Key Insights

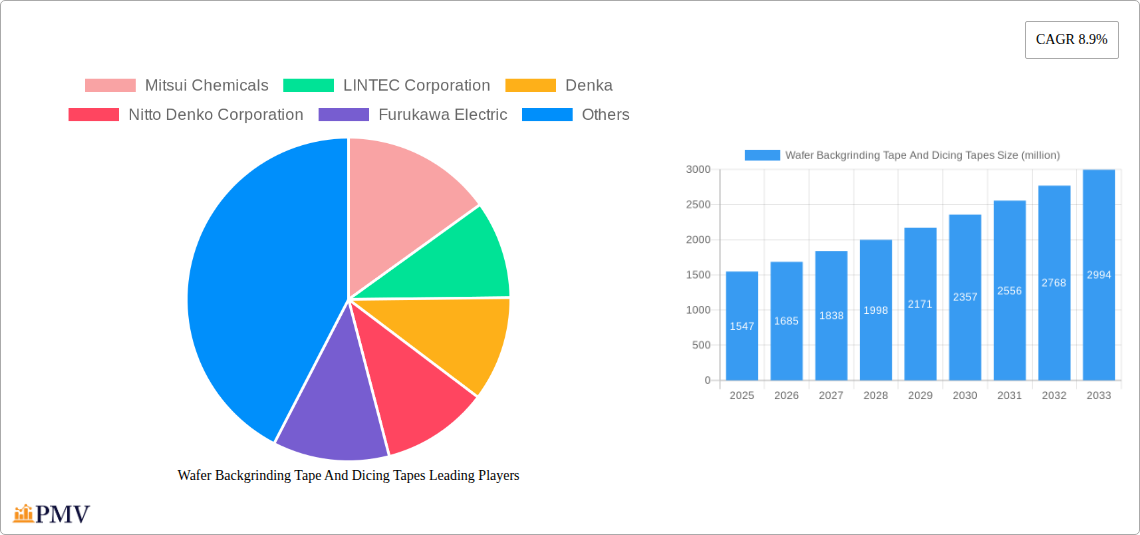

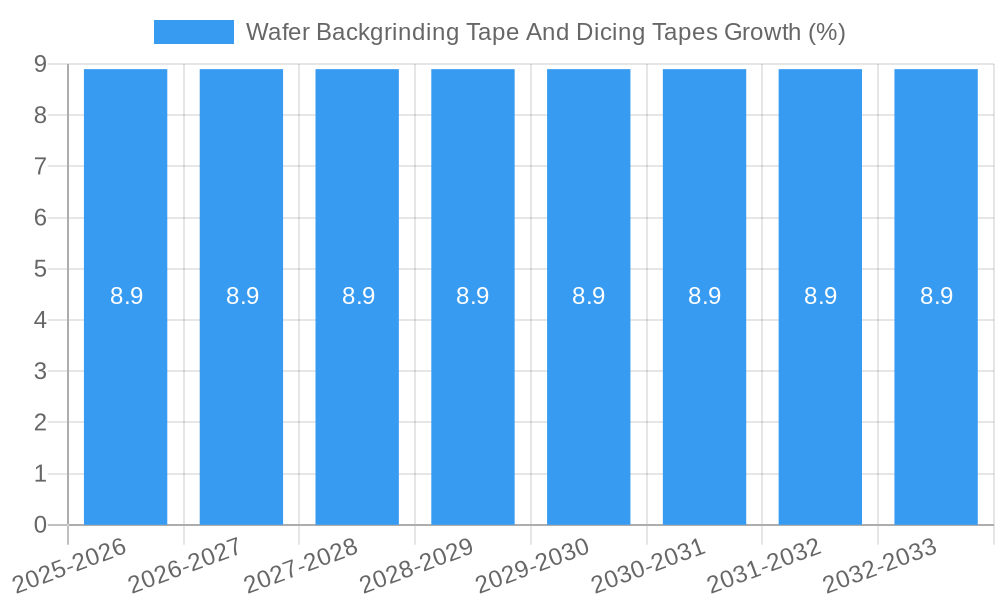

The global Wafer Backgrinding Tape and Dicing Tape market is poised for significant expansion, projected to reach a valuation of approximately $1547 million by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 8.9% anticipated over the forecast period of 2025-2033. A primary driver fueling this upward trajectory is the escalating demand for advanced semiconductor devices across a multitude of industries, including consumer electronics, automotive, telecommunications, and industrial automation. The continuous miniaturization and increasing complexity of integrated circuits necessitate high-performance backgrinding and dicing tapes that ensure precision, wafer integrity, and efficient manufacturing processes. Key applications such as wafer backgrinding, which prepares the wafer for subsequent manufacturing steps, and dicing, which separates individual chips, are critical to semiconductor fabrication. The market's expansion is further stimulated by ongoing technological advancements in tape formulations, offering enhanced adhesion, UV curability for precise bonding and debonding, and improved thermal management capabilities.

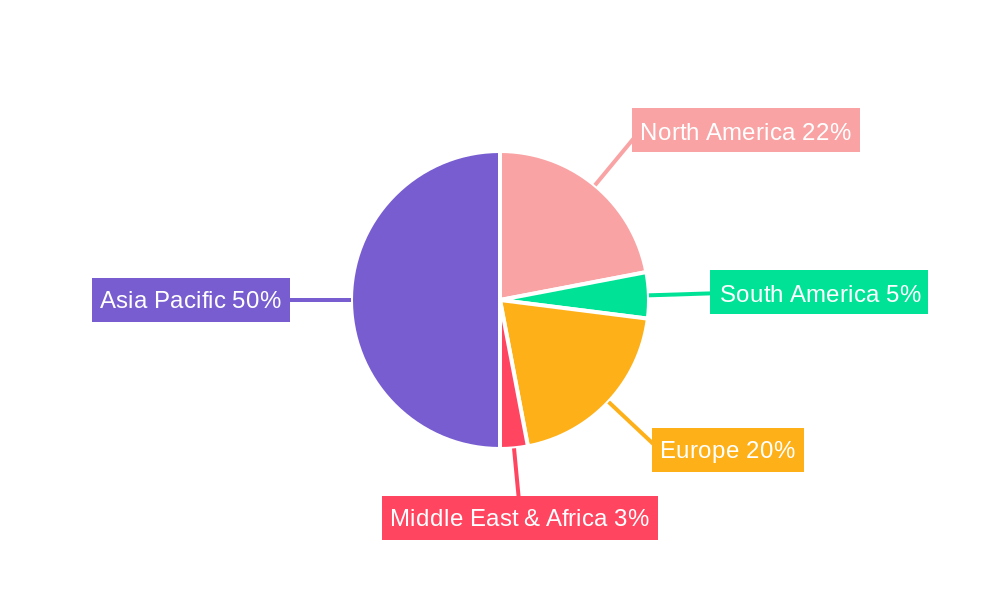

The market is segmented by application, with Back Grinding Tape and Dicing Tape being the primary categories, and by type, encompassing UV Tape and Non-UV Tape. The UV tape segment, in particular, is expected to witness substantial growth due to its superior control over adhesion and debonding, which is crucial for delicate semiconductor wafers. Geographically, the Asia Pacific region is anticipated to dominate the market, driven by the concentration of semiconductor manufacturing hubs in China, Japan, South Korea, and Taiwan, along with growing domestic demand. North America and Europe also represent significant markets, fueled by innovation in advanced electronics and the automotive sector's increasing reliance on sophisticated semiconductors. While the market benefits from strong growth drivers, potential restraints such as fluctuating raw material prices and the emergence of alternative wafer processing techniques could pose challenges. However, the ongoing innovation by leading companies like Mitsui Chemicals, LINTEC Corporation, Denka, and Nitto Denko Corporation in developing next-generation tapes with enhanced functionalities and sustainability will continue to propel market growth.

Here's the detailed SEO-optimized report description for Wafer Backgrinding Tape and Dicing Tapes, designed for immediate use without modification.

This in-depth market research report offers a detailed examination of the global Wafer Backgrinding Tape and Dicing Tapes market, providing critical insights into its structure, competitive landscape, evolving trends, and future trajectory. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025 and a detailed forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to understand market dynamics and capitalize on emerging opportunities. We delve into key segments, regional dominance, technological innovations, growth drivers, and challenges, supported by extensive data and expert analysis.

Wafer Backgrinding Tape And Dicing Tapes Market Structure & Competitive Dynamics

The Wafer Backgrinding Tape and Dicing Tapes market is characterized by a moderate to high level of concentration, with several key players dominating significant portions of the market share. As of 2025, the leading companies, including Mitsui Chemicals, LINTEC Corporation, Denka, and Nitto Denko Corporation, collectively hold an estimated market share exceeding fifty million. The innovation ecosystem is robust, driven by continuous R&D efforts focused on developing advanced materials with improved adhesion, precision, and durability for semiconductor manufacturing processes. Regulatory frameworks, particularly those concerning environmental impact and material safety, are increasingly influencing product development and market entry. Product substitutes, such as alternative wafer thinning techniques, pose a minor threat due to the established performance and cost-effectiveness of specialized tapes. End-user trends, primarily driven by the miniaturization and increased complexity of semiconductor devices, are pushing demand for higher performance tapes. Mergers and acquisitions (M&A) activity, while not rampant, plays a role in market consolidation. Recent M&A deals in the broader semiconductor materials sector have seen valuations in the hundreds of million, indicating the strategic importance of this niche.

- Market Concentration: Dominated by a few key global players.

- Innovation Ecosystem: Driven by advancements in adhesion technology and material science.

- Regulatory Frameworks: Focus on environmental compliance and material safety standards.

- Product Substitutes: Limited impact due to specialized performance requirements.

- End-User Trends: Miniaturization and advanced packaging driving demand for high-performance tapes.

- M&A Activities: Strategic consolidations aimed at expanding product portfolios and market reach.

Wafer Backgrinding Tape And Dicing Tapes Industry Trends & Insights

The Wafer Backgrinding Tape and Dicing Tapes industry is experiencing consistent growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is primarily fueled by the relentless demand for semiconductors across diverse sectors, including consumer electronics, automotive, telecommunications, and artificial intelligence. Technological disruptions are at the forefront, with the development of UV-curable dicing tapes revolutionizing wafer processing by offering precise control over adhesion and debonding, significantly reducing wafer damage. The increasing adoption of advanced packaging technologies, such as 3D ICs and wafer-level packaging, further elevates the need for high-precision backgrinding and dicing tapes. Consumer preferences are increasingly shifting towards thinner and more powerful electronic devices, directly translating into a demand for thinner wafers and, consequently, specialized tapes that can accommodate these processes. Competitive dynamics are intense, with companies vying for market share through product differentiation, technological superiority, and strategic partnerships. The market penetration of advanced UV tapes is steadily increasing, driven by their superior performance in high-volume manufacturing environments, contributing to an estimated market penetration rate of over sixty-five percent for UV tapes by 2033. The historical performance from 2019–2024 demonstrated a steady upward trend, with market revenue growing from approximately five hundred million to eight hundred million.

Dominant Markets & Segments in Wafer Backgrinding Tape And Dicing Tapes

The Back Grinding Tape segment is currently the dominant force within the Wafer Backgrinding Tape and Dicing Tapes market, holding an estimated forty-five percent of the total market share. This dominance is attributed to its fundamental role in semiconductor fabrication, where it protects the wafer surface during the thinning process, crucial for creating thinner and more efficient chips. Regionally, Asia Pacific continues to be the leading market, accounting for an estimated fifty-five percent of global revenue. This leadership is driven by the concentration of semiconductor manufacturing hubs in countries like Taiwan, South Korea, China, and Japan, supported by favorable government policies, substantial infrastructure investments in semiconductor foundries, and a robust ecosystem of electronics manufacturing.

Within the Type segmentation, UV Tape is experiencing rapid growth and is projected to outpace Non-UV Tape in the coming years. By 2033, UV Tapes are expected to capture over sixty-five percent of the market share for dicing applications. The key drivers for UV Tape dominance include:

- Enhanced Precision and Control: UV light enables precise and rapid adhesion and debonding, minimizing wafer damage and improving throughput.

- Reduced Contamination: UV curing and debonding processes often generate fewer byproducts compared to thermal methods, crucial for high-purity semiconductor manufacturing.

- Adaptability to Advanced Processes: UV tapes are essential for complex processes like wafer thinning and dicing for advanced packaging, including 3D stacking and fan-out wafer-level packaging.

- Economic Policies: Government initiatives promoting advanced semiconductor manufacturing and R&D in key Asia Pacific nations directly stimulate demand for these high-performance tapes.

- Infrastructure: Significant investments in state-of-the-art semiconductor fabrication plants (fabs) in the region create a continuous demand for cutting-edge materials.

Wafer Backgrinding Tape And Dicing Tapes Product Innovations

Recent product innovations in the Wafer Backgrinding Tape and Dicing Tapes market are centered around enhancing precision, reducing defects, and improving process efficiency. Manufacturers are developing thinner tapes with superior adhesion control and minimal residue upon removal, crucial for advanced semiconductor nodes. UV-curable tapes continue to be a major focus, offering precise control over adhesion and debonding through light exposure, leading to significantly reduced wafer breakage and contamination. Innovations in material science are leading to tapes with enhanced thermal stability and chemical resistance, crucial for demanding fabrication environments. These advancements provide competitive advantages by enabling higher yields, faster processing speeds, and the production of more complex and reliable semiconductor devices, fitting perfectly with the industry's push towards miniaturization and performance.

Report Segmentation & Scope

This report meticulously segments the Wafer Backgrinding Tape and Dicing Tapes market based on critical parameters to provide granular insights. The primary segmentations include:

- Application:

- Back Grinding Tape: This segment encompasses tapes used to protect the backside of semiconductor wafers during the grinding and thinning processes. Market size is estimated at nine hundred million for 2025, with a projected CAGR of 6.8%.

- Dicing Tape: This segment includes tapes used to hold diced semiconductor chips together on a wafer before they are picked and packaged. Market size is projected at seven hundred million for 2025, with a CAGR of 7.2%.

- Type:

- UV Tape: Tapes that utilize UV light for adhesion and/or debonding. This segment is experiencing rapid growth, with a projected market size of six hundred million in 2025 and a CAGR of 8.1%.

- Non-UV Tape: Traditional dicing tapes that rely on thermal or mechanical methods for adhesion and debonding. The market size for this segment is estimated at five hundred million in 2025, with a CAGR of 5.5%.

Key Drivers of Wafer Backgrinding Tape And Dicing Tapes Growth

The growth of the Wafer Backgrinding Tape and Dicing Tapes market is propelled by several interconnected factors. The insatiable global demand for semiconductors, driven by advancements in AI, 5G, IoT, and electric vehicles, is the primary engine of growth. Technological advancements in semiconductor manufacturing, particularly the trend towards wafer thinning and advanced packaging techniques like 3D integration, necessitate high-performance backgrinding and dicing tapes. Furthermore, the increasing complexity and smaller feature sizes of integrated circuits demand greater precision and reliability in every step of the fabrication process, directly benefiting the adoption of advanced tape solutions. Economic policies promoting domestic semiconductor production and R&D in key regions also contribute significantly to market expansion.

Challenges in the Wafer Backgrinding Tape And Dicing Tapes Sector

Despite robust growth, the Wafer Backgrinding Tape and Dicing Tapes sector faces several challenges. Intense price competition among manufacturers can squeeze profit margins, particularly for standard tape types. Evolving environmental regulations concerning material composition and disposal can necessitate costly product redesigns and manufacturing process adjustments. Supply chain disruptions, as witnessed in recent years, can impact the availability of raw materials and finished goods, leading to production delays and increased costs. The high cost of R&D for developing next-generation tapes with enhanced properties can also be a barrier to entry for smaller players. Furthermore, the stringent quality control requirements in the semiconductor industry mean that any deviation in tape performance can have significant financial repercussions for fabs, demanding unwavering consistency.

Leading Players in the Wafer Backgrinding Tape And Dicing Tapes Market

- Mitsui Chemicals

- LINTEC Corporation

- Denka

- Nitto Denko Corporation

- Furukawa Electric

- Sekisui Chemical

- Maxell Sliontec

- Resonac Corporation

- Sumitomo Bakelite Company

- D&X Co., Ltd

- KGK Chemical Corporation

- AI Technology, Inc. (AIT)

- Ultron System

- Daehyun ST

- Solar Plus Company

- Alliance Material Co., Ltd (AMC)

- 3M

- Shanghai Guke Adhesive Tape Technology

- Plusco Tech

- Taicang Zhanxin Adhesive Material

- Cybrid Technologies

- ZZSM

- BYE POLYMER MATERIAL

- ZHONGSHAN CROWN ADHESIVE PRODUCTS

- Yantai Darbond Technology

- Sunliky New Material Technology

- GTA Material

Key Developments in Wafer Backgrinding Tape And Dicing Tapes Sector

- 2023 Q3: Nitto Denko Corporation launched a new generation of UV-curable dicing tapes offering enhanced adhesion control for advanced wafer-level packaging.

- 2023 Q4: LINTEC Corporation announced a strategic partnership with a leading foundry to co-develop specialized backgrinding tapes for next-generation chip architectures.

- 2024 Q1: Denka introduced a new line of dicing tapes with improved thermal stability, designed for high-temperature semiconductor processing.

- 2024 Q2: Mitsui Chemicals expanded its production capacity for high-performance backgrinding tapes to meet the surging demand from the automotive semiconductor sector.

- 2024 Q3: Resonac Corporation acquired a smaller specialty adhesive tape manufacturer to broaden its product portfolio in dicing tape applications.

Strategic Wafer Backgrinding Tape And Dicing Tapes Market Outlook

- 2023 Q3: Nitto Denko Corporation launched a new generation of UV-curable dicing tapes offering enhanced adhesion control for advanced wafer-level packaging.

- 2023 Q4: LINTEC Corporation announced a strategic partnership with a leading foundry to co-develop specialized backgrinding tapes for next-generation chip architectures.

- 2024 Q1: Denka introduced a new line of dicing tapes with improved thermal stability, designed for high-temperature semiconductor processing.

- 2024 Q2: Mitsui Chemicals expanded its production capacity for high-performance backgrinding tapes to meet the surging demand from the automotive semiconductor sector.

- 2024 Q3: Resonac Corporation acquired a smaller specialty adhesive tape manufacturer to broaden its product portfolio in dicing tape applications.

Strategic Wafer Backgrinding Tape And Dicing Tapes Market Outlook

The strategic outlook for the Wafer Backgrinding Tape and Dicing Tapes market remains exceptionally strong, driven by persistent innovation and the ever-increasing demand for advanced semiconductor solutions. Growth accelerators include the continued expansion of AI and machine learning, the rollout of 5G infrastructure, and the burgeoning automotive electronics market, all of which rely heavily on sophisticated semiconductor components. The increasing adoption of wafer-level packaging and advanced 3D integration technologies will further propel the demand for high-precision dicing and backgrinding tapes. Companies that invest in R&D for next-generation materials, focus on sustainable manufacturing practices, and forge strong collaborative relationships with semiconductor manufacturers are poised for significant success. Strategic opportunities lie in developing tapes with superior performance characteristics, such as ultra-low particle generation and precise debonding for fragile substrates, thereby capturing market share in high-value segments. The market is expected to continue its upward trajectory, with revenue projected to exceed two billion by 2033.

Wafer Backgrinding Tape And Dicing Tapes Segmentation

-

1. Application

- 1.1. Back Grinding Tape

- 1.2. Dicing Tape

-

2. Type

- 2.1. UV Tape

- 2.2. Non-UV Tape

Wafer Backgrinding Tape And Dicing Tapes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Wafer Backgrinding Tape And Dicing Tapes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wafer Backgrinding Tape And Dicing Tapes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Back Grinding Tape

- 5.1.2. Dicing Tape

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. UV Tape

- 5.2.2. Non-UV Tape

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Wafer Backgrinding Tape And Dicing Tapes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Back Grinding Tape

- 6.1.2. Dicing Tape

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. UV Tape

- 6.2.2. Non-UV Tape

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Wafer Backgrinding Tape And Dicing Tapes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Back Grinding Tape

- 7.1.2. Dicing Tape

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. UV Tape

- 7.2.2. Non-UV Tape

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Wafer Backgrinding Tape And Dicing Tapes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Back Grinding Tape

- 8.1.2. Dicing Tape

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. UV Tape

- 8.2.2. Non-UV Tape

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Wafer Backgrinding Tape And Dicing Tapes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Back Grinding Tape

- 9.1.2. Dicing Tape

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. UV Tape

- 9.2.2. Non-UV Tape

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Wafer Backgrinding Tape And Dicing Tapes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Back Grinding Tape

- 10.1.2. Dicing Tape

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. UV Tape

- 10.2.2. Non-UV Tape

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mitsui Chemicals

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LINTEC Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Denka

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nitto Denko Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Furukawa Electric

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sekisui Chemical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Maxell Sliontec

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Resonac Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sumitomo Bakelite Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 D&X Co. Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KGK Chemical Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AI Technology Inc. (AIT)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ultron System

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Daehyun ST

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Solar Plus Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Alliance Material Co. Ltd (AMC)

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 3M

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Shanghai Guke Adhesive Tape Technology

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Plusco Tech

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Taicang Zhanxin Adhesive Material

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Cybrid Technologies

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 ZZSM

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 BYE POLYMER MATERIAL

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 ZHONGSHAN CROWN ADHESIVE PRODUCTS

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Yantai Darbond Technology

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Sunliky New Material Technology

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 GTA Material

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.1 Mitsui Chemicals

List of Figures

- Figure 1: Global Wafer Backgrinding Tape And Dicing Tapes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Application 2024 & 2032

- Figure 3: North America Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Type 2024 & 2032

- Figure 5: North America Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Country 2024 & 2032

- Figure 7: North America Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Application 2024 & 2032

- Figure 9: South America Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Type 2024 & 2032

- Figure 11: South America Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Country 2024 & 2032

- Figure 13: South America Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Wafer Backgrinding Tape And Dicing Tapes Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Wafer Backgrinding Tape And Dicing Tapes Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Wafer Backgrinding Tape And Dicing Tapes Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Wafer Backgrinding Tape And Dicing Tapes Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wafer Backgrinding Tape And Dicing Tapes?

The projected CAGR is approximately 8.9%.

2. Which companies are prominent players in the Wafer Backgrinding Tape And Dicing Tapes?

Key companies in the market include Mitsui Chemicals, LINTEC Corporation, Denka, Nitto Denko Corporation, Furukawa Electric, Sekisui Chemical, Maxell Sliontec, Resonac Corporation, Sumitomo Bakelite Company, D&X Co., Ltd, KGK Chemical Corporation, AI Technology, Inc. (AIT), Ultron System, Daehyun ST, Solar Plus Company, Alliance Material Co., Ltd (AMC), 3M, Shanghai Guke Adhesive Tape Technology, Plusco Tech, Taicang Zhanxin Adhesive Material, Cybrid Technologies, ZZSM, BYE POLYMER MATERIAL, ZHONGSHAN CROWN ADHESIVE PRODUCTS, Yantai Darbond Technology, Sunliky New Material Technology, GTA Material.

3. What are the main segments of the Wafer Backgrinding Tape And Dicing Tapes?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1547 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wafer Backgrinding Tape And Dicing Tapes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wafer Backgrinding Tape And Dicing Tapes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wafer Backgrinding Tape And Dicing Tapes?

To stay informed about further developments, trends, and reports in the Wafer Backgrinding Tape And Dicing Tapes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence