Key Insights

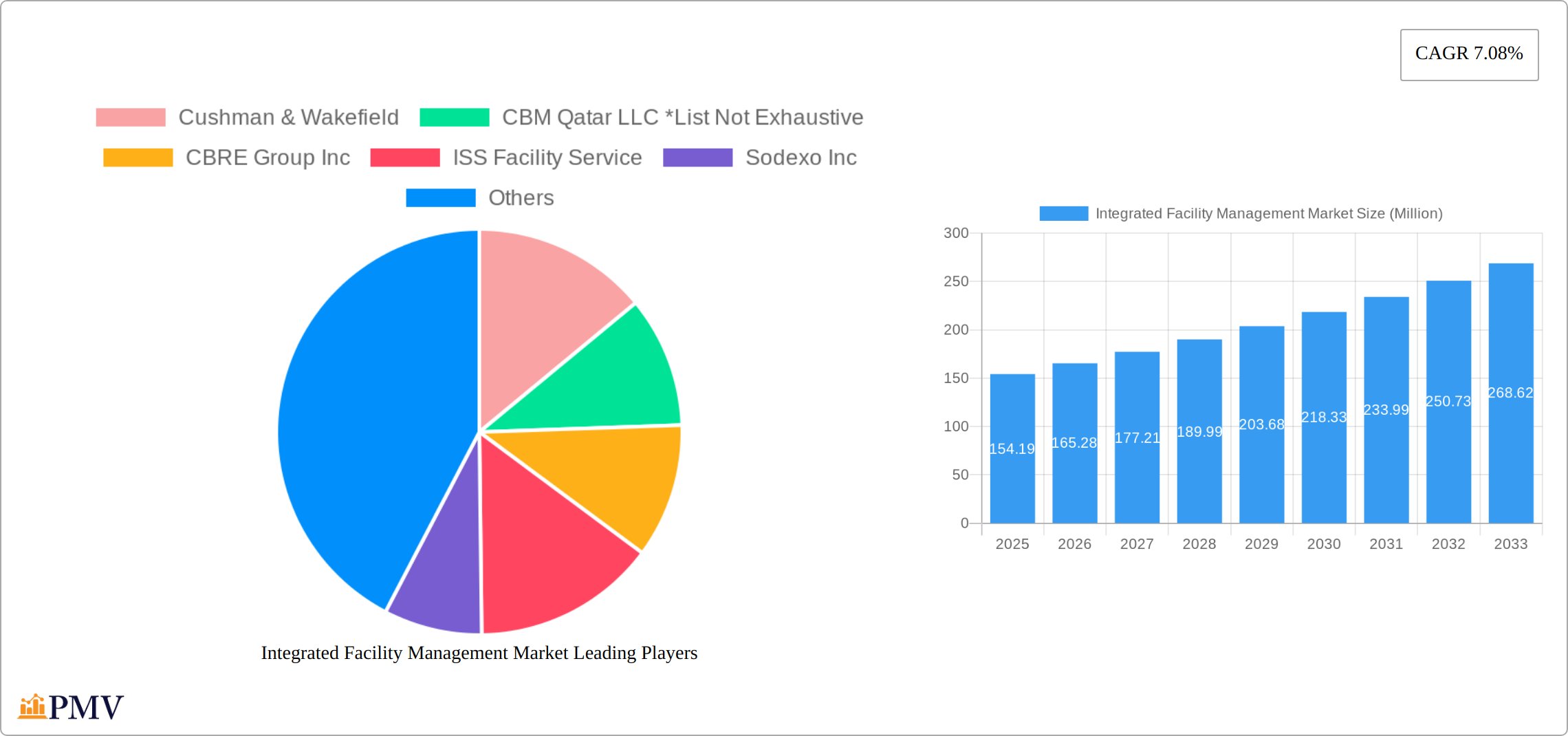

The Integrated Facility Management (IFM) market is experiencing robust growth, projected to reach \$154.19 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.08% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing demand for efficient and cost-effective facility operations across various sectors, including commercial real estate, public infrastructure, and industrial facilities, is a major catalyst. Businesses are increasingly recognizing the strategic value of outsourcing non-core functions like maintenance, cleaning, and security to specialized IFM providers, allowing them to focus on their core competencies. Secondly, technological advancements, such as the adoption of smart building technologies and data analytics, are streamlining IFM operations and improving efficiency, further fueling market growth. The growing emphasis on sustainability and environmental responsibility within building management also contributes to the rising demand for IFM services, as providers often implement energy-efficient solutions and waste reduction strategies. Finally, the rise of remote work models has prompted businesses to optimize their office spaces, leading to increased demand for flexible and scalable IFM solutions.

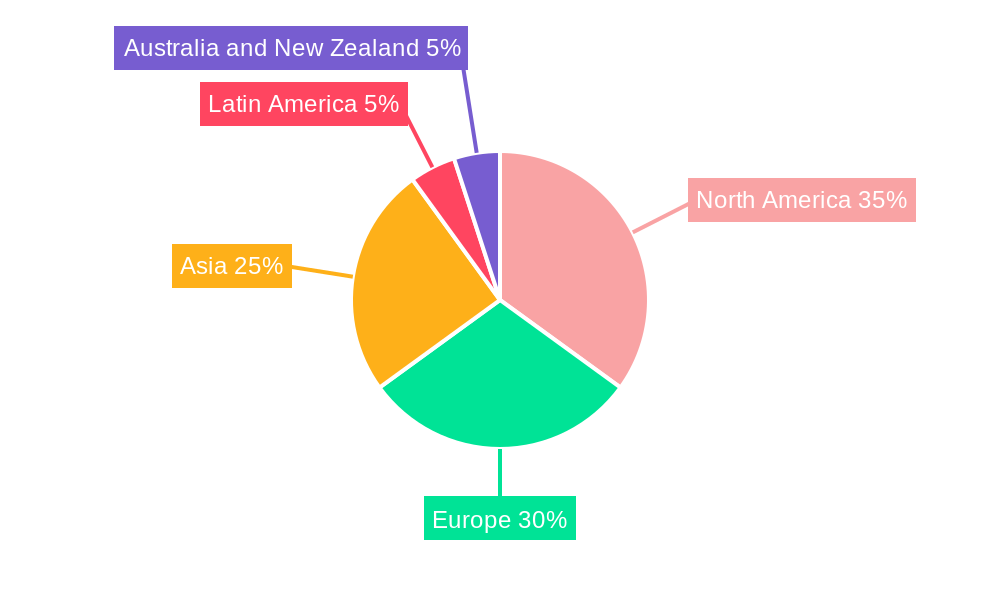

The IFM market is segmented by type (Hard FM, encompassing maintenance and repairs; and Soft FM, encompassing cleaning, security, and catering) and end-user (Public/Infrastructure, Commercial, Industrial, Institutional, and Other). While precise regional breakdowns are unavailable, it's reasonable to assume a significant market share for North America and Europe initially, given their established commercial real estate markets and higher adoption rates of advanced technologies. However, Asia's rapid economic development and burgeoning infrastructure projects are expected to drive significant growth in the coming years, presenting substantial opportunities for IFM providers. Competition is fierce, with major players like Cushman & Wakefield, CBRE Group Inc., ISS Facility Services, and Sodexo Inc. vying for market share. However, smaller, specialized firms catering to niche markets also hold considerable potential for growth. The continued emphasis on operational efficiency, technological integration, and sustainable practices will remain key differentiators in this competitive landscape.

Integrated Facility Management Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Integrated Facility Management (IFM) market, offering invaluable insights for stakeholders seeking to understand its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this report leverages extensive market research to deliver actionable intelligence. The report segments the market by type (Hard FM, Soft FM) and end-user (Public/Infrastructure, Commercial, Industrial, Institutional, Other End-Users), offering granular analysis across various geographical regions.

Integrated Facility Management Market Market Structure & Competitive Dynamics

The Integrated Facility Management (IFM) market is characterized by a dynamic and evolving competitive landscape. While a few large, established multinational corporations command significant market share through comprehensive service offerings and global reach, the market also benefits from a vibrant ecosystem of specialized, regional players. These smaller entities often excel in delivering niche services, fostering innovation and catering to specific client needs. Projections for 2025 indicate that key players such as CBRE Group Inc., Cushman & Wakefield, and Sodexo Inc. are anticipated to collectively hold a substantial portion of the market share, with smaller, agile companies accounting for the remainder. This competitive intensity is further amplified by ongoing technological advancements, notably the integration of Building Information Modeling (BIM) for enhanced design and management, and the pervasive adoption of IoT-enabled solutions for real-time data collection and operational optimization. The sector is also subject to stringent regulatory frameworks governing safety, sustainability, and data privacy, which significantly influence operational strategies and cost structures. While integrated solutions are preferred, competition from specialized service providers offering singular FM aspects still exerts some market pressure.

Mergers and acquisitions (M&A) continue to be a significant driver of consolidation and strategic expansion within the IFM sector. The historical period from 2019 to 2024 witnessed a robust M&A environment, with numerous deals aimed at expanding service portfolios, enhancing geographical presence, and acquiring new technological capabilities. The total value of these transactions underscores a strategic imperative for larger firms to bolster their market positions. The average deal value in 2024 reflects a maturing market where strategic acquisitions are becoming more targeted. End-user demand for outsourcing non-core functions and a growing preference for data-driven, seamless IFM solutions are key catalysts fueling this ongoing M&A activity, shaping the competitive contours of the market.

Integrated Facility Management Market Industry Trends & Insights

The Integrated Facility Management market is poised for significant and sustained growth, fueled by a confluence of powerful economic and societal trends. In 2024, the global market size was estimated at approximately $XX Million, with projections indicating a robust expansion to $XX Million by 2033, representing a Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033. The escalating pace of urbanization worldwide, coupled with the increasing complexity and scale of modern infrastructure and commercial buildings, are primary catalysts for this surge in demand. As buildings become more sophisticated, the necessity for efficient, cost-effective, and integrated management solutions becomes paramount. Technological advancements are playing a transformative role, with innovations such as AI-driven predictive maintenance offering proactive problem-solving and smart building technologies enhancing operational efficiency and resource optimization, thereby accelerating the market's upward trajectory.

A significant shift in consumer preferences is also evident, with a clear move towards holistic IFM solutions that not only streamline operations but also significantly enhance the occupant experience. This trend is particularly pronounced in sectors like commercial real estate and institutional facilities, where building owners are increasingly prioritizing occupant well-being, comfort, and productivity, alongside optimizing energy consumption. The competitive landscape remains fiercely contested, compelling companies to invest heavily in cutting-edge technologies and strategic collaborations to maintain their market leadership and adapt to the evolving demands of their clientele. The increasing adoption of smart building technologies is a key indicator of this evolution, with projections suggesting a penetration rate of xx% by 2033, underscoring the growing reliance on intelligent and connected facility management systems.

Dominant Markets & Segments in Integrated Facility Management Market

The Commercial segment stands as the dominant force within the IFM market, capturing an estimated xx% of the total market value in 2025. This leadership is directly attributable to the sheer volume and diversity of commercial properties globally, all of which necessitate comprehensive and efficient facility management strategies to ensure operational continuity, cost-effectiveness, and optimal user experience.

- Key Drivers for Commercial Segment Dominance:

- High density and extensive coverage of commercial real estate portfolios worldwide.

- A strong imperative among businesses to enhance operational efficiency and control costs.

- Accelerated adoption and integration of advanced smart building technologies to optimize performance.

The Public/Infrastructure segment, while currently smaller, exhibits exceptional growth potential, largely driven by substantial government investments in developing and upgrading public infrastructure. This segment is forecast to experience a robust CAGR of xx% throughout the forecast period, indicating a significant expansion in demand for specialized IFM services in public-facing facilities.

- Key Drivers for Public/Infrastructure Segment Growth:

- Increased public sector spending allocated to critical infrastructure development and modernization projects.

- A growing emphasis on sustainable and energy-efficient management practices for public assets.

- Stringent regulatory mandates and policy initiatives aimed at improving energy efficiency and ensuring safety standards in public infrastructure.

Examining the "By Type" segmentation, Hard FM services, which encompass essential infrastructure maintenance like HVAC, electrical systems, and building fabric, currently hold a larger market share. This is due to their foundational necessity in any facility. However, Soft FM services, which focus on the operational aspects and occupant experience such as cleaning, catering, security, and reception, are anticipated to witness a faster growth rate. This accelerated growth is propelled by an increasing corporate focus on creating productive and well-being-centric work environments and the demand for seamless, integrated workplace solutions.

-

Key Drivers for Hard FM Dominance:

- The indispensable and fundamental nature of hard services for the basic functioning of any facility.

- Significant initial capital investments required for building and maintaining essential building infrastructure.

-

Key Drivers for Soft FM Growth:

- Heightened corporate emphasis on employee well-being, productivity, and overall workplace experience.

- Escalating demand for comprehensive and integrated solutions that enhance the daily functioning of a workspace.

- Technological advancements that enable more efficient and innovative delivery of soft facility management services.

Geographically, North America and Europe currently dominate the IFM market, owing to their well-established economies and high levels of adoption for sophisticated IFM services. Nevertheless, emerging economies, particularly in the Asia-Pacific and Middle East regions, are demonstrating remarkable growth potential, driven by rapid urbanization, significant infrastructure development, and increasing foreign investment.

Integrated Facility Management Market Product Innovations

Recent product innovations focus on integrating AI, IoT, and data analytics into IFM solutions. This involves predictive maintenance systems, smart sensors for energy management, and real-time monitoring platforms to optimize operational efficiency and reduce costs. These advancements offer significant competitive advantages by improving service delivery, reducing downtime, and enhancing transparency for clients. The market fit for these innovations is exceptionally high, particularly among large corporations seeking to optimize their facilities and reduce operating expenses.

Report Segmentation & Scope

This comprehensive report segments the Integrated Facility Management market across key dimensions to provide detailed insights. The segmentation by Type includes Hard FM, encompassing critical services such as HVAC maintenance, electrical repairs, plumbing, and building security systems, and Soft FM, which covers services like catering, cleaning, waste management, pest control, and front-of-house operations. The segmentation by End-User spans across Public/Infrastructure, Commercial, Industrial, Institutional, and Other End-Users. Each segment is subjected to rigorous analysis, providing detailed insights into market size, growth projections, and the prevailing competitive landscape. Projections indicate that Hard FM services are expected to reach $XX Million by 2033, while Soft FM services are anticipated to grow to $XX Million, largely propelled by the escalating demand for enhanced workplace experiences. The Commercial sector is projected to maintain its leading market position throughout the forecast period.

Key Drivers of Integrated Facility Management Market Growth

Several key factors fuel the growth of the Integrated Facility Management market. Technological advancements, such as IoT sensors and AI-powered predictive maintenance, enhance efficiency and reduce costs. Stringent environmental regulations push for sustainable facility management practices, creating demand for energy-efficient solutions. Economic growth, particularly in emerging markets, leads to increased construction activity and a higher demand for integrated facilities management. For example, the recent Amazon data center development in Chile (USD 205 Million investment) significantly boosts the demand for hard facility management services.

Challenges in the Integrated Facility Management Market Sector

The Integrated Facility Management market faces challenges, including regulatory complexities around data privacy and sustainability compliance. Supply chain disruptions can impact the availability of essential materials and equipment, leading to project delays and increased costs. Intense competition among established players and new entrants creates pressure on pricing and profit margins, necessitating continuous innovation and cost optimization. These challenges, if not properly addressed, can affect the overall market growth trajectory. For instance, potential supply chain bottlenecks resulting in equipment shortages could increase project costs by an estimated xx% in 2026.

Leading Players in the Integrated Facility Management Market Market

- Cushman & Wakefield

- CBM Qatar LLC

- CBRE Group Inc

- ISS Facility Service

- Sodexo Inc

- Facilicom

- Jones Lang LaSalle IP Inc

- AHI Facility Services Inc

- Compass Group PLC

- EMCOR Facility Services

Key Developments in Integrated Facility Management Market Sector

- January 2024: Egyptian developer LMD signed a facility management agreement with Imdaad-Misr, marking Imdaad-Misr's entry into the Egyptian market and boosting the demand for integrated FM services.

- January 2024: Amazon Web Services (AWS) approved for a USD 205 Million data center project in Chile, significantly increasing the demand for hard facility management services. This project's completion by April 2025 will create significant short-term demand, with further expansion planned for 2028.

Strategic Integrated Facility Management Market Market Outlook

The Integrated Facility Management market presents a strong growth outlook, driven by technological innovation, increasing urbanization, and a growing emphasis on sustainability. Strategic opportunities lie in developing data-driven solutions, embracing smart building technologies, and expanding into emerging markets. Companies focusing on integrated, end-to-end solutions and leveraging advanced technologies will be best positioned to capitalize on this growth. The market's future hinges on the continued adoption of sustainable practices and the seamless integration of technology across facility management operations.

Integrated Facility Management Market Segmentation

-

1. Type

- 1.1. Hard FM

- 1.2. Soft FM

-

2. End -User

- 2.1. Public/Infrastructure

- 2.2. Commercial

- 2.3. Industrial

- 2.4. Institutional

- 2.5. Other End-Users

Integrated Facility Management Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Australia and new Zealand

Integrated Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.08% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rebounding Commercial Activity Expected to Drive Growth; Emphasis on Green and Sustainable Building Practices

- 3.3. Market Restrains

- 3.3.1. High Installation Costs Coupled with Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Commercial Segment to be the Largest End-user Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Integrated Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hard FM

- 5.1.2. Soft FM

- 5.2. Market Analysis, Insights and Forecast - by End -User

- 5.2.1. Public/Infrastructure

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.2.4. Institutional

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Australia and new Zealand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Integrated Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hard FM

- 6.1.2. Soft FM

- 6.2. Market Analysis, Insights and Forecast - by End -User

- 6.2.1. Public/Infrastructure

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.2.4. Institutional

- 6.2.5. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Integrated Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hard FM

- 7.1.2. Soft FM

- 7.2. Market Analysis, Insights and Forecast - by End -User

- 7.2.1. Public/Infrastructure

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.2.4. Institutional

- 7.2.5. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Integrated Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hard FM

- 8.1.2. Soft FM

- 8.2. Market Analysis, Insights and Forecast - by End -User

- 8.2.1. Public/Infrastructure

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.2.4. Institutional

- 8.2.5. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Integrated Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hard FM

- 9.1.2. Soft FM

- 9.2. Market Analysis, Insights and Forecast - by End -User

- 9.2.1. Public/Infrastructure

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.2.4. Institutional

- 9.2.5. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Australia and new Zealand Integrated Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hard FM

- 10.1.2. Soft FM

- 10.2. Market Analysis, Insights and Forecast - by End -User

- 10.2.1. Public/Infrastructure

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.2.4. Institutional

- 10.2.5. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Integrated Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Integrated Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Integrated Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Integrated Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and new Zealand Integrated Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Cushman & Wakefield

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 CBM Qatar LLC *List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 CBRE Group Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 ISS Facility Service

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Sodexo Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Facilicom

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Jones Lang LaSalle IP Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 AHI Facility Services Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Compass Group PLC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 EMCOR Facility Services

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Cushman & Wakefield

List of Figures

- Figure 1: Global Integrated Facility Management Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Integrated Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Integrated Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Integrated Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Integrated Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Integrated Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Integrated Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Integrated Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Integrated Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Australia and new Zealand Integrated Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Australia and new Zealand Integrated Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Integrated Facility Management Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Integrated Facility Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Integrated Facility Management Market Revenue (Million), by End -User 2024 & 2032

- Figure 15: North America Integrated Facility Management Market Revenue Share (%), by End -User 2024 & 2032

- Figure 16: North America Integrated Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Integrated Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Integrated Facility Management Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Integrated Facility Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Integrated Facility Management Market Revenue (Million), by End -User 2024 & 2032

- Figure 21: Europe Integrated Facility Management Market Revenue Share (%), by End -User 2024 & 2032

- Figure 22: Europe Integrated Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Integrated Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Integrated Facility Management Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Integrated Facility Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Integrated Facility Management Market Revenue (Million), by End -User 2024 & 2032

- Figure 27: Asia Integrated Facility Management Market Revenue Share (%), by End -User 2024 & 2032

- Figure 28: Asia Integrated Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Integrated Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Integrated Facility Management Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America Integrated Facility Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America Integrated Facility Management Market Revenue (Million), by End -User 2024 & 2032

- Figure 33: Latin America Integrated Facility Management Market Revenue Share (%), by End -User 2024 & 2032

- Figure 34: Latin America Integrated Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Integrated Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Australia and new Zealand Integrated Facility Management Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Australia and new Zealand Integrated Facility Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Australia and new Zealand Integrated Facility Management Market Revenue (Million), by End -User 2024 & 2032

- Figure 39: Australia and new Zealand Integrated Facility Management Market Revenue Share (%), by End -User 2024 & 2032

- Figure 40: Australia and new Zealand Integrated Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Australia and new Zealand Integrated Facility Management Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Integrated Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Integrated Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Integrated Facility Management Market Revenue Million Forecast, by End -User 2019 & 2032

- Table 4: Global Integrated Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Integrated Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Integrated Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Integrated Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Integrated Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Integrated Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Integrated Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Integrated Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Integrated Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Integrated Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Integrated Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Integrated Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Integrated Facility Management Market Revenue Million Forecast, by End -User 2019 & 2032

- Table 17: Global Integrated Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Integrated Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Integrated Facility Management Market Revenue Million Forecast, by End -User 2019 & 2032

- Table 20: Global Integrated Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Integrated Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Integrated Facility Management Market Revenue Million Forecast, by End -User 2019 & 2032

- Table 23: Global Integrated Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Integrated Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Integrated Facility Management Market Revenue Million Forecast, by End -User 2019 & 2032

- Table 26: Global Integrated Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Integrated Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Integrated Facility Management Market Revenue Million Forecast, by End -User 2019 & 2032

- Table 29: Global Integrated Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Integrated Facility Management Market?

The projected CAGR is approximately 7.08%.

2. Which companies are prominent players in the Integrated Facility Management Market?

Key companies in the market include Cushman & Wakefield, CBM Qatar LLC *List Not Exhaustive, CBRE Group Inc, ISS Facility Service, Sodexo Inc, Facilicom, Jones Lang LaSalle IP Inc, AHI Facility Services Inc, Compass Group PLC, EMCOR Facility Services.

3. What are the main segments of the Integrated Facility Management Market?

The market segments include Type, End -User.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Rebounding Commercial Activity Expected to Drive Growth; Emphasis on Green and Sustainable Building Practices.

6. What are the notable trends driving market growth?

Commercial Segment to be the Largest End-user Segment.

7. Are there any restraints impacting market growth?

High Installation Costs Coupled with Maintenance Costs.

8. Can you provide examples of recent developments in the market?

January 2024 - Egyptian developer LMD signed a facility management advisory and services agreement with Imdaad-Misr, the Egyptian subsidiary of UAE-based integrated facility management company Imdaad, for two projects. With the agreement, Imdaad-Misr will mark its entry into Egypt, involving the hard and soft integrated FM services for LMD's villas-only project Stei8ht in New Cairo and ZOYA Ghazala Bay at Sidi Abdelrahman on the North Coast. Further, Imdaad-Misr will render facility management advisory services during the two projects' initial design and development phases. Such developments are propelling the market growth in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Integrated Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Integrated Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Integrated Facility Management Market?

To stay informed about further developments, trends, and reports in the Integrated Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence