Key Insights

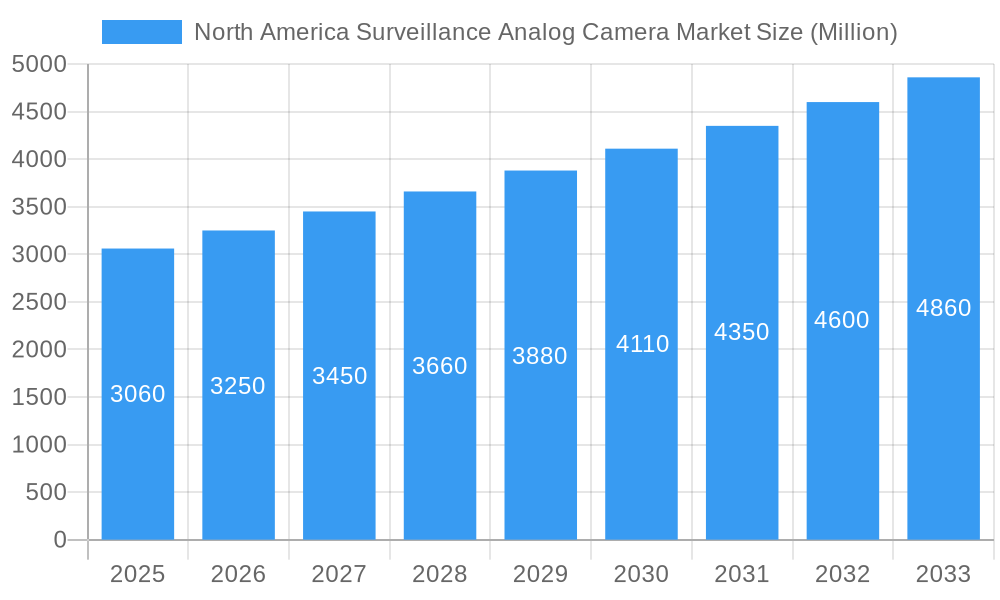

The North American surveillance analog camera market, while facing a decline due to the rapid adoption of IP-based systems, still holds a significant, albeit shrinking, market share. The market size in 2025 is estimated at $3.06 billion, reflecting a Compound Annual Growth Rate (CAGR) of 6.30% from 2019 to 2024. This positive CAGR, despite the overall trend towards IP cameras, suggests a persistent demand, likely driven by factors such as cost-effectiveness for smaller businesses or legacy system integration needs in established infrastructures. Cost remains a key driver for maintaining some analog camera usage, particularly in budget-conscious applications, such as smaller retail stores or residential security. However, this market segment is expected to experience a slowdown in growth due to technological advancements and the increasing affordability of IP cameras. The limitations of analog technology in terms of image quality, scalability, and remote monitoring capabilities contribute to the market's decline. This is further exacerbated by the rising demand for advanced features like analytics and integration with broader security systems, which are largely unavailable in analog systems. The key restraining factors include the obsolescence of analog technology, increasing demand for higher resolution imaging, and the rising popularity of cloud-based surveillance solutions.

North America Surveillance Analog Camera Market Market Size (In Billion)

Major players like Johnson Controls, Bosch, and Hikvision continue to maintain a presence in the analog market, likely focusing on servicing existing installations and offering cost-effective solutions for niche applications. Despite the projected decline, the market is not expected to disappear entirely in the forecast period (2025-2033). A gradual transition rather than an abrupt shift is anticipated, with a slow reduction in market size over the next decade, as older systems require replacement, and newer installations favor IP technology. This transition will be driven by the ongoing technological advancements in IP cameras, decreasing costs, and increasing awareness of the benefits of network video surveillance among businesses and consumers.

North America Surveillance Analog Camera Market Company Market Share

North America Surveillance Analog Camera Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America surveillance analog camera market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers a detailed understanding of market dynamics, competitive landscapes, and future growth trajectories. The study period is 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period covered is 2019-2024.

North America Surveillance Analog Camera Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the North American surveillance analog camera market. The market exhibits moderate concentration, with several key players holding significant market share. However, the presence of numerous smaller players fosters competition and innovation. The market's structure is influenced by factors such as regulatory frameworks related to data privacy and security, technological advancements driving product innovation, and the continuous emergence of substitute technologies like IP-based cameras. End-user trends, particularly increasing demand from commercial and residential sectors, are major drivers of growth. M&A activity has been relatively consistent, with deal values varying depending on the size and strategic fit of the acquired company. Key metrics such as market share and M&A deal values are detailed within the full report. The competitive dynamics are shaped by factors including:

- Market Concentration: Moderate, with a few dominant players and several smaller niche players. xx% of market share is held by the top 5 players (estimated).

- Innovation Ecosystems: Significant R&D investment by key players focusing on improved image quality, low-light performance, and enhanced analytics.

- Regulatory Frameworks: Compliance with data privacy regulations (e.g., CCPA, GDPR) influences market practices and technology adoption.

- Product Substitutes: The rise of IP-based cameras presents a key challenge to analog cameras, impacting market growth.

- End-User Trends: Increased demand from commercial (retail, banking, healthcare) and residential sectors driving market growth.

- M&A Activities: Moderate level of mergers and acquisitions, with deal values ranging from xx Million to xx Million (estimated). Examples include [mention specific examples if available, otherwise omit].

North America Surveillance Analog Camera Market Industry Trends & Insights

The North America surveillance analog camera market has witnessed a complex interplay of growth drivers and challenges over the past few years. While the overall market is projected to exhibit a CAGR of xx% during the forecast period, the market penetration of analog cameras continues to face pressure from the advancement of IP-based surveillance systems. The transition to digital security solutions influences consumer preference and necessitates manufacturers to innovate and adapt. Key factors driving market growth include the increasing demand for security solutions in various sectors, government initiatives to improve public safety, and rising awareness regarding crime prevention. However, the market faces challenges from the relatively lower cost and features available in IP-based systems. Technological advancements such as improved low-light capabilities and integration with advanced analytics are also creating opportunities for the analog market, particularly in niche segments where affordability remains a major criterion.

Specific market trends include:

- Growth Drivers: Increased security concerns, government initiatives, and advancements in analog camera technology.

- Technological Disruptions: Competition from IP cameras and the impact of emerging technologies like AI and IoT.

- Consumer Preferences: Balancing factors like cost, ease of installation, and image quality.

- Competitive Dynamics: Ongoing competition between established players and emerging market entrants.

Dominant Markets & Segments in North America Surveillance Analog Camera Market

The North American surveillance analog camera market shows variations in regional and segmental dominance. While a precise ranking requires in-depth analysis of sales data, preliminary observations suggest that certain regions and segments are performing better than others.

- Dominant Region/Country: [Specify the most dominant region based on market research data. If data is unavailable, use 'xx' or a reasoned estimate. Example: The 'xx' region is expected to dominate due to [reasons]].

- Key Drivers (Bullet Points):

- Strong economic growth

- Favorable government policies supporting security infrastructure development

- High adoption rate among commercial and residential users

- [Add more relevant drivers based on your research]

[Detailed dominance analysis paragraph explaining the factors behind the dominance of the chosen region/country. Include specific numbers or estimates if available. If unavailable, use placeholders and reasoning for the estimations.]

[Repeat the above structure for the dominant segment (e.g., by camera type, resolution, or application). Again, replace placeholders with data from your research whenever possible]

North America Surveillance Analog Camera Market Product Innovations

Recent product innovations in the North American surveillance analog camera market emphasize enhanced features in existing analog technology to remain competitive. Manufacturers are focusing on improving low-light performance, incorporating advanced noise reduction techniques, and offering higher resolutions within the analog format. These innovations aim to improve image quality and make analog cameras more attractive to cost-conscious consumers. The market fit for these enhanced analog cameras lies primarily in situations where cost, ease of installation, and familiarity with existing analog infrastructure are crucial. Key technological trends driving product innovations include the integration of improved image sensors, more efficient signal processing, and better power management.

Report Segmentation & Scope

This report segments the North America surveillance analog camera market across several key dimensions to provide a granular understanding of the market's dynamics. These segments include [mention specific segments based on the actual report segments, for example]:

- By Camera Type: Fixed dome cameras, bullet cameras, PTZ cameras, etc. Each segment showcases varying growth projections and competitive dynamics, with [mention any insights about the relative growth or dominance of certain segments, based on available data].

- By Resolution: 2MP, 3MP, 5MP, etc. The market is predominantly driven by [mention the predominant resolution segment], although there is growing demand for [mention other resolution segment trends].

- By Application: Residential, commercial, industrial, etc. The [mention dominant application segment] contributes to a substantial share of the market, owing to factors like [reasons].

- By End-User: Retail, banking, healthcare, government, etc. [similar analysis for end-user segments, as done for application segments].

Each segment will be analyzed for its market size, growth projections, and competitive landscape.

Key Drivers of North America Surveillance Analog Camera Market Growth

Several factors contribute to the growth of the North American surveillance analog camera market. These include:

- Technological Advancements: Improved low-light performance, higher resolutions, and the integration of advanced features like digital noise reduction are extending the lifespan and use cases of analog cameras.

- Economic Factors: Cost-effectiveness remains a key driver for adoption, particularly in budget-conscious applications and in regions with limited infrastructure.

- Regulatory Compliance: The need for compliance with security and safety standards drives adoption in regulated sectors.

Challenges in the North America Surveillance Analog Camera Market Sector

Despite the market’s ongoing presence, certain factors pose challenges:

- Competition from IP Cameras: The superior features and scalability of IP cameras exert substantial competitive pressure.

- Technological Limitations: Analog technology's inherent limitations regarding image quality, flexibility, and integration with advanced features restrict its growth potential.

- Supply Chain Disruptions: Global supply chain dynamics can impact the availability and cost of components, affecting market stability.

Leading Players in the North America Surveillance Analog Camera Market Market

- Johnson Controls Inc

- Bosch Sicherheitssysteme GmbH

- Pelco

- Axis Communications AB

- Eagle Eye Networks

- Hangzhou Hikvision Digital Technology Co Ltd

- Panasonic Corporation

- Hanwha Vision America

- Dahua Technology Co Ltd

- Zhejiang Uniview Technologies Co Ltd

- IDIS Ltd

- ACTi Corporation

- Teledyne FLIR LLC

- Honeywell International Inc

Key Developments in North America Surveillance Analog Camera Market Sector

- October 2023: Hikvision launched its ColorVu Fixed Turret (DS-2CE70DF0T-MF) and Bullet (DS-2CE10DF0T-F) cameras, featuring an F1.0 aperture for superior low-light color imaging. These cameras support HD over analog cabling, offering a cost-effective upgrade path for existing systems. The inclusion of 3D DNR and a 65-foot white light distance significantly improves night vision capabilities.

- July 2023: Hikvision introduced two new 5 MP ColorVu TurboHD cameras (DS-2CE10KF0T-FS and DS-2CE70KF0T-MFS0) enhancing its HD over analog offerings with high-definition, 24/7 full-color visuals.

Strategic North America Surveillance Analog Camera Market Market Outlook

The future of the North American surveillance analog camera market hinges on the successful adaptation of existing technologies to compete with the growing market share of IP cameras. While the analog market is likely to see reduced overall growth, opportunities exist in specialized segments where cost-effectiveness and familiarity remain key factors. Strategic opportunities lie in developing niche applications, focusing on robust, easy-to-install systems for specific environments, and integrating advanced features within analog technology to extend its relevance in the years to come. Continued innovation, particularly in low-light performance and image enhancement, will be crucial for sustaining market presence.

North America Surveillance Analog Camera Market Segmentation

-

1. End-user Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation and Logistics

- 1.5. Industrial

- 1.6. Others

North America Surveillance Analog Camera Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Surveillance Analog Camera Market Regional Market Share

Geographic Coverage of North America Surveillance Analog Camera Market

North America Surveillance Analog Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Effectiveness and Affordability; Utilization of Existing Infrastructure

- 3.3. Market Restrains

- 3.3.1. Cost Effectiveness and Affordability; Utilization of Existing Infrastructure

- 3.4. Market Trends

- 3.4.1. Convenience and Cost Effectiveness Are Driving the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Surveillance Analog Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation and Logistics

- 5.1.5. Industrial

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Johnson Controls Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Sicherheitssysteme GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pelco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Axis Communications AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eagle Eye Networks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Panasonic Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hanwha Vision America

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dahua Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zhejiang Uniview Technologies Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IDIS Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ACTi Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Teledyne FLIR LLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Honeywell International Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls Inc

List of Figures

- Figure 1: North America Surveillance Analog Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Surveillance Analog Camera Market Share (%) by Company 2025

List of Tables

- Table 1: North America Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: North America Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 3: North America Surveillance Analog Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Surveillance Analog Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: North America Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: North America Surveillance Analog Camera Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: North America Surveillance Analog Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: North America Surveillance Analog Camera Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States North America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada North America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Surveillance Analog Camera Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico North America Surveillance Analog Camera Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Surveillance Analog Camera Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the North America Surveillance Analog Camera Market?

Key companies in the market include Johnson Controls Inc, Bosch Sicherheitssysteme GmbH, Pelco, Axis Communications AB, Eagle Eye Networks, Hangzhou Hikvision Digital Technology Co Ltd, Panasonic Corporation, Hanwha Vision America, Dahua Technology Co Ltd, Zhejiang Uniview Technologies Co Ltd, IDIS Ltd, ACTi Corporation, Teledyne FLIR LLC, Honeywell International Inc.

3. What are the main segments of the North America Surveillance Analog Camera Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Effectiveness and Affordability; Utilization of Existing Infrastructure.

6. What are the notable trends driving market growth?

Convenience and Cost Effectiveness Are Driving the Demand.

7. Are there any restraints impacting market growth?

Cost Effectiveness and Affordability; Utilization of Existing Infrastructure.

8. Can you provide examples of recent developments in the market?

October 2023: Hikvision unveiled the ColorVu Fixed Turret (DS-2CE70DF0T-MF) and Bullet (DS-2CE10DF0T-F) Cameras, the first of their kind to feature an F1.0 aperture. These 2 MP analog cameras deliver top-notch, full-color imaging 24/7, support HD over analog cabling for seamless upgrades, and come equipped with 3D Digital Noise Reduction (DNR) technology. Notably, the ColorVu Cameras sport an impressive F1.0 aperture, ensuring vibrant color even in dimly lit environments. The inclusion of 3D DNR technology enhances image clarity, effectively minimizing interference and noise. Additionally, boasting a white light distance of up to 65 feet, these cameras excel at capturing bright and detailed night scenes, leaving no corner in the dark unnoticed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Surveillance Analog Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Surveillance Analog Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Surveillance Analog Camera Market?

To stay informed about further developments, trends, and reports in the North America Surveillance Analog Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence