Key Insights

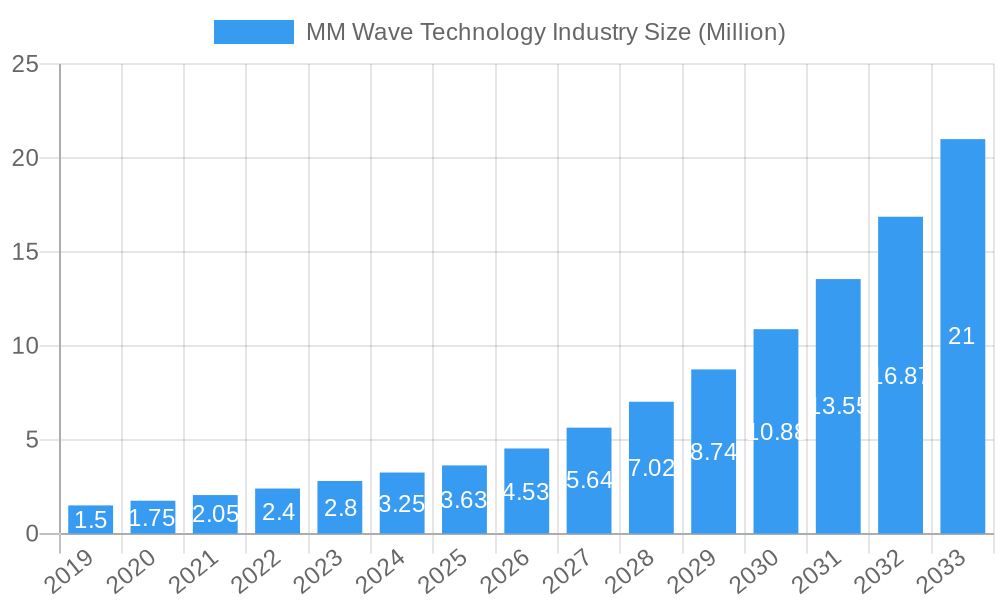

The millimeter wave (MMWave) technology market is poised for explosive growth, driven by its critical role in enabling next-generation wireless communication. With a current market size of $3.63 billion and a projected Compound Annual Growth Rate (CAGR) of an impressive 24.60% from 2025 to 2033, this sector is rapidly expanding. The primary drivers fueling this surge include the insatiable demand for higher bandwidth and lower latency, essential for the widespread adoption of 5G and future 6G networks, as well as the burgeoning Internet of Things (IoT) ecosystem. Advancements in chip technology, miniaturization of components, and increasing investment in advanced telecommunications infrastructure are further accelerating this market. Key trends include the integration of MMWave into fixed wireless access (FWA) solutions, offering a viable alternative to fiber optics, and its growing application in high-definition imaging for industrial automation, security, and automotive sensing.

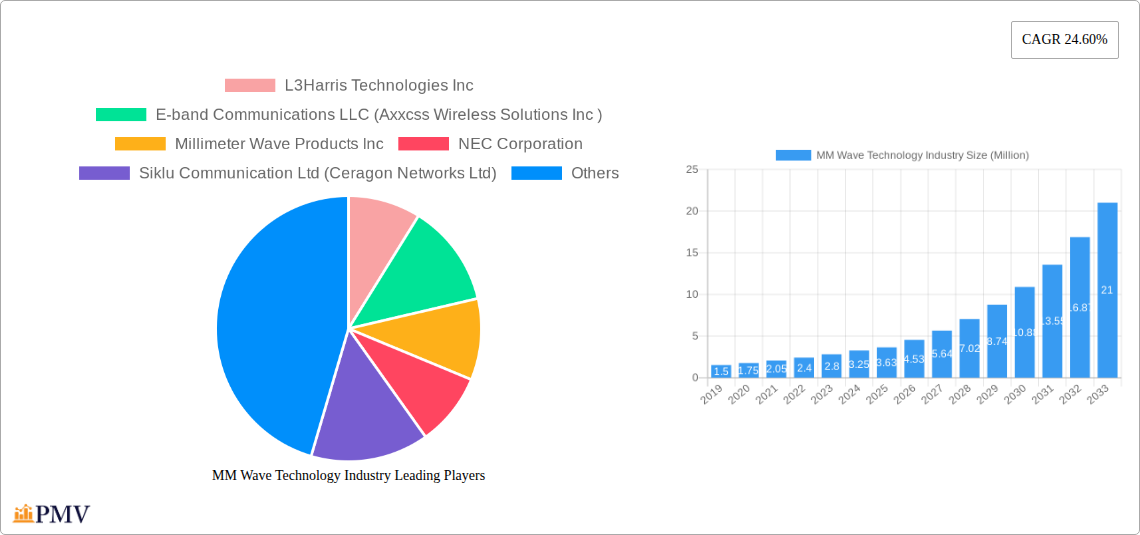

MM Wave Technology Industry Market Size (In Million)

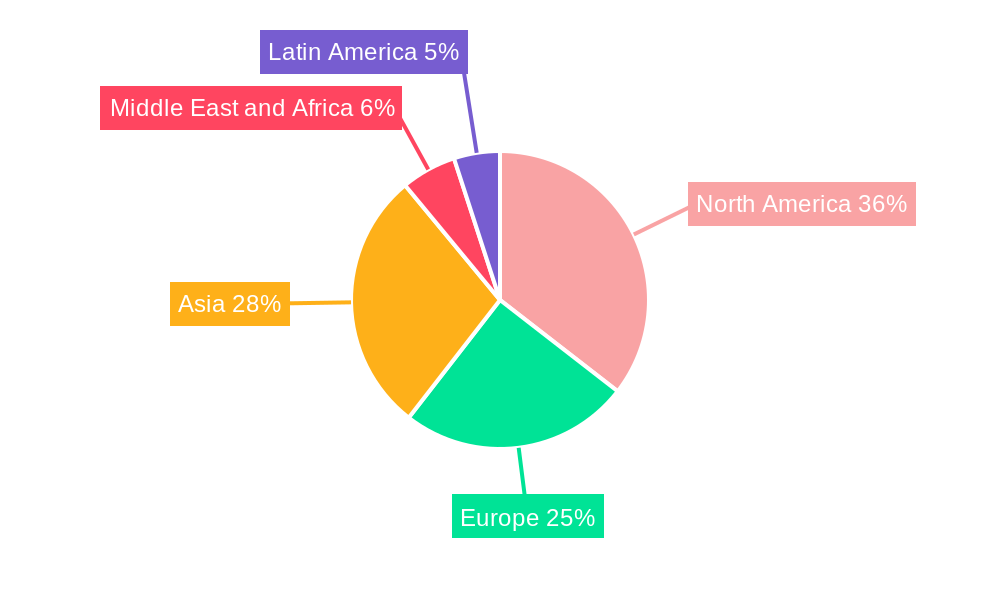

Despite its immense potential, the market faces certain restraints, including the current high cost of MMWave components and the inherent propagation challenges associated with its shorter range and susceptibility to environmental interference. However, ongoing research and development are actively addressing these limitations, with innovations in beamforming and antenna design enhancing signal reliability and extending coverage. The market is segmented by component type, with Antennas and Transceivers, and Communications and Networking being key contributors, and by licensing model, with both fully/partly licensed and unlicensed spectrum playing significant roles. Major players such as L3Harris Technologies, NEC Corporation, and Siklu Communication are heavily investing in R&D and strategic partnerships to capture a larger market share in this dynamic landscape. North America and Asia are expected to dominate regional markets, propelled by robust 5G deployments and strong technological innovation.

MM Wave Technology Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the global Millimeter Wave (MMWave) technology market, exploring its intricate structure, competitive landscape, and pivotal industry trends. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, this report provides actionable insights for stakeholders seeking to capitalize on the burgeoning opportunities within the 5G mmWave, wireless backhaul, broadband wireless access, and 6G technology sectors. Our detailed examination of market dynamics, including segment-specific projections and growth drivers, ensures a robust understanding of the factors shaping the future of mmWave communications.

MM Wave Technology Industry Market Structure & Competitive Dynamics

The MM Wave Technology Industry is characterized by a dynamic and evolving market structure. While it currently exhibits a moderate level of market concentration, with several key players dominating specific segments, the rapid pace of innovation and increasing investment in 5G infrastructure and advanced wireless solutions are fostering a more competitive ecosystem. The innovation ecosystem thrives on collaborations between established telecommunication equipment manufacturers, semiconductor developers, and specialized mmWave component providers. Regulatory frameworks, particularly around spectrum allocation and licensing for mmWave frequencies, play a crucial role in shaping market entry and competitive advantages. The presence of readily available unlicensed mmWave spectrum in certain regions fosters innovation and adoption by smaller players, while fully/partly licensed spectrum is critical for large-scale deployments by telecommunication operators. Product substitutes, though limited in the high-frequency domain, exist in lower-frequency wireless technologies for specific applications. End-user trends are increasingly demanding higher bandwidth, lower latency, and greater mobility, directly fueling the adoption of mmWave technology for applications ranging from fixed wireless access to vehicle-to-everything (V2X) communications. Mergers and acquisition (M&A) activities are significant, driven by the strategic imperative for companies to acquire specialized mmWave expertise, expand their product portfolios, and gain market share. For instance, recent M&A activities indicate a consolidated market value of approximately USD 1.5 Billion within the last two years, signaling a trend towards consolidation and strategic partnerships. The market share distribution highlights the dominance of companies in Antennas and Transceiver segments, holding an estimated 40% of the total market value, followed by Communications and Networking at 30%.

MM Wave Technology Industry Industry Trends & Insights

The MM Wave Technology Industry is experiencing unprecedented growth, driven by the insatiable demand for faster, more reliable, and higher-capacity wireless connectivity. Key market growth drivers include the ongoing global rollout of 5G networks, which heavily relies on mmWave spectrum for achieving ultra-high speeds and low latency, especially in dense urban environments. The expansion of Fixed Wireless Access (FWA) solutions, offering a viable alternative to fiber optic broadband in underserved areas, is another significant catalyst. Furthermore, the increasing adoption of Internet of Things (IoT) devices, autonomous vehicles, and enhanced mobile broadband (eMBB) services are pushing the boundaries of current wireless capabilities, making mmWave technology indispensable. Technological disruptions are primarily focused on advancements in mmWave chipsets, antenna design, beamforming techniques, and signal processing to overcome the inherent challenges of mmWave propagation, such as path loss and atmospheric attenuation. Research into 6G technology also points towards a continued and expanded role for mmWave frequencies, potentially extending into sub-terahertz ranges. Consumer preferences are increasingly aligning with the benefits offered by mmWave, including seamless streaming of high-definition content, lag-free online gaming, and efficient data transfer. Competitive dynamics are intensifying as companies vie for technological leadership and market penetration. The market penetration of mmWave in urban 5G deployments is projected to reach 65% by 2028. The Compound Annual Growth Rate (CAGR) for the MM Wave Technology Industry is estimated at a robust 28.5% over the forecast period, signifying substantial market expansion. Innovations in miniaturization and power efficiency of mmWave components are critical for their integration into a wider array of devices, from smartphones to industrial sensors. The development of cost-effective manufacturing processes for mmWave integrated circuits is also a crucial trend impacting market accessibility and adoption rates.

Dominant Markets & Segments in MM Wave Technology Industry

The MM Wave Technology Industry is experiencing dominant growth in key geographical regions and specific market segments. North America and Asia-Pacific currently lead in market adoption, driven by aggressive 5G network deployments and significant investments in digital infrastructure. China, in particular, is a major player, with substantial government support for 5G and advanced wireless technologies. The Antennas and Transceiver segment is the largest and fastest-growing, capturing an estimated 45% of the market share due to their critical role in enabling mmWave communications. This dominance is fueled by advancements in phased array antennas and integrated transceiver modules. The Communications and Networking segment, encompassing components like mmWave modules for base stations and user equipment, follows closely with 35% market share. The Licensing Model: Unlicensed is a significant driver for niche applications and private networks, fostering rapid innovation and adoption in sectors like industrial automation and smart cities, with an estimated market size of USD 2 Billion by 2025. However, Fully/Partly Licensed spectrum remains crucial for large-scale public mobile networks, driving substantial investments in infrastructure and services, projected to reach USD 15 Billion by 2027.

Key Drivers for Dominance in North America & Asia-Pacific:

- Aggressive 5G network rollout and investment by major telecommunication operators.

- Government initiatives and funding for digital transformation and smart city projects.

- High consumer demand for high-speed broadband and advanced wireless services.

- Strong presence of leading technology companies investing in mmWave R&D.

Dominance Analysis of Segments:

- Antennas and Transceiver: This segment's dominance is attributed to the fundamental need for specialized mmWave antennas capable of precise beamforming and highly integrated transceivers that handle the complexities of higher frequencies. Innovations in materials science and miniaturization are further propelling this segment.

- Communications and Networking: As the backbone of mmWave deployments, this segment benefits from the increasing need for high-capacity backhaul solutions and robust network infrastructure for 5G and future wireless generations. The demand for mmWave integrated circuits and modules for base stations and end-user devices is substantial.

- Interface: While a smaller segment, the growth of mmWave interfaces is critical for seamless integration of mmWave capabilities into existing and new devices, including dongles and adapters for broadband wireless access.

- Frequency and Related Components: The development and availability of specialized mmWave components like filters, amplifiers, and power dividers are essential enablers for the entire mmWave ecosystem.

- Imaging: The application of mmWave technology in advanced imaging systems for security, medical diagnostics, and industrial inspection is a growing niche, contributing to segment diversification.

- Other Components: This segment encompasses a range of supporting hardware and software essential for mmWave system functionality, including test and measurement equipment.

MM Wave Technology Industry Product Innovations

Product innovations in the MM Wave Technology Industry are rapidly expanding the capabilities and applications of this transformative technology. Recent developments include highly integrated mmWave RFIC solutions for 5G user equipment, enabling smaller form factors and improved power efficiency. Advancements in antenna-in-package (AiP) technology are crucial for mass-market adoption, allowing for compact and cost-effective integration of mmWave transceivers and antennas. Furthermore, the development of robust mmWave modules for fixed wireless access and enterprise backhaul is enabling fiber-like speeds without the need for extensive cabling. These innovations are driven by the demand for higher bandwidth, lower latency, and greater spectral efficiency, positioning mmWave as a key enabler for future wireless communication standards and emerging applications such as augmented reality (AR) and virtual reality (VR).

Report Segmentation & Scope

This report segments the MM Wave Technology Industry across critical parameters to provide a granular understanding of the market landscape. The segmentation by Type of Component includes Antennas and Transceiver, Communications and Networking, Interface, Frequency and Related Components, Imaging, and Other Components. The Antennas and Transceiver segment is projected to experience a market size of approximately USD 10 Billion by 2027, driven by demand for advanced antenna arrays and integrated RF front-ends. The Communications and Networking segment, including mmWave modules and chipsets, is expected to reach USD 8 Billion by 2027.

The segmentation by Licensing Model encompasses Fully/Partly Licensed and Unlicensed spectrum. The Fully/Partly Licensed segment is anticipated to dominate the market, accounting for an estimated USD 12 Billion in market value by 2027, due to its crucial role in carrier-grade 5G deployments. The Unlicensed spectrum segment is projected to grow at a CAGR of 25%, driven by industrial and private network applications, reaching a market size of USD 3 Billion by 2027.

Key Drivers of MM Wave Technology Industry Growth

The MM Wave Technology Industry is propelled by a confluence of powerful growth drivers. The relentless global expansion of 5G networks is a primary catalyst, with mmWave technology being essential for unlocking the full potential of high-frequency bands, delivering ultra-fast speeds and low latency crucial for enhanced mobile broadband (eMBB) and massive machine-type communications (mMTC). The increasing demand for higher bandwidth in enterprise and residential applications fuels the adoption of Fixed Wireless Access (FWA) solutions, offering a cost-effective alternative to fiber. Furthermore, the burgeoning Internet of Things (IoT) ecosystem, with its ever-growing number of connected devices, necessitates higher capacity and lower latency wireless technologies, which mmWave provides. Government initiatives worldwide to promote digital connectivity and smart city development are also significant drivers, encouraging investment in mmWave infrastructure.

Challenges in the MM Wave Technology Industry Sector

Despite its immense potential, the MM Wave Technology Industry faces several significant challenges. The inherent nature of mmWave propagation, characterized by higher path loss and susceptibility to obstruction by physical barriers like walls and foliage, necessitates sophisticated beamforming techniques and denser network deployments, increasing infrastructure costs. Regulatory hurdles related to spectrum allocation and licensing, though improving, can still be complex and vary significantly across different regions, impacting deployment timelines. Supply chain complexities for specialized mmWave components and the need for highly skilled engineering talent can also pose constraints. Furthermore, ensuring interoperability between diverse mmWave equipment from different vendors and overcoming consumer awareness gaps regarding the benefits of mmWave are ongoing challenges that require concerted industry efforts.

Leading Players in the MM Wave Technology Industry Market

- L3Harris Technologies Inc

- E-band Communications LLC (Axxcss Wireless Solutions Inc )

- Millimeter Wave Products Inc

- NEC Corporation

- Siklu Communication Ltd (Ceragon Networks Ltd)

- Bridgewave Communications Inc (REMEC Broadband Wireless Networks LLC)

- Keysight Technologies Inc

- Smiths Interconnect Group Limited

- Ducommun Incorporated

- Farran Technology Ltd

- Eravant (SAGE Millimeter Inc )

Key Developments in MM Wave Technology Industry Sector

- November 2023: Throughout the UK, localities were aided in adopting advanced wireless technologies and enhancing their digital connectivity, including drones to monitor livestock and crops, smart systems to decrease congestion, and moveable 5G networks to allow super-fast live programs from remote locations. The ten multi-local authority zones across all four parts of the UK will obtain a share of EUR 36 million (USD 38.95 million) as they develop into 5G Innovation Regions (5GIRs). The capital will drive the adoption and development of advanced wireless technologies, including 5G, ensuring groups in cities, towns, and rural areas fully benefit from the benefits advanced digital technologies and wireless connectivity can provide and attract commercial investment to develop the economy.

- August 2023: Fujitsu announced the new millimeter-wave chip for 5G that supports multibeam multiplexing, allowing up to four beams to be multiplexed by a single millimeter-wave chip for the radio units of 5G base stations. The development was a crucial part of the "Research and Development Project of the Enhanced Infrastructures for Post-5G Information and Communication Systems" commissioned by Japan's New Energy and Industrial Technology Development Organization (NEDO).

Strategic MM Wave Technology Industry Market Outlook

The strategic outlook for the MM Wave Technology Industry is exceptionally promising, driven by its indispensable role in enabling the next generation of wireless communication. The ongoing global push towards comprehensive 5G coverage, coupled with the anticipated evolution towards 6G technology, will continue to fuel significant demand for mmWave components and solutions. Expansion into new application areas, such as advanced industrial automation, intelligent transportation systems, and immersive extended reality (XR) experiences, presents substantial growth accelerators. Furthermore, the increasing focus on private networks and enterprise solutions for enhanced connectivity in diverse environments will unlock new market opportunities. Strategic investments in research and development, particularly in overcoming propagation challenges and reducing costs, will be critical for sustained market leadership. The industry is poised for continued innovation and expansion, solidifying mmWave technology as a cornerstone of the future digital landscape.

MM Wave Technology Industry Segmentation

-

1. Type of Component

- 1.1. Antennas and Transceiver

- 1.2. Communications and Networking

- 1.3. Interface

- 1.4. Frequency and Related Components

- 1.5. Imaging

- 1.6. Other Components

-

2. Licensing Model

- 2.1. Fully/Partly Licensed

- 2.2. Unlicensed

MM Wave Technology Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 4. Middle East and Africa

- 5. Latin America

MM Wave Technology Industry Regional Market Share

Geographic Coverage of MM Wave Technology Industry

MM Wave Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Proliferation of Wireless Backhaul of Base Stations; Evolution of 5G is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Need for Manufacturing of Compatible Components and Rising Cost of Components; Technological Vulnerabilities Leading to Reduced Wave Strength

- 3.4. Market Trends

- 3.4.1. Antennas and Transceivers Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MM Wave Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 5.1.1. Antennas and Transceiver

- 5.1.2. Communications and Networking

- 5.1.3. Interface

- 5.1.4. Frequency and Related Components

- 5.1.5. Imaging

- 5.1.6. Other Components

- 5.2. Market Analysis, Insights and Forecast - by Licensing Model

- 5.2.1. Fully/Partly Licensed

- 5.2.2. Unlicensed

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 6. North America MM Wave Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Component

- 6.1.1. Antennas and Transceiver

- 6.1.2. Communications and Networking

- 6.1.3. Interface

- 6.1.4. Frequency and Related Components

- 6.1.5. Imaging

- 6.1.6. Other Components

- 6.2. Market Analysis, Insights and Forecast - by Licensing Model

- 6.2.1. Fully/Partly Licensed

- 6.2.2. Unlicensed

- 6.1. Market Analysis, Insights and Forecast - by Type of Component

- 7. Europe MM Wave Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Component

- 7.1.1. Antennas and Transceiver

- 7.1.2. Communications and Networking

- 7.1.3. Interface

- 7.1.4. Frequency and Related Components

- 7.1.5. Imaging

- 7.1.6. Other Components

- 7.2. Market Analysis, Insights and Forecast - by Licensing Model

- 7.2.1. Fully/Partly Licensed

- 7.2.2. Unlicensed

- 7.1. Market Analysis, Insights and Forecast - by Type of Component

- 8. Asia MM Wave Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Component

- 8.1.1. Antennas and Transceiver

- 8.1.2. Communications and Networking

- 8.1.3. Interface

- 8.1.4. Frequency and Related Components

- 8.1.5. Imaging

- 8.1.6. Other Components

- 8.2. Market Analysis, Insights and Forecast - by Licensing Model

- 8.2.1. Fully/Partly Licensed

- 8.2.2. Unlicensed

- 8.1. Market Analysis, Insights and Forecast - by Type of Component

- 9. Middle East and Africa MM Wave Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Component

- 9.1.1. Antennas and Transceiver

- 9.1.2. Communications and Networking

- 9.1.3. Interface

- 9.1.4. Frequency and Related Components

- 9.1.5. Imaging

- 9.1.6. Other Components

- 9.2. Market Analysis, Insights and Forecast - by Licensing Model

- 9.2.1. Fully/Partly Licensed

- 9.2.2. Unlicensed

- 9.1. Market Analysis, Insights and Forecast - by Type of Component

- 10. Latin America MM Wave Technology Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Component

- 10.1.1. Antennas and Transceiver

- 10.1.2. Communications and Networking

- 10.1.3. Interface

- 10.1.4. Frequency and Related Components

- 10.1.5. Imaging

- 10.1.6. Other Components

- 10.2. Market Analysis, Insights and Forecast - by Licensing Model

- 10.2.1. Fully/Partly Licensed

- 10.2.2. Unlicensed

- 10.1. Market Analysis, Insights and Forecast - by Type of Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 E-band Communications LLC (Axxcss Wireless Solutions Inc )

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Millimeter Wave Products Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NEC Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siklu Communication Ltd (Ceragon Networks Ltd)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bridgewave Communications Inc (REMEC Broadband Wireless Networks LLC)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Keysight Technologies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Smiths Interconnect Group Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ducommun Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Farran Technology Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Eravant (SAGE Millimeter Inc )

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global MM Wave Technology Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America MM Wave Technology Industry Revenue (Million), by Type of Component 2025 & 2033

- Figure 3: North America MM Wave Technology Industry Revenue Share (%), by Type of Component 2025 & 2033

- Figure 4: North America MM Wave Technology Industry Revenue (Million), by Licensing Model 2025 & 2033

- Figure 5: North America MM Wave Technology Industry Revenue Share (%), by Licensing Model 2025 & 2033

- Figure 6: North America MM Wave Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America MM Wave Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe MM Wave Technology Industry Revenue (Million), by Type of Component 2025 & 2033

- Figure 9: Europe MM Wave Technology Industry Revenue Share (%), by Type of Component 2025 & 2033

- Figure 10: Europe MM Wave Technology Industry Revenue (Million), by Licensing Model 2025 & 2033

- Figure 11: Europe MM Wave Technology Industry Revenue Share (%), by Licensing Model 2025 & 2033

- Figure 12: Europe MM Wave Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe MM Wave Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia MM Wave Technology Industry Revenue (Million), by Type of Component 2025 & 2033

- Figure 15: Asia MM Wave Technology Industry Revenue Share (%), by Type of Component 2025 & 2033

- Figure 16: Asia MM Wave Technology Industry Revenue (Million), by Licensing Model 2025 & 2033

- Figure 17: Asia MM Wave Technology Industry Revenue Share (%), by Licensing Model 2025 & 2033

- Figure 18: Asia MM Wave Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia MM Wave Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa MM Wave Technology Industry Revenue (Million), by Type of Component 2025 & 2033

- Figure 21: Middle East and Africa MM Wave Technology Industry Revenue Share (%), by Type of Component 2025 & 2033

- Figure 22: Middle East and Africa MM Wave Technology Industry Revenue (Million), by Licensing Model 2025 & 2033

- Figure 23: Middle East and Africa MM Wave Technology Industry Revenue Share (%), by Licensing Model 2025 & 2033

- Figure 24: Middle East and Africa MM Wave Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa MM Wave Technology Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America MM Wave Technology Industry Revenue (Million), by Type of Component 2025 & 2033

- Figure 27: Latin America MM Wave Technology Industry Revenue Share (%), by Type of Component 2025 & 2033

- Figure 28: Latin America MM Wave Technology Industry Revenue (Million), by Licensing Model 2025 & 2033

- Figure 29: Latin America MM Wave Technology Industry Revenue Share (%), by Licensing Model 2025 & 2033

- Figure 30: Latin America MM Wave Technology Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America MM Wave Technology Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MM Wave Technology Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 2: Global MM Wave Technology Industry Revenue Million Forecast, by Licensing Model 2020 & 2033

- Table 3: Global MM Wave Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global MM Wave Technology Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 5: Global MM Wave Technology Industry Revenue Million Forecast, by Licensing Model 2020 & 2033

- Table 6: Global MM Wave Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States MM Wave Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada MM Wave Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global MM Wave Technology Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 10: Global MM Wave Technology Industry Revenue Million Forecast, by Licensing Model 2020 & 2033

- Table 11: Global MM Wave Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom MM Wave Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany MM Wave Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France MM Wave Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global MM Wave Technology Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 16: Global MM Wave Technology Industry Revenue Million Forecast, by Licensing Model 2020 & 2033

- Table 17: Global MM Wave Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China MM Wave Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan MM Wave Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India MM Wave Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea MM Wave Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global MM Wave Technology Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 23: Global MM Wave Technology Industry Revenue Million Forecast, by Licensing Model 2020 & 2033

- Table 24: Global MM Wave Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global MM Wave Technology Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 26: Global MM Wave Technology Industry Revenue Million Forecast, by Licensing Model 2020 & 2033

- Table 27: Global MM Wave Technology Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MM Wave Technology Industry?

The projected CAGR is approximately 24.60%.

2. Which companies are prominent players in the MM Wave Technology Industry?

Key companies in the market include L3Harris Technologies Inc, E-band Communications LLC (Axxcss Wireless Solutions Inc ), Millimeter Wave Products Inc, NEC Corporation, Siklu Communication Ltd (Ceragon Networks Ltd), Bridgewave Communications Inc (REMEC Broadband Wireless Networks LLC), Keysight Technologies Inc, Smiths Interconnect Group Limited, Ducommun Incorporated, Farran Technology Ltd, Eravant (SAGE Millimeter Inc ).

3. What are the main segments of the MM Wave Technology Industry?

The market segments include Type of Component, Licensing Model.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Proliferation of Wireless Backhaul of Base Stations; Evolution of 5G is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Antennas and Transceivers Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Need for Manufacturing of Compatible Components and Rising Cost of Components; Technological Vulnerabilities Leading to Reduced Wave Strength.

8. Can you provide examples of recent developments in the market?

November 2023 - Throughout the UK, localities were aided in adopting advanced wireless technologies and enhancing their digital connectivity, including drones to monitor livestock and crops, smart systems to decrease congestion, and moveable 5G networks to allow super-fast live programs from remote locations. The ten multi-local authority zones across all four parts of the UK will obtain a share of EUR 36 million (USD 38.95 million) as they develop into 5G Innovation Regions (5GIRs). The capital will drive the adoption and development of advanced wireless technologies, including 5G, ensuring groups in cities, towns, and rural areas fully benefit from the benefits advanced digital technologies and wireless connectivity can provide and attract commercial investment to develop the economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MM Wave Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MM Wave Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MM Wave Technology Industry?

To stay informed about further developments, trends, and reports in the MM Wave Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence