Key Insights

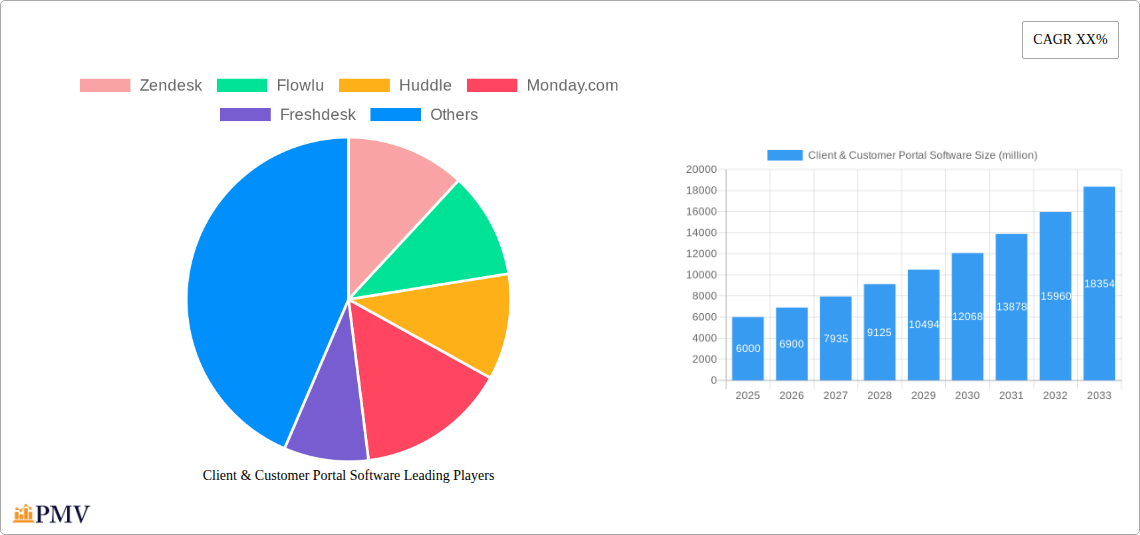

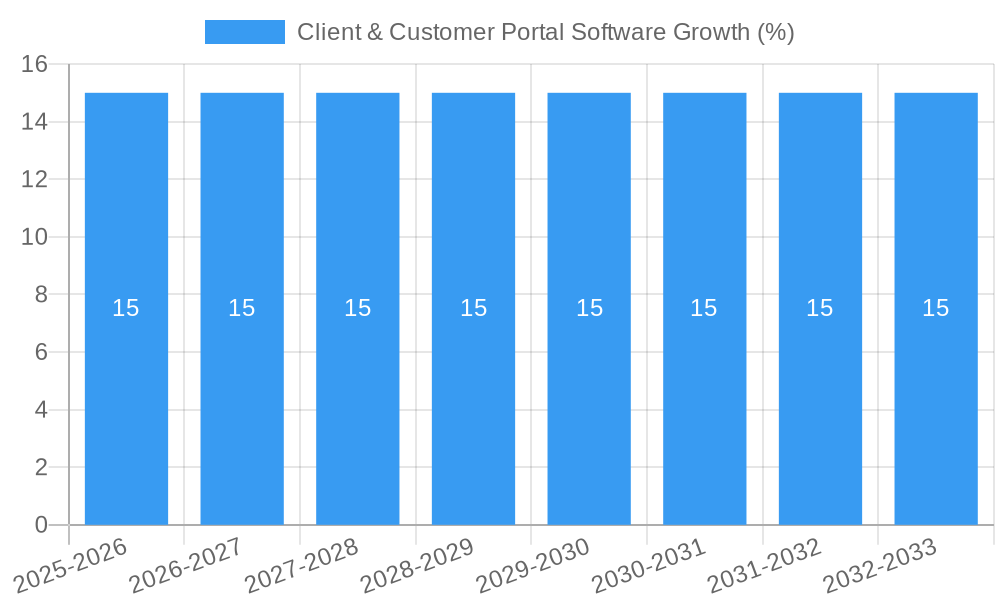

The global Client & Customer Portal Software market is projected for substantial growth, estimated to reach a market size of approximately $6,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 15%. This expansion is fueled by an increasing demand for enhanced customer engagement and streamlined business operations across various industries. Small and Medium Enterprises (SMEs) represent a significant segment, actively seeking cost-effective and efficient solutions to manage client interactions and support. Large enterprises, on the other hand, are leveraging these platforms to improve scalability, offer advanced self-service options, and foster stronger customer loyalty. The rising adoption of cloud-based solutions, driven by their flexibility, accessibility, and lower upfront costs, is a dominant trend shaping the market. However, the significant upfront investment required for robust on-premises implementations and the persistent concerns around data security and privacy for some organizations act as notable restraints. The competitive landscape is characterized by a blend of established players and emerging innovators, all vying to capture market share through feature-rich offerings and tailored solutions.

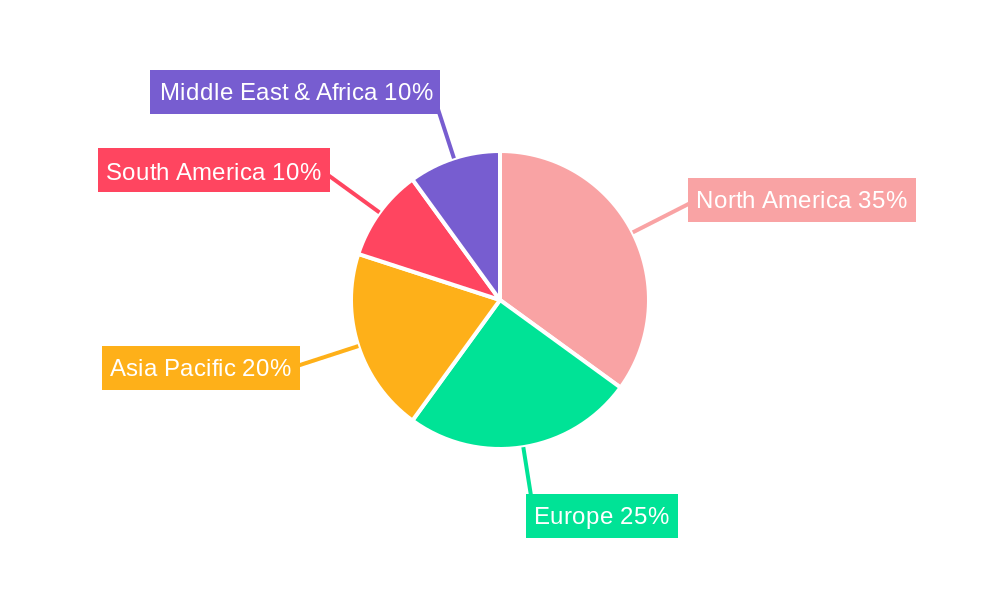

The market's trajectory is further influenced by several key trends. The integration of artificial intelligence (AI) and machine learning (ML) is becoming paramount, enabling intelligent automation of customer support, personalized user experiences, and predictive analytics. The proliferation of mobile-first strategies is also driving demand for responsive and mobile-compatible portal solutions. Geographically, North America currently leads the market, driven by early adoption of digital technologies and a strong presence of large enterprises. Asia Pacific, however, is anticipated to exhibit the highest growth rate, propelled by rapid digitalization, a burgeoning SME sector, and increasing internet penetration. As businesses globally recognize the critical role of exceptional client and customer service in achieving competitive advantage, the demand for sophisticated and intuitive portal software is expected to continue its upward climb throughout the forecast period.

This comprehensive report delves into the intricate landscape of the Client & Customer Portal Software market, offering deep insights into its structure, competitive dynamics, trends, and future outlook. Covering a study period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, this report provides a detailed forecast from 2025 to 2033, leveraging historical data from 2019 to 2024. We examine key players such as Zendesk, Flowlu, Huddle, Monday.com, Freshdesk, SuiteDash, Zoho Creator, HappyFox, SupportBee, AzureDesk, Accelo, MangoApps, and SuiteDash. The report segments the market by application, including SMEs and Large Enterprises, and by type, encompassing Cloud-based and On-premises solutions. We also analyze industry developments to provide a holistic view of this rapidly evolving sector.

Client & Customer Portal Software Market Structure & Competitive Dynamics

The Client & Customer Portal Software market exhibits a moderately concentrated structure, with key players like Zendesk, Freshdesk, and Monday.com holding significant market share, estimated to be over $2,000 million collectively. The innovation ecosystem is driven by continuous advancements in cloud technology, AI-powered customer service, and integration capabilities. Regulatory frameworks, particularly concerning data privacy and security (e.g., GDPR, CCPA), are increasingly influencing product development and market entry, with compliance costs estimated to be in the range of $100 million to $200 million annually for larger enterprises. Product substitutes, including traditional email support and basic CRM functionalities, are present but are increasingly being outmaneuvered by the comprehensive features offered by dedicated portal solutions. End-user trends highlight a growing demand for self-service options, personalized communication, and seamless integration with existing business tools, contributing to a projected user adoption rate of 70% by 2030. Mergers and acquisitions (M&A) activities are a notable aspect of the market's competitive dynamics. Recent M&A deals, such as potential acquisitions in the SMB segment, have been valued between $50 million and $500 million, indicating consolidation and strategic expansion efforts.

- Market Concentration: Dominated by a few key players, with emerging startups focusing on niche solutions.

- Innovation Ecosystem: Strong emphasis on AI, automation, and enhanced user experience.

- Regulatory Frameworks: Growing influence of data privacy and security regulations.

- Product Substitutes: Traditional support channels, but diminishing relevance for advanced needs.

- End-User Trends: Demand for self-service, personalization, and integration.

- M&A Activities: Strategic acquisitions to expand product portfolios and market reach, with deal values ranging from $50 million to $500 million.

Client & Customer Portal Software Industry Trends & Insights

The Client & Customer Portal Software industry is experiencing robust growth, fueled by a confluence of technological advancements, evolving customer expectations, and the imperative for businesses to enhance client relationships. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% during the forecast period, reaching an estimated market size of over $15,000 million by 2033. A primary growth driver is the increasing adoption of cloud-based solutions, offering scalability, accessibility, and cost-effectiveness for businesses of all sizes. This shift is exemplified by the migration of a significant portion of SMEs towards cloud-based portal solutions, estimated at over 80% by 2028. Technological disruptions, including the integration of Artificial Intelligence (AI) and Machine Learning (ML) for personalized support, automated responses, and predictive analytics, are transforming the user experience and operational efficiency of customer portals. AI-powered chatbots and intelligent knowledge bases are becoming standard features, leading to a reduction in customer support resolution times by an average of 30%. Consumer preferences are increasingly leaning towards self-service options, where clients can access information, manage their accounts, and track progress without direct human intervention. This trend is supported by the growing digital savviness of the global population. The competitive dynamics are characterized by a focus on offering feature-rich platforms with seamless integrations, intuitive user interfaces, and robust security protocols. Companies are investing heavily in R&D to differentiate their offerings, with a substantial portion of their revenue, estimated at 10-15%, allocated to innovation. The rise of remote work and distributed teams has further amplified the need for accessible and collaborative client interaction platforms, making customer portals indispensable for maintaining strong business relationships in a globalized marketplace. The market penetration of client and customer portal software is expected to reach over 65% of target businesses by the end of the forecast period.

Dominant Markets & Segments in Client & Customer Portal Software

The Client & Customer Portal Software market demonstrates significant dominance in North America, driven by a mature technology infrastructure, a high concentration of SMEs and Large Enterprises, and a strong emphasis on customer experience as a competitive differentiator. The United States, in particular, accounts for an estimated 45% of the global market share, supported by favorable economic policies that encourage digital transformation and significant investment in SaaS solutions.

Application Segment Dominance:

- SMEs: Small and Medium-sized Enterprises represent a rapidly growing segment, driven by the need for cost-effective, scalable, and user-friendly solutions to manage client interactions. The adoption rate among SMEs is projected to grow at a CAGR of 16% due to increasing awareness of the benefits of centralized client communication and support. Key drivers for SME adoption include affordability, ease of implementation, and the ability to compete with larger businesses by offering enhanced customer service.

- Large Enterprises: Large Enterprises, while already having higher adoption rates, continue to be a substantial market due to their complex operational needs and a greater focus on customer retention and loyalty. These organizations leverage portals for robust project management, secure document sharing, and comprehensive client onboarding processes. The market size for Large Enterprises is estimated to be over $8,000 million. Economic policies that incentivize technological investment and a higher budget allocation for IT infrastructure contribute to their sustained demand.

Type Segment Dominance:

- Cloud-based: Cloud-based solutions are the dominant type within the market, accounting for approximately 85% of all deployments. This dominance is attributed to their inherent scalability, flexibility, lower upfront costs, and the ability to access the portal from anywhere, anytime. The increasing reliability and security of cloud infrastructure, coupled with the growing preference for subscription-based software models, further propel cloud adoption. The market for cloud-based solutions is projected to reach over $12,000 million by 2033. Infrastructure development, including widespread internet connectivity and data center proliferation, is a critical enabling factor.

- On-premises: While less dominant, on-premises solutions remain relevant for organizations with stringent data security requirements or specific regulatory mandates that necessitate complete control over their IT environment. The market share for on-premises solutions is estimated to be around 15%. However, the higher implementation and maintenance costs, coupled with the inflexibility compared to cloud alternatives, are leading to a gradual decline in their market share, though a niche market will persist.

Client & Customer Portal Software Product Innovations

Recent product innovations in Client & Customer Portal Software are centered around enhancing user experience, automating workflows, and providing deeper analytical insights. Key advancements include AI-driven chatbots that offer 24/7 customer support and intelligent ticket routing, leading to faster resolution times. Enhanced collaboration features, such as real-time document co-editing and integrated communication tools, are streamlining client-provider interactions. Furthermore, sophisticated customization options allow businesses to tailor the portal's look, feel, and functionality to their specific brand identity and client needs. The integration of advanced analytics dashboards provides businesses with actionable data on client engagement, support trends, and service performance, enabling proactive improvements. These innovations are designed to foster greater client satisfaction and operational efficiency, with an estimated $500 million invested annually in R&D by leading vendors.

Report Segmentation & Scope

This report segments the Client & Customer Portal Software market into the following key categories for in-depth analysis:

- Application:

- SMEs: This segment encompasses small and medium-sized enterprises seeking affordable and agile solutions to manage client interactions, support, and project collaboration. Projections indicate a market size of over $5,000 million with a strong CAGR of 16%. Competitive dynamics involve vendors offering feature-rich, cost-effective packages tailored for this demographic.

- Large Enterprises: This segment focuses on large organizations with complex workflows, requiring robust security, extensive customization, and advanced integration capabilities for their client portal needs. The market size is estimated at over $10,000 million, with a CAGR of 14%. Key competitive factors include scalability, comprehensive feature sets, and strong enterprise-grade support.

- Types:

- Cloud-based: This segment includes software delivered via the internet, offering scalability, accessibility, and lower upfront costs. The market size is projected to exceed $12,000 million, with a CAGR of 15%. Competitive advantages lie in rapid deployment, automatic updates, and cost-efficiency.

- On-premises: This segment covers software installed and managed on a company's own servers, providing maximum control over data security and infrastructure. The market is estimated at approximately $3,000 million, with a slower CAGR of 8%. This segment appeals to organizations with stringent data sovereignty and security requirements.

Key Drivers of Client & Customer Portal Software Growth

The growth of the Client & Customer Portal Software market is primarily propelled by several key factors. Technologically, the pervasive adoption of cloud computing and the integration of Artificial Intelligence (AI) and Machine Learning (ML) are enabling more sophisticated, personalized, and efficient client interactions. Economically, businesses across all sectors are increasingly recognizing the ROI of enhanced customer satisfaction and retention, leading to greater investment in dedicated portal solutions. Regulatory factors, such as the growing emphasis on data privacy and compliance (e.g., GDPR, CCPA), are also driving demand for secure and auditable client portal platforms that offer transparent data handling. Furthermore, the global shift towards digital-first business models and the demand for seamless self-service options from customers are significant catalysts for market expansion.

Challenges in the Client & Customer Portal Software Sector

Despite its robust growth, the Client & Customer Portal Software sector faces several challenges. Integration complexity with existing legacy systems can pose a significant hurdle for some organizations, leading to extended implementation times and increased costs, estimated at $10,000 to $50,000 per integration. Data security and privacy concerns remain paramount, with breaches potentially leading to severe reputational damage and financial losses, requiring continuous investment in advanced security measures. Fierce competition among vendors, particularly in the crowded SMB segment, can lead to price wars and pressure on profit margins. Furthermore, the ongoing need for continuous innovation and feature development to keep pace with evolving customer expectations and technological advancements requires substantial R&D investment, which can be a strain on smaller vendors. The adoption curve for new technologies, like advanced AI features, can also be slow for less tech-savvy businesses.

Leading Players in the Client & Customer Portal Software Market

- Zendesk

- Flowlu

- Huddle

- Monday.com

- Freshdesk

- SuiteDash

- Zoho Creator

- HappyFox

- SupportBee

- AzureDesk

- Accelo

- MangoApps

Key Developments in Client & Customer Portal Software Sector

- 2023 Q4: Zendesk launches enhanced AI-powered analytics for customer insights.

- 2024 Q1: Freshdesk introduces advanced omnichannel support features for improved client communication.

- 2024 Q2: Monday.com expands its workflow automation capabilities within its client portal offering.

- 2024 Q3: SuiteDash announces deeper integration with popular CRM and marketing automation tools.

- 2024 Q4: Zoho Creator unveils a low-code platform for custom portal development, empowering SMEs.

- 2025 Q1: Accelo introduces enhanced project management and time-tracking features for service-based businesses.

- 2025 Q2: Huddle focuses on enterprise-grade security enhancements and compliance certifications.

Strategic Client & Customer Portal Software Market Outlook

The strategic outlook for the Client & Customer Portal Software market remains highly promising, driven by the ongoing digital transformation initiatives across industries and the escalating demand for streamlined client engagement solutions. Future growth accelerators include the continued advancement of AI and automation, leading to more intelligent and predictive client service capabilities. The increasing focus on personalized client experiences will further drive the adoption of customizable portal solutions. Furthermore, the expanding reach of cloud infrastructure globally and the growing acceptance of subscription-based software models will continue to democratize access to sophisticated portal functionalities, particularly for SMEs. Strategic opportunities lie in developing integrated platforms that offer a holistic view of the client journey, from initial contact to ongoing support and loyalty programs, thus fostering deeper, long-term client relationships.

Client & Customer Portal Software Segmentation

-

1. Application

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. Types

- 2.1. Cloud-based

- 2.2. On-premises

Client & Customer Portal Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Client & Customer Portal Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Client & Customer Portal Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud-based

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Client & Customer Portal Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. SMEs

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud-based

- 6.2.2. On-premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Client & Customer Portal Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. SMEs

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud-based

- 7.2.2. On-premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Client & Customer Portal Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. SMEs

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud-based

- 8.2.2. On-premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Client & Customer Portal Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. SMEs

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud-based

- 9.2.2. On-premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Client & Customer Portal Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. SMEs

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud-based

- 10.2.2. On-premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Zendesk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flowlu

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Huddle

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Monday.com

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Freshdesk

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SuiteDash

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zoho Creator

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Portal

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HappyFox

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SupportBee

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AzureDesk

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Accelo

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MangoApps

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 SuiteDash

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Zendesk

List of Figures

- Figure 1: Global Client & Customer Portal Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Client & Customer Portal Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Client & Customer Portal Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Client & Customer Portal Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Client & Customer Portal Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Client & Customer Portal Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Client & Customer Portal Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Client & Customer Portal Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Client & Customer Portal Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Client & Customer Portal Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Client & Customer Portal Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Client & Customer Portal Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Client & Customer Portal Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Client & Customer Portal Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Client & Customer Portal Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Client & Customer Portal Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Client & Customer Portal Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Client & Customer Portal Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Client & Customer Portal Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Client & Customer Portal Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Client & Customer Portal Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Client & Customer Portal Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Client & Customer Portal Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Client & Customer Portal Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Client & Customer Portal Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Client & Customer Portal Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Client & Customer Portal Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Client & Customer Portal Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Client & Customer Portal Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Client & Customer Portal Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Client & Customer Portal Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Client & Customer Portal Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Client & Customer Portal Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Client & Customer Portal Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Client & Customer Portal Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Client & Customer Portal Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Client & Customer Portal Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Client & Customer Portal Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Client & Customer Portal Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Client & Customer Portal Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Client & Customer Portal Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Client & Customer Portal Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Client & Customer Portal Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Client & Customer Portal Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Client & Customer Portal Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Client & Customer Portal Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Client & Customer Portal Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Client & Customer Portal Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Client & Customer Portal Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Client & Customer Portal Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Client & Customer Portal Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Client & Customer Portal Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Client & Customer Portal Software?

Key companies in the market include Zendesk, Flowlu, Huddle, Monday.com, Freshdesk, SuiteDash, Zoho Creator, Portal, HappyFox, SupportBee, AzureDesk, Accelo, MangoApps, SuiteDash.

3. What are the main segments of the Client & Customer Portal Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Client & Customer Portal Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Client & Customer Portal Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Client & Customer Portal Software?

To stay informed about further developments, trends, and reports in the Client & Customer Portal Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence