Key Insights

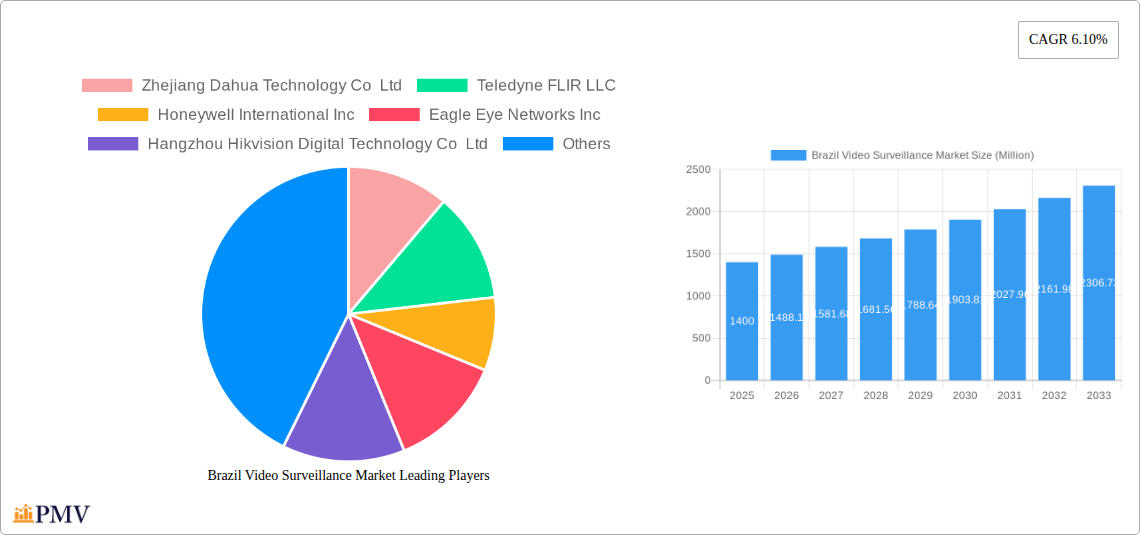

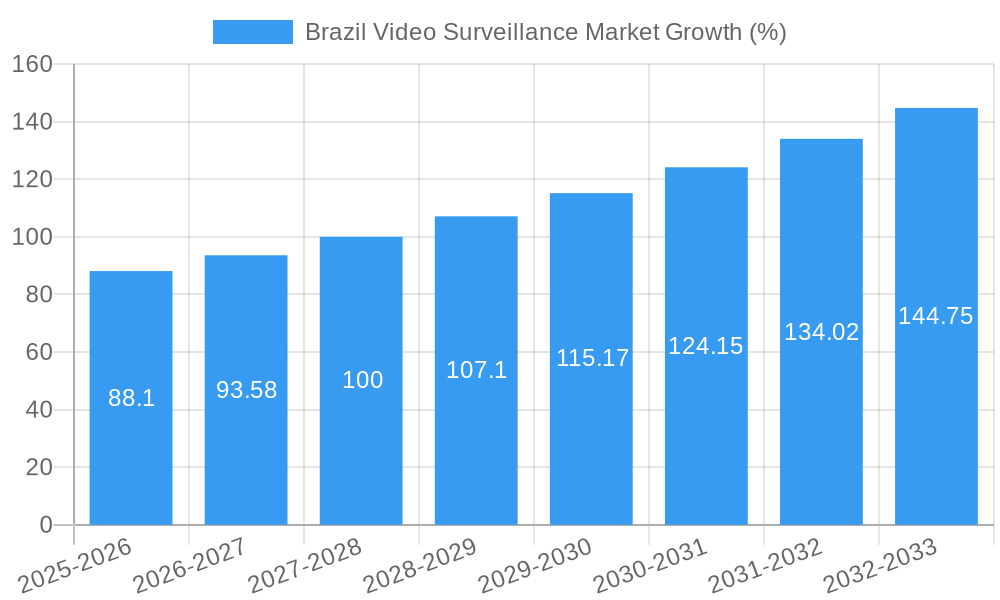

The Brazil video surveillance market, valued at $1.40 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing concerns regarding public safety and crime rates are fueling demand for advanced surveillance solutions across residential, commercial, and governmental sectors. Secondly, technological advancements, such as the proliferation of high-definition cameras, intelligent video analytics, and cloud-based storage solutions, are enhancing the efficiency and effectiveness of video surveillance systems. Furthermore, the rising adoption of Internet of Things (IoT) devices and the increasing integration of video surveillance with other security systems are contributing to market growth. Finally, government initiatives promoting infrastructure development and smart city projects are creating significant opportunities for the deployment of sophisticated video surveillance infrastructure.

However, certain challenges hinder market growth. High initial investment costs associated with advanced video surveillance systems, particularly for small and medium-sized businesses (SMBs), can act as a restraint. Furthermore, concerns regarding data privacy and security regulations are influencing adoption rates and necessitate robust cybersecurity measures. Despite these constraints, the long-term outlook for the Brazil video surveillance market remains positive, driven by the continuous demand for enhanced security and the ongoing technological advancements in the sector. Key players like Zhejiang Dahua Technology, Hikvision, and Honeywell are strategically positioned to capitalize on this growth, focusing on innovation and expanding their market presence through partnerships and strategic acquisitions. The market segmentation will likely see continued growth in IP-based systems, cloud-based solutions, and specialized applications in sectors like transportation and retail.

Brazil Video Surveillance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil video surveillance market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth prospects. The report leverages extensive data analysis to deliver actionable intelligence and forecasts, empowering businesses to navigate this dynamic market effectively.

Brazil Video Surveillance Market Structure & Competitive Dynamics

The Brazilian video surveillance market exhibits a moderately concentrated structure, with several multinational and domestic players vying for market share. The market is characterized by intense competition, driven by technological innovations and evolving end-user demands. Key players such as Zhejiang Dahua Technology Co Ltd, Teledyne FLIR LLC, Honeywell International Inc, Eagle Eye Networks Inc, Hangzhou Hikvision Digital Technology Co Ltd, Axis Communications AB, Bosch Security Systems Incorporated, Samsung Group, Verkada Inc, Motorola Solutions Inc, Infinova Group, and Johnson Controls, (list not exhaustive) contribute significantly to the market's overall value. Market share fluctuates based on product launches, technological advancements, and successful marketing strategies. The total market value in 2025 is estimated at xx Million.

- Market Concentration: The market exhibits a Herfindahl-Hirschman Index (HHI) of xx, indicating a moderately concentrated market.

- Innovation Ecosystems: A robust ecosystem of research institutions, technology providers, and system integrators fuels continuous product innovation.

- Regulatory Frameworks: Government regulations concerning data privacy and cybersecurity are shaping market practices.

- Product Substitutes: Limited direct substitutes exist; however, alternative security solutions may pose indirect competitive threats.

- End-User Trends: Increasing demand from government agencies, commercial establishments, and residential sectors drives market growth.

- M&A Activities: Several M&A deals, valued at approximately xx Million in the past five years, reflect industry consolidation trends.

Brazil Video Surveillance Market Industry Trends & Insights

The Brazil video surveillance market is experiencing robust growth, driven by several factors. The rising adoption of smart city initiatives, along with increasing concerns about crime and public safety, fuels demand for advanced surveillance solutions. Technological advancements, such as the incorporation of AI and analytics capabilities in video surveillance systems, are further driving market expansion. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is gradually increasing, particularly in urban areas and high-security zones. Consumer preference is shifting toward integrated solutions that offer enhanced security, analytics, and remote management capabilities. Competitive dynamics remain intense, with companies focusing on product differentiation, cost optimization, and strategic partnerships to gain market share. The projected market size in 2033 is estimated at xx Million.

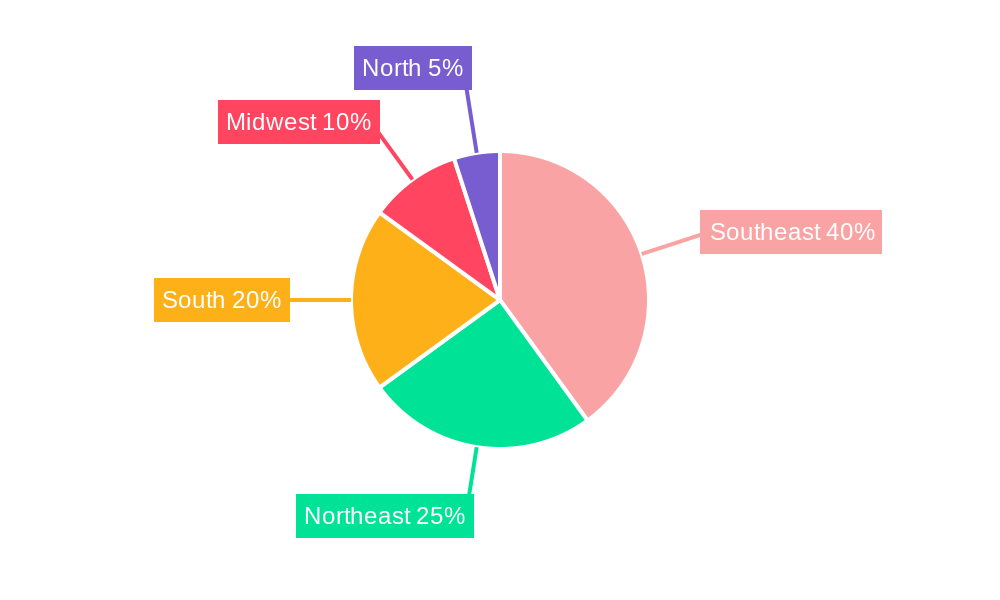

Dominant Markets & Segments in Brazil Video Surveillance Market

The Southeastern region of Brazil dominates the video surveillance market due to its high population density, robust economic activity, and significant infrastructure investments. São Paulo, in particular, emerges as a key market hub.

- Key Drivers for Southeastern Dominance:

- High concentration of commercial and industrial establishments.

- Extensive deployment of smart city infrastructure projects.

- Strong government initiatives to enhance public safety and security.

- High level of disposable income in the region.

Brazil Video Surveillance Market Product Innovations

Recent product innovations focus on improving image quality, enhancing analytics capabilities, and integrating AI-powered features for enhanced security and efficiency. The market is witnessing a growing demand for high-definition cameras, thermal imaging systems, and advanced video analytics software. Products emphasizing ease of use, remote accessibility, and cloud-based solutions are gaining popularity. The integration of AI and machine learning is enabling real-time threat detection and predictive analytics, further driving market growth.

Report Segmentation & Scope

The report segments the Brazil video surveillance market based on several factors:

- By Product Type: IP cameras, analog cameras, video recorders (DVR/NVR), video management systems (VMS), and other related accessories. IP cameras are projected to hold the largest market share, driven by their advanced features and flexibility.

- By Application: Residential, commercial, industrial, government, and transportation. The commercial sector is expected to show significant growth due to increasing security concerns.

- By Technology: Cloud-based, on-premise, and hybrid solutions. Cloud-based solutions are gaining momentum due to their scalability and cost-effectiveness.

Key Drivers of Brazil Video Surveillance Market Growth

Several factors contribute to the growth of the Brazil video surveillance market:

- Rising Crime Rates: The increasing crime rates in urban centers are driving demand for enhanced security measures.

- Smart City Initiatives: Government investments in smart city projects are accelerating the adoption of advanced surveillance technologies.

- Technological Advancements: Innovations in AI, analytics, and cloud computing are enhancing the capabilities of video surveillance systems.

- Government Regulations: Regulations mandating security measures in certain sectors are boosting market demand.

Challenges in the Brazil Video Surveillance Market Sector

The Brazil video surveillance market faces certain challenges:

- High Initial Investment Costs: The high initial investment required for deploying sophisticated video surveillance systems can be a barrier for some users.

- Data Privacy Concerns: Concerns about data privacy and security are impacting the adoption of certain technologies.

- Cybersecurity Risks: Vulnerabilities in video surveillance systems to cyberattacks pose a significant challenge.

- Economic Fluctuations: Economic uncertainties and fluctuations may influence the overall market growth.

Leading Players in the Brazil Video Surveillance Market Market

- Zhejiang Dahua Technology Co Ltd

- Teledyne FLIR LLC

- Honeywell International Inc

- Eagle Eye Networks Inc

- Hangzhou Hikvision Digital Technology Co Ltd

- Axis Communications AB

- Bosch Security Systems Incorporated

- Samsung Group

- Verkada Inc

- Motorola Solutions Inc

- Infinova Group

- Johnson Controls

Key Developments in Brazil Video Surveillance Market Sector

- July 2024: Axis Communications launched the AXIS Q1809-LE Bullet Camera, an all-in-one outdoor solution with a custom telephoto lens for long-distance surveillance. This enhances forensic capabilities and expands application possibilities across various sectors.

- June 2024: Hikvision integrated VCA 3.0 into its Heatpro bi-spectrum thermal cameras, improving performance, detection, and accuracy. This upgrade showcases Hikvision's commitment to advanced security technology.

Strategic Brazil Video Surveillance Market Outlook

The Brazil video surveillance market holds significant growth potential, driven by ongoing technological advancements and increasing demand for enhanced security solutions across various sectors. Strategic opportunities exist for companies that can offer innovative, cost-effective, and scalable solutions that address the specific needs and challenges of the Brazilian market. Focusing on AI-powered analytics, cloud-based platforms, and robust cybersecurity measures will be crucial for success in this rapidly evolving market. The long-term outlook for the Brazil video surveillance market remains positive, with strong growth anticipated throughout the forecast period.

Brazil Video Surveillance Market Segmentation

-

1. Type

-

1.1. Hardware

-

1.1.1. Camera

- 1.1.1.1. Analog

- 1.1.1.2. IP Cameras

-

1.1.1. Camera

-

1.2. Software

- 1.2.1. Video Analytics

- 1.2.2. Video Management

- 1.3. Services (VSAAS)

-

1.1. Hardware

-

2. End-user Vertical

- 2.1. Commercial

- 2.2. Infrastructure

- 2.3. Institutional

- 2.4. Defense

- 2.5. Residential

Brazil Video Surveillance Market Segmentation By Geography

- 1. Brazil

Brazil Video Surveillance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Concern About Security and Safety; Advances in Technology

- 3.2.2 Such as IoT

- 3.2.3 Artificial Intelligence

- 3.2.4 and Voice Controlled Assistants

- 3.3. Market Restrains

- 3.3.1 Rising Concern About Security and Safety; Advances in Technology

- 3.3.2 Such as IoT

- 3.3.3 Artificial Intelligence

- 3.3.4 and Voice Controlled Assistants

- 3.4. Market Trends

- 3.4.1. IP Cameras Significantly Gaining Popularity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Video Surveillance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Camera

- 5.1.1.1.1. Analog

- 5.1.1.1.2. IP Cameras

- 5.1.1.1. Camera

- 5.1.2. Software

- 5.1.2.1. Video Analytics

- 5.1.2.2. Video Management

- 5.1.3. Services (VSAAS)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Commercial

- 5.2.2. Infrastructure

- 5.2.3. Institutional

- 5.2.4. Defense

- 5.2.5. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Zhejiang Dahua Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Teledyne FLIR LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honeywell International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eagle Eye Networks Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axis Communications AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch Security Systems Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Samsung Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Verkada Ince

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Motorola Solutions Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Infinova Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Johnson Controls*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Zhejiang Dahua Technology Co Ltd

List of Figures

- Figure 1: Brazil Video Surveillance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Video Surveillance Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Video Surveillance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Video Surveillance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Brazil Video Surveillance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Brazil Video Surveillance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Brazil Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Brazil Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 7: Brazil Video Surveillance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Video Surveillance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Brazil Video Surveillance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Brazil Video Surveillance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Brazil Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: Brazil Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 13: Brazil Video Surveillance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Video Surveillance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Video Surveillance Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Brazil Video Surveillance Market?

Key companies in the market include Zhejiang Dahua Technology Co Ltd, Teledyne FLIR LLC, Honeywell International Inc, Eagle Eye Networks Inc, Hangzhou Hikvision Digital Technology Co Ltd, Axis Communications AB, Bosch Security Systems Incorporated, Samsung Group, Verkada Ince, Motorola Solutions Inc, Infinova Group, Johnson Controls*List Not Exhaustive.

3. What are the main segments of the Brazil Video Surveillance Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Concern About Security and Safety; Advances in Technology. Such as IoT. Artificial Intelligence. and Voice Controlled Assistants.

6. What are the notable trends driving market growth?

IP Cameras Significantly Gaining Popularity.

7. Are there any restraints impacting market growth?

Rising Concern About Security and Safety; Advances in Technology. Such as IoT. Artificial Intelligence. and Voice Controlled Assistants.

8. Can you provide examples of recent developments in the market?

July 2024: Axis Communications unveiled its latest offering, the AXIS Q1809-LE Bullet Camera. This all-in-one outdoor solution boasts a custom telephoto lens designed for optimal long-distance surveillance, ensuring superior image quality and enhanced forensic capabilities. Axis touts the versatility of the AXIS Q1809-LE, asserting its suitability across diverse applications, ranging from smart cities and airports to stadiums and transportation hubs. Notably, the camera is designed for immediate deployment straight out of the box.June 2024: Hikvision, a leading player in the security solutions sector, rolled out a major enhancement to its Heatpro bi-spectrum thermal cameras by incorporating VCA 3.0. This upgrade is not merely cosmetic; it is a strategic move to boost performance, detection capabilities, and accuracy. By integrating VCA 3.0, Hikvision underscores its dedication to cutting-edge security solutions. The latest algorithms in VCA 3.0 mark a leap in processing power and efficiency, heightening the cameras' ability to pinpoint and analyze potential security threats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Video Surveillance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Video Surveillance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Video Surveillance Market?

To stay informed about further developments, trends, and reports in the Brazil Video Surveillance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence