Key Insights

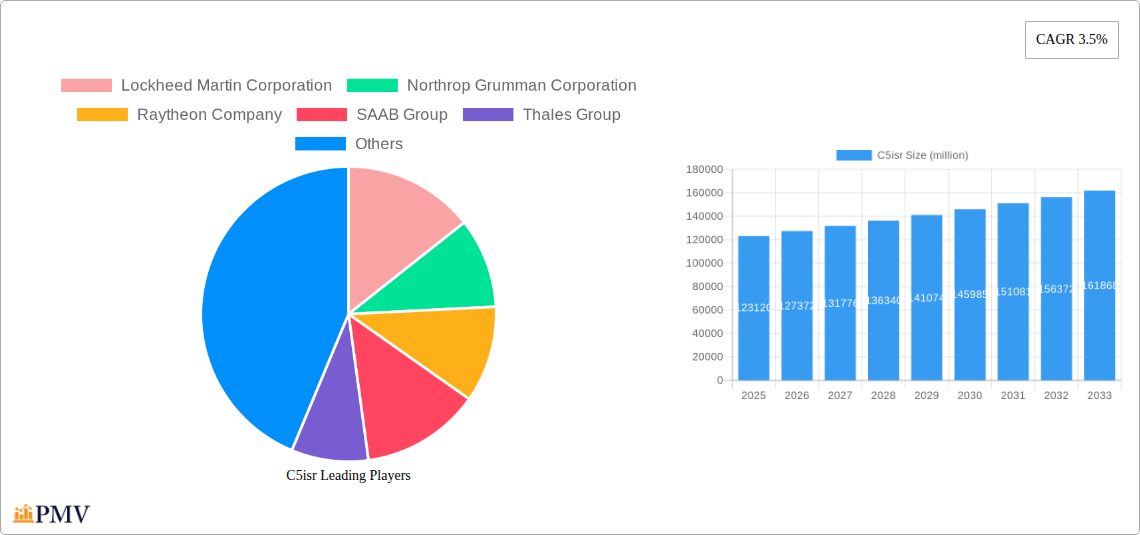

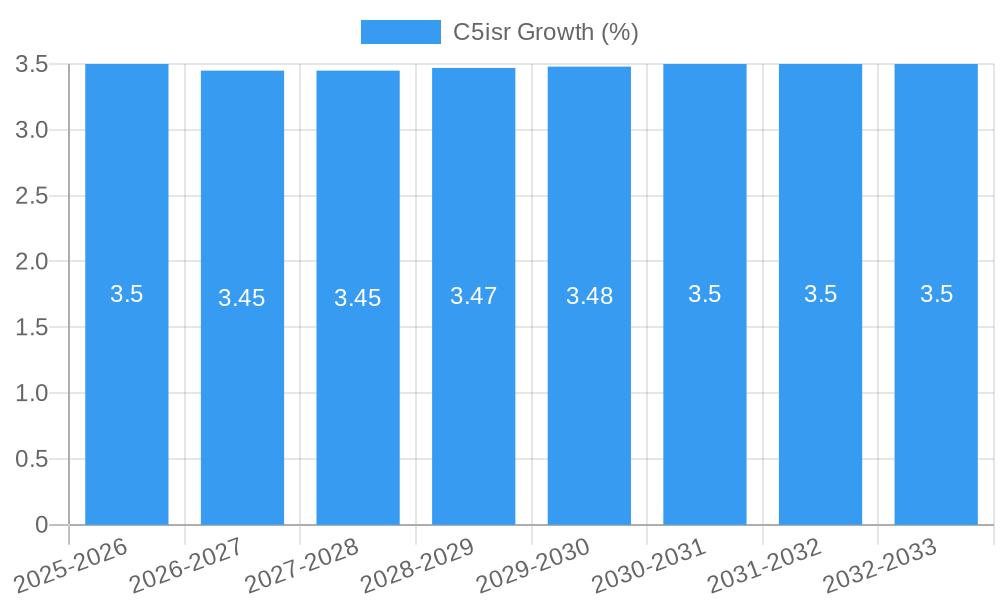

The global C5ISR market is projected to reach a substantial valuation of approximately USD 123,120 million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 3.5% for the forecast period extending through 2033. This significant market size underscores the critical role of Command, Control, Communication, Computers, Combat, Intelligence, Surveillance, and Reconnaissance (C5ISR) systems in modern defense and security operations. The primary drivers of this growth are the escalating geopolitical tensions worldwide, the continuous need for enhanced situational awareness, and the rapid advancements in technology, particularly in areas like artificial intelligence, machine learning, and advanced sensor technologies. Governments globally are prioritizing modernization efforts for their defense forces, leading to increased investments in sophisticated C5ISR platforms that offer superior battlefield management, interoperability, and data processing capabilities. The market is segmented across various applications, including communication, combat, and intelligence, surveillance, and reconnaissance (ISR), with each segment experiencing dynamic growth driven by specific operational requirements.

The market's expansion is further fueled by the increasing integration of C5ISR capabilities across land, airborne, and naval platforms. Innovations in areas such as secure communications, cyber warfare capabilities, and autonomous systems are reshaping the defense landscape. The demand for networked warfare capabilities, where seamless data exchange and coordinated actions are paramount, is a significant trend. While the market presents immense opportunities, it also faces certain restraints, including the high cost of research and development, lengthy procurement cycles within government defense agencies, and the evolving threat landscape that necessitates continuous adaptation. However, the strategic importance of maintaining technological superiority and ensuring national security will continue to propel the market forward. Leading companies like Lockheed Martin Corporation, Northrop Grumman Corporation, and Raytheon Company are at the forefront of innovation, investing heavily in R&D to deliver cutting-edge C5ISR solutions and secure significant market share.

This in-depth C5ISR (Command, Control, Communication, Computers, Combat, Intelligence, Surveillance, and Reconnaissance) market report provides a definitive forecast and analysis of the global C5ISR industry from 2019 to 2033. Covering a historical period of 2019-2024, a base year of 2025, and an estimated year of 2025, this report offers critical insights into market structure, competitive dynamics, industry trends, dominant segments, product innovations, growth drivers, challenges, and the strategic outlook for key players. With a projected market size in the billions of dollars, this study is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving C5ISR landscape.

C5ISR Market Structure & Competitive Dynamics

The global C5ISR market, projected to reach trillions in value by 2033, exhibits a moderately concentrated structure characterized by the presence of major defense contractors alongside a growing number of specialized technology providers. Innovation ecosystems are thriving, driven by intense R&D investments in areas like artificial intelligence, cloud computing, and advanced sensor technologies. Regulatory frameworks, primarily dictated by national security interests and international arms control agreements, significantly shape market entry and product development. While direct product substitutes are limited due to the specialized nature of C5ISR systems, advancements in commercially available technologies can sometimes be adapted for military applications, creating indirect competitive pressures. End-user trends are dominated by the increasing demand for integrated, multi-domain solutions that enhance situational awareness and rapid decision-making. Mergers and Acquisitions (M&A) activity remains robust, with recent deals valued in the billions, aimed at consolidating capabilities, acquiring niche technologies, and expanding market reach. Notable M&A activity has been observed among leading companies such as Lockheed Martin Corporation, Northrop Grumman Corporation, and Raytheon Company, aiming to bolster their integrated C5ISR portfolios. Market share distribution reflects a strong presence of established players, but emerging threats and evolving operational requirements are creating opportunities for agile and innovative companies.

C5ISR Industry Trends & Insights

The C5ISR industry is experiencing robust growth, driven by escalating geopolitical tensions, the proliferation of advanced threats, and the imperative for enhanced national security. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period of 2025-2033, reaching a market valuation in the trillions. Key market growth drivers include the ongoing modernization of defense forces worldwide, the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) for data analysis and decision support, and the demand for interconnected, networked warfare capabilities. Technological disruptions, such as advancements in quantum computing for secure communications and the miniaturization of sensor technology for pervasive surveillance, are reshaping the C5ISR landscape. Consumer preferences, in this context, translate to defense forces demanding C5ISR solutions that offer greater agility, interoperability, and resilience in complex operational environments. Competitive dynamics are characterized by a strong emphasis on technological superiority, cost-effectiveness, and the ability to provide end-to-end solutions. Market penetration is steadily increasing across all segments, particularly in regions with active defense modernization programs. The integration of cyber warfare capabilities into traditional C5ISR platforms is a significant trend, reflecting the evolving nature of modern conflict. Furthermore, the growing importance of space-based assets for intelligence, surveillance, and reconnaissance is driving significant investment in related C5ISR technologies.

Dominant Markets & Segments in C5ISR

The Airborne segment is currently the dominant market within the global C5ISR industry, driven by the critical role of aerial platforms in intelligence gathering, surveillance, reconnaissance, and command and control operations. Countries with substantial defense budgets and advanced air forces, such as the United States, China, and nations within NATO, are leading the demand for sophisticated airborne C5ISR systems. This dominance is further bolstered by ongoing investments in next-generation fighter jets, unmanned aerial vehicles (UAVs), and strategic bombers, all of which are increasingly equipped with integrated C5ISR suites.

- Key Drivers for Airborne Dominance:

- Enhanced Situational Awareness: Airborne platforms provide a superior vantage point for real-time data collection and dissemination, crucial for effective command and control.

- Precision Strike Capabilities: Integration with advanced targeting and combat systems allows for highly accurate and effective strike operations.

- Intelligence, Surveillance, and Reconnaissance (ISR) Missions: Airborne ISR platforms are indispensable for monitoring enemy movements, gathering intelligence, and providing early warning.

- Network-Centric Warfare: The ability of airborne systems to act as nodes in a larger communication network is vital for modern warfare.

- Technological Advancements: Continuous innovation in sensor technology, data processing, and communication systems for aircraft fuels demand.

Beyond the airborne domain, the Land segment is also experiencing significant growth, particularly with the rise of intelligent battlefield management systems, cyber warfare capabilities, and integrated C5ISR solutions for ground forces. The Naval segment, while currently smaller, is witnessing substantial investment in modernizing naval fleets with advanced C5ISR systems for maritime surveillance, anti-submarine warfare, and fleet command and control.

Within the application segments:

- Intelligence, Surveillance, and Reconnaissance (ISR) remains a primary driver of the C5ISR market due to the persistent need for actionable intelligence and battlefield awareness.

- Command and Control (C2) systems are increasingly sophisticated, aiming to provide seamless coordination and decision-making across all operational domains.

- Communication systems are evolving towards secure, resilient, and high-bandwidth networks to support data-intensive C5ISR operations.

- Computers are central to processing vast amounts of data generated by sensors and for running advanced analytical algorithms.

- Combat integration ensures that C5ISR capabilities directly support and enhance offensive and defensive military operations.

C5ISR Product Innovations

The C5ISR market is abuzz with product innovations focused on enhancing operational effectiveness and providing decisive advantages. Key developments include the integration of Artificial Intelligence (AI) and Machine Learning (ML) for autonomous target recognition, predictive maintenance, and intelligent data fusion. Advancements in quantum encryption are promising ultra-secure communication channels, while the miniaturization of sensors and processing units enables pervasive ISR capabilities across all domains. Edge computing is being deployed to enable real-time data analysis closer to the source, reducing latency and improving response times. These innovations offer significant competitive advantages by providing enhanced situational awareness, accelerated decision cycles, and increased resilience against sophisticated threats. The market fit for these products is strong, driven by the global demand for modernized and technologically superior defense capabilities.

Report Segmentation & Scope

This comprehensive report meticulously segments the global C5ISR market across key dimensions. The Application segments include Command, Control, Communication, Computers, Combat, and Intelligence, Surveillance, and Reconnaissance (ISR). Each of these segments is analyzed for its market size, projected growth, and competitive dynamics. For instance, the ISR segment is expected to witness substantial growth driven by increasing global security concerns, with market sizes projected in the billions by 2033. The Type segmentation encompasses Land, Airborne, and Naval C5ISR systems. The Airborne segment is projected to maintain its leading position, with market sizes estimated to reach billions by 2033 due to its critical role in modern warfare. The Land and Naval segments are also poised for significant expansion, driven by defense modernization efforts. The scope of this report covers the historical period of 2019-2024, a base year of 2025, and a forecast period extending to 2033, offering a holistic view of market evolution.

Key Drivers of C5ISR Growth

The growth of the C5ISR sector is propelled by a confluence of critical factors. Geopolitical instability and the rise of asymmetric warfare necessitate advanced surveillance, intelligence, and communication capabilities. Nations are undertaking extensive defense modernization programs, investing heavily in next-generation C5ISR systems to maintain a technological edge. The rapid evolution of digital technologies, including AI, machine learning, cloud computing, and big data analytics, is enabling the development of more sophisticated and integrated C5ISR solutions. The increasing threat landscape, encompassing cyber warfare and sophisticated adversary tactics, also drives the demand for resilient and multi-domain C5ISR platforms. For example, advancements in AI-powered threat detection systems are a significant growth accelerant.

Challenges in the C5ISR Sector

Despite its robust growth, the C5ISR sector faces several significant challenges. The complex and evolving regulatory landscape, particularly concerning data security and international collaboration, can pose hurdles to market entry and product deployment. Supply chain disruptions, amplified by global events and geopolitical tensions, can impact the availability of critical components and extend lead times, leading to projected delays of up to xx months for certain critical systems. The high cost of research, development, and acquisition of advanced C5ISR systems requires substantial upfront investment, making it a significant barrier for smaller players. Intense competitive pressures, both from established defense giants and emerging technology firms, demand continuous innovation and cost optimization. Furthermore, the integration of legacy systems with new technologies presents ongoing interoperability challenges, requiring significant engineering effort.

Leading Players in the C5ISR Market

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Company

- SAAB Group

- Thales Group

- General Dynamics

- Israel Aerospace Industries Ltd.

- Finmeccanica Spa

- BAE Systems

- SELEX ES

- Almaz-Antey

- Reutech Radar Systems

- Aselsan

- Ausair Power

- Huntington Ingalls Industries

- L-3 Communications

- United Aircraft Corp.

- Honeywell International

- SAFRRAN

- Textron

- Mitsubishi Heavy industries

- General Electric

- Elbit Systems

- Hindustan Aeronautics

- ThyssenKrupp

- CACI International

- Tactical Missiles Corp

Key Developments in C5ISR Sector

- 2023: Lockheed Martin announced a new AI-powered C5ISR platform aimed at enhancing battlefield intelligence, projected to cost millions in R&D.

- 2023: Northrop Grumman secured a multi-year contract valued at over billions for advanced airborne surveillance systems.

- 2024: Raytheon Company unveiled its next-generation secure communication suite for naval applications.

- 2024: Thales Group announced the successful integration of its C5ISR solutions into a new fighter aircraft program.

- 2024: SAAB Group reported significant advancements in its modular C5ISR architecture, enabling rapid deployment and upgrades.

- 2024: General Dynamics announced a strategic partnership to develop advanced cyber defense capabilities for C5ISR systems.

- 2024: Israel Aerospace Industries Ltd. showcased its latest unmanned aerial system with integrated advanced ISR payloads.

- 2024: BAE Systems acquired a specialized technology firm for millions to bolster its electronic warfare C5ISR offerings.

Strategic C5ISR Market Outlook

- 2023: Lockheed Martin announced a new AI-powered C5ISR platform aimed at enhancing battlefield intelligence, projected to cost millions in R&D.

- 2023: Northrop Grumman secured a multi-year contract valued at over billions for advanced airborne surveillance systems.

- 2024: Raytheon Company unveiled its next-generation secure communication suite for naval applications.

- 2024: Thales Group announced the successful integration of its C5ISR solutions into a new fighter aircraft program.

- 2024: SAAB Group reported significant advancements in its modular C5ISR architecture, enabling rapid deployment and upgrades.

- 2024: General Dynamics announced a strategic partnership to develop advanced cyber defense capabilities for C5ISR systems.

- 2024: Israel Aerospace Industries Ltd. showcased its latest unmanned aerial system with integrated advanced ISR payloads.

- 2024: BAE Systems acquired a specialized technology firm for millions to bolster its electronic warfare C5ISR offerings.

Strategic C5ISR Market Outlook

The strategic outlook for the C5ISR market remains exceptionally strong, driven by persistent global security needs and the relentless pace of technological innovation. Growth accelerators include the increasing adoption of AI and machine learning for intelligent data processing, the expanding role of unmanned systems, and the ongoing demand for resilient, multi-domain C5ISR capabilities. Strategic opportunities lie in developing integrated solutions that offer seamless interoperability across different platforms and domains, as well as in providing advanced cybersecurity features to protect critical C5ISR infrastructure. Investments in quantum computing and advanced sensor technologies will also be crucial for future market leadership. The continued modernization of defense forces worldwide, coupled with the emergence of new geopolitical threats, ensures a sustained demand for cutting-edge C5ISR solutions, with market potential expected to reach trillions by 2033.

C5isr Segmentation

-

1. Application

- 1.1. Command

- 1.2. Control

- 1.3. Communication

- 1.4. Computers

- 1.5. Combat

- 1.6. Intelligence

- 1.7. Surveillance and Reconnaissance

-

2. Type

- 2.1. Land

- 2.2. Airborne

- 2.3. Naval

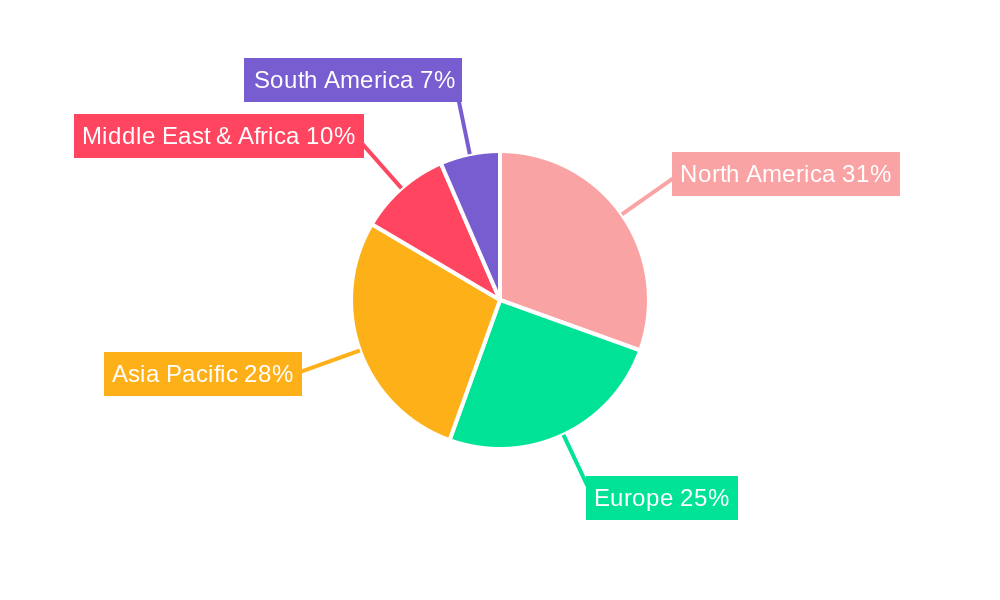

C5isr Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

C5isr REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global C5isr Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Command

- 5.1.2. Control

- 5.1.3. Communication

- 5.1.4. Computers

- 5.1.5. Combat

- 5.1.6. Intelligence

- 5.1.7. Surveillance and Reconnaissance

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Land

- 5.2.2. Airborne

- 5.2.3. Naval

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America C5isr Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Command

- 6.1.2. Control

- 6.1.3. Communication

- 6.1.4. Computers

- 6.1.5. Combat

- 6.1.6. Intelligence

- 6.1.7. Surveillance and Reconnaissance

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Land

- 6.2.2. Airborne

- 6.2.3. Naval

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America C5isr Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Command

- 7.1.2. Control

- 7.1.3. Communication

- 7.1.4. Computers

- 7.1.5. Combat

- 7.1.6. Intelligence

- 7.1.7. Surveillance and Reconnaissance

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Land

- 7.2.2. Airborne

- 7.2.3. Naval

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe C5isr Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Command

- 8.1.2. Control

- 8.1.3. Communication

- 8.1.4. Computers

- 8.1.5. Combat

- 8.1.6. Intelligence

- 8.1.7. Surveillance and Reconnaissance

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Land

- 8.2.2. Airborne

- 8.2.3. Naval

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa C5isr Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Command

- 9.1.2. Control

- 9.1.3. Communication

- 9.1.4. Computers

- 9.1.5. Combat

- 9.1.6. Intelligence

- 9.1.7. Surveillance and Reconnaissance

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Land

- 9.2.2. Airborne

- 9.2.3. Naval

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific C5isr Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Command

- 10.1.2. Control

- 10.1.3. Communication

- 10.1.4. Computers

- 10.1.5. Combat

- 10.1.6. Intelligence

- 10.1.7. Surveillance and Reconnaissance

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Land

- 10.2.2. Airborne

- 10.2.3. Naval

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Lockheed Martin Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Northrop Grumman Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Raytheon Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SAAB Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thales Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 General Dynamics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Israel Aerospace Industries Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Finmeccanica Spa

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BAE Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SELEX ES

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Almaz-Antey

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Reutech Radar Systems

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Aselsan

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ausair Power

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Huntington Ingalls Industries

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 L-3 Communications

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 United Aircraft Corp.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Honeywell International

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 SAFRRAN Textron

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Mitsubishi Heavy industries

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 General Electric

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Elbit Systems

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Hindustan Aeronautics

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 ThyssenKrupp

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 CACI International

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Tactical Missiles Corp

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: Global C5isr Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America C5isr Revenue (million), by Application 2024 & 2032

- Figure 3: North America C5isr Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America C5isr Revenue (million), by Type 2024 & 2032

- Figure 5: North America C5isr Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America C5isr Revenue (million), by Country 2024 & 2032

- Figure 7: North America C5isr Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America C5isr Revenue (million), by Application 2024 & 2032

- Figure 9: South America C5isr Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America C5isr Revenue (million), by Type 2024 & 2032

- Figure 11: South America C5isr Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America C5isr Revenue (million), by Country 2024 & 2032

- Figure 13: South America C5isr Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe C5isr Revenue (million), by Application 2024 & 2032

- Figure 15: Europe C5isr Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe C5isr Revenue (million), by Type 2024 & 2032

- Figure 17: Europe C5isr Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe C5isr Revenue (million), by Country 2024 & 2032

- Figure 19: Europe C5isr Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa C5isr Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa C5isr Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa C5isr Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa C5isr Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa C5isr Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa C5isr Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific C5isr Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific C5isr Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific C5isr Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific C5isr Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific C5isr Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific C5isr Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global C5isr Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global C5isr Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global C5isr Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global C5isr Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global C5isr Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global C5isr Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global C5isr Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global C5isr Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global C5isr Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global C5isr Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global C5isr Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global C5isr Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global C5isr Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global C5isr Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global C5isr Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global C5isr Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global C5isr Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global C5isr Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global C5isr Revenue million Forecast, by Country 2019 & 2032

- Table 41: China C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania C5isr Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific C5isr Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the C5isr?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the C5isr?

Key companies in the market include Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Company, SAAB Group, Thales Group, General Dynamics, Israel Aerospace Industries Ltd., Finmeccanica Spa, BAE Systems, SELEX ES, Almaz-Antey, Reutech Radar Systems, Aselsan, Ausair Power, Huntington Ingalls Industries, L-3 Communications, United Aircraft Corp., Honeywell International, SAFRRAN, Textron, Mitsubishi Heavy industries, General Electric, Elbit Systems, Hindustan Aeronautics, ThyssenKrupp, CACI International, Tactical Missiles Corp.

3. What are the main segments of the C5isr?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 123120 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "C5isr," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the C5isr report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the C5isr?

To stay informed about further developments, trends, and reports in the C5isr, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence