Key Insights

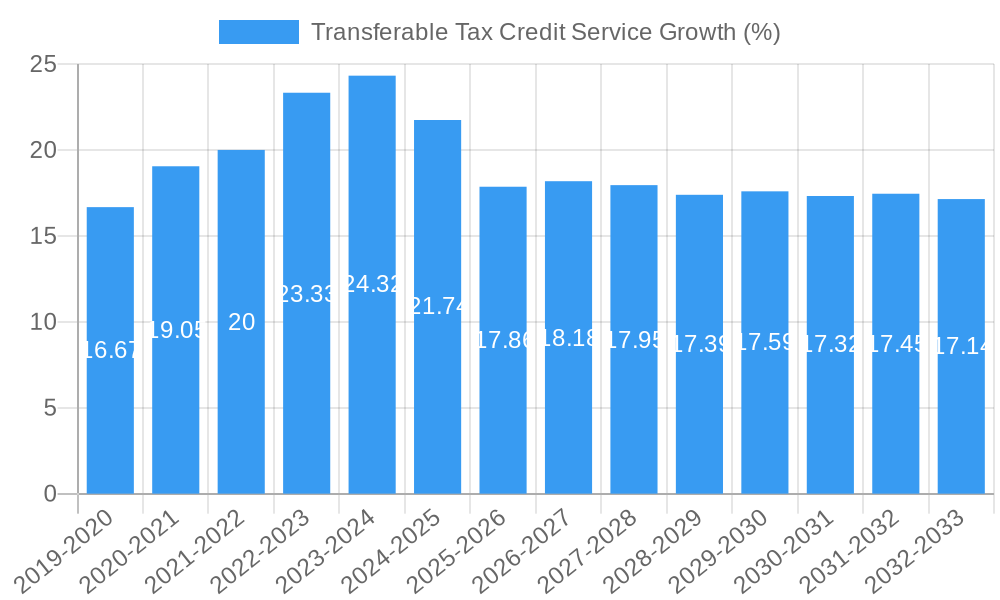

The Transferable Tax Credit Service market is poised for significant expansion, projected to reach an estimated \$5,600 million by 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of approximately 18% through 2033. This rapid growth is primarily fueled by the increasing adoption of renewable energy sources, driving demand for sophisticated tax credit management solutions. Governments worldwide are incentivizing green energy development through tax credits, creating a complex landscape that necessitates specialized services for businesses to effectively leverage these financial benefits. The preservation of historic buildings also contributes to market growth, as tax credits are often utilized to fund restoration projects, further emphasizing the value of transferable tax credit services in facilitating these endeavors. The market is characterized by a strong emphasis on consulting services, where experts guide clients through the intricate process of identifying, acquiring, and monetizing tax credits, alongside transaction services that streamline the actual exchange of these credits.

The market's growth trajectory is further bolstered by supportive government policies and a growing awareness among businesses of the financial advantages offered by transferable tax credits. However, the market faces certain restraints, including the evolving regulatory landscape which can introduce complexities and compliance challenges. Fluctuations in tax credit values and the potential for economic downturns can also impact market dynamics. Despite these challenges, the overarching trend towards sustainability and decarbonization, coupled with innovative financial mechanisms, ensures a bright future for the transferable tax credit service market. Key players are actively investing in technology and expanding their service offerings to cater to the burgeoning demand from diverse sectors, including renewable energy developers, real estate investors, and corporations aiming to offset their tax liabilities while supporting environmental initiatives.

This in-depth report provides a comprehensive analysis of the transferable tax credit service market, offering critical insights into its structure, trends, and future outlook. Covering the study period from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, this report delves into the dynamics shaping this rapidly evolving sector. We provide actionable intelligence for businesses operating within or looking to enter the renewable energy tax credit, historic preservation tax credit, and other burgeoning transferable tax credit areas.

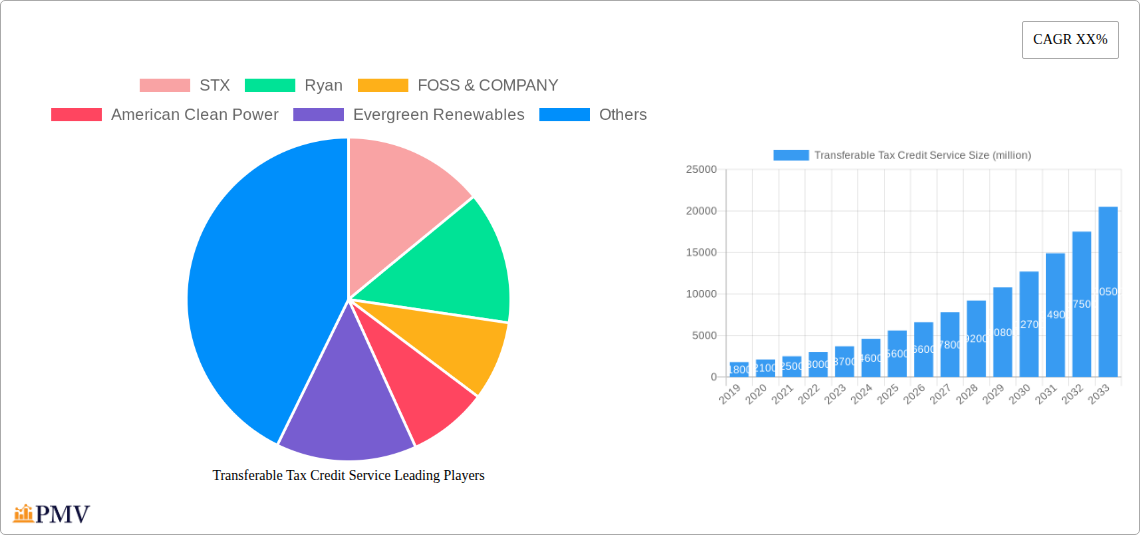

Transferable Tax Credit Service Market Structure & Competitive Dynamics

The transferable tax credit service market exhibits a moderately concentrated structure, with a growing number of specialized firms and established financial institutions vying for market share. Key players like STX, Ryan, and FOSS & COMPANY are leveraging their expertise in tax equity, transferable tax credits, and green tax incentives to gain a competitive edge. The innovation ecosystem is driven by the increasing demand for renewable energy development financing and the complexities associated with navigating various state and federal tax credit programs. Regulatory frameworks, particularly those related to the Inflation Reduction Act (IRA) and its implications for clean energy tax credits, play a pivotal role in market dynamics. Product substitutes, such as traditional project financing or direct investment without tax credit utilization, are present but increasingly less attractive given the enhanced benefits of transferable credits. End-user trends are strongly influenced by the economic viability of renewable energy projects and the desire for historic building preservation. Mergers and acquisitions (M&A) activities are on the rise, with significant deal values in the tax credit syndication and tax credit trading space, indicating consolidation and strategic expansion by leading firms. For instance, recent M&A in the sector have reached values in the hundreds of millions. Market share is a key metric, with dominant firms holding estimated market shares of over 15% in specific service niches.

Transferable Tax Credit Service Industry Trends & Insights

The transferable tax credit service industry is experiencing robust growth, driven by a confluence of favorable economic policies, technological advancements, and increasing environmental consciousness. The Inflation Reduction Act (IRA) has been a monumental catalyst, unlocking new opportunities and significantly expanding the scope and value of renewable energy tax credits, including the Investment Tax Credit (ITC) and Production Tax Credit (PTC). This legislative push, coupled with evolving consumer preferences for sustainable solutions and corporate environmental, social, and governance (ESG) mandates, is fueling demand for transferable tax credit consulting services and transaction services. The market penetration of transferable tax credits, particularly within the renewable energy sector, is projected to reach approximately 40% by 2025. The Compound Annual Growth Rate (CAGR) of this market is estimated to be in the high double digits, exceeding 25% for the forecast period of 2025–2033. Technological disruptions are primarily centered around enhanced data analytics and platforms that streamline the process of identifying, valuing, and transacting tax credits, thereby reducing transaction costs. Companies like American Clean Power and Evergreen Renewables are at the forefront of innovation, developing sophisticated tools for tax equity analysis and credit monetization. The competitive landscape is intensifying, with a clear trend towards specialization, as firms like Basis Climate and Moss Adams focus on specific niches within the tax credit market. The growing awareness of historic building preservation tax credits and other niche tax credit opportunities is also contributing to market expansion. The estimated market size for transferable tax credit services is expected to surpass several million by the base year of 2025, with projections indicating a sustained upward trajectory.

Dominant Markets & Segments in Transferable Tax Credit Service

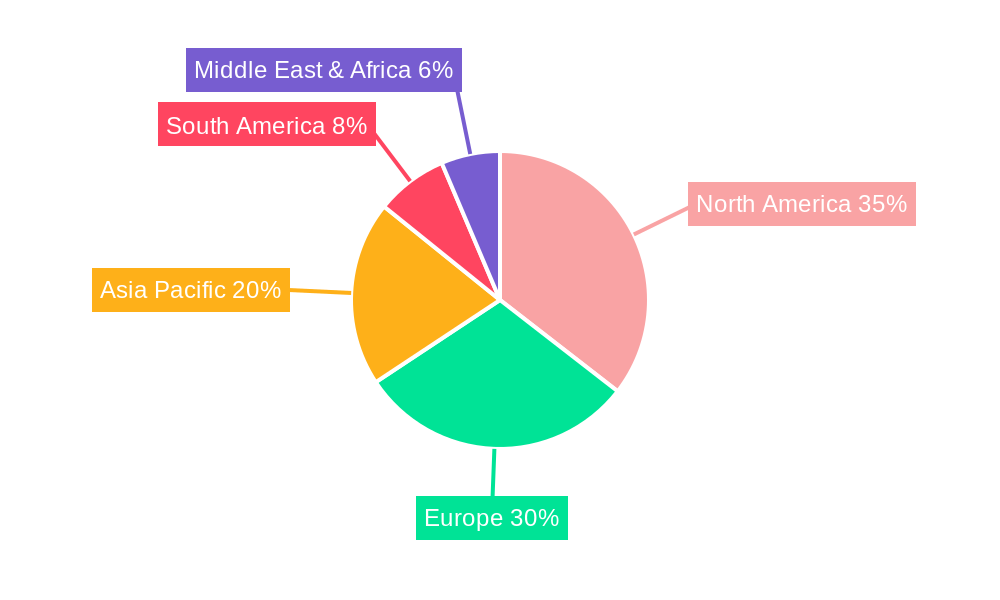

The transferable tax credit service market is experiencing significant dominance in specific regions and segments. Geographically, North America, particularly the United States, stands out as the leading market due to its comprehensive and evolving federal tax credit landscape, including significant incentives for renewable energy development and historic preservation.

Application Dominance:

- Renewable Energy Development: This segment is the undisputed leader, driven by substantial federal and state incentives for solar, wind, and other clean energy projects. The Inflation Reduction Act has amplified this dominance, creating a massive pipeline of projects seeking financing through tax credit monetization. Economic policies promoting decarbonization and energy independence are key drivers.

- Historic Building Preservation: While smaller than renewable energy, this segment shows strong growth, fueled by government programs aimed at revitalizing historical structures. Tax incentives play a crucial role in making these often cost-intensive projects financially viable.

- Others: This segment encompasses emerging areas such as clean hydrogen tax credits, carbon capture tax credits, and other nascent tax credit programs that are gaining traction.

Type Dominance:

- Consulting Services: The complexity of transferable tax credit rules and regulations necessitates expert guidance, making consulting services the dominant type. Firms offer strategic advice on credit eligibility, structuring, and compliance.

- Transaction Services: As the market matures, the demand for efficient and secure tax credit transaction platforms and brokerage services is surging. Crux and TP ICAP are prominent players in this domain, facilitating the buying and selling of tax credits.

The dominance of these segments is underpinned by robust government support, the increasing attractiveness of tax equity investments, and the growing awareness among developers and investors of the financial advantages offered by transferable tax credits. Infrastructure development supporting clean energy and the preservation of cultural heritage are also significant contributing factors.

Transferable Tax Credit Service Product Innovations

Product innovations in the transferable tax credit service market are largely focused on enhancing efficiency, transparency, and accessibility for market participants. This includes the development of sophisticated tax credit valuation tools, AI-powered platforms for credit sourcing, and streamlined transaction marketplaces. Companies are introducing integrated solutions that offer end-to-end tax credit management, from initial project assessment and credit eligibility verification to the actual sale or purchase of credits. These innovations aim to reduce transaction friction, minimize compliance risks, and maximize the financial returns for both credit originators and investors. The competitive advantage lies in offering robust data analytics, secure transaction protocols, and expert guidance tailored to specific tax credit types like the clean energy production tax credit and historic rehabilitation tax credit.

Report Segmentation & Scope

This report meticulously segments the transferable tax credit service market across key areas for detailed analysis. The primary segmentation includes:

Application:

- Renewable Energy Development: This segment, projected to reach several million in market size by 2025, encompasses services supporting solar, wind, battery storage, and other clean energy projects. Growth drivers include policy support and decreasing technology costs.

- Historic Building Preservation: Valued in the millions by 2025, this segment focuses on services for the rehabilitation and preservation of historic structures, driven by tax incentives and urban renewal initiatives.

- Others: This segment includes emerging applications such as clean hydrogen, carbon capture, and other specialized tax credit opportunities. Its market size is growing rapidly, with projections indicating significant future expansion.

Types:

- Consulting Services: This segment, estimated at several million in 2025, provides expert advice on tax credit eligibility, structuring, compliance, and optimization. Competitive dynamics are characterized by deep industry expertise and strong client relationships.

- Transaction Services: Projected to be in the millions by 2025, this segment focuses on the brokerage, syndication, and trading of transferable tax credits. Key players are developing robust platforms to facilitate efficient and secure deals.

Key Drivers of Transferable Tax Credit Service Growth

The growth of the transferable tax credit service market is propelled by several significant factors. Foremost is the robust regulatory support, exemplified by the Inflation Reduction Act (IRA), which provides substantial incentives for renewable energy development and other green initiatives. Economic factors, such as the increasing demand for sustainable energy solutions and the need for capital to finance these projects, are crucial. Technological advancements, including sophisticated data analytics and digital platforms, are streamlining tax credit monetization and transaction processes, making them more efficient and accessible. Furthermore, growing corporate ESG commitments are driving companies to invest in and leverage green tax credits.

Challenges in the Transferable Tax Credit Service Sector

Despite its strong growth, the transferable tax credit service sector faces certain challenges. Regulatory hurdles, including evolving interpretations and potential changes in tax laws, can create uncertainty for investors and developers. Supply chain issues, particularly in the renewable energy sector, can impact project timelines and, consequently, the timing of tax credit realization. Intense competitive pressures among service providers can lead to price erosion in certain service areas. Moreover, the complexity of tax credit valuation and compliance requirements can still pose a barrier for less experienced market participants, leading to potential errors and financial losses.

Leading Players in the Transferable Tax Credit Service Market

- STX

- Ryan

- FOSS & COMPANY

- American Clean Power

- Evergreen Renewables

- Basis Climate

- Moss Adams

- Crux

- TP ICAP

- Patriot REC

Key Developments in Transferable Tax Credit Service Sector

- 2023: The widespread implementation and interpretation of the Inflation Reduction Act (IRA) leads to a surge in demand for renewable energy tax credit services.

- 2023: Several new platforms for tax credit trading are launched, aiming to increase liquidity and transparency in the market.

- 2022: Major acquisitions in the tax equity syndication space, with deal values reaching hundreds of millions, indicating market consolidation.

- 2021: Increased focus on historic preservation tax credit consulting as a result of renewed interest in urban development and heritage conservation.

- 2020: Initial impacts of the pandemic highlight the resilience of renewable energy development and its associated financing mechanisms, including transferable tax credits.

Strategic Transferable Tax Credit Service Market Outlook

- 2023: The widespread implementation and interpretation of the Inflation Reduction Act (IRA) leads to a surge in demand for renewable energy tax credit services.

- 2023: Several new platforms for tax credit trading are launched, aiming to increase liquidity and transparency in the market.

- 2022: Major acquisitions in the tax equity syndication space, with deal values reaching hundreds of millions, indicating market consolidation.

- 2021: Increased focus on historic preservation tax credit consulting as a result of renewed interest in urban development and heritage conservation.

- 2020: Initial impacts of the pandemic highlight the resilience of renewable energy development and its associated financing mechanisms, including transferable tax credits.

Strategic Transferable Tax Credit Service Market Outlook

The strategic outlook for the transferable tax credit service market remains exceptionally bright. Continued policy support for clean energy and sustainable development will fuel ongoing demand for tax credit consulting and transaction services. The increasing sophistication of digital platforms and data analytics will further enhance market efficiency and accessibility, attracting a wider range of investors. Opportunities exist in emerging tax credit sectors and in providing specialized expertise to navigate complex international and state-level tax incentive programs. The trend towards strategic partnerships and M&A is likely to continue, leading to further consolidation and the emergence of larger, more comprehensive service providers. The market is poised for significant growth, driven by the imperative to decarbonize and invest in sustainable infrastructure.

Transferable Tax Credit Service Segmentation

-

1. Application

- 1.1. Renewable Energy Development

- 1.2. Historic Building Preservation

- 1.3. Others

-

2. Types

- 2.1. Consulting Services

- 2.2. Transaction Services

Transferable Tax Credit Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Transferable Tax Credit Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Transferable Tax Credit Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Renewable Energy Development

- 5.1.2. Historic Building Preservation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Consulting Services

- 5.2.2. Transaction Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Transferable Tax Credit Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Renewable Energy Development

- 6.1.2. Historic Building Preservation

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Consulting Services

- 6.2.2. Transaction Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Transferable Tax Credit Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Renewable Energy Development

- 7.1.2. Historic Building Preservation

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Consulting Services

- 7.2.2. Transaction Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Transferable Tax Credit Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Renewable Energy Development

- 8.1.2. Historic Building Preservation

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Consulting Services

- 8.2.2. Transaction Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Transferable Tax Credit Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Renewable Energy Development

- 9.1.2. Historic Building Preservation

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Consulting Services

- 9.2.2. Transaction Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Transferable Tax Credit Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Renewable Energy Development

- 10.1.2. Historic Building Preservation

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Consulting Services

- 10.2.2. Transaction Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 STX

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ryan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FOSS & COMPANY

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 American Clean Power

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Evergreen Renewables

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Basis Climate

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Moss Adams

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crux

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TP ICAP

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Patriot REC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 STX

List of Figures

- Figure 1: Global Transferable Tax Credit Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Transferable Tax Credit Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Transferable Tax Credit Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Transferable Tax Credit Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Transferable Tax Credit Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Transferable Tax Credit Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Transferable Tax Credit Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Transferable Tax Credit Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Transferable Tax Credit Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Transferable Tax Credit Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Transferable Tax Credit Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Transferable Tax Credit Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Transferable Tax Credit Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Transferable Tax Credit Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Transferable Tax Credit Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Transferable Tax Credit Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Transferable Tax Credit Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Transferable Tax Credit Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Transferable Tax Credit Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Transferable Tax Credit Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Transferable Tax Credit Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Transferable Tax Credit Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Transferable Tax Credit Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Transferable Tax Credit Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Transferable Tax Credit Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Transferable Tax Credit Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Transferable Tax Credit Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Transferable Tax Credit Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Transferable Tax Credit Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Transferable Tax Credit Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Transferable Tax Credit Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Transferable Tax Credit Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Transferable Tax Credit Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Transferable Tax Credit Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Transferable Tax Credit Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Transferable Tax Credit Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Transferable Tax Credit Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Transferable Tax Credit Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Transferable Tax Credit Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Transferable Tax Credit Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Transferable Tax Credit Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Transferable Tax Credit Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Transferable Tax Credit Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Transferable Tax Credit Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Transferable Tax Credit Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Transferable Tax Credit Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Transferable Tax Credit Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Transferable Tax Credit Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Transferable Tax Credit Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Transferable Tax Credit Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Transferable Tax Credit Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Transferable Tax Credit Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Transferable Tax Credit Service?

Key companies in the market include STX, Ryan, FOSS & COMPANY, American Clean Power, Evergreen Renewables, Basis Climate, Moss Adams, Crux, TP ICAP, Patriot REC.

3. What are the main segments of the Transferable Tax Credit Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Transferable Tax Credit Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Transferable Tax Credit Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Transferable Tax Credit Service?

To stay informed about further developments, trends, and reports in the Transferable Tax Credit Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence