Key Insights

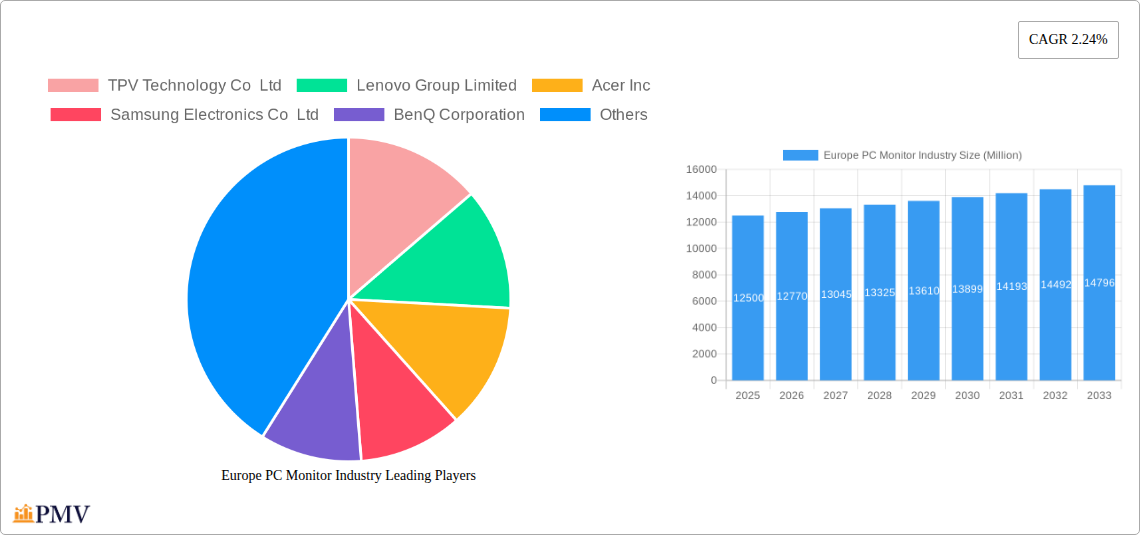

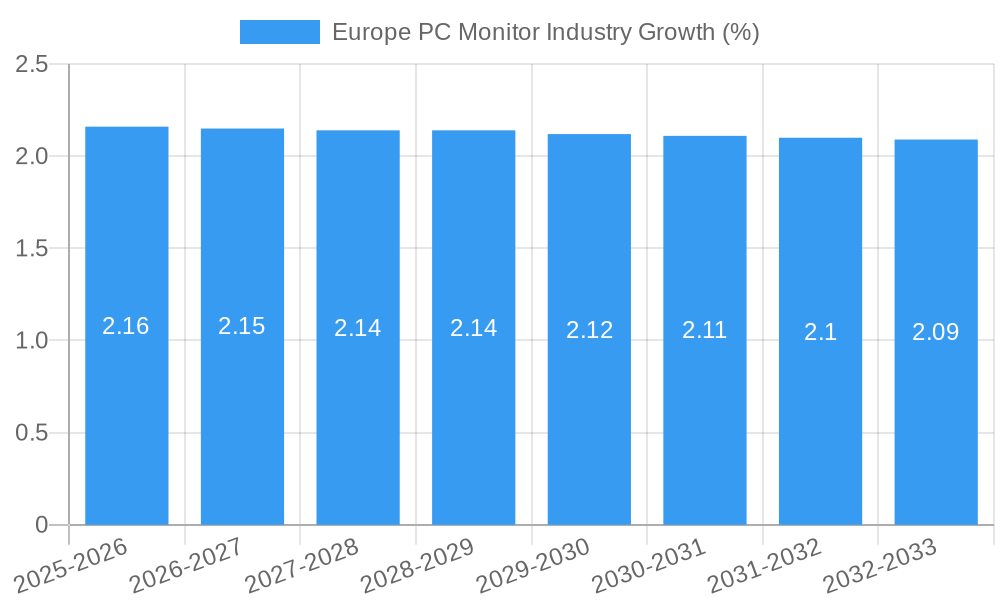

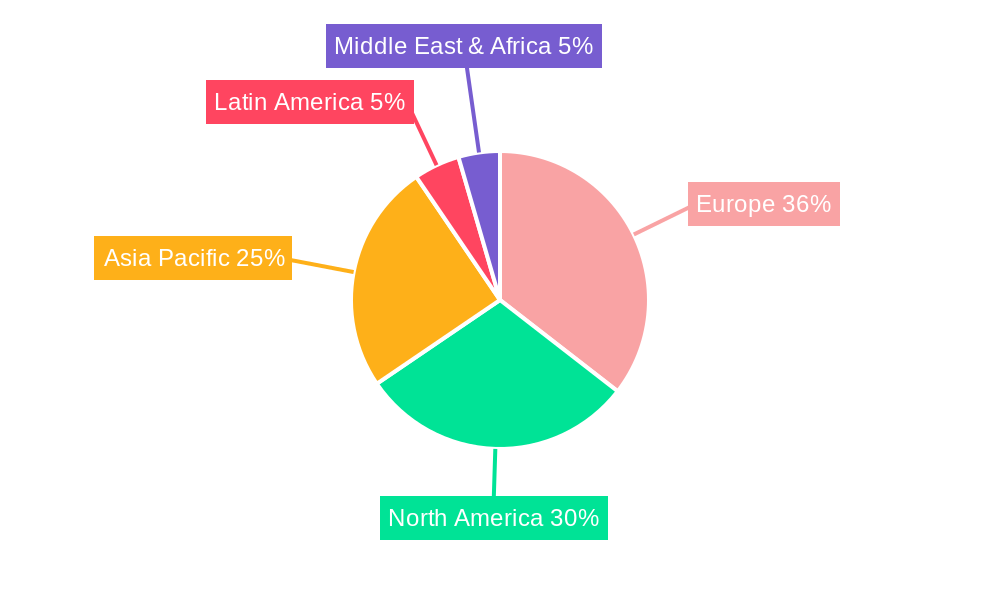

The European PC Monitor Industry is poised for steady growth, with a projected market size of approximately USD 12,500 million in 2025 and a Compound Annual Growth Rate (CAGR) of 2.24% anticipated over the forecast period of 2025-2033. This expansion is primarily fueled by the increasing demand for enhanced visual experiences across both consumer and commercial sectors, particularly in gaming. The burgeoning gaming market, driven by the proliferation of e-sports and sophisticated graphics in video games, necessitates higher resolution and faster refresh rates, pushing manufacturers to innovate with advanced technologies. Furthermore, the ongoing trend of remote work and hybrid professional environments continues to bolster the demand for reliable and high-quality monitors for home offices and business setups. The shift towards more energy-efficient LED monitors over older technologies also contributes to market growth, aligning with environmental consciousness and cost-saving initiatives.

Key market restraints include the maturity of some segments, particularly standard resolution displays, and the high cost associated with cutting-edge technologies like QLED and advanced gaming monitors, which could limit adoption among price-sensitive consumers. However, the introduction of innovative features such as higher refresh rates, adaptive sync technologies (like NVIDIA G-Sync and AMD FreeSync), and improved color accuracy are expected to drive upgrades and maintain market momentum. The competitive landscape, featuring prominent players like Samsung, LG, Acer, and Dell, intensifies innovation and encourages strategic pricing. Europe, with its robust technological infrastructure and affluent consumer base, represents a significant market for PC monitors, with countries like the UK, Germany, and France leading the demand. The ongoing evolution of display technologies, coupled with a sustained need for effective display solutions for work and entertainment, will shape the trajectory of the European PC Monitor Industry in the coming years.

This in-depth report provides a definitive analysis of the Europe PC Monitor Industry, offering strategic insights and actionable intelligence for stakeholders. Covering the historical period (2019–2024), base year (2025), and an extensive forecast period (2025–2033), this research delves into market structure, competitive dynamics, industry trends, dominant segments, product innovations, growth drivers, challenges, and key players. Leverage our expert analysis to navigate the evolving European display market and capitalize on emerging opportunities in high-resolution monitors, gaming displays, and professional-grade screens.

Europe PC Monitor Industry Market Structure & Competitive Dynamics

The Europe PC Monitor Industry exhibits a moderately concentrated market structure, with leading players like TPV Technology Co Ltd, Lenovo Group Limited, Acer Inc, Samsung Electronics Co Ltd, BenQ Corporation, ASUSTeK Computer Inc, HP Development Company L P, Micro-Star INT'L CO LTD, Dell Technologies Inc, ViewSonic Corporation Inc, and LG Electronics dominating market share. Innovation ecosystems are robust, driven by continuous R&D investment in display technologies such as IPS monitors, VA panels, and enhanced gaming monitor features. Regulatory frameworks primarily focus on energy efficiency standards and e-waste management, influencing manufacturing processes and product lifecycles. Product substitutes include integrated displays in laptops and tablets, but dedicated monitors continue to hold a strong position due to superior performance and ergonomics. End-user trends show a growing demand for 4K monitors, 1440p monitors, and monitors with higher refresh rates, particularly in the gaming and professional consumer segments. Merger and acquisition (M&A) activities are moderate, focusing on consolidating market share and acquiring technological capabilities. The overall market value is projected to exceed tens of billions of Euros within the forecast period, with M&A deal values ranging from tens to hundreds of millions of Euros, impacting market consolidation and competitive landscapes.

Europe PC Monitor Industry Industry Trends & Insights

The Europe PC Monitor Industry is experiencing significant growth, propelled by a confluence of technological advancements, evolving consumer preferences, and dynamic competitive landscapes. A key market growth driver is the increasing demand for enhanced visual experiences across diverse applications. The surge in remote work and hybrid models continues to fuel the need for professional-grade monitors that offer superior ergonomics, color accuracy, and productivity features. Simultaneously, the burgeoning e-sports and gaming sector in Europe is a major catalyst, driving sales of high-refresh-rate gaming monitors with features like low response times and adaptive sync technologies. Technological disruptions are constantly reshaping the market, with advancements in display panel technologies like OLED monitors, Mini-LED backlighting, and higher resolutions such as 6K monitors and 8K monitors becoming increasingly accessible. The consumer segment is gravitating towards larger screen sizes and immersive viewing experiences, while the commercial sector focuses on efficiency, collaboration tools, and advanced graphics capabilities. Competitive dynamics are characterized by intense product differentiation, strategic pricing, and aggressive marketing campaigns from major manufacturers. Market penetration for advanced features like HDR (High Dynamic Range) and extended color gamuts is steadily increasing, indicating a maturing market that values quality and performance. The projected Compound Annual Growth Rate (CAGR) for the Europe PC Monitor Industry is robust, estimated to be in the high single digits, reflecting sustained demand and ongoing innovation. Market penetration of advanced display technologies is anticipated to reach over 70% within the forecast period.

Dominant Markets & Segments in Europe PC Monitor Industry

The Europe PC Monitor Industry is characterized by distinct regional dominance and segment preferences. Germany, the United Kingdom, and France represent the largest markets due to their strong economies, high disposable incomes, and substantial enterprise adoption of display technologies. Within these leading markets, the 1920x1080 (Full HD) resolution segment continues to command a significant market share due to its balance of affordability and performance, catering to a broad range of consumer and commercial applications. However, the 2560x1440 (QHD) and 3840x2160 (4K UHD) resolution segments are experiencing rapid growth, driven by demand for sharper visuals in professional work, content creation, and advanced gaming.

Resolution:

- 1920x1080 (Full HD): Remains a dominant segment, particularly in the entry-level consumer and basic office use. Key drivers include cost-effectiveness and widespread compatibility.

- 2560x1440 (QHD): Rapidly gaining traction, driven by a demand for enhanced detail in gaming and professional tasks.

- 3840x2160 (4K UHD): Experiencing robust growth, especially in content creation, professional design, and premium consumer segments seeking immersive experiences.

- Other Resolutions (including 6K, 8K): Niche but growing, particularly for specialized professional applications and early adopters of cutting-edge technology.

Type:

- LCD Monitor (In-Plane Switching (IPS), Twisted Nematic (TN), Vertical Alignment (VA)): IPS panels dominate due to their superior color accuracy and wide viewing angles, making them ideal for professional use and general consumers. VA panels offer better contrast ratios, appealing to home entertainment and some gaming. TN panels, while faster, are declining in relevance outside of high-end competitive gaming.

- LED Monitor: This is the ubiquitous backlight technology for LCDs, so its dominance is inherent.

- Others (QLED, Plasma, etc.): QLED technology is gaining traction, offering enhanced brightness and color volume, particularly in premium segments. Plasma is largely obsolete.

Application:

- Consumer and Commercial: This broad segment remains the largest, encompassing home users, educational institutions, and corporate offices. Drivers include the need for productivity, entertainment, and digital learning.

- Gaming: A high-growth segment characterized by demand for performance-oriented features such as high refresh rates, low response times, and adaptive sync. The increasing popularity of esports and PC gaming fuels this segment's expansion.

- Other Applications: Includes specialized areas like medical imaging, digital signage, and content creation workstations, where specific color accuracy and resolution are paramount.

Key drivers for dominance in specific segments include economic policies that support consumer spending, infrastructure supporting advanced connectivity (e.g., DisplayPort 2.0), and increasing consumer awareness of display technology benefits.

Europe PC Monitor Industry Product Innovations

The Europe PC Monitor Industry is witnessing a rapid pace of product innovation, focusing on delivering superior visual experiences and enhanced functionality. Key developments include the integration of higher resolutions, such as Dell's recent announcement of a 32-inch monitor with 6K resolution, leveraging IPS Black technology for exceptional contrast and Zoom-certified collaboration features, catering to sophisticated professional needs. Lenovo's launch of new ThinkVision monitors, like the P27pz-30 and P32pz-30, with 1,152 dimming zones for minimized halo effects, demonstrates a commitment to improving image quality and reducing visual fatigue for demanding users. These innovations aim to provide competitive advantages by offering sharper imagery, better color reproduction, wider viewing angles, and advanced features like high refresh rates and HDR support. The market fit for these products is strong across both the gaming monitor and professional display segments, where users are willing to invest in premium visual performance.

Report Segmentation & Scope

This report meticulously segments the Europe PC Monitor Industry to provide a granular understanding of its diverse landscape. The market is analyzed across key parameters including:

- Resolution: Segments such as 1366x768, 1920x1080, 1536x864, 1440x900, 1280x720, and Other Resolutions (including emerging high resolutions like 4K, 5K, 6K, and 8K) are individually assessed for their market size, growth projections, and competitive dynamics.

- Type: The analysis covers LCD Monitor (further broken down by panel technologies like In-Plane Switching (IPS), Twisted Nematic (TN), and Vertical Alignment (VA)), LED Monitor, and Others (QLED, Plasma, etc.). Each type is evaluated for its market penetration and future growth potential.

- Application: The report details the Consumer and Commercial segments, the rapidly growing Gaming application, and Other Applications (including professional, medical, and industrial use). Growth projections for each application are provided, along with an overview of the competitive landscape within these sectors.

Key Drivers of Europe PC Monitor Industry Growth

The Europe PC Monitor Industry is propelled by several interconnected growth drivers. The ongoing digital transformation across businesses and the sustained adoption of remote and hybrid work models are increasing the demand for productivity monitors and professional displays that enhance collaboration and efficiency. Technological advancements, particularly in display panel technology leading to higher resolutions (e.g., 4K monitors, 6K monitors) and improved color accuracy, are attracting consumers and professionals alike. The burgeoning e-sports and gaming market in Europe is a significant catalyst, driving demand for high-refresh-rate, low-response-time gaming monitors. Furthermore, increasing consumer awareness and willingness to invest in premium visual experiences for entertainment and content creation contribute to sustained market expansion. Government initiatives promoting digital infrastructure and digital literacy also indirectly support the PC monitor market.

Challenges in the Europe PC Monitor Industry Sector

Despite robust growth, the Europe PC Monitor Industry faces several challenges. Intense competition among leading manufacturers like Samsung Electronics Co Ltd and HP Development Company L P leads to price pressures and margin erosion, especially in the mainstream segments. Supply chain disruptions, including shortages of crucial components like display driver ICs and panel glass, can impact production volumes and lead times, potentially hindering market growth. Evolving regulatory landscapes concerning energy efficiency and e-waste management require continuous adaptation and investment in sustainable manufacturing practices, adding to operational costs. Furthermore, the increasing prevalence of integrated displays in laptops and mobile devices presents a substitution threat, particularly for basic monitor needs. The significant R&D investment required for cutting-edge technologies like OLED monitors and Mini-LED displays can also be a barrier for smaller players.

Leading Players in the Europe PC Monitor Industry Market

- TPV Technology Co Ltd

- Lenovo Group Limited

- Acer Inc

- Samsung Electronics Co Ltd

- BenQ Corporation

- ASUSTeK Computer Inc

- HP Development Company L P

- Micro-Star INT'L CO LTD

- Dell Technologies Inc

- ViewSonic Corporation Inc

- LG Electronics

Key Developments in Europe PC Monitor Industry Sector

- May 2023: Dell Inc. announced the launch of Dell's 32-inch monitor with a 6K resolution. The company released its new desktop at CES 2023 and claimed it's the first 6K monitor with IPS Black and a Zoom-certified collaboration keyboard, significantly enhancing professional collaboration and visual fidelity.

- December 2022: Lenovo announced that the company has launched New ThinkVision Monitors, i.e., P27pz-30 and P32pz-30. These monitors are built to offer 1,152 dimming zones that help minimize the blurring halo effect that appears around objects on the screen, providing superior contrast and image quality for discerning users.

Strategic Europe PC Monitor Industry Market Outlook

- May 2023: Dell Inc. announced the launch of Dell's 32-inch monitor with a 6K resolution. The company released its new desktop at CES 2023 and claimed it's the first 6K monitor with IPS Black and a Zoom-certified collaboration keyboard, significantly enhancing professional collaboration and visual fidelity.

- December 2022: Lenovo announced that the company has launched New ThinkVision Monitors, i.e., P27pz-30 and P32pz-30. These monitors are built to offer 1,152 dimming zones that help minimize the blurring halo effect that appears around objects on the screen, providing superior contrast and image quality for discerning users.

Strategic Europe PC Monitor Industry Market Outlook

The strategic outlook for the Europe PC Monitor Industry remains highly positive, fueled by continuous innovation and evolving consumer and professional demands. The market is poised for sustained growth driven by the increasing adoption of high-resolution displays like 4K monitors and 6K monitors, alongside the growing popularity of specialized gaming monitors with advanced features. The trend towards larger screen sizes and immersive viewing experiences will continue to shape product development. Emerging technologies such as Mini-LED and advancements in panel efficiency offer significant opportunities for differentiation and premium market positioning. Strategic focus on enhancing color accuracy, refresh rates, and connectivity will be crucial for capturing market share. Furthermore, the growing emphasis on sustainability and energy-efficient designs will shape future product lifecycles and consumer preferences, presenting opportunities for companies that prioritize eco-friendly manufacturing and product longevity. The market's resilience and adaptability to technological advancements suggest a dynamic and promising future, with significant potential for market expansion and value creation.

Europe PC Monitor Industry Segmentation

-

1. Resolution

- 1.1. 1366x768

- 1.2. 1920x1080

- 1.3. 1536x864

- 1.4. 1440x900

- 1.5. 1280x720

- 1.6. Other Resolutions

-

2. Type

-

2.1. LCD Monitor

- 2.1.1. In-Plane Switching (IPS)

- 2.1.2. Twisted Nematic (TN)

- 2.1.3. Vertical Alignment (VA)

- 2.2. LED Monitor

- 2.3. CRT

- 2.4. Others (QLED, Plasma, etc.)

-

2.1. LCD Monitor

-

3. Application

- 3.1. Consumer and Commercial

- 3.2. Gaming

- 3.3. Other Applications

Europe PC Monitor Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe PC Monitor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Work From Home Jobs due to Pendamic; Availability of High Speed Internet for Gamming

- 3.3. Market Restrains

- 3.3.1. Affected Supply Chain Distribution Due to Covid-19 Pandemic

- 3.4. Market Trends

- 3.4.1. Gaming Monitors to Witness the Fastest Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resolution

- 5.1.1. 1366x768

- 5.1.2. 1920x1080

- 5.1.3. 1536x864

- 5.1.4. 1440x900

- 5.1.5. 1280x720

- 5.1.6. Other Resolutions

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. LCD Monitor

- 5.2.1.1. In-Plane Switching (IPS)

- 5.2.1.2. Twisted Nematic (TN)

- 5.2.1.3. Vertical Alignment (VA)

- 5.2.2. LED Monitor

- 5.2.3. CRT

- 5.2.4. Others (QLED, Plasma, etc.)

- 5.2.1. LCD Monitor

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Consumer and Commercial

- 5.3.2. Gaming

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Resolution

- 6. Germany Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe PC Monitor Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 TPV Technology Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Lenovo Group Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Acer Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Samsung Electronics Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BenQ Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ASUSTeK Computer Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 HP Development Company L P

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Micro-Star INT'L CO LTD

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Dell Technologies Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 ViewSonic Corporation Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 LG Electronics

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 TPV Technology Co Ltd

List of Figures

- Figure 1: Europe PC Monitor Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe PC Monitor Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe PC Monitor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe PC Monitor Industry Revenue Million Forecast, by Resolution 2019 & 2032

- Table 3: Europe PC Monitor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe PC Monitor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Europe PC Monitor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe PC Monitor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe PC Monitor Industry Revenue Million Forecast, by Resolution 2019 & 2032

- Table 15: Europe PC Monitor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Europe PC Monitor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe PC Monitor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe PC Monitor Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe PC Monitor Industry?

The projected CAGR is approximately 2.24%.

2. Which companies are prominent players in the Europe PC Monitor Industry?

Key companies in the market include TPV Technology Co Ltd, Lenovo Group Limited, Acer Inc, Samsung Electronics Co Ltd, BenQ Corporation, ASUSTeK Computer Inc, HP Development Company L P, Micro-Star INT'L CO LTD, Dell Technologies Inc, ViewSonic Corporation Inc, LG Electronics.

3. What are the main segments of the Europe PC Monitor Industry?

The market segments include Resolution, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Work From Home Jobs due to Pendamic; Availability of High Speed Internet for Gamming.

6. What are the notable trends driving market growth?

Gaming Monitors to Witness the Fastest Market Growth.

7. Are there any restraints impacting market growth?

Affected Supply Chain Distribution Due to Covid-19 Pandemic.

8. Can you provide examples of recent developments in the market?

May 2023: Dell Inc. announced the launch of Dell's 32-inch monitor with a 6K resolution. The company released its new desktop at CES 2023 and claimed it's the first 6K monitor with IPS Black and a Zoom-certified collaboration keyboard.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe PC Monitor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe PC Monitor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe PC Monitor Industry?

To stay informed about further developments, trends, and reports in the Europe PC Monitor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence