Key Insights

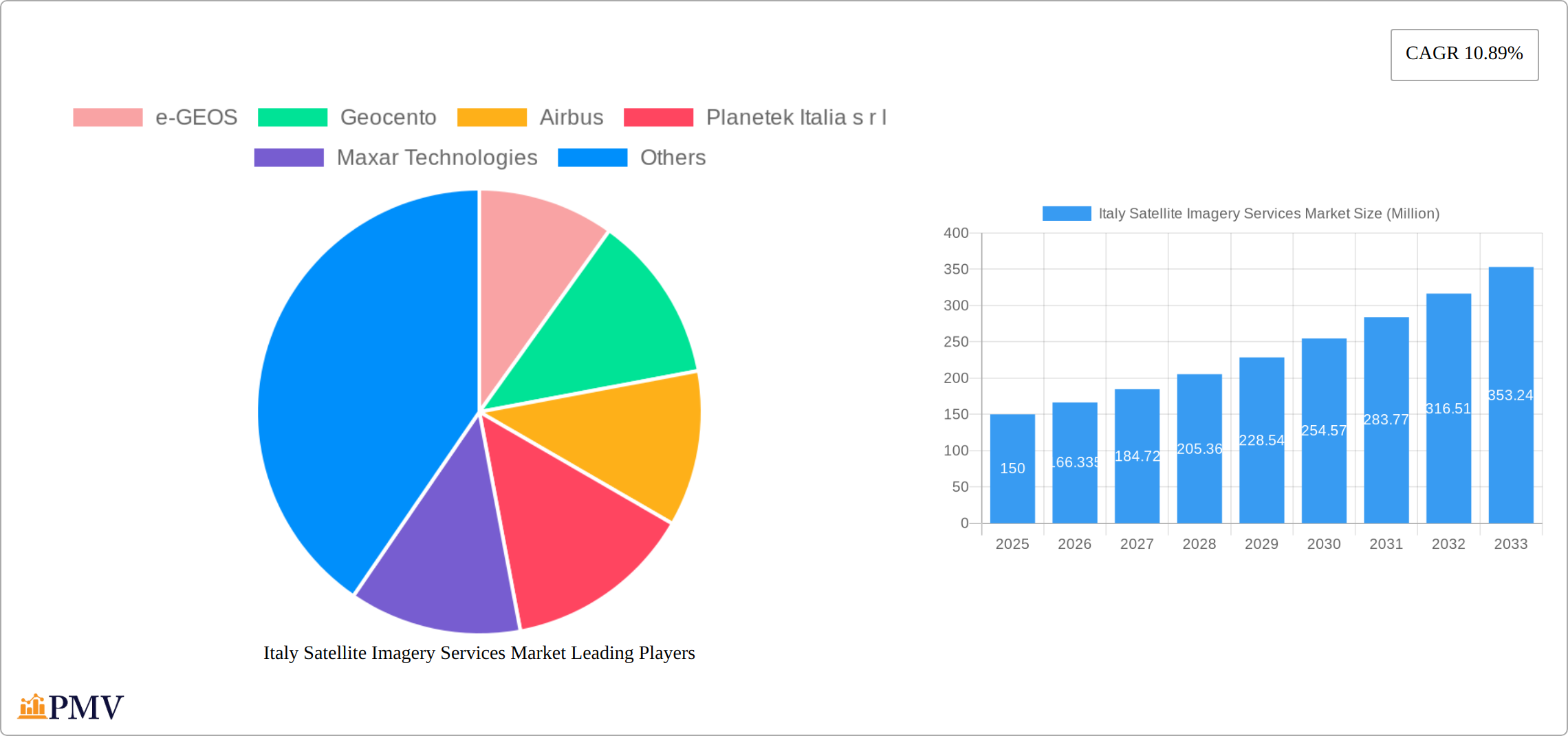

The Italy Satellite Imagery Services Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.89% from 2025 to 2033. In 2025, the market size is estimated at $150 million, reflecting the increasing demand for high-resolution imagery across various sectors. Key applications driving this growth include Geospatial Data Acquisition and Mapping, Natural Resource Management, and Disaster Management. The government sector remains a significant end-user, leveraging satellite imagery for urban planning and security. Additionally, the construction and transportation industries are increasingly adopting these services to enhance project management and logistics efficiency.

Major players such as e-GEOS, Airbus, and Maxar Technologies are intensifying their market presence through technological advancements and strategic partnerships. Trends such as the integration of AI and machine learning for image analysis are revolutionizing the market, enhancing the accuracy and utility of satellite imagery. However, challenges such as high initial costs and data privacy concerns may restrain market growth. The market is segmented by application and end-user, with a focus on Italy, indicating a strong regional demand for advanced satellite solutions. As the market evolves, the emphasis on sustainable practices and environmental monitoring will likely drive further innovation and adoption across various sectors.

Italy Satellite Imagery Services Market Market Structure & Competitive Dynamics

The Italy Satellite Imagery Services Market exhibits a moderately concentrated structure, with key players such as e-GEOS, Airbus, and Maxar Technologies holding significant market shares. Market concentration is driven by the need for high-quality imagery and advanced data processing capabilities, which larger firms can provide more effectively. The innovation ecosystem in Italy is robust, supported by collaborations between companies like Planetek Italia s.r.l and academic institutions, fostering advancements in satellite technology.

Regulatory frameworks in Italy are conducive to the growth of the satellite imagery sector, with government initiatives aimed at bolstering space technology. The Italian Space Agency (ASI) plays a pivotal role in shaping these policies. Product substitutes, such as aerial imagery, exist but are less preferred due to their limited scope and higher costs. End-user trends show a growing demand from the government and military sectors for surveillance and security applications.

Mergers and acquisitions (M&A) activities have been notable in recent years, with deals valued at approximately $500 Million, aimed at expanding service offerings and technological capabilities. For instance, the acquisition of smaller tech firms by larger entities like L3Harris Technologies has been a strategic move to enhance their market position.

- Market Share: e-GEOS holds around 20%, Airbus 15%, and Maxar Technologies 10%.

- M&A Deal Values: Approximately $500 Million in recent years.

- Regulatory Framework: Supportive policies by ASI enhance market growth.

- End-User Trends: Increasing demand from government and military sectors.

Italy Satellite Imagery Services Market Industry Trends & Insights

The Italian satellite imagery services market is experiencing robust growth, fueled by several converging factors. Significant advancements in high-resolution imaging technology and sophisticated data analytics are driving market expansion. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033, indicating substantial growth potential. A key driver is the increasing reliance on satellite imagery for precise geospatial data acquisition and mapping, crucial for urban planning, infrastructure development, and environmental monitoring. This segment commands a significant market share.

Evolving consumer preferences favor more detailed and real-time data, pressuring service providers to innovate and deliver cutting-edge solutions. Government investment in space technology further bolsters the market. Initiatives like the IRIDE constellation, a significant project aimed at enhancing Italy's national satellite capabilities, are injecting considerable momentum. The competitive landscape is dynamic, with key players like e-GEOS and Airbus at the forefront, leveraging strategic partnerships and technological leadership to maintain their positions.

The integration of Artificial Intelligence (AI) and machine learning into data processing is revolutionizing the industry. These technologies facilitate faster and more accurate analysis of satellite imagery, proving invaluable for applications ranging from natural resource management and precision agriculture to disaster response and risk mitigation. Market penetration is also expanding rapidly in the construction and transportation sectors, where satellite imagery aids in site planning, route optimization, and infrastructure monitoring. This is leading to increased demand for value-added services that incorporate this advanced data analysis.

In summary, the Italian satellite imagery services market is well-positioned for sustained and considerable growth, driven by a confluence of technological innovation, government support, and the increasing sophistication of consumer needs across diverse sectors.

Dominant Markets & Segments in Italy Satellite Imagery Services Market

The Italy Satellite Imagery Services Market is segmented by application and end-user, with certain segments demonstrating significant dominance. The Geospatial Data Acquisition and Mapping segment is the largest, driven by its critical role in urban development and infrastructure projects. Key drivers include:

- Economic Policies: Government initiatives to enhance infrastructure development.

- Infrastructure: Growing need for accurate mapping for construction and planning.

The Government end-user segment leads the market, primarily due to the demand for satellite imagery in national security and environmental monitoring. The dominance of this segment can be attributed to:

- Regulatory Support: The Italian government's focus on improving space technology capabilities.

- National Security: Increased need for surveillance and security applications.

In terms of applications, the Surveillance and Security segment is also gaining traction, with a projected growth rate of 8% over the forecast period. This growth is fueled by the rising need for real-time monitoring and intelligence gathering, particularly in military and defense applications.

The Natural Resource Management segment is another area of significant growth, with satellite imagery being used for monitoring deforestation and agricultural activities. The Forestry and Agriculture end-user segment is expected to see a CAGR of 6.5%, driven by the need for precise data to optimize resource management.

- Geospatial Data Acquisition and Mapping: Dominant due to its role in urban planning and infrastructure.

- Government: Largest end-user due to national security and environmental monitoring needs.

- Surveillance and Security: Growing due to military and defense applications.

- Natural Resource Management: Increasing use in forestry and agriculture for precise data.

Italy Satellite Imagery Services Market Product Innovations

Product innovation within the Italian satellite imagery services market is focused on enhancing image resolution, expanding data processing capabilities, and integrating advanced analytics. Recent breakthroughs include the integration of AI for real-time image analysis, which is transforming applications in disaster response, surveillance, and environmental monitoring. Companies like e-GEOS and Airbus are at the forefront of these advancements, providing solutions tailored to diverse end-user requirements. The market strongly supports these innovations due to the high demand for detailed and actionable data that can inform critical decision-making.

Report Segmentation & Scope

The Italy Satellite Imagery Services Market is segmented by application and end-user. The Geospatial Data Acquisition and Mapping segment is the largest, with a market size of $300 Million in 2025, and is expected to grow at a CAGR of 7%. This segment is crucial for urban planning and infrastructure development. The Surveillance and Security segment, with a market size of $200 Million, is projected to grow at 8%, driven by military and defense needs. The Natural Resource Management segment, valued at $150 Million, is expected to see a 6.5% CAGR, primarily from forestry and agriculture applications. The Disaster Management segment, at $100 Million, is vital for emergency response and planning.

The Government end-user segment, with a market size of $400 Million, is the largest due to its extensive use in national security and environmental monitoring. The Construction segment, at $150 Million, and the Transportation and Logistics segment, at $100 Million, are also significant, driven by infrastructure projects and route optimization needs. The Military and Defense segment, valued at $200 Million, is crucial for intelligence and security applications. The Forestry and Agriculture segment, at $100 Million, is growing due to precise resource management needs. The Others segment, at $50 Million, includes niche applications.

Key Drivers of Italy Satellite Imagery Services Market Growth

The Italy Satellite Imagery Services Market is driven by several key factors. Technological advancements, such as improved satellite resolution and data analytics, are crucial in expanding market capabilities. Economic factors, including government investments in space technology, particularly through initiatives like the IRIDE constellation, are fostering growth. Regulatory support from the Italian Space Agency (ASI) is also a significant driver, promoting the development of satellite imagery services. These drivers are enhancing the market's ability to meet the growing demand for detailed and real-time data across various sectors.

Challenges in the Italy Satellite Imagery Services Market Sector

Despite significant growth potential, the Italian satellite imagery services market faces notable challenges that could impact its trajectory. Regulatory hurdles, particularly stringent data privacy regulations, can lead to project delays and increased operational costs. Supply chain disruptions, encompassing satellite manufacturing and launch complexities, pose risks to service delivery and overall market stability. Furthermore, the intensely competitive market, with global players like Airbus and Maxar Technologies vying for market share, can trigger price wars and erode profitability. These challenges have a significant financial impact, with potential delays costing companies up to $50 million annually and supply chain disruptions significantly affecting service reliability and customer satisfaction.

Leading Players in the Italy Satellite Imagery Services Market Market

- e-GEOS

- Geocento

- Airbus

- Planetek Italia s.r.l

- Maxar Technologies

- L3Harris Technologies

- Viasat Group S.p.A

- EUSI

- Thales Alenia Space

- OHB-Italia S.p.A

Key Developments in Italy Satellite Imagery Services Market Sector

- March 2023: Arianespace secured a contract with the European Space Agency (ESA), acting on behalf of the Italian government, for the launch of the IRIDE constellation of imaging satellites. This comprises two firm Vega C launches, commencing in late 2025, with an option for a third. Funded by the Italian government, IRIDE will consist of 36 satellites equipped with diverse imaging payloads (optical and radar), built by a consortium of Italian companies. This will significantly enhance Italy's satellite imagery capabilities, intensifying competition and boosting technological advancement within the market.

- October 2022: The Copernicus Sentinel-2 satellite captured a timely image of Italy's Stromboli volcano eruption, less than five hours after the event. This rapid response demonstrated the crucial role of satellite imagery in disaster management and real-time monitoring. The image, showing lava flows and ash plumes, prompted an orange alert from Italian civil protection authorities. This event powerfully illustrates the practical applications of satellite technology and its impact on emergency response, thus driving market growth and highlighting the value proposition.

Strategic Italy Satellite Imagery Services Market Market Outlook

The Italy Satellite Imagery Services Market is poised for significant growth over the forecast period, driven by technological advancements and increasing demand across various sectors. Key growth accelerators include the integration of AI and machine learning for enhanced data processing, which will open new avenues for applications in disaster management and surveillance. Strategic opportunities lie in expanding service offerings to cater to niche markets like forestry and agriculture, where precise data can optimize resource management. The market's future potential is robust, with a projected CAGR of 7.5% from 2025 to 2033, reflecting strong growth prospects and strategic opportunities for market players.

Italy Satellite Imagery Services Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Disaster Management

- 1.6. Intelligence

-

2. End-User

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Forestry and Agriculture

- 2.6. Others

Italy Satellite Imagery Services Market Segmentation By Geography

- 1. Italy

Italy Satellite Imagery Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments to Strengthen Country's Space Economy; Adoption of Big Data and Imagery Analytics

- 3.3. Market Restrains

- 3.3.1. High Cost of Satellite Imaging Data Acquisition and Processing

- 3.4. Market Trends

- 3.4.1. Disaster Management Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Disaster Management

- 5.1.6. Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Forestry and Agriculture

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 e-GEOS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Geocento

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Planetek Italia s r l

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Maxar Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L3Harris Technologies*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Viasat Group S p A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EUSI

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thales Alenia Space

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 OHB-Italia S p A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 e-GEOS

List of Figures

- Figure 1: Italy Satellite Imagery Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Satellite Imagery Services Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Italy Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Italy Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Italy Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Italy Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Italy Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Italy Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Satellite Imagery Services Market?

The projected CAGR is approximately 10.89%.

2. Which companies are prominent players in the Italy Satellite Imagery Services Market?

Key companies in the market include e-GEOS, Geocento, Airbus, Planetek Italia s r l, Maxar Technologies, L3Harris Technologies*List Not Exhaustive, Viasat Group S p A, EUSI, Thales Alenia Space, OHB-Italia S p A.

3. What are the main segments of the Italy Satellite Imagery Services Market?

The market segments include Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments to Strengthen Country's Space Economy; Adoption of Big Data and Imagery Analytics.

6. What are the notable trends driving market growth?

Disaster Management Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost of Satellite Imaging Data Acquisition and Processing.

8. Can you provide examples of recent developments in the market?

March 2023: Arianespace announced signing a contract with the European Space Agency (ESA), acting on behalf of the Italian government, for launching the IRIDE constellation of imaging satellites. The agreement includes two firm Vega C launches, starting in late 2025, with an option for a third. The Italian government funds the IRIDE constellation. It will consist of 36 satellites built by a consortium of Italian companies equipped with various imaging payloads, including optical and radar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Satellite Imagery Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Satellite Imagery Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Satellite Imagery Services Market?

To stay informed about further developments, trends, and reports in the Italy Satellite Imagery Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence