Key Insights

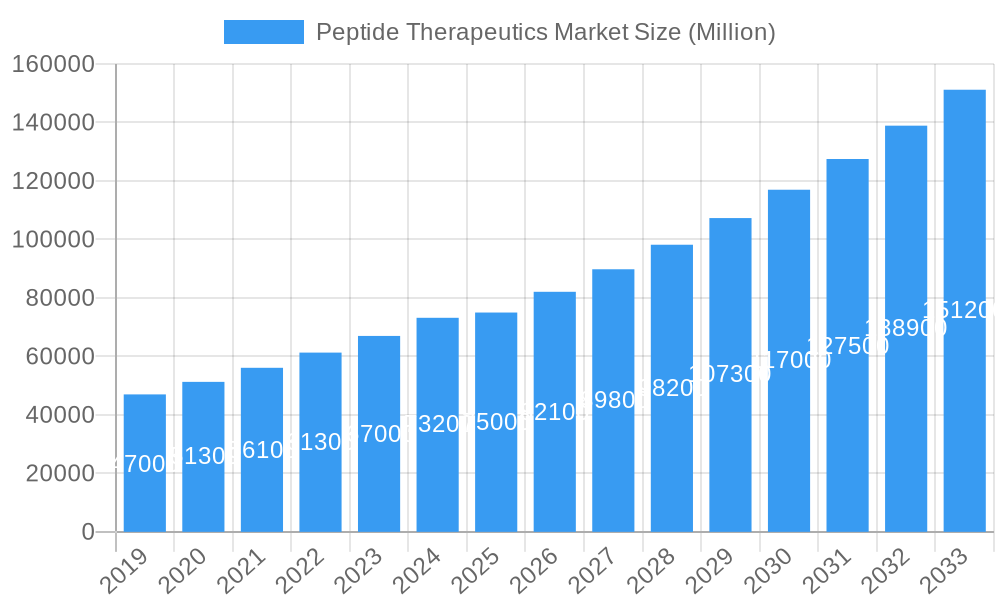

The global Peptide Therapeutics Market is set for substantial growth, projected to reach USD 49.7 billion by 2025, with a compound annual growth rate (CAGR) of 8.1% through 2033. This expansion is driven by the increasing incidence of chronic diseases like gastrointestinal disorders, neurological conditions, metabolic disorders, and cancer, for which peptide-based therapies offer high specificity, efficacy, and favorable safety profiles. Advancements in peptide synthesis, drug delivery systems, and a deeper understanding of biological pathways are further broadening the therapeutic applications of these compounds. The market encompasses both generic and branded peptide therapeutics.

Peptide Therapeutics Market Market Size (In Billion)

Key growth catalysts include a robust pipeline of peptide drugs in clinical development and significant research and development investments by leading pharmaceutical and biotechnology firms. Innovations in drug delivery, such as oral and parenteral formulations, are enhancing patient compliance and therapeutic outcomes. However, challenges such as high manufacturing costs, complex regulatory pathways, and potential immunogenicity require ongoing consideration. The expanding therapeutic applications into niche indications and strategic collaborations among key industry players highlight a dynamic and competitive landscape. North America and Europe currently lead the market, supported by strong healthcare infrastructure and R&D investment, while the Asia Pacific region is expected to experience significant growth due to rising healthcare expenditure and an expanding patient population.

Peptide Therapeutics Market Company Market Share

This comprehensive report provides an in-depth analysis of the global peptide therapeutics market, a rapidly growing pharmaceutical segment driven by innovation and demand for targeted therapies. The study covers the period from 2019 to 2033, with 2025 as the base year and projections extending to 2033. Gain critical insights into market dynamics, growth drivers, challenges, and competitive strategies within the peptide drug market, including peptide API trends and the impact of novel peptide drugs.

Peptide Therapeutics Market Market Structure & Competitive Dynamics

The global peptide therapeutics market exhibits a moderately concentrated structure, with a blend of large, established pharmaceutical giants and agile, specialized biotechnology firms. Innovation ecosystems are flourishing, fueled by substantial R&D investments in peptide synthesis, peptide drug delivery systems, and peptide-based biologics. Regulatory frameworks, while stringent, are evolving to accommodate the unique nature of peptide therapeutics, with agencies like the FDA and EMA providing clear pathways for drug approval. Product substitutes are primarily small molecule drugs and other biologics, but the increasing specificity and reduced side effects of peptide therapies are carving out distinct market niches. End-user trends are dominated by the rising prevalence of chronic diseases such as metabolic disorders, cancer, and neurological disorders, necessitating advanced therapeutic solutions. Mergers and acquisitions (M&A) are a significant feature, with strategic deals aimed at consolidating market share, acquiring novel technologies, and expanding product portfolios. Recent M&A activities have seen valuations ranging from tens of millions to billions of dollars, reflecting the high growth potential and strategic importance of this sector. Key players are actively engaging in partnerships and collaborations to accelerate drug development and market penetration. The market share of leading companies is dynamic, influenced by pipeline advancements and successful product launches.

Peptide Therapeutics Market Industry Trends & Insights

The peptide therapeutics market is poised for robust growth, projected to expand at a CAGR of xx% from 2025 to 2033. This expansion is underpinned by several key industry trends and insights. The increasing understanding of peptide biology and advanced peptide engineering techniques are enabling the development of highly specific and potent therapeutic peptides. This has led to a surge in peptide drug approvals for a wide range of indications, from metabolic disorders like diabetes and obesity to complex conditions such as neurological disorders and cancer. The peptide API market is experiencing significant growth as demand for these complex molecules escalates. Furthermore, advancements in peptide drug delivery systems, including oral peptide delivery, subcutaneous injections, and novel nanocarrier technologies, are enhancing patient compliance and therapeutic efficacy, thereby driving market penetration.

The market is also witnessing a growing preference for branded peptide drugs due to their proprietary formulations and established clinical benefits, although the generic peptide market is gaining traction as patents expire and cost-effective alternatives emerge. Technological disruptions, particularly in peptide synthesis technologies such as solid-phase peptide synthesis (SPPS) and liquid-phase peptide synthesis (LPPS), are contributing to more efficient and scalable production of peptides, thereby reducing manufacturing costs and increasing accessibility.

Consumer preferences are shifting towards treatments with fewer side effects and improved efficacy, areas where peptide therapeutics often excel. The competitive dynamics are characterized by intense R&D efforts, strategic alliances, and a continuous pursuit of therapeutic differentiation. The rising incidence of chronic diseases globally, coupled with an aging population, further fuels the demand for innovative peptide-based treatments. The peptide therapeutics market value is expected to reach several hundred billion dollars by the end of the forecast period, underscoring its critical role in modern medicine.

Dominant Markets & Segments in Peptide Therapeutics Market

The peptide therapeutics market is characterized by dominant regions and segments that are shaping its global trajectory. North America, particularly the United States, remains the largest and most influential market due to its strong R&D infrastructure, significant healthcare spending, and early adoption of novel therapies.

Marketing Type:

- Branded Peptide Drugs: These dominate the market share owing to their established efficacy, robust clinical trial data, and premium pricing. The strong intellectual property protection associated with branded drugs allows for sustained market leadership.

- Generic Peptide Drugs: While currently holding a smaller market share, the generic segment is expected to witness significant growth as key peptide drug patents expire, driving demand for cost-effective alternatives.

Application:

- Metabolic Disorders: This segment is the leading application area, driven by the high global prevalence of diabetes, obesity, and related conditions. Blockbuster peptide drugs targeting these disorders contribute significantly to market revenue.

- Cancer: The application of peptide therapeutics in oncology is rapidly expanding, with ongoing research into peptide vaccines, peptide-drug conjugates, and peptide-based immunotherapies showing promising results.

- Gastrointestinal Disorders: Peptide therapies are also gaining traction for various gastrointestinal conditions, offering targeted and effective treatment options.

- Neurological Disorders: While a developing area, significant research efforts are focused on leveraging peptide therapeutics for conditions like Alzheimer's and Parkinson's disease, indicating future growth potential.

Route of Administration:

- Parenteral: This remains the most prevalent route of administration, accounting for the largest market share due to the need for peptides to bypass the digestive system for optimal absorption and efficacy. Subcutaneous and intravenous injections are common.

- Oral: The development of oral peptide drug delivery systems is a significant trend, and while currently a smaller segment, it holds immense potential to improve patient convenience and market penetration.

Key Drivers of Dominance in these Segments:

- Economic Policies: Favorable reimbursement policies and government incentives for pharmaceutical R&D in leading economies bolster market growth.

- Infrastructure: Advanced healthcare infrastructure, including well-equipped hospitals and clinics, facilitates the administration and monitoring of peptide therapies.

- Regulatory Support: Clear and supportive regulatory pathways for the approval of novel peptide drugs encourage investment and innovation.

- Disease Burden: High and increasing prevalence of target diseases directly translates to a larger patient pool and thus, greater market demand.

Peptide Therapeutics Market Product Innovations

Product innovations in the peptide therapeutics market are primarily focused on enhancing efficacy, improving safety profiles, and developing novel delivery mechanisms. Companies are investing heavily in research and development to discover new peptide targets and design peptides with optimized pharmacokinetic and pharmacodynamic properties. Key innovations include the development of longer-acting peptide formulations, combination therapies leveraging the synergistic effects of peptides with other drugs, and advanced peptide-drug conjugates for targeted cancer therapy. The competitive advantage for innovators lies in their ability to address unmet medical needs with highly specific and potent therapies, often leading to improved patient outcomes and reduced side effects compared to existing treatment modalities.

Report Segmentation & Scope

This report meticulously segments the peptide therapeutics market to provide a granular view of its various facets. The segmentation covers:

- Marketing Type: Generic and Branded peptides are analyzed, with growth projections and market sizes for each, considering their respective competitive dynamics and market penetration strategies.

- Application: The market is segmented by key applications including Gastrointestinal Disorders, Neurological Disorders, Metabolic Disorders, Cancer, and Other Applications. Each segment's current market size, projected growth, and the competitive landscape driven by specific therapeutic needs are detailed.

- Route of Administration: Analysis includes Parenteral, Oral, and Other Routes of Administration. This segmentation highlights the evolution of drug delivery technologies and their impact on market accessibility and patient compliance, with accompanying growth projections and competitive considerations.

The scope of this report encompasses a comprehensive analysis of these segments, providing detailed market sizes, compound annual growth rates (CAGRs), and competitive insights for each.

Key Drivers of Peptide Therapeutics Market Growth

Several key factors are propelling the growth of the peptide therapeutics market. The increasing global burden of chronic diseases, such as diabetes, obesity, and cancer, necessitates advanced and targeted therapeutic interventions, which peptide drugs are well-positioned to provide. Advances in peptide synthesis technology and drug discovery platforms are enabling the development of more complex and potent peptides with improved specificity and reduced off-target effects. Furthermore, the growing understanding of disease mechanisms at a molecular level is opening up new avenues for peptide-based drug development. Favorable regulatory pathways and increasing R&D investments by pharmaceutical and biotechnology companies are also significant growth accelerators. The development of novel peptide drug delivery systems, including oral and sustained-release formulations, is enhancing patient compliance and expanding the therapeutic potential of peptides, further driving market expansion.

Challenges in the Peptide Therapeutics Market Sector

Despite its significant growth potential, the peptide therapeutics market faces several challenges. The complexity and cost associated with peptide synthesis and manufacturing remain a significant hurdle, impacting the affordability and accessibility of these drugs, especially in developing economies. Regulatory hurdles, while easing, can still be extensive and time-consuming, particularly for novel peptide therapies and complex biologics. The susceptibility of peptides to enzymatic degradation and poor oral bioavailability necessitates sophisticated drug delivery systems, adding to development costs and complexity. Furthermore, intense competition from established small molecule drugs and other biologic therapies requires continuous innovation and a clear demonstration of superior therapeutic value. Supply chain vulnerabilities and ensuring consistent product quality across global manufacturing sites also present ongoing challenges.

Leading Players in the Peptide Therapeutics Market Market

- Novo Nordisk AS

- Novartis AG

- Ever Neuro Pharma GmbH

- SELLAS Life Sciences Group (Galena Biopharmaceuticals)

- Amgen Inc

- AstraZeneca PLC

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Teva Pharmaceuticals Industries Ltd

- Zealand Pharma AG

- Bristol-Myers Squibb Company

- GlaxoSmithKline PLC

- Pfizer Inc

Key Developments in Peptide Therapeutics Market Sector

- November 2022: Enterome developed one of the first-in-class immunomodulatory drugs based on its bacterial mimicry drug discovery platform. Enterome reported the safety, immunogenicity, and efficacy data of its Phase 1/2 clinical trial of EO2401, in combination with an immune checkpoint inhibitor, for treating patients with first progression/recurrence of glioblastoma (ROSALIE trial).

- September 2022: The life science group Sartorius, through its French-listed subgroup Sartorius StedimBiotech, acquired Albumedix Ltd. Albumedix is one of the key players in the field of recombinant albumin-based solutions.

Strategic Peptide Therapeutics Market Market Outlook

The strategic outlook for the peptide therapeutics market is exceptionally bright, driven by continued innovation and an expanding therapeutic landscape. The increasing focus on personalized medicine and the development of targeted therapies for rare and chronic diseases will fuel further demand for peptide-based solutions. Investments in advanced drug discovery technologies, coupled with the evolution of peptide drug delivery systems, will unlock new treatment possibilities and enhance patient outcomes. Strategic collaborations and partnerships among pharmaceutical companies, academic institutions, and contract research organizations will accelerate the R&D pipeline and facilitate market entry. The growing emphasis on biologics and precision medicine positions peptide therapeutics as a cornerstone of future pharmaceutical innovation, promising significant growth and market expansion in the coming years.

Peptide Therapeutics Market Segmentation

-

1. Marketing Type

- 1.1. Generic

- 1.2. Branded

-

2. Application

- 2.1. Gastrointestinal Disorders

- 2.2. Neurological Disorders

- 2.3. Metabolic Disorders

- 2.4. Cancer

- 2.5. Other Applications

-

3. Route of Administration

- 3.1. Parenteral

- 3.2. Oral

- 3.3. Other Routes of Administration

Peptide Therapeutics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Peptide Therapeutics Market Regional Market Share

Geographic Coverage of Peptide Therapeutics Market

Peptide Therapeutics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Cancer and Metabolic Disorders; Rising Investments in Research and Development of Novel Drugs; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Instability of Peptides; High Cost of Developing Drugs and Stringent Regulatory Requirements for Drug Approval

- 3.4. Market Trends

- 3.4.1. Cancer Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Peptide Therapeutics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Marketing Type

- 5.1.1. Generic

- 5.1.2. Branded

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastrointestinal Disorders

- 5.2.2. Neurological Disorders

- 5.2.3. Metabolic Disorders

- 5.2.4. Cancer

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Route of Administration

- 5.3.1. Parenteral

- 5.3.2. Oral

- 5.3.3. Other Routes of Administration

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Marketing Type

- 6. North America Peptide Therapeutics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Marketing Type

- 6.1.1. Generic

- 6.1.2. Branded

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Gastrointestinal Disorders

- 6.2.2. Neurological Disorders

- 6.2.3. Metabolic Disorders

- 6.2.4. Cancer

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Route of Administration

- 6.3.1. Parenteral

- 6.3.2. Oral

- 6.3.3. Other Routes of Administration

- 6.1. Market Analysis, Insights and Forecast - by Marketing Type

- 7. Europe Peptide Therapeutics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Marketing Type

- 7.1.1. Generic

- 7.1.2. Branded

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Gastrointestinal Disorders

- 7.2.2. Neurological Disorders

- 7.2.3. Metabolic Disorders

- 7.2.4. Cancer

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Route of Administration

- 7.3.1. Parenteral

- 7.3.2. Oral

- 7.3.3. Other Routes of Administration

- 7.1. Market Analysis, Insights and Forecast - by Marketing Type

- 8. Asia Pacific Peptide Therapeutics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Marketing Type

- 8.1.1. Generic

- 8.1.2. Branded

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Gastrointestinal Disorders

- 8.2.2. Neurological Disorders

- 8.2.3. Metabolic Disorders

- 8.2.4. Cancer

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Route of Administration

- 8.3.1. Parenteral

- 8.3.2. Oral

- 8.3.3. Other Routes of Administration

- 8.1. Market Analysis, Insights and Forecast - by Marketing Type

- 9. Middle East and Africa Peptide Therapeutics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Marketing Type

- 9.1.1. Generic

- 9.1.2. Branded

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Gastrointestinal Disorders

- 9.2.2. Neurological Disorders

- 9.2.3. Metabolic Disorders

- 9.2.4. Cancer

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Route of Administration

- 9.3.1. Parenteral

- 9.3.2. Oral

- 9.3.3. Other Routes of Administration

- 9.1. Market Analysis, Insights and Forecast - by Marketing Type

- 10. South America Peptide Therapeutics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Marketing Type

- 10.1.1. Generic

- 10.1.2. Branded

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Gastrointestinal Disorders

- 10.2.2. Neurological Disorders

- 10.2.3. Metabolic Disorders

- 10.2.4. Cancer

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Route of Administration

- 10.3.1. Parenteral

- 10.3.2. Oral

- 10.3.3. Other Routes of Administration

- 10.1. Market Analysis, Insights and Forecast - by Marketing Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Novo Nordisk AS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Novartis AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ever Neuro Pharma GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SELLAS Life Sciences Group (Galena Biopharmaceuticals)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amgen Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AstraZeneca PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Takeda Pharmaceutical Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eli Lilly and Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Teva Pharmaceuticals Industries Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zealand Pharma AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bristol-Myers Squibb Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GlaxoSmithKline PLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Pfizer Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Novo Nordisk AS

List of Figures

- Figure 1: Global Peptide Therapeutics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Peptide Therapeutics Market Revenue (billion), by Marketing Type 2025 & 2033

- Figure 3: North America Peptide Therapeutics Market Revenue Share (%), by Marketing Type 2025 & 2033

- Figure 4: North America Peptide Therapeutics Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Peptide Therapeutics Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Peptide Therapeutics Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 7: North America Peptide Therapeutics Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 8: North America Peptide Therapeutics Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Peptide Therapeutics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Peptide Therapeutics Market Revenue (billion), by Marketing Type 2025 & 2033

- Figure 11: Europe Peptide Therapeutics Market Revenue Share (%), by Marketing Type 2025 & 2033

- Figure 12: Europe Peptide Therapeutics Market Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Peptide Therapeutics Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Peptide Therapeutics Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 15: Europe Peptide Therapeutics Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 16: Europe Peptide Therapeutics Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Peptide Therapeutics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Peptide Therapeutics Market Revenue (billion), by Marketing Type 2025 & 2033

- Figure 19: Asia Pacific Peptide Therapeutics Market Revenue Share (%), by Marketing Type 2025 & 2033

- Figure 20: Asia Pacific Peptide Therapeutics Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Peptide Therapeutics Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Peptide Therapeutics Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 23: Asia Pacific Peptide Therapeutics Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 24: Asia Pacific Peptide Therapeutics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Peptide Therapeutics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Peptide Therapeutics Market Revenue (billion), by Marketing Type 2025 & 2033

- Figure 27: Middle East and Africa Peptide Therapeutics Market Revenue Share (%), by Marketing Type 2025 & 2033

- Figure 28: Middle East and Africa Peptide Therapeutics Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Peptide Therapeutics Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Peptide Therapeutics Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 31: Middle East and Africa Peptide Therapeutics Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 32: Middle East and Africa Peptide Therapeutics Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Peptide Therapeutics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Peptide Therapeutics Market Revenue (billion), by Marketing Type 2025 & 2033

- Figure 35: South America Peptide Therapeutics Market Revenue Share (%), by Marketing Type 2025 & 2033

- Figure 36: South America Peptide Therapeutics Market Revenue (billion), by Application 2025 & 2033

- Figure 37: South America Peptide Therapeutics Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Peptide Therapeutics Market Revenue (billion), by Route of Administration 2025 & 2033

- Figure 39: South America Peptide Therapeutics Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 40: South America Peptide Therapeutics Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Peptide Therapeutics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Peptide Therapeutics Market Revenue billion Forecast, by Marketing Type 2020 & 2033

- Table 2: Global Peptide Therapeutics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Peptide Therapeutics Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 4: Global Peptide Therapeutics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Peptide Therapeutics Market Revenue billion Forecast, by Marketing Type 2020 & 2033

- Table 6: Global Peptide Therapeutics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Peptide Therapeutics Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 8: Global Peptide Therapeutics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Peptide Therapeutics Market Revenue billion Forecast, by Marketing Type 2020 & 2033

- Table 13: Global Peptide Therapeutics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Peptide Therapeutics Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 15: Global Peptide Therapeutics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Peptide Therapeutics Market Revenue billion Forecast, by Marketing Type 2020 & 2033

- Table 23: Global Peptide Therapeutics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Peptide Therapeutics Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 25: Global Peptide Therapeutics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Peptide Therapeutics Market Revenue billion Forecast, by Marketing Type 2020 & 2033

- Table 33: Global Peptide Therapeutics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Peptide Therapeutics Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 35: Global Peptide Therapeutics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Peptide Therapeutics Market Revenue billion Forecast, by Marketing Type 2020 & 2033

- Table 40: Global Peptide Therapeutics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Peptide Therapeutics Market Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 42: Global Peptide Therapeutics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Peptide Therapeutics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Peptide Therapeutics Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Peptide Therapeutics Market?

Key companies in the market include Novo Nordisk AS, Novartis AG, Ever Neuro Pharma GmbH, SELLAS Life Sciences Group (Galena Biopharmaceuticals), Amgen Inc, AstraZeneca PLC, Takeda Pharmaceutical Company Limited, Eli Lilly and Company, Teva Pharmaceuticals Industries Ltd, Zealand Pharma AG, Bristol-Myers Squibb Company, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Peptide Therapeutics Market?

The market segments include Marketing Type, Application, Route of Administration.

4. Can you provide details about the market size?

The market size is estimated to be USD 49.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Cancer and Metabolic Disorders; Rising Investments in Research and Development of Novel Drugs; Technological Advancements.

6. What are the notable trends driving market growth?

Cancer Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Instability of Peptides; High Cost of Developing Drugs and Stringent Regulatory Requirements for Drug Approval.

8. Can you provide examples of recent developments in the market?

November 2022: Enterome developed one of the first-in-class immunomodulatory drugs based on its bacterial mimicry drug discovery platform. Enterome reported the safety, immunogenicity, and efficacy data of its Phase 1/2 clinical trial of EO2401, in combination with an immune checkpoint inhibitor, for treating patients with first progression/recurrence of glioblastoma (ROSALIE trial).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Peptide Therapeutics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Peptide Therapeutics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Peptide Therapeutics Market?

To stay informed about further developments, trends, and reports in the Peptide Therapeutics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence