Key Insights

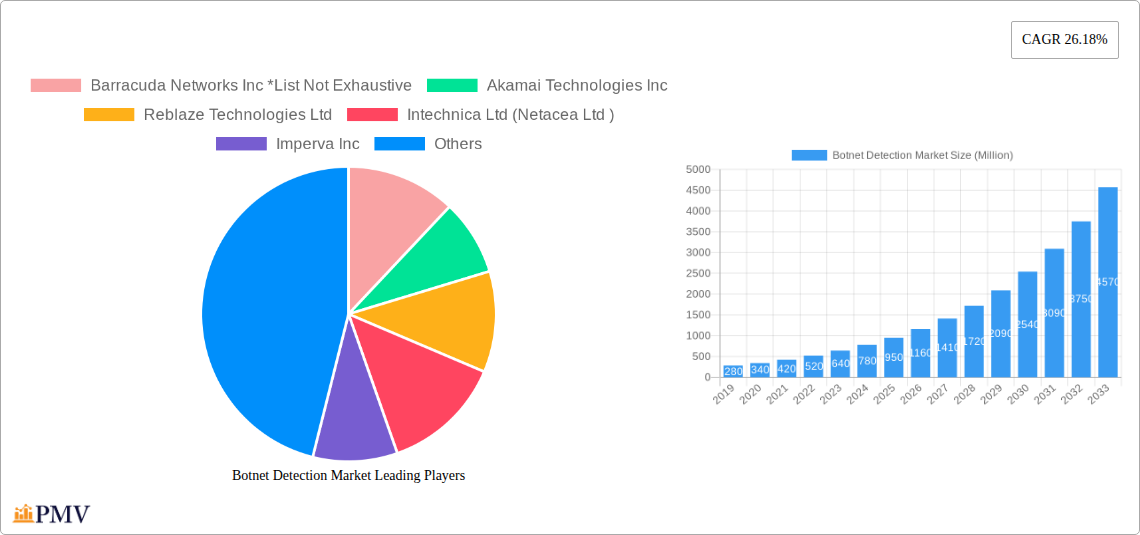

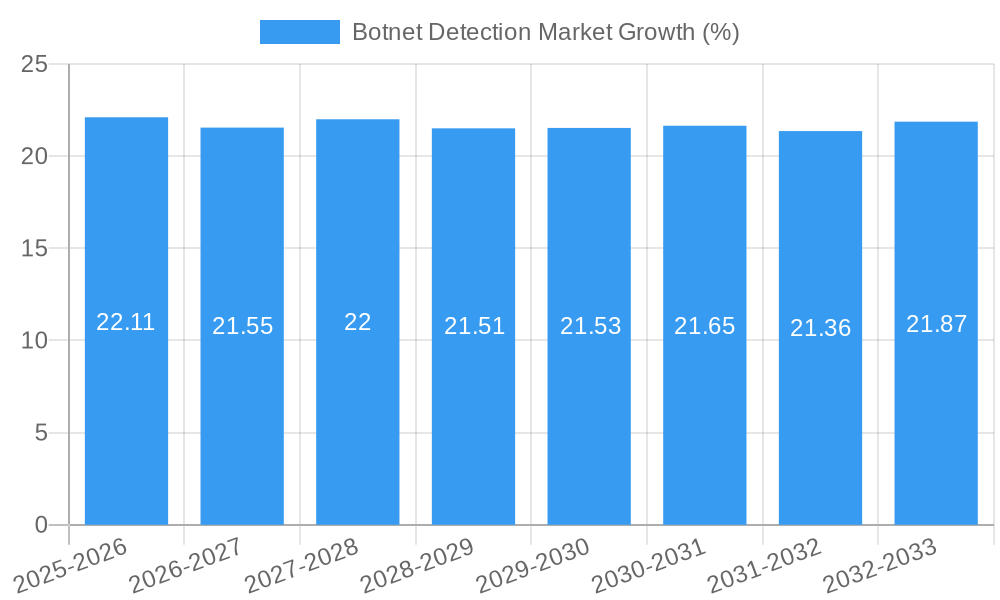

The Botnet Detection Market is poised for explosive growth, projected to reach $1.12 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 26.18% anticipated to extend through 2033. This surge is primarily fueled by the escalating sophistication and volume of botnet attacks, which pose significant threats to organizations across all sectors. The increasing reliance on digital infrastructure, coupled with the proliferation of IoT devices, creates larger attack surfaces that botnets readily exploit. Key market drivers include the growing need for advanced threat intelligence, the demand for real-time bot detection and mitigation, and the rising adoption of cloud-based security solutions offering scalability and efficiency. Furthermore, stringent data privacy regulations worldwide are compelling businesses to invest in robust security measures, including sophisticated botnet detection capabilities, to safeguard sensitive information and maintain customer trust.

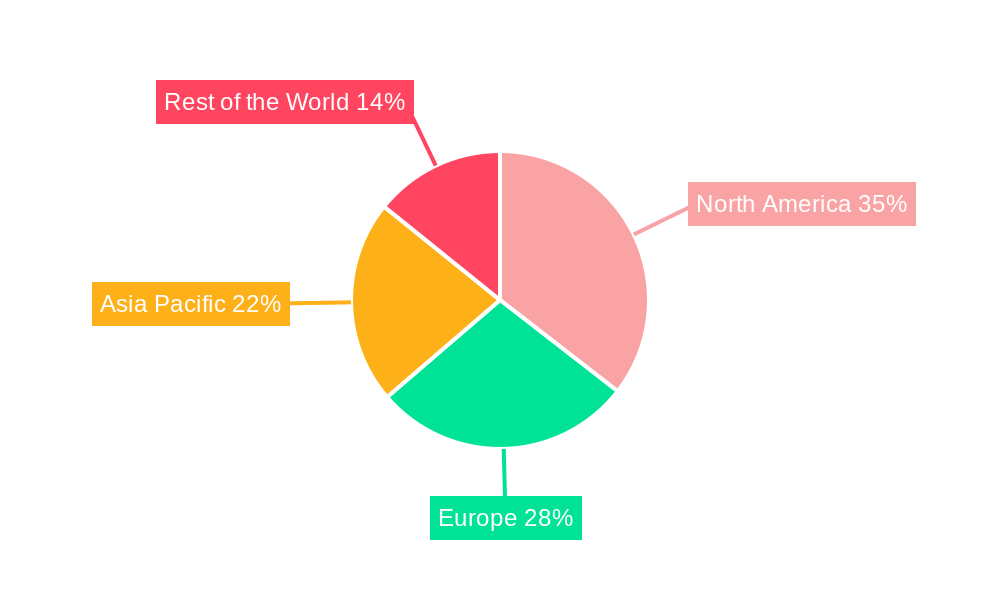

The market is characterized by a dynamic interplay of technological advancements and evolving threat landscapes. Solution providers are continuously innovating, offering a range of specialized tools such as behavioral analysis, machine learning-powered anomaly detection, and signature-based identification to counter diverse botnet methodologies. Services, including managed security services and threat hunting, are also gaining traction as organizations seek expert assistance in managing complex security environments. While on-premise deployments continue to hold a share, cloud-based solutions are witnessing accelerated adoption due to their flexibility, cost-effectiveness, and rapid deployment capabilities, particularly among Small and Medium-sized Enterprises (SMEs) and large enterprises alike. Geographically, North America and Europe are leading the adoption of botnet detection solutions, driven by mature cybersecurity markets and a high prevalence of cyber threats. However, the Asia Pacific region is emerging as a significant growth area, fueled by rapid digital transformation and increasing awareness of cyber risks. Despite robust growth prospects, challenges such as the high cost of implementing advanced solutions and a shortage of skilled cybersecurity professionals could present hurdles, but the overwhelming imperative for robust cyber defense is expected to drive continued market expansion.

This in-depth market research report provides a detailed analysis of the global Botnet Detection Market, offering crucial insights into market dynamics, growth drivers, challenges, and competitive landscapes. Spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving botnet threat landscape. We meticulously analyze key segments, including component, deployment type, organization size, and end-user verticals, providing actionable intelligence for strategic decision-making.

Botnet Detection Market Market Structure & Competitive Dynamics

The Botnet Detection Market is characterized by a moderately concentrated structure, with a mix of established cybersecurity giants and innovative startups vying for market share. Key players are continually investing in research and development to counter increasingly sophisticated botnets. The innovation ecosystem is vibrant, driven by the relentless evolution of botnet techniques, necessitating advanced threat intelligence and rapid response capabilities. Regulatory frameworks are evolving to address the growing threat of cybercrime, including botnet proliferation, influencing market adoption of compliant solutions. Product substitutes are limited, as dedicated botnet detection solutions offer specialized capabilities beyond general cybersecurity tools. End-user trends show a clear shift towards proactive threat mitigation and automated detection, fueled by the rising volume and complexity of botnet attacks. Mergers and acquisitions (M&A) are a significant feature, with companies acquiring specialized technologies and talent to enhance their offerings. For instance, the acquisition of Linode LLC by Akamai Technologies Inc. in March 2022 for approximately $900 Million signifies a strategic move to bolster cloud-based security solutions. The market share of leading providers is continually being reshaped by these strategic maneuvers and technological advancements.

Botnet Detection Market Industry Trends & Insights

The Botnet Detection Market is experiencing robust growth, driven by several key factors. The escalating volume and sophistication of botnet attacks across various industries present a primary growth driver. Businesses are increasingly aware of the significant financial and reputational damage that botnet-driven activities, such as Distributed Denial of Service (DDoS) attacks, credential stuffing, and content scraping, can inflict. This heightened awareness translates into increased demand for advanced botnet detection solutions. Technological disruptions, including the proliferation of IoT devices and the expansion of cloud computing, have inadvertently created new vulnerabilities that botnets exploit, further fueling market expansion. The evolution of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing botnet detection, enabling more accurate identification of malicious traffic patterns and behavioral anomalies that traditional signature-based methods miss. Consumer preferences are also shifting towards automated, real-time threat detection and response, pushing vendors to offer intelligent, self-learning platforms. Competitive dynamics are intensifying as vendors differentiate themselves through advanced analytics, integration capabilities, and specialized threat intelligence. The estimated Compound Annual Growth Rate (CAGR) for the Botnet Detection Market is projected to be around 15.8%, reaching an estimated market size of $7,500 Million by 2033. Market penetration is steadily increasing across all enterprise segments as organizations prioritize robust cybersecurity postures. The growing need for protecting sensitive data and ensuring service availability in sectors like BFSI and e-commerce is a significant catalyst. Furthermore, the rise of sophisticated fraud schemes powered by botnets in the Media & Entertainment and Advertising sectors is creating new avenues for market growth. The proactive approach to cybersecurity, moving beyond reactive measures, is a defining trend.

Dominant Markets & Segments in Botnet Detection Market

The Botnet Detection Market exhibits distinct dominance across various regions and segments. North America currently leads the market, driven by a strong concentration of technology companies, stringent regulatory compliance requirements, and a high level of cybersecurity awareness. The United States, in particular, is a major contributor due to its significant digital infrastructure and the prevalence of sophisticated cyber threats.

Component: The Solution segment is currently the dominant force within the Botnet Detection Market. This includes advanced software platforms and tools that offer comprehensive capabilities for identifying, analyzing, and mitigating botnet activities. The demand for integrated solutions that provide end-to-end botnet protection is high.

Deployment Type: Cloud deployment models are witnessing significant traction and are poised for continued dominance. The scalability, flexibility, and cost-effectiveness of cloud-based solutions make them attractive for organizations of all sizes. This trend is amplified by the increasing adoption of cloud infrastructure across industries.

Organization Size: Large Enterprises represent the largest market segment. These organizations typically possess larger attack surfaces, handle vast amounts of sensitive data, and are prime targets for advanced persistent threats and large-scale botnet attacks. Consequently, they invest more heavily in sophisticated botnet detection solutions. However, the SME segment is showing rapid growth as cyber threats become more democratized.

End-user Vertical: The IT & Telecom sector stands out as a dominant end-user vertical. This is attributed to the critical nature of their services, the vast amount of data they handle, and their extensive network infrastructure, making them frequent targets for botnets.

- The BFSI (Banking, Financial Services, and Insurance) sector is another major contributor, driven by the imperative to protect sensitive financial data and maintain customer trust against fraudulent activities powered by bots.

- The Retail sector is also a significant market due to the increasing reliance on e-commerce and the need to prevent inventory hoarding, price manipulation, and data breaches caused by bots.

- Media & Entertainment is a rapidly growing vertical, as bots are extensively used for illegal content distribution, ad fraud, and scalping tickets.

Botnet Detection Market Product Innovations

Product innovations in the Botnet Detection Market are primarily focused on leveraging advanced AI and ML algorithms for real-time, adaptive threat detection. Vendors are developing solutions that can accurately distinguish between human and bot traffic by analyzing behavioral patterns, device fingerprints, and contextual data. Key innovations include sophisticated anomaly detection engines, behavioral analytics platforms, and integrated threat intelligence feeds that provide up-to-date information on emerging botnet campaigns. Competitive advantages are being gained through enhanced accuracy in bot identification, reduced false positives, and seamless integration with existing security infrastructure, such as SIEM and SOAR platforms. The focus is on providing proactive defense mechanisms that can not only detect but also predict and prevent botnet attacks before they cause significant damage.

Report Segmentation & Scope

This report segments the Botnet Detection Market across several key dimensions to provide a granular understanding of market dynamics.

Component: The market is segmented into Solution and Service. The Solution segment encompasses botnet detection software, platforms, and tools, while the Service segment includes managed security services, threat intelligence, and consulting related to botnet detection and mitigation.

Deployment Type: We analyze the market based on On-premise and Cloud deployment models. On-premise solutions offer organizations greater control over their data and infrastructure, whereas cloud-based solutions provide scalability and ease of management.

Organization Size: The market is categorized into SMEs and Large Enterprises. SMEs are increasingly adopting cost-effective and scalable botnet detection solutions, while large enterprises often require comprehensive and highly customizable security architectures.

End-user Vertical: The report examines the market across key verticals including Retail, BFSI, Travel & Hospitality, IT & Telecom, Media & Entertainment, and Other Enterprises. Each vertical faces unique botnet threats and has specific security requirements.

Key Drivers of Botnet Detection Market Growth

Several key factors are driving the growth of the Botnet Detection Market. The relentless increase in the volume and sophistication of botnet attacks globally is the primary catalyst. Cybercriminals are continuously developing new tactics, techniques, and procedures (TTPs) to evade traditional security measures. The growing adoption of cloud computing and the proliferation of IoT devices have expanded the attack surface, creating more opportunities for botnets to infiltrate networks. Furthermore, the increasing regulatory focus on data privacy and cybersecurity, such as GDPR and CCPA, compels organizations to invest in robust botnet detection solutions to ensure compliance and avoid hefty penalties. The escalating financial losses associated with botnet-driven fraud, including credential stuffing, account takeovers, and ad fraud, are also significant motivators for market growth.

Challenges in the Botnet Detection Market Sector

Despite the strong growth trajectory, the Botnet Detection Market faces several challenges. The rapidly evolving nature of botnet threats necessitates continuous innovation and adaptation from solution providers, leading to higher R&D costs. The sheer volume of data generated by botnet activities can overwhelm existing detection systems, leading to alert fatigue and potential missed threats. The lack of skilled cybersecurity professionals capable of effectively managing and interpreting botnet detection tools also poses a significant hurdle. Additionally, the cost of advanced botnet detection solutions can be prohibitive for some organizations, particularly SMEs, creating a barrier to adoption. Finally, the global nature of botnets means that effective detection often requires international collaboration and intelligence sharing, which can be complex to coordinate.

Leading Players in the Botnet Detection Market Market

- Barracuda Networks Inc

- Akamai Technologies Inc

- Reblaze Technologies Ltd

- Intechnica Ltd (Netacea Ltd )

- Imperva Inc

- PerimeterX Inc (HUMAN Security Inc )

- DATADOME Group

- Radware Ltd

- Oracle Corporation

- Cloudflare Inc

Key Developments in Botnet Detection Market Sector

- August 2022: MiQ and HUMAN Security, Inc. announced a partnership to increase quality, transparency, and trust in connected TV (CTV) advertisers. The partnership will provide MiQ clients and advertisers with a suite of ad fraud detection to ensure that only 'real humans' interact with their CTV investments. Sophisticated bots and fraud pose a significantly increased threat to CTV campaigns. MiQ would augment its existing fraud prevention measures to utilize the intelligence from HUMAN and better identify and exclude sources of bot-driven fraud.

- March 2022: Akamai Technologies, Inc. announced the acquisition of Linode LLC. The company announced signing an agreement for Akamai to acquire Linode in exchange for approximately USD 900 Million. The acquisition aims to provide businesses with a developer-friendly and widely distributed platform to build, run, and secure applications.

Strategic Botnet Detection Market Market Outlook

- August 2022: MiQ and HUMAN Security, Inc. announced a partnership to increase quality, transparency, and trust in connected TV (CTV) advertisers. The partnership will provide MiQ clients and advertisers with a suite of ad fraud detection to ensure that only 'real humans' interact with their CTV investments. Sophisticated bots and fraud pose a significantly increased threat to CTV campaigns. MiQ would augment its existing fraud prevention measures to utilize the intelligence from HUMAN and better identify and exclude sources of bot-driven fraud.

- March 2022: Akamai Technologies, Inc. announced the acquisition of Linode LLC. The company announced signing an agreement for Akamai to acquire Linode in exchange for approximately USD 900 Million. The acquisition aims to provide businesses with a developer-friendly and widely distributed platform to build, run, and secure applications.

Strategic Botnet Detection Market Market Outlook

The strategic outlook for the Botnet Detection Market remains highly positive. Continued investment in AI and ML-powered solutions will be critical for vendors to stay ahead of evolving threats. The increasing convergence of cybersecurity solutions, such as integrating botnet detection with broader threat intelligence and security orchestration, automation, and response (SOAR) platforms, will offer enhanced efficacy. The growing demand for specialized botnet detection for emerging technologies like 5G networks and advanced IoT deployments presents significant growth opportunities. Furthermore, the increasing awareness of the impact of botnets on brand reputation and customer trust will drive proactive adoption strategies across all industry verticals. Strategic partnerships and collaborations, as exemplified by the MiQ and HUMAN Security, Inc. alliance, will become increasingly important for market players to enhance their capabilities and expand their reach. The market is expected to see sustained innovation focused on real-time anomaly detection, behavioral analysis, and predictive capabilities.

Botnet Detection Market Segmentation

-

1. Component

- 1.1. Solution

- 1.2. Service

-

2. Deployment Type

- 2.1. On-premise

- 2.2. Cloud

-

3. Organization Size

- 3.1. SMEs

- 3.2. Large Enterprise

-

4. End-user Vertical

- 4.1. Retail

- 4.2. BFSI

- 4.3. Travel & Hospitality

- 4.4. IT &Telecom

- 4.5. Media & Entertainment

- 4.6. Other En

Botnet Detection Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

Botnet Detection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Connected Devices; Increasing Need For Security against Botnet in Organizations; Increasing Usage of APIs By Online Businesses

- 3.3. Market Restrains

- 3.3.1 Lack of Education among Users and Low Usage of Tools; Use of Conventional BOT Protection Methods

- 3.3.2 Such as Captcha Or Create Account

- 3.4. Market Trends

- 3.4.1. Media and Entertainment Industry is Expected to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Botnet Detection Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solution

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. SMEs

- 5.3.2. Large Enterprise

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. Retail

- 5.4.2. BFSI

- 5.4.3. Travel & Hospitality

- 5.4.4. IT &Telecom

- 5.4.5. Media & Entertainment

- 5.4.6. Other En

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Botnet Detection Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solution

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. SMEs

- 6.3.2. Large Enterprise

- 6.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.4.1. Retail

- 6.4.2. BFSI

- 6.4.3. Travel & Hospitality

- 6.4.4. IT &Telecom

- 6.4.5. Media & Entertainment

- 6.4.6. Other En

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Botnet Detection Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solution

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. SMEs

- 7.3.2. Large Enterprise

- 7.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.4.1. Retail

- 7.4.2. BFSI

- 7.4.3. Travel & Hospitality

- 7.4.4. IT &Telecom

- 7.4.5. Media & Entertainment

- 7.4.6. Other En

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Botnet Detection Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solution

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. SMEs

- 8.3.2. Large Enterprise

- 8.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.4.1. Retail

- 8.4.2. BFSI

- 8.4.3. Travel & Hospitality

- 8.4.4. IT &Telecom

- 8.4.5. Media & Entertainment

- 8.4.6. Other En

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World Botnet Detection Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solution

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. SMEs

- 9.3.2. Large Enterprise

- 9.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.4.1. Retail

- 9.4.2. BFSI

- 9.4.3. Travel & Hospitality

- 9.4.4. IT &Telecom

- 9.4.5. Media & Entertainment

- 9.4.6. Other En

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. North America Botnet Detection Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 11. Europe Botnet Detection Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United Kingdom

- 11.1.2 Germany

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific Botnet Detection Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 Rest of Asia Pacific

- 13. Rest of the World Botnet Detection Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Latin America

- 13.1.2 Middle East

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Barracuda Networks Inc *List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Akamai Technologies Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Reblaze Technologies Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Intechnica Ltd (Netacea Ltd )

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Imperva Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 PerimeterX Inc (HUMAN Security Inc )

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 DATADOME Group

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Radware Ltd

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Oracle Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Cloudflare Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Barracuda Networks Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Botnet Detection Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Botnet Detection Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Botnet Detection Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Botnet Detection Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Botnet Detection Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Botnet Detection Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Botnet Detection Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Botnet Detection Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Botnet Detection Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Botnet Detection Market Revenue (Million), by Component 2024 & 2032

- Figure 11: North America Botnet Detection Market Revenue Share (%), by Component 2024 & 2032

- Figure 12: North America Botnet Detection Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 13: North America Botnet Detection Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 14: North America Botnet Detection Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 15: North America Botnet Detection Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 16: North America Botnet Detection Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 17: North America Botnet Detection Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 18: North America Botnet Detection Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Botnet Detection Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Botnet Detection Market Revenue (Million), by Component 2024 & 2032

- Figure 21: Europe Botnet Detection Market Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe Botnet Detection Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 23: Europe Botnet Detection Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 24: Europe Botnet Detection Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 25: Europe Botnet Detection Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 26: Europe Botnet Detection Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 27: Europe Botnet Detection Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 28: Europe Botnet Detection Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Botnet Detection Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Botnet Detection Market Revenue (Million), by Component 2024 & 2032

- Figure 31: Asia Pacific Botnet Detection Market Revenue Share (%), by Component 2024 & 2032

- Figure 32: Asia Pacific Botnet Detection Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 33: Asia Pacific Botnet Detection Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 34: Asia Pacific Botnet Detection Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 35: Asia Pacific Botnet Detection Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 36: Asia Pacific Botnet Detection Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 37: Asia Pacific Botnet Detection Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 38: Asia Pacific Botnet Detection Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Asia Pacific Botnet Detection Market Revenue Share (%), by Country 2024 & 2032

- Figure 40: Rest of the World Botnet Detection Market Revenue (Million), by Component 2024 & 2032

- Figure 41: Rest of the World Botnet Detection Market Revenue Share (%), by Component 2024 & 2032

- Figure 42: Rest of the World Botnet Detection Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 43: Rest of the World Botnet Detection Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 44: Rest of the World Botnet Detection Market Revenue (Million), by Organization Size 2024 & 2032

- Figure 45: Rest of the World Botnet Detection Market Revenue Share (%), by Organization Size 2024 & 2032

- Figure 46: Rest of the World Botnet Detection Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 47: Rest of the World Botnet Detection Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 48: Rest of the World Botnet Detection Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Rest of the World Botnet Detection Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Botnet Detection Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Botnet Detection Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Botnet Detection Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 4: Global Botnet Detection Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 5: Global Botnet Detection Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Global Botnet Detection Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Botnet Detection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Botnet Detection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Kingdom Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Botnet Detection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Botnet Detection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Latin America Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Middle East Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Botnet Detection Market Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Global Botnet Detection Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 25: Global Botnet Detection Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 26: Global Botnet Detection Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 27: Global Botnet Detection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Canada Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Botnet Detection Market Revenue Million Forecast, by Component 2019 & 2032

- Table 31: Global Botnet Detection Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 32: Global Botnet Detection Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 33: Global Botnet Detection Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 34: Global Botnet Detection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United Kingdom Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Germany Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: France Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Botnet Detection Market Revenue Million Forecast, by Component 2019 & 2032

- Table 40: Global Botnet Detection Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 41: Global Botnet Detection Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 42: Global Botnet Detection Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 43: Global Botnet Detection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: China Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: India Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Botnet Detection Market Revenue Million Forecast, by Component 2019 & 2032

- Table 49: Global Botnet Detection Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 50: Global Botnet Detection Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 51: Global Botnet Detection Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 52: Global Botnet Detection Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Latin America Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Middle East Botnet Detection Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Botnet Detection Market?

The projected CAGR is approximately 26.18%.

2. Which companies are prominent players in the Botnet Detection Market?

Key companies in the market include Barracuda Networks Inc *List Not Exhaustive, Akamai Technologies Inc, Reblaze Technologies Ltd, Intechnica Ltd (Netacea Ltd ), Imperva Inc, PerimeterX Inc (HUMAN Security Inc ), DATADOME Group, Radware Ltd, Oracle Corporation, Cloudflare Inc.

3. What are the main segments of the Botnet Detection Market?

The market segments include Component, Deployment Type, Organization Size, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Connected Devices; Increasing Need For Security against Botnet in Organizations; Increasing Usage of APIs By Online Businesses.

6. What are the notable trends driving market growth?

Media and Entertainment Industry is Expected to Register Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Education among Users and Low Usage of Tools; Use of Conventional BOT Protection Methods. Such as Captcha Or Create Account.

8. Can you provide examples of recent developments in the market?

August 2022 - MiQ and HUMAN Security, Inc. announced a partnership to increase quality, transparency, and trust in connected TV (CTV) advertisers. The partnership will provide MiQ clients and advertisers with a suite of ad fraud detection to ensure that only 'real humans' interact with their CTV investments. Sophisticated bots and fraud pose a significantly increased threat to CTV campaigns. MiQ would augment its existing fraud prevention measures to utilize the intelligence from HUMAN and better identify and exclude sources of bot-driven fraud.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Botnet Detection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Botnet Detection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Botnet Detection Market?

To stay informed about further developments, trends, and reports in the Botnet Detection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence