Key Insights

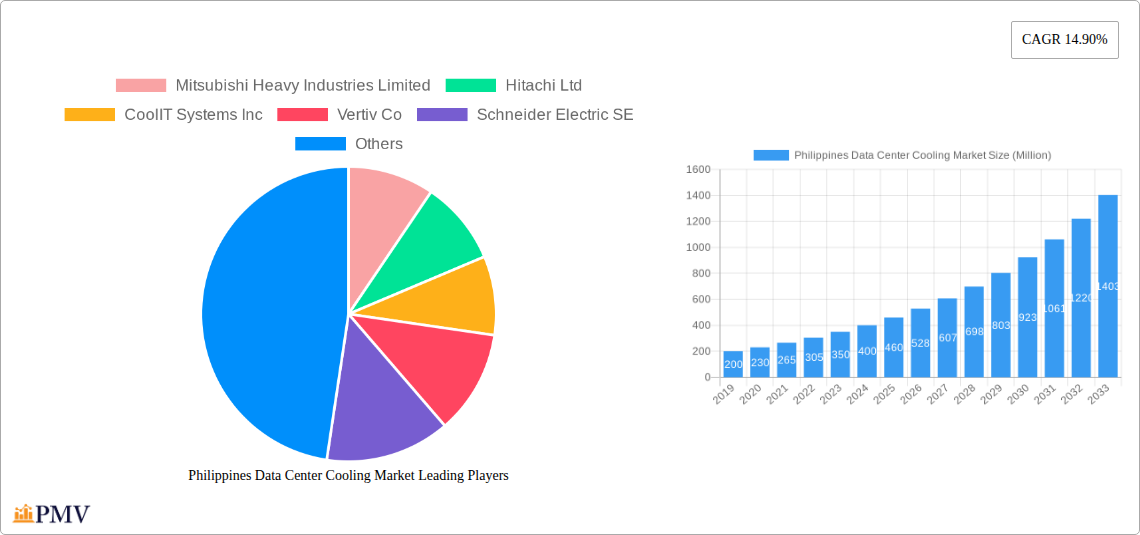

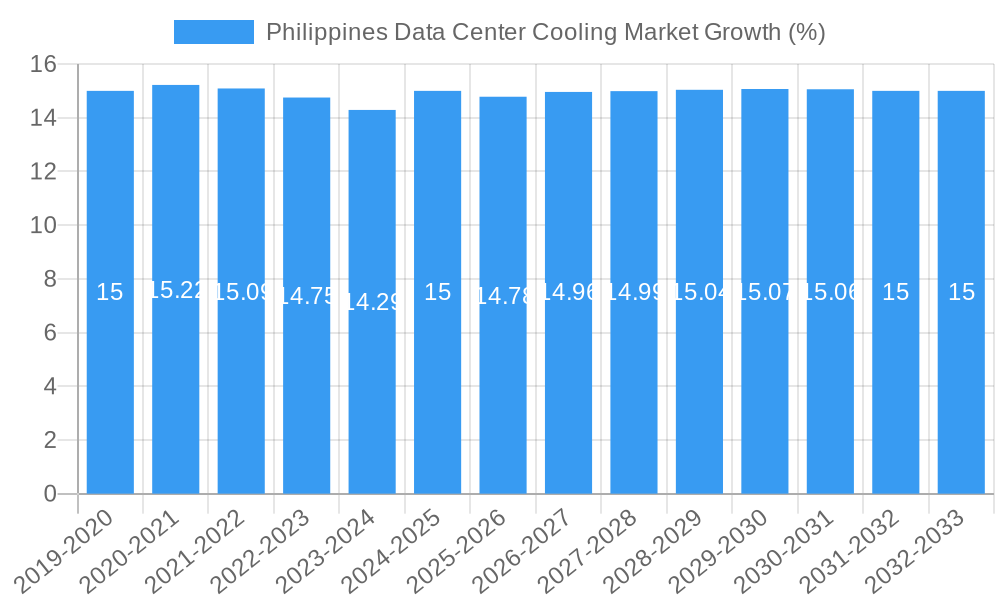

The Philippines Data Center Cooling Market is poised for significant expansion, projected to reach approximately \$500 million in market size by 2025, with a robust Compound Annual Growth Rate (CAGR) of 14.90% anticipated through 2033. This impressive growth is primarily fueled by the escalating demand for data processing and storage driven by rapid digitalization across various sectors. The burgeoning IT and Telecom industry, coupled with the increasing adoption of cloud services by enterprises and the expansion of hyperscale facilities, are key demand generators. Furthermore, the growing reliance on digital infrastructure for retail and consumer goods, healthcare, and media and entertainment applications within the Philippines is substantially contributing to market expansion. The government's initiatives to bolster digital infrastructure and attract foreign investment in technology sectors are also playing a crucial role in stimulating the data center cooling market.

The market is witnessing a pronounced shift towards more efficient and sustainable cooling technologies. While air-based cooling, encompassing chillers, CRAHs, and other systems, continues to hold a significant share, liquid-based cooling solutions are rapidly gaining traction. Immersion cooling and direct-to-chip cooling are emerging as critical technologies, particularly for high-density computing environments found in hyperscale and advanced enterprise data centers, offering superior thermal management and energy efficiency. Restraints include the high initial investment costs associated with advanced cooling systems and the need for skilled personnel for installation and maintenance. However, these challenges are being mitigated by the long-term operational cost savings and the increasing availability of specialized service providers. The market segmentation also highlights the dominance of hyperscalers and enterprises in adopting these advanced cooling solutions, underscoring the evolving landscape of data center infrastructure in the Philippines.

Philippines Data Center Cooling Market: Comprehensive Analysis and Forecast (2019-2033)

This detailed report offers an in-depth analysis of the Philippines Data Center Cooling Market, providing critical insights for stakeholders involved in digital infrastructure, IT, and related industries. Covering the study period from 2019 to 2033, with a base year of 2025, this report leverages a robust methodology to deliver accurate market sizing, growth projections, and competitive intelligence. Our research identifies key market drivers, emerging trends, and strategic opportunities within the rapidly evolving Philippine data center landscape. The report delves into segmentation by cooling technology, type, and end-user verticals, offering actionable data to inform strategic decision-making.

Philippines Data Center Cooling Market Market Structure & Competitive Dynamics

The Philippines data center cooling market is characterized by a dynamic and evolving competitive landscape. Market concentration is moderate, with a blend of established global players and emerging local providers vying for market share. Innovation ecosystems are actively developing, driven by the increasing demand for high-density computing and energy-efficient solutions. Regulatory frameworks, while still maturing, are increasingly emphasizing sustainability and data sovereignty, influencing investment decisions in cooling infrastructure. Product substitutes are plentiful, ranging from traditional air-based cooling systems to advanced liquid cooling technologies. End-user trends are shifting towards greater adoption of hyperscale and colocation facilities, requiring scalable and efficient cooling solutions. Merger and acquisition activities are anticipated to play a significant role in market consolidation, with estimated deal values in the tens of millions of USD as companies seek to expand their technological capabilities and market reach. Key players include Mitsubishi Heavy Industries Limited, Hitachi Ltd, CoolIT Systems Inc, Vertiv Co, Schneider Electric SE, Emerson Electric Co, Rittal GmbH & Co KG, Johnson Controls Inc, Fujitsu General Limited, and Stulz GmbH.

- Market Share Analysis: Detailed market share breakdowns for leading cooling technology providers and segment leaders.

- M&A Landscape: Analysis of recent and potential merger and acquisition activities, including strategic rationale and estimated deal values.

- Innovation Ecosystems: Overview of partnerships and collaborations driving innovation in data center cooling within the Philippines.

- Regulatory Impact: Examination of how government policies and data center regulations are shaping market dynamics and investment.

Philippines Data Center Cooling Market Industry Trends & Insights

The Philippines data center cooling market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is propelled by several interconnected industry trends and insights. The burgeoning digital economy, fueled by increasing internet penetration, cloud adoption, and the proliferation of data-intensive applications such as AI and IoT, is a primary growth driver. This surge in data generation necessitates significant investment in robust and efficient data center infrastructure, with cooling being a critical component. Technological disruptions are at the forefront, with a notable shift towards liquid-based cooling solutions, including immersion cooling and direct-to-chip cooling, to manage the thermal challenges posed by high-performance computing (HPC) and denser server configurations. Consumer preferences are increasingly aligned with sustainability and energy efficiency, driving demand for eco-friendly cooling technologies that reduce operational costs and environmental impact. Competitive dynamics are intensifying, with both global hyperscalers and local enterprises seeking reliable and scalable cooling solutions. The market penetration of advanced cooling technologies is steadily increasing, moving beyond niche applications to mainstream data center designs. Key metrics such as power usage effectiveness (PUE) are becoming paramount, pushing for innovative cooling approaches that minimize energy consumption. The government’s focus on digital transformation and attracting foreign investment in technology sectors further bolsters the demand for modern data center facilities and their associated cooling systems. The report forecasts the market size for the base year 2025 to be approximately $xxx Million, with significant growth projected throughout the forecast period.

Dominant Markets & Segments in Philippines Data Center Cooling Market

The Philippines data center cooling market exhibits clear dominance in specific segments and verticals, driven by unique economic, technological, and infrastructural factors.

Cooling Technology Dominance:

- Air-based Cooling: Remains a dominant segment, primarily driven by the widespread adoption of Chiller and Economizer systems for large-scale data centers and Computer Room Air Handlers (CRAH) for enterprise deployments. The established infrastructure and familiarity with these technologies contribute to their continued market share.

- Key Drivers: Cost-effectiveness for existing infrastructure, readily available skilled workforce for installation and maintenance, and suitability for moderate rack densities.

- Detailed Dominance Analysis: Chiller and economizer systems are integral to the operational efficiency of hyperscale and large colocation facilities, offering reliable temperature control for vast server farms. CRAH units provide precise cooling for enterprise on-premise data centers, adapting to varying IT loads.

- Liquid-based Cooling: Witnessing rapid growth, particularly Immersion Cooling and Direct-to-chip Cooling, as the demand for HPC and AI workloads intensifies. While currently a smaller segment, its growth trajectory is steep due to its superior thermal management capabilities for high-density racks.

- Key Drivers: Increasing demand for AI/ML and HPC applications, the need to manage high heat loads from advanced processors, and the pursuit of higher energy efficiency.

- Detailed Dominance Analysis: Immersion cooling, in particular, is poised for significant market penetration as it offers unparalleled heat dissipation for densely packed server environments, reducing the need for traditional CRAC units and improving overall data center PUE.

Type Dominance:

- Colocation: Emerges as a dominant type, fueled by businesses seeking cost-effective and scalable data center solutions without the burden of managing their own physical infrastructure. This trend supports the demand for diverse cooling technologies to cater to various client needs.

- Key Drivers: Growing demand for outsourced IT services, cost savings, flexibility, and scalability for businesses of all sizes.

- Detailed Dominance Analysis: Colocation providers are investing heavily in advanced cooling infrastructure to attract and retain clients, often offering specialized cooling solutions for high-density deployments.

- Hyperscalers (Owned and Leased): While a significant consumer of cooling solutions, their large-scale, often custom-built facilities, are driving innovation in large-scale cooling technologies. Their investments contribute substantially to market value.

- Key Drivers: Expansion of cloud services, increasing demand for data storage and processing power, and the continuous drive for operational efficiency.

- Detailed Dominance Analysis: Hyperscalers are often early adopters of cutting-edge cooling technologies, pushing the boundaries of what is possible in terms of thermal management and energy efficiency.

- Enterprise (On-premise): Continues to be a significant segment, particularly for organizations with specific security or compliance requirements, requiring tailored cooling solutions for their private data centers.

- Key Drivers: Data security and compliance needs, control over IT infrastructure, and specialized application requirements.

- Detailed Dominance Analysis: Enterprise data centers often leverage a mix of air-based and increasingly liquid-based cooling technologies to meet their unique operational demands and maintain optimal IT equipment performance.

End-user Vertical Dominance:

- IT and Telecom: Represents the largest and most dominant end-user vertical, driven by the continuous expansion of telecommunications networks, cloud service providers, and the ever-increasing demand for data processing and storage.

- Key Drivers: Exponential growth in data traffic, demand for faster network speeds, cloud migration, and the adoption of 5G technology.

- Detailed Dominance Analysis: This sector requires robust, scalable, and highly efficient cooling solutions to support their vast network infrastructure and data processing centers, driving innovation in both air and liquid cooling.

- Retail and Consumer Goods: Shows growing importance due to the rise of e-commerce and the need for data analytics to understand consumer behavior and optimize supply chains.

- Key Drivers: Growth of e-commerce, data analytics for personalization and inventory management, and digital transformation initiatives.

- Detailed Dominance Analysis: Retailers are increasingly leveraging data centers to support their online operations and gain competitive insights, necessitating adequate cooling for their IT infrastructure.

- Federal and Institutional Agencies: Significant investors in data center infrastructure for national security, public services, and research, demanding reliable and secure cooling solutions.

- Key Drivers: National security initiatives, public service delivery, digital government transformation, and research and development.

- Detailed Dominance Analysis: Government agencies often require highly secure and resilient data centers, driving demand for advanced cooling systems that ensure continuous operation and data integrity.

Philippines Data Center Cooling Market Product Innovations

- Key Drivers: Cost-effectiveness for existing infrastructure, readily available skilled workforce for installation and maintenance, and suitability for moderate rack densities.

- Detailed Dominance Analysis: Chiller and economizer systems are integral to the operational efficiency of hyperscale and large colocation facilities, offering reliable temperature control for vast server farms. CRAH units provide precise cooling for enterprise on-premise data centers, adapting to varying IT loads.

- Key Drivers: Increasing demand for AI/ML and HPC applications, the need to manage high heat loads from advanced processors, and the pursuit of higher energy efficiency.

- Detailed Dominance Analysis: Immersion cooling, in particular, is poised for significant market penetration as it offers unparalleled heat dissipation for densely packed server environments, reducing the need for traditional CRAC units and improving overall data center PUE.

- Colocation: Emerges as a dominant type, fueled by businesses seeking cost-effective and scalable data center solutions without the burden of managing their own physical infrastructure. This trend supports the demand for diverse cooling technologies to cater to various client needs.

- Key Drivers: Growing demand for outsourced IT services, cost savings, flexibility, and scalability for businesses of all sizes.

- Detailed Dominance Analysis: Colocation providers are investing heavily in advanced cooling infrastructure to attract and retain clients, often offering specialized cooling solutions for high-density deployments.

- Hyperscalers (Owned and Leased): While a significant consumer of cooling solutions, their large-scale, often custom-built facilities, are driving innovation in large-scale cooling technologies. Their investments contribute substantially to market value.

- Key Drivers: Expansion of cloud services, increasing demand for data storage and processing power, and the continuous drive for operational efficiency.

- Detailed Dominance Analysis: Hyperscalers are often early adopters of cutting-edge cooling technologies, pushing the boundaries of what is possible in terms of thermal management and energy efficiency.

- Enterprise (On-premise): Continues to be a significant segment, particularly for organizations with specific security or compliance requirements, requiring tailored cooling solutions for their private data centers.

- Key Drivers: Data security and compliance needs, control over IT infrastructure, and specialized application requirements.

- Detailed Dominance Analysis: Enterprise data centers often leverage a mix of air-based and increasingly liquid-based cooling technologies to meet their unique operational demands and maintain optimal IT equipment performance.

End-user Vertical Dominance:

- IT and Telecom: Represents the largest and most dominant end-user vertical, driven by the continuous expansion of telecommunications networks, cloud service providers, and the ever-increasing demand for data processing and storage.

- Key Drivers: Exponential growth in data traffic, demand for faster network speeds, cloud migration, and the adoption of 5G technology.

- Detailed Dominance Analysis: This sector requires robust, scalable, and highly efficient cooling solutions to support their vast network infrastructure and data processing centers, driving innovation in both air and liquid cooling.

- Retail and Consumer Goods: Shows growing importance due to the rise of e-commerce and the need for data analytics to understand consumer behavior and optimize supply chains.

- Key Drivers: Growth of e-commerce, data analytics for personalization and inventory management, and digital transformation initiatives.

- Detailed Dominance Analysis: Retailers are increasingly leveraging data centers to support their online operations and gain competitive insights, necessitating adequate cooling for their IT infrastructure.

- Federal and Institutional Agencies: Significant investors in data center infrastructure for national security, public services, and research, demanding reliable and secure cooling solutions.

- Key Drivers: National security initiatives, public service delivery, digital government transformation, and research and development.

- Detailed Dominance Analysis: Government agencies often require highly secure and resilient data centers, driving demand for advanced cooling systems that ensure continuous operation and data integrity.

Philippines Data Center Cooling Market Product Innovations

- Key Drivers: Exponential growth in data traffic, demand for faster network speeds, cloud migration, and the adoption of 5G technology.

- Detailed Dominance Analysis: This sector requires robust, scalable, and highly efficient cooling solutions to support their vast network infrastructure and data processing centers, driving innovation in both air and liquid cooling.

- Key Drivers: Growth of e-commerce, data analytics for personalization and inventory management, and digital transformation initiatives.

- Detailed Dominance Analysis: Retailers are increasingly leveraging data centers to support their online operations and gain competitive insights, necessitating adequate cooling for their IT infrastructure.

- Key Drivers: National security initiatives, public service delivery, digital government transformation, and research and development.

- Detailed Dominance Analysis: Government agencies often require highly secure and resilient data centers, driving demand for advanced cooling systems that ensure continuous operation and data integrity.

Product innovations in the Philippines data center cooling market are focused on enhancing energy efficiency, increasing cooling capacity for high-density racks, and improving sustainability. We are observing advancements in liquid-based cooling technologies, such as more efficient immersion fluids and advanced direct-to-chip cooling modules, designed to directly address the heat generated by modern processors and GPUs. Innovative air-based cooling solutions include intelligent economizers and advanced CRAH units with improved airflow management and variable speed drives. These innovations offer a competitive advantage by reducing operational expenditure (OPEX) through lower energy consumption and extending the lifespan of IT equipment by maintaining optimal operating temperatures. The market fit for these innovations is strong, driven by increasing data center build-outs and the growing demand for sustainable digital infrastructure.

Report Segmentation & Scope

This comprehensive report segments the Philippines data center cooling market by Cooling Technology, Type, and End-user Vertical, providing granular analysis and detailed forecasts.

- Cooling Technology: The report dissects the market into Air-based Cooling (Chiller and Economizer, CRAH, Cooling, Other Air-based Cooling Technologies) and Liquid-based Cooling (Immersion Cooling, Direct-to-chip Cooling, Rear-door Heat Exchanger). Growth projections and market sizes for each sub-segment are provided, highlighting the rapid adoption of liquid cooling solutions.

- Type: Segmentation includes Hyperscalers (Owned and Leased), Enterprise (On-premise), and Colocation. Analysis focuses on the growth drivers and competitive dynamics within each type, with colocation facilities expected to exhibit significant expansion.

- End-user Vertical: The market is further segmented by IT and Telecom, Retail and Consumer Goods, Healthcare, Media and Entertainment, Federal and Institutional Agencies, and Other End-user Verticals. The IT and Telecom sector is identified as the largest segment, with significant growth anticipated across all verticals due to increasing digitalization.

Key Drivers of Philippines Data Center Cooling Market Growth

Several key factors are driving the growth of the Philippines data center cooling market. Firstly, the rapid digitalization of the Philippine economy, coupled with increasing cloud adoption and the proliferation of data-intensive applications like Artificial Intelligence (AI) and the Internet of Things (IoT), is creating an unprecedented demand for data center infrastructure. Secondly, the government's focus on developing the digital economy and attracting foreign direct investment in technology sectors is fostering a conducive environment for data center expansion. Thirdly, the need for energy-efficient and sustainable cooling solutions, driven by rising energy costs and environmental regulations, is pushing the adoption of advanced technologies like liquid cooling. Finally, the continuous advancement in IT hardware, leading to higher power densities per rack, necessitates sophisticated cooling solutions to maintain optimal operating temperatures.

Challenges in the Philippines Data Center Cooling Market Sector

Despite the robust growth, the Philippines data center cooling market faces several challenges. High upfront capital investment for advanced cooling infrastructure, particularly liquid cooling systems, can be a significant barrier for some businesses. Furthermore, the availability of skilled labor for the installation, maintenance, and operation of these sophisticated systems remains a concern. Supply chain disruptions, exacerbated by global geopolitical events, can impact the timely delivery of critical cooling components. Regulatory hurdles and the evolving landscape of data sovereignty laws also present challenges that require careful navigation. Finally, intense competition from established players and the need to continuously innovate to meet evolving customer demands put pressure on market participants.

Leading Players in the Philippines Data Center Cooling Market Market

- Mitsubishi Heavy Industries Limited

- Hitachi Ltd

- CoolIT Systems Inc

- Vertiv Co

- Schneider Electric SE

- Emerson Electric Co

- Rittal GmbH & Co KG

- Johnson Controls Inc

- Fujitsu General Limited

- Stulz GmbH

Key Developments in Philippines Data Center Cooling Market Sector

- March 2023: Interactive, a leading managed service provider, introduced the Immersion Data Center Cooling solution, designed to enhance high-performance computing (HPC) capabilities for its clients. Collaborating closely with digital infrastructure provider Vertiv, Interactive has integrated green revolution cooling tanks into its system. These tanks employ a single-phase, non-conductive coolant that ensures the safety of electrical components while boasting a remarkable heat transfer capacity, estimated to be 1200 times greater than that of traditional air cooling methods. This development signifies a significant step towards the adoption of advanced liquid cooling in the Philippines.

- May 2022: In a significant development, Intel committed a substantial investment of USD 700 million towards the establishment of a state-of-the-art research facility dedicated to liquid and immersion cooling technologies. This initiative underscores Intel's commitment to advancing data center sustainability. Simultaneously, Intel unveiled a pioneering immersion-cooled reference design, positioning it as an industry leader in promoting the widespread adoption of immersion-cooling technologies within data centers across the globe. This move by a key hardware manufacturer signals a strong industry push towards liquid cooling.

Strategic Philippines Data Center Cooling Market Market Outlook

The Philippines data center cooling market is poised for substantial growth, driven by accelerating digitalization, increasing demand for high-performance computing, and a growing emphasis on energy efficiency. Strategic opportunities lie in the continued expansion of colocation facilities and the adoption of liquid-based cooling technologies by hyperscalers and large enterprises. The government's commitment to digital transformation will further fuel investments in data center infrastructure, creating a favorable market outlook. Companies that can offer innovative, sustainable, and cost-effective cooling solutions will be well-positioned to capitalize on this burgeoning market. The strategic integration of advanced cooling technologies is paramount for meeting the evolving demands of the Philippine digital economy.

Philippines Data Center Cooling Market Segmentation

-

1. Cooling Technology

-

1.1. Air-based Cooling

- 1.1.1. Chiller and Economizer

- 1.1.2. CRAH

- 1.1.3. Cooling

- 1.1.4. Other Air-based Cooling Technologies

-

1.2. Liquid-based Cooling

- 1.2.1. Immersion Cooling

- 1.2.2. Direct-to-chip Cooling

- 1.2.3. Rear-door Heat Exchanger

-

1.1. Air-based Cooling

-

2. Type

- 2.1. Hyperscalers (Owned and Leased)

- 2.2. Enterprise (On-premise)

- 2.3. Colocation

-

3. End-user Vertical

- 3.1. IT and Telecom

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. Media and Entertainment

- 3.5. Federal and Institutional Agencies

- 3.6. Other End-user Verticals

Philippines Data Center Cooling Market Segmentation By Geography

- 1. Philippines

Philippines Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Volume of Digital Data; Emergence of Green Data Centers

- 3.3. Market Restrains

- 3.3.1 Costs

- 3.3.2 Adaptability Requirements

- 3.3.3 and Power Outages

- 3.4. Market Trends

- 3.4.1. Liquid-based Cooling is the Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.1.1. Chiller and Economizer

- 5.1.1.2. CRAH

- 5.1.1.3. Cooling

- 5.1.1.4. Other Air-based Cooling Technologies

- 5.1.2. Liquid-based Cooling

- 5.1.2.1. Immersion Cooling

- 5.1.2.2. Direct-to-chip Cooling

- 5.1.2.3. Rear-door Heat Exchanger

- 5.1.1. Air-based Cooling

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hyperscalers (Owned and Leased)

- 5.2.2. Enterprise (On-premise)

- 5.2.3. Colocation

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. IT and Telecom

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. Media and Entertainment

- 5.3.5. Federal and Institutional Agencies

- 5.3.6. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Heavy Industries Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hitachi Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CoolIT Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vertiv Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Emerson Electric Co *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rittal GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Johnson Controls Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fujitsu General Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Stulz GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Heavy Industries Limited

List of Figures

- Figure 1: Philippines Data Center Cooling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Philippines Data Center Cooling Market Share (%) by Company 2024

List of Tables

- Table 1: Philippines Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Philippines Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 3: Philippines Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Philippines Data Center Cooling Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: Philippines Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Philippines Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Philippines Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 8: Philippines Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 9: Philippines Data Center Cooling Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 10: Philippines Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Data Center Cooling Market?

The projected CAGR is approximately 14.90%.

2. Which companies are prominent players in the Philippines Data Center Cooling Market?

Key companies in the market include Mitsubishi Heavy Industries Limited, Hitachi Ltd, CoolIT Systems Inc, Vertiv Co, Schneider Electric SE, Emerson Electric Co *List Not Exhaustive, Rittal GmbH & Co KG, Johnson Controls Inc, Fujitsu General Limited, Stulz GmbH.

3. What are the main segments of the Philippines Data Center Cooling Market?

The market segments include Cooling Technology, Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volume of Digital Data; Emergence of Green Data Centers.

6. What are the notable trends driving market growth?

Liquid-based Cooling is the Fastest Growing Segment.

7. Are there any restraints impacting market growth?

Costs. Adaptability Requirements. and Power Outages.

8. Can you provide examples of recent developments in the market?

March 2023: Interactive, a leading managed service provider, introduced the Immersion Data Center Cooling solution, designed to enhance high-performance computing (HPC) capabilities for its clients. Collaborating closely with digital infrastructure provider Vertiv, Interactive has integrated green revolution cooling tanks into its system. These tanks employ a single-phase, non-conductive coolant that ensures the safety of electrical components while boasting a remarkable heat transfer capacity, estimated to be 1200 times greater than that of traditional air cooling methods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Data Center Cooling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Data Center Cooling Market?

To stay informed about further developments, trends, and reports in the Philippines Data Center Cooling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence