Key Insights

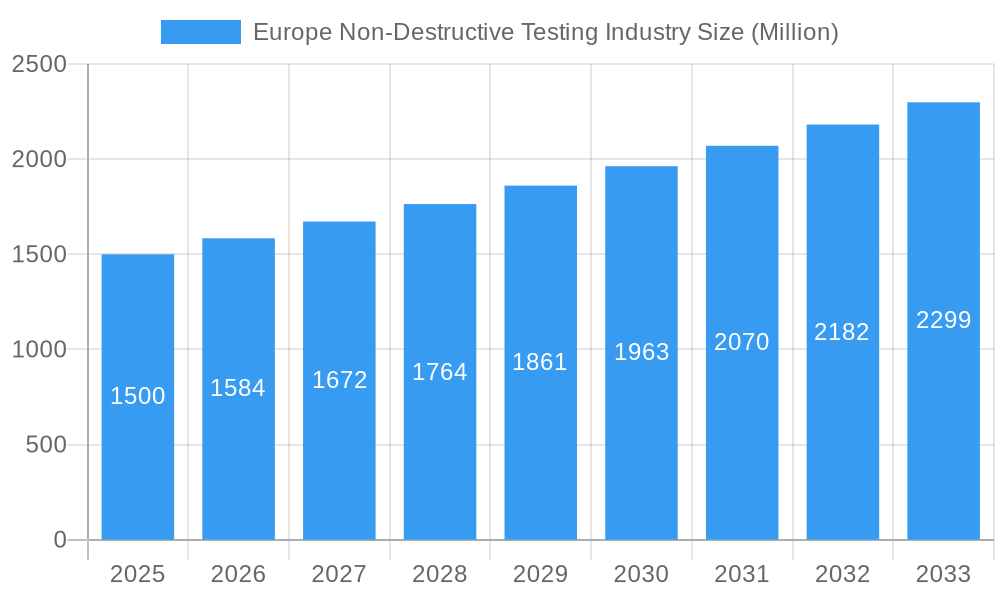

The European Non-Destructive Testing (NDT) market is poised for significant expansion, with a projected market size of 5564.55 million by 2025. This robust growth is anticipated at a Compound Annual Growth Rate (CAGR) of 6.5% from the base year 2024 through 2033. Key drivers include escalating demand from the Oil & Gas, Aerospace & Defense, and Automotive & Transportation sectors, propelled by increasingly stringent safety regulations and the imperative for comprehensive product lifecycle quality control. Technological advancements, encompassing sophisticated imaging techniques and the integration of AI and automation, are further accelerating market development. The market is segmented by NDT type (Equipment, Services), testing technology (Radiography, Ultrasonic, Magnetic Particle, Liquid Penetrant, Visual Inspection, and Others), and end-user industries. Leading markets within Europe include Germany, France, the UK, and Italy, reflecting high industrial output and rigorous quality benchmarks. Growth is expected to be widespread across European nations, supported by investments in infrastructure and manufacturing.

Europe Non-Destructive Testing Industry Market Size (In Billion)

Despite challenges such as substantial initial investment costs for advanced NDT equipment and a scarcity of skilled professionals, the European NDT market outlook remains highly positive. The increasing adoption of advanced NDT methodologies for ensuring product integrity and averting critical failures, alongside a rising focus on predictive maintenance, is expected to counterbalance these restraints. The integration of digitalization and cloud-based solutions within the NDT sector will further enhance market expansion through streamlined operations and improved data analytics. Intense competition among established and emerging NDT solution providers is fostering continuous innovation and a diverse array of offerings for varied industrial applications. The European NDT market is set to remain a vital component of the global NDT landscape, benefiting from strong regulatory frameworks and ongoing advancements in testing technologies.

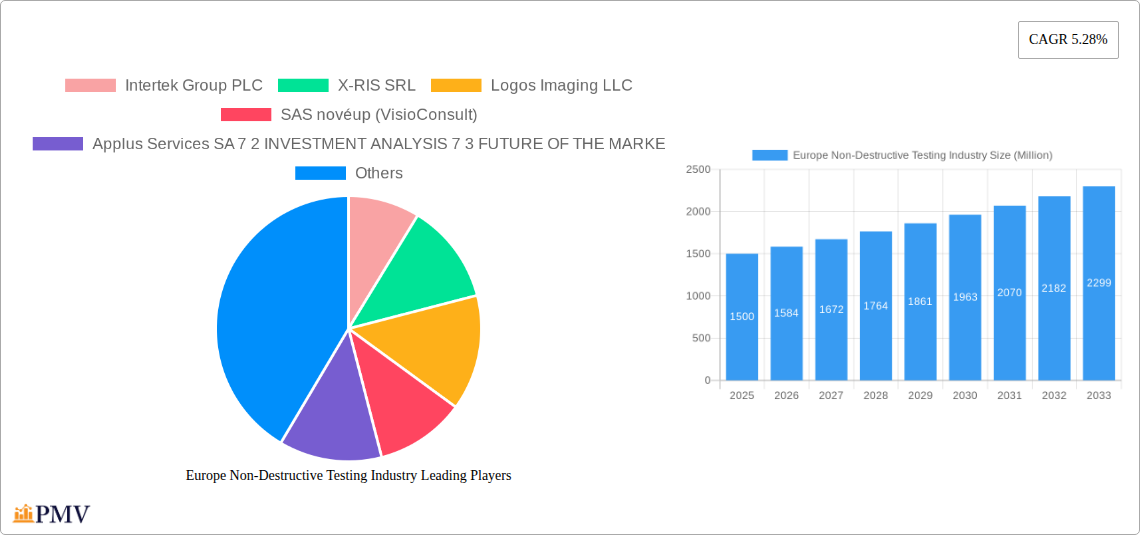

Europe Non-Destructive Testing Industry Company Market Share

Europe Non-Destructive Testing (NDT) Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European Non-Destructive Testing (NDT) industry, covering market size, segmentation, competitive landscape, and future growth prospects. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The report offers actionable insights for industry stakeholders, investors, and strategic decision-makers. The total market value in 2025 is estimated at €XX Million.

Europe Non-Destructive Testing Industry Market Structure & Competitive Dynamics

The European NDT market exhibits a moderately concentrated structure, with a few large multinational players and numerous smaller specialized firms. Key players such as Intertek Group PLC, Bureau Veritas SA, and Olympus Corporation hold significant market share, estimated at a combined XX%. However, the market also features a dynamic ecosystem of smaller companies specializing in niche testing technologies or end-user industries. Innovation is driven by continuous advancements in inspection technologies and the increasing demand for improved safety and reliability across various sectors.

Regulatory frameworks, particularly within the aerospace and defense sectors, play a crucial role in shaping industry practices and standards. Stringent quality control regulations drive the adoption of advanced NDT techniques and the demand for certified services. Product substitutes, while limited, include visual inspections, which are often less comprehensive and reliable than advanced NDT methods. End-user trends towards automation, digitalization, and improved efficiency are transforming the NDT landscape, favoring providers offering integrated solutions and data analytics capabilities.

M&A activity within the industry has been moderate in recent years, with deal values averaging approximately €XX Million annually. Consolidation is expected to continue, driven by the need for broader service offerings and geographic expansion. Some notable examples include: (Specific M&A deals with values would be added here, if available. If not, replace with an example below). For instance, a potential acquisition of a smaller firm specializing in ultrasonic testing by a larger player could be valued at approximately €XX Million, extending their service offerings and market reach.

Europe Non-Destructive Testing Industry Industry Trends & Insights

The European NDT market is experiencing robust growth, driven by several key factors. The increasing demand for infrastructure development, particularly in renewable energy and transportation, fuels the adoption of NDT for quality assurance and safety inspections. The aerospace and defense sectors continue to be major contributors due to stringent regulatory requirements and the need for reliable component inspection. Technological advancements, such as the integration of artificial intelligence (AI) and robotics in NDT systems, are improving inspection speed, accuracy, and efficiency, driving market growth.

The market is witnessing a shift towards non-destructive testing services rather than equipment purchases. This trend is primarily driven by the rising demand for specialized expertise and the increasing complexity of testing procedures. Clients are often more inclined to outsource their NDT needs to specialized service providers, leveraging their expertise and advanced equipment. The market is projected to witness a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). The market penetration of advanced NDT technologies such as phased array ultrasonic testing (PAUT) and digital radiography is steadily increasing. This is largely attributed to their enhanced capabilities and improved data analysis features. Competitive dynamics are shaped by technological innovation, pricing strategies, and the ability to provide comprehensive and tailored solutions to diverse end-user industries.

Dominant Markets & Segments in Europe Non-Destructive Testing Industry

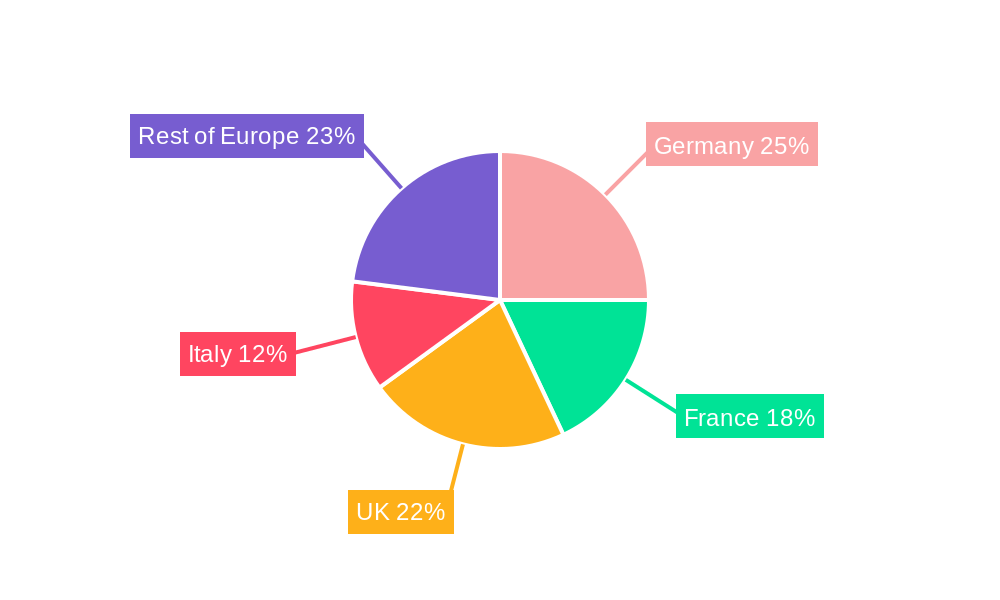

The European Non-Destructive Testing (NDT) industry is characterized by the significant contributions of its leading economies, with the United Kingdom, Germany, and France standing out as the largest national markets. This dominance is a direct result of their robust and diverse industrial bases, coupled with stringent regulatory frameworks that mandate high standards for safety, quality, and asset integrity.

- Key Drivers for UK Dominance: A cornerstone of the UK's strong NDT market is its advanced aerospace and defense sectors, which demand the highest levels of inspection reliability. Significant ongoing investments in infrastructure, including transportation networks and energy facilities, further propel NDT services. Furthermore, the UK boasts a mature and well-established NDT services ecosystem, encompassing a wide array of specialized providers and cutting-edge technologies.

- Key Drivers for German Dominance: Germany's leadership is underpinned by its massive automotive and manufacturing industries, where precision and quality control are paramount. The nation's inherent strengths in advanced technological development translate directly into sophisticated NDT solutions. A deeply ingrained focus on quality assurance across all industrial applications ensures a consistent demand for NDT services.

- Key Drivers for French Dominance: France's significant market share is propelled by substantial investments in its energy sector, particularly in nuclear power generation and the burgeoning renewable energy landscape. Extensive infrastructure projects, from transportation to urban development, also necessitate comprehensive NDT solutions. The presence of major global NDT service providers headquartered or with significant operations in France further solidifies its market position.

Segment Dominance:

- By Type: The services segment is projected to maintain its dominant position and experience robust growth. This is largely attributed to the increasing trend of companies outsourcing their NDT needs to specialized third-party providers, allowing them to focus on core competencies while ensuring access to expertise and advanced technologies.

- By Testing Technology: Ultrasonic testing (UT) continues to hold the largest market share. Its versatility, portability, and suitability for detecting internal flaws in a wide range of materials and geometries make it indispensable across numerous industries. Radiography remains a critical technology, especially in high-stakes sectors like aerospace and defense, where its ability to provide volumetric inspection is essential for detecting subsurface defects.

- By End-user Industry: The aerospace and defense, oil and gas, and automotive sectors are consistently the largest consumers of NDT services. The inherent safety-critical nature of these industries, coupled with their continuous need for asset integrity and regulatory compliance, drives significant and sustained market demand for NDT solutions.

Beyond these leading markets, Italy and Russia represent notable, albeit smaller, markets that exhibit significant growth potential. This potential is intrinsically linked to their ongoing industrial developments and critical infrastructure investments. The collective "Rest of Europe" segment encompasses a diverse range of national economies, each with unique market dynamics influenced by regional economic activities, specific industry strengths, and varying regulatory landscapes.

Europe Non-Destructive Testing Industry Product Innovations

Recent innovations focus on enhancing inspection speed, accuracy, and data analysis capabilities. The integration of AI and machine learning in NDT systems is automating defect detection and improving diagnostic accuracy. Portable and handheld devices are gaining popularity for increased accessibility and on-site inspection. The development of advanced sensors and data analytics tools facilitates real-time data processing and remote monitoring, improving overall efficiency. These innovations are improving market fit by addressing specific industry needs for faster and more reliable inspection processes.

Report Segmentation & Scope

This comprehensive report provides an in-depth analysis of the European NDT market, meticulously segmenting it across several key parameters to offer a nuanced understanding of its structure and dynamics:

By Type: The market is segmented into Equipment and Services. The services segment is projected to exhibit higher growth rates, driven by the increasing trend of outsourcing NDT functions by end-user industries to specialized providers.

By Testing Technology: Key NDT technologies covered include Radiography, Ultrasonic, Magnetic Particle, Liquid Penetrant, Visual Inspection, and Other Technologies (such as eddy current testing, thermal imaging, acoustic emission, etc.). Ultrasonic testing currently holds the largest market share, followed closely by radiography, reflecting their widespread application and effectiveness.

By End-user Industry: The report analyzes NDT demand across major sectors such as Oil and Gas, Aerospace and Defense, Automotive and Transportation, Power and Energy, Construction, and Other End-user Industries (including general manufacturing, pharmaceuticals, etc.). The Aerospace and Defense and Oil and Gas sectors are identified as key growth drivers, exhibiting the highest demand for advanced NDT solutions.

By Country: The market is broken down by key geographical regions: United Kingdom, Germany, France, Italy, Russia, and the Rest of Europe. The United Kingdom, Germany, and France are confirmed as the dominant markets, accounting for the largest share of the European NDT industry.

Key Drivers of Europe Non-Destructive Testing Industry Growth

The sustained and robust growth of the European Non-Destructive Testing (NDT) industry is propelled by a confluence of critical factors. A paramount driver is the ever-increasing demand for enhanced safety and rigorous quality control across a multitude of industrial sectors. This imperative is further amplified by stringent regulatory requirements, particularly in safety-critical industries like aerospace and defense, which mandate meticulous inspections and adherence to strict standards. Technological advancements are also playing a pivotal role, with innovations continuously improving the efficiency, accuracy, and scope of NDT inspections, leading to wider adoption. Furthermore, significant infrastructure development projects across the continent, encompassing new constructions, upgrades, and the expansion of renewable energy facilities, inherently create a substantial demand for NDT services to ensure structural integrity and longevity. Growing demand from key industries such as the Oil and Gas and Aerospace and Defense sectors, in particular, is a major catalyst, driving the adoption of more sophisticated and advanced NDT techniques to meet their evolving needs.

Challenges in the Europe Non-Destructive Testing Industry Sector

Despite its strong growth trajectory, the European NDT industry encounters several significant challenges. The high initial investment costs associated with acquiring cutting-edge NDT equipment and implementing advanced technologies can be a substantial barrier for some companies, particularly smaller enterprises. Compounding this is a persistent issue of skilled labor shortages; a lack of adequately trained and experienced NDT technicians can hinder service delivery and adoption of new methodologies. The market also faces intense competition, not only among established NDT service providers but also from new entrants and in-house inspection departments. Furthermore, external economic factors such as fluctuating commodity prices and broader economic uncertainties can impact investment decisions, leading to slower market growth. Navigating the complexities of regulatory compliance across different European nations and the continuous need for technological upgrades to remain competitive add further layers of challenge for businesses operating within the sector.

Leading Players in the Europe Non-Destructive Testing Industry Market

- Intertek Group PLC

- X-RIS SRL

- Logos Imaging LLC

- SAS novéup (VisioConsult)

- Applus Services SA

- Teledyne ICM

- Novo DR Ltd

- Zetec Inc

- 3DX-RAY Ltd (Image Scan Holdings Plc)

- YXLON International GmbH (COMET Group)

- Bureau Veritas SA

- Olympus Corporation

- Magnaflux Corp

- Scanna MSC

- GE Measurement and Control

Key Developments in Europe Non-Destructive Testing Industry Sector

- 2022 Q4: Olympus Corporation, a global leader in NDT, launched a new state-of-the-art phased array ultrasonic testing system, enhancing inspection capabilities for complex geometries and challenging materials.

- 2023 Q1: A significant strategic merger between two prominent NDT service providers in Germany was completed, aiming to consolidate expertise, expand service offerings, and strengthen market position within the robust German industrial landscape.

- 2023 Q2: Intertek Group PLC, a leading global quality assurance and inspection company, announced the strategic expansion of its NDT services specifically tailored for the renewable energy sector, recognizing the growing importance of wind, solar, and other green energy infrastructure. (This section is designed to be a placeholder for further specific developments, including potential product launches, strategic partnerships, significant contract wins, and major market trends with precise dates as they become available.)

Strategic Europe Non-Destructive Testing Industry Market Outlook

The European NDT market is poised for continued growth, driven by technological innovation, increasing demand for safety and quality control, and ongoing infrastructure investments. Strategic opportunities exist for companies specializing in advanced NDT technologies, data analytics, and customized solutions for specific end-user industries. The market is expected to see significant expansion in the renewable energy, transportation, and construction sectors. Focusing on sustainable practices and digitalization will be key to capturing market share in the coming years.

Europe Non-Destructive Testing Industry Segmentation

-

1. Type

- 1.1. Equipment

- 1.2. Services

-

2. Testing Technology

- 2.1. Radiography

- 2.2. Ultrasonic

- 2.3. Magnetic Particle

- 2.4. Liquid Penetrant

- 2.5. Visual Inspection

- 2.6. Other Technologies

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Aerospace and Defense

- 3.3. Automotive and Transportation

- 3.4. Power and Energy

- 3.5. Construction

- 3.6. Other End-user Industries (Manufacturing, etc.)

Europe Non-Destructive Testing Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Non-Destructive Testing Industry Regional Market Share

Geographic Coverage of Europe Non-Destructive Testing Industry

Europe Non-Destructive Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Stringent Regulations Mandating Safety Standards; Increasing Investment in Aerospace and Defense

- 3.3. Market Restrains

- 3.3.1. ; Lack of Skilled Personnel and Training Facilities

- 3.4. Market Trends

- 3.4.1. Power and Energy Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Non-Destructive Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Testing Technology

- 5.2.1. Radiography

- 5.2.2. Ultrasonic

- 5.2.3. Magnetic Particle

- 5.2.4. Liquid Penetrant

- 5.2.5. Visual Inspection

- 5.2.6. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Aerospace and Defense

- 5.3.3. Automotive and Transportation

- 5.3.4. Power and Energy

- 5.3.5. Construction

- 5.3.6. Other End-user Industries (Manufacturing, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intertek Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 X-RIS SRL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Logos Imaging LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SAS novéup (VisioConsult)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Applus Services SA 7 2 INVESTMENT ANALYSIS 7 3 FUTURE OF THE MARKE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teledyne ICM

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novo DR Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zetec Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 3DX-RAY Ltd (Image Scan Holdings Plc)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 YXLON International GmbH ( COMET Group)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bureau Veritas SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Olympus Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Magnaflux Corp

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Scanna MSC

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 GE Measurement and Control

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Intertek Group PLC

List of Figures

- Figure 1: Europe Non-Destructive Testing Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Non-Destructive Testing Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Non-Destructive Testing Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Non-Destructive Testing Industry Revenue million Forecast, by Testing Technology 2020 & 2033

- Table 3: Europe Non-Destructive Testing Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Non-Destructive Testing Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe Non-Destructive Testing Industry Revenue million Forecast, by Type 2020 & 2033

- Table 6: Europe Non-Destructive Testing Industry Revenue million Forecast, by Testing Technology 2020 & 2033

- Table 7: Europe Non-Destructive Testing Industry Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe Non-Destructive Testing Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Non-Destructive Testing Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Non-Destructive Testing Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Non-Destructive Testing Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Non-Destructive Testing Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Non-Destructive Testing Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Non-Destructive Testing Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Non-Destructive Testing Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Non-Destructive Testing Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Non-Destructive Testing Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Non-Destructive Testing Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Non-Destructive Testing Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Non-Destructive Testing Industry?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Europe Non-Destructive Testing Industry?

Key companies in the market include Intertek Group PLC, X-RIS SRL, Logos Imaging LLC, SAS novéup (VisioConsult), Applus Services SA 7 2 INVESTMENT ANALYSIS 7 3 FUTURE OF THE MARKE, Teledyne ICM, Novo DR Ltd, Zetec Inc, 3DX-RAY Ltd (Image Scan Holdings Plc), YXLON International GmbH ( COMET Group), Bureau Veritas SA, Olympus Corporation, Magnaflux Corp, Scanna MSC, GE Measurement and Control.

3. What are the main segments of the Europe Non-Destructive Testing Industry?

The market segments include Type, Testing Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5564.55 million as of 2022.

5. What are some drivers contributing to market growth?

; Stringent Regulations Mandating Safety Standards; Increasing Investment in Aerospace and Defense.

6. What are the notable trends driving market growth?

Power and Energy Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

; Lack of Skilled Personnel and Training Facilities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Non-Destructive Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Non-Destructive Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Non-Destructive Testing Industry?

To stay informed about further developments, trends, and reports in the Europe Non-Destructive Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence