Key Insights

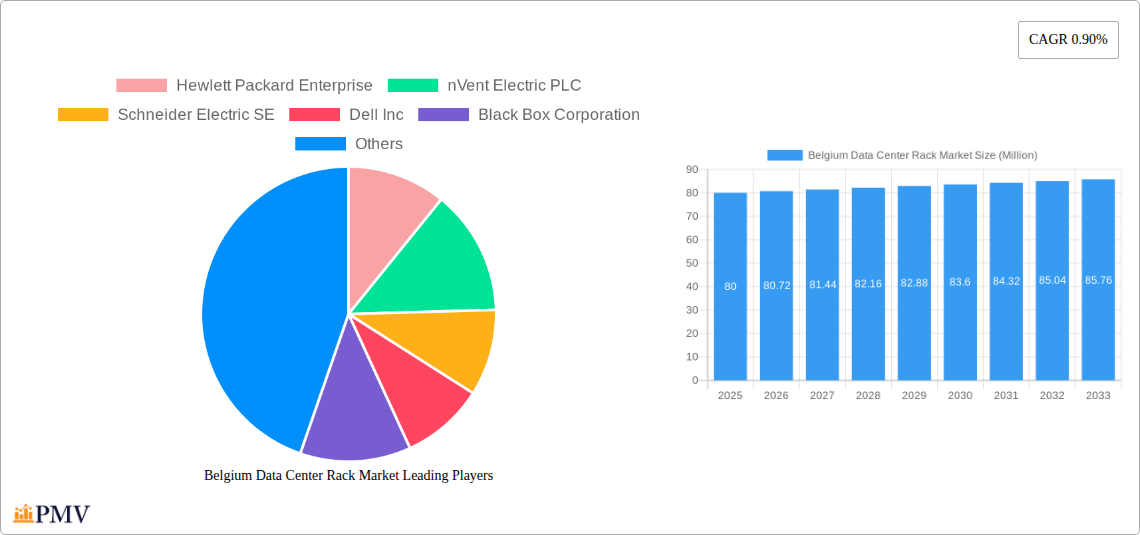

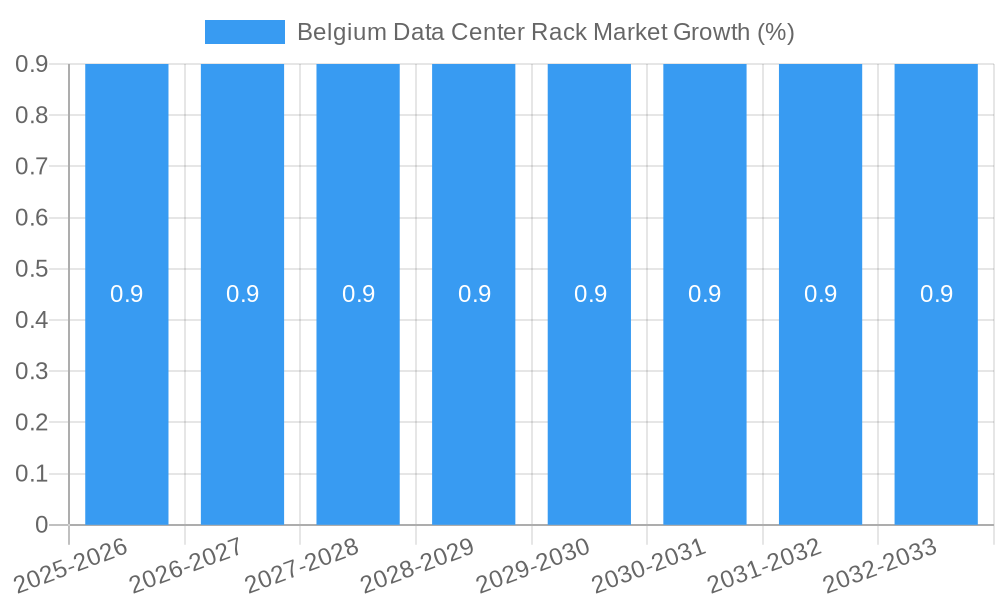

The Belgium Data Center Rack Market is poised for steady, albeit modest, growth, driven by increasing digital transformation initiatives across various sectors. With an estimated market size of approximately USD 80 million in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 0.90% through 2033. This growth is primarily fueled by the burgeoning demand for efficient and scalable data storage solutions from the IT & Telecommunication and BFSI sectors, which are at the forefront of adopting advanced technologies like cloud computing, big data analytics, and artificial intelligence. Government entities are also significant contributors, investing in secure and robust data infrastructure for public services and national security. The Media & Entertainment industry's shift towards high-definition content delivery and streaming services further bolsters the need for reliable data center rack infrastructure. While the overall growth rate might appear conservative, it reflects a mature market undergoing continuous upgrades and expansions rather than explosive new market creation.

Key drivers for this market include the ongoing need for modernization of existing data centers, the deployment of new colocation facilities, and the increasing adoption of high-density computing solutions, which necessitate advanced rack configurations like half and full racks. Trends such as the rise of edge computing and the growing emphasis on energy efficiency within data centers are also shaping the market, encouraging the adoption of smarter and more integrated rack solutions. However, the market faces certain restraints, including the high capital expenditure associated with establishing and upgrading data center infrastructure and the ongoing challenges related to skilled labor availability for installation and maintenance. Nevertheless, the strategic importance of Belgium as a European data hub, coupled with continued investments in digital infrastructure, ensures a stable demand for data center racks, with a particular focus on advanced features and robust build quality to support evolving technological demands.

This comprehensive report offers a detailed examination of the Belgium data center rack market, providing critical insights into its structure, growth drivers, key segments, and future trajectory. With the base year set at 2025 and a forecast period extending to 2033, this analysis leverages historical data from 2019-2024 and estimated figures for 2025 to deliver actionable intelligence for industry stakeholders. The report delves into market dynamics, technological advancements, and competitive landscapes, making it an essential resource for anyone involved in data center infrastructure, colocation services, and IT hardware deployment in Belgium.

Belgium Data Center Rack Market Market Structure & Competitive Dynamics

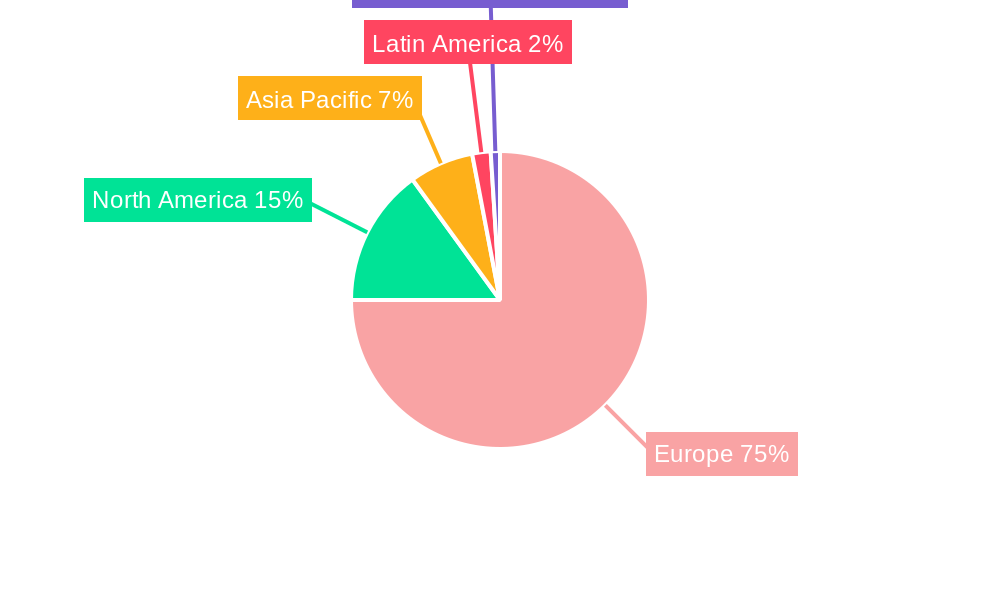

The Belgium data center rack market exhibits a moderately concentrated structure, with key players vying for market share through innovation and strategic partnerships. The presence of established global giants alongside agile local providers fosters a dynamic competitive environment. Innovation ecosystems are flourishing, driven by the increasing demand for high-density computing and advanced cooling solutions. Regulatory frameworks in Belgium, particularly concerning data privacy and environmental sustainability, are shaping market development and influencing investment decisions. While product substitutes exist in broader IT infrastructure solutions, the specialized nature of data center racks ensures a dedicated market. End-user trends are increasingly leaning towards scalable and energy-efficient rack solutions, with significant adoption across sectors. Merger and acquisition activities are anticipated to play a crucial role in market consolidation and expansion. For instance, the January 2022 acquisition of DC Star by Datacenter United, facilitated by an investment from TINC, underscores the M&A landscape's potential, with a deal value of xx Million. Anticipated market share for key players will be detailed in the full report.

Belgium Data Center Rack Market Industry Trends & Insights

The Belgium data center rack market is poised for substantial growth, driven by a confluence of technological advancements and escalating demand for digital services. The continuous rise in data generation, fueled by the proliferation of IoT devices, AI-driven applications, and cloud computing adoption, necessitates robust and scalable data center infrastructure. This directly translates into an increased demand for high-quality, efficient data center racks. Technological disruptions, such as the increasing adoption of liquid cooling solutions and the growing popularity of open compute project (OCP) designs, are reshaping rack manufacturing and deployment strategies. These innovations aim to enhance power efficiency, reduce operational costs, and improve thermal management. Consumer preferences are shifting towards customizable and modular rack solutions that can adapt to evolving IT needs and future expansion plans. The CAGR for the Belgium data center rack market is projected to be xx%, reflecting a strong upward trend. Market penetration of advanced rack technologies is expected to accelerate, especially in the full rack segment, catering to hyperscale and enterprise data centers. The competitive dynamics are characterized by a focus on product differentiation, supply chain reliability, and offering end-to-end solutions that encompass not just racks but also power distribution units (PDUs), cooling systems, and management software. The emphasis on sustainability and energy efficiency is also becoming a paramount factor, with data center operators actively seeking racks that contribute to lower PUE (Power Usage Effectiveness) ratios. The market penetration of specialized racks, such as those designed for high-density compute, is expected to witness significant growth.

Dominant Markets & Segments in Belgium Data Center Rack Market

Within the Belgium data center rack market, the Full Rack segment is projected to be the dominant force, driven by the increasing need for high-density computing power and scalable infrastructure for large-scale data center deployments. This dominance is underpinned by substantial investments in new data center builds and expansions by major cloud providers and enterprise organizations. Economic policies favoring digital infrastructure development and government initiatives promoting technological adoption further bolster this segment.

Rack Size Dominance:

- Full Rack: This segment is expected to lead due to the growing demand for housing extensive server infrastructure, networking equipment, and storage solutions in hyperscale and enterprise data centers. Key drivers include the expansion of cloud services, the need for high-performance computing, and the consolidation of IT resources.

- Half Rack: While not as dominant as Full Racks, Half Racks will continue to serve small to medium-sized businesses and niche applications requiring contained and manageable rack footprints.

- Quarter Rack: Quarter Racks will find application in edge computing deployments and smaller enterprise environments where space and power are at a premium.

End-User Dominance:

- IT & Telecommunication: This sector consistently emerges as the largest consumer of data center racks, propelled by the relentless expansion of network infrastructure, the growth of cloud services, and the demand for telecommunications data processing. Belgium's position as a major European connectivity hub further solidifies this dominance.

- BFSI (Banking, Financial Services, and Insurance): The BFSI sector is a significant end-user, driven by the critical need for secure, reliable, and high-performance data processing for financial transactions, regulatory compliance, and customer data management. Investments in digital transformation and fintech solutions are key growth catalysts.

- Government: Government agencies require robust and secure data center solutions for public services, defense, and administrative functions. Initiatives focused on digital governance and smart city projects contribute to sustained demand.

- Media & Entertainment: With the surge in digital content creation, streaming, and data analytics for audience engagement, this sector is a growing end-user, demanding flexible and scalable data center rack solutions.

- Other End-Users: This category encompasses diverse industries such as healthcare, manufacturing, and research, all of which are increasingly reliant on data center infrastructure for their operations and innovation.

The dominance of these segments is further influenced by Belgium's strategic geographical location, its advanced digital infrastructure, and a conducive business environment that attracts significant foreign investment in data center development.

Belgium Data Center Rack Market Product Innovations

Product innovations in the Belgium data center rack market are focused on enhancing thermal management, power efficiency, and modularity. Advancements include integrated liquid cooling solutions for high-density computing, intelligent rack management systems for real-time monitoring, and customizable configurations to meet specific client needs. Competitive advantages are being gained by manufacturers offering solutions that reduce PUE, simplify deployment, and provide greater scalability. The growing adoption of OCP-inspired designs, such as Eaton Corporation's Open Rack v3 (ORV3) compatible solution, signifies a move towards standardization and interoperability, fostering a more agile and cost-effective data center ecosystem.

Report Segmentation & Scope

The Belgium data center rack market is meticulously segmented to provide a granular understanding of its landscape. This segmentation is based on Rack Size and End-User industries, allowing for targeted analysis of growth prospects and market dynamics.

- Rack Size: The market is analyzed across Quarter Rack, Half Rack, and Full Rack categories, each catering to distinct deployment needs and scales. Growth projections and market sizes for each of these will be detailed, highlighting their unique competitive dynamics and adoption rates.

- End-User: Key end-user segments include IT & Telecommunication, BFSI, Government, and Media & Entertainment, alongside a broader Other End-Users category. The report will delineate the market size, growth trajectory, and specific demands of each end-user vertical, providing insights into their current and future requirements for data center racks.

Key Drivers of Belgium Data Center Rack Market Growth

The Belgium data center rack market is experiencing robust growth driven by several key factors. The escalating demand for cloud computing services and the increasing volume of data generated by businesses and consumers are primary accelerators. Belgium's strategic position as a major European data hub, coupled with government initiatives promoting digital transformation and smart city development, further stimulates investment in data center infrastructure. Technological advancements, such as the adoption of AI, IoT, and 5G, necessitate more powerful and efficient data processing capabilities, thereby increasing the demand for advanced data center racks. Furthermore, the growing emphasis on energy efficiency and sustainability is pushing manufacturers to develop and deploy eco-friendly rack solutions.

Challenges in the Belgium Data Center Rack Market Sector

Despite the positive growth trajectory, the Belgium data center rack market faces several challenges. Regulatory hurdles related to data privacy and environmental compliance can sometimes slow down deployment and increase operational costs. Supply chain disruptions and raw material price volatility can impact manufacturing timelines and cost-effectiveness. Intense competition among established players and emerging vendors also puts pressure on profit margins, demanding continuous innovation and efficient operational strategies. The significant capital investment required for building and upgrading data center facilities can also be a barrier for smaller enterprises looking to expand their IT infrastructure.

Leading Players in the Belgium Data Center Rack Market Market

- Hewlett Packard Enterprise

- nVent Electric PLC

- Schneider Electric SE

- Dell Inc

- Black Box Corporation

- Rittal GMBH & Co KG

- Norden Communication

- Vertic Group Corp

- Eaton Corporation

Key Developments in Belgium Data Center Rack Market Sector

- January 2022: Belgian infrastructure investment firm TINC invested in local data center firm Datacenter United to fund its acquisition of DC Star. Datacenter United increased the number of data centers it managed to six. In addition to the three existing locations in Antwerp and Brussels, the three DC Star data centers in Burcht, Ghent, and Oostkamp are now also part of the Datacenter United ecosystem.

- October 2022: Eaton Corporation announced the launch of an Open Rack v3 (ORV3) compatible solution by the Open Compute Project (OCP). It was purpose-built and pre-configured, focused on providing critical power in an efficient and scalable manner for data centers wishing to deploy ORV3 racks.

Strategic Belgium Data Center Rack Market Market Outlook

- January 2022: Belgian infrastructure investment firm TINC invested in local data center firm Datacenter United to fund its acquisition of DC Star. Datacenter United increased the number of data centers it managed to six. In addition to the three existing locations in Antwerp and Brussels, the three DC Star data centers in Burcht, Ghent, and Oostkamp are now also part of the Datacenter United ecosystem.

- October 2022: Eaton Corporation announced the launch of an Open Rack v3 (ORV3) compatible solution by the Open Compute Project (OCP). It was purpose-built and pre-configured, focused on providing critical power in an efficient and scalable manner for data centers wishing to deploy ORV3 racks.

Strategic Belgium Data Center Rack Market Market Outlook

The strategic outlook for the Belgium data center rack market remains highly positive, fueled by ongoing digital transformation initiatives and Belgium's established role as a crucial data hub in Europe. The market is expected to witness continued growth driven by investments in hyperscale data centers, enterprise IT modernization, and edge computing deployments. The increasing adoption of sustainable and energy-efficient rack solutions will present significant opportunities for manufacturers. Furthermore, strategic collaborations and partnerships among equipment providers, colocation facilities, and end-users will be instrumental in shaping the future landscape, ensuring that the market remains innovative, competitive, and capable of meeting the evolving demands of the digital economy.

Belgium Data Center Rack Market Segmentation

-

1. Rack Size

- 1.1. Quarter Rack

- 1.2. Half Rack

- 1.3. Full Rack

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Belgium Data Center Rack Market Segmentation By Geography

- 1. Belgium

Belgium Data Center Rack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid adoption of Cloud Services in the country; Significant growth in Data generation

- 3.3. Market Restrains

- 3.3.1. Increasing number of Data Security Breaches; Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication sector accounted for majority market share in 2022.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 5.1.1. Quarter Rack

- 5.1.2. Half Rack

- 5.1.3. Full Rack

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hewlett Packard Enterprise

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 nVent Electric PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schneider Electric SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Black Box Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rittal GMBH & Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Norden Communication

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vertic Group Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eaton Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hewlett Packard Enterprise

List of Figures

- Figure 1: Belgium Data Center Rack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Belgium Data Center Rack Market Share (%) by Company 2024

List of Tables

- Table 1: Belgium Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Belgium Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 3: Belgium Data Center Rack Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Belgium Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Belgium Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Belgium Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 7: Belgium Data Center Rack Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Belgium Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Data Center Rack Market?

The projected CAGR is approximately 0.90%.

2. Which companies are prominent players in the Belgium Data Center Rack Market?

Key companies in the market include Hewlett Packard Enterprise, nVent Electric PLC, Schneider Electric SE, Dell Inc, Black Box Corporation, Rittal GMBH & Co KG, Norden Communication, Vertic Group Corp, Eaton Corporation.

3. What are the main segments of the Belgium Data Center Rack Market?

The market segments include Rack Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid adoption of Cloud Services in the country; Significant growth in Data generation.

6. What are the notable trends driving market growth?

IT & Telecommunication sector accounted for majority market share in 2022..

7. Are there any restraints impacting market growth?

Increasing number of Data Security Breaches; Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

January 2022: Belgian infrastructure investment firm TINC invested in local data center firm Datacenter United to fund its acquisition of DC Star. Datacenter United increased the number of data centers it managed to six. In addition to the three existing locations in Antwerp and Brussels, the three DC Star data centers in Burcht, Ghent, and Oostkamp are now also part of the Datacenter United ecosystem.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Data Center Rack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Data Center Rack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Data Center Rack Market?

To stay informed about further developments, trends, and reports in the Belgium Data Center Rack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence