Key Insights

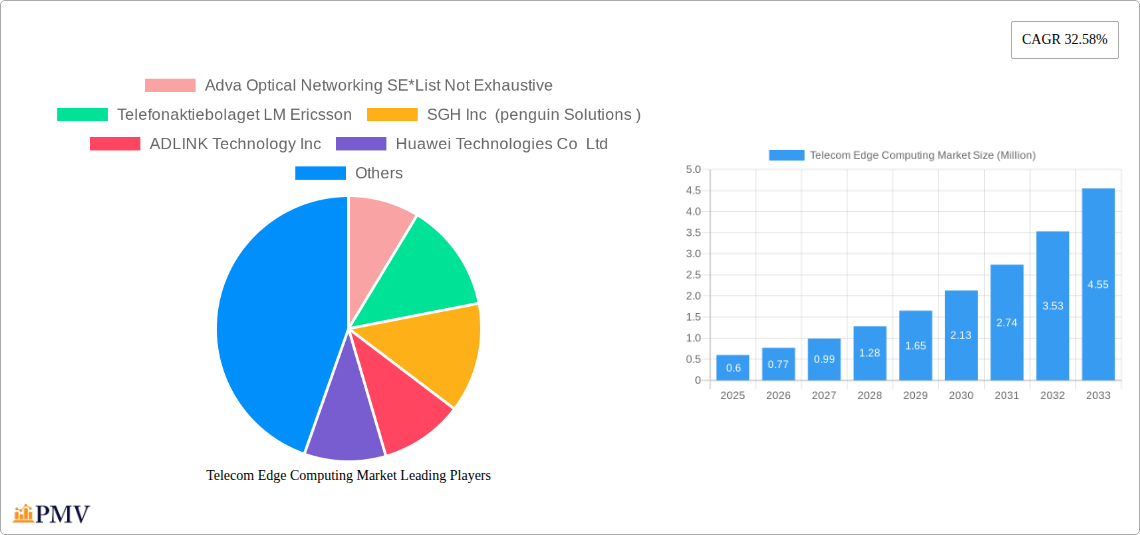

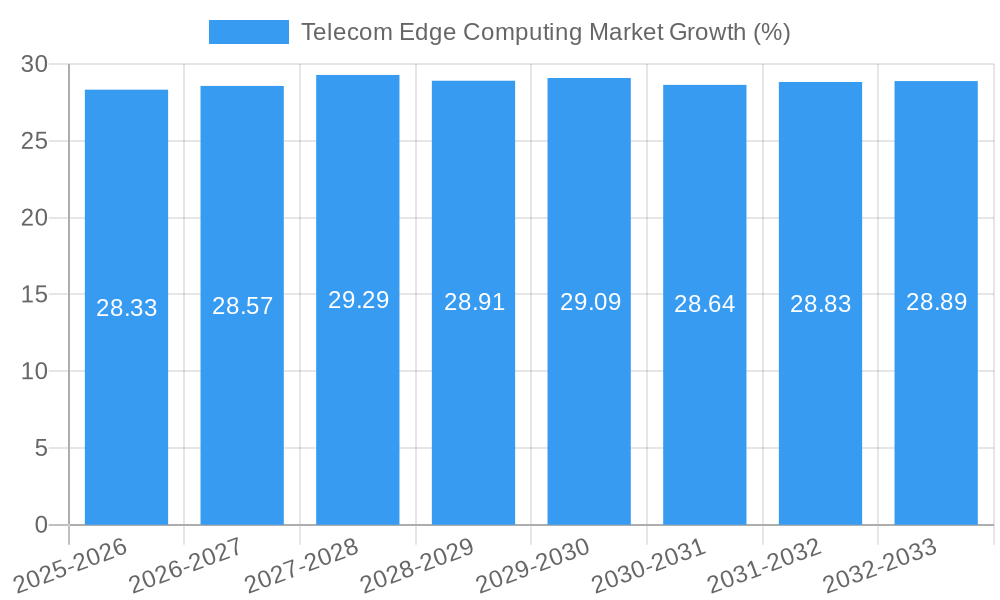

The Telecom Edge Computing Market is poised for explosive growth, projected to reach a substantial USD 0.6 million in 2025 and expand at a remarkable Compound Annual Growth Rate (CAGR) of 32.58% through 2033. This rapid ascent is fueled by a confluence of powerful drivers, chief among them the escalating demand for real-time data processing, ultra-low latency applications, and enhanced network efficiency. The proliferation of 5G networks, the burgeoning Internet of Things (IoT) ecosystem, and the increasing need for localized data analytics are all acting as significant catalysts for this market's expansion. Edge computing in telecom allows for data to be processed closer to the source, reducing reliance on centralized cloud infrastructure and enabling a new wave of innovative services. Key industries such as Financial Services, Retail, and Healthcare are recognizing the transformative potential of edge solutions for improved customer experiences, operational efficiencies, and faster decision-making. The market is segmented into hardware and software components, with both expected to witness robust demand as telecommunications providers and enterprises invest in the necessary infrastructure and platforms.

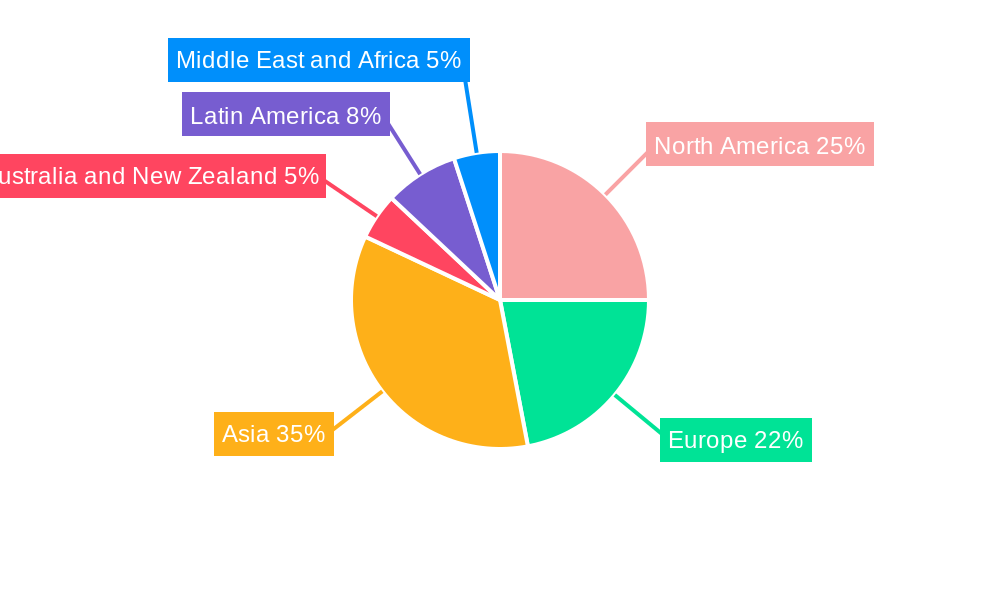

The trajectory of the Telecom Edge Computing Market is further shaped by emerging trends like the integration of Artificial Intelligence (AI) and Machine Learning (ML) at the edge, enabling more intelligent and autonomous operations. The development of specialized edge platforms and solutions tailored for specific industry needs is also a significant trend. However, the market is not without its restraints. Significant capital investment for deploying edge infrastructure, challenges in managing distributed edge deployments, and concerns around data security and privacy at the edge present hurdles to overcome. Despite these challenges, the overwhelming market potential and the strategic importance of edge computing for the future of telecommunications and digital transformation are expected to drive sustained innovation and investment. Major players like Huawei, Nokia, Ericsson, and Verizon are actively involved in shaping this dynamic market, with Asia expected to emerge as a dominant region due to its rapid technological adoption and extensive telecom infrastructure development.

This in-depth report provides a detailed examination of the global Telecom Edge Computing Market, offering crucial insights into market dynamics, emerging trends, competitive landscape, and future growth trajectories. Analyzing the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is essential for stakeholders seeking to understand and capitalize on the rapidly evolving edge computing ecosystem within the telecommunications sector. Our analysis encompasses key segments including hardware, software, and diverse end-user industries such as financial services, retail, healthcare, industrial, and energy. The report leverages extensive historical data from 2019–2024 to provide robust estimations and predictions.

Telecom Edge Computing Market Market Structure & Competitive Dynamics

The Telecom Edge Computing Market exhibits a moderately consolidated structure, with leading telecommunications operators and technology providers vying for market share. Innovation ecosystems are flourishing, driven by the need for low-latency, high-bandwidth solutions that edge computing uniquely addresses. Regulatory frameworks, particularly concerning data privacy and network neutrality, play a significant role in shaping market entry and operational strategies. While direct product substitutes are limited, the evolving cloud infrastructure and advancements in traditional data center capabilities present indirect competitive pressures. End-user trends indicate a strong pull from industries demanding real-time data processing and localized computation, such as industrial automation and autonomous systems. Mergers and acquisitions (M&A) activity is moderate, with key players acquiring specialized capabilities or expanding their geographical reach. For instance, recent M&A deals in the broader edge computing space have seen valuations exceeding $500 Million, reflecting the strategic importance of these technologies. Market share analysis reveals that the top 5 players command an estimated 60% of the current market.

- Market Concentration: Moderate, with significant influence from established telecom operators and infrastructure providers.

- Innovation Ecosystems: Thriving, fueled by partnerships between telecom firms, cloud providers, and hardware manufacturers.

- Regulatory Frameworks: Evolving, with a focus on data governance, security, and infrastructure deployment.

- Product Substitutes: Limited direct substitutes, but advancements in centralized cloud solutions and on-premise processing present indirect competition.

- End-User Trends: Growing demand for real-time analytics, IoT integration, and enhanced mobile experiences.

- M&A Activities: Strategic acquisitions focused on niche technologies and market expansion.

Telecom Edge Computing Market Industry Trends & Insights

The Telecom Edge Computing Market is experiencing a robust growth phase, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 25% during the forecast period. This expansion is propelled by several key market growth drivers, most notably the insatiable demand for ultra-low latency applications, critical for emerging technologies like 5G, artificial intelligence (AI), and the Internet of Things (IoT). The proliferation of connected devices, estimated to reach over 100 Billion by 2030, generates vast amounts of data that require localized processing closer to the source for real-time insights and decision-making, thereby reducing backhaul traffic and operational costs. Technological disruptions are a constant feature, with advancements in hardware miniaturization, energy-efficient processors, and software-defined networking (SDN) enabling more powerful and versatile edge solutions. Consumer preferences are shifting towards hyper-personalized experiences and instant access to services, directly benefiting edge deployments in retail and entertainment. Furthermore, the increasing adoption of private 5G networks by enterprises is creating new revenue streams and use cases for telecom operators. Competitive dynamics are intensifying, with a clear trend towards vertical integration, where telecom companies are not only providing connectivity but also offering end-to-end edge computing solutions, including managed services and application development platforms. The market penetration of edge computing solutions is steadily increasing across various sectors, with early adopters in industrial IoT and telecommunications already demonstrating significant ROI. The estimated market size for Telecom Edge Computing is projected to reach $150 Billion by 2028, up from an estimated $40 Billion in 2024.

Dominant Markets & Segments in Telecom Edge Computing Market

The Telecommunications segment stands out as a dominant force within the Telecom Edge Computing Market, driven by the inherent need for network optimization, enhanced mobile broadband (eMBB), and ultra-reliable low-latency communication (URLLC) capabilities essential for 5G deployment. The global reach of telecom infrastructure makes them natural custodians and enablers of edge deployments. Within the component segmentation, Hardware holds a significant market share, encompassing specialized servers, networking equipment, and storage solutions designed for distributed environments. Key drivers for hardware dominance include the increasing need for powerful, compact, and energy-efficient computing at the network edge.

Key Drivers for Dominance:

Telecommunications:

- 5G rollout and its demand for low latency and high bandwidth.

- Need for network function virtualization (NFV) and virtualized radio access networks (vRAN).

- Deployment of Multi-access Edge Computing (MEC) for localized data processing and services.

- Growth in enterprise private 5G networks.

Hardware Component:

- Demand for ruggedized and compact edge servers.

- Advancements in AI-accelerated chips for edge inference.

- Development of specialized networking equipment for distributed architectures.

- Increasing integration of GPUs and other accelerators for high-performance edge tasks.

The Industrial sector is emerging as a crucial end-user segment, witnessing rapid adoption of edge computing for factory automation, predictive maintenance, and real-time monitoring, estimated to grow at a CAGR of 28%. The Healthcare and Life Sciences industry is also a significant growth area, leveraging edge for remote patient monitoring, AI-powered diagnostics, and secure handling of sensitive medical data, with a projected market size of $15 Billion by 2028. The Financial and Banking Industry is increasingly adopting edge solutions for fraud detection, algorithmic trading, and enhanced customer experiences at branches. The Retail sector is utilizing edge for in-store analytics, personalized promotions, and inventory management.

Telecom Edge Computing Market Product Innovations

Product innovations in the Telecom Edge Computing Market are centered around enhancing processing power, reducing latency, and improving security at the network edge. Key developments include the introduction of specialized edge servers with AI accelerators for real-time inference, the integration of open-source software frameworks for simplified deployment and management of edge applications, and advancements in containerization technologies like Kubernetes for orchestrating distributed workloads. These innovations offer significant competitive advantages by enabling new use cases such as real-time video analytics for security and retail, autonomous vehicle communication, and enhanced augmented reality (AR)/virtual reality (VR) experiences. The market fit for these innovations is strong across industries demanding immediate data processing and decision-making capabilities.

Report Segmentation & Scope

The Telecom Edge Computing Market is segmented across various components and end-user industries. The Hardware segment, encompassing specialized servers, gateways, and networking infrastructure, is projected to reach $70 Billion by 2028. The Software segment, including operating systems, edge platforms, and management tools, is expected to grow to $60 Billion by 2028.

- Hardware: This segment includes the physical infrastructure required for edge deployments, such as compact servers, networking switches, and storage devices. Its growth is fueled by the increasing demand for powerful yet distributed computing capabilities.

- Software: This segment comprises the operating systems, middleware, orchestration platforms, and application development tools that enable the functionality of edge computing solutions. Its expansion is driven by the need for seamless integration and management of distributed applications.

- Financial and Banking Industry: This sector is leveraging edge for real-time fraud detection and enhanced customer transaction processing, contributing an estimated $8 Billion to the market by 2028.

- Retail: Edge computing is transforming retail through in-store analytics and personalized customer experiences, with a projected market size of $10 Billion by 2028.

- Healthcare and Life Sciences: This industry is adopting edge for remote patient monitoring, AI-driven diagnostics, and secure data handling, with a significant growth trajectory.

- Industrial: Industrial automation, predictive maintenance, and IoT integration are key drivers for edge adoption, leading to a projected market of $20 Billion by 2028.

- Energy and Utilities: Edge computing is crucial for smart grid management, real-time monitoring, and operational efficiency in this sector.

- Telecommunications: As the foundational enabler, this segment plays a pivotal role, with edge computing enhancing network performance and enabling new services.

- Other End-users: This category includes emerging applications in transportation, smart cities, and entertainment, collectively contributing to market growth.

Key Drivers of Telecom Edge Computing Market Growth

The Telecom Edge Computing Market is primarily driven by the exponential growth of data generated by connected devices and the increasing demand for real-time processing capabilities. The pervasive rollout of 5G networks is a significant catalyst, enabling ultra-low latency and high bandwidth crucial for edge applications. The rapid adoption of Internet of Things (IoT) devices across various industries creates a substantial need for localized data analytics and decision-making. Furthermore, the push towards AI and machine learning (ML) at the edge for faster inference and predictive capabilities is a key growth accelerator. Government initiatives promoting digital transformation and smart city development also contribute to market expansion by fostering the deployment of distributed computing infrastructure.

Challenges in the Telecom Edge Computing Market Sector

Despite its rapid growth, the Telecom Edge Computing Market faces several challenges. Security and data privacy concerns are paramount, given the distributed nature of edge deployments and the sensitive data they often process. High deployment and maintenance costs for widespread edge infrastructure can be a significant barrier, especially for smaller enterprises. Interoperability and standardization issues between different hardware and software vendors can hinder seamless integration and scalability. Furthermore, the shortage of skilled personnel with expertise in edge computing technologies and distributed systems presents a talent acquisition challenge for many organizations. Regulatory hurdles concerning data localization and cross-border data flows can also impact global deployment strategies.

Leading Players in the Telecom Edge Computing Market Market

- Adva Optical Networking SE

- Telefonaktiebolaget LM Ericsson

- SGH Inc (penguin Solutions)

- ADLINK Technology Inc

- Huawei Technologies Co Ltd

- Nokia Corporation

- Verizon Communication Ltd

- AT&T Inc

- Comsovereign Holding Corp

- Vodafone Group PLC

Key Developments in Telecom Edge Computing Market Sector

- April 2024: Swisscom and Ericsson have prolonged their strategic alliance for three years. Ericsson will persist as the primary provider of hardware and software for what is recognized as Switzerland's premier network. This extended collaboration is poised to empower Swisscom to elevate its customer experience and advance its mobile network, with a pronounced emphasis on sustainability.

- February 2024: Nokia and A1 Austria (A1) have achieved a significant milestone by conducting the industry's inaugural trial of 5G edge cloud network slicing in collaboration with Microsoft. This trial, conducted in Vienna, Austria, leveraged Nokia's 5G edge slicing solution, seamlessly integrated with Microsoft Azure's managed edge compute, on A1's operational network. By implementing edge cloud network slicing, A1 can now deliver enterprise cloud applications to mobile users, ensuring a high-capacity, secure, and ultra-low latency network experience.

Strategic Telecom Edge Computing Market Market Outlook

- April 2024: Swisscom and Ericsson have prolonged their strategic alliance for three years. Ericsson will persist as the primary provider of hardware and software for what is recognized as Switzerland's premier network. This extended collaboration is poised to empower Swisscom to elevate its customer experience and advance its mobile network, with a pronounced emphasis on sustainability.

- February 2024: Nokia and A1 Austria (A1) have achieved a significant milestone by conducting the industry's inaugural trial of 5G edge cloud network slicing in collaboration with Microsoft. This trial, conducted in Vienna, Austria, leveraged Nokia's 5G edge slicing solution, seamlessly integrated with Microsoft Azure's managed edge compute, on A1's operational network. By implementing edge cloud network slicing, A1 can now deliver enterprise cloud applications to mobile users, ensuring a high-capacity, secure, and ultra-low latency network experience.

Strategic Telecom Edge Computing Market Market Outlook

The strategic outlook for the Telecom Edge Computing Market is exceptionally promising, driven by continuous innovation and expanding adoption across diverse industries. The ongoing evolution of 5G Advanced and future wireless technologies will further enhance edge capabilities, enabling more sophisticated applications. The increasing integration of AI and ML at the edge for real-time intelligence and autonomous systems presents substantial growth opportunities. Strategic partnerships between telecom operators, cloud providers, and hardware manufacturers will be crucial for developing comprehensive, end-to-end edge solutions. The market is poised for significant growth as businesses recognize the tangible benefits of reduced latency, improved operational efficiency, and enhanced customer experiences delivered by edge computing. Investments in research and development, coupled with proactive engagement with regulatory bodies, will be key to navigating future challenges and capitalizing on emerging market potential.

Telecom Edge Computing Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

-

2. End-user

- 2.1. Financial and Banking Industry

- 2.2. Retail

- 2.3. Healthcare and Life Sciences

- 2.4. Industrial

- 2.5. Energy and Utilities

- 2.6. Telecommunications

- 2.7. Other End-users

Telecom Edge Computing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Telecom Edge Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 32.58% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Widespread Adoption and Growth of Latency-specific Applications; Rising Application of 5G & Industrial IoT Services Among End-user Industries

- 3.3. Market Restrains

- 3.3.1. Lack of a Common Security Framework

- 3.4. Market Trends

- 3.4.1. Rising Application of 5G and Industrial IoT Services Among End-user Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Financial and Banking Industry

- 5.2.2. Retail

- 5.2.3. Healthcare and Life Sciences

- 5.2.4. Industrial

- 5.2.5. Energy and Utilities

- 5.2.6. Telecommunications

- 5.2.7. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Financial and Banking Industry

- 6.2.2. Retail

- 6.2.3. Healthcare and Life Sciences

- 6.2.4. Industrial

- 6.2.5. Energy and Utilities

- 6.2.6. Telecommunications

- 6.2.7. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Financial and Banking Industry

- 7.2.2. Retail

- 7.2.3. Healthcare and Life Sciences

- 7.2.4. Industrial

- 7.2.5. Energy and Utilities

- 7.2.6. Telecommunications

- 7.2.7. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Financial and Banking Industry

- 8.2.2. Retail

- 8.2.3. Healthcare and Life Sciences

- 8.2.4. Industrial

- 8.2.5. Energy and Utilities

- 8.2.6. Telecommunications

- 8.2.7. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Financial and Banking Industry

- 9.2.2. Retail

- 9.2.3. Healthcare and Life Sciences

- 9.2.4. Industrial

- 9.2.5. Energy and Utilities

- 9.2.6. Telecommunications

- 9.2.7. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Financial and Banking Industry

- 10.2.2. Retail

- 10.2.3. Healthcare and Life Sciences

- 10.2.4. Industrial

- 10.2.5. Energy and Utilities

- 10.2.6. Telecommunications

- 10.2.7. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Hardware

- 11.1.2. Software

- 11.2. Market Analysis, Insights and Forecast - by End-user

- 11.2.1. Financial and Banking Industry

- 11.2.2. Retail

- 11.2.3. Healthcare and Life Sciences

- 11.2.4. Industrial

- 11.2.5. Energy and Utilities

- 11.2.6. Telecommunications

- 11.2.7. Other End-users

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. North America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Adva Optical Networking SE*List Not Exhaustive

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Telefonaktiebolaget LM Ericsson

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 SGH Inc (penguin Solutions )

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 ADLINK Technology Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Huawei Technologies Co Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Nokia Corporation

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Verizon Communication Ltd

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 AT&T Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Comsovereign Holding Corp

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Vodafone Group PLC

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Adva Optical Networking SE*List Not Exhaustive

List of Figures

- Figure 1: Global Telecom Edge Computing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 17: North America Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 18: North America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 21: Europe Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 23: Europe Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 24: Europe Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 27: Asia Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 28: Asia Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 29: Asia Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 30: Asia Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 33: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 34: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 35: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 36: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 39: Latin America Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 40: Latin America Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 41: Latin America Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 42: Latin America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 45: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 46: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 47: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 48: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Telecom Edge Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: Global Telecom Edge Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 18: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 19: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 21: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 22: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 25: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 27: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 28: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 30: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 31: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 33: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 34: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Edge Computing Market?

The projected CAGR is approximately 32.58%.

2. Which companies are prominent players in the Telecom Edge Computing Market?

Key companies in the market include Adva Optical Networking SE*List Not Exhaustive, Telefonaktiebolaget LM Ericsson, SGH Inc (penguin Solutions ), ADLINK Technology Inc, Huawei Technologies Co Ltd, Nokia Corporation, Verizon Communication Ltd, AT&T Inc, Comsovereign Holding Corp, Vodafone Group PLC.

3. What are the main segments of the Telecom Edge Computing Market?

The market segments include Component, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.6 Million as of 2022.

5. What are some drivers contributing to market growth?

Widespread Adoption and Growth of Latency-specific Applications; Rising Application of 5G & Industrial IoT Services Among End-user Industries.

6. What are the notable trends driving market growth?

Rising Application of 5G and Industrial IoT Services Among End-user Industries.

7. Are there any restraints impacting market growth?

Lack of a Common Security Framework.

8. Can you provide examples of recent developments in the market?

April 2024 - Swisscom and Ericsson have prolonged their strategic alliance for three years. Ericsson will persist as the primary provider of hardware and software for what is recognized as Switzerland's premier network. This extended collaboration is poised to empower Swisscom to elevate its customer experience and advance its mobile network, with a pronounced emphasis on sustainability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom Edge Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom Edge Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom Edge Computing Market?

To stay informed about further developments, trends, and reports in the Telecom Edge Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence