Key Insights

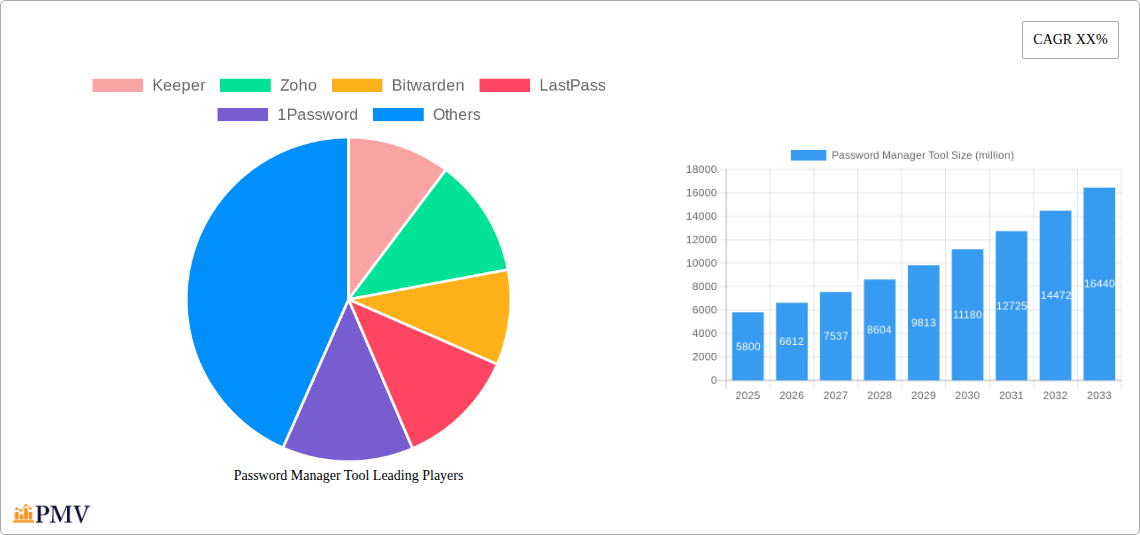

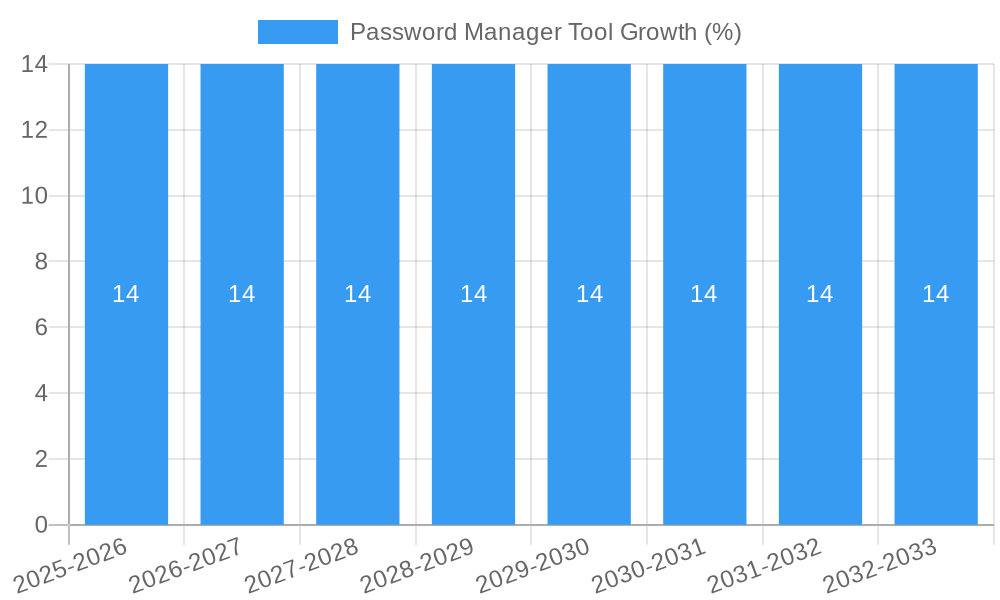

The global Password Manager Tool market is experiencing robust growth, projected to reach an estimated $5,800 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 14% through 2033. This significant expansion is fueled by an increasing awareness of cybersecurity threats and the imperative for robust password management solutions across all organizational sizes. Small and Medium-sized Enterprises (SMEs) represent a substantial segment of the market, actively adopting these tools to enhance their security posture and comply with evolving data protection regulations. Large enterprises, with their complex IT infrastructures and vast amounts of sensitive data, are also major contributors to market growth, seeking enterprise-grade solutions for centralized management and streamlined access control. The increasing reliance on cloud-based solutions, offering scalability, accessibility, and cost-effectiveness, is a dominant trend, although on-premises solutions continue to hold relevance for organizations with stringent data sovereignty requirements.

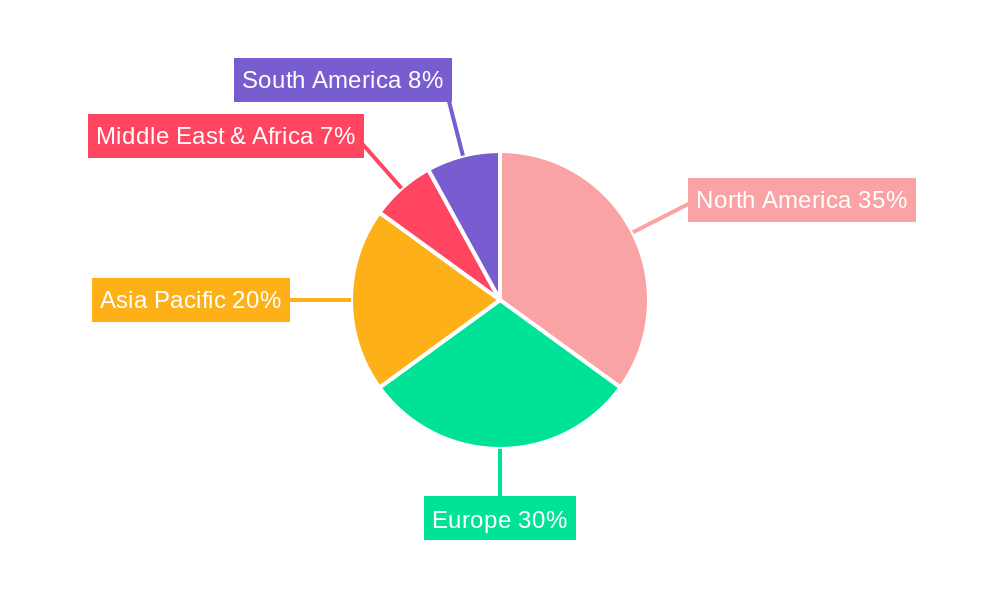

The market's dynamism is further shaped by several key drivers. The escalating sophistication of cyberattacks, including ransomware and phishing attempts, has made strong, unique passwords a critical first line of defense. Consequently, businesses are prioritizing password managers to enforce password policies, reduce human error, and streamline the onboarding/offboarding process for employees. The proliferation of connected devices and the increasing adoption of remote work models have also amplified the need for secure and accessible password management across multiple platforms and locations. While the market presents immense opportunities, potential restraints include concerns around data privacy, the perceived complexity of implementation for some smaller businesses, and the ongoing challenge of user adoption and education. Nevertheless, the overarching need for enhanced digital security and operational efficiency is expected to propel the password manager tool market forward, with North America and Europe leading in adoption, followed by a rapidly growing Asia Pacific region.

This in-depth report provides a detailed analysis of the global Password Manager Tool market, covering historical trends, current market dynamics, and future projections from 2019 to 2033. With a base year of 2025 and an estimated year of 2025, the forecast period extends from 2025 to 2033, offering valuable insights for stakeholders seeking to understand market structure, competitive landscapes, and growth opportunities within this critical cybersecurity sector.

Password Manager Tool Market Structure & Competitive Dynamics

The global password manager tool market is characterized by a moderate to high degree of concentration, with several key players dominating significant market share. Innovation ecosystems are robust, driven by continuous advancements in cybersecurity features, integration capabilities, and user experience enhancements. Regulatory frameworks surrounding data privacy and security, such as GDPR and CCPA, are increasingly influencing product development and market entry strategies, adding a layer of complexity and compliance requirements. Product substitutes, including built-in browser password managers and manual password management, exist but are increasingly being outpaced by the advanced security and convenience offered by dedicated password manager tools. End-user trends highlight a growing awareness of cybersecurity threats and a demand for secure, efficient password management solutions across both individual and enterprise segments. Mergers and acquisitions (M&A) activities are a significant factor in shaping the competitive landscape, with larger players acquiring innovative startups to expand their offerings and market reach. For instance, recent M&A deal values have reached hundreds of millions, indicating the strategic importance and financial health of this sector. Key market share holders, such as Keeper, Zoho, and Bitwarden, consistently invest in research and development to maintain their competitive edge.

Password Manager Tool Industry Trends & Insights

The password manager tool industry is experiencing robust growth, driven by escalating cyber threats and the increasing adoption of digital services across all demographics. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period. Market penetration is steadily increasing, with an estimated XX% of internet users now employing password manager solutions. Technological disruptions, including the integration of artificial intelligence for anomaly detection, advanced biometric authentication methods, and enhanced encryption protocols, are revolutionizing the capabilities of these tools. Consumer preferences are leaning towards user-friendly interfaces, seamless cross-device synchronization, and robust security features that go beyond basic password storage, such as secure note-taking and identity theft protection. The competitive dynamics are intensifying, with established players like LastPass, 1Password, and LogMeOnce continuously innovating to capture market share. Furthermore, emerging players and niche solutions are catering to specific industry needs and user segments, fostering a dynamic and evolving market. The ongoing shift towards remote work and the proliferation of sophisticated phishing attacks further underscore the critical role of password managers in safeguarding digital identities and sensitive information, thereby fueling sustained market expansion. The increasing complexity of online accounts and the rise of credential stuffing attacks are compelling individuals and organizations alike to adopt dedicated password management solutions for enhanced security and operational efficiency.

Dominant Markets & Segments in Password Manager Tool

The Cloud-based segment is demonstrably dominant within the password manager tool market, driven by its inherent scalability, accessibility, and ease of deployment for both SMEs and Large Enterprises. This segment is projected to account for over 70% of the total market value, estimated to reach several billion dollars by 2025. The widespread availability of high-speed internet infrastructure and the increasing preference for Software-as-a-Service (SaaS) solutions contribute significantly to its dominance. Economic policies that encourage digital transformation and the growing reliance on cloud computing for business operations further bolster the adoption of cloud-based password manager tools.

- Key Drivers for Cloud-based Dominance:

- Scalability: Effortlessly adapts to growing user bases and data requirements for businesses of all sizes.

- Accessibility: Enables secure access from any device with an internet connection, crucial for remote and hybrid work environments.

- Ease of Deployment: Minimal IT overhead for installation and maintenance, making it attractive for resource-constrained SMEs.

- Automatic Updates: Ensures users always have the latest security patches and features without manual intervention.

The Large Enterprises segment also exhibits significant growth and market penetration, driven by the stringent security requirements and the need for centralized control and auditing capabilities. Large enterprises are increasingly adopting password manager solutions as a fundamental component of their cybersecurity strategy, with market spending in this segment estimated at billions of dollars annually. Economic incentives for cybersecurity investments and the increasing regulatory scrutiny on data breaches are key accelerators for this segment.

- Key Drivers for Large Enterprise Adoption:

- Centralized Management: Provides IT administrators with oversight and control over user access and password policies.

- Advanced Security Features: Offers robust encryption, multi-factor authentication (MFA), and granular access controls tailored for enterprise needs.

- Compliance Requirements: Aids organizations in meeting industry-specific regulations and data protection mandates.

- Integration Capabilities: Seamless integration with existing IT infrastructure and single sign-on (SSO) solutions.

While On-premises solutions still hold a niche market, particularly for organizations with specific data sovereignty concerns or highly sensitive data, their market share is steadily declining relative to cloud-based alternatives, with an estimated market size in the hundreds of millions.

Password Manager Tool Product Innovations

Recent product innovations in the password manager tool market are centered on enhancing security, user experience, and integration capabilities. Companies like 1Password and Bitwarden are pushing the boundaries with advanced features such as built-in VPN services, secure file sharing, and comprehensive identity monitoring. The integration of AI for predictive threat detection and automated password rotation is also gaining traction. Competitive advantages are being carved out through seamless cross-platform compatibility, intuitive user interfaces, and robust support for various authentication methods, including hardware security keys and advanced biometrics. This focus on innovation ensures that password manager tools remain indispensable for safeguarding digital assets in an increasingly complex threat landscape.

Report Segmentation & Scope

This report meticulously segments the global password manager tool market across key dimensions to provide granular insights. The Application segmentation includes Small and Medium-sized Enterprises (SMEs) and Large Enterprises, each with distinct adoption drivers and market dynamics. The Types segmentation differentiates between Cloud-based and On-premises solutions, reflecting varying deployment preferences and infrastructure requirements. Growth projections and market sizes for each segment are detailed within the report, offering a comprehensive view of the competitive landscape and opportunities within each niche. For SMEs, the cloud-based segment is expected to see a CAGR of over 18%, reaching market values in the billions. Large Enterprises, while still showing strong growth, are projected to have a CAGR of around 12% in the cloud-based segment, with on-premises solutions for this segment holding a market size in the hundreds of millions.

Key Drivers of Password Manager Tool Growth

The global password manager tool market is experiencing substantial growth, propelled by a confluence of technological, economic, and regulatory factors. The escalating sophistication of cyber threats, including ransomware and sophisticated phishing attacks, has significantly heightened awareness among individuals and organizations regarding the imperative of robust password security. Economically, the increasing digitization of businesses and the widespread adoption of cloud services necessitate comprehensive digital identity management solutions, driving demand for password managers. Regulatory frameworks, such as the GDPR and CCPA, impose stringent data protection requirements, compelling businesses to adopt advanced security measures, including password management tools, to avoid hefty penalties. Furthermore, the growing trend of remote work has amplified the need for secure access to corporate resources from disparate locations, making password managers an essential tool for maintaining productivity and security.

Challenges in the Password Manager Tool Sector

Despite the robust growth, the password manager tool sector faces several challenges that impact market expansion. Regulatory hurdles, while driving adoption, can also present compliance complexities for vendors in different jurisdictions, requiring significant investment in legal and technical adaptations. Supply chain issues, though less direct, can indirectly affect the availability and cost of hardware components used in some advanced authentication solutions. Competitive pressures are immense, with a crowded market forcing vendors to continuously innovate and offer competitive pricing to retain and attract customers. The perception of complexity and the inertia to switch from existing, albeit less secure, manual password management practices also pose a restraint. Quantifiable impacts of these challenges can include increased R&D costs due to regulatory changes, and reduced profit margins due to intense competition, potentially impacting market growth by an estimated XX%.

Leading Players in the Password Manager Tool Market

- Keeper

- Zoho

- Bitwarden

- LastPass

- 1Password

- LogMeOnce

- Roboform

- Password Boss

- Dashlane

- Nordpass

- Sticky Password

- RememBear

- Avira

- Blur

- Enpass

- True Key

- mSecure

- KeePass

- ADSelfservice Plus

- Norton

- Trend Micro

- Intuitive Password

- SaferPass

- SplashID

- Device42

- IT Glue

- Hypervault

- N-able

- Passbolt

- SpiderOak

Key Developments in Password Manager Tool Sector

- 2023/07: Bitwarden launches enhanced MFA options, including FIDO2 security keys, strengthening its enterprise security posture.

- 2023/09: 1Password introduces a new secure sharing feature for teams, streamlining collaboration while maintaining high security standards.

- 2024/01: LastPass announces enhanced breach response protocols and increased transparency following past security incidents.

- 2024/04: Zoho strengthens its suite with advanced password auditing tools for business users, enhancing compliance capabilities.

- 2024/08: Keeper Security introduces new AI-powered features for enhanced threat detection and user guidance, bolstering its proactive security offerings.

Strategic Password Manager Tool Market Outlook

The strategic outlook for the password manager tool market remains exceptionally strong, driven by the pervasive and evolving nature of cyber threats. Growth accelerators include the increasing integration of password managers with broader identity and access management (IAM) solutions, the expansion into untapped emerging markets, and the development of more sophisticated features for niche industries. Strategic opportunities lie in catering to the growing demand for passwordless authentication solutions and leveraging AI to offer predictive security intelligence. The market is poised for continued expansion as organizations and individuals recognize the indispensable role of secure password management in protecting digital assets and ensuring business continuity in an increasingly interconnected world, with future market potential estimated to reach tens of billions of dollars.

Password Manager Tool Segmentation

-

1. Application

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. Types

- 2.1. Cloud-based

- 2.2. On-premises

Password Manager Tool Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Password Manager Tool REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Password Manager Tool Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud-based

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Password Manager Tool Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. SMEs

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud-based

- 6.2.2. On-premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Password Manager Tool Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. SMEs

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud-based

- 7.2.2. On-premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Password Manager Tool Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. SMEs

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud-based

- 8.2.2. On-premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Password Manager Tool Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. SMEs

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud-based

- 9.2.2. On-premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Password Manager Tool Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. SMEs

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud-based

- 10.2.2. On-premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Keeper

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zoho

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bitwarden

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LastPass

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 1Password

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LogMeOnce

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Roboform

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Password Boss

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dashlane

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nordpass

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sticky Password

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 RememBear

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Avira

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Blur

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Enpass

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 True key

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 mSecure

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Keepass

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 ADSelfservice Plus

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Norton

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Trend Micro

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Intuitive Password

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 SaferPass

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 SplashID

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Device42

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 IT Glue

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Hypervault

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 N-able

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Passbolt

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 SpiderOak

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.1 Keeper

List of Figures

- Figure 1: Global Password Manager Tool Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Password Manager Tool Revenue (million), by Application 2024 & 2032

- Figure 3: North America Password Manager Tool Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Password Manager Tool Revenue (million), by Types 2024 & 2032

- Figure 5: North America Password Manager Tool Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Password Manager Tool Revenue (million), by Country 2024 & 2032

- Figure 7: North America Password Manager Tool Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Password Manager Tool Revenue (million), by Application 2024 & 2032

- Figure 9: South America Password Manager Tool Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Password Manager Tool Revenue (million), by Types 2024 & 2032

- Figure 11: South America Password Manager Tool Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Password Manager Tool Revenue (million), by Country 2024 & 2032

- Figure 13: South America Password Manager Tool Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Password Manager Tool Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Password Manager Tool Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Password Manager Tool Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Password Manager Tool Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Password Manager Tool Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Password Manager Tool Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Password Manager Tool Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Password Manager Tool Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Password Manager Tool Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Password Manager Tool Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Password Manager Tool Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Password Manager Tool Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Password Manager Tool Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Password Manager Tool Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Password Manager Tool Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Password Manager Tool Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Password Manager Tool Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Password Manager Tool Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Password Manager Tool Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Password Manager Tool Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Password Manager Tool Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Password Manager Tool Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Password Manager Tool Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Password Manager Tool Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Password Manager Tool Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Password Manager Tool Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Password Manager Tool Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Password Manager Tool Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Password Manager Tool Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Password Manager Tool Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Password Manager Tool Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Password Manager Tool Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Password Manager Tool Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Password Manager Tool Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Password Manager Tool Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Password Manager Tool Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Password Manager Tool Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Password Manager Tool Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Password Manager Tool?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Password Manager Tool?

Key companies in the market include Keeper, Zoho, Bitwarden, LastPass, 1Password, LogMeOnce, Roboform, Password Boss, Dashlane, Nordpass, Sticky Password, RememBear, Avira, Blur, Enpass, True key, mSecure, Keepass, ADSelfservice Plus, Norton, Trend Micro, Intuitive Password, SaferPass, SplashID, Device42, IT Glue, Hypervault, N-able, Passbolt, SpiderOak.

3. What are the main segments of the Password Manager Tool?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Password Manager Tool," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Password Manager Tool report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Password Manager Tool?

To stay informed about further developments, trends, and reports in the Password Manager Tool, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence