Key Insights

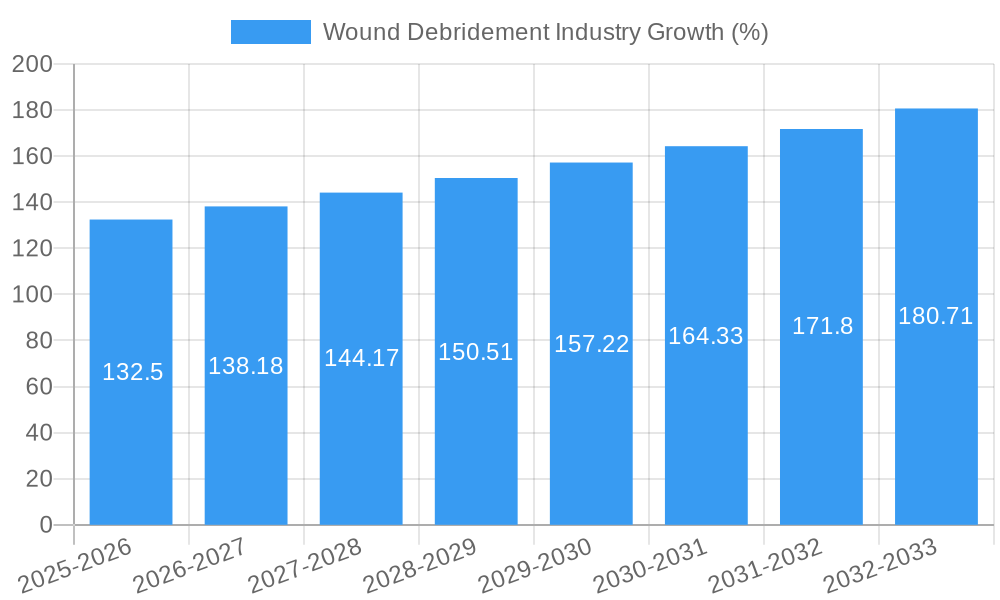

The global Wound Debridement Market is poised for robust expansion, projected to reach approximately USD 4.95 million by 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 5.97% through 2033. This sustained growth is fundamentally driven by the increasing prevalence of chronic wounds, including diabetic foot ulcers, venous leg ulcers, and pressure ulcers, which often necessitate debridement for effective healing. The aging global population further contributes to this demand, as older individuals are more susceptible to chronic conditions leading to wound development. Technological advancements in wound care solutions, particularly in the development of advanced debridement products and minimally invasive surgical techniques, are also key catalysts. These innovations offer improved patient outcomes, reduced healing times, and enhanced patient comfort, thereby fostering greater adoption by healthcare professionals.

The market's trajectory is significantly influenced by the rising incidence of lifestyle-related diseases like diabetes and obesity, which directly impact wound healing capabilities and increase the likelihood of chronic wound formation. Furthermore, growing awareness and access to advanced wound care treatments in emerging economies, coupled with increased healthcare expenditure, are creating substantial opportunities for market players. While surgical debridement remains a cornerstone, there's a discernible shift towards less invasive methods like enzymatic and autolytic debridement, driven by their efficacy in preserving healthy tissue and minimizing patient discomfort. The product landscape is diverse, with gels, ointments, creams, and surgical devices dominating, while mechanical debridement pads and other specialized products cater to specific wound needs. The focus on developing cost-effective and efficient debridement solutions will be paramount for sustained market leadership.

Wound Debridement Industry Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth wound debridement market report offers a detailed analysis of the global wound care solutions landscape, focusing on critical wound management techniques. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base year of 2025, this report is an indispensable resource for stakeholders seeking to understand the dynamics of advanced wound care and necrotic tissue removal. With a projected market size expected to reach billions, this study dives deep into market segmentation, key growth drivers, emerging trends, and the competitive strategies of leading players in the wound healing market.

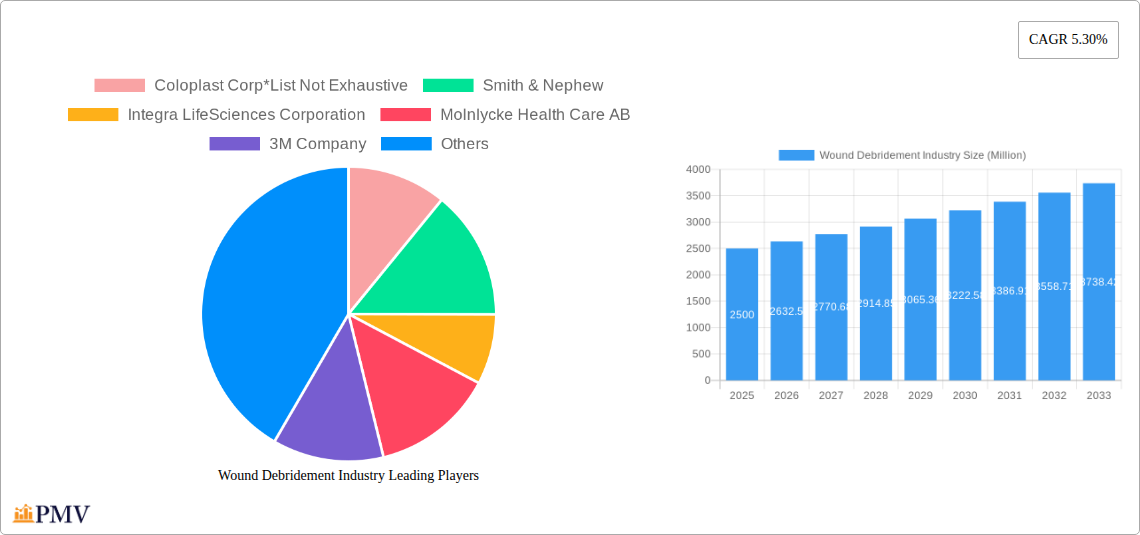

Wound Debridement Industry Market Structure & Competitive Dynamics

The wound debridement industry exhibits a moderately consolidated market structure, characterized by the presence of several large multinational corporations alongside a growing number of innovative small and medium-sized enterprises (SMEs). Key players like Smith + Nephew, Convatec Group PLC, PAUL HARTMANN AG, and B Braun SE command significant market share due to their extensive product portfolios, established distribution networks, and strong brand recognition in medical device manufacturing. Innovation ecosystems are vibrant, driven by continuous R&D in biologics for wound healing and minimally invasive wound care. Regulatory frameworks, particularly those governed by the FDA and EMA, play a crucial role in market entry and product approval, influencing the pace of innovation and market access for new wound debridement technologies.

- Market Concentration: Dominated by a mix of global giants and specialized providers.

- Innovation Ecosystems: Fueled by advancements in enzymatic debridement agents and ultrasonic wound cleaning.

- Regulatory Frameworks: Strict adherence to quality and safety standards impacts product lifecycles.

- Product Substitutes: While diverse, direct substitutes for effective debridement are limited, emphasizing the importance of specialized solutions.

- End-User Trends: Growing preference for less invasive and faster-acting wound healing therapies.

- M&A Activities: Significant M&A activity is observed as larger players aim to acquire innovative technologies and expand market reach. For instance, acquisitions in the surgical wound management segment are common, with deal values often in the tens to hundreds of millions, and potentially exceeding a billion for highly strategic acquisitions.

Wound Debridement Industry Industry Trends & Insights

The wound debridement industry is experiencing robust growth, driven by an aging global population, an increasing prevalence of chronic diseases such as diabetes and peripheral artery disease, and a rising incidence of surgical procedures. The market penetration of advanced wound care products is steadily increasing as healthcare providers and patients recognize the benefits of effective debridement in accelerating healing, reducing infection rates, and minimizing scarring. Technological disruptions are a major trend, with a significant shift towards minimally invasive wound debridement methods, including enzymatic, autolytic, and ultrasonic approaches, which offer improved patient comfort and reduced recovery times compared to traditional surgical debridement.

The increasing adoption of ultrasound debridement devices is a testament to this trend, offering precise and controlled tissue removal. Furthermore, the development of novel wound debridement gels, ointments, and creams with enhanced bioactivity and targeted delivery mechanisms is expanding the therapeutic options available. Consumer preferences are leaning towards products that promote a moist wound healing environment and are easy to use, driving demand for self-directed wound care solutions. The competitive landscape is dynamic, with companies investing heavily in R&D to develop next-generation debridement technologies and therapies. Biologics for wound healing and regenerative medicine are emerging as significant growth areas.

The increasing awareness and adoption of these advanced techniques contribute to the market's compound annual growth rate (CAGR), which is estimated to be in the range of 5-7%. This growth is further fueled by strategic partnerships and collaborations between medical device manufacturers, pharmaceutical companies, and research institutions. The market is also witnessing a geographical expansion of wound management solutions, with emerging economies showing increased investment in healthcare infrastructure and a greater demand for specialized wound care. The focus on preventative wound care and the management of complex wounds, such as diabetic foot ulcers and pressure ulcers, continues to be a primary market driver. The estimated market size for wound debridement is projected to reach between $10-15 Billion by 2028, and potentially $20-25 Billion by 2033, reflecting sustained innovation and market demand.

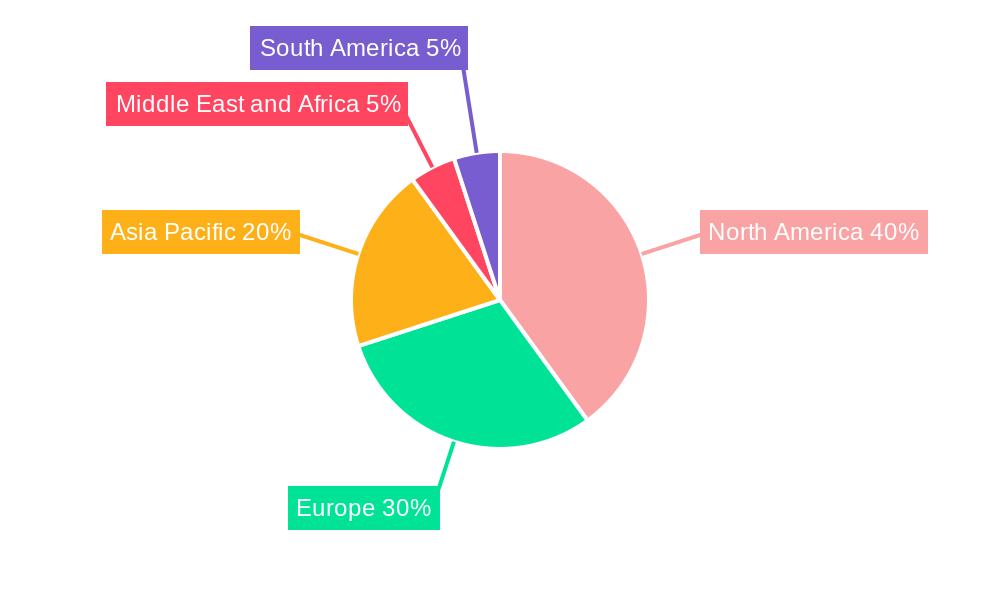

Dominant Markets & Segments in Wound Debridement Industry

The wound debridement industry is characterized by distinct market dominance across various segments, driven by specific clinical needs, technological advancements, and regional healthcare infrastructure. Globally, North America, particularly the United States, stands out as the dominant market for wound debridement products and services. This leadership is attributed to a combination of factors, including a high prevalence of chronic diseases that lead to complex wounds, advanced healthcare infrastructure, significant R&D investment, and a higher reimbursement rate for advanced wound care treatments.

Within the Product segmentation, Surgical Devices currently hold a substantial market share, owing to their established efficacy in acute wound management and trauma cases. However, Gels, Ointments & Creams are witnessing rapid growth, driven by the increasing demand for less invasive and patient-friendly debridement options, especially for chronic wounds. Ultrasound Devices are also gaining significant traction due to their precision and ability to preserve healthy tissue, presenting a compelling alternative to traditional methods.

In terms of Method, the Surgical Method remains prevalent due to its immediate effectiveness in removing large amounts of necrotic tissue. Nevertheless, the Enzymatic Method and Mechanical Method (including advanced debridement pads) are projected to experience the fastest growth. This shift is fueled by their perceived benefits of reduced pain, minimal damage to healthy tissue, and suitability for home care settings. The Autolytic Method, while often a component of other debridement strategies, is increasingly integrated into advanced dressings.

Analyzing Wound Type, Chronic Ulcers represent the largest and fastest-growing segment. The escalating rates of diabetes and cardiovascular diseases worldwide contribute to a significant increase in conditions like diabetic foot ulcers, venous leg ulcers, and pressure ulcers, all of which necessitate effective debridement for healing. Surgical & Traumatic Wounds form another substantial segment, with debridement being a critical step in the management of post-operative complications and injuries. Burns also represent a significant application area, where debridement is essential for preparing the wound bed for grafting and promoting re-epithelialization.

- Dominant Region: North America leads due to high disease prevalence, robust healthcare systems, and strong R&D.

- Key Drivers: Advanced medical technology adoption, favorable reimbursement policies, and a large patient pool with chronic conditions.

- Dominant Product Segment: Surgical Devices currently lead, but Gels, Ointments & Creams, and Ultrasound Devices are rapidly expanding due to their less invasive nature.

- Key Drivers: Patient preference for comfort, ease of use, and reduced intervention invasiveness.

- Dominant Method: Surgical Method for acute situations; Enzymatic and Mechanical Methods showing highest growth for chronic wound management.

- Key Drivers: Minimizing patient discomfort, reducing healing time, and promoting tissue regeneration.

- Dominant Wound Type: Chronic Ulcers are the largest segment, driven by the global epidemic of diabetes and aging population.

- Key Drivers: Increasing incidence of chronic diseases, longer life expectancies, and improved diagnostics.

Wound Debridement Industry Product Innovations

Product innovation in the wound debridement industry is primarily focused on enhancing efficacy, improving patient comfort, and reducing the risk of infection. Companies are developing advanced mechanical debridement pads with novel abrasive surfaces that offer controlled yet thorough tissue removal. In the realm of enzymatic debridement agents, research is yielding new formulations with broader spectrum activity against various types of necrotic tissue and biofilms, often combined with antimicrobial properties. The development of ultrasound debridement devices is another significant area, with new models offering enhanced portability, user-friendliness, and targeted energy delivery. Smart dressings incorporating debridement capabilities and monitoring systems are also emerging, promising more personalized and effective wound management.

Report Segmentation & Scope

This comprehensive wound debridement market report provides detailed insights across key segments:

Product Segmentation:

- Gels, Ointments & Creams: This segment encompasses topical formulations designed to soften and liquefy necrotic tissue, facilitating its removal. Growth is driven by ease of application and patient preference for non-invasive treatments. Market size is projected to reach approximately $3-4 Billion by 2033.

- Surgical Devices: This includes instruments like scalpels, curettes, and forceps used for sharp debridement. While a mature segment, it remains crucial for acute wound management, with a market size estimated around $2-3 Billion.

- Ultrasound Devices: These devices utilize ultrasonic energy for wound cleaning and debridement, offering precision and minimal collateral damage. This segment is experiencing rapid growth, anticipated to reach $1.5-2 Billion.

- Mechanical Debridement Pads: Featuring abrasive surfaces, these pads are used for physical removal of tissue. This segment offers a balance between effectiveness and ease of use, with a projected market size of $1-1.5 Billion.

- Other Wound Debridement Products: This category includes irrigation solutions, specialized dressings, and other ancillary products supporting debridement.

Method Segmentation:

- Surgical Method: This invasive technique involves the sharp removal of devitalized tissue. It remains a cornerstone of wound care, particularly in emergent situations.

- Enzymatic Method: Utilizes enzymes to break down necrotic tissue. This method is gaining popularity due to its targeted action and reduced patient discomfort.

- Mechanical Method: Involves physical removal of tissue through methods like abrasion, irrigation, or using debridement pads.

- Autolytic Method: Leverages the body's own enzymes to break down necrotic tissue, typically facilitated by occlusive dressings.

- Other Methods: Encompasses newer or less common debridement techniques.

Wound Type Segmentation:

- Chronic Ulcers: Including diabetic foot ulcers, venous leg ulcers, and pressure ulcers. This is the largest and fastest-growing segment due to the rise in chronic diseases.

- Surgical & Traumatic Wounds: Covering wounds resulting from surgery or injury, where debridement is crucial for healing and infection prevention.

- Burns: Debridement is a critical step in burn management to prepare the wound bed for reconstruction.

Key Drivers of Wound Debridement Industry Growth

The wound debridement industry is propelled by a confluence of factors, primarily the increasing global prevalence of chronic diseases like diabetes and peripheral vascular disease, which directly contribute to the incidence of hard-to-heal wounds. The aging population worldwide also plays a significant role, as older individuals are more susceptible to conditions requiring wound debridement. Advancements in wound care technology, including the development of less invasive and more effective debridement methods such as enzymatic and ultrasonic treatments, are enhancing clinical outcomes and patient satisfaction. Favorable reimbursement policies in developed nations also encourage the adoption of advanced wound care solutions. Furthermore, increased healthcare expenditure and the expanding reach of healthcare services in emerging economies are opening up new markets for wound debridement products.

Challenges in the Wound Debridement Industry Sector

Despite its robust growth, the wound debridement industry faces several challenges. Stringent regulatory approval processes for new medical devices and therapeutic agents can lead to extended product development timelines and increased costs. The high cost of advanced wound debridement products and treatments can be a barrier to adoption, particularly in resource-limited settings and for patients with inadequate insurance coverage. Furthermore, a lack of skilled healthcare professionals trained in advanced wound management techniques can limit the effective utilization of innovative debridement solutions. Competitive pressures from established players and the emergence of novel therapies also necessitate continuous innovation and cost-effectiveness strategies. Supply chain disruptions and the need for sterile and specialized manufacturing also pose operational challenges.

Leading Players in the Wound Debridement Industry Market

- Histologics LLC

- Convatec Group PLC

- Bioventus (Misonix Inc)

- Arobella Medical

- RLS Global

- PulseCare Medical

- Medaxis

- DeRoyal Industries Inc

- PAUL HARTMANN AG

- Smith + Nephew

- B Braun SE

- Lohmann & Rauscher

Key Developments in Wound Debridement Industry Sector

- March 2023: SolasCure announced the final closing of a GBP 10.9 million (USD 13.3 million) Series B fund to advance wound care innovation. The funding will support the development of Aurase Wound Gel and progress toward further Phase II clinical trials of innovative wound debriding enzymes. This development signifies a significant investment in novel enzymatic debridement technologies.

- February 2023: SERDA Therapeutics submitted an Investigational New Drug Application (IND) to the United States FDA for its lead product SN514 hydrogel, an enzymatic wound debriding agent. This marks a crucial step towards the clinical evaluation and potential market introduction of a new enzymatic solution.

Strategic Wound Debridement Industry Market Outlook

The strategic outlook for the wound debridement industry is highly positive, driven by sustained innovation and an increasing global demand for effective wound management solutions. The future market potential lies in the continued development and adoption of minimally invasive debridement techniques, such as advanced enzymatic and ultrasonic therapies, which offer superior patient outcomes and reduced healthcare costs. Expansion into emerging markets with growing healthcare infrastructure and increasing awareness of chronic wound management presents a significant growth opportunity. Strategic initiatives will focus on developing integrated wound care platforms, leveraging digital health technologies for remote patient monitoring and treatment optimization, and fostering collaborations to accelerate the commercialization of groundbreaking wound healing technologies. The focus on personalized medicine and targeted debridement strategies will be paramount.

Wound Debridement Industry Segmentation

-

1. Product

- 1.1. Gels

- 1.2. Ointments & Creams

- 1.3. Surgical Devices

- 1.4. Ultrasound Devices

- 1.5. Mechanical Debridement Pads

- 1.6. Other Wound Debridement Products

-

2. Method

- 2.1. Surgical Method

- 2.2. Enzymatic Method

- 2.3. Mechanical Method

- 2.4. Autolytic Method

- 2.5. Other Methods

-

3. Wound Type

- 3.1. Chronic Ulcers

- 3.2. Surgical & Traumatic Wounds

- 3.3. Burns

Wound Debridement Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Wound Debridement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Diabetes and Associated Wounds; Increase in Volume of Surgical Procedures; Growing Geriatric Population

- 3.3. Market Restrains

- 3.3.1. High Treatment Cost

- 3.4. Market Trends

- 3.4.1. Gels in Product Segment is Expected to Have a Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wound Debridement Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Gels

- 5.1.2. Ointments & Creams

- 5.1.3. Surgical Devices

- 5.1.4. Ultrasound Devices

- 5.1.5. Mechanical Debridement Pads

- 5.1.6. Other Wound Debridement Products

- 5.2. Market Analysis, Insights and Forecast - by Method

- 5.2.1. Surgical Method

- 5.2.2. Enzymatic Method

- 5.2.3. Mechanical Method

- 5.2.4. Autolytic Method

- 5.2.5. Other Methods

- 5.3. Market Analysis, Insights and Forecast - by Wound Type

- 5.3.1. Chronic Ulcers

- 5.3.2. Surgical & Traumatic Wounds

- 5.3.3. Burns

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Wound Debridement Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Gels

- 6.1.2. Ointments & Creams

- 6.1.3. Surgical Devices

- 6.1.4. Ultrasound Devices

- 6.1.5. Mechanical Debridement Pads

- 6.1.6. Other Wound Debridement Products

- 6.2. Market Analysis, Insights and Forecast - by Method

- 6.2.1. Surgical Method

- 6.2.2. Enzymatic Method

- 6.2.3. Mechanical Method

- 6.2.4. Autolytic Method

- 6.2.5. Other Methods

- 6.3. Market Analysis, Insights and Forecast - by Wound Type

- 6.3.1. Chronic Ulcers

- 6.3.2. Surgical & Traumatic Wounds

- 6.3.3. Burns

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Wound Debridement Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Gels

- 7.1.2. Ointments & Creams

- 7.1.3. Surgical Devices

- 7.1.4. Ultrasound Devices

- 7.1.5. Mechanical Debridement Pads

- 7.1.6. Other Wound Debridement Products

- 7.2. Market Analysis, Insights and Forecast - by Method

- 7.2.1. Surgical Method

- 7.2.2. Enzymatic Method

- 7.2.3. Mechanical Method

- 7.2.4. Autolytic Method

- 7.2.5. Other Methods

- 7.3. Market Analysis, Insights and Forecast - by Wound Type

- 7.3.1. Chronic Ulcers

- 7.3.2. Surgical & Traumatic Wounds

- 7.3.3. Burns

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Wound Debridement Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Gels

- 8.1.2. Ointments & Creams

- 8.1.3. Surgical Devices

- 8.1.4. Ultrasound Devices

- 8.1.5. Mechanical Debridement Pads

- 8.1.6. Other Wound Debridement Products

- 8.2. Market Analysis, Insights and Forecast - by Method

- 8.2.1. Surgical Method

- 8.2.2. Enzymatic Method

- 8.2.3. Mechanical Method

- 8.2.4. Autolytic Method

- 8.2.5. Other Methods

- 8.3. Market Analysis, Insights and Forecast - by Wound Type

- 8.3.1. Chronic Ulcers

- 8.3.2. Surgical & Traumatic Wounds

- 8.3.3. Burns

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Wound Debridement Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Gels

- 9.1.2. Ointments & Creams

- 9.1.3. Surgical Devices

- 9.1.4. Ultrasound Devices

- 9.1.5. Mechanical Debridement Pads

- 9.1.6. Other Wound Debridement Products

- 9.2. Market Analysis, Insights and Forecast - by Method

- 9.2.1. Surgical Method

- 9.2.2. Enzymatic Method

- 9.2.3. Mechanical Method

- 9.2.4. Autolytic Method

- 9.2.5. Other Methods

- 9.3. Market Analysis, Insights and Forecast - by Wound Type

- 9.3.1. Chronic Ulcers

- 9.3.2. Surgical & Traumatic Wounds

- 9.3.3. Burns

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Wound Debridement Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Gels

- 10.1.2. Ointments & Creams

- 10.1.3. Surgical Devices

- 10.1.4. Ultrasound Devices

- 10.1.5. Mechanical Debridement Pads

- 10.1.6. Other Wound Debridement Products

- 10.2. Market Analysis, Insights and Forecast - by Method

- 10.2.1. Surgical Method

- 10.2.2. Enzymatic Method

- 10.2.3. Mechanical Method

- 10.2.4. Autolytic Method

- 10.2.5. Other Methods

- 10.3. Market Analysis, Insights and Forecast - by Wound Type

- 10.3.1. Chronic Ulcers

- 10.3.2. Surgical & Traumatic Wounds

- 10.3.3. Burns

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Wound Debridement Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Europe Wound Debridement Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Asia Pacific Wound Debridement Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. Middle East and Africa Wound Debridement Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. South America Wound Debridement Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Histologics LLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Convatec Group PLC

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bioventus (Misonix Inc )

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Arobella Medical

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 RLS Global

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 PulseCare Medical

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Medaxis

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 DeRoyal Industries Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 PAUL HARTMANN AG

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Smith + Nephew

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 B Braun SE

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Lohmann & Rauscher

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Histologics LLC

List of Figures

- Figure 1: Global Wound Debridement Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Wound Debridement Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Wound Debridement Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Wound Debridement Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Wound Debridement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Wound Debridement Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Wound Debridement Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Wound Debridement Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Wound Debridement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Wound Debridement Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Wound Debridement Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Wound Debridement Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Wound Debridement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Wound Debridement Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: Middle East and Africa Wound Debridement Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: Middle East and Africa Wound Debridement Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: Middle East and Africa Wound Debridement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa Wound Debridement Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Wound Debridement Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: South America Wound Debridement Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: South America Wound Debridement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Wound Debridement Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Wound Debridement Industry Revenue (Million), by Product 2024 & 2032

- Figure 24: North America Wound Debridement Industry Volume (K Unit), by Product 2024 & 2032

- Figure 25: North America Wound Debridement Industry Revenue Share (%), by Product 2024 & 2032

- Figure 26: North America Wound Debridement Industry Volume Share (%), by Product 2024 & 2032

- Figure 27: North America Wound Debridement Industry Revenue (Million), by Method 2024 & 2032

- Figure 28: North America Wound Debridement Industry Volume (K Unit), by Method 2024 & 2032

- Figure 29: North America Wound Debridement Industry Revenue Share (%), by Method 2024 & 2032

- Figure 30: North America Wound Debridement Industry Volume Share (%), by Method 2024 & 2032

- Figure 31: North America Wound Debridement Industry Revenue (Million), by Wound Type 2024 & 2032

- Figure 32: North America Wound Debridement Industry Volume (K Unit), by Wound Type 2024 & 2032

- Figure 33: North America Wound Debridement Industry Revenue Share (%), by Wound Type 2024 & 2032

- Figure 34: North America Wound Debridement Industry Volume Share (%), by Wound Type 2024 & 2032

- Figure 35: North America Wound Debridement Industry Revenue (Million), by Country 2024 & 2032

- Figure 36: North America Wound Debridement Industry Volume (K Unit), by Country 2024 & 2032

- Figure 37: North America Wound Debridement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: North America Wound Debridement Industry Volume Share (%), by Country 2024 & 2032

- Figure 39: Europe Wound Debridement Industry Revenue (Million), by Product 2024 & 2032

- Figure 40: Europe Wound Debridement Industry Volume (K Unit), by Product 2024 & 2032

- Figure 41: Europe Wound Debridement Industry Revenue Share (%), by Product 2024 & 2032

- Figure 42: Europe Wound Debridement Industry Volume Share (%), by Product 2024 & 2032

- Figure 43: Europe Wound Debridement Industry Revenue (Million), by Method 2024 & 2032

- Figure 44: Europe Wound Debridement Industry Volume (K Unit), by Method 2024 & 2032

- Figure 45: Europe Wound Debridement Industry Revenue Share (%), by Method 2024 & 2032

- Figure 46: Europe Wound Debridement Industry Volume Share (%), by Method 2024 & 2032

- Figure 47: Europe Wound Debridement Industry Revenue (Million), by Wound Type 2024 & 2032

- Figure 48: Europe Wound Debridement Industry Volume (K Unit), by Wound Type 2024 & 2032

- Figure 49: Europe Wound Debridement Industry Revenue Share (%), by Wound Type 2024 & 2032

- Figure 50: Europe Wound Debridement Industry Volume Share (%), by Wound Type 2024 & 2032

- Figure 51: Europe Wound Debridement Industry Revenue (Million), by Country 2024 & 2032

- Figure 52: Europe Wound Debridement Industry Volume (K Unit), by Country 2024 & 2032

- Figure 53: Europe Wound Debridement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 54: Europe Wound Debridement Industry Volume Share (%), by Country 2024 & 2032

- Figure 55: Asia Pacific Wound Debridement Industry Revenue (Million), by Product 2024 & 2032

- Figure 56: Asia Pacific Wound Debridement Industry Volume (K Unit), by Product 2024 & 2032

- Figure 57: Asia Pacific Wound Debridement Industry Revenue Share (%), by Product 2024 & 2032

- Figure 58: Asia Pacific Wound Debridement Industry Volume Share (%), by Product 2024 & 2032

- Figure 59: Asia Pacific Wound Debridement Industry Revenue (Million), by Method 2024 & 2032

- Figure 60: Asia Pacific Wound Debridement Industry Volume (K Unit), by Method 2024 & 2032

- Figure 61: Asia Pacific Wound Debridement Industry Revenue Share (%), by Method 2024 & 2032

- Figure 62: Asia Pacific Wound Debridement Industry Volume Share (%), by Method 2024 & 2032

- Figure 63: Asia Pacific Wound Debridement Industry Revenue (Million), by Wound Type 2024 & 2032

- Figure 64: Asia Pacific Wound Debridement Industry Volume (K Unit), by Wound Type 2024 & 2032

- Figure 65: Asia Pacific Wound Debridement Industry Revenue Share (%), by Wound Type 2024 & 2032

- Figure 66: Asia Pacific Wound Debridement Industry Volume Share (%), by Wound Type 2024 & 2032

- Figure 67: Asia Pacific Wound Debridement Industry Revenue (Million), by Country 2024 & 2032

- Figure 68: Asia Pacific Wound Debridement Industry Volume (K Unit), by Country 2024 & 2032

- Figure 69: Asia Pacific Wound Debridement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 70: Asia Pacific Wound Debridement Industry Volume Share (%), by Country 2024 & 2032

- Figure 71: Middle East and Africa Wound Debridement Industry Revenue (Million), by Product 2024 & 2032

- Figure 72: Middle East and Africa Wound Debridement Industry Volume (K Unit), by Product 2024 & 2032

- Figure 73: Middle East and Africa Wound Debridement Industry Revenue Share (%), by Product 2024 & 2032

- Figure 74: Middle East and Africa Wound Debridement Industry Volume Share (%), by Product 2024 & 2032

- Figure 75: Middle East and Africa Wound Debridement Industry Revenue (Million), by Method 2024 & 2032

- Figure 76: Middle East and Africa Wound Debridement Industry Volume (K Unit), by Method 2024 & 2032

- Figure 77: Middle East and Africa Wound Debridement Industry Revenue Share (%), by Method 2024 & 2032

- Figure 78: Middle East and Africa Wound Debridement Industry Volume Share (%), by Method 2024 & 2032

- Figure 79: Middle East and Africa Wound Debridement Industry Revenue (Million), by Wound Type 2024 & 2032

- Figure 80: Middle East and Africa Wound Debridement Industry Volume (K Unit), by Wound Type 2024 & 2032

- Figure 81: Middle East and Africa Wound Debridement Industry Revenue Share (%), by Wound Type 2024 & 2032

- Figure 82: Middle East and Africa Wound Debridement Industry Volume Share (%), by Wound Type 2024 & 2032

- Figure 83: Middle East and Africa Wound Debridement Industry Revenue (Million), by Country 2024 & 2032

- Figure 84: Middle East and Africa Wound Debridement Industry Volume (K Unit), by Country 2024 & 2032

- Figure 85: Middle East and Africa Wound Debridement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 86: Middle East and Africa Wound Debridement Industry Volume Share (%), by Country 2024 & 2032

- Figure 87: South America Wound Debridement Industry Revenue (Million), by Product 2024 & 2032

- Figure 88: South America Wound Debridement Industry Volume (K Unit), by Product 2024 & 2032

- Figure 89: South America Wound Debridement Industry Revenue Share (%), by Product 2024 & 2032

- Figure 90: South America Wound Debridement Industry Volume Share (%), by Product 2024 & 2032

- Figure 91: South America Wound Debridement Industry Revenue (Million), by Method 2024 & 2032

- Figure 92: South America Wound Debridement Industry Volume (K Unit), by Method 2024 & 2032

- Figure 93: South America Wound Debridement Industry Revenue Share (%), by Method 2024 & 2032

- Figure 94: South America Wound Debridement Industry Volume Share (%), by Method 2024 & 2032

- Figure 95: South America Wound Debridement Industry Revenue (Million), by Wound Type 2024 & 2032

- Figure 96: South America Wound Debridement Industry Volume (K Unit), by Wound Type 2024 & 2032

- Figure 97: South America Wound Debridement Industry Revenue Share (%), by Wound Type 2024 & 2032

- Figure 98: South America Wound Debridement Industry Volume Share (%), by Wound Type 2024 & 2032

- Figure 99: South America Wound Debridement Industry Revenue (Million), by Country 2024 & 2032

- Figure 100: South America Wound Debridement Industry Volume (K Unit), by Country 2024 & 2032

- Figure 101: South America Wound Debridement Industry Revenue Share (%), by Country 2024 & 2032

- Figure 102: South America Wound Debridement Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wound Debridement Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Wound Debridement Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Wound Debridement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Global Wound Debridement Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Global Wound Debridement Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 6: Global Wound Debridement Industry Volume K Unit Forecast, by Method 2019 & 2032

- Table 7: Global Wound Debridement Industry Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 8: Global Wound Debridement Industry Volume K Unit Forecast, by Wound Type 2019 & 2032

- Table 9: Global Wound Debridement Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Wound Debridement Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Global Wound Debridement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Wound Debridement Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Global Wound Debridement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Wound Debridement Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Global Wound Debridement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Wound Debridement Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Global Wound Debridement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Wound Debridement Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Global Wound Debridement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Wound Debridement Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Global Wound Debridement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 22: Global Wound Debridement Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 23: Global Wound Debridement Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 24: Global Wound Debridement Industry Volume K Unit Forecast, by Method 2019 & 2032

- Table 25: Global Wound Debridement Industry Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 26: Global Wound Debridement Industry Volume K Unit Forecast, by Wound Type 2019 & 2032

- Table 27: Global Wound Debridement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Wound Debridement Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: United States Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Canada Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Mexico Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Global Wound Debridement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 36: Global Wound Debridement Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 37: Global Wound Debridement Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 38: Global Wound Debridement Industry Volume K Unit Forecast, by Method 2019 & 2032

- Table 39: Global Wound Debridement Industry Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 40: Global Wound Debridement Industry Volume K Unit Forecast, by Wound Type 2019 & 2032

- Table 41: Global Wound Debridement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Wound Debridement Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Germany Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: United Kingdom Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: United Kingdom Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: France Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Italy Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Italy Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Spain Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Spain Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Rest of Europe Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Europe Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Global Wound Debridement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 56: Global Wound Debridement Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 57: Global Wound Debridement Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 58: Global Wound Debridement Industry Volume K Unit Forecast, by Method 2019 & 2032

- Table 59: Global Wound Debridement Industry Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 60: Global Wound Debridement Industry Volume K Unit Forecast, by Wound Type 2019 & 2032

- Table 61: Global Wound Debridement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Wound Debridement Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 63: China Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: China Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 65: Japan Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Japan Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: India Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: India Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Australia Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Australia Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: South Korea Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: South Korea Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Rest of Asia Pacific Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Asia Pacific Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Global Wound Debridement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 76: Global Wound Debridement Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 77: Global Wound Debridement Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 78: Global Wound Debridement Industry Volume K Unit Forecast, by Method 2019 & 2032

- Table 79: Global Wound Debridement Industry Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 80: Global Wound Debridement Industry Volume K Unit Forecast, by Wound Type 2019 & 2032

- Table 81: Global Wound Debridement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Global Wound Debridement Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 83: GCC Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: GCC Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: South Africa Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: South Africa Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Rest of Middle East and Africa Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Rest of Middle East and Africa Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Global Wound Debridement Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 90: Global Wound Debridement Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 91: Global Wound Debridement Industry Revenue Million Forecast, by Method 2019 & 2032

- Table 92: Global Wound Debridement Industry Volume K Unit Forecast, by Method 2019 & 2032

- Table 93: Global Wound Debridement Industry Revenue Million Forecast, by Wound Type 2019 & 2032

- Table 94: Global Wound Debridement Industry Volume K Unit Forecast, by Wound Type 2019 & 2032

- Table 95: Global Wound Debridement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 96: Global Wound Debridement Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 97: Brazil Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Brazil Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: Argentina Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Argentina Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 101: Rest of South America Wound Debridement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: Rest of South America Wound Debridement Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wound Debridement Industry?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the Wound Debridement Industry?

Key companies in the market include Histologics LLC, Convatec Group PLC, Bioventus (Misonix Inc ), Arobella Medical, RLS Global, PulseCare Medical, Medaxis, DeRoyal Industries Inc, PAUL HARTMANN AG, Smith + Nephew, B Braun SE, Lohmann & Rauscher.

3. What are the main segments of the Wound Debridement Industry?

The market segments include Product, Method, Wound Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Diabetes and Associated Wounds; Increase in Volume of Surgical Procedures; Growing Geriatric Population.

6. What are the notable trends driving market growth?

Gels in Product Segment is Expected to Have a Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Treatment Cost.

8. Can you provide examples of recent developments in the market?

March 2023: SolasCure announced the final closing of a GBP 10.9 million (USD 13.3 million) Series B fund to advance wound care innovation. The funding will support the development of Aurase Wound Gel and progress toward further Phase II clinical trials of innovative wound debriding enzymes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wound Debridement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wound Debridement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wound Debridement Industry?

To stay informed about further developments, trends, and reports in the Wound Debridement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence