Key Insights

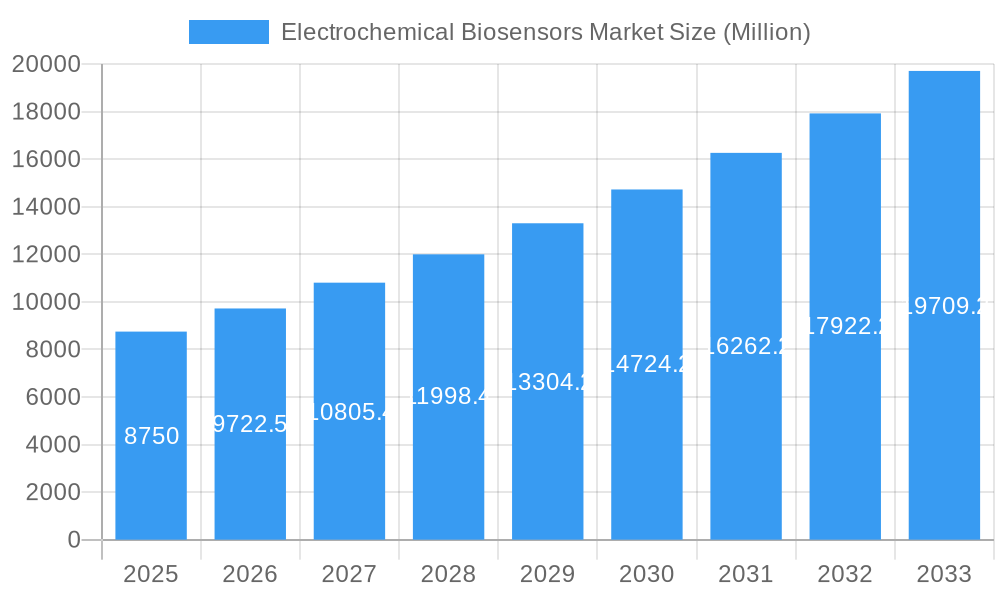

The Electrochemical Biosensors Market is poised for significant expansion, driven by its critical role in health monitoring, environmental analysis, and industrial process control. With a substantial market size projected at approximately $8,750 million, the sector is set to grow at a robust CAGR of 11.20% from 2025 to 2033. This rapid growth is underpinned by increasing demand for early disease detection, personalized medicine, and advanced diagnostic tools, particularly in the healthcare sector. The integration of electrochemical biosensors into wearable devices and point-of-care diagnostics further fuels this momentum, making them indispensable for continuous health tracking and rapid medical assessments. Additionally, stringent environmental regulations and the need for effective pollution monitoring are creating substantial opportunities in the environmental science and industrial sectors, necessitating accurate and reliable sensing solutions.

Electrochemical Biosensors Market Market Size (In Billion)

The market's dynamism is further shaped by key technological advancements and evolving end-user industry needs. Potentiometric and amperometric sensors, valued for their sensitivity and specificity, are leading the charge in diverse applications across the Oil & Gas, Chemical & Petrochemicals, Medical, Automotive, and Food & Beverage industries. Emerging trends include miniaturization, enhanced multiplexing capabilities for detecting multiple analytes simultaneously, and the development of disposable biosensors for cost-effectiveness and convenience. While the market presents a promising outlook, potential restraints such as high initial development costs for novel biosensor technologies, regulatory hurdles for medical applications, and the need for skilled personnel for operation and maintenance, could pose challenges. However, the relentless pursuit of innovation and the expanding application landscape are expected to outweigh these limitations, ensuring sustained growth and widespread adoption of electrochemical biosensors globally.

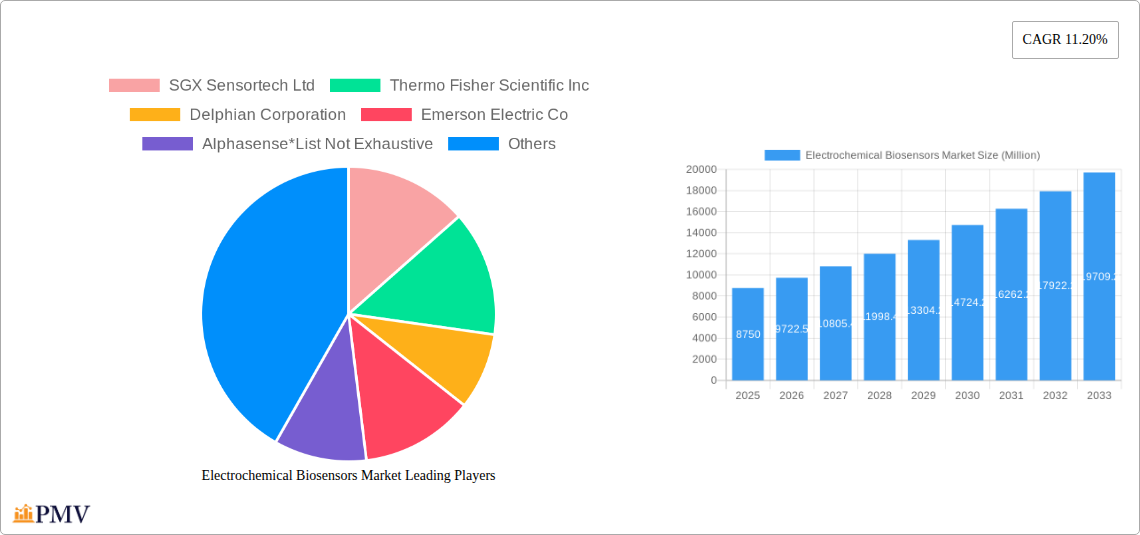

Electrochemical Biosensors Market Company Market Share

This in-depth market research report offers a detailed examination of the global Electrochemical Biosensors Market, providing critical insights into its structure, competitive landscape, burgeoning trends, dominant segments, and future outlook. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand the evolving dynamics of electrochemical sensor technology and its diverse applications. We delve into amperometric sensors, potentiometric sensors, and conductometric sensors across key end-user industries such as Medical, Oil and Gas, Chemical and Petrochemicals, Food & Beverage, and Automotive.

Electrochemical Biosensors Market Market Structure & Competitive Dynamics

The Electrochemical Biosensors Market is characterized by a moderate to high level of market concentration, with key players like SGX Sensortech Ltd, Thermo Fisher Scientific Inc, Delphian Corporation, Emerson Electric Co, and Alphasense leading innovation and market penetration. The ecosystem is driven by continuous research and development in biosensor technology, particularly in enhancing sensitivity, selectivity, and miniaturization. Regulatory frameworks, though evolving, play a significant role, especially in the medical and food industries, influencing product approvals and market access. Product substitutes exist, primarily in traditional sensing methods, but electrochemical biosensors are gaining traction due to their cost-effectiveness and real-time monitoring capabilities. End-user trends favor point-of-care diagnostics, environmental monitoring, and industrial process control. Merger and acquisition (M&A) activities are observed as companies seek to expand their product portfolios and geographical reach. For instance, significant M&A deals valued in the tens to hundreds of millions are anticipated to consolidate the market and foster technological advancements.

Electrochemical Biosensors Market Industry Trends & Insights

The Electrochemical Biosensors Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15-20% during the forecast period. This expansion is primarily fueled by increasing demand for rapid and accurate diagnostic tools in the healthcare sector, advancements in wearable biosensors for continuous health monitoring, and stringent environmental regulations necessitating effective pollution detection. Technological disruptions, such as the development of novel nanomaterials and microfluidic integration, are significantly enhancing the performance of electrochemical sensors. Consumer preferences are shifting towards user-friendly, portable, and data-rich sensing solutions, driving the adoption of smartphone-integrated biosensors. Competitive dynamics are intensifying, with established players investing heavily in R&D and emerging companies focusing on niche applications and disruptive innovations. Market penetration is steadily increasing across various industries, driven by the cost-effectiveness and superior performance of electrochemical biosensors compared to conventional methods. The market is also witnessing a rise in customized biosensor solutions tailored to specific industry needs.

Dominant Markets & Segments in Electrochemical Biosensors Market

The Medical segment currently dominates the Electrochemical Biosensors Market, driven by the escalating demand for in-vitro diagnostics, point-of-care testing (POCT), and continuous glucose monitoring (CGM) devices. This dominance is further bolstered by favorable reimbursement policies and government initiatives supporting healthcare innovation.

- Medical:

- Key Drivers: Rising prevalence of chronic diseases, an aging global population, increased R&D in biotechnology, and the growing adoption of personalized medicine. The demand for rapid disease detection and management fuels the growth of electrochemical biosensors for conditions like diabetes, cardiovascular diseases, and infectious diseases.

- Oil and Gas:

- Key Drivers: Growing need for efficient monitoring of environmental parameters, process control in exploration and production, and detection of hazardous gases. Amperometric sensors are crucial for detecting H2S, SO2, and other corrosive gases, ensuring operational safety and environmental compliance.

- Chemical and Petrochemicals:

- Key Drivers: Stringent safety regulations, demand for process optimization, and the need for real-time monitoring of chemical reactions and environmental pollutants. Conductometric sensors and potentiometric sensors find applications in quality control and leak detection.

- Food & Beverage:

- Key Drivers: Increasing focus on food safety, quality assurance, and the detection of contaminants and spoilage markers. Electrochemical biosensors are used for detecting pathogens, allergens, and assessing shelf life.

- Automotive:

- Key Drivers: Evolution towards emission control, advanced driver-assistance systems (ADAS), and cabin air quality monitoring. Electrochemical sensors play a role in detecting NOx, CO, and VOCs.

Electrochemical Biosensors Market Product Innovations

Product innovation in the Electrochemical Biosensors Market is primarily focused on miniaturization, improved sensitivity and selectivity, and the development of multiplexed sensing platforms. The integration of nanotechnology, such as graphene and metal nanoparticles, is enhancing the electrochemical properties of biosensors, leading to more accurate and faster detection. Novel applications are emerging in non-invasive diagnostics, wearable health trackers, and advanced environmental monitoring systems. Competitive advantages are derived from patenting novel electrode materials, enzyme immobilization techniques, and signal processing algorithms. The trend towards disposable and low-cost biosensor strips for point-of-care applications is also a significant driver of product development.

Report Segmentation & Scope

The Electrochemical Biosensors Market is segmented by Type and End-user Industry.

- By Type: The report meticulously analyzes Potentiometric Sensors, Amperometric Sensors, and Conductometric Sensors. Each type exhibits distinct growth trajectories and market sizes, influenced by their specific applications and technological advancements. Amperometric sensors are expected to witness substantial growth due to their widespread use in medical diagnostics and environmental monitoring.

- By End-user Industry: This segmentation includes Oil and Gas, Chemical and Petrochemicals, Medical, Automotive, Food & Beverage, and Other End-user Industry. The Medical segment is anticipated to hold the largest market share throughout the forecast period. The report details the market size and projected growth for each of these segments, alongside an analysis of the competitive dynamics within them.

Key Drivers of Electrochemical Biosensors Market Growth

The primary growth drivers for the Electrochemical Biosensors Market are the escalating demand for advanced healthcare diagnostics and monitoring solutions, particularly in managing chronic diseases like diabetes. Technological advancements in nanotechnology and microfluidics are enabling the development of more sensitive, selective, and portable biosensors. Furthermore, stringent environmental regulations and the growing need for industrial process control are propelling the adoption of electrochemical sensors in sectors like oil & gas and chemical manufacturing. The increasing prevalence of point-of-care testing and the development of wearable devices for continuous health tracking are also significant contributors to market expansion.

Challenges in the Electrochemical Biosensors Market Sector

Despite the promising growth, the Electrochemical Biosensors Market faces certain challenges. These include the complex regulatory approval processes for medical devices, particularly for novel diagnostic tools, which can lead to extended time-to-market. Supply chain disruptions for specialized materials and components can impact production and costs. Furthermore, the high initial investment required for research and development, coupled with intense competition, can pose barriers to entry for smaller players. Ensuring the long-term stability and calibration of electrochemical biosensors in diverse environmental conditions also remains a technical hurdle.

Leading Players in the Electrochemical Biosensors Market Market

- SGX Sensortech Ltd

- Thermo Fisher Scientific Inc

- Delphian Corporation

- Emerson Electric Co

- Alphasense

- Ametek Inc

- Figaro USA Inc

- Conductive Technologies Inc

- Dragerwerk AG

- MSA Safety

- Membrapor AG

Key Developments in Electrochemical Biosensors Market Sector

- July 2022: Researchers at the Suzhou Institute of Biomedical Engineering and Technology (SIBET) announced proposing a hand-in-hand structured DNA assembly strategy and developed an electrochemical/fluorescent dual-mode biosensor for circulating tumor DNA based on methylene blue and red-emissive carbon nanodots, showcasing advancements in cancer diagnostics.

- September 2021: Alphasense launched two new electrochemical sensors, the VOC-A4 and VOC-B4, specifically designed to target Volatile Organic Compounds (VOCs). These sensors are ideal companions for amperometric 4-electrode air quality sensors and offer adjustable voltage settings (0V, 0.1V, 0.2V, or 0.3V) for detecting a range of gases, enhancing air quality monitoring capabilities.

Strategic Electrochemical Biosensors Market Market Outlook

The strategic outlook for the Electrochemical Biosensors Market is exceptionally bright, driven by the continuous innovation in sensing technologies and their expanding application spectrum. Future growth will be accelerated by the integration of artificial intelligence (AI) and machine learning (ML) for enhanced data interpretation and predictive diagnostics. The increasing focus on personalized medicine and the growing demand for non-invasive monitoring solutions present significant strategic opportunities. Expansion into emerging economies and the development of affordable, user-friendly biosensor platforms will further drive market penetration. Strategic collaborations between technology providers, healthcare institutions, and regulatory bodies will be crucial for unlocking the full potential of electrochemical biosensors.

Electrochemical Biosensors Market Segmentation

-

1. Type

- 1.1. Potentiometric Sensors

- 1.2. Amperometric Sensors

- 1.3. Conductometric Sensors

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemicals

- 2.3. Medical

- 2.4. Automotive

- 2.5. Food & Beverage

- 2.6. Other End-user Industry

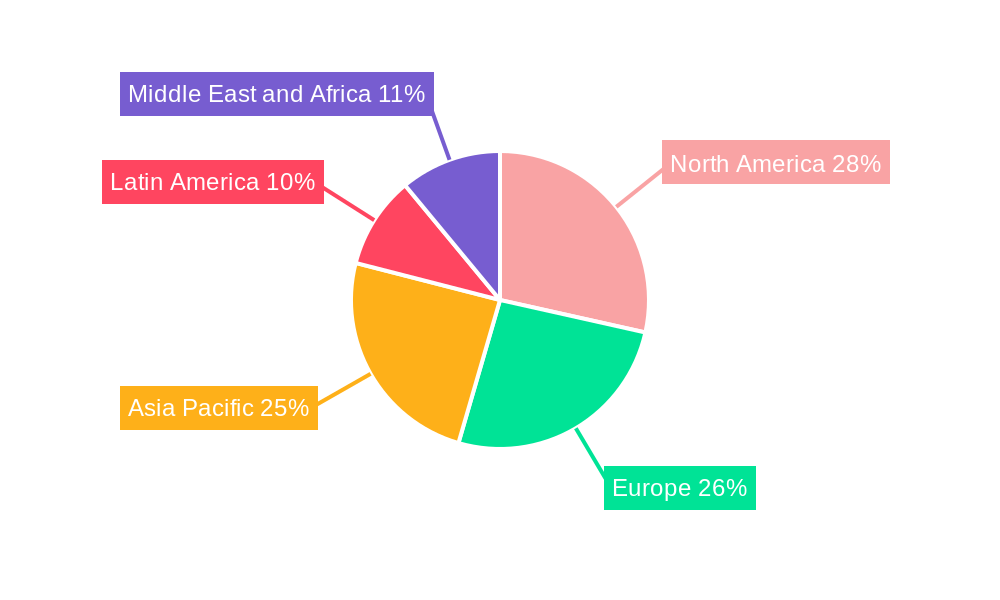

Electrochemical Biosensors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Electrochemical Biosensors Market Regional Market Share

Geographic Coverage of Electrochemical Biosensors Market

Electrochemical Biosensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Nanotechnology-based Sensors; Government Rules and Regulations for Safety in Hazardous Places

- 3.3. Market Restrains

- 3.3.1. Slower Adoption Rates in Small- and Medium-sized Organizations; High Capital Requirements

- 3.4. Market Trends

- 3.4.1. Medical Sector to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Potentiometric Sensors

- 5.1.2. Amperometric Sensors

- 5.1.3. Conductometric Sensors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemicals

- 5.2.3. Medical

- 5.2.4. Automotive

- 5.2.5. Food & Beverage

- 5.2.6. Other End-user Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Potentiometric Sensors

- 6.1.2. Amperometric Sensors

- 6.1.3. Conductometric Sensors

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Chemical and Petrochemicals

- 6.2.3. Medical

- 6.2.4. Automotive

- 6.2.5. Food & Beverage

- 6.2.6. Other End-user Industry

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Potentiometric Sensors

- 7.1.2. Amperometric Sensors

- 7.1.3. Conductometric Sensors

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Chemical and Petrochemicals

- 7.2.3. Medical

- 7.2.4. Automotive

- 7.2.5. Food & Beverage

- 7.2.6. Other End-user Industry

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Potentiometric Sensors

- 8.1.2. Amperometric Sensors

- 8.1.3. Conductometric Sensors

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Chemical and Petrochemicals

- 8.2.3. Medical

- 8.2.4. Automotive

- 8.2.5. Food & Beverage

- 8.2.6. Other End-user Industry

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Potentiometric Sensors

- 9.1.2. Amperometric Sensors

- 9.1.3. Conductometric Sensors

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Chemical and Petrochemicals

- 9.2.3. Medical

- 9.2.4. Automotive

- 9.2.5. Food & Beverage

- 9.2.6. Other End-user Industry

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Potentiometric Sensors

- 10.1.2. Amperometric Sensors

- 10.1.3. Conductometric Sensors

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Chemical and Petrochemicals

- 10.2.3. Medical

- 10.2.4. Automotive

- 10.2.5. Food & Beverage

- 10.2.6. Other End-user Industry

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SGX Sensortech Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thermo Fisher Scientific Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Delphian Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Emerson Electric Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alphasense*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ametek Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Figaro USA Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Conductive Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dragerwerk AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MSA Safety

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Membrapor AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 SGX Sensortech Ltd

List of Figures

- Figure 1: Global Electrochemical Biosensors Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Electrochemical Biosensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Electrochemical Biosensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Electrochemical Biosensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Electrochemical Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Electrochemical Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electrochemical Biosensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Electrochemical Biosensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Electrochemical Biosensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Electrochemical Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Electrochemical Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electrochemical Biosensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Electrochemical Biosensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Electrochemical Biosensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Electrochemical Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Electrochemical Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Electrochemical Biosensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Latin America Electrochemical Biosensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Electrochemical Biosensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Latin America Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Electrochemical Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Electrochemical Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Electrochemical Biosensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Electrochemical Biosensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Electrochemical Biosensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Electrochemical Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Electrochemical Biosensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrochemical Biosensors Market?

The projected CAGR is approximately 9.12%.

2. Which companies are prominent players in the Electrochemical Biosensors Market?

Key companies in the market include SGX Sensortech Ltd, Thermo Fisher Scientific Inc, Delphian Corporation, Emerson Electric Co, Alphasense*List Not Exhaustive, Ametek Inc, Figaro USA Inc, Conductive Technologies Inc, Dragerwerk AG, MSA Safety, Membrapor AG.

3. What are the main segments of the Electrochemical Biosensors Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Nanotechnology-based Sensors; Government Rules and Regulations for Safety in Hazardous Places.

6. What are the notable trends driving market growth?

Medical Sector to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

Slower Adoption Rates in Small- and Medium-sized Organizations; High Capital Requirements.

8. Can you provide examples of recent developments in the market?

July 2022 - Researchers at the Suzhou Institute of Biomedical Engineering and Technology (SIBET) announced proposing a hand-in-hand structured DNA assembly strategy and developed an electrochemical/fluorescent dual-mode biosensor for circulating tumor DNA based on methylene blue and red-emissive carbon nanodots.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrochemical Biosensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrochemical Biosensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrochemical Biosensors Market?

To stay informed about further developments, trends, and reports in the Electrochemical Biosensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence