements and data residency policies can influence market entry and operations. Product substitutes, primarily cloud-based Infrastructure as a Service (IaaS) offerings, present a continuous competitive challenge, necessitating a focus on hybrid and on-premises solutions with compelling value propositions. End-user trends are heavily influenced by the rapid digital transformation across key industries, pushing demand for scalable, secure, and efficient server infrastructure. Mergers and acquisitions (M&A) activity is anticipated to remain a significant factor, with larger players seeking to consolidate market presence and acquire innovative technologies. Estimated M&A deal values in the Brazilian IT infrastructure sector are projected to reach several hundred million for strategic acquisitions. Market share for leading vendors fluctuates based on product cycles and competitive pricing.

- Market Concentration: Dominated by a few key global vendors, with increasing participation from local system integrators and cloud providers.

- Innovation Ecosystem: Driven by partnerships, R&D investments, and the adoption of open-source technologies.

- Regulatory Frameworks: Supportive of technological advancement, with ongoing adjustments related to data privacy and digital sovereignty.

- Product Substitutes: Cloud services (IaaS, PaaS) represent the primary alternative, compelling hybrid solutions.

- End-User Trends: Digitalization, AI/ML adoption, IoT expansion, and edge computing are key demand drivers.

- M&A Activities: Expected to continue as companies seek to expand their portfolios and market reach.

Brazil Servers Market Industry Trends & Insights

The Brazil servers market is experiencing robust growth, fueled by a confluence of technological advancements, evolving business strategies, and a strong push towards digital transformation across all sectors. The compound annual growth rate (CAGR) is projected to be a healthy 8.5% over the forecast period, driven by substantial investments in IT infrastructure. Key growth drivers include the escalating adoption of cloud computing, necessitating powerful on-premises server solutions for hybrid environments and data sovereignty. The proliferation of Big Data analytics and Artificial Intelligence (AI) and Machine Learning (ML) workloads demands high-performance computing capabilities, directly translating into increased sales of advanced server configurations. Furthermore, the ongoing expansion of the Internet of Things (IoT) ecosystem requires robust server infrastructure at the edge and in centralized data centers to manage vast amounts of data generated by connected devices. Consumer preferences are shifting towards more energy-efficient, scalable, and secure server solutions. Businesses are increasingly seeking servers that can seamlessly integrate with their existing infrastructure while offering the flexibility to adapt to future demands. Competitive dynamics are characterized by intense price competition, a focus on delivering value-added services, and strategic partnerships aimed at expanding market reach and technological capabilities. The market penetration of advanced server technologies, such as those supporting AI and edge computing, is expected to rise significantly. The overall market size is projected to reach approximately $2,000 million by 2033.

- Digital Transformation: A primary catalyst, encouraging businesses to upgrade and expand their server capabilities.

- Cloud Computing Adoption: Drives demand for hybrid and multi-cloud compatible server solutions.

- Big Data & AI/ML: Fuels the need for high-performance and specialized server architectures.

- IoT Expansion: Creates demand for edge and centralized server infrastructure to handle data processing and management.

- Energy Efficiency & Scalability: Increasingly important considerations for end-users when selecting server hardware.

- Competitive Landscape: Characterized by global players and local integrators focusing on price, service, and strategic alliances.

- Market Penetration: Growing adoption of advanced server technologies, particularly in high-end and specialized segments.

Dominant Markets & Segments in Brazil Servers Market

The Brazil servers market exhibits distinct dominance across various segments, driven by specific industry needs and technological adoption rates.

Operating System:

- Linux: Holds a dominant position, accounting for an estimated 45% market share. Its open-source nature, cost-effectiveness, and flexibility make it a preferred choice for a wide range of applications, from web servers to high-performance computing clusters. Key drivers for Linux dominance include its robust community support, extensive customization options, and suitability for cloud environments.

- Windows: Commands a significant market share of approximately 35%. Its strong integration with enterprise applications, user-friendly interface, and widespread adoption in business environments, particularly for SMBs and large enterprises running Microsoft-centric IT infrastructures, solidify its position.

- UNIX: Holds a smaller but critical niche, estimated at 15% market share, primarily in legacy enterprise systems and specialized financial applications where its stability and security are paramount.

- Other Operating Systems: Representing about 5% of the market, these include IBM's i5/OS and z/OS, crucial for specific mainframe environments within large financial institutions and government entities.

Server Class:

- Volume Servers: Dominates the market with an estimated 55% share, driven by their cost-effectiveness and suitability for large-scale deployments in data centers, cloud providers, and businesses with high transaction volumes.

- Mid-range Servers: Account for approximately 30% of the market, offering a balance of performance, scalability, and cost for growing businesses and specific departmental applications.

- High-end Servers: Represent about 15% of the market share, catering to mission-critical applications, large-scale analytics, and AI workloads where extreme performance and reliability are essential.

Server Type:

- Rack Optimized Servers: Lead the market with an estimated 50% share due to their space efficiency, scalability, and ease of management in data center environments.

- Blade Servers: Hold a significant 30% share, offering high-density computing power and efficient power and cooling for environments with space constraints.

- Tower Servers: Account for approximately 15% of the market, primarily used by SMBs and for remote office deployments where their standalone nature and ease of setup are advantageous.

- Multi-node Servers: Representing around 5%, these are gaining traction for specific workloads requiring high parallelism and density.

End-user Industry:

- IT and Telecommunications: This sector is the largest consumer of servers, accounting for an estimated 30% of the market, driven by the continuous need for infrastructure upgrades, cloud services expansion, and network support.

- BFSI (Banking, Financial Services, and Insurance): Represents a substantial 25% of the market. This industry relies heavily on servers for transaction processing, data analytics, risk management, and secure data storage, demanding high performance and reliability.

- Manufacturing: With an estimated 15% market share, this sector is increasingly adopting servers for industrial automation, IoT integration, supply chain management, and data analytics to optimize operations.

- Retail: Accounts for approximately 10% of the market, driven by e-commerce growth, inventory management, customer analytics, and point-of-sale systems.

- Healthcare: With a 10% share, this sector's server demand is growing due to the adoption of electronic health records (EHRs), medical imaging, telemedicine, and data analytics for patient care.

- Media and Entertainment: Represents about 5% of the market, driven by content creation, streaming services, and digital asset management.

- Other End-user Verticals: Comprise the remaining 5%, including government, education, and research institutions.

Brazil Servers Market Product Innovations

Product innovations in the Brazil servers market are largely centered around enhancing performance, improving energy efficiency, and enabling advanced computing capabilities. The introduction of new processor architectures, such as the IBM Power10, is yielding significant performance boosts, particularly for AI and edge computing workloads. Companies are focusing on developing servers optimized for specific applications, including those with high-density configurations for data centers and specialized units for IoT data processing. The integration of advanced cooling technologies and power management systems is also a key trend, reducing operational costs and environmental impact. Competitive advantages are being built on the ability to offer scalable, secure, and future-proof server solutions that align with the evolving digital infrastructure needs of Brazilian businesses.

Report Segmentation & Scope

This report provides a comprehensive analysis of the Brazil servers market, segmented across key dimensions to offer granular insights. The Operating System segmentation includes Linux, Windows, UNIX, and Other Operating Systems (i5/OS, z/OS, etc.), with projections for Linux and Windows to maintain dominance due to their widespread adoption and flexibility. The Server Class segmentation covers High-end Server, Mid-range Server, and Volume Server, highlighting the continued demand for volume servers driven by cost-efficiency and scalability, while high-end servers cater to specialized compute needs. The Server Type segmentation includes Blade, Multi-node, Tower, and Rack Optimized servers, with rack-optimized and blade servers expected to lead in data center environments. The End-user Industry segmentation analyzes the market across IT and Telecommunications, BFSI, Manufacturing, Retail, Healthcare, Media and Entertainment, and Other End-user Verticals, with IT/Telecom and BFSI projected to remain the largest segments. Market sizes for each segment are projected to grow steadily, with competitive dynamics varying based on industry-specific demands and technological maturity.

Key Drivers of Brazil Servers Market Growth

The Brazil servers market growth is propelled by several pivotal factors. The ongoing digital transformation across all industries mandates increased investment in robust server infrastructure to support new applications and services. The rapid adoption of cloud computing, both public and private, fuels the demand for hybrid solutions and on-premises servers for data control and specialized workloads. The burgeoning Internet of Things (IoT) ecosystem requires significant server capacity for data ingestion, processing, and analytics at the edge and in centralized data centers. Furthermore, the increasing focus on Big Data analytics and Artificial Intelligence (AI) necessitates high-performance computing capabilities, driving demand for advanced server architectures. Government initiatives promoting technological innovation and digital inclusion also contribute to market expansion.

Challenges in the Brazil Servers Market Sector

Despite the positive growth trajectory, the Brazil servers market faces certain challenges. Economic volatility and fluctuating currency exchange rates can impact import costs and overall IT spending. Complex tax regulations and customs procedures can add to the cost and complexity of importing server hardware. Supply chain disruptions, exacerbated by global events, can lead to longer lead times and increased costs for components and finished products. Intense price competition among vendors and the growing preference for pay-as-you-go cloud services can pressure margins for on-premises server sales. Additionally, the need for skilled IT professionals to manage and maintain advanced server infrastructure can be a bottleneck in some regions.

Leading Players in the Brazil Servers Market Market

- Hewlett Packard Enterprise Co

- Dell Technologies Inc

- Lenovo Group Limited

- Cisco Systems Inc

- Positivo Tecnologia S/A

- Oracle Corporation

- Super Micro Computer Inc

- IBM Corporation

- Fujitsu Limited

- Huawei Technologies Co Ltd

Key Developments in Brazil Servers Market Sector

- May 2024: IBM unveiled its latest addition to its server lineup, the IBM Power S1012. This new system, powered by the cutting-edge Power10 processor, boasts a 1-socket, half-wide design. It is a performance powerhouse, offering a remarkable 3X boost in performance per core compared to its predecessor, the Power S812. This enhancement amplifies AI workloads and seamlessly extends its reach from the core to the cloud and even the edge, promising heightened business value across diverse industries.

- October 2023: BWS IoT partnered with Emnify's IoT SuperNetwork, leveraging a multi-operator SIM card. Its goal is to scale connections to a projected one million devices by 2024. This strategic alliance amplifies BWS IoT's offerings on a national scale and bolsters its global presence.

Strategic Brazil Servers Market Market Outlook

- May 2024: IBM unveiled its latest addition to its server lineup, the IBM Power S1012. This new system, powered by the cutting-edge Power10 processor, boasts a 1-socket, half-wide design. It is a performance powerhouse, offering a remarkable 3X boost in performance per core compared to its predecessor, the Power S812. This enhancement amplifies AI workloads and seamlessly extends its reach from the core to the cloud and even the edge, promising heightened business value across diverse industries.

- October 2023: BWS IoT partnered with Emnify's IoT SuperNetwork, leveraging a multi-operator SIM card. Its goal is to scale connections to a projected one million devices by 2024. This strategic alliance amplifies BWS IoT's offerings on a national scale and bolsters its global presence.

Strategic Brazil Servers Market Market Outlook

The strategic outlook for the Brazil servers market is overwhelmingly positive, characterized by strong growth accelerators and significant future potential. The continued push for digitalization across all sectors, coupled with increasing adoption of cloud-native architectures, will drive sustained demand for flexible and scalable server solutions. The expanding IoT landscape in Brazil presents a substantial opportunity for edge computing and data processing servers. Furthermore, the growing emphasis on data analytics and AI/ML will create a robust market for high-performance and specialized server hardware. Strategic opportunities lie in offering integrated hybrid cloud solutions, focusing on energy-efficient and sustainable server technologies, and providing value-added services such as managed services and cybersecurity. Companies that can adapt to evolving technological trends and cater to the specific needs of Brazilian industries will be well-positioned for success.

Brazil Servers Market Segmentation

-

1. Operating System

- 1.1. Linux

- 1.2. Windows

- 1.3. UNIX

- 1.4. Other Operating Systems ((i5/OS, z/OS, etc.)

-

2. Server Class

- 2.1. High-end Server

- 2.2. Mid-range Server

- 2.3. Volume Server

-

3. Server Type

- 3.1. Blade

- 3.2. Multi-node

- 3.3. Tower

- 3.4. Rack Optimized

-

4. End-user Industry

- 4.1. IT and Telecommunications

- 4.2. BFSI

- 4.3. Manufacturing

- 4.4. Retail

- 4.5. Healthcare

- 4.6. Media and Entertainment

- 4.7. Other End-user Verticals

Brazil Servers Market Segmentation By Geography

- 1. Brazil

Brazil Servers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry

- 3.4. Market Trends

- 3.4.1. IT and Telecommunications Industry to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Servers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 5.1.1. Linux

- 5.1.2. Windows

- 5.1.3. UNIX

- 5.1.4. Other Operating Systems ((i5/OS, z/OS, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Server Class

- 5.2.1. High-end Server

- 5.2.2. Mid-range Server

- 5.2.3. Volume Server

- 5.3. Market Analysis, Insights and Forecast - by Server Type

- 5.3.1. Blade

- 5.3.2. Multi-node

- 5.3.3. Tower

- 5.3.4. Rack Optimized

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. IT and Telecommunications

- 5.4.2. BFSI

- 5.4.3. Manufacturing

- 5.4.4. Retail

- 5.4.5. Healthcare

- 5.4.6. Media and Entertainment

- 5.4.7. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hewlett Packard Enterprise Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dell Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lenovo Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Positivo Tecnologia S/A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oracle Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Super Micro Computer Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IBM Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fujitsu Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huawei Technologies Co Ltd7 3 Import and Export Analysis in Brazi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hewlett Packard Enterprise Co

List of Figures

- Figure 1: Brazil Servers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Servers Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Servers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Servers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Brazil Servers Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 4: Brazil Servers Market Volume Billion Forecast, by Operating System 2019 & 2032

- Table 5: Brazil Servers Market Revenue Million Forecast, by Server Class 2019 & 2032

- Table 6: Brazil Servers Market Volume Billion Forecast, by Server Class 2019 & 2032

- Table 7: Brazil Servers Market Revenue Million Forecast, by Server Type 2019 & 2032

- Table 8: Brazil Servers Market Volume Billion Forecast, by Server Type 2019 & 2032

- Table 9: Brazil Servers Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Brazil Servers Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 11: Brazil Servers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Brazil Servers Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: Brazil Servers Market Revenue Million Forecast, by Operating System 2019 & 2032

- Table 14: Brazil Servers Market Volume Billion Forecast, by Operating System 2019 & 2032

- Table 15: Brazil Servers Market Revenue Million Forecast, by Server Class 2019 & 2032

- Table 16: Brazil Servers Market Volume Billion Forecast, by Server Class 2019 & 2032

- Table 17: Brazil Servers Market Revenue Million Forecast, by Server Type 2019 & 2032

- Table 18: Brazil Servers Market Volume Billion Forecast, by Server Type 2019 & 2032

- Table 19: Brazil Servers Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Brazil Servers Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 21: Brazil Servers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Servers Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Servers Market?

The projected CAGR is approximately 8.41%.

2. Which companies are prominent players in the Brazil Servers Market?

Key companies in the market include Hewlett Packard Enterprise Co, Dell Technologies Inc, Lenovo Group Limited, Cisco Systems Inc, Positivo Tecnologia S/A, Oracle Corporation, Super Micro Computer Inc, IBM Corporation, Fujitsu Limited, Huawei Technologies Co Ltd7 3 Import and Export Analysis in Brazi.

3. What are the main segments of the Brazil Servers Market?

The market segments include Operating System, Server Class, Server Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.05 Million as of 2022.

5. What are some drivers contributing to market growth?

The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry.

6. What are the notable trends driving market growth?

IT and Telecommunications Industry to Witness Major Growth.

7. Are there any restraints impacting market growth?

The Surge of Fintech and Crypto Exchanges in Brazil; Application of AI and Big Data Analytics in the Healthcare Industry.

8. Can you provide examples of recent developments in the market?

May 2024: IBM unveiled its latest addition to its server lineup, the IBM Power S1012. This new system, powered by the cutting-edge Power10 processor, boasts a 1-socket, half-wide design. It is a performance powerhouse, offering a remarkable 3X boost in performance per core compared to its predecessor, the Power S812. This enhancement amplifies AI workloads and seamlessly extends its reach from the core to the cloud and even the edge, promising heightened business value across diverse industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Servers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Servers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Servers Market?

To stay informed about further developments, trends, and reports in the Brazil Servers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence