Key Insights

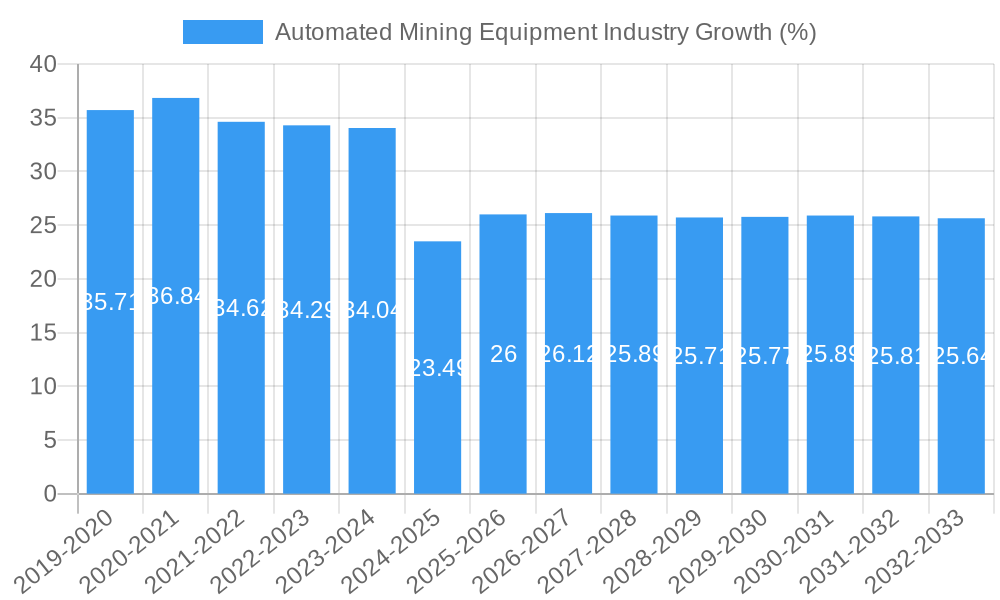

The Automated Mining Equipment industry is experiencing an unprecedented surge in growth, projected to reach a substantial market size of approximately USD 3,890 million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 35.38%. This explosive expansion is primarily fueled by an escalating demand for increased operational efficiency, enhanced safety protocols in hazardous mining environments, and the persistent need to optimize resource extraction from increasingly challenging geological formations. Key drivers such as the adoption of advanced technologies like AI, IoT, and robotics are revolutionizing mining operations, enabling remote control, real-time data analytics, and autonomous vehicle deployment. Furthermore, the global push for sustainable mining practices and reduced environmental impact is also a significant catalyst, as automated systems can be programmed for precise material handling and reduced energy consumption. The market is witnessing robust innovation across its segments, with significant advancements in autonomous haul trucks, robotic drills, and sophisticated fleet management software.

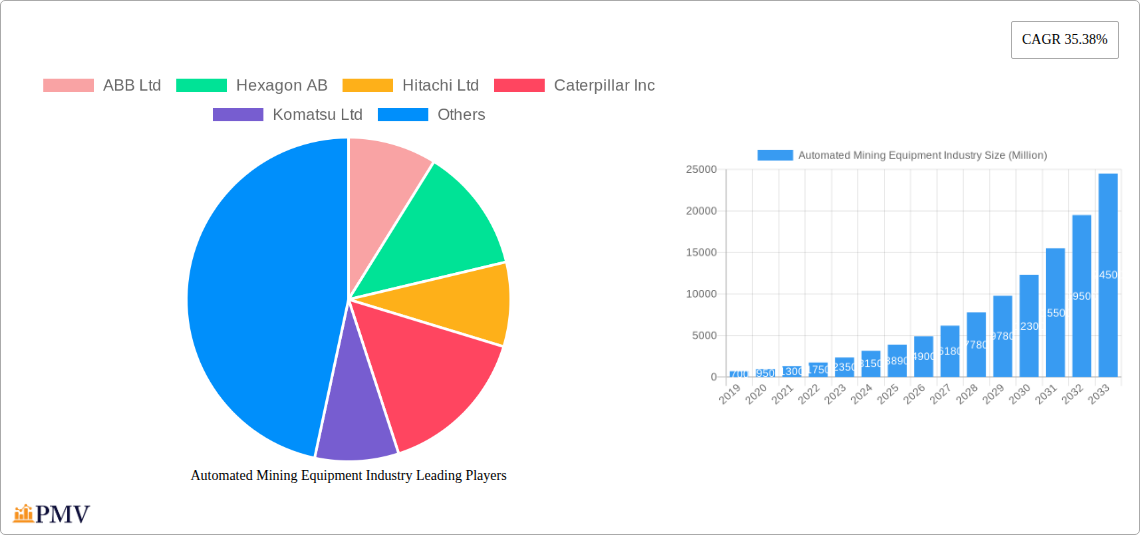

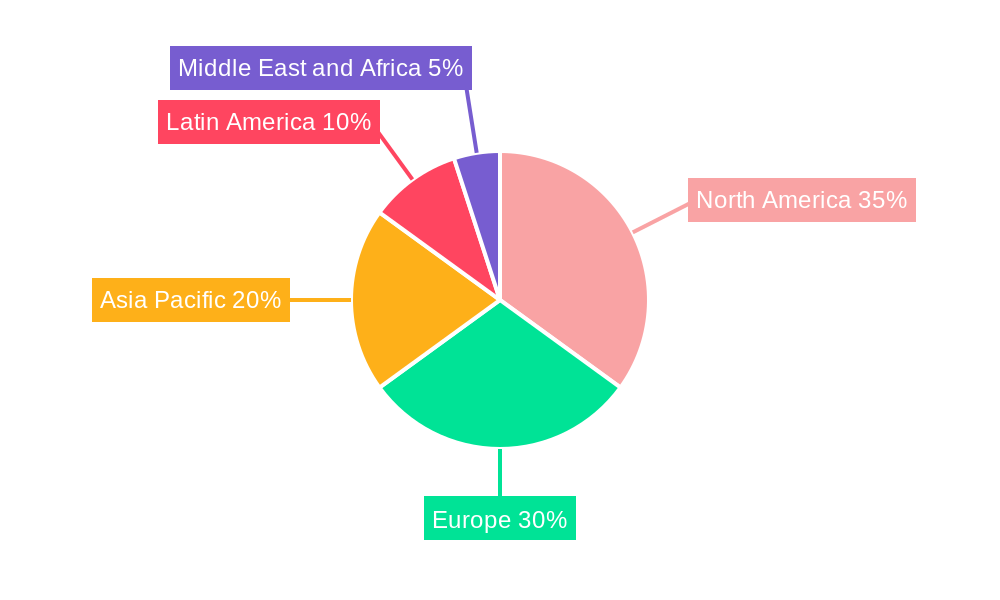

The competitive landscape is characterized by the presence of major global players like Caterpillar Inc., Komatsu Ltd., ABB Ltd, and Hexagon AB, who are actively investing in research and development to offer cutting-edge automated solutions. The growth trajectory is expected to continue robustly throughout the forecast period of 2025-2033. North America and Europe are anticipated to lead in adoption due to established mining infrastructure and stringent safety regulations, while the Asia Pacific region is poised for rapid growth driven by its expanding mining sector and increasing technological adoption. While the market faces potential restraints such as high initial investment costs for automation and the need for skilled labor to manage and maintain these advanced systems, the overwhelming benefits in terms of productivity, safety, and cost reduction are expected to outweigh these challenges, solidifying its position as a transformative force in the global mining industry.

Unlock the future of mining with this in-depth analysis of the Automated Mining Equipment Industry. This report provides critical insights into market dynamics, technological advancements, and strategic opportunities within the global automated mining sector. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this research is essential for stakeholders seeking to navigate this rapidly evolving landscape. Explore market segmentation, growth drivers, challenges, and competitive intelligence for the automated mining technology market.

Automated Mining Equipment Industry Market Structure & Competitive Dynamics

The Automated Mining Equipment Industry is characterized by a moderately concentrated market, with key players investing heavily in research and development to maintain a competitive edge. Innovation ecosystems are thriving, driven by advancements in artificial intelligence, robotics, and IoT, leading to a surge in autonomous and semi-automated mining solutions. Regulatory frameworks, while evolving, are gradually adapting to the increased adoption of advanced mining technologies, focusing on safety and efficiency standards. Product substitutes are emerging, particularly in the form of advanced conventional equipment retrofitted with automation features, but fully autonomous systems offer distinct advantages in terms of operational continuity and safety. End-user trends indicate a strong preference for solutions that enhance productivity, reduce operational costs, and improve worker safety, driving the demand for sophisticated automated mining hardware and software. Merger and acquisition (M&A) activities are anticipated to escalate as larger players seek to acquire innovative technologies and expand their market reach. For instance, M&A deals in the past have ranged from tens of millions to hundreds of millions, impacting market share significantly. The estimated market share of leading players is projected to exceed 30% collectively by the forecast period.

Automated Mining Equipment Industry Industry Trends & Insights

The Automated Mining Equipment Industry is on an upward trajectory, fueled by a confluence of technological innovations, increasing demand for critical minerals, and a global imperative for enhanced operational efficiency and safety in mining operations. The market is experiencing significant growth, with a projected Compound Annual Growth Rate (CAGR) of approximately 15-20% over the forecast period. This robust growth is underpinned by the increasing adoption of Industry 4.0 principles in mining, leading to the integration of AI, machine learning, and the Internet of Things (IoT) into mining equipment and processes.

Technological disruptions are at the forefront of this transformation. Advanced robotics and automation are enabling the development of fully autonomous haul trucks, excavators, and drilling systems, capable of operating 24/7 with minimal human intervention. This not only boosts productivity but also significantly reduces the risks associated with hazardous mining environments. The development of sophisticated software solutions, including advanced fleet management systems, real-time data analytics platforms, and predictive maintenance algorithms, further enhances the capabilities and efficiency of automated mining equipment. These software solutions are becoming increasingly integral, acting as the "brains" behind the hardware, optimizing operational workflows and providing actionable insights.

Consumer preferences are shifting towards integrated solutions that offer end-to-end automation, from exploration and extraction to processing and logistics. Mining companies are actively seeking partners who can provide not just equipment but also comprehensive service and support packages, including installation, maintenance, and training. This trend is driving the growth of the services segment within the automated mining equipment market, encompassing consulting, system integration, and ongoing operational support.

Competitive dynamics are intensifying, with established global mining equipment manufacturers expanding their portfolios to include automated solutions, while new technology-focused companies are emerging, specializing in niche automation capabilities. Strategic partnerships and collaborations are becoming crucial for players to leverage combined expertise and accelerate innovation. The market penetration of advanced automation technologies is expected to reach over 50% in large-scale mining operations by the end of the forecast period, indicating a fundamental shift in how mining is conducted globally. The increasing focus on sustainability and environmental responsibility also plays a role, as automated systems can be optimized for fuel efficiency and reduced emissions.

Dominant Markets & Segments in Automated Mining Equipment Industry

The Automated Mining Equipment Industry exhibits distinct regional and segmental dominance, driven by a combination of economic policies, infrastructure development, and resource endowments.

Leading Region:

North America, particularly the United States and Canada, currently holds a significant share of the automated mining equipment market. This dominance is attributed to:

- Robust Mining Sector: The presence of extensive reserves of coal, metals, and minerals necessitates advanced extraction techniques.

- Technological Adoption: A high propensity to adopt new technologies, driven by a focus on safety, efficiency, and cost reduction.

- Government Initiatives: Supportive policies and investments in research and development for advanced manufacturing and automation.

- Infrastructure: Well-developed infrastructure that supports the deployment and operation of complex automated mining systems.

Dominant Segments:

Within the Component segmentation, Hardware commands the largest market share, driven by the substantial investment in the core machinery of mining operations.

- Hardware:

- Excavators: The demand for large-scale, automated excavators is high for both surface and underground mining. Key drivers include their role in material handling and overburden removal.

- Load Haul Dump (LHD) Machines: These are critical for underground mining operations and are increasingly being automated for greater efficiency and safety in confined spaces.

- Robotic Trucks: Autonomous haulage systems (AHS) and robotic trucks are revolutionizing mine logistics, promising significant improvements in fleet utilization and reduced labor costs.

- Drillers and Breakers: Automated drilling rigs and rock breakers enhance precision and safety in rock excavation and fragmentation.

- Other Equipments: This includes a range of automated auxiliary vehicles, tunnel boring machines, and specialized equipment for specific mining applications.

The Software segment is experiencing the fastest growth, as sophisticated control systems, AI-driven analytics, and fleet management platforms become indispensable for optimizing automated operations. This segment is crucial for realizing the full potential of automated hardware.

The Services segment, encompassing installation, maintenance, training, and consulting, is also a vital and growing component. As mining companies increasingly rely on complex automated systems, the need for expert support and integrated solutions is paramount. This segment facilitates the smooth integration and long-term performance of automated mining equipment.

The dominance of these segments is further influenced by mining industry trends such as the increasing depth and complexity of mining operations, the scarcity of skilled labor, and the growing emphasis on environmental compliance and sustainability, all of which are addressed by advancements in automated mining technology.

Automated Mining Equipment Industry Product Innovations

Product innovation in the Automated Mining Equipment Industry is centered on enhancing autonomy, connectivity, and data-driven decision-making. Companies are developing advanced robotic excavators and LHDs equipped with sophisticated sensors and AI for autonomous navigation and operation, significantly improving safety and efficiency. Robotic trucks with advanced obstacle detection and swarm intelligence are transforming haulage operations. Drillers and breakers are incorporating real-time geological data integration for optimized performance and reduced wear. The integration of these hardware components with advanced software for predictive maintenance, fleet management, and real-time operational optimization provides a strong competitive advantage. These innovations address the critical need for increased productivity, reduced operational costs, and enhanced safety in challenging mining environments.

Report Segmentation & Scope

This report segments the Automated Mining Equipment Industry by key components to provide a granular market analysis. The primary segmentation includes Hardware, Software, and Services.

Hardware: This segment encompasses a wide range of automated mining machinery. Key sub-segments include Excavators, Load Haul Dump (LHD) machines, Robotic Trucks, Drillers and Breakers, and Other Equipments. Growth projections for this segment are robust, driven by the continued demand for advanced extraction machinery. Market sizes are substantial, reflecting the capital-intensive nature of mining operations. Competitive dynamics are characterized by a mix of established OEMs and specialized technology providers.

Software: This segment includes all digital solutions that enable and enhance automated mining operations. This includes fleet management systems, AI-driven analytics, autonomous control software, and mine planning and simulation tools. This segment is projected to exhibit the highest growth rate due to the increasing reliance on data and intelligent systems. Market sizes are growing rapidly as software becomes integral to operational efficiency. Competition is intense, with an emphasis on innovation in AI and data processing.

Services: This segment covers all post-sales support and operational assistance. It includes installation, maintenance, repair, training, consulting, and managed services for automated mining equipment. This segment is expected to show steady growth as more complex automated systems are deployed, requiring specialized expertise for their upkeep and optimal utilization. Market sizes are significant and are projected to expand as service providers offer comprehensive solutions. Competitive dynamics involve service contracts and partnerships with equipment manufacturers.

Key Drivers of Automated Mining Equipment Industry Growth

The growth of the Automated Mining Equipment Industry is propelled by several critical factors. Technological Advancements in AI, robotics, and IoT are enabling more sophisticated and autonomous mining solutions. The increasing demand for critical minerals required for renewable energy technologies and electronics is driving the need for efficient and safe extraction methods. Economic factors, such as the rising cost of labor and the pressure to reduce operational expenditures, make automation an attractive proposition for mining companies. Furthermore, regulatory frameworks that prioritize worker safety and environmental sustainability are indirectly encouraging the adoption of automated systems that minimize human exposure to hazardous conditions and optimize resource utilization. The pursuit of enhanced productivity and efficiency across all mining operations is a primary catalyst, with automated equipment offering consistent performance and continuous operation.

Challenges in the Automated Mining Equipment Industry Sector

Despite significant growth, the Automated Mining Equipment Industry faces several challenges. High initial investment costs for advanced automated systems can be a barrier for smaller mining operations. Regulatory hurdles related to the certification and deployment of autonomous machinery in diverse mining environments still exist, requiring ongoing adaptation and standardization. Cybersecurity risks associated with connected and autonomous systems pose a threat to operational integrity and data security. Technical complexities in integrating diverse systems and ensuring interoperability can lead to implementation challenges. Furthermore, the availability of skilled personnel to operate, maintain, and manage these advanced technologies remains a concern, necessitating significant investment in training and development programs. Supply chain disruptions for specialized components can also impact production and deployment timelines.

Leading Players in the Automated Mining Equipment Industry Market

- ABB Ltd

- Hexagon AB

- Hitachi Ltd

- Caterpillar Inc

- Komatsu Ltd

- Rockwell Automation Inc

- Trimble Inc

- Autonomous Solutions Inc

- Atlas Copco

- AB Volvo

Key Developments in Automated Mining Equipment Industry Sector

- March 2021 - Liebherr has launched R 9600: The advanced hydraulic mining excavators. The Liebherr's hydraulic excavators set new standards in open pit mining equipment and fitted with the most advanced Liebherr Mining technologies, including Assistance Systems and Semi-Automated functions.

- February 2020 - Trimble announced that the company sold its majority ownership of Mining Information Systems (MIS) to Herga Group, headquartered in Brisbane, Australia. The Herga Group has been a Trimble dealer for more than 30 years representing the construction geospatial and portfolios in Australia and New Zealand. MIS provides information systems for enterprise-wide management and monitoring of ore processing and mining operations. MIS system integrates and collects data across functional areas and sources, regardless of data origin.

Strategic Automated Mining Equipment Industry Market Outlook

- March 2021 - Liebherr has launched R 9600: The advanced hydraulic mining excavators. The Liebherr's hydraulic excavators set new standards in open pit mining equipment and fitted with the most advanced Liebherr Mining technologies, including Assistance Systems and Semi-Automated functions.

- February 2020 - Trimble announced that the company sold its majority ownership of Mining Information Systems (MIS) to Herga Group, headquartered in Brisbane, Australia. The Herga Group has been a Trimble dealer for more than 30 years representing the construction geospatial and portfolios in Australia and New Zealand. MIS provides information systems for enterprise-wide management and monitoring of ore processing and mining operations. MIS system integrates and collects data across functional areas and sources, regardless of data origin.

Strategic Automated Mining Equipment Industry Market Outlook

The strategic outlook for the Automated Mining Equipment Industry is exceptionally promising, driven by a continued surge in demand for efficiency, safety, and productivity enhancements. Future market potential lies in the further integration of AI and machine learning for predictive analytics and autonomous decision-making. Strategic opportunities include the development of modular and scalable automation solutions catering to a wider range of mine sizes and types, as well as the expansion of integrated service offerings that provide end-to-end support. Collaboration between equipment manufacturers, technology providers, and mining operators will be crucial for accelerating innovation and overcoming implementation challenges. The increasing focus on sustainability and ESG (Environmental, Social, and Governance) factors will also create opportunities for automated solutions that minimize environmental impact and improve social responsibility in mining operations, driving substantial market growth.

Automated Mining Equipment Industry Segmentation

-

1. Component

-

1.1. Hardware

- 1.1.1. Excavators

- 1.1.2. Load Haul Dump

- 1.1.3. Robotic truck

- 1.1.4. Drillers and Breakers

- 1.1.5. Other Equipments

- 1.2. Software

- 1.3. Services

-

1.1. Hardware

Automated Mining Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Automated Mining Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 35.38% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Increasing Productivity and Improving Workers Safety; Growing Concerns about Reduction of Operational Costs

- 3.3. Market Restrains

- 3.3.1. Dynamic Oil & Gas situation; Political Challenges between Developed Economies

- 3.4. Market Trends

- 3.4.1. Excavators is Expected to Hold Significant Market Share in the Hardware Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automated Mining Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Excavators

- 5.1.1.2. Load Haul Dump

- 5.1.1.3. Robotic truck

- 5.1.1.4. Drillers and Breakers

- 5.1.1.5. Other Equipments

- 5.1.2. Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Automated Mining Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.1.1. Excavators

- 6.1.1.2. Load Haul Dump

- 6.1.1.3. Robotic truck

- 6.1.1.4. Drillers and Breakers

- 6.1.1.5. Other Equipments

- 6.1.2. Software

- 6.1.3. Services

- 6.1.1. Hardware

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Automated Mining Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.1.1. Excavators

- 7.1.1.2. Load Haul Dump

- 7.1.1.3. Robotic truck

- 7.1.1.4. Drillers and Breakers

- 7.1.1.5. Other Equipments

- 7.1.2. Software

- 7.1.3. Services

- 7.1.1. Hardware

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Automated Mining Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.1.1. Excavators

- 8.1.1.2. Load Haul Dump

- 8.1.1.3. Robotic truck

- 8.1.1.4. Drillers and Breakers

- 8.1.1.5. Other Equipments

- 8.1.2. Software

- 8.1.3. Services

- 8.1.1. Hardware

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Automated Mining Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.1.1. Excavators

- 9.1.1.2. Load Haul Dump

- 9.1.1.3. Robotic truck

- 9.1.1.4. Drillers and Breakers

- 9.1.1.5. Other Equipments

- 9.1.2. Software

- 9.1.3. Services

- 9.1.1. Hardware

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Automated Mining Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.1.1. Excavators

- 10.1.1.2. Load Haul Dump

- 10.1.1.3. Robotic truck

- 10.1.1.4. Drillers and Breakers

- 10.1.1.5. Other Equipments

- 10.1.2. Software

- 10.1.3. Services

- 10.1.1. Hardware

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. North America Automated Mining Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Automated Mining Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Automated Mining Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Automated Mining Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Automated Mining Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 ABB Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Hexagon AB

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Hitachi Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Caterpillar Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Komatsu Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Rockwell Automation Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Trimble Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Autonomous Solutions Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Atlas Copco

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 AB Volvo*List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 ABB Ltd

List of Figures

- Figure 1: Global Automated Mining Equipment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automated Mining Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automated Mining Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automated Mining Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automated Mining Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automated Mining Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automated Mining Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Automated Mining Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Automated Mining Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Automated Mining Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Automated Mining Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Automated Mining Equipment Industry Revenue (Million), by Component 2024 & 2032

- Figure 13: North America Automated Mining Equipment Industry Revenue Share (%), by Component 2024 & 2032

- Figure 14: North America Automated Mining Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Automated Mining Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Automated Mining Equipment Industry Revenue (Million), by Component 2024 & 2032

- Figure 17: Europe Automated Mining Equipment Industry Revenue Share (%), by Component 2024 & 2032

- Figure 18: Europe Automated Mining Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Automated Mining Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Automated Mining Equipment Industry Revenue (Million), by Component 2024 & 2032

- Figure 21: Asia Pacific Automated Mining Equipment Industry Revenue Share (%), by Component 2024 & 2032

- Figure 22: Asia Pacific Automated Mining Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Automated Mining Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Automated Mining Equipment Industry Revenue (Million), by Component 2024 & 2032

- Figure 25: Latin America Automated Mining Equipment Industry Revenue Share (%), by Component 2024 & 2032

- Figure 26: Latin America Automated Mining Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Automated Mining Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Automated Mining Equipment Industry Revenue (Million), by Component 2024 & 2032

- Figure 29: Middle East and Africa Automated Mining Equipment Industry Revenue Share (%), by Component 2024 & 2032

- Figure 30: Middle East and Africa Automated Mining Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Automated Mining Equipment Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automated Mining Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automated Mining Equipment Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Automated Mining Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Automated Mining Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Automated Mining Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Automated Mining Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Automated Mining Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Automated Mining Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Automated Mining Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Automated Mining Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Automated Mining Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Automated Mining Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Automated Mining Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Automated Mining Equipment Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 15: Global Automated Mining Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Automated Mining Equipment Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 17: Global Automated Mining Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Automated Mining Equipment Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 19: Global Automated Mining Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Automated Mining Equipment Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 21: Global Automated Mining Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Automated Mining Equipment Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 23: Global Automated Mining Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automated Mining Equipment Industry?

The projected CAGR is approximately 35.38%.

2. Which companies are prominent players in the Automated Mining Equipment Industry?

Key companies in the market include ABB Ltd, Hexagon AB, Hitachi Ltd, Caterpillar Inc, Komatsu Ltd, Rockwell Automation Inc, Trimble Inc, Autonomous Solutions Inc, Atlas Copco, AB Volvo*List Not Exhaustive.

3. What are the main segments of the Automated Mining Equipment Industry?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Increasing Productivity and Improving Workers Safety; Growing Concerns about Reduction of Operational Costs.

6. What are the notable trends driving market growth?

Excavators is Expected to Hold Significant Market Share in the Hardware Segment.

7. Are there any restraints impacting market growth?

Dynamic Oil & Gas situation; Political Challenges between Developed Economies.

8. Can you provide examples of recent developments in the market?

March 2021 - Liebherr has launched R 9600: The advanced hydraulic mining excavators. The Liebherr's hydraulic excavators set new standards in open pit mining equipment and fitted with the most advanced Liebherr Mining technologies, including Assistance Systems and Semi-Automated functions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automated Mining Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automated Mining Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automated Mining Equipment Industry?

To stay informed about further developments, trends, and reports in the Automated Mining Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence