Key Insights

The Automatic Identification System (AIS) market is experiencing robust growth, projected to reach \$384.51 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.85% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for enhanced maritime safety and security is a primary driver, pushing for wider AIS adoption across various vessel types and applications. Furthermore, the growing need for efficient fleet management, particularly within the shipping and logistics sectors, fuels the demand for real-time vessel tracking and monitoring capabilities provided by AIS technology. Stringent regulatory requirements mandating AIS installations on commercial vessels further contribute to market growth. Technological advancements, such as the integration of AIS with other technologies like IoT and satellite communication, are also expanding the capabilities and applications of AIS, enhancing its appeal to various stakeholders. The market segmentation reveals a balanced distribution across application areas, with fleet management, vessel tracking, and maritime security leading the way. Vessel-based platforms currently dominate the market, but onshore platforms are experiencing growth as data analytics and remote monitoring gain traction. Key players in the market, including Wärtsilä, Kongsberg Gruppen, and Garmin, are actively engaged in product innovation and strategic partnerships to strengthen their market positions.

AIS Industry Market Size (In Million)

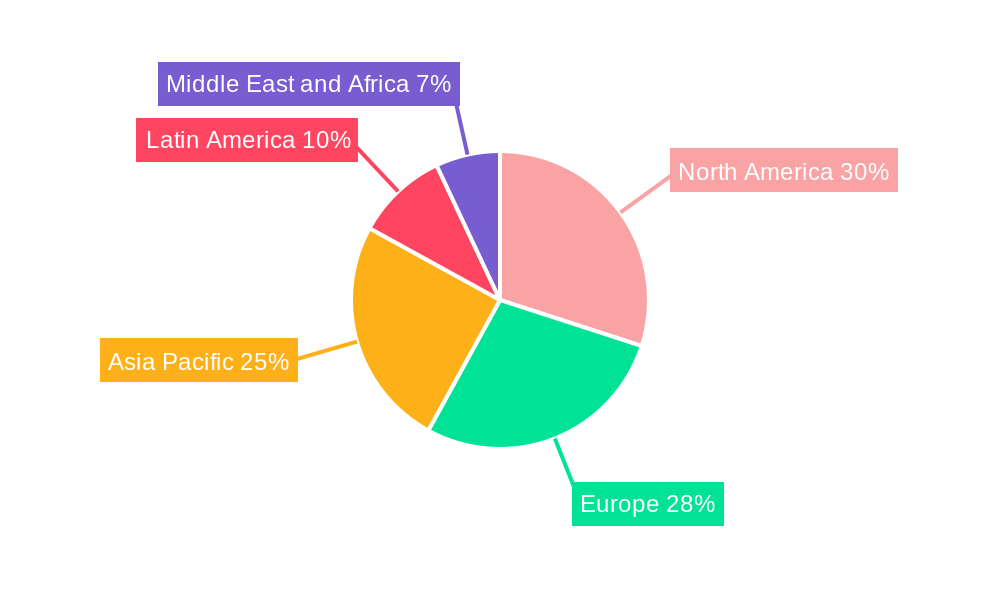

The geographical distribution of the AIS market shows considerable diversity, although precise regional breakdowns are not available. However, based on the established dominance of maritime trade in regions like North America, Europe, and Asia Pacific, it's reasonable to expect a significant market presence across these areas. Developing economies in Asia Pacific and the Middle East and Africa are also likely experiencing growing adoption, driven by infrastructure development and expanding maritime trade. The competitive landscape, though relatively fragmented, involves a mix of established players and emerging technology providers. Continued innovation in areas like data analytics, satellite communication integration, and the development of cost-effective solutions will shape the future of the AIS market. The long-term forecast suggests sustainable growth, driven by persistent demand for improved maritime safety, operational efficiency, and regulatory compliance.

AIS Industry Company Market Share

Comprehensive Report: AIS Industry Market Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the Automatic Identification System (AIS) industry, projecting a market valued at $XX Million by 2033. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. This report is crucial for understanding market dynamics, competitive landscapes, and future growth opportunities within the AIS sector. It incorporates key industry developments, highlighting challenges and opportunities across diverse segments and applications.

AIS Industry Market Structure & Competitive Dynamics

The AIS industry exhibits a moderately concentrated market structure, with several major players vying for market share. Key companies include Wärtsilä OYJ Abp, C N S Systems AB, Kongsberg Gruppen ASA, ComNav Marine Ltd, Garmin Ltd, Furuno Electric Co Ltd, Orbcomm Inc, Japan Radio Company Ltd, Saab AB, L3 Technologies Inc, ExactEarth Ltd, and True Heading AB. However, the market also accommodates numerous smaller, specialized firms. Innovation ecosystems are dynamic, driven by advancements in satellite technology, data analytics, and AI-powered solutions. Regulatory frameworks, particularly concerning data privacy and maritime security, heavily influence market operations. Product substitution is limited, with AIS remaining the primary technology for vessel tracking and management. End-user trends indicate a growing preference for integrated solutions offering enhanced functionalities and data insights. M&A activity has been moderate, with deal values averaging $XX Million annually in recent years, primarily driven by strategic acquisitions aimed at expanding technological capabilities and market reach. Market share data for leading companies is as follows: Wärtsilä OYJ Abp (xx%), Kongsberg Gruppen ASA (xx%), Garmin Ltd (xx%), with others accounting for the remaining share.

AIS Industry Industry Trends & Insights

The global AIS industry is experiencing robust growth, driven by increasing demand for enhanced maritime safety, security, and efficiency. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Key growth drivers include the rising adoption of AIS technology in various applications like fleet management, vessel tracking, and maritime security. Technological disruptions, such as the integration of IoT (Internet of Things) and AI capabilities into AIS systems, are further accelerating market expansion. Consumer preferences are shifting towards integrated platforms that offer comprehensive data analytics and real-time monitoring capabilities. However, competitive pressures necessitate continuous innovation and strategic partnerships to maintain a leading edge. Market penetration remains relatively high in developed economies, but significant growth potential exists in emerging markets, driven by infrastructure development and increasing maritime activities.

Dominant Markets & Segments in AIS Industry

Dominant Regions: The Asia-Pacific region is expected to dominate the AIS market, driven by significant growth in maritime trade and increasing investments in maritime infrastructure. Europe and North America also hold substantial market shares, largely due to stringent maritime regulations and well-established maritime industries.

Dominant Application Segments:

- Fleet Management: This segment dominates due to the operational efficiency and cost savings provided by real-time vessel monitoring and management capabilities.

- Vessel Tracking: This is a key segment driven by the growing need for enhanced maritime security and safety.

- Maritime Security: This segment is experiencing significant growth due to increasing concerns over piracy, smuggling, and illegal activities at sea. Governments and private companies are increasingly investing in AIS-based security solutions.

- Other Applications: Accident investigation and infrastructure protection are growing segments, leveraging AIS data for post-incident analysis and infrastructure monitoring.

Dominant Platform Segments:

- Vessel-Based: Vessel-based AIS remains the dominant segment, due to its inherent role in collision avoidance and vessel tracking.

- On-Shore: The onshore segment is growing rapidly due to advancements in data analytics and the emergence of cloud-based solutions that offer remote monitoring capabilities. Key drivers for this growth include improvements in connectivity and data processing capabilities.

AIS Industry Product Innovations

Recent product innovations focus on integrating AI and machine learning algorithms to enhance data analytics and decision-making capabilities within the AIS systems. Integration with other maritime technologies, such as weather forecasting and route optimization tools, is another major trend. The market is witnessing increased development of compact, cost-effective AIS transponders for smaller vessels, expanding market accessibility. The competitive advantages of newer products are centered on improved accuracy, enhanced data processing speed, and the ability to provide integrated solutions with value-added services.

Report Segmentation & Scope

The report segments the AIS market based on Application (Fleet Management, Vessel Tracking, Maritime Security, Other Applications), and Platform (Vessel-Based, On-Shore). Each segment's growth projection, market size, and competitive dynamics are analyzed. For instance, the Fleet Management segment is expected to experience a CAGR of xx% during the forecast period, driven by the increasing demand for optimized fleet operations. The Vessel-Based platform holds the largest market share but faces competition from growing On-Shore solutions, which offer centralized data management and analysis capabilities.

Key Drivers of AIS Industry Growth

The AIS industry's growth is propelled by several factors: Stringent maritime regulations mandating AIS usage for larger vessels are driving adoption. Advancements in satellite technology and improved data analytics capabilities are enhancing the value proposition of AIS. Increased awareness of maritime security threats is boosting demand for advanced AIS-based security solutions. Finally, cost reductions in AIS equipment are making the technology more accessible to smaller vessels and operators.

Challenges in the AIS Industry Sector

The AIS industry faces challenges including the high initial investment costs for AIS equipment, especially for smaller vessels. Concerns surrounding data security and privacy remain a significant challenge, requiring robust security measures and data protection strategies. Furthermore, the industry is subject to fluctuating fuel prices, which affect the cost of operation and maintenance for vessel-based AIS systems. Finally, competition from alternative vessel tracking technologies, although limited, necessitates continuous innovation and adaptation.

Leading Players in the AIS Industry Market

- Wartsila OYJ Abp

- C N S Systems AB

- Kongsberg Gruppen ASA

- ComNav Marine Ltd

- Garmin Ltd

- Furuno Electric Co Ltd

- Orbcomm Inc

- Japan Radio Company Ltd

- Saab AB

- L3 Technologies Inc

- ExactEarth Ltd

- True Heading AB

Key Developments in AIS Industry Sector

- November 2022: A study highlighted the significant issue of AIS disabling in commercial fisheries, concealing up to 6% of vessel activity and potentially masking illegal fishing practices. This underscores the need for more robust monitoring and enforcement mechanisms.

- May 2022: The QUAD initiative for enhanced marine security, including tracking "dark shipping," signals increased government focus on AIS data for monitoring illegal activities and protecting national interests. This development is expected to significantly boost demand for advanced AIS solutions.

Strategic AIS Industry Market Outlook

The AIS industry is poised for substantial growth, driven by ongoing technological advancements and increasing regulatory scrutiny. Strategic opportunities lie in developing integrated solutions that leverage AI and big data analytics, improving decision-making and operational efficiency. Expansion into emerging markets and the development of cost-effective AIS solutions for smaller vessels will also present significant growth opportunities. Focusing on enhancing data security and addressing privacy concerns will be crucial for maintaining market trust and fostering long-term growth.

AIS Industry Segmentation

-

1. Application

- 1.1. Fleet Management

- 1.2. Vessel Tracking

- 1.3. Maritime Security

- 1.4. Other Ap

-

2. Platform

- 2.1. Vessel-Based

- 2.2. On-Shore

AIS Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

AIS Industry Regional Market Share

Geographic Coverage of AIS Industry

AIS Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Maritime Traffic; Need for Improvement in Vessel Dwell Time and Port Performance

- 3.3. Market Restrains

- 3.3.1 Costs

- 3.3.2 Adaptability Requirements

- 3.3.3 and Power Outages

- 3.4. Market Trends

- 3.4.1. Fleet Management is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global AIS Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Fleet Management

- 5.1.2. Vessel Tracking

- 5.1.3. Maritime Security

- 5.1.4. Other Ap

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Vessel-Based

- 5.2.2. On-Shore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America AIS Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Fleet Management

- 6.1.2. Vessel Tracking

- 6.1.3. Maritime Security

- 6.1.4. Other Ap

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Vessel-Based

- 6.2.2. On-Shore

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe AIS Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Fleet Management

- 7.1.2. Vessel Tracking

- 7.1.3. Maritime Security

- 7.1.4. Other Ap

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Vessel-Based

- 7.2.2. On-Shore

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia AIS Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Fleet Management

- 8.1.2. Vessel Tracking

- 8.1.3. Maritime Security

- 8.1.4. Other Ap

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Vessel-Based

- 8.2.2. On-Shore

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia and New Zealand AIS Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Fleet Management

- 9.1.2. Vessel Tracking

- 9.1.3. Maritime Security

- 9.1.4. Other Ap

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Vessel-Based

- 9.2.2. On-Shore

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America AIS Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Fleet Management

- 10.1.2. Vessel Tracking

- 10.1.3. Maritime Security

- 10.1.4. Other Ap

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Vessel-Based

- 10.2.2. On-Shore

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Middle East and Africa AIS Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Fleet Management

- 11.1.2. Vessel Tracking

- 11.1.3. Maritime Security

- 11.1.4. Other Ap

- 11.2. Market Analysis, Insights and Forecast - by Platform

- 11.2.1. Vessel-Based

- 11.2.2. On-Shore

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Wartsila OYJ Abp

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 C N S Systems AB

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kongsberg Gruppen ASA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 ComNav Marine Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Garmin Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Furuno Electric Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Orbcomm Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Japan Radio Company Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Saab AB

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 L3 Technologies Inc *List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 ExactEarth Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 True Heading AB

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Wartsila OYJ Abp

List of Figures

- Figure 1: Global AIS Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America AIS Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America AIS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America AIS Industry Revenue (Million), by Platform 2025 & 2033

- Figure 5: North America AIS Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 6: North America AIS Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America AIS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe AIS Industry Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe AIS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe AIS Industry Revenue (Million), by Platform 2025 & 2033

- Figure 11: Europe AIS Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Europe AIS Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe AIS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia AIS Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia AIS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia AIS Industry Revenue (Million), by Platform 2025 & 2033

- Figure 17: Asia AIS Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 18: Asia AIS Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia AIS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand AIS Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Australia and New Zealand AIS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Australia and New Zealand AIS Industry Revenue (Million), by Platform 2025 & 2033

- Figure 23: Australia and New Zealand AIS Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 24: Australia and New Zealand AIS Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand AIS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America AIS Industry Revenue (Million), by Application 2025 & 2033

- Figure 27: Latin America AIS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Latin America AIS Industry Revenue (Million), by Platform 2025 & 2033

- Figure 29: Latin America AIS Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 30: Latin America AIS Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America AIS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa AIS Industry Revenue (Million), by Application 2025 & 2033

- Figure 33: Middle East and Africa AIS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Middle East and Africa AIS Industry Revenue (Million), by Platform 2025 & 2033

- Figure 35: Middle East and Africa AIS Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 36: Middle East and Africa AIS Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa AIS Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global AIS Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global AIS Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Global AIS Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global AIS Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global AIS Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 6: Global AIS Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global AIS Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global AIS Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 9: Global AIS Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global AIS Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global AIS Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 12: Global AIS Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global AIS Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global AIS Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 15: Global AIS Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global AIS Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global AIS Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 18: Global AIS Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global AIS Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global AIS Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 21: Global AIS Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the AIS Industry?

The projected CAGR is approximately 6.85%.

2. Which companies are prominent players in the AIS Industry?

Key companies in the market include Wartsila OYJ Abp, C N S Systems AB, Kongsberg Gruppen ASA, ComNav Marine Ltd, Garmin Ltd, Furuno Electric Co Ltd, Orbcomm Inc, Japan Radio Company Ltd, Saab AB, L3 Technologies Inc *List Not Exhaustive, ExactEarth Ltd, True Heading AB.

3. What are the main segments of the AIS Industry?

The market segments include Application, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 384.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Maritime Traffic; Need for Improvement in Vessel Dwell Time and Port Performance.

6. What are the notable trends driving market growth?

Fleet Management is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Costs. Adaptability Requirements. and Power Outages.

8. Can you provide examples of recent developments in the market?

November 2022: On November 2, a study published in Science Advances presented the first global dataset on automatic identification system (AIS) disabling in commercial fisheries. The study revealed that AIS disabling, which conceals up to 6% of vessel activity, is a significant issue in the industry. Data about international fishing activity, including illicit, unreported, and unregulated fishing, can be found in the shipboard AIS, developed as a collision avoidance tool. AIS equipment aboard fishing boats may be disabled. However, a recent examination of purposeful disabling incidents in commercial fisheries reveals that while some disabling incidents might be justified, others are cover-ups for unlawful activity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "AIS Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the AIS Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the AIS Industry?

To stay informed about further developments, trends, and reports in the AIS Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence