Key Insights

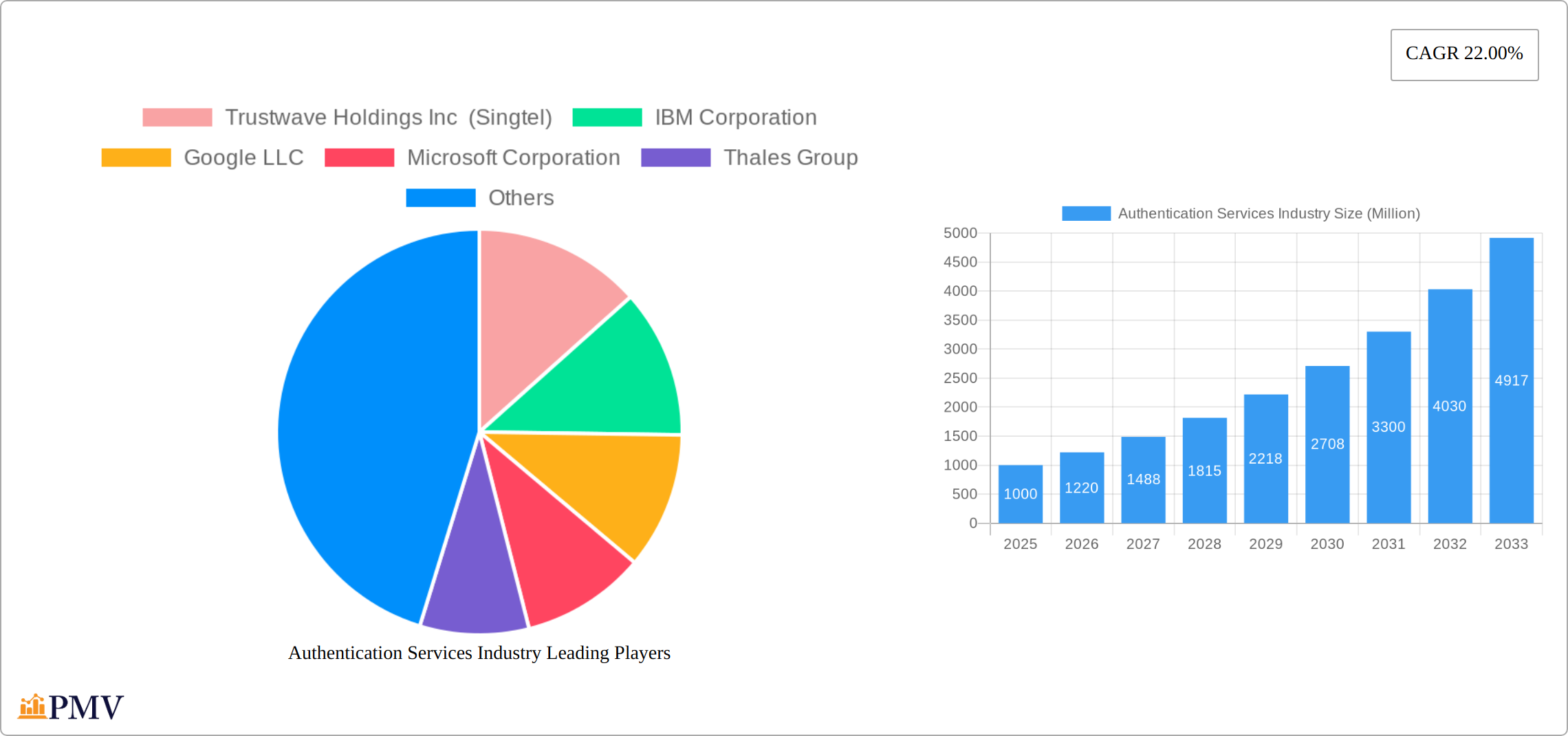

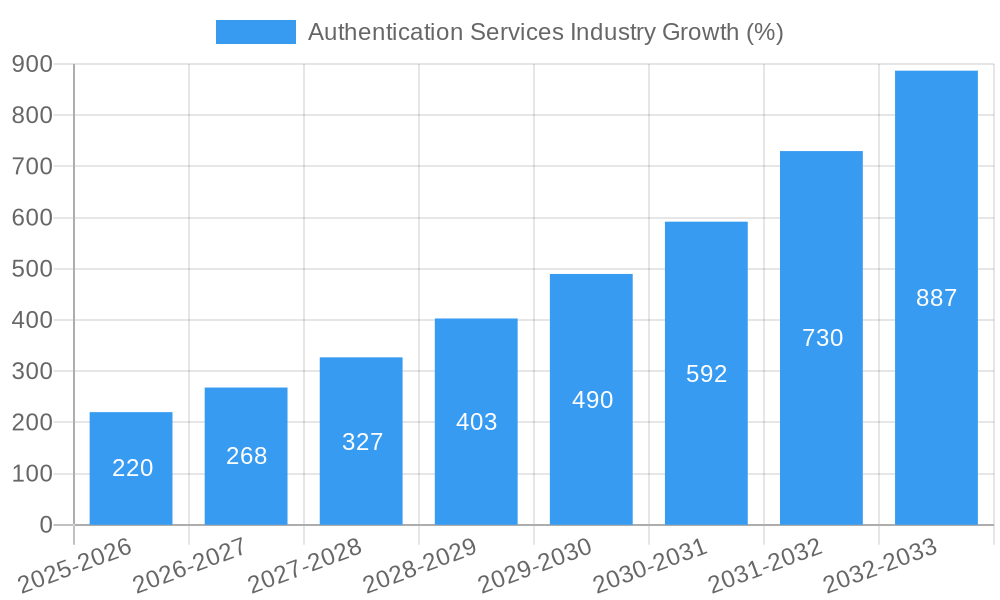

The Authentication Services market is experiencing robust growth, projected to reach a substantial size with a Compound Annual Growth Rate (CAGR) of 22% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of cyber threats and data breaches across diverse sectors, including IT & Telecommunications, BFSI (Banking, Financial Services, and Insurance), Government & Defense, and Healthcare, necessitates strong authentication measures. Furthermore, the rise of cloud computing, remote work, and the Internet of Things (IoT) has broadened the attack surface, pushing organizations to adopt advanced authentication solutions. The shift towards multi-factor authentication (MFA), offering enhanced security compared to single-factor authentication (SFA), is a significant market driver. Growth is also fueled by the growing demand for robust compliance management services and managed public key infrastructure (PKI) to ensure regulatory adherence and secure digital identities. Key players like Trustwave, IBM, Google, Microsoft, and Okta are driving innovation and competition within this space, constantly evolving their offerings to meet evolving security needs.

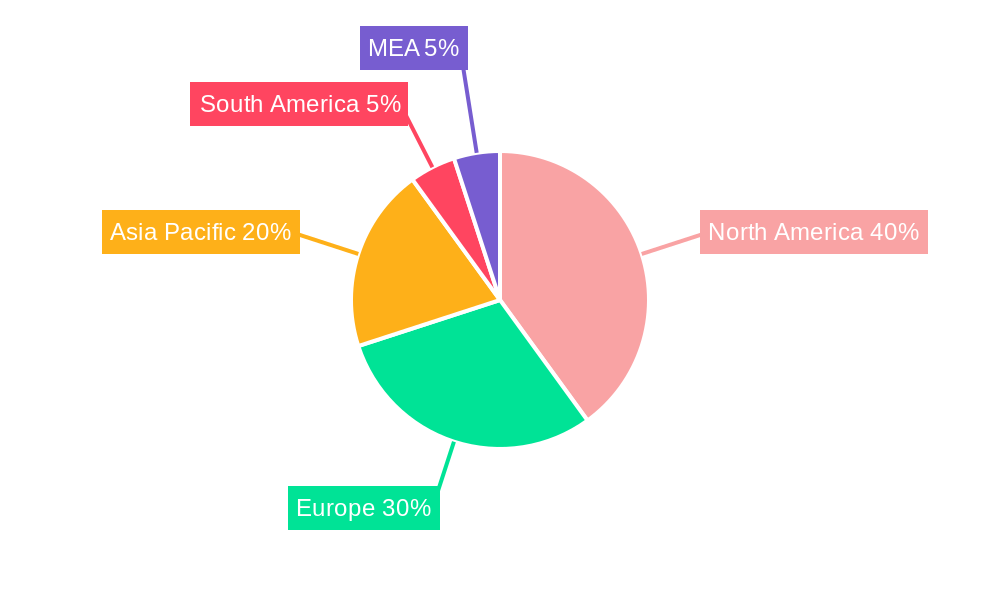

The market segmentation reveals significant opportunities within specific areas. Multi-factor authentication is expected to witness faster growth compared to single-factor authentication, driven by its superior security features. Within service types, compliance management and managed PKI are experiencing high demand, reflecting the increasing importance of regulatory compliance and secure digital certificate management. Geographically, North America and Europe currently hold substantial market share, however, rapidly growing economies in Asia-Pacific are predicted to exhibit higher growth rates in the coming years, particularly in countries like China and India. The market's continued expansion hinges upon technological advancements, evolving regulations, and the ongoing need for robust cybersecurity solutions across industries facing sophisticated cyber threats. The adoption of innovative authentication technologies, such as behavioral biometrics and passwordless authentication, will continue to shape the market's future.

Authentication Services Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Authentication Services market, offering invaluable insights for businesses, investors, and industry stakeholders. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report projects a market valued at $XX Million in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This in-depth analysis covers key market segments, competitive dynamics, technological advancements, and growth drivers, offering actionable strategies for success in this rapidly evolving landscape.

Authentication Services Industry Market Structure & Competitive Dynamics

The Authentication Services market is characterized by a dynamic and evolving landscape, moving towards a moderately concentrated structure. Prominent global players such as IBM Corporation, Google LLC, Microsoft Corporation, Thales Group, and Tata Communications are key influencers, driving innovation and setting industry standards. The ecosystem is fueled by continuous advancements in multi-factor authentication (MFA), sophisticated biometric authentication techniques, and the emerging integration of blockchain technology for enhanced security and transparency. Regulatory mandates like GDPR and CCPA are not merely compliance hurdles but also significant market drivers, compelling vendors to develop and offer robust, verifiable, and privacy-preserving authentication solutions. While traditional password-based systems are increasingly vulnerable and being phased out, the industry is actively innovating to replace them with more secure alternatives. A crucial trend is the end-user demand for frictionless and intuitive authentication experiences, pushing vendors to prioritize superior user experience (UX) and seamless integration into daily workflows. The market has also seen considerable strategic consolidation through mergers and acquisitions (M&A) in recent years. Deal values have exceeded $XX Million over the past five years, reflecting a strategic push by larger entities to acquire innovative technologies, expand their service portfolios, and gain a stronger foothold in new and existing geographical markets.

- Market Concentration: The market is moderately concentrated, with the top 5 players expected to command approximately XX% of the market share by 2025, indicating a competitive yet consolidated environment.

- Innovation Focus: Key innovation areas include the advancement and integration of MFA, the refinement of biometric technologies (e.g., facial recognition, fingerprint, voice biometrics), and the exploration of blockchain for secure identity management.

- Regulatory Landscape: Stringent global and regional regulations, including GDPR and CCPA, are pivotal in shaping market demands, emphasizing the need for compliant, secure, and transparent authentication solutions.

- M&A Activity: Significant M&A activity, with combined deal values surpassing $XX Million since 2019, signals a trend towards market consolidation and strategic expansion by leading entities.

Authentication Services Industry Industry Trends & Insights

The Authentication Services market is experiencing robust growth, driven by several key factors. The increasing prevalence of cyber threats and data breaches is compelling organizations across all sectors to invest in sophisticated authentication solutions. The shift towards cloud computing and remote work models is further fueling demand for secure access management tools. Technological disruptions, such as the adoption of AI and machine learning for fraud detection and risk assessment, are enhancing the effectiveness of authentication systems. Consumer preferences increasingly favor frictionless and secure authentication experiences, leading to the adoption of biometric and passwordless authentication methods. The market is witnessing intense competition, with established players expanding their product portfolios and new entrants focusing on niche segments. The market's CAGR is projected at XX%, with a market penetration rate expected to reach XX% by 2033.

Dominant Markets & Segments in Authentication Services Industry

North America currently leads the Authentication Services market, a position sustained by its advanced IT infrastructure, heightened cybersecurity awareness, and substantial investments in digital transformation across various sectors. This dominance is further reinforced by a strong regulatory framework that prioritizes data security. Within the market segments, specific areas are experiencing exceptional growth and demand:

- By Authentication Type: Multi-Factor Authentication (MFA) stands out as the fastest-growing segment, projected to grow at a Compound Annual Growth Rate (CAGR) of XX%. This rapid expansion is directly attributed to its superior ability to mitigate security risks compared to single-factor methods.

- By Service Type: Managed Public Key Infrastructure (PKI) services are a leading segment. The increasing need for secure digital identities, robust certificate management, and verifiable digital signatures for a wide range of applications, from e-commerce to enterprise security, fuels this segment's prominence.

- By End-user Industry: The Banking, Financial Services, and Insurance (BFSI) sector remains a primary consumer of authentication services. This is driven by stringent regulatory compliance demands, the high value of transactions processed, and the critical need to protect sensitive customer data from increasingly sophisticated cyber threats.

Key Drivers for Dominant Regions/Segments:

- North America: A robust digital infrastructure, advanced cybersecurity adoption, and aggressive digital transformation initiatives are key drivers.

- BFSI Sector: The critical need to meet rigorous regulatory compliance, secure high-value financial transactions, and safeguard sensitive customer information.

- Multi-Factor Authentication (MFA): Its proven effectiveness in significantly enhancing security and reducing susceptibility to credential stuffing and brute-force attacks.

- Managed Public Key Infrastructure (PKI): The essential requirement for secure digital certificate lifecycle management and reliable digital identity verification across digital ecosystems.

Authentication Services Industry Product Innovations

Recent innovations include the rise of passwordless authentication, leveraging biometrics like fingerprint and facial recognition, and incorporating behavioral biometrics for enhanced security. The integration of AI and machine learning enables adaptive authentication, providing real-time risk assessment and personalized security measures. These advancements offer improved user experience and enhanced protection against sophisticated attacks. The market fit for these innovations is strong, driven by rising security concerns and the demand for frictionless access management.

Report Segmentation & Scope

This report offers a comprehensive analysis of the Authentication Services market, meticulously segmented to provide deep insights into its various facets. The segmentation includes:

- Authentication Type: Covering Single Factor Authentication and Multi-Factor Authentication (MFA), detailing their adoption rates and growth trajectories.

- Service Type: Encompassing Compliance Management, Managed Public Key Infrastructure (PKI), Subscription Keys Management, and Other Service Types, providing a granular view of service offerings and demand.

- End-user Industry: Analyzing the adoption and impact of authentication services across key sectors such as IT and Telecommunications, BFSI, Government & Defense, Healthcare, and Other End-user Industries.

Each segment is subjected to thorough analysis, including projections for growth, current market sizes, and the competitive dynamics within. This detailed approach aims to deliver a granular understanding of the overall market landscape. Market sizes for each segment are projected to reach a substantial $XX Million by 2033, underscoring the significant growth potential across the entire authentication services value chain.

Key Drivers of Authentication Services Industry Growth

The Authentication Services market's growth is fueled by several factors. Technological advancements, like AI-powered authentication and biometric solutions, enhance security and user experience. The increasing frequency and severity of cyberattacks are driving demand for robust authentication measures. Furthermore, stringent government regulations, such as GDPR and CCPA, compel organizations to strengthen their security postures, bolstering the market. Economic factors, like increased investment in digital infrastructure and cloud adoption, contribute to market expansion.

Challenges in the Authentication Services Industry Sector

The Authentication Services sector faces challenges including the complexity of integrating multiple authentication methods, the potential for usability issues with advanced authentication techniques, and the ever-evolving threat landscape, necessitating constant adaptation. Supply chain vulnerabilities can impact the availability of components and services. Intense competition from established players and new entrants also presents a significant challenge. These factors can potentially limit market growth by XX% if not addressed effectively.

Leading Players in the Authentication Services Industry Market

- Trustwave Holdings Inc (Singtel)

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Thales Group

- Tata Communications

- OneLogin Inc

- CA Technology Inc (Broadcom Inc)

- Okta Inc

- Entrust Datacard Corporation

Key Developments in Authentication Services Industry Sector

- 2022 Q4: Okta Inc launched a new passwordless authentication solution.

- 2023 Q1: IBM Corporation announced enhanced security features for its PKI management platform.

- 2023 Q2: Google LLC integrated advanced biometric authentication into its cloud services.

- (Further developments to be added based on data)

Strategic Authentication Services Industry Market Outlook

The Authentication Services market is poised for robust and sustained growth, propelled by a confluence of factors including continuous technological innovation, the escalating global threat landscape of cyberattacks, and increasingly stringent regulatory compliance requirements worldwide. Strategic avenues for success in this market lie in the development of avant-garde authentication solutions that artfully blend advanced security methodologies with an emphasis on delivering exceptionally seamless and intuitive user experiences. Cultivating a focus on niche market segments and forging strategic partnerships will be paramount for achieving and maintaining a competitive edge in this rapidly evolving arena. The market is anticipated to experience substantial expansion, with continued upward trends projected throughout the forecast period, indicating a promising future for the industry.

Authentication Services Industry Segmentation

-

1. Authentication Type

- 1.1. Single Factor Authentication

- 1.2. Multi Factor Authentication

-

2. Service Type

- 2.1. Compliance Management

- 2.2. Managed Public Key Infrastructure (PKI)

- 2.3. Subscription Keys Management

- 2.4. Other Service Types

-

3. End-user Industry

- 3.1. IT and Telecommunications

- 3.2. BFSI

- 3.3. Government & Defense

- 3.4. Healthcare

- 3.5. Other End-user Industries

Authentication Services Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Authentication Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 22.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in the Number of Digital Identities; Authentication Needed for Security Compliances and Regulations; Growing Adoption of Bring Your Own Device (BYOD)

- 3.3. Market Restrains

- 3.3.1. ; High Cost Involved with Matured Authentication Methods

- 3.4. Market Trends

- 3.4.1. Multi Factor Authentication is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Authentication Type

- 5.1.1. Single Factor Authentication

- 5.1.2. Multi Factor Authentication

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Compliance Management

- 5.2.2. Managed Public Key Infrastructure (PKI)

- 5.2.3. Subscription Keys Management

- 5.2.4. Other Service Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecommunications

- 5.3.2. BFSI

- 5.3.3. Government & Defense

- 5.3.4. Healthcare

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Authentication Type

- 6. North America Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Authentication Type

- 6.1.1. Single Factor Authentication

- 6.1.2. Multi Factor Authentication

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Compliance Management

- 6.2.2. Managed Public Key Infrastructure (PKI)

- 6.2.3. Subscription Keys Management

- 6.2.4. Other Service Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. IT and Telecommunications

- 6.3.2. BFSI

- 6.3.3. Government & Defense

- 6.3.4. Healthcare

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Authentication Type

- 7. Europe Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Authentication Type

- 7.1.1. Single Factor Authentication

- 7.1.2. Multi Factor Authentication

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Compliance Management

- 7.2.2. Managed Public Key Infrastructure (PKI)

- 7.2.3. Subscription Keys Management

- 7.2.4. Other Service Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. IT and Telecommunications

- 7.3.2. BFSI

- 7.3.3. Government & Defense

- 7.3.4. Healthcare

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Authentication Type

- 8. Asia Pacific Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Authentication Type

- 8.1.1. Single Factor Authentication

- 8.1.2. Multi Factor Authentication

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Compliance Management

- 8.2.2. Managed Public Key Infrastructure (PKI)

- 8.2.3. Subscription Keys Management

- 8.2.4. Other Service Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. IT and Telecommunications

- 8.3.2. BFSI

- 8.3.3. Government & Defense

- 8.3.4. Healthcare

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Authentication Type

- 9. Latin America Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Authentication Type

- 9.1.1. Single Factor Authentication

- 9.1.2. Multi Factor Authentication

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Compliance Management

- 9.2.2. Managed Public Key Infrastructure (PKI)

- 9.2.3. Subscription Keys Management

- 9.2.4. Other Service Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. IT and Telecommunications

- 9.3.2. BFSI

- 9.3.3. Government & Defense

- 9.3.4. Healthcare

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Authentication Type

- 10. Middle East and Africa Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Authentication Type

- 10.1.1. Single Factor Authentication

- 10.1.2. Multi Factor Authentication

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Compliance Management

- 10.2.2. Managed Public Key Infrastructure (PKI)

- 10.2.3. Subscription Keys Management

- 10.2.4. Other Service Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. IT and Telecommunications

- 10.3.2. BFSI

- 10.3.3. Government & Defense

- 10.3.4. Healthcare

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Authentication Type

- 11. North America Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Authentication Services Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Trustwave Holdings Inc (Singtel)

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 IBM Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Google LLC

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Microsoft Corporation

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Thales Group

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Tata Communications

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 OneLogin Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 CA Technology Inc (Broadcom Inc )

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Okta Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Entrust Datacard Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Trustwave Holdings Inc (Singtel)

List of Figures

- Figure 1: Global Authentication Services Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Authentication Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Authentication Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Authentication Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Authentication Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Authentication Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Authentication Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Authentication Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Authentication Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Authentication Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Authentication Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Authentication Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Authentication Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Authentication Services Industry Revenue (Million), by Authentication Type 2024 & 2032

- Figure 15: North America Authentication Services Industry Revenue Share (%), by Authentication Type 2024 & 2032

- Figure 16: North America Authentication Services Industry Revenue (Million), by Service Type 2024 & 2032

- Figure 17: North America Authentication Services Industry Revenue Share (%), by Service Type 2024 & 2032

- Figure 18: North America Authentication Services Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: North America Authentication Services Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: North America Authentication Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Authentication Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Authentication Services Industry Revenue (Million), by Authentication Type 2024 & 2032

- Figure 23: Europe Authentication Services Industry Revenue Share (%), by Authentication Type 2024 & 2032

- Figure 24: Europe Authentication Services Industry Revenue (Million), by Service Type 2024 & 2032

- Figure 25: Europe Authentication Services Industry Revenue Share (%), by Service Type 2024 & 2032

- Figure 26: Europe Authentication Services Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Europe Authentication Services Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Europe Authentication Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Authentication Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Authentication Services Industry Revenue (Million), by Authentication Type 2024 & 2032

- Figure 31: Asia Pacific Authentication Services Industry Revenue Share (%), by Authentication Type 2024 & 2032

- Figure 32: Asia Pacific Authentication Services Industry Revenue (Million), by Service Type 2024 & 2032

- Figure 33: Asia Pacific Authentication Services Industry Revenue Share (%), by Service Type 2024 & 2032

- Figure 34: Asia Pacific Authentication Services Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 35: Asia Pacific Authentication Services Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 36: Asia Pacific Authentication Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Pacific Authentication Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Authentication Services Industry Revenue (Million), by Authentication Type 2024 & 2032

- Figure 39: Latin America Authentication Services Industry Revenue Share (%), by Authentication Type 2024 & 2032

- Figure 40: Latin America Authentication Services Industry Revenue (Million), by Service Type 2024 & 2032

- Figure 41: Latin America Authentication Services Industry Revenue Share (%), by Service Type 2024 & 2032

- Figure 42: Latin America Authentication Services Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 43: Latin America Authentication Services Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 44: Latin America Authentication Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 45: Latin America Authentication Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East and Africa Authentication Services Industry Revenue (Million), by Authentication Type 2024 & 2032

- Figure 47: Middle East and Africa Authentication Services Industry Revenue Share (%), by Authentication Type 2024 & 2032

- Figure 48: Middle East and Africa Authentication Services Industry Revenue (Million), by Service Type 2024 & 2032

- Figure 49: Middle East and Africa Authentication Services Industry Revenue Share (%), by Service Type 2024 & 2032

- Figure 50: Middle East and Africa Authentication Services Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 51: Middle East and Africa Authentication Services Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 52: Middle East and Africa Authentication Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 53: Middle East and Africa Authentication Services Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Authentication Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Authentication Services Industry Revenue Million Forecast, by Authentication Type 2019 & 2032

- Table 3: Global Authentication Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Global Authentication Services Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global Authentication Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Authentication Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Authentication Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Authentication Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Authentication Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Authentication Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Authentication Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: United Arab Emirates Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa Authentication Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Authentication Services Industry Revenue Million Forecast, by Authentication Type 2019 & 2032

- Table 52: Global Authentication Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 53: Global Authentication Services Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 54: Global Authentication Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global Authentication Services Industry Revenue Million Forecast, by Authentication Type 2019 & 2032

- Table 56: Global Authentication Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 57: Global Authentication Services Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 58: Global Authentication Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Authentication Services Industry Revenue Million Forecast, by Authentication Type 2019 & 2032

- Table 60: Global Authentication Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 61: Global Authentication Services Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 62: Global Authentication Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Global Authentication Services Industry Revenue Million Forecast, by Authentication Type 2019 & 2032

- Table 64: Global Authentication Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 65: Global Authentication Services Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 66: Global Authentication Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 67: Global Authentication Services Industry Revenue Million Forecast, by Authentication Type 2019 & 2032

- Table 68: Global Authentication Services Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 69: Global Authentication Services Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 70: Global Authentication Services Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Authentication Services Industry?

The projected CAGR is approximately 22.00%.

2. Which companies are prominent players in the Authentication Services Industry?

Key companies in the market include Trustwave Holdings Inc (Singtel), IBM Corporation, Google LLC, Microsoft Corporation, Thales Group, Tata Communications, OneLogin Inc, CA Technology Inc (Broadcom Inc ), Okta Inc, Entrust Datacard Corporation.

3. What are the main segments of the Authentication Services Industry?

The market segments include Authentication Type, Service Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growth in the Number of Digital Identities; Authentication Needed for Security Compliances and Regulations; Growing Adoption of Bring Your Own Device (BYOD).

6. What are the notable trends driving market growth?

Multi Factor Authentication is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; High Cost Involved with Matured Authentication Methods.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Authentication Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Authentication Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Authentication Services Industry?

To stay informed about further developments, trends, and reports in the Authentication Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence