Key Insights

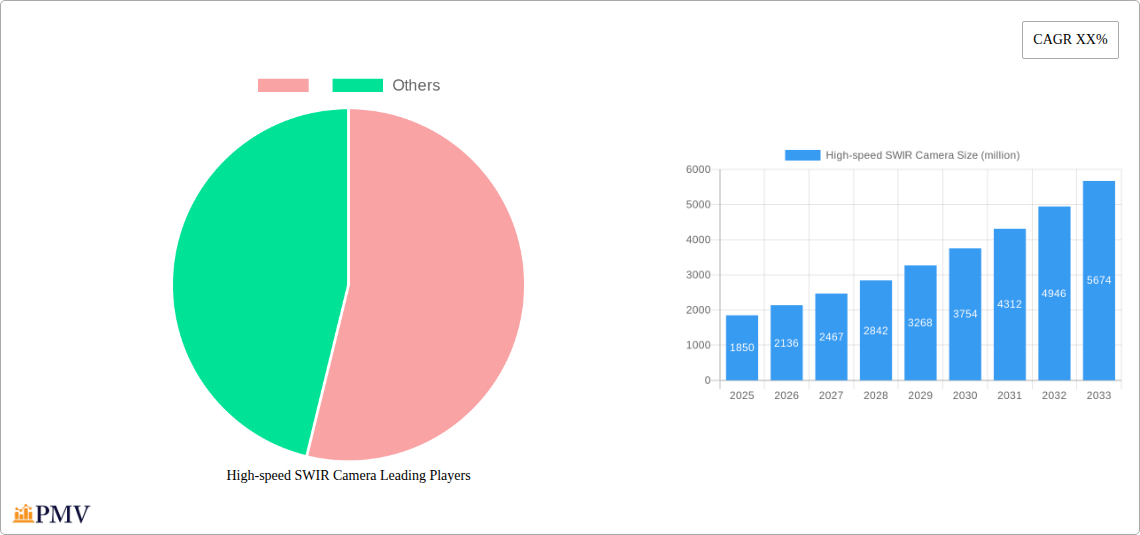

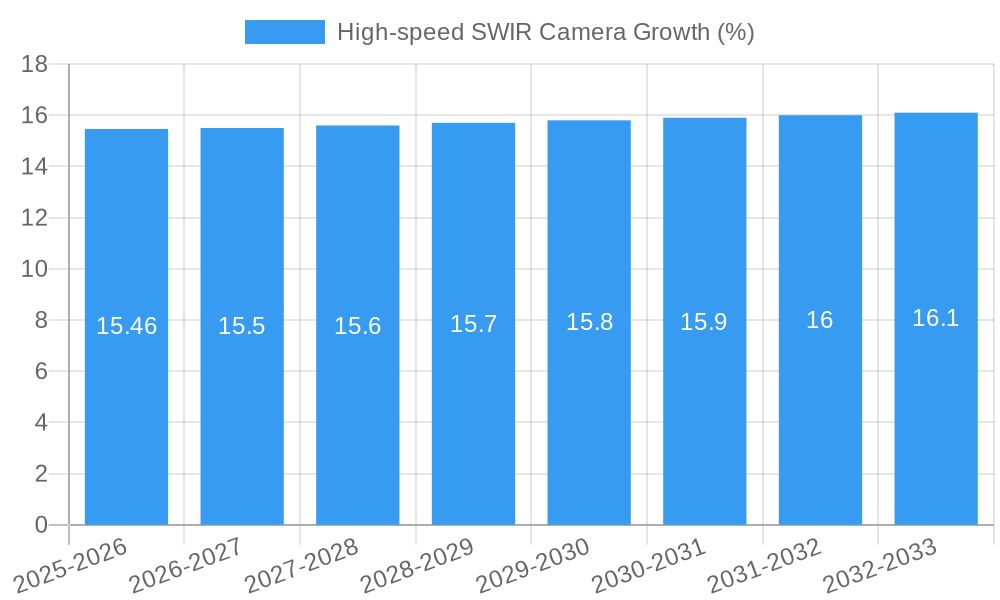

The High-speed SWIR Camera market is poised for significant expansion, projected to reach an estimated $1,850 million by the end of 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 15.5% anticipated over the forecast period from 2025 to 2033. This remarkable growth is underpinned by a confluence of powerful drivers, most notably the escalating demand for enhanced imaging capabilities across diverse industrial sectors. The increasing adoption of SWIR (Short-Wave Infrared) technology in applications such as industrial inspection and quality control, where it enables the detection of subtle material defects and impurities invisible to the human eye or standard visible light cameras, is a primary catalyst. Furthermore, advancements in agriculture and food processing are leveraging SWIR for rapid quality assessment, spoilage detection, and ripeness monitoring, contributing substantially to market momentum. The pharmaceutical and medical imaging sectors are also witnessing a surge in demand for high-speed SWIR cameras for applications like disease diagnosis and surgical guidance, further propelling market expansion.

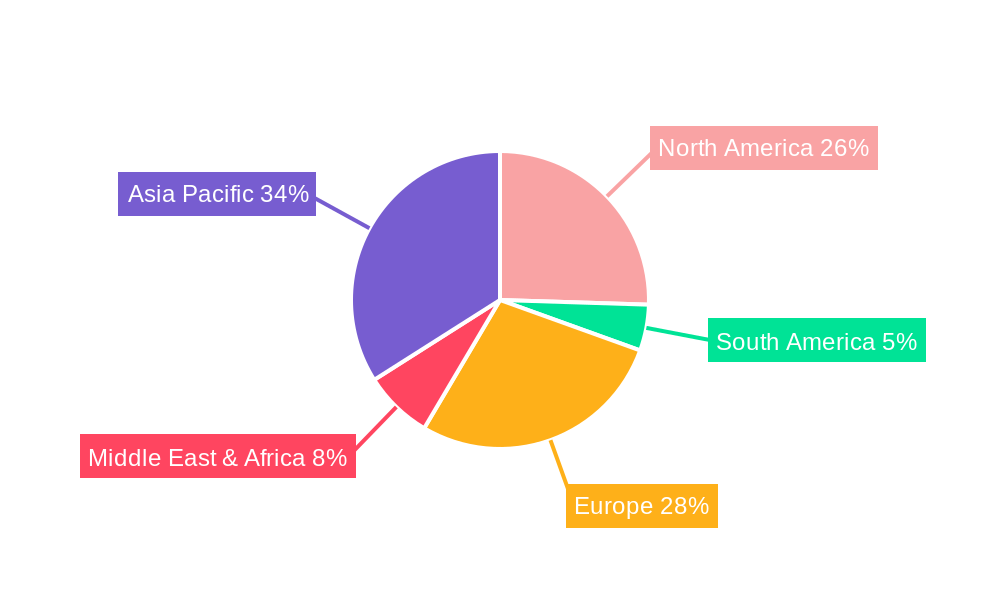

The market's trajectory is further bolstered by the growing need for precision and efficiency in semiconductor and electronics inspection, where SWIR imaging facilitates the identification of micro-defects and structural anomalies. Remote sensing and environmental monitoring applications, including water resource management and pollution detection, are also benefiting from the unique capabilities of SWIR technology. While the market presents immense opportunities, certain restraints, such as the initial high cost of advanced SWIR camera systems and the need for specialized expertise for operation and data interpretation, could temper growth to a degree. However, ongoing technological innovations, including improvements in sensor sensitivity, frame rates, and miniaturization, coupled with increasing market penetration and economies of scale, are expected to mitigate these challenges. The Asia Pacific region is anticipated to lead the market in terms of both consumption and growth, driven by rapid industrialization and significant investments in advanced manufacturing and technology across countries like China and India.

This in-depth report provides a detailed analysis of the high-speed SWIR camera market, offering critical insights for stakeholders across various industries. The study meticulously examines the market's structure, competitive landscape, emerging trends, technological advancements, and growth projections from 2019 to 2033, with a base and estimated year of 2025. We delve into the intricate dynamics of this rapidly evolving sector, equipping you with actionable intelligence to navigate its complexities and capitalize on future opportunities.

High-speed SWIR Camera Market Structure & Competitive Dynamics

The high-speed SWIR camera market exhibits a dynamic and moderately concentrated structure, with several key players vying for market dominance. Innovation plays a pivotal role, fueled by a robust ecosystem of research institutions and technology developers focused on enhancing camera performance, sensitivity, and spectral range. Regulatory frameworks, particularly concerning data privacy and industrial safety standards, are influencing product development and market entry. The market is characterized by a low threat of product substitutes due to the unique capabilities of SWIR imaging in detecting invisible features. End-user trends are increasingly driven by the demand for real-time defect detection, process optimization, and enhanced imaging capabilities in challenging environments. Merger and acquisition (M&A) activities are a strategic tool for market consolidation and technological integration. Key M&A deals collectively represent billions of dollars in market value, indicating a strong consolidation trend. Market share distribution is constantly shifting as companies introduce novel technologies and expand their application reach. The competitive landscape is shaped by a balance of established players and emerging innovators, each contributing to the market's overall growth and diversification.

High-speed SWIR Camera Industry Trends & Insights

The high-speed SWIR camera industry is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 15.5% during the forecast period of 2025–2033. This expansion is primarily driven by the escalating demand for advanced imaging solutions in critical industrial and scientific applications. Technological disruptions, particularly in detector technology and miniaturization, are enabling higher frame rates, improved sensitivity, and more compact camera designs, making high-speed SWIR cameras accessible for a wider range of applications. Consumer preferences are leaning towards solutions that offer enhanced accuracy, real-time data acquisition, and seamless integration into existing workflows. The competitive dynamics are intensifying, with companies investing heavily in research and development to differentiate their product offerings and capture market share. Market penetration is steadily increasing across various sectors, as the unique advantages of SWIR imaging, such as its ability to see through haze, fog, and smoke, and to identify materials based on their spectral signatures, become more widely recognized. The growing adoption of automation and Industry 4.0 principles further fuels the demand for sophisticated imaging systems. The market is also influenced by evolving environmental regulations and the increasing need for non-destructive testing and quality control methods.

Dominant Markets & Segments in High-speed SWIR Camera

The high-speed SWIR camera market is experiencing significant growth across multiple key application segments and type categories.

Dominant Application Segments:

- Semiconductor and Electronics Inspection: This segment holds a leading position due to the critical need for high-resolution, high-speed imaging to detect defects, anomalies, and material compositions during semiconductor manufacturing and electronics assembly. The pursuit of smaller, more intricate components necessitates SWIR's ability to penetrate packaging and inspect internal structures, driving substantial market demand. Economic policies supporting advanced manufacturing and technological innovation within this sector are significant drivers.

- Industrial Inspection and Quality Control: Broadly encompassing various manufacturing processes, this segment benefits from SWIR's capability to identify surface defects, assess material uniformity, and perform non-destructive testing in real-time. The drive for improved product quality and reduced manufacturing waste propels the adoption of these advanced cameras. Investments in industrial automation and smart factory initiatives are key infrastructural drivers.

- Pharmaceuticals and Medical Imaging: SWIR imaging is gaining traction for applications like drug inspection, wound analysis, and surgical guidance due to its ability to differentiate between various organic and inorganic materials. The increasing focus on patient safety and diagnostic accuracy is a major growth accelerator. Regulatory approvals for medical imaging devices play a crucial role in market expansion.

- Defense and Aerospace: SWIR technology's resilience to adverse weather conditions and its capability for target identification and surveillance make it indispensable in defense and aerospace applications. The continuous need for advanced surveillance and reconnaissance systems fuels significant demand. Government procurement policies and defense modernization programs are vital.

- Agriculture and Food Processing: SWIR cameras are increasingly used for crop health monitoring, ripeness assessment, and food quality control, enabling precision agriculture and reducing food spoilage. The growing global population and the demand for sustainable food production are key drivers.

- Remote Sensing and Environmental Monitoring: SWIR's ability to detect subtle spectral changes makes it invaluable for monitoring vegetation health, water quality, and atmospheric conditions. The increasing global focus on climate change and environmental protection supports market growth.

- Security and Surveillance: Applications range from night vision and border surveillance to counterfeit detection, leveraging SWIR's ability to see in low-light and identify materials invisible to the naked eye.

- Research and Scientific Imaging: This segment benefits from SWIR's unique spectral properties for various scientific investigations, including materials science and chemical analysis.

- Others: This category encompasses emerging applications and niche markets where SWIR technology offers specific advantages.

Dominant Camera Types:

- SWIR Area Scan Camera: These cameras are prevalent across most industrial and scientific applications, offering a full 2D field of view for detailed inspection and analysis. Their versatility makes them a cornerstone of the market.

- SWIR Line Scan SWIR Camera: Essential for high-speed, continuous inspection of moving objects or surfaces, line scan cameras are critical in applications like web inspection and high-throughput manufacturing processes.

The dominance of specific regions is influenced by the concentration of manufacturing hubs, research institutions, and government investments in advanced technologies.

High-speed SWIR Camera Product Innovations

Recent product innovations in the high-speed SWIR camera market focus on enhanced resolution, increased sensitivity, broader spectral coverage, and faster frame rates, often achieved through advanced InGaAs sensor technology. These advancements enable superior defect detection in semiconductor manufacturing, more precise material sorting in agriculture, and clearer imaging in challenging environmental conditions for remote sensing. Key competitive advantages stem from miniaturization, improved thermal management, and integrated data processing capabilities, making these cameras more versatile and user-friendly for applications in industrial inspection, medical imaging, and security surveillance.

Report Segmentation & Scope

This report segments the high-speed SWIR camera market based on key application areas and camera types.

- Application Segments: Industrial Inspection and Quality Control, Agriculture and Food Processing, Pharmaceuticals and Medical Imaging, Semiconductor and Electronics Inspection, Remote Sensing and Environmental Monitoring, Security and Surveillance, Research and Scientific Imaging, Defense and Aerospace, and Others. Each segment is analyzed for its specific growth projections, market sizes, and the unique competitive dynamics driving adoption.

- Camera Types: SWIR Area Scan Camera and SWIR Line Scan SWIR Camera. This segmentation explores the market share, technological evolution, and application-specific advantages of each camera type, along with their respective growth trajectories.

Key Drivers of High-speed SWIR Camera Growth

The growth of the high-speed SWIR camera market is propelled by several critical factors. Technological advancements in InGaAs sensor technology are enabling higher performance and lower costs. The increasing demand for automation and Industry 4.0 initiatives across manufacturing sectors necessitates real-time, non-destructive inspection capabilities. Stringent quality control regulations in industries like pharmaceuticals and automotive are driving the adoption of advanced imaging solutions. Furthermore, the growing need for effective surveillance and reconnaissance in defense and security applications, coupled with the expansion of remote sensing for environmental monitoring, significantly contributes to market expansion. The development of specialized SWIR imaging applications in medical diagnostics and scientific research also acts as a substantial growth accelerator.

Challenges in the High-speed SWIR Camera Sector

Despite its promising growth, the high-speed SWIR camera sector faces certain challenges. The high initial cost of advanced SWIR cameras can be a barrier to adoption for smaller enterprises and in cost-sensitive applications. Supply chain complexities for specialized components and manufacturing processes can lead to production lead times and potential disruptions. Intense competition among a growing number of players, including both established camera manufacturers and new entrants, puts pressure on pricing and profit margins. Furthermore, the need for specialized knowledge and skilled personnel for optimal implementation and data analysis can limit widespread adoption in some sectors. Regulatory hurdles, particularly in medical and defense applications, can also impact market entry and product development timelines.

Leading Players in the High-speed SWIR Camera Market

- Teledyne FLIR

- Xenics

- AMETEK Vision

- Fujifilm Corporation

- Excelitas Technologies

- Oryx Vision

- Princeton Instruments

- Headwall Photonics

- BAE Systems

- Huber + Suhner

- Jenoptik

- Admesy

- Kyndryl

- Sierra Nevada Corporation

Key Developments in High-speed SWIR Camera Sector

- 2024: Launch of next-generation high-speed SWIR cameras with improved pixel sensitivity and reduced noise, enabling enhanced imaging in low-light conditions.

- 2023: Significant advancements in SWIR sensor technology, leading to smaller form factors and lower power consumption for portable applications.

- 2023: Increased adoption of SWIR cameras in the semiconductor industry for advanced defect detection in wafer fabrication.

- 2022: Strategic partnerships formed between SWIR camera manufacturers and AI/machine learning solution providers to enhance automated inspection capabilities.

- 2021: Expansion of SWIR applications in the pharmaceutical sector for drug inspection and quality control.

- 2020: Introduction of SWIR line scan cameras with unprecedented line rates for high-throughput industrial inspection.

- 2019: Growing investment in research and development for SWIR imaging in medical diagnostics and surgical assistance.

Strategic High-speed SWIR Camera Market Outlook

- 2024: Launch of next-generation high-speed SWIR cameras with improved pixel sensitivity and reduced noise, enabling enhanced imaging in low-light conditions.

- 2023: Significant advancements in SWIR sensor technology, leading to smaller form factors and lower power consumption for portable applications.

- 2023: Increased adoption of SWIR cameras in the semiconductor industry for advanced defect detection in wafer fabrication.

- 2022: Strategic partnerships formed between SWIR camera manufacturers and AI/machine learning solution providers to enhance automated inspection capabilities.

- 2021: Expansion of SWIR applications in the pharmaceutical sector for drug inspection and quality control.

- 2020: Introduction of SWIR line scan cameras with unprecedented line rates for high-throughput industrial inspection.

- 2019: Growing investment in research and development for SWIR imaging in medical diagnostics and surgical assistance.

Strategic High-speed SWIR Camera Market Outlook

The strategic outlook for the high-speed SWIR camera market is exceptionally positive, driven by continuous technological innovation and expanding application horizons. Future growth will be accelerated by the integration of artificial intelligence and machine learning for advanced data analysis and automated decision-making. The increasing demand for predictive maintenance and condition monitoring in industrial settings will further boost adoption. Expansion into emerging markets and the development of cost-effective solutions will broaden market reach. Strategic opportunities lie in leveraging SWIR technology for novel applications in sustainability, advanced manufacturing, and personalized medicine, ensuring sustained growth and market leadership for innovative players.

High-speed SWIR Camera Segmentation

-

1. Application

- 1.1. Industrial Inspection and Quality Control

- 1.2. Agriculture and Food Processing

- 1.3. Pharmaceuticals and Medical Imaging

- 1.4. Semiconductor and Electronics Inspection

- 1.5. Remote Sensing and Environmental Monitoring

- 1.6. Security and Surveillance

- 1.7. Research and Scientific Imaging

- 1.8. Defense and Aerospace

- 1.9. Others

-

2. Types

- 2.1. SWIR Area Scan Camera

- 2.2. SWIR Line Scan SWIR Camera

High-speed SWIR Camera Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High-speed SWIR Camera REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High-speed SWIR Camera Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industrial Inspection and Quality Control

- 5.1.2. Agriculture and Food Processing

- 5.1.3. Pharmaceuticals and Medical Imaging

- 5.1.4. Semiconductor and Electronics Inspection

- 5.1.5. Remote Sensing and Environmental Monitoring

- 5.1.6. Security and Surveillance

- 5.1.7. Research and Scientific Imaging

- 5.1.8. Defense and Aerospace

- 5.1.9. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. SWIR Area Scan Camera

- 5.2.2. SWIR Line Scan SWIR Camera

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High-speed SWIR Camera Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Industrial Inspection and Quality Control

- 6.1.2. Agriculture and Food Processing

- 6.1.3. Pharmaceuticals and Medical Imaging

- 6.1.4. Semiconductor and Electronics Inspection

- 6.1.5. Remote Sensing and Environmental Monitoring

- 6.1.6. Security and Surveillance

- 6.1.7. Research and Scientific Imaging

- 6.1.8. Defense and Aerospace

- 6.1.9. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. SWIR Area Scan Camera

- 6.2.2. SWIR Line Scan SWIR Camera

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America High-speed SWIR Camera Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Industrial Inspection and Quality Control

- 7.1.2. Agriculture and Food Processing

- 7.1.3. Pharmaceuticals and Medical Imaging

- 7.1.4. Semiconductor and Electronics Inspection

- 7.1.5. Remote Sensing and Environmental Monitoring

- 7.1.6. Security and Surveillance

- 7.1.7. Research and Scientific Imaging

- 7.1.8. Defense and Aerospace

- 7.1.9. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. SWIR Area Scan Camera

- 7.2.2. SWIR Line Scan SWIR Camera

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe High-speed SWIR Camera Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Industrial Inspection and Quality Control

- 8.1.2. Agriculture and Food Processing

- 8.1.3. Pharmaceuticals and Medical Imaging

- 8.1.4. Semiconductor and Electronics Inspection

- 8.1.5. Remote Sensing and Environmental Monitoring

- 8.1.6. Security and Surveillance

- 8.1.7. Research and Scientific Imaging

- 8.1.8. Defense and Aerospace

- 8.1.9. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. SWIR Area Scan Camera

- 8.2.2. SWIR Line Scan SWIR Camera

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa High-speed SWIR Camera Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Industrial Inspection and Quality Control

- 9.1.2. Agriculture and Food Processing

- 9.1.3. Pharmaceuticals and Medical Imaging

- 9.1.4. Semiconductor and Electronics Inspection

- 9.1.5. Remote Sensing and Environmental Monitoring

- 9.1.6. Security and Surveillance

- 9.1.7. Research and Scientific Imaging

- 9.1.8. Defense and Aerospace

- 9.1.9. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. SWIR Area Scan Camera

- 9.2.2. SWIR Line Scan SWIR Camera

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific High-speed SWIR Camera Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Industrial Inspection and Quality Control

- 10.1.2. Agriculture and Food Processing

- 10.1.3. Pharmaceuticals and Medical Imaging

- 10.1.4. Semiconductor and Electronics Inspection

- 10.1.5. Remote Sensing and Environmental Monitoring

- 10.1.6. Security and Surveillance

- 10.1.7. Research and Scientific Imaging

- 10.1.8. Defense and Aerospace

- 10.1.9. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. SWIR Area Scan Camera

- 10.2.2. SWIR Line Scan SWIR Camera

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

List of Figures

- Figure 1: Global High-speed SWIR Camera Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America High-speed SWIR Camera Revenue (million), by Application 2024 & 2032

- Figure 3: North America High-speed SWIR Camera Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America High-speed SWIR Camera Revenue (million), by Types 2024 & 2032

- Figure 5: North America High-speed SWIR Camera Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America High-speed SWIR Camera Revenue (million), by Country 2024 & 2032

- Figure 7: North America High-speed SWIR Camera Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America High-speed SWIR Camera Revenue (million), by Application 2024 & 2032

- Figure 9: South America High-speed SWIR Camera Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America High-speed SWIR Camera Revenue (million), by Types 2024 & 2032

- Figure 11: South America High-speed SWIR Camera Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America High-speed SWIR Camera Revenue (million), by Country 2024 & 2032

- Figure 13: South America High-speed SWIR Camera Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe High-speed SWIR Camera Revenue (million), by Application 2024 & 2032

- Figure 15: Europe High-speed SWIR Camera Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe High-speed SWIR Camera Revenue (million), by Types 2024 & 2032

- Figure 17: Europe High-speed SWIR Camera Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe High-speed SWIR Camera Revenue (million), by Country 2024 & 2032

- Figure 19: Europe High-speed SWIR Camera Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa High-speed SWIR Camera Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa High-speed SWIR Camera Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa High-speed SWIR Camera Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa High-speed SWIR Camera Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa High-speed SWIR Camera Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa High-speed SWIR Camera Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High-speed SWIR Camera Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific High-speed SWIR Camera Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific High-speed SWIR Camera Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific High-speed SWIR Camera Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific High-speed SWIR Camera Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific High-speed SWIR Camera Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global High-speed SWIR Camera Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global High-speed SWIR Camera Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global High-speed SWIR Camera Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global High-speed SWIR Camera Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global High-speed SWIR Camera Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global High-speed SWIR Camera Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global High-speed SWIR Camera Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global High-speed SWIR Camera Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global High-speed SWIR Camera Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global High-speed SWIR Camera Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global High-speed SWIR Camera Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global High-speed SWIR Camera Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global High-speed SWIR Camera Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global High-speed SWIR Camera Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global High-speed SWIR Camera Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global High-speed SWIR Camera Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global High-speed SWIR Camera Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global High-speed SWIR Camera Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global High-speed SWIR Camera Revenue million Forecast, by Country 2019 & 2032

- Table 41: China High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific High-speed SWIR Camera Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High-speed SWIR Camera?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the High-speed SWIR Camera?

Key companies in the market include N/A.

3. What are the main segments of the High-speed SWIR Camera?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High-speed SWIR Camera," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High-speed SWIR Camera report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High-speed SWIR Camera?

To stay informed about further developments, trends, and reports in the High-speed SWIR Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence